Engineering Economics Problems: Capitalized Cost & Depreciation

advertisement

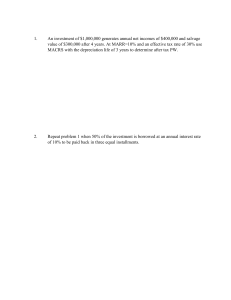

1. A dam project of the Philippine Government was established to cost Php 340,000,000 during its construction. It was also determined that the dam will require Php2,000,000 maintenance and operating expenses every year and an additional cost of Php 16,000,000 of major repairs every 10 years. What will be the capitalized cost of all these expenses if money is worth 7% per year? 2. A passenger train was bought at Php 36,000,000 and will incur Php. 1,500,000 of annual operation and maintenance expense in the first 5 years and will increase to Php 2,500,000 thereafter until it reaches its economic life of 20 years. Find the capitalized cost at i=5% yearly if the train will have a salvage value of Php3,000,000 and would be replaced by a new one at the end of its economic life with the same maintenance and operating expenses. 3. A contractor can buy a truck for Php 800,000 or rent them by Php 1,200 per day. The truck has a salvage value of Php 100,000 at the end of its useful life of 5 years. The annual cost of maintenance is Php 20,000. Which is more cost efficient buying the truck or rent it? Use i= 14% 4. A Construction firm is considering establishing an engineering computer center. This center will be equipped with three engineering workstations that would cost Php. 50,000 each and has a service life of 5 years. The expected salvage value of each workstation is Php. 5,000. The annual operating & maintenance cost would be Php. 12,000 for each workstation. At a MARR of 20% determine the annual cost for operating the engineering center. 5. A contractor can buy dumptrucks for Php. 800,000 each (surplus) or rent them for Php. 1189/ day. The truck has a salvage value of Php. 100,000 at the end of its useful life of 5 years. Annual cost of maintenance is Php. 20,000. If money is worth 14% per annum. Determine the number of days per year that a truck must be used to warrant the purchase of the truck. 6. To decrease cost of operating a lock in a large river, a new system of operation is proposed. It will cost Php. 450,000 to design and build. It is estimated that it will have a reworked every 10 years at a cost of Php. 50,000. In addition, there will be an expenditure of Php. 40,000 at the end of the fifth year for a new type of gear that will not be available until then. The annual operating cost are expected to be Php. 30,000 for the first 15 years and Php. 25,000 a year thereafter. Compute the capitalized cost of perpetual service at i = 10%. 1. A machine costing P45,000 is estimated to have a salvage value of P4,350 when retired at the end off 6 years. Depreciation cost is computed using a constant percentage of the declining book value. What is the annual rate of depreciation in percent? (32.25%) 2. An engineer bought an equipment or P500,000. Other expenses including installation amounted to P30,000. At the end of its estimated useful life of 10 years, the salvage value will be 10% of the first cost. Using Straight line method of depreciation, what is the book value after 5 years? (P291,500.00) 3. An asset is purchased for P9,000. Its estimated life is 10 years, after which it will be sold for P1,000. Find the book value during the third year if Sum of the Year’s Digit Method is used. (P5, 072.72) 4. A construction equipment costing P480,000 has a life expectancy of 12 years with a salvage value of 10 % of the first cost. Using depreciation by sinking fund method, What is the book value of the Machine after 5 years, assume i = 8%? (P346,457.29) 5. A machine costing P50,000 has a life expectancy of 6 years and an estimated salvage value of P8,000. Calculate the depreciation charge at the end of the fourth period using fixed percentage method? (P5,264.00) BenDan Corporation makes a policy that for any new equipment purchased, the annual depreciation cost should not exceed 20% of the first cost at any time with no salvage value. Determine the length of service life necessary if the depreciation used is the Sum of the Year’s Digit Method. (9 years) 6. At 6%, find the capitalized cost of a bridge whose cost is P200M and life is 20 years, if the bridge must be partially rebuilt at a cost of P100M at the end of each 20 years. (P245.31M) 7. A company uses a type of truck which costs P2M, with life of 3 years and a final salvage value of P320,000 How much could the company afford to pay for another type of truck for the same purpose, whose life is 4 years with a final salvage value of P400,000, if money is worth 4%? (P2,585,964.73) 8. A bridge cost P1M . It is estimated that the same bridge should be renovated every 50 year at a cost of P800,000 . Annual repairs and maintenance are estimated to be P30,000 per year. If the interest rate is 5%, determine the capitalized cost of the bridge? (P1,676,428.00) 9. A new plant to produce a steel tubing requires and initial investment of P10M. It is expected that after 3 years of operation, an additional investment of P5M will be required, after 6 years of operation another investment of P3M. Annual operating cost will be P3M & annual revenues will be P8M. The life of the plant is 10 years. If the interest rate is 15% per year, compounded annually, what is the NPV (Net Present Value) of this plant? (P10.51M) 1. An electronic balance costs P90,000 and has an estimated salvage value of P8,000 at the end of its 10 years life time. What would be the book value after 3 years, using the straight line method in solving for the depreciation. (BV3 = P65,400) 2. An equipment costing P250,000 has an estimated life of 15 years with a book value of P30,000 at the end of the period. Compute the depreciation charge and its book value after 10 years using sinking fund method. Use i=8% (d=P8,102.50; BV10 = P132,622.63) 3. An equipment costs P1,500,000. At the end of its economic life of five years, its salvage value is P500,000. Using Sum of the Years Digit Method of Depreciation, what will be its book value for the third year? (BV3 = P700,000) 4. An equipment costing P250,000 has an estimated life of 15 years with a book value of P30,000 at the end of the period. Compute the depreciation charge and its book value after 10 years using declining balance method. (d10=P9,234.93; BV10 = P60,832.80) 5. Determine the rate of depreciation, the total depreciation up to the end of the 8 th year and the book value at the end of 8 years for an asset that costs P15,000 new and has an estimated scrap value of P2,000 at the end of 10 years by double declining method? (D8=P2,516.58; BV8=P12,483.43; rate of dep.=20%) 6. A property is purchased at P100,000 with a salvage value of 10% of the original cost after 8 years of service. If during the first 4 years of service it produces 100 units per year and 80 units each year for the remaining years, what will be the book value after 5 years of service using service output method?