Capturing-the-value-premium---global-evidence-from-a-f 2018 Journal-of-Banki

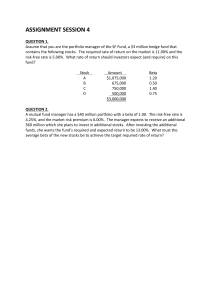

advertisement