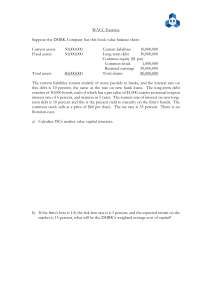

MCI Communication Corp.: Issuing Debt to Repurchase Stock October 9, 2023 1. What message is MCI trying to send to the financial markets? MCI’s stock performance over the last few years has been lower than the market most of its peers, that is the management of the firm has decided to improve that performance to provide the shareholders with the better return. In order to do this the management needs the market to see the stock with a higher earnings potential than in the previous years. So, the strategy is to issue 2 billion in debt to repurchase than amount in stocks, this will decrease the amount of shares outstanding and the earnings per share could go up. So, the signal the management sends to the markets is that the firm is going to be much more aggressive with a more complex capital structure that will enable the company to have a higher growth potential. 2. What would be the effect of the issuing of debt to repurchase the stocks? a. The number of shares outstanding for MCI is going to decrease by the amount they are able to repurchase with the proceeds from the issuing of the debt, taking into consideration the stock price at the moment. So shares outstanding will decrease. b. The book value of equity of the firm is going to decrease also as a consequence of less stocks outstanding at the same book price of stocks. c. The price per share of MCI stock will increase because of the addition of the present value of the interest tax shield arising from the increase in debt. So, this decision immediately has an effect in the stock price by increasing it by almost to $2 per share. d. The EPS are going to lower a little in the first year from $0.79 per stock to $0.76 because of the great increase in the interest expense generated by the debt the firm got into. 3. Prior to repurchase of stock using the money form the debt issued, the WACC for the firm was 10.45%, we got into this value by using the book value of the debt and the before tax cost of debt and also the proportion of equity with the cost of equity calculated by using the unlevered beta of the firm and the actual risk-free rate and the market risk premium. 4. So, after issuing the $2 billion in debt and these proceeds being used to repurchase stocks, then the WACC would increase by a little margin to 10.48%. The WACC increases because the before-tax cost of debt will increase by a little margin as a result of a higher debt-to-equity. 5. Yes, I do recommend that MCI increases its use of debt as the debt-to-equity of the firm is so low and does not give too much space for the equity to receive a higher return. Increasing debt will allow the firm to repurchase stocks and provide a better EPS to be higher for the remaining stocks. This would also increase the interest expense and the interest rate will also increase because of a higher default risk. The firm plans to issue $2 billion in debt to repurchase stocks by that same value, but the amount could be even higher as the debt-to-equity would not get to a high value as the competitors of the firm, that in general these peers companies do very well.