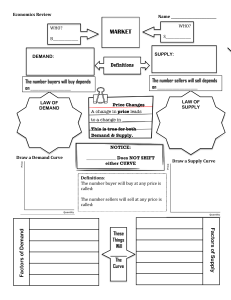

Autumn 2018 23115 Economics University of Technology Sydney Topics: ● ● ● ● ● ● ● ● Demand and supply with applications; Equilibrium and Elasticity; Effects of Government policies on market outcomes; Markets and market failure: efficiency and equity; Measuring GDP, Price Indices and Unemployment; Introduction to Aggregate Supply and Demand Analysis; Introduction to Money, Money Markets and Interest Rates; Exchange Rates and the Balance of Payments. 1 WEEK ONE ● ● ● Course Description Introduction to Economics Readings: Principles of Economics, Chapter 1 (pp 4-11) WEEK TWO ● ● Tutorial 1 - 4 Lessons from Economics; Case Study #1 ○ Preparatory activities: Download and attempt tutorial questions & Case Study #1 Lecture 2 - Demand and Supply ○ Readings: Chapter 4 (until page 84 included) Markets and competition: ● Many buyer and sellers, which means there is not really any market power ○ No power to manipulate price ○ Little to no differentiation between products Demand: ● Demand is solely determined by buyer or potential buyer of the product ● Quantity demanded: ○ The amount of a good that buyers are willing and able to purchase. ● Relationship between price and quantity demand can be expressed in two ways: ○ Demand schedule ○ ● Demand Curve The quantity demanded of any good is the amount of the good that buyers are willing and able to purchase. The price of the good is the central determinant of the quantity demanded. 2 ● ● ● Only includes price, and quantity demanded Does not include income or anything else Price is always going to be on the vertical axis Market demand vs individual demand: In almost all markets there are many buyers, and we cannot study markets effectively until we understand the total demand for a given product in a given market. ● The market demand is the sum of each individual demand ● For example if there are two buyers in the market, the market demand is the sum of these two demands ● This is represented in the graph below: Changes in prices of goods generates a movement along the demand curve, and is a change in quantity demanded. Shifts in the demand curve: If the price stays constant, for example, and another factor changes, this is called a shift in the demand curve, either to the left or right. Here, we say there is a change in demand rather than referring to the movement as quantity demanded as we did above. Factors influencing shifts in the demand curve ● Income can also affect the demand of a good, and the relationship between income and demand depends of what type the good is. ○ Normal goods are ones where an increased income leads to an increased demand ○ Inferior goods are ones where an increased income leads to an decreased demand ● Price of related goods can also affect demand, as consumers will be likely to switch to a cheaper product if the two products are similar. ○ Substitutes are goods which could be replaced by another, for example some people view frozen yogurt as a substitute for ice-cream, meaning if a froyo store and an ice-cream store were next door, a consumer may decide which they eat based on other factors, such as price. ○ Complements are two goods where the decrease of the price of one good leads to the increase in price of another ● Tastes - people look at the results of changes in taste ● Expectations - there are expectations regarding future incomes and future prices ● Number of buyers - the amount of demand for a product should naturally increase with the population of the area surrounding that product. Behaviour or producers / sellers: ● The quality supplied is the amount of a good that sellers are willing and able to sell ● As the price increases of a product, the amount of products the seller is willing to provide goes up as well. This is because the seller has to make it worth their while to be providing the goods. The S curve in the below diagram is sloping upward so to reflect this law of supply. 3 The supply curve: ● The quantity supplied of any good or service is the amount sellers are willing and able to sell. Price again is a large determinant of the quantity supplied. If the price of ice-cream, for example, is high, selling it is more profitable and you can afford more supply. ● The law of supply is: other things being equal, when the price of a good rises, the quantity supplied of the good also rises, and when the price falls, the quantity supplied also falls. Market supply versus individual supply: ● The market supply is the sum of all the supplies of all sellers. ● This is represented in the graph below: Shifts in the supply curve: The market supply curve is drawn with all other things held constant. This means that when one factor change, the whole supply curve will shift. For example, if the price of sugar falls, selling ice-cream will be more profitable, thus raising the supply of ice-cream. In this higher supply, the curve will shift to the right. Factors influencing shifts in the supply curve: ● Input prices - the cost of the inputs needed to produce a good will determine how much of it is bought, and thus how much of the final product can be created. ● Technology - more advanced technology may be able to produce a higher quantity of goods at a lower cost, meaning more supplies are created. ● Expectations - Sellers may have expectations about the rising and falling cost of products in the future. For example, in winter an ice-cream seller may choose to put more ice-cream in storage, as they can expect to make more profits off the ice-cream if they save it until summer to sell more of it. ● Number of sellers 4 WEEK THREE ● ● ● Tutorial 2 - Problems on Demand and Supply ○ Preparatory activities: Download and attempt tutorial questions Lecture 3 - Equilibrium; Elasticity ○ Readings: Principles of Economics, Chapters 4 and 5 Assessments: ○ Online problem set "Assessed 1" is released at 11:45pm on Friday, 30 Mar (due 11:45pm Thursday, 5 Apr). Supply and demand together: ● If the demand and supply curve are drawn up on the same graph, there is one point where the curve will intersect. This point is called the Equilibrium. ● This point is generally defined as a balanced force, and at the equilibrium price, the quantity of the goods that buyers are willing and able to buy balances the quantity that sellers are willing and able to sell. ● It is sometimes referred to as the market-clearing price. ● ● ● Points where the business is not at equilibrium price are shown below. The first shows a business where the price is above the equilibrium price, and the business is selling too many goods in comparison to their supply, leaving them with a surplus of goods. The second shows a business where the price is below the equilibrium price, and the business is not selling enough goods in comparison to their supply, leaving them with a shortage of goods. Analysing changes in equilibrium: 5 ● ● ● ● Supply and demand both change a market’s equilibrium, which in turn determine the price of the good and the amount of the good that buyers purchase and sellers produce. When an event shifts one of these curves, the market gets a new equilibrium price. The analysis of this change is called comparative statics as it involves both an old and new equilibrium When analyzing how some events affect a market, we proceed in three steps: ○ First deciding whether the event shifts the supply curve, demand curve, or both curves. ○ Second, whether the curve shifts to the left or right ○ Thirds, using a supply-and-demand diagram to compare the initial equilibrium with the new one, showing how the shift affects equilibrium price and quantity. Shifts in curves versus movement along curves: ● ‘Supply’ refers to the position of the supply curve ● ‘Quantity supplied’ refers to the amount suppliers wish to sell ● When hot weather drives ice-cream sales up, the amount that company’s supply rises, but the supply curve remains the same. Here, supply does not change because the weather does not change company’s desire to sell at a given price. When the price rises, the quantity supplied rises, causing an increase in quantity supplied represented by a movement along the supply curve. ○ The shift in the supply curve is called ‘change in supply’ ○ The shift in the demand curve is called ‘change in the quantity supplied’ ○ The movement along a fixed demand curve is called ‘change in the quantity demanded’. Changes in both supply and demand: The elasticity of demand: ● How much buyers and sellers respond to changing market conditions ● When a market condition changes, we can analyse how this affects not only the direction of the effects, but their intensity. ● When discussing demand, the direction of quantity demanded was observed, however not the size of the change. Elasticity measures how much demand responds to its determinants. 6 The price elasticity of demand: ● Measures how much the quantity demanded responds to a change in price ● Measures the willingness of customers to buy less as the price of a good rises ● Elasticity is said to occur is the quantity demanded responds substantially to change in price, and inelastic if it only slightly responds to a change in price Determinants of price elasticity of demand: ● While there is no overarching claim of how elastic a demand curve is we can draw some conclusions on what influences price elasticity of demand: ○ Availability of close substitutes = if a product has a close substitute, the demand is more elastic because of a consumer’s ability to switch to the alternate product. For example a price raise in butter will cause the amount of butter sold to drop due to a consumer’s ability to switch to margarine. ○ Necessities versus luxuries = While necessities have relatively inelastic demands due to their inability to go without, luxuries are most elastic, as the price will dramatically influence whether or not the product is bought. ○ Definition of the market = How market boundaries are drawn in a market influences the elasticity of said market. Generally speaking, broadly defined markets will be less elastic than narrowly defined markets. For example, the ‘food’ market is inelastic, while the ‘ice-cream’ market is. ○ Time horizon = More elastic demand will occur over a longer time horizon. The variety of demand curves: ● Demand is elastic when the elasticity is greater than 1, and inelastic when it is less than 1. If demand is exactly one, demand has unit elasticity. ● Price elasticity has a close relationship with the demand curve slope, as the price elasticity measures how much quantity demanded responds to the price. ● Generally, the flatter the demand curve that passes through a given point, the greater the price elasticity of demand. The steeper the demand curve, the smaller the price elasticity. Total revenue and the price elasticity of demand: In any market, the total revenue is P x Q (price of the good multiplied by the quantity of the good sold). In the below diagram, the height of the box is P and the width is Q, so the total revenue is $4 x 100, which is $400. How total revenue changes as one moves along the demand curve: ● If the demand is inelastic, an increase in price causes an increase in total revenue 7 ● If the demand is elastic, an increase in price causes a decrease in total revenue. Inelastic demand: Elastic demand: Elasticity and total revenue along a linear demand curve: Even though the slope of a linear demand curve is constant, the elasticity isn’t. This is because the slope is the ratio of changes in the two variables, and the elasticity is the ratio of percentage changes in two variables. ● Small elasticity: ○ If the price is low, and consumers are buying a lot, a $1 price increase and two-unit reduction in quantity demanded constitutes a large percentage increase in the price and a small percentage decrease in quantity demanded, resulting in a small elasticity. ● Large elasticity: ○ When the price is high, however, the same $1 increase and two-unit reduction constitutes a small percentage increase in price, and a large percentage decrease in quantity demanded, resulting in large elasticity. Other demand elasticities: ● The income elasticity of demand: ○ This is used to measure how the quantity demanded changes as consumer income changes ○ 8 ○ ● Most goods are normal goods, so higher income raises the quantity demanded, and due to quantity demanded and income moving in the same direction, normal goods have positive income elasticities. ○ That is, normal goods have positive income elasticity (greater than 0) ○ Inferior goods, have negative income elasticity (less than 0) The cross-price elasticity of demand: ○ This is used to measure how the quantity demanded of one good changes as the price of another good changes. ○ ○ The cross-price elasticity will either be negative or positive depending on whether the two goods are substitutes or complements. Price elasticity of supply: ● Supply is elastic if the price elasticity of supply is greater than 1, inelastic if the price elasticity of supply is smaller than 1, and unit elastic if the price elasticity of supply is equal to 1. ● Measures how much the quantity supplied responds to changes in the price. ● Supply of a good is classified elastic if the quantity supplied responds substantially to changes in the price, and inelastic if the it only responds slightly. ● Determinants: ○ The flexibility of sellers to change the amount of goods produced (the supply of a one-off painting is inelastic, whereas books, pens and car are elastic) ○ The time period being considered (supply is more elastic over longer periods) ○ The variety of supply curves: ● As the elasticity rises, the curve gets flatter. 9 WEEK FOUR ● ● ● ● Tutorial 3: Problems on Equilibrium; Elasticity ○ Preparatory activities: Download and attempt tutorial questions Lecture 4 - Government Policies Readings: Principles of Economics, Chapter 6 Assessments: ○ Online problem set "Assessed 1" is due 11:45pm Thursday, 5 April ○ Online problem set "Assessed 2" is released at 11:45pm on Friday, 6 April (due 11:45pm Thursday, 12 April). Markets and government policies: Markets can not solely rely on the supply and demand of its consumers, as this would be unfair. Instead, there must be regulations that prevent markets from, for example, selling products at the highest price possible making them unattainable by most consumers. It is normal for buyers to try and buy at the lowest price, and sellers to try and sell at the highest price. To control the cost at which a market product can be sold, there are price controls. These are: A price ceiling = The legal maximum price that a good can be sold at ● Not binding - meaning the price ceiling is above the price that balances supply and demand, and has no effect on the price or the quantity of goods sold. ● ○ Binding constraint on the market - the alternative outcome where the price ceiling is below the equilibrium. ○ ○ ○ ○ Supply and demand forces can move towards the equilibrium, but legally not reach it, meaning the market price equals the ceiling price, causing a shortage due to the quantity demanded being larger than the quantity supplied. Some mechanisms for rationing the produce would develop naturally, such as long lines for buyers who are willing OR, sellers could ration the produce how they like (e.g selling only to friends). Not all buyers benefit from this policy, however, as the shortage causes buyers to miss out. 10 A price floor = The legal minimum price that a good can be sold at ● Not binding - meaning the equilibrium is above the price floor and the price floor has no effect ● ○ Binding constraint on the market - the alternative outcome where the equilibrium price is below the floor. ○ The market price equals the price of the floor ○ The quantity of ice-cream supplied exceeds the quantity demanded, and there is a surplus Taxes: Tax incidence - study of the questions regarding the distribution of a tax burden ● Tax on sellers: ○ A tax on sellers will shift the supply curve to the left. ○ The new equilibrium must also be examined. ○ Implications: ■ Although sellers provide the tax for the government, the burden is shared by both buyers and sellers ■ Sellers get to keep less of the profit, and sellers spend more for the product. ■ Taxes essentially discourage market activity. ● Tax on buyers: ○ A tax on buyers will shift the demand curve to the left ○ The new equilibrium must also be examined. ○ Implications: ■ Taxes levied on sellers and taxes levied on buyers are equivalent ■ In both cases, the tax places a wedge between the price that buyers pay and the price that sellers receive. The wedge between the buyers’ price and the sellers’ price is the same, regardless of whether the tax is levied on buyers or sellers ■ The difference between seller and buyers taxes is just who sends the money to the government Elasticity and tax incidence: Although the burden of tax has been said to be shared between buyers and sellers, it is rarely shared evenly. To see how the tax will be divided, the impact of tax in the two markets must be considered. ● In one case the supply curve is elastic and the demand curve is inelastic, meaning the amount of money received by sellers falls a little bit, but it is not as big an impact as the price rise of the goods bought by buyers. ○ This means the buyer suffers more from the tax than the seller 11 ● ○ In another case, the supply curve is inelastic and the demand curve is elastic. This is when the amount of money paid by buyers rises slightly, but the amount of money received by sellers drops a lot. ○ This means the seller suffers more from the tax than the buyer ○ The lesson from this example is that the burden of tax falls more heavily on the side of the market that is less elastic. This is because: ● Elasticity is measuring how willing buyers and sellers of a particular market are to leave when conditions become unfavourable. ● The less elasticity in a market, the less available alternatives to move to ● This means that the impact of the tax will not drive people away from the market, and instead, they bear the burden of the tax. Subsidy: While taxes are used to shrink the size of a market, subsidies are used to grow the size of a market, and are payments from government to consumer in order to encourage production and consumption. How subsidies affect market outcomes: ● If a government decides to award a certain business $1 for each product sold, while the quantity demanded of the good will go unchanged, not shifting the demand curve, the business will be willing to sell more of the product, thus shifting the supply curve to the right. 12 ● ● ● The new equilibrium must also be examined. Implications: ○ In a subsidy, the price paid by a consumer is less than what the sellers are receiving, due to the money that is also provided to the business by the government. ○ Buyers and sellers both share the benefits, making them popular among the whole market. ○ Because subsidies are expensive for the government, however, they tend to tax other parts of the economy. 13 WEEK FIVE ● ● ● ● Tutorial 4: Problems on Government Policies; Case study #2 ○ Preparatory activities: Download and attempt tutorial questions; Download and go through Case Study #2 Lecture 5 - Efficiency of Markets; The cost of Taxation Readings: Principles of Economics, Chapters 7 and 8 Assessments: ○ Online problem set "Assessed 2" is due 11:45pm Thursday 12 April ○ Online problem set "Assessed 3" is released at 11:45pm Friday 13 April (due 11:45pm Thursday, 19 April). Welfare economics: ● How the allocation of resources affects the wellbeing of economics. ● Done by analysis of market transactional benefits, and how benefits can be made as large as possible by society. ● Conclusion - in any market, the equilibrium of supply and demand maximises the total benefits received by all buyers and sellers combined. ● Welfare is measured using participants’ surplus - (consumer surplus and producer surplus). Consumer surplus: ● Willingness to pay: ○ A buyers maximum amount is called their willingness to pay, and is a measure of the buyers value of the good. ○ Buyers would want to buy at a price lower than their willingness to pay, and refuse to buy at a price higher than their willingness to pay. ○ A buyer who finds an item the same value as their willingness to pay would be equally happy buying or keeping their money. ● Consumer surplus: ○ The amount a buyer is willing to pay for a good minus the amount they actually pay for it. ○ E.g, if a buyer is willing to pay $100 for a good, and only buys it for $80, the consumer surplus is $20. Using the demand curve to measure consumer surplus: ● Closely related to the demand curve ● First, you would find the market demand schedule for the good, and then take note of the relationship between height of demand curve and buyers’ willingness to pay. ● At any given quantity on the demand curve, the price given shows the willingness to pay of the marginal buyer (buyer to leave the market first if the price rose). ● E.g (as seen in graph below) the demand curve at 4 albums is $50, at 3 albums $70, etc. 14 ● ● Surplus can also be measure in the graph, by minusing the willing price paid by the actual price sold. The area below the demand curve and above the price measures the consumer surplus in a market. How a lower price raises consumer surplus: ● When a price falls as seen in the graph below, the consumer surplus increases. ● The buys who were willing to pay the higher price are still paying the lower price, and are better off for paying less ● The increased consumer surplus of these buyers is equivalent to their price reduction. ● Buyers who are willing to buy only because of the price drop as well as buyers who would have also bought at the higher price may now decide to purchase more of the good because it is now cheaper, increasing the quantity demanded in the market. What does consumer surplus measure: ● Consumer surplus essentially measures the benefit of a buyer from the perception of the buyer themself. ● In terms of satisfying buyers, is a good measure of economic well being. ● Sometimes, policymakers do not care about consumer surplus as they do not care for the preferences of buyers. ● Most markets show that consumer surplus does not reflect economic well being. Producer surplus: ● Willingness to pay: ○ A seller's minimum amount is called their willingness to sell, and is a measure of the sellers value of the good. ○ Sellers would want to sell at a price higher than their willingness to sell, and refuse to sell at a price lower than their willingness to sell. ○ A seller who finds an item the same value as their willingness to sell would be equally happy selling or keeping their service. ● Producer surplus: ○ The amount a seller is paid minus the cost of production. ○ E.g, if a seller is willing to sell a service for $100, and instead sell it for $120, the producer surplus is $20. Using the supply curve to measure producer surplus: ● Closely related to the supply curve 15 ● ● First, you would find the market supply schedule for the service, and then take note of the relationship between height of supply curve and sellers willingness to sell. At any given quantity on the supply curve, the price given shows the willingness to sell of the marginal seller (seller to leave the market first if the price fell). E.g (as seen in graph below) the supply curve at 4 painters is $900, at 3 albums $800, etc. ● The area below the price and above the supply curve measures the producer surplus in a market. ● How a higher price raises producer surplus: ● When a price rises as seen in the graph below, the consumer surplus increases. ● The sellers who were willing to sell at the lower price are still paying the higher price, and are better off for making more ● The increased consumer surplus of these buyers is equivalent to their price increase. ● Sellers who are willing to sell only because of the price rise as well as sellers who would have also sold at the lower price may now decide to sell more of the good / service because it is now more expensive, increasing the quantity supplied in the market. Market efficiency: ● Consumer and producer surplus each assist economists in studying the welfare of buyers and sellers in a market. ● The question is posed: Is the allocation of resources determined by free markets in any way desirable? 16 ● The benevolent social planner: ○ Aims to maximise economic wellbeing for all ○ First must decide on how economic wellbeing of a society can be measured - one way is total surplus. ○ An allocation of resources is considered to exhibit efficiency if it maximises total surplus. ○ An allocation of resources is not considered efficient some of the gains from trade among buyers and sellers are not realised, OR if a good is not being consumed by those who value it the highest. ○ Equity is also considered, such as fairness of distribution among buyers and sellers alike. Evaluating the market equilibrium: 17 WEEK SIX ● Tutorial 5 - Problems on Efficiency of Markets; The cost of Taxation ○ ● ● ● Preparatory activities: Download and attempt tutorial questions Lecture 6 - Externalities Readings: Principles of Economics, Chapter 10 Assessments: ○ Online problem set "Assessed 3" is due 11:45 pm Thursday, 19 Apr Welfare Economics recapped: ● At any given quantity, the willingness to pay of the marginal buyer is determined by the height of the demand curve. ● At any given quantity, the willingness to sell of the marginal seller is determined by the height of the supply curve. ● Without government policy, price is in the hands of supply and demand. Negative Externalities: ● Negative externalities are costs suffered by any third party as a result of an economic transaction. ● For example, a factory that emits smoke which is a health risk for society. ● These externalities mean that the cost to society would be higher than that going towards those who run the factories. ● The diagram below illustrates how the production of aluminium affects society. ○ The social curve is above the supply curve. This is because it considers external costs imposed (i.e pollution) ○ The vertical distance between the curves highlights the cost of the pollution. ○ Social planners who look after negative externalities wants to maximise market surplus, however need to take into account the costs associated with not only producing aluminium, but also the pollution that will occur as a result. ○ The amount needed to be chosen is where the demand curve intercepts the social-cost curve. (The new equilibrium) ● ● One way to achieve a desired outcome would be taxing the product, so to shift the supply curve upwards (to the left) This is referred to as internalizing an externality. 18 ● ● Production would taken into account pollution costs to determine how much to produce, the market price would reflect the tax and producers and aluminium consumers will want to buy less. Negative externalities lead markets to produce a larger quantity than socially desirable. Positive Externalities: ● Positive externalities are those which yield benefits on third parties, such as education (i.e leading to a more educated population) ● The diagram below illustrates how the ‘production’ of education affects society. ○ The social curve is above the demand curve. This is because the social value is better than the private value. ○ The amount needed to be chosen is where the demand curve intercepts the social-value curve. (The new equilibrium) ● ● In order to push consumers towards the new equilibrium (of the social-value curve), governments will ‘internalise the externality’ and subsidise things that prove beneficial to society, like education. Positive externalities lead markets to produce a smaller quantity than is socially desirable. Public Policies on Externalities: ● From the above information, it is evident that externalities lead to inefficiency in allocating resources in markets. ● These inefficiencies can be remedied by both public and private policymakers, who ultimately attempt to move the allocation of resources closer to the social optimum. ● Government solutions: ○ Command-and-control policies: ■ Regulates behaviour directly, either by requiring or forbidding activities. ■ This means benefits of pollution by companies would be outweighed by the external costs to society. The government therefore introduces a policy that prohibits the act altogether. ■ HOWEVER, banning ALL pollution would actually be unreasonable, as all forms of transport let out pollution. So to ensure that the policy is realistic the government might instead regulate, audit and monitor activities that may damage the environment. ■ Instead of instituting a ban of pollution altogether, a regulator may dictate a maximum level of pollution allowed to be emitted. ○ Market-based policy 1: Corrective taxes and subsidies: ■ Market based policies provide incentives so private decision makers can solve issues on their own. 19 ■ ○ Governments can choose to tax unfavourable activities and subsidies positive externalities. ■ Corrective taxes (or Pigovian taxes) are those which aim to correct effects of negative externalities. ■ Ideal corrective taxes and subsidies are equal to the external costs and benefits respectively of their activities. Market-based policy 2: Tradable Pollution Permits: ■ In essence, the passed agreement for one company to pollute more if the other pollutes less. The end result is still the same, with the same amount of pollution being produced. ■ In this, the scarce resource of pollution permits are being created, effectively developing a market governed by forces of supply and demand. ■ While corrective taxes require companies involved to pay taxes to the government, pollution permits are bought, however both are internalising the externality of pollution by ultimately increasing the cost to pollute. ■ The below diagram shows the similarities of the two policies: Private solutions: ● Externality issues can also be solved by societal moral codes, for example the general disapproval associated with littering. ● Greenpeace is a good example of a private solution, with the non-for-profit organisation funded by donations. ● Internalising activities are also one of the reasons some firms are in two different types of business. For example, if there were two businesses, a bee farm and an apple farm, it would make sense for them to rely on each other, as the bees pollinate the trees, and the trees feed the bees to then produce honey. If they do not communicate, however, the wrong number of bees / trees may be bought for each other, where there could otherwise have been a good reliance. It would here make sense for one company to own both the trees and the bees. ● Instead of one company owning both businesses in the tree / bee example above, it could also be an option to have a contract specifying how many trees and bees each company wants the other to have. The Coase Theorem: ● The Coase Theorem suggests that the private market is in fact very good in dealing with externalities. ● According to the theory, ‘If private parties can bargain without cost over the allocation of resources, then the private market will always solve the problem of externalities and allocate resources efficiently’. 20 ● ● ● For example, when considering a man who lives with a noisy dog and his neighbour, it is asked whether the man should have to send his dog away, or the neighbour suffer the noise. A social planner would have to consider which has more value - the man’s time with his dog, or the neighbours right to peace and quiet. The theorem claims the issue will amend itself. If the neighbour offers the man money to get rid of his dog, the man will have to decide whether the dog or money is worth more (if the money is greater than the benefit of keeping the dog). The bargaining over the price here will allow the two to reach an efficient outcome. Why private solutions do not always work: ● Private individuals, however, will often fail to resolve issues arisen from externalities. ● Failure can arise as a result of: ○ Transaction costs: ■ The costs associated with the bargaining between the two parties. ■ If the cost of solving an issue outweighs the benefit, the issue may not be resolved. ■ Higher bargaining costs may also see the deal deemed as unworthwhile. WEEK SEVEN STUVAC 21 WEEK EIGHT ● Tutorial 6 - Problems on Externalities ○ Case study #3 ○ Preparatory activities: Download and attempt tutorial questions and go through Case Study #3 ● ● Lecture 7 - Macroeconomics; Macro Variables: GDP and Price Indices Readings: ○ ● Principles of Economics, Chapter 24 and 25 (relevant pages) Assessments: ○ Online "News Analysis Microeconomics" is released at 11:45pm Friday, 4 May (due 11:45pm Thursday, 17 May). Gross Domestic Product: ● To judge whether a nation is doing well in the economy, we look at the total income made by everyone in the country. ● Measures BOTH the total income, and the total expenditure. This is because for an economy, income must equal expenditure. ● This is true, as all transactions consist of a buyer and seller, as any amount of money spent on an export, is also the same amount that whoever is exporting it will earn. ● GDP is: ○ The market value, meaning it measures the value of economic activity in one single value. ○ Measured within a certain period of time, usually a year or quarter. Even at a quarter, the reports usually show the GDP at an annual rate (multiplied by 4 for an estimation). 22 ○ ● ● Seasonal adjustment - unadjusted, it shows how some times of the year (i.e Christmas) produce more goods than others. The adjustment is made to take out the seasonal economic fluctuations. GDP includes: ○ All economic goods, the market value of housing services, etc. ○ GDP also only includes the value of final goods, not intermediate goods. (The price of an immediate good is already included in the price of the final good), however, there is an exception to this. If an intermediate good is added to a businesses inventory and sold at a later date rather than being used, it is counted as a ‘final’ product, and added to the GDP. When the intermediate good is eventually used, GDP for the later date is reduced accordingly. ○ Items are included in a country’s GDP if they are produced there, despite their nationality being different. GDP does not include: ○ Illicit goods (i.e illegal drugs), or items produced and consumed within the home (such as home grown veggies). ○ Second hand sales are not included in GDP, as GDP only includes items that have just been produced. ○ Gross national product (GNP) is the value of just the country’s permanent residents, therefore excluding income from foreigners. Real vs Nominal GDP: ● An increase in total spending from one year to the next is a result of either: ○ A larger output of goods / services in the economy, or ○ Higher prices for goods / services ● Real GDP: ○ Real GDP is used when economist choose to separate these two outcomes and measure the total quantity of goods / services produces that are not affected by changes in the price. ○ Real GDP looks for what the value of goods / services would be if the value was the same as previous years. ○ This shows how the overall production has changed over time. ○ Real GDP is not affected by changes in prices. ○ It shows how well the economy can satisfy people’s needs, and is a better option for gauging economic well being. ○ Growth in GDP refers to the growth using the percentage change in real GDP from earlier. ● Nominal GDP: ○ Nominal GDP uses current prices to value the production of goods and services. The GDP deflator: ● Measures current prices relative to the prices in the base year. ● Essentially lets us know the rise in nominal GDP attributable to a rise in prices rather than quantities produced. GDP and economic wellbeing: ● GDP tells us the average income and expenditure of an individual. ● While it is helpful, GDP is not a perfect measure of wellbeing due to some things being excluded (i.e leisure, the quality of the environment, volunteer work). ● It is important to note what is left out of GDP, as while it is a good measure of economic welfare, it does not measure everything. 23 The consumer price index: ● Overall cost of goods / services bought by a common citizen, with data collected each month by the ABS. ● Steps to calculating consumer price index: ○ Fix the basket - if one product in the economy is bought more than another, it should be given greater weight in measuring the cost of living. The basket of goods is the filled with the goods and services commonly bought by a customer. ○ Find the prices - Prices of the goods and services in the basket at each point in time need to be found. ○ Calculate the basket cost - The basket cost needs to be calculated at different times. ○ Choose a base year and calculate the index - Designate a base year (benchmark) to compare all other years to. The price of the basket goods is then divided by the price of the basket in the base year multiplied by 100. ○ Calculate the inflation rate - This is the percentage change in the price index from the previous period. Problems in measuring the cost of living: ● Measure of the aggregate price level in the economy. ● The index is there to measure changes in living costs, however there a few issues with this: ○ Substitution bias - prices changing between years is not done proportionately (some rise more than others), and buyers will buy less of the more expensive goods and more of the cheaper goods, but the index assumes a fixed basket of goods. ○ Introduction of new goods - consumers are given more variety when new products are released. Greater variety = more valuable dollars. This is not reflected, however, in the index which again relies on a fixed basket of goods. ○ Unmeasured quality change - The value of a dollar falls if a good deteriorates from one year to the next regardless of the actual price of the good. Quality rise also results in dollar rise. The ABS accounts for quality change by adjusting prices, however quality is hard to measure. The GDP deflator vs the Consumer price index: ● Both are monitored in order to gauge how quickly prices are rising. ● Differences between them: ○ GDP deflator reflects the prices of goods / services domestically produced, but the CPI reflects prices of goods / services bought by customers. ○ CPI compares a fixed basket of goods with that of the base year, while the GDP deflator automatically changes over time. Nominal and Real Interest rates: ● Interest rates always involve comparison between two points of time. ● Interest rates paid to the bank is called the nominal interest rate, while the one corrected for the sake of inflation is called the real interest rate. 24 WEEK NINE ● Tutorial 7 - Problems on Macroeconomics; Macro Variables: GDP and Price Indices; ○ Case study #4 ○ Preparatory activities: Download and attempt tutorial questions; Download and go through Case Study #4 ● Lecture 8 - Macroeconomic Problems; Unemployment; Inflation ● Readings: ○ Principles of Economics, Chapters 28 and 30 Assessments: ○ Online problem set "Assessed 4" is released at 11:45 pm Friday, 11 May (due 11:45 pm Thursday, 17 May). ● Measuring unemployment: ● Unemployment in Australia is measured by the ABS, who gain data and statistics on types of employment, average length of the working week, etc. ● This data is gathered from the Labour Force Survey, which regularly surveys a third of the population ages 15+. ● The survey also breaks down participants into three categories: ○ Employed ■ Is at a paid job for a least one hour a week. ○ Unemployed ■ Has to be actively looking for a job ○ Not in the labour force ■ Neither employed or unemployed. ● May 2016 Breakdown of the adult population in terms of the labour market: Key statistics for the labour market: 25 Unemployment: ● Limitations: ○ For society to be moving in and out of the labour force is a common occurrence, meaning statistics can sometimes be difficult to interpret for unemployment. ○ There are also limitation to the unemployment statistic, as some who consider themselves unemployed may be using this to gain difference government benefits. ○ Some may also try to find a job, however not be successful, who are then classified as discouraged workers, and do not show up in unemployment statistics. ● How long the unemployed go without work: ○ Short term unemployment isn’t a big issue, however long term unemployment can result in individuals suffering from economic shortage, psychological issues and skill deterioration. ○ This shows us that the longer the term of unemployment, the more costly it can become. ○ Research has also shown that those in unemployment are more likely to be long term than short term. Causes of unemployment: ● Although idealistically wages and worker skills would balance one another to create a perfect equilibrium in labour supplied and demanded, it does not always work this way. ● Frictional employment: ○ Unemployment experienced in between job hunting. This type of unemployment is short term for the individual, but long term for society as it is constantly present. ● Structural unemployment: ○ An occurrence resulting from mismatch between required skills and skills possessed by workers. Usually a longer term unemployment to account for the time taken to learn new skills required. ● Classical unemployment: ○ When the real wage in the labour market is above to market clearing level that equates supply of and demand for labour. Reasons for an above equilibrium wage include: ○ Minimum wage laws: ■ When a minimum-wage law forces up the wage, there is naturally more workers willing to work than there are companies willing to hire at the higher cost. 26 ■ ○ ○ Minimum wage laws are binding for last skilled members of the labour force, so it is for these individuals that unemployment can become an issue. If the wage is above the equilibrium, classical unemployment will occur. ■ Unions: ■ Not all markets use supply and demand for operation. Some will turn to negotiations between unions and employers. ■ Unions will use collective bargaining in order to agree on employment terms. ■ Union bargaining with firms will look at wanting higher wages and better benefits / working conditions. ■ Sometimes the result of the unions’ intervention will be the union raising the wage above the equilibrium level thus resulting in classical unemployment. Efficiency wages: ■ Efficiency wages refer to a company increases wages in order to motivate workers towards better performance, however since this method is essentially pushing the wages above their equilibrium, it can again result in classical unemployment. ■ Although raising wages may seem costly for businesses, it can actually prove to be more financially beneficial to the company if the efficiency increased in workers outweighs the cost used to motivate them. ■ This efficiency can be looked at in a few ways - specifically worker health, turnover, effort and quality. ■ Worker health - It is theorised that if a worker receives a higher wage, they will afford a more healthy lifestyle and therefore be more productive. ■ Worker turnover - where a lower worker turnover rate can increase profitability for a business, and reducing turnover can occur as a result of increased wages. ■ Worker effort - Higher paid workers are more likely to want to keep their jobs, and will therefore give their best effort. ■ Worker quality - A higher wage from the start of the hiring process will hopefully attract better quality workers to apply for the job. Inflation: ● The increase of prices in an economy. ● Indexes include CPI and GDP deflator. ● When inflation occurs at very high levels, it is referred to as hyperinflation ● Demand-pull inflation: ○ When agents plan to buy more goods and services that what is currently being produced in the economy. ● Cost-push inflation: ○ The total income that agents want to earn is greater than what they actually earn. 27 WEEK TEN ● ● ● ● Tutorial 8 - Problems on Macroeconomic Problems; Unemployment; Inflation ○ Preparatory activities: Download and attempt tutorial questions Lecture 9 - Aggregate Demand and Supply Model Readings ○ Principles of Economics, Chapter 33 Assessments: ○ Online problem set "Assessed 4" is due 11:45 Thursday, 17 May ○ Online problem set "Assessed 5" is released at 11:45pm on Friday, 18 May (due 11:45 pm Thursday, 24 May). Economic Fluctuations: ● Fluctuations are irregular and unpredictable ○ This is a result of changes in business conditions ○ GDP has a prime role in determining how much an economy fluctuates by, as well as if the outcome of economic activity is good or bad. ○ The business cycle highlights how business does well with a higher GDP ● Most macroeconomic quantities fluctuate together ○ When monitoring short-run fluctuations, any of the measures for economic activity can be used. ○ Usually, when one measure of economic activity falls, the other do too. ○ Although fluctuations occur together, however, they may fluctuate in different amounts. ● As output falls, unemployment rises ○ Essentially what this means is the fall of GDP will result in higher levels of unemployment. How the short run differs from the long run: ● Most analysis comes from the classical dichotomy and monetary neutrality. ● Classical dichotomy: ○ Separating variables into real variables and nominal variables ○ Changes in the money supply here do not have any impact on the real variables in the long run, however do have impact on the nominal variables. ○ In looking at this, it is commonly believed that the classical theory describes the world in the long run but not the short run, as it is only after a few years that changes n interest rates and prices and nominal variables will affect real GDP. ● Monetary nautrality: ○ This method is not appropriate when looking at year by year economical changes. ● Therefore both methods must be avoided when looking at the economy in terms of the short run. The basic model of economic fluctuations: ● When looking at the short run economy, we must look at the economy’s output of goods and services (measured by real GDP) as well as the inflation rate measured by the CPI or GDP deflator. ● Output is a real variable, inflation is nominal. ● Fluctuations are analysed using a model of aggregate demand and aggregate supply. ○ Vertical axis - the economy’s overall inflation rate ○ Horizontal axis - The economy's overall quantity of goods and services. ○ Demand curve - Quantity of goods and services demanded at an inflation rate ○ Supply curve - quantity of goods and services supplied at an inflation rate 28 ● Although the curve appears to be a large version of the supply and demand models, differences include: ○ The microeconomic substitution from one market to another isn’t possible when looking at the entire economy. The aggregate demand curve: ● Quantity demanded of goods / services in the economy at an inflation rate. ● Falls in inflation rates will result in higher output quantities. ● ● ● ● ● GDP = The sum of consumption + Investment + Purchases + Net Exports The interest rate effect: ○ If inflation reaches above 3%, interest rates are then increased. Lower inflation also results in lower interest rates, meaning better spending and increased demand for goods and services. The wealth effect: ○ When inflation falls, your money becomes more valuable as they can now be used on goods and services, meaning decreased inflation rates make consumers feel richer, and spend more, increasing the demand for goods and services. The exchange rate effect: ○ Because lower inflation rates mean lower interest rates, sometimes this results in higher returns sought overseas. If the interest rate on Australian government bond falls, a fund may choose to sell AUstralian bonds in favour of German bonds. Why the curve may shift: ○ If society feel concerns about retirement funds and reduce consumption. (shifts the curve to the left) ○ If faster technology is produced and firms invest in it. (curve shifts to the right) ○ If the government spends more on military equipment (demand curve shifts to the right) ○ We see that shifts occur as a result of both private behaviour and public policy. 29 The aggregate supply curve: ● Quantity supplied of goods / services in the economy at an inflation rate. ● The curve is vertical in the long run, but upward sloping in the short run. ● In the long run, quantity supplied of output is dependant on other quantities of capital, labour, etc, and therefore means that quantity supplied is not dependant on the overall inflation rate. The long run aggregate supply curve: ● The long-run supply curve shows how quantity of output (real variable) isn’t dependant on level of prices (nominal variable), showing how the vertical long-run curve is in compliance with classical dichotomy and monetary neutrality. ● Why the curve may shift: ○ The curve will shift with any economical change which alters the natural rate of output. ○ Increased economical capital stock will increase quantity supplied and shift the curve to the right. ○ The natural rate of unemployment also impacts the curve shift. If award wages were raised, the natural unemployment rate would rise and smaller quantities would be supplied, shifting the curve to the left. Short run aggregate supply: ● Why the curve is upward sloping in the short run: ○ In a small amount of time, price levels would generally raise the quantity supplied. ● Why the short run aggregate supply curve might shift: ○ Events that shift the long run curve generally shift the short run curve too ○ An increased economic capital stock would increase productivity in the long and short run, shifting the curve to the right 30 ○ Minimum wage increases rase the natural rate of unemployment in the long and short run, shifting the curve to the left. Theories: ● The new classical misperceptions theory: ○ Changes in the inflation rate can temporarily mislead market supplies. ○ This can result in supplies responded to price changes and show an upward sloping aggregate supply curve. ● The keynesian sticky-wage theory: ○ Slopes upwards as a result of slow adjustments to nominal wages in the short run. ○ This slow adjustment can affect long-term contracts. ● The new keynesian sticky-price theory: ○ Some goods and services also adjust sluggishly in response to changing economic conditions. ○ The slow adjustment is a result of costs that are incurred when adjusting prices (referred to as ‘menu costs’) Recession: ● If aggregate demand falls there is a left shift in the aggregate demand curve with less output. ● When recessions like this occur, we know that increased government spending would increase goods and services demanded and shift the demand curve to the right. Policymakers should act quickly to try and return the economy to its original state. ● The RBA could also reduce the cash rate to increase demand. ● Below are the effects of an aggregate demand fall: ● ● Increased production costs could also drive up prices and result in smaller quantities of output supplied. Stagflation - when the economy experiences both falling output (stagnation) and rising prices (inflation). 31 WEEK ELEVEN ● ● ● ● Tutorial 9: Problems on Macroeconomic Analysis; Aggregate Demand and Supply and Aggregate Supply Model ○ Preparatory activities: Download and attempt tutorial questions Lecture 10 - Monetary Policy and Fiscal Policy Readings: ○ Principles of Economics, Chapters 29 (relevant pages) and 34 Assessments: ○ Online problem set "Assessed 5" is due 11:45 pm on Thursday, 24 May. ○ Online problem set "Assessed 6" is released at 11:45pm on Friday, 25 May (due 11:45 pm on Thursday, 31 May). The Money Market: ● We are interested in two components of the money supply - currency and current deposits ● There are many other measures though, such as broad money and M3. ● Deposits at non financial institutions are included The Central Bank: ● The agency responsible for overseeing the financial system ● Reserve bank is independent of government and does not directly instruct government ● Reserve bank act however is amended as change passes due to changes in financial systems ● When the bank moves the cash rate, the treasurer steps in to congratulate any banks moving early. ● Prime roles of the bank: ○ Determining monetary policy ○ Guarantor of stability in the banking system Monetary policy: ● The bank has an inflation targeting objection - the target agreed to and put into place is a 2-3% band. It is not a tight band where as soon as it’s gone over 3% an intervention occurs, but rather when it is for a prolonged amount of time that inflation has stayed above 3%. ● High inflation results in an increase in interest rates, meaning lower inflation and output. Money market: ● Has characteristics similar to the supply and demand framework ● Here the good is that the money supply and price of money is interest rate ● Money supply is fixed and controlled by central bank ● Liquidity preference model - demand for money is an expression of holding a liquid asset (cash), and depending on people's expenditure, the demand for money will change ● Preference to hold money expressed in this model 32 Interest-rate effect: ● Assumption made ● Making the assumption that the price falls, and thus so does demand for money - shift to the left ● Same basket of goods requires less money Monetary policy and aggregate demand: Exchange settlement accounts: ● How central bank affects cash rate ● Accounts held by institution with reserve banks ● Used to settle transactions between banks ● Money in accounts - exchange settlement fund ● Price of these funds is called the cash rate ● When a bank settles a transaction is uses these accounts Fiscal policy: ● This is the government's ability to make choices regarding taxes or purchases ● The aggregate-demand curve directly shifts when purchases of goods and services are changes by the government ● The shift does not change by the exact amount of money, however, but rather differs gue to the multiplier effect, or the overcrowding effect. ● The multiplier effect: ○ Each dollar spent on a good or service can raise aggregate demand by more than just this dollar, as there are more repercussion from making a purchase than just the money directly associated with that purchase. ○ For example, when consumer spending rises, firms make more which they can then spend of more employees and goods which can lead to higher profits, which work to increase consumer spending. 33 ● The crowding out effect: ○ This effect works in the opposite way to the multiplier effect ○ It shows how increased purchases in goods and services can actually lead to increased inflation rates, which result in the RBA increase cash rates and subsequent higher interest rates too. ○ This can then reduce demand for goods and services, rather than raising it as suggested in the multiplier effect. Government budget: ● The difference between spending and revenue by the government 34 WEEK TWELVE ● ● ● ● Tutorial 10: Problems on Monetary Policy and Fiscal Policy; Case study #5 ○ Preparatory activities: Download and attempt tutorial questions; Download and go through Case Study #5 Lecture 11 - External Sector; Balance of Payments; Exchange Rates Reading: ○ Principles of Economics, Chapter 31 Assessments: ○ Online problem set "Assessed 6" is due 11:45 pm on Thursday, 31 May. ○ Online "News Analysis Macroeconomics" is released at 11:45 pm on Friday, 1 June (due 11:45 pm Thursday, 14 June). International flows of goods and services: ● Balance of trade - difference between imports and exports ● If exports are greater than import - trade surplus ● If imports are greater than exports - trade deficit ● Equal amount of imports as exports - balanced trade ● Drivers of import and exports include ○ Consumer taste ○ Price ○ Exchange rates ○ Government policies - some policies on the sorts of assets you can buy or how much foreign ownership is allowed ○ Cost of goods transportation ● We can see how a lot of the factors work together - i.e sometimes government policies include campaigns of buying of Australian made goods - this can influence preferences, imports and exchange rates ● ● Upward trend may be due to technology and represents the growing trend of importation and exportation Trade deficit represented here as imports are greater than exports The international flow of assets: ● Movements of money between two countries - specifically looking at financial and physical assets ● Capital inflow and capital outflow difference is reflected in the net foreign investment (NFI) ○ Capital outflow - money leaving australia in pursuit of overseas assets 35 ○ ○ ● ● Inflow -money coming in by purchasing domestic assets by foreigners here in Australia Measuring the types of foreign investments: ○ Foreign direct investment: ■ Has significant ownership lying in domestic residents ■ More long terms in characteristics ■ More ownership control ■ Requires long term planning ○ Foreign portfolio investment: ■ Reflective of lease control ■ If buying shares you’re potentially having smaller ownership NFI influencers: ○ Foreign financial assets / domestic financial assets interest rates ○ Interest rate differential = difference between interest rates on foreign financial assets and domestic financial assets ○ Return rates / dividend yields on foreign domestic shares ○ Exchange rates ■ Favourable rates may make products cheaper ■ Influences the prices ○ Economic / political risks ○ Government policies Balance of payments: ● Measuring money coming in and going out ● Current account: ○ Trade position ○ Exports and imports ○ Transfers recorded ● Capital account: ○ Measures financial transaction that take place between one country and another ○ Money coming in recorded as positive value ○ Money leaving record as negative value ● Two accounts offset one another ● What is represented as a negative value in one account is a positive value in another account Exchange rates: ● When paying for money of another currency, you are demanding money (affecting demand) ● Paying for these dollars is putting money into the foreign exchange market ● This also means the supply of your own currency is increasing ● Imports contribute to increase in supply ● Exchange rate rises are called appreciations, and falls are called depreciations ● Exchange rates are volatile with large fluctuations. ● Influencers of exchange rates: ○ World economy state ○ Australian economy state ○ Relative inflation rates ○ Interest rate differentials ○ 36 ● ● ● ● Supply sources: ○ Good and service importation ○ Income payments to o verseas ○ Purchasing foreign assets (financial capital outflow) ○ Central bank sales of australian dollars Demand sources: ○ Exports ○ Overseas income payments (coming from overseas) ○ Inflows of financial capital ○ Purchases of Australian dollars by the Central bank Equilibrium exchange rate: Disequilibria can occur as a result of two different possibilities: ○ Competition between sellers (suppliers): ■ Above equilibrium exchange rate means excess supply leads to competition between suppliers ■ They will lower the price to compete and get business ■ This means demand for currency increases, as because u move closer to equilibrium, demand increases ■ Lower exchange rate is more favourable ○ Competition between buyers (demanders) 37 WEEK THIRTEEN ● ● ● Tutorial 11: Problems on External Sector; Balance of Payments; Exchange Rates; Case study #6 ○ Preparatory activities: Download and attempt tutorial questions; Download and go through Case Study #6 Lecture: Revision Session (Lecturers will either offer a revision class or make themselves available for consultation). Assessments: No assessment is due/released this week. 38