Hansen F (412416180) - Enron The Smartest Guys in the Room

advertisement

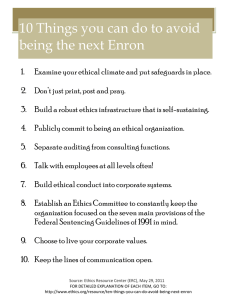

Hansen Feriandy 許瀚昇 (412416180) Enron The Smartest Guys in the Room The Enron scandal, as portrayed in the documentary "Enron: The Smartest Guys in the Room," represents a seminal event in corporate history, replete with a complex interplay of legal and ethical issues that reverberated throughout the financial world. This discussion will provide a comprehensive analysis of the Enron case, dissecting the core legal and ethical concerns it raised: • Accounting Fraud: Central to the Enron debacle was an elaborate accounting fraud. Enron's leadership, in connivance with its auditors from Arthur Andersen, orchestrated an intricate web of financial deception. This stratagem leveraged special purpose entities (SPEs) and off-balance sheet accounting methods to conceal an astronomical sum of debt while concurrently inflating reported profits. These actions flagrantly contravened securities laws, notably the Securities Exchange Act, and fundamentally undermined the principles of faithful financial reporting. This intricate subterfuge embodied a callous disregard for the ethical imperative of truthful and transparent financial disclosure. The consequences were dire as investors, the public, and even Enron's own employees were misled, suffering severe financial losses. • Insider Trading: Enron insiders, including high-ranking executives such as Kenneth Lay and Jeffrey Skilling, were embroiled in insider trading. They executed the sale of their Enron shares while concurrently promoting the stock to employees and the general public. This occurred while they were cognizant of the corporation's precarious financial precipice. Insider trading of this nature is not only illegal but also embodies a profound ethical breach. It constitutes a betrayal of trust, as these insiders exploited their privileged positions for personal gain, causing substantial financial harm to investors and employees who were financially devastated by the subsequent collapse. • Lack of Transparency: The core of the Enron scandal also lay in its persistent lack of transparency. The convoluted financial structures, transactions, and a labyrinthine corporate structure obscured the actual financial health of the company. The opacity of Enron's financial reporting violated both the letter and spirit of generally accepted accounting principles (GAAP). This dearth of transparency, both from a legal and ethical standpoint, deprived investors of the critical information required to make informed decisions and concealed the company's colossal debt. • Corporate Governance: The Enron case served as a poignant illustration of corporate governance failures. The board of directors at Enron was beset by conflicts of interest and a paucity of independent oversight. This scenario raises profound ethical concerns surrounding the effectiveness of corporate governance and the board's fiduciary responsibility to shareholders. The directors' lack of vigilance permitted unchecked misconduct within the organization. • Employee Deception: Enron's management actively encouraged employees to invest their retirement savings in Enron stock, which ultimately plummeted to worthlessness. This was not merely a legal violation; it represented an egregious ethical breach. Employees reposed trust in their leadership with their financial futures, and this trust was grievously betrayed as they lost their life savings. Hansen Feriandy 許瀚昇 (412416180) • Regulatory Failures: Regulatory agencies, most notably the Securities and Exchange Commission (SEC), were sluggish in detecting and reacting to the issues at Enron. This gave rise to concerns regarding the efficacy of regulatory oversight and the capacity of these agencies to safeguard investor interests. These regulatory lapses underscore the necessity for reforms that would bolster their capacity to identify and counter corporate malfeasance effectively. • Toxic Corporate Culture: The Enron corporate culture was imbued with an insatiable quest for short-term profits, often at the expense of ethical behavior and long-term sustainability. It was encapsulated in slogans such as "rank and yank," which cultivated intense internal competition among employees. The absence of ethical values and accountability at the highest echelons of the company engendered an environment in which fraudulent practices were not only condoned but, at times, even encouraged. The ramifications of the Enron scandal were profound. It precipitated significant changes in corporate governance and accounting regulations, notably the Sarbanes-Oxley Act, which sought to bolster corporate accountability and transparency. Additionally, the scandal led to the dissolution of Arthur Andersen, one of the "Big Five" accounting firms of the time. The Enron case serves as an indelible reminder of the fundamental imperatives of ethics, transparency, and accountability within the corporate sphere. It underscores the pivotal role of regulators in safeguarding the interests of investors and the public. The lessons derived from this episode remain salient as they continue to inform regulatory and ethical practices within the contemporary business environment.