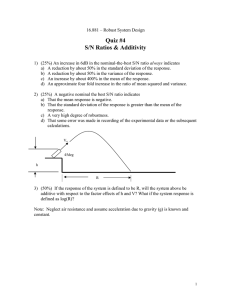

Chapter 6: The Meaning and Measurement of Risk and Return *Expected Return Defined and Measured:Holding-period return HPR (historical or realized rate of return): the rate of return earned on an investment, which equals the dollar gain divided by the amount invested. والذي يساوي الرب ح، معدل العائد المكتسب على االستثمار:)عائد فترة االحتفاظ (معدل العائد التاريخي أو المحقق .بالدوالر مقسوما على المبلغ المستثمر فيه We can formalize the return calculations using equations (6-1) and (6-2): Holding-period dollar gain would be: Note: It’s not requirement that dividend to have value, maybe equal zero. So if D=0 HPR = (End. Price ÷ Beg. Price) - 1 Example: find holding period rate of return for each following: Stock A B C End. Price 4 3 2 Beg. Price 4.3 3.1 1.9 Dividend 0 1 0 Solution: HPR(A)= (4 ÷ 4.3) - 1 or (4 - 4.3 + 0) ÷ 4.3 = -0.069 loss. HPR(B)= (3 - 3.1 + 1) ÷ 3.1 = 0.29 gain. HPR(C)= (2 ÷ 1.9) - 1 or (2 - 1.9 + 0) ÷ 1.9 = 0.053 gain. Expected rate of return: the arithmetic mean or average of all possible outcomes where those outcomes are weighted by the probability that each will occur. المتوسط الحسابي أو المتوسط لجميع النتائج المحتملة حيث يتم ترجيح هذه النتائج:معدل العائد المتوقع .باحتمال حدوث كل منها To illustrate, assume you are considering an investment costing $10,000, for which the future cash flows from owning the security depend on the state of the economy, as estimated in Table 6-1. OR: Expected cash flow = ∑ (Pb × CF) For the present illustration: Expected cash flow = (0.2×$1,000) + (0.3×$1,200) + (0.5×$1,400) = $1,260 Rate of return = (cash flow ÷ investment cost) Example:20% 30% 50% Machine cost $5,000 350 500 1,500 Find: Expected future cash flow and expected rate of return. Solution: Expected CF = ∑ ( Pb × CF ) Expected CF = ( 20% × 350 ) + ( 30% × 500 ) + ( 50% × 1,500 ) Expected CF = 70 + 150 + 750 Expected CF = $970 Expected rate of return: 1) ( 350 ÷ 5,000 ) × 20% = 0.07 × 0.2 = 0.014 2) ( 500 ÷ 5,000 ) × 30% = 0.1 × 0.3 = 0.03 3) ( 1,500 ÷ 5,000 ) × 50% = 0.3 × 0.5 = 0.15 Expected rate of return= ∑ (rate of return × Pb)= ∑ ((CF ÷ investment cost) × Pb) Expected rate of return = 0.014 + 0.03 + 0.15 = 0.194 Can you do it? page224: You are contemplating making a $5,000 investment that would have the following possible outcomes in cash flow each year. What is the expected value of the future cash flows and the expected rate of return? Solution: Expected value of future cash flow= ∑ ( Pb × CF ) Expected value of future cash flow= (350 × 0.3) + (625 × 0.5) + (900 × 0.2) Expected value of future cash flow= 105 + 312.5 + 180 Expected value of future cash flow= $597.5 Expected rate of return= ∑ ((CF ÷ investment cost) × Pb) Expected rate of return= ((350 ÷ 5,000) × 0.3) + ((625 ÷ 5,000) × 0.5) + ((900 ÷ 5,000) × 0.2) Expected rate of return= (0.07 × 0.3) + (0.125 × 0.5) + (0.18 × 0.2) Expected rate of return= 0.021 + 0.0625 + 0.036 Expected rate of return= 0.1195 or 11.95% *Risk defined and measured:Risk: potential variability in future cash flows. . التقلبات المحتملة في التدفقات النقدية المستقبلية:المخاطرة Standard deviation (σ): a statistical measure of the spread of a probability distribution calculated by squaring the difference between each outcome and its expected value, weighting each value by its probability, summing over all possible outcomes, and taking the square root of this sum. مقياس إحصائي النتشار التوزي ع االحتمالي المحسوب عن طريق تربيع الفرق بين كل نتيجة:)σ( االنحراف المعياري وأخذ الجذر التربيعي لهذا، وجمع جميع النتائج الممكنة، وترجيح كل قيمة حسب احتمالها، وقيمتها المتوقعة .المجموع 2 Variance= (standard deviation) For the case where there are n possible returns (that is, states of the economy), we calculate the variance as follows: We calculate the standard deviation using the following five-step procedure: Step 1: Calculate the expected rate of return of the investment. Step 2: Subtract the expected rate of return from each of the possible rates of return and square the difference. Step 3: Multiply the squared differences calculated in step 2 by the probability that those outcomes will occur. Step 4: Sum all the values calculated in step 3 together. The sum is the variance of the distribution of possible rates of return. Variance: is actually the average squared difference between the possible rates of return and the expected rate of return. . هو في الواقع متوسط الفرق التربيعي بين معدالت العائد المحتملة ومعدل العائد المتوقع:التباين Step 5: Take the square root of the variance calculated in step 4 to calculate the standard deviation of the distribution of possible rates of return. To illustrate by example: Can you do it? Page 228: In the preceding “Can You Do It?” on page 224, we computed the expected cash flow of $597.50 and the expected return of 12 percent on a $5,000 investment. Now let’s calculate the standard deviation of the returns. The probabilities of possible returns are given as follows: r 7% 12.5% 18% Total r 12% 12% 12% ( r - r ) ( r - r )2 -5% 0.0025 0.5% 0.000025 6% 0.0036 Pb 0.3 0.5 0.2 ( r - r )2 × Pb 0.00075 0.0000125 0.00072 0.14825% Standard deviation = 0.0385 or 3.85% Note: Return Return Risk So Risk Risk So Risk Variance & Satandard deviation . Variance & standard deviation . Example 6.1: page 230:You are considering two investments, X and Y. The distributions of possible returns are shown below: Compute the expected return and standard deviation for each investment. Would you have a preference for one investment over the other if you were making the decision? Solution: Expected return for Investment X: Return (r) -10% 5% 20% 30% 40% Total Probability (Pb) 0.05 0.25 0.40 0.25 0.05 Expected return (r) = r × Pb -0.005 0.0125 0.08 0.075 0.02 0.1825 or 18.25% Expected return for Investment Y: Return (r) 0% 5% 16% 24% 32% Total Probability (Pb) 0.05 0.25 0.40 0.25 0.05 Expected return (r) = r × Pb 0 0.0125 0.064 0.06 0.016 0.1525 or 15.25% Variance for Investment X: r -10% 5% 20% 30% 40% Total r 18.25% 18.25% 18.25% 18.25% 18.25% (r-r) ( r - r )2 -28.25% 0.0798 -13.25% 0.01756 1.75% 0.000306 11.75% 0.013806 21.75% 0.047306 Pb 0.05 0.25 0.40 0.25 0.05 ( r - r )2× Pb 0.00399 0.00439 0.0001224 0.0034515 0.0023653 0.01432 Standard deviation = 0.11966 or 11.966% Pb 0.05 0.25 0.40 0.25 0.05 ( r - r )2× Pb 0.001163 0.002628 0.0000624 0.001914 0.0014028 0.00717 Standard deviation = 0.0846 or 8.46% Variance for Investment Y: r 0% 5% 16% 24% 32% Total r 15.25% 15.25% 15.25% 15.25% 15.25% (r-r) ( r - r )2 -15.25% 0.02326 -10.25% 0.01051 1.25% 0.000156 8.75% 0.007656 16.75% 0.028056 In this case, you will have to take on more risk if you want additional expected return. (There is no money tree.) Thus, the choice depends on the investor’s preference for risk and return. There is no single right answer. يعني الموضوع يعود لتفضيل المستثمر Risk and Diversification: المخاطر والتنوع We can divide the total risk (total variability) of our portfolio into two types of risk: (1) company-unique risk, or unsystematic risk. (2) market risk, or systematic risk. Unsystematic risk (companyunique risk or diversifiable risk): the risk related to an investment return that can be eliminated through diversification. Unsystematic risk is the result of factors that are unique to the particular firm. Also called companyunique risk or diversifiable risk. المخاطر المتعلقة بعائد االستثمار:)المخاطر غير المنتظمة (مخاطر الشركة الفريدة أو المخاطر القابلة للتنوي ع . المخاطر غير المنتظمة هي نتيجة لعوامل فريدة من نوعها لشركة معينة.الذي يمكن القضاء عليه من خالل التنوي ع .وتسمى أيضا مخاطر الشركة الفريدة أو المخاطر القابلة للتنوي ع Systematic risk (market risk or nondiversifiable risk): (1) the risk related to an investment return that cannot be eliminated through diversification. Systematic risk results from factors that affect all stocks. Also called market risk or nondiversifiable risk. (2) The risk of a project from the viewpoint of a well-diversified shareholder. This measure takes into account that some of the project’s risk will be diversified away as the project is combined with the firm’s other projects, and, in addition, some of the remaining risk will be diversified away by shareholders as they combine this stock with other stocks in their portfolios. ) المخاطر المتعلقة بعائد االستثمار الذي1( :)المخاطر المنهجية (مخاطر السوق أو المخاطر غير القابلة للتنوي ع وتسمى. تنتج المخاطر المنهجية عن العوامل التي تؤثر على جميع األسهم.ال يمكن القضاء عليه من خالل التنوي ع .) مخاطر المشروع من وجهة نظر مساهم متنوع بشكل جيد2( .أيضا مخاطر السوق أو المخاطر غير القابلة للتنوي ع يأخذ هذا اإلجراء في االعتبار أن بعض مخاطر المشروع سيتم تنويعها بعيدا حيث يتم دمج المشروع مع مشاري ع سيتم تنوي ع بعض المخاطر المتبقية بعيدا من قبل المساهمين حيث يقومون، باإلضافة إلى ذلك، الشركة األخرى .بدمج هذا السهم مع األسهم األخرى في محافظهم االستثمارية Measuring Market Risk:- . إذا كانت موجودة نفس القانون ّأول التشابتر، بالقانون ألنه التوزيعات سنوية والقانون شهريdividends ال يوجد For instance, the holding-period returns for eBay and the S&P 500 Index for June 2014 are computed as follows: eBay return= (stock price at end of June 2014 ÷ stock price at end of May 2014) – 1 = ($50.06 ÷ $50.73) - 1 = -0.0132 = -1.32% S&P 500 Index return= (index value at end of June 2014 ÷ index value at end of May 2014) – 1 = ($1,960 ÷ $1,924) - 1 = 0.0187 = 1.87% The Average holding-period return is found by summing the returns and dividing by the number of months; that is, and the standard deviation is computed as follows: Characteristic line: the line of “best fit” through a series of returns for a firm’s stock relative to the market’s returns. The slope of the line, frequently called beta, represents the average movement of the firm’s stock returns in response to a movement in the market’s returns. ، يمثل ميل الخط. خط "األنسب" من خالل سلسلة من العوائد لسهم الشركة بالنسبة لعوائد السوق:خط مميز . متوسط حركة عوائد أسهم الشركة استجابة لحركة عوائد السوق، الذي يطلق عليه غالبا بيتا Beta: the relationship between an investment’s returns and the market’s returns. This is a measure of the investment’s nondiversifiable risk. . هذا مقياس لمخاطر االستثمار غير القابلة للتنوي ع. العالقة بين عوائد االستثمار وعوائد السوق:بيتا