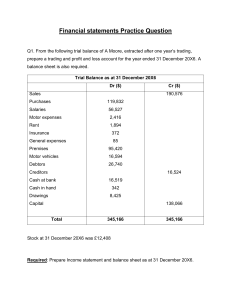

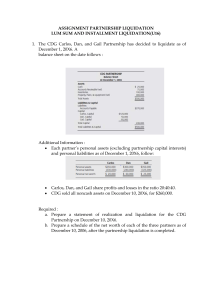

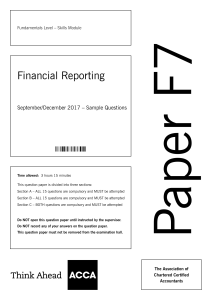

ACCA Revision Question Bank Financial Reporting For Examinations from September 2017 to June 2018 F7 Becker Professional Education, a global leader in professional education, has been developing study materials for the ACCA for more than 20 years. Thousands of students studying for the ACCA Qualification have succeeded in their professional examinations studying with its Platinum and Gold ALP training centers in Central and Eastern Europe and Central Asia. Nearly half a million professionals have advanced their careers through Becker Professional Education's courses. Throughout its 60-year history, Becker has earned a strong track record of student success through world-class teaching, curriculum and learning tools. Becker Professional Education has been awarded ACCA Approved Content Provider Status for its ACCA materials, as well as materials for the Diploma in International Financial Reporting (DipIFR). We provide a single solution for individuals and companies in need of global accounting certifications and continuing professional education. Becker Professional Education's ACCA Study Materials All of Becker’s materials are authored by experienced ACCA lecturers and are used in the delivery of classroom courses. Study Text: Gives complete coverage of the syllabus with a focus on learning outcomes. It is designed to be used both as a reference text and as part of integrated study. It also includes the ACCA Syllabus and Study Guide, exam advice and commentaries and a Study Question Bank containing practice questions relating to each topic covered. Revision Question Bank: Exam style and standard questions together with comprehensive answers to support and prepare students for their exams. The Revision Question Bank also includes past examination questions (updated where relevant), model answers and alternative solutions and tutorial notes. Revision Essentials Handbook*: A condensed, easy-to-use aid to revision containing essential technical content and exam guidance. *Revision Essentials Handbook are substantially derived from content reviewed by ACCA’s examining team. ACCA F7 FINANCIAL REPORTING REVISION QUESTION BANK For Examinations from September 2017 to June 2018 ® ©2017 DeVry/Becker Educational Development Corp. All rights reserved. (i) No responsibility for loss occasioned to any person acting or refraining from action as a result of any material in this publication can be accepted by the author, editor or publisher. This training material has been prepared and published by Becker Professional Development International Limited: www.becker.com/acca Copyright ©2017 DeVry/Becker Educational Development Corp. All rights reserved. The trademarks used herein are owned by DeVry/Becker Educational Development Corp. or their respective owners and may not be used without permission from the owner. No part of this training material may be translated, reprinted or reproduced or utilised in any form either in whole or in part or by any electronic, mechanical or other means, now known or hereafter invented, including photocopying and recording, or in any information storage and retrieval system without express written permission. Request for permission or further information should be addressed to the Permissions Department, DeVry/Becker Educational Development Corp. Acknowledgement Past ACCA examination questions are the copyright of the Association of Chartered Certified Accountants and have been reproduced by kind permission. (ii) ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) CONTENTS Question Page Answer Marks Date worked 1 2 5 7 9 12 16 18 19 20 21 1001 1001 1002 1003 1003 1004 1005 1006 1007 1007 1007 14 24 18 12 22 28 16 10 10 10 18 23 25 27 1008 1009 1010 12 14 12 29 31 33 34 37 39 43 46 48 50 52 53 57 1011 1011 1012 1013 1014 1014 1016 1017 1019 1019 1020 1021 1022 16 12 10 18 12 30 18 22 14 10 14 24 22 OBJECTIVE TEST QUESTIONS1 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 International Financial Reporting Standards Conceptual Framework IAS 1 Presentation of Financial Statements Accounting Policies IFRS 15 Revenue from Contracts with Customers Inventory and Biological Assets IAS 16 Property, Plant and Equipment IAS 23 Borrowing Costs Government Grants IAS 40 Investment Property IAS 38 Intangible Assets Non-current Assets Held for Sale and Discontinued Operations IAS 36 Impairment of Assets IFRS 16 Leases IAS 37 Provisions, Contingent Liabilities and Contingent Assets IAS 10 Events after the Reporting Period IAS 12 Income Taxes Financial Instruments Conceptual Principles of Groups Consolidated Statement of Financial Position Consolidation Adjustments Consolidated Statement of Comprehensive Income Investments in Associates Foreign Currency transactions Analysis and Interpretation IAS 7 Statement of Cash Flows IAS 33 Earnings per Share As shown by the Specimen Examination Section B will include “objective test case” questions of 10 marks each and Section C will include 20 mark constructed response (“long”) questions. Additional useful question practice on examinable topics that is not exam style is indicated (*). 1 All OT questions are 2 marks each. ©2017 DeVry/Becker Educational Development Corp. All rights reserved. (iii) FINANCIAL REPORTING (F7) – REVISION QUESTION BANK Question Page Answer Marks Date worked 60 1024 10 61 63 64 66 67 1024 1026 1029 1032 1035 20 20 20 20 20 69 1037 10 70 71 1038 1038 10 15 72 74 1040 1040 10 10 75 76 1041 1041 10 15 78 1043 10 79 81 1044 1044 10 10 82 1045 10 83 1045 10 CONCEPTUAL FRAMEWORK 1 Wardle (ACCA J10 adapted **) IAS 1 PRESENTATION OF FINANCIAL STATEMENTS 2 3 4 5 6 Dexon (ACCA J08 adapted) Sandown (ACCA D09 adapted) Cavern (ACCA D10 adapted) Fresco (ACCA J12 adapted) Atlas (ACCA J13 adapted) ACCOUNTING POLICIES 7 Emerald (ACCA D07 adapted **) IFRS 15 REVENUE FROM CONTRACTS WITH CUSTOMERS 8 9* Derringdo (ACCA J03 adapted **) Linnet (ACCA J04) IAS 16 PROPERTY, PLANT AND EQUIPMENT 10 11 Dearing (ACCA D08 adapted **) Shawler (ACCA D12 adapted **) IAS 38 INTANGIBLE ASSETS 12 13 Dexterity (ACCA J04 adapted **) Darby (ACCA D09) IAS 36 IMPAIRMENT OF ASSETS 14 ESP (ACCA J12 adapted **) IAS 37 PROVISIONS 15 16 Borough (ACCA D11 adapted **) Radar (ACCA J13 adapted **) IAS 10 EVENTS AFTER THE REPORTING PERIOD 17 Waxwork (ACCA J09 adapted **) FINANCIAL INSTRUMENTS 18 Pingway (ACCA J08 adapted **) ** These are in the style of “OT-case” questions that now feature in Section B of the examination. (iv) ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) Question Page Answer Marks Date worked 85 86 87 89 90 92 93 1046 1048 1050 1052 1054 1055 1056 20 20 20 20 20 10 20 95 1058 10 96 98 101 103 105 107 1059 1061 1065 1067 1069 1071 20 20 20 20 20 10 110 112 114 116 1072 1074 1076 1079 20 20 20 20 118 119 1082 1082 10 10 121 122 124 126 128 1083 1084 1084 1085 1086 10 10 10 10 10 CONSOLIDATED FINANCIAL STATEMENTS 19 20 21 22 23 24 25 Patronic (ACCA J08 adapted) Pedantic (ACCA D08) Pandar (ACCA D09 adapted) Prodigal (ACCA J11 adapted) Viagem (ACCA D12 adapted) Paradigm (ACCA J13 adapted **) Polestar (ACCA D13 adapted) FOREIGN CURRENCY TRANSACTIONS 26 Rangoon ** ANALYSIS AND INTERPRETATION 27 28 29 30 31 32 Witton Way Iona Harbin (ACCA D07 adapted) Victular (ACCA D08 adapted) Hardy (ACCA D10) Quartile (ACCA D12 adapted **) IAS 7 STATEMENT OF CASH FLOWS 33 34 35 36 Crosswire (ACCA D09 adapted) Morocco (ACCA J12 adapted) Monty (ACCA J13 adapted) Kingdom (ACCA D13 adapted) IAS 33 EARNINGS PER SHARE 37 38 Savoir (ACCA J06 adapted **) Rebound (ACCA J11 adapted **) COMPOSITE IFRS QUESTIONS 39 40 41 42 43 Errsea (ACCA J07 adapted **) Skeptic (ACCA J14 adapted **) Candy (ACCA J14 adapted **) Moston (ACCA D15 adapted **) Noston (ACCA D15 adapted **) ©2017 DeVry/Becker Educational Development Corp. All rights reserved. (v) FINANCIAL REPORTING (F7) – REVISION QUESTION BANK Question Page Answer Marks Date worked 130 1087 30 135 137 138 1088 1088 1088 10 10 10 140 141 1090 1092 20 20 144 1095 30 149 150 152 1096 1096 1097 10 10 10 153 155 1097 1100 20 20 2 19 30 6 8 10 20 20 20 10 10 10 12 14 21 22 25 20 20 Specimen Exam (applicable from September 2016) Section A Section B 16-20 21-25 26-30 Section C 31 32 15 Objective Test (OT) Questions “OT case” Questions Telepath Neutron Speculate “Constructed response” questions Kandy Tangier September 2016 Exam Section A Section B 16-20 21-25 26-30 Section C 31 32 15 Objective Test (OT) Questions “OT case” Questions Aphrodite Blocks (adapted) Mighty IT “Constructed response” questions Triage Gregory December 2016 Exam Section A 15 Objective Test (OT) Questions Section B “OT case” Questions 16-20 Artem 21-25 Maykorn 26-30 Vitrion Section C “Constructed response” questions 31 Laurel 32 Landing Marking scheme OBJECTIVE TEST QUESTION PRACTICE FOR COMPUTER BASED EXAMINATIONS This section includes OT question types that will appear only in a computer-based exam, but provides valuable practice for all students whichever version of the exam they are sitting. (vi) ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) 1 INTERNATIONAL FINANCIAL REPORTING STANDARDS 1.1 Which ONE of the following is NOT a function of the IASB? A B C D 1.2 Which ONE of the following is NOT part of the process of developing a new International Financial Reporting Standard? A B C D 1.3 IASB IFRS Foundation IFRS IC IFRS Advisory Council According to the International Accounting Standards Board, in whose interests are financial reporting standards issued? A B C D 1.6 Management of an entity IASB Primary users of financial statements Local stock exchange Which body develops International Financial Reporting Standards? A B C D 1.5 Issuing a discussion paper that sets out the possible options for a new standard Publishing clarification of an IFRS where conflicting interpretations have developed Drafting an IFRS for public comment Analysing the feedback received on a discussion paper Whose needs are general purpose financial statements intended to meet? A B C D 1.4 Responsibility for all IFRS technical matters Publication of IFRSs Overall supervisory body of the IFRS organisations Final approval of interpretations by the IFRS Interpretations Committee Company directors The public Company auditors The government The issue of a new IFRS means that: (1) (2) (3) (4) An existing standard may be partially or completely withdrawn Issues that are not covered by an existing standard are introduced Issues raised by users of existing standards are explained and clarified Current financial reporting practice is modified Which combination of the above will most likely be the result of issuing a new IFRS? A B C D 1, 2 and 3 2, 3 and 4 1, 3 and 4 1, 2 and 4 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 1 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK 1.7 IFRS requirements would be most relevant to the financial statements of which of the following entities? A B C D An association established by royal charter A charitable trust A community benefit society A limited liability partnership (14 marks) 2 CONCEPTUAL FRAMEWORK 2.1 Which ONE of the following is stated as an underlying assumption according to the IASB’s Conceptual Framework for Financial Reporting? A B C D 2.2 Neutrality Accruals Relevance Going concern The IASB uses the Conceptual Framework for Financial Reporting (Framework) to assist in developing new standards. Which one of the following is NOT covered by the Framework? A B C D 2.3 The format of financial statements The objective of financial statements Concepts of capital maintenance The elements of financial statements An item meets the definition of an element in accordance with the Conceptual Framework for Financial Reporting. Which of the following criteria must be met for an item to be recognised in the financial statements? 2.4**1 1 2 (1) It is probable that any future economic benefit associated with the item will flow to or from the entity (2) The item has a cost or value that can be measured with reliability (3) The rights or obligations associated with the item are controlled by the entity A B C D 1 only 2 only 1 and 2 only 1, 2 and 3 Which of the following statements regarding financial information are correct? (1) Faithful representation means that the legal form of a transaction must be reflected in financial statements, regardless of the economic substance (2) Under the recognition concept only items capable of being measured in monetary terms can be recognised in financial statements (3) It may sometimes be necessary to exclude information that is relevant and reliable from financial statements because it is too difficult for some users to understand Questions highlighted ** are also presented at the end of this Revision Question Bank in the OT Question Practice for CBEs section. ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) A B C D 2.5 2.6 1 only 2 only 1 and 2 only 1, 2 and 3 Which of the following statements are correct? (1) The money measurement concept requires all assets and liabilities to be accounted for at original (historical) cost (2) Faithful representation means that the economic substance of a transaction should be reflected in the financial statements, not necessarily its legal form (3) The realisation concept means that profits or gains cannot normally be recognised in the statement of profit or loss until cash has been received A B C D 1 and 2 only 1 and 3 only 2 and 3 only 1, 2 and 3 IFRS 13 Fair Value Measurement sets out a fair value hierarchy that categorises inputs into three levels. Which of the following inputs would have the highest authority? A B C D 2.7 Unobservable inputs Directly observable inputs other than quoted prices Quoted prices in active markets at the measurement date Market-corroborated inputs The IASB’s Conceptual Framework for Financial Reporting identifies qualitative characteristics of financial statements. Which TWO of the following characteristics are fundamental qualitative characteristics according to the IASB’s Framework? 2.8 (1) (2) (3) (4) Relevance Understandability Faithful representation Comparability A B C D 1 and 2 1 and 3 2 and 4 3 and 4 Which of the following is the underlying assumption in the International Accounting Standards Board’s Conceptual Framework for Financial Reporting? A B C D Accruals Reliability Going concern Relevance ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 3 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK 2.9** On 31 December 20X3 Tenby sold $100,000 trade receivables to a debt factor, for $90,000. If the factor has not collected the debt by 28 February 20X4 it can be returned to Tenby. What is the current asset for the trade receivables in Tenby’s statement of financial position as at 31 December 20X3? A B C D 2.10 $nil $10,000 $90,000 $100,000 Although most items in financial statements are shown at their historical cost, increasingly the IASB is requiring or allowing current cost to be used in many areas of financial reporting. Drexler acquired an item of plant on 1 October 20X2 at a cost of $500,000. It has an expected life of five years (straight-line depreciation) and an estimated residual value of 10% of its historical cost or current cost as appropriate. As at 30 September 20X4, the manufacturer of the plant still makes the same item of plant and its current price is $600,000. What is the correct carrying amount to be shown in the statement of financial position of Drexler as at 30 September 20X4 under historical cost and current cost? A B C D 2.11 Historical cost $ 320,000 320,000 300,000 300,000 Current cost $ 600,000 384,000 600,000 384,000 Recognition is the process of including within the financial statements items which meet the definition of an element in the IASB’s Conceptual Framework for Financial Reporting. Which of the following items should be recognised as an asset in the statement of financial position of a company? 2.12 A A skilled and efficient workforce which has been very expensive to train. Some of these staff are still in the employment of the company B A highly lucrative contract signed during the year which is due to commence shortly after the year end C A government grant relating to the purchase of an item of plant several years ago which has a remaining life of four years D A receivable from a customer which has been sold (factored) to a finance company. The finance company has full recourse to the company for any losses Comparability is identified as an enhancing qualitative characteristic in the IASB’s Conceptual framework for financial reporting. Which of the following does NOT improve comparability? 4 A Restating the financial statements of previous years when there has been a change of accounting policy B Prohibiting changes of accounting policy unless required by an IFRS or to give more relevant and reliable information C Disclosing discontinued operations in financial statements D Applying an entity’s current accounting policy to a transaction which an entity has not engaged in before (24 marks) ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) 3 IAS 1 PRESENTATION OF FINANCIAL STATEMENTS 3.1 XYZ decided to change its reporting date which will result in a 15-month reporting period. Which of the following two items must be disclosed in accordance with IAS 1 Presentation of Financial Statements? 3.2 3.3 (1) The reason for the period being longer than 12 months (2) A statement that similar entities have also changed their accounting period (3) A statement that comparative amounts used in the financial statements are not entirely comparable (4) Whether the change is just for the current period or for the foreseeable future A B C D 1 and 2 1 and 3 2 and 4 3 and 4 Which of the following disclosures are specifically required by IAS 1 Presentation of Financial Statements? (1) (2) (3) (4) The name of the reporting entity or other means of identification The names of all major shareholders The level of rounding used in presenting amounts in the financial statements Whether the financial statements cover the individual entity or a group of entities A B C D 2, 3 and 4 1, 3 and 4 1, 2 and 4 1, 2 and 3 Which item must be shown as a line item in the statement of financial position? A B C D 3.4 Intangible assets Work in progress Trade receivables Taxation Balances under the following headings are extracted from the books of Ego: (1) (2) (3) Staff costs – wages and salaries Raw materials and consumables Own work capitalised The accountant wishes to use a classification of expenses within profit by nature format. Which of the above balances may be included without further analysis in the statement of profit or loss? A B C D 1 and 2 only 1 and 3 only 2 and 3 only 1, 2 and 3 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 5 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK 3.5 During the year ended 31 March 20X7 Woolf sold a property for $1,550,000. The property was purchased on 1 July 20W4 for $100,000, had an expected life of 20 years and had been revalued to $1,900,000 on 31 March 20X4. Woolf depreciates properties on a straight-line basis over the assets’ useful life, with a full year’s depreciation in the year of acquisition and none in the year of disposal. Woolf revalues another property to $2,000,000 on 31 March 20X7. Its historical cost was $1,000,000 and accumulated depreciation on the property was $350,000. How are these transactions reflected in other comprehensive income and profit or loss? A B C D 3.6** Other comprehensive income $1,350,000 gain $500,000 loss $1,350,000 gain $500,000 loss Profit or loss $1,510,000 profit $1,510,000 profit $30,000 profit $30,000 profit Bell made a profit of $183,000 for the year ended 30 June 20X7 and paid a dividend during the year of $18,000. During the year the company wrote off development costs of $45,000 directly to retained earnings as a prior period adjustment and revalued a property with a carrying amount of $60,000 to $135,000. What was total comprehensive income for period ended 30 June 20X7? A B C D 3.7 $195,000 $240,000 $258,000 $318,000 IAS 1 Presentation of Financial Statements encourages an analysis of expenses to be presented in the statement of profit or loss. This analysis must use a classification based on either the nature of expense, or its function, such as: (1) (2) (3) (4) (5) Raw materials and consumables used Distribution costs Employee benefit costs Cost of sales Depreciation and amortisation expense Which of the above should be disclosed in the statement profit or loss if a manufacturing entity uses analysis based on function? A B C D 3.8** 1, 3 and 4 2 and 4 1 and 5 2, 3 and 5 DT’s final dividend for the year ended 31 October 20X5 of $150,000 was declared on 1 February 20X6 and paid in cash on 1 April 20X6. The financial statements were approved on 31 March 20X6. Which of the following statements reflect the correct treatment of the dividend in the financial statements of DT? 6 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) 3.9 (1) The payment settles an accrued liability in the statement of financial position as at 31 October 20X5 (2) The dividend is shown as a deduction in the statement of profit or loss for the year ended 31 October 20X6 (3) The dividend is shown as an accrued liability in the statement of financial position as at 31 October 20X6 (4) The $150,000 dividend was shown in the notes to the financial statements at 31 October 20X5 (5) The dividend is shown as a deduction in the statement of changes in equity for the year ended 31 October 20X6. A B C D 1 and 2 1 and 4 3 and 5 4 and 5 Which of the following items must be disclosed in the notes to the financial statements? (1) (2) (3) (4) Useful lives of assets or depreciation rates used Increases in asset values as a result of revaluations in the period Depreciation expense for the period Reconciliation of carrying amounts of non-current assets at the beginning and end of period A B C D 1, 2, 3 and 4 1 and 2 only 1 and 3 only 2, 3 and 4 only (18 marks) 4 ACCOUNTING POLICIES 4.1 According to IAS 8 Accounting Policies, Changes in Accounting Estimates and Errors, which of the following is a change in accounting policy that requires retrospective application? 4.2 A The depreciation of the production facility has been reclassified from administration expenses to cost of sales in the current and future years B The depreciation method of vehicles was changed from straight line depreciation to reducing balance C The provision for warranty claims was changed from 10% of sales revenue to 5% D Based on information that became available in the current period a provision was made for an injury compensation claim relating to an incident in a previous year Which of the following would require retrospective application in accordance with IAS 8 Accounting Policies, Changes in Accounting Estimates and Errors? A A change in method of depreciating machinery from straight line to reducing balance B Commencing capitalisation of borrowing costs in accordance with IAS 23 Borrowing Costs. Borrowing costs previously had been charged to profit or loss C A changes in method of calculating provisions for warranty claims on products sold D Making a provision in the current year for a legal claim that was disclosed as a contingent liability in the previous year’s financial statements ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 7 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK 4.3** 4.4 Which of the following would be classified as “a change in accounting policy” as determined by IAS 8 Accounting Policies, Changes in Accounting Estimates and Errors? A Increasing the loss allowance for trade receivables for 20X6 from 5% to 10% of outstanding balances B Changing the depreciation of plant and equipment from straight line depreciation to reducing balance depreciation C Changing the valuation method of inventory from first-in first-out to weighted average D Changing the useful economic life of its motor vehicles from six years to four years The draft 20X5 statement of financial position of Vale reported retained earnings of $1,644,900 and net assets of $6,957,300. Following the completion of the draft 20X5 statement of financial position it was discovered that several items of inventory had been valued at selling price at the 20X4 year end. This meant that the opening inventory value for 20X5 was overstated by $300,000. The closing inventory had been correctly valued in the draft 20X5 statement of financial position. If the error is corrected before the 20X5 financial statements are finalised, what amounts will be reported for retained earnings and net assets in the statement of financial position? A B C D 4.5** Retained earnings $1,644,900 $1,644,900 $1,944,900 $1,944,900 Net assets $6,657,300 $6,957,300 $6,657,300 $6,957,300 In 20X3 Falkirk identified that a fraud had been perpetrated by an employee who had been making payments to himself amounting to $6,200,000. $1,400,000 million were payments made in 20X3, $1,800,000 in 20X2 and $3,000,000 prior to 20X2; the double entry to the payments had created false assets. What is the amount of fraud to be recognised as an expense in the statement of profit or loss for 20X3? A B C D 4.6 $nil $1,400,000 $3,200,000 $6,200,000 Which of the following is a change of accounting policy under IAS 8 Accounting Policies, Changes in Accounting Estimates and Errors? A Classifying commission earned as revenue in the statement of profit or loss, having previously classified it as other operating income B Switching to purchasing plant using leases from a previous policy of purchasing plant for cash C Changing the value of a subsidiary’s inventory in line with the group policy for inventory valuation when preparing the consolidated financial statements D Revising the remaining useful life of a depreciable asset (12 marks) 8 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) 5 IFRS 15 REVENUE FROM CONTRACTS WITH CUSTOMERS 5.1 IFRS 15 Revenue from Contracts with Customers identifies five steps in the core principle of recognising revenue. Which of the following is NOT a step in the recognition process? A B C D 5.2 Identify the performance obligations in a contract Allocate the transaction price to the performance obligations in the contract Identify the contract with a customer Assess whether significant risks and rewards of ownership have been transferred to the buyer OC signed a contract to provide office cleaning services for a client for a period of one year from 1 October 20X8 for a fee of $500 per month. The contract required the client to make one payment to OC covering all 12 months’ service in advance. The contract cost to OC was estimated at $300 per month for wages, materials and administration costs. OC received $6,000 on 1 October 20X8. What profit or loss on the contract should OC recognise in its statement of profit or loss for the year ended 31 March 20X9? A B C D 5.3 $600 loss $1,200 profit $2,400 profit $4,200 profit LP received an order to supply 10,000 units of product A every month for two years. The customer had negotiated a low price of $200 per 1,000 units and agreed to pay $12,000 in advance every 6 months. The customer made the first payment on 1 July 20X2 and LP supplied the goods each month from 1 July 20X2. LP’s year end is 30 September. In addition to recording the cash received, what entries should LP record, in its financial statements for the year ended 30 September 20X2, in accordance with IFRS 15 Revenue from Contracts with Customers? A B C D 5.4 Include $6,000 in revenue for the year and create a trade receivable for $36,000 Include $6,000 in revenue for the year and create a current liability for $6,000 Include $12,000 in revenue for the year and create a trade receivable for $36,000 Include $12,000 in revenue for the year but do not create a trade receivable or current liability On 31 March, DT received an order from a new customer, XX, for products with a sales value of $900,000. XX enclosed a deposit with the order of $90,000. On 31 March, DT had not obtained credit references of XX and has not determined if it will meet this order. According to IFRS 15 Revenue from Contracts with Customers, how should DT record this transaction in its financial statements for the year ended 31 March? ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 9 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK 5.5 5.6** (1) (2) (3) (4) (5) Include $900,000 as revenue for the year Include $90,000 as revenue for the year Do not include anything as revenue for the year Create a trade receivable for $810,000 Create a trade payable for $90,000 A B C D 1 and 4 2 and 5 3 and 4 3 and 5 Which of the following statements best describes a bill-and-hold arrangement? A The customer accepts the goods in advance of being billed by the seller B The seller bills the customer but retains possession of the goods until the customer requires delivery C The customer pays for the goods in instalments and the goods are delivered to the customer once the final instalment has been made D The customer has a specific period of time to inspect and approve the goods before payment is required Digger commenced contract X47 on 1 July 20X3. Performance obligations under the contract are to be satisfied over time and the stage of completion is regularly assessed. Details for the first year of the contract were as follows: $ Amounts invoiced 2,400 Costs incurred at date of last assessment 1,800 Costs incurred since last assessment 200 Amounts received 2,100 Total contract price 4,200 Estimated costs to complete 1,200 Survey of performance completed 2,520 Digger invoices the customer immediately on receiving an assessment of the value of the work done. What amount should Digger include as cost of sales for the X47 contract for the year ended 30 June 20X4, assuming revenue is based on performance completed? A B C D 5.7 $1,800,000 $1,828,000 $1,920,000 $2,000,000 Augustus is involved in a number of contracts at 30 September 20X3, which have been assessed as contracts where the performance obligation is satisfied over a period of time. The company calculates revenue on an output basis using the value of performance completed. At that date the following information is available with respect to contract ZX45: Contract price Costs incurred to date Estimated further costs to completion Survey of performance completed Amounts invoiced and paid by customer 10 $ 225 115 65 125 145 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) This contract is with a new customer. Augustus required the customer to pay an up-front deposit that is included in the amounts invoiced and paid. What amount should be included in the statement of financial position of Augustus in respect of contract ZX45 as at 30 September 20X3? A B C D 5.8 $nil $5,000 liability $5,000 asset $20,000 liability On 31 March 20X9 Dune entered into a contract to sell some machinery for $700,000. The contract required Dune to buy back the goods in two-year’s time for $500,000. How should the contract be accounted for in Dune’s financial statements? 5.9 A Recognise $700,000 revenue and account for the costs of repurchase in two years’ time B Account for the transaction as a lease in accordance with IFRS 16 Leases C Recognise a financial liability for the repurchase price and recognise $700,000 revenue D Recognise a financial liability for $500,000 and recognise revenue for $200,000 for the difference between the selling price and the repurchase price Which of the following indicators is NOT considered when determining whether performance obligations are satisfied at a point in time? A B C D 5.10 The customer is likely to reject delivery of the asset The customer has the significant risks and rewards of ownership of the asset The customer has legal title to the asset The customer has an obligation to pay for the asset During the month of March, Jolly Tar sells 10 units of a product for $200 each to SandyBeach. SandyBeach can claim a 5% prompt payment discount if the invoice is paid within 30 days. SandyBeach has also been subject to bankruptcy rumours in the national press. Jolly Tar estimates that there is a 20% probability that SandyBeach will not pay for the goods. What amount of revenue will be included in Jolly Tar’s profit or loss in respect of this transaction? A B C D $nil $1,600 $1,900 $2,000 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 11 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK 5.11 Repro, a company which sells photocopying equipment, has prepared its draft financial statements for the year ended 30 September 20X4. It has included the following transactions in revenue at the stated amounts below. Which of these has been correctly included in revenue according to IFRS 15 Revenue from Contracts with Customers? A Agency sales of $250,000 on which Repro is entitled to a commission B Sale proceeds of $20,000 for motor vehicles which were no longer required by Repro C Sales of $150,000 on 30 September 20X1. The amount invoiced to and received from the customer was $180,000, which includes $30,000 for ongoing servicing work to be done by Repro over the next two years D Sales of $200,000 on 1 October 20X3 to an established customer which (with the agreement of Repro) will be paid in full on 30 September 20X5. Repro has a cost of capital of 10% (22 marks) 6 INVENTORY AND BIOLOGICAL ASSETS 6.1** At 30 September 20X1 the closing inventory of a company has been incorrectly stated at $386,400. The following items were included in this total at cost: (1) 1,000 items which had cost $18 each. These items were all sold in October 20X1 for $15 each, and the company incurred $800 of costs to sell the goods (2) Five items which had been purchased for $100 each eight years ago. These items were sold in October 20X1 for $1,000 each, net of selling expenses What is the carrying amount of inventory in the company’s statement of financial position at 30 September 20X1? A B C D 6.2 $382,600 $384,200 $387,100 $400,600 The inventory value for the financial statements of Q for the year ended 31 December 20X1 was based on an inventory count on 4 January 20X2, which gave a total inventory value of $836,200. Between 31 December and 4 January 20X2, the following transactions were recorded: Purchases of goods for resale Sales revenue (gross profit margin 30%) Faulty goods returned by Q to supplier $ 8,600 14,000 700 What is the carrying amount of inventory that should be included in the financial statements as at 31 December 20X1? A B C D 12 $818,500 $834,300 $838,100 $853,900 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) 6.3 6.4 According to IAS 2 Inventories, which of the following costs should be included in valuing the inventories of a manufacturing company? (1) (2) (3) (4) Carriage inwards Carriage outwards Depreciation of factory plant General administrative overheads A B C D 1 and 3 1, 2 and 4 2 and 3 only 2, 3 and 4 IAS 2 Inventories defines the extent to which overheads are included in the cost of inventories of finished goods. Which of the following statements about the IAS 2 requirements relating to overheads are TRUE? 6.5 6.6 (1) Finished goods inventories may be valued on the basis of labour and materials cost only, without including overheads (2) Factory management costs should be included in fixed overheads allocated to inventories of finished goods A B C D 1 only 2 only Both 1 and 2 Neither 1 nor 2 Which of the following are TRUE in respect of the valuation of inventory? (1) The carrying amount should be as close as possible to net realisable value (2) The valuation of finished goods inventory must include production overheads (3) Production overheads included in valuing inventory should be calculated by reference to the company’s normal level of production during the period (4) In assessing net realisable value, inventory items must be considered separately, or in groups of similar items, not by taking the inventory value as a whole A B C D 1 and 2 1 and 3 2, 3 and 4 3 and 4 only The net realisable value of inventory is defined as the actual or estimated selling price less all costs to be incurred in marketing, selling and distribution. Which of all the following additional items should be deducted in calculating the net realisable value of inventory? A B C D Trade discounts No Yes Yes Yes Settlement discounts Yes No Yes Yes ©2017 DeVry/Becker Educational Development Corp. All rights reserved. Costs to completion Yes Yes No Yes 13 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK 6.7** 6.8 Which of the following items should be included in the cost of inventory of a service provider? (1) (2) (3) (4) Salary of staff engaged in the service contract Profit margin factored into the contract price Depreciation of office computer used by staff engaged on contract Salary of sales staff who negotiated the service contract A B C D 1 and 2 1 and 3 2 and 4 3 and 4 First-in first-out is one method allowed by IAS 2 Inventories for determining the purchase price or cost of production of finished goods inventory. Which of the following valuation methods is also allowed by IAS 2? A B C D 6.9 Both last-in first-out and weighted average Only last-in first-out Only weighted average Neither last-in first-out nor weighted average During the year ended 31 December 20X6 Grasmere purchased the following items for resale: Date March June Number of items 20 20 Cost price per item $11 $13 This was a new product line and by 31 December 20X6 twenty items were left unsold. At that date they were being sold at $12 an item and it would have cost Grasmere $10 an item to buy further supplies. Grasmere determines cost of inventory under the first-in first-out method. At what amount should finished goods inventory be shown in the statement of financial position as at 31 December 20X6? A B C D 6.10 $200 $220 $240 $260 Toulouse makes three different products. The following table shows the inventory valuation for each of the products under different bases: Product I Product II Product III First-infirst-out $ 10 13 9 —— 32 —— Last-infirst-out $ 11 15 5 —— 31 —— Net realisable value $ 12 14 7 —— 33 —— At what amount should Toulouse’s inventory be stated in accordance with IAS 2 Inventories? 14 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) A B C D 6.11 Which of the following is does NOT fall within the scope of IAS 41 Agriculture? A B C D 6.12 $28 $30 $31 $32 Sheep Wool Wine Vines XYZ Farm purchased 100 turkeys for $10,000 on 17 November 20X1. At the year end, 31 December 20X1, the estimated sales price of the 100 turkeys was measured at $10,500. The following costs are expected to be incurred in respect to the sale of the turkeys: Transportation cost Finance cost Income taxes related to this sale $ 700 300 1,000 What amount should be recognised for the biological assets in XYZ’s statement of financial position as at 31 December 20X1? A B C D 6.13 Which of the following is NOT an example of agricultural activity, as defined in IAS 41 Agriculture? A B C D 6.14 $8,500 $9,800 $10,000 $10,500 Cultivating orchards Floriculture Fish farming Sale of harvested crops On 30 September 20X4, Razor’s closing inventory was counted and valued at its cost of $1 million. Some items of inventory which had cost $210,000 had been damaged in a flood (on 15 September 20X4) and are not expected to achieve their normal selling price which is calculated to achieve a gross profit margin of 30%. The sale of these goods will be handled by an agent who sells them at 80% of the normal selling price and charges Razor a commission of 25%. At what amount will the closing inventory of Razor be reported in its statement of financial position as at 30 September 20X4? A B C D $1 million $790,000 $180,000 $970,000 (28 marks) ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 15 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK 7 IAS 16 PROPERTY, PLANT AND EQUIPMENT 7.1 On 1 January 20X1 a company purchased some plant. The invoice showed: Cost of plant Delivery to factory One year warranty covering breakdown during 20X1 $ 48,000 400 800 –––––– 49,200 ——— Modifications to the factory building costing $2,200 were necessary to install the plant. What amount should be capitalised for the plant in the company’s records in accordance with IAS 16 Property, Plant and Equipment? A B C D 7.2 $48,000 $48,400 $50,600 $51,400 At 31 December 20X6 Cutie owned a building that had cost $800,000 on 1 January 20W7. It was being depreciated at 2% per year. On 31 December 20X6 a revaluation to $1,000,000 was recognised. At this date the building had a remaining useful life of 40 years. Which of the following pairs of figures correctly reflects the effects of the revaluation? A B C D 7.3** 7.4 Depreciation charge for year ending 31 December 20X7 $ 25,000 25,000 20,000 20,000 Revaluation surplus as at 31 December 20X6 $ 200,000 360,000 200,000 360,000 Which of the following statements are correct? (1) All non-current assets must be depreciated (2) If goodwill is revalued, the surplus appears in the statement of changes in equity (3) If a tangible non-current asset is revalued, all tangible assets of the same class should be revalued (4) In a company’s published statement of financial position, tangible assets and intangible assets must be shown separately A B C D 1 and 2 1 and 4 2 and 3 3 and 4 ABC has revalued its property for the first time this year. Management proposes to expense the depreciation based on the original historical cost to profit or loss and offset the additional depreciation based on the revalued amount against the revaluation surplus. Under IAS 16 Property, Plant and Equipment is this policy permitted? 16 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) A B C D 7.5 Yes, it is required Yes, it is allowed but not required Yes, it is allowed only in prescribed circumstances No it is not allowed Thames depreciates non-current assets at 20% per annum on a reducing balance basis. All non-current assets were purchased on 1 April 20X3. The carrying amount on 31 March 20X6 is $20,000. What is the accumulated depreciation (to the nearest $000) as at 31 March 20X6? A B C D 7.6 $15,000 $19,000 $30,000 $39,000 The following information relates to the disposal of two machines by Halwell: Cost Selling price Profit/(loss) on sale Machine 1 $ 120,000 90,000 30,000 Machine 2 $ 100,000 40,000 (20,000) What was the total accumulated depreciation on both machines sold? A B C D 7.7 $80,000 $100,000 $120,000 $140,000 Lydd purchased production machinery costing $100,000, having an estimated useful life of twenty years and a residual value of $2,000. After being in use for six years the remaining useful life of the machinery is revised and estimated to be twenty-five years, with an unchanged residual value. What is the annual depreciation charge on the machinery in year 7? A B C D 7.8 $3,226 $3,161 $2,824 $2,744 Upton makes up its financial statements to 31 December each year. On 1 January 20X0 it bought a machine with a useful life of 10 years for $200,000 and started to depreciate it at 15% per annum on the reducing balance basis. On 31 December 20X3 the accumulated depreciation was $95,600 and the carrying amount $104,400. During 20X4 the company changed the basis of depreciation to straight line. Which of the following is the correct accounting treatments in the financial statements of Upton for the year ended 31 December 20X4? A B C D Depreciation charge ($10,440) Depreciation charge ($17,400) Depreciation charge ($17,400) Depreciation charge ($20,000) No prior period adjustment No prior period adjustment Prior period adjustment $15,600 Extraordinary item $15,600 (16 marks) ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 17 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK 8 IAS 23 BORROWING COSTS 8.1 Under what conditions can an entity capitalise borrowing costs? 8.2 8.3 A The borrowing costs are incurred for purchases of inventory items B The borrowing costs are directly attributable to the acquisition, construction, or production of a qualifying asset C The borrowing costs are directly attributable to the acquisition, construction, or production of routinely manufactured assets D The borrowing costs are incurred for purchases of property, plant and equipment Which of the following would qualify as a borrowing cost as defined in IAS 23 Borrowing Costs? (1) (2) (3) (4) Premium on redemption of preference share capital Discount on the issue of convertible debt Interest expense calculated using the effective interest rate Finance charges related to right-of-use leases A B C D 1, 2 and 3 only 2, 3 and 4 only 1 and 4 only 1, 2, 3 and 4 For which of the following categories of funds used to construct a factory, that is a qualifying asset, can borrowing costs NOT be capitalised? A B C D 8.4 Which qualitative characteristic is applied by IAS 23 Borrowing Costs to the capitalisation of borrowing costs? A B C D 8.5 Funds borrowed specifically to construct the factory Funds borrowed in advance of expenditure on the factory General borrowed funds used to finance the building of the factory Funds borrowed that have been applied to the construction of a new office Consistency Timeliness Materiality Understandability QI is incurring expenditure on project 275 which meets the definition of a qualifying asset, in accordance with IAS 23 Borrowing Costs. The company has the following debt components: (1) (2) (3) (4) 6% $100,000 debt used specifically to finance project 274 7% $500,000 preference share capital 10% $80,000 short-term loan 4% $200,000 convertible debt What capitalisation rate would QI apply to expenditure incurred on project 275? A B C D 7% 6.75% 6.54% 4% (10 marks) 18 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) 9 GOVERNMENT GRANTS 9.1 Which of the following accounting policies for grants related to assets is allowed under IAS 20 Accounting for Government Grants and Disclosure of Government Assistance? 9.2 (1) (2) (3) Deduct from the cost of related asset in the statement of financial position Include in liabilities in the statement of financial position Credit profit and loss immediately with cash received A B C D 1, 2 and 3 1 and 2 only 1 and 3 only 2 and 3 only Under IAS 20 Accounting for Government Grants and Disclosure of Government Assistance, what is the correct term for a loan which the lender undertakes to waive repayment of under certain conditions? A B C D 9.3 9.4 A forgivable loan A non-payable loan A non-recourse loan A recourse loan Under IAS 20 Accounting for Government Grants and Disclosure of Government Assistance, how are government grants related to depreciable assets treated in the profit or loss? A The government grant is recognised over the period and in the proportions in which depreciation expense on those assets is recognised B The government grant must be recognised in the year in which the depreciable asset is received and the following year only C The government grant must be recognised over a period of five years D The government grant must be recognised over a period of no more than 10 years IAS 20 Accounting for Government Grants and Disclosure of Government Assistance defines government assistance as an action by government designed to provide an economic benefit specific to an entity qualifying under certain criteria. Which of the following is an example of government assistance? A B C D 9.5 Free technical or marketing advice Provision of infrastructure by improvement to the general transportation network Supply of improved facilities such as irrigation A cash grant to buy a new item of plant On 1 January 20X1 Emex received a government grant of $100,000 to assist in the purchase of new machinery costing $1,000,000 with a useful life of five years. The grant is repayable on a sliding scale if the machine is sold within five years; that is the full amount if sold in the first year, 80% if sold in the second year and so on. The management of Emex intends to use the machine for five years. The accounting policy is to offset the grant against the cost of the asset. What will be the depreciation expense for the year ended 31 December 20X2 and what provision will be required for the repayment of the grant as at 31 December 20X2? ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 19 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK A B C D Depreciation charge $000 180 180 200 200 Provision $000 60 Nil 60 Nil (10 marks) 10 IAS 40 INVESTMENT PROPERTY 10.1 Which of the following is investment property according to IAS 40 Investment Property? A B C D 10.2** 10.3 Which of the following are examples of investment property in accordance with IAS 40 Investment Property? (1) (2) (3) (4) Property held for long-term capital appreciation Owner-occupied property Land held for an undetermined future use Property occupied by employees A B C D 1 and 2 1 and 3 2 and 4 3 and 4 Which of the following is an investment property under IAS 40 Investment Property? A B C D 10.4 10.5** A building that is vacant but held to be rented to third parties Property under construction on behalf of third parties Property that is available for sale in the ordinary course of business Owner-occupied property Under IAS 40 Investment Property, which of the following transfers would result in a change from cost measurement to fair value measurement? (1) (2) (3) A transfer from investment property to owner-occupied property A transfer from inventories to property available for rental A transfer from investment property to inventories, when the property is intended for sale A B C D 1 only 2 only 1 and 2 only 1, 2 and 3 There are many reasons why businesses acquire assets: (1) (2) (3) (4) (5) 20 An investment in land and or buildings other than leased property A property owned and occupied by an entity for its own purposes A property which is held to earn rentals or for capital appreciation An investment in land and or buildings whether let to third parties or occupied by an entity within a group For administrative purposes For use in the supply of services For use in the production of goods To earn rental income For capital appreciation ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) For what purpose is investment property held according to IAS 40 Investment Property? A B C D 1, 2 and 3 2, 3 and 4 1, 4 and 4 4 and 5 only (10 marks) 11 IAS 38 INTANGIBLE ASSETS 11.1 Which of the following could be classified as deferred development expenditure in M’s statement of financial position as at 31 March 20X1 according to IAS 38 Intangible Assets? 11.2 11.3 A $120,000 spent on developing a prototype and testing a new type of propulsion system for trains. The project needs further work on it as the propulsion system is currently not viable B A payment of $50,000 to a local university’s engineering faculty to research new environmentally friendly building techniques C $35,000 spent on consumer testing a new type of electric bicycle. The project is near completion and the product will probably be launched in the next 12 months. M is not yet certain that there is going to be a viable market for the finished product D $65,000 spent on developing a special type of new packaging for a new energy efficient light bulb. The packaging is expected to be used by M for many years and is expected to reduce M’s distribution costs by $35,000 a year Which of the following would most likely result in the recognition of an asset in KJH’s statement of financial position at 31 January 20X2? A KJH spent $50,000 on an advertising campaign in January 20X2. KJH expects the advertising to generate additional sales of $100,000 over the period February to April 20X2 B KJH is taking legal action against a contractor for faulty work. Advice from its legal team is that it is probable that KJH may receive $250,000 in settlement of its claim within the next 12 months C KJH purchased the copyright and film rights to the next book to be written by a famous author for $75,000 on 1 March 20X1. A first manuscript has already been received and advance orders suggest that the book will be a best seller D KJH has developed a new brand name internally. The directors value the brand name at $150,000 In accordance with IAS 38 Intangible Assets, which of the following statements is correct? A Capitalised development expenditure must be amortised over a period not exceeding five years B If all the conditions specified in IAS 38 are met, development expenditure may be capitalised if the directors decide to do so C Capitalised development costs are shown in the statement of financial position under the heading of Intangible Assets D Amortisation of capitalised development expenditure will appear as an item in a company’s statement of changes in equity ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 21 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK 11.4 Which of the following is NOT an intangible asset? A B C D 11.5 Which of the following may be included in a company’s statement of financial position as an intangible asset under IAS 38 Intangible Assets? A B C D 11.6 Patents Development costs Short leaseholds Licences Payment on account of patents Expenditure on completed research Start-up costs Internally-generated goodwill Henna was incorporated on 1 January 20X6. At 31 December 20X6 the following costs had been incurred: $ (1) Legal fees incurred in establishing the entity 80,000 (2) Customer lists purchased from a company that has gone out of business 100,000 (3) Goodwill created by the company 80,000 (4) Patents purchased for valuable consideration 70,000 (5) Costs incurred by the company in developing patents 60,000 What is the total cost of intangible assets to be recognised in the statement of financial position of Henna at 31 December 20X6 in accordance with IAS 38 Intangible Assets? A B C D 11.7 Which of the following conditions would preclude any part of the development expenditure to which it relates from being capitalised? A B C D 11.8 $310,000 $250,000 $230,000 $170,000 The development is incomplete The benefits flowing from the completed development are expected to exceed its cost Funds are unlikely to be available to complete the development The development is expected to give rise to more than one product On 1 October 20X1 Hyena paid $500,000 deposit towards the cost of a laboratory for research and development. On 31 December 20X1, Hyena’s financial year end, the laboratory had still not been completed. Where should the payment of $500,000 appear in Hyena’s statement of financial position as at 31 December 20X1? A B C D 22 Development costs under intangible assets Payments on account under intangible assets Payments on account under tangible non-current assets Payments on account under current assets ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) 11.9 RD’s figures for research and development are as follows: Research Development expenditure in the year Brought forward deferred development expenditure Written off deferred expenditure in the year $267,000 $215,000 $305,000 ** ** To be calculated. At 31 December 20X4 the balance carried forward for development expenditure was $375,000. What amount will RD charge to profit or loss for research and development for 20X4? A B C D $267,000 $412,000 $482,000 $787,000 (18 marks) 12 NON-CURRENT ASSETS HELD FOR SALE AND DISCONTINUED OPERATIONS 12.1 PQ has ceased operations overseas in the current accounting period. This resulted in the closure of a number of small retail outlets. Which of the following costs would be excluded from the loss on discontinued operations? A B C D 12.2** Loss on the disposal of the retail outlets Redundancy costs for overseas staff Cost of restructuring head office as a result of closing the overseas operations Trading losses of the overseas retail outlets up to the date of closure BN has an asset that was classified as held for sale at 31 March 20X2. The asset had a carrying amount of $900 and a fair value of $800. The cost of disposal was estimated to be $50. In accordance with IFRS 5 Non-current Assets Held for Sale and Discontinued Operations, at what amount should the asset be stated in BN’s statement of financial position as at 31 March 20X2? A B C D 12.3 $750 $800 $850 $900 During the year to 30 April 20X9 two companies carried out major re-organisations of their activities. The re-organisations were as follows: Maynard closed down its manufacturing division on 1 January 20X9. This division accounted for 30% of Maynard’s revenue, Maynard will now focus all of their efforts on its retail division. Grant purchased a group of companies in February 20X9. One of the subsidiaries within the group, Lytton, did not meet the profile required by Grant and therefore the intention of Grant is to sell this subsidiary as soon as possible, and no later than 30 September 20X9. Which of these re-organisations would be classified as discontinued operations for the year ended 30 April 20X9? ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 23 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK A B C D 12.4 Maynard only Lytton only Both Maynard and Lytton Neither Maynard or Lytton On 1 January 20X0 Beech purchased an asset for $500,000, the asset had a useful life of eight years and nil residual value. On 1 July 20X3 the asset was classified as held for sale in accordance with IFRS 5 Noncurrent Assets Held for Sale and Discontinuing Activities. On that date the fair value less cost of disposing of the asset were assessed as $254,000. What is the total expense to be recognised in respect of this asset in the statement of profit or loss for 20X3? A B C D 12.5 $31,250 $56,650 $58,500 $62,500 In order for an asset to be classified as held for sale in accordance with IFRS 5 Non-current Assets Held for Sale and Discontinuing Activities the sale of the asset must be highly probable. Which TWO of the following are indicators that the sale of the asset is highly probable? 12.6 (1) The asset has been advertised for sale in a trade journal (2) A contract with a buyer has been signed (3) The market value of similar assets is $50,000 and management hopes to sell the asset for a profit of $30,000 (4) Necessary repairs to the asset will be carried out when management has signed a contract for the sale A B C D 1 and 2 2 and 3 3 and 4 1 and 4 As at 30 September 20X3 Dune’s property in its statement of financial position was: Property at cost (useful life 15 years) Accumulated depreciation $45 million $6 million On 1 April 20X4, Dune decided to sell the property. The property is being marketed by a property agent at a price of $42 million, which was considered a reasonably achievable price at that date. The expected costs to sell have been agreed at $1 million. Recent market transactions suggest that actual selling prices achieved for this type of property in the current market conditions are 10% less than the price at which they are marketed. At 30 September 20X4 the property has not been sold. At what amount should the property be reported in Dune’s statement of financial position as at 30 September 20X4? 24 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) A B C D $36 million $37·5 million $36·8 million $42 million (12 marks) 13 IAS 36 IMPAIRMENT OF ASSETS 13.1 The following information relates to three assets held by a company: Asset A $000 100 80 90 Carrying amount Fair value less costs of disposal Value in use B $000 50 60 70 C $000 40 35 30 What is the total impairment loss? A B C D 13.2 Nil $10,000 $15,000 $20,000 Dodgy has a property which is currently stated at a revalued carrying amount of $253,000. Due to a slump in property prices the value of the property is currently only $180,000. The historical cost carrying amount of the property is $207,000. How should the above impairment in value be reflected in the financial statements in accordance with IAS 36 Impairment of Assets? A B C D 13.3 Profit or loss account Dr $73,000 Dr $27,000 Dr $73,000 – Other comprehensive income Cr $46,000 Dr $46,000 – Dr $73,000 Noddy has an item of equipment included in its statement of financial position at a carrying amount of $2,750. The asset had been revalued several years ago. If the asset had not been revalued its carrying amount would only have been $1,250. An impairment review of the asset has been undertaken and it is estimated that the recoverable amount of the asset is only $1,000. Noddy has not made any annual transfers from the revaluation surplus to retained earnings. How much of the impairment loss should be charged to other comprehensive income in accordance with IAS 36 Impairment of Assets? A B C D $1,750 $1,500 Nil $250 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 25 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK 13.4** In 20X3 Angry revalued at $360,000 a plot of land which had been purchased in 20X1 for $300,000 and recognised a revaluation gain of $60,000. In 20X4 Angry revalued to $130,000 a second plot of land which had been purchased for $100,000 in 20X2 and recognised a further revaluation gain of $30,000. In 20X5 Angry wishes to write down the value of the first plot of land from $360,000 to $260,000 because of an impairment in its value due to changes in market prices. There have been no other movements on the revaluation surplus. What amounts should be recognised in the financial statements for 20X5 for the impairment loss? A B C D 13.5 Profit or loss $100,000 $40,000 $10,000 Nil Other Comprehensive Income Nil $60,000 $90,000 $100,000 The following measures relate to a non-current asset: (1) (2) (3) (4) Carrying amount Net realisable value Value in use Replacement cost $20,000 $18,000 $22,000 $50,000 What is the recoverable amount of the asset? A B C D 13.6 $18,000 $20,000 $22,000 $50,000 The net assets of Fyngle, a cash generating unit, are: Property, plant and equipment Allocated goodwill Product patent Net current assets (at net realisable value) $ 200,000 50,000 20,000 30,000 ––––––– 300,000 ––––––– As a result of adverse publicity, Fyngle has a recoverable amount of only $200,000. What would be the carrying amount of Fyngle’s property, plant and equipment after the allocation of the impairment loss? A B C D 26 $154,545 $170,000 $160,000 $133,333 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) 13.7 Which of the following is NOT an indicator of impairment under IAS 36 Impairment of Assets? A Advances in the technological environment in which an asset is employed have an adverse impact on its future use B An increase in interest rates which increases the discount rate an entity uses C The carrying amount of an entity’s net assets is lower than the entity’s number of shares in issue multiplied by its share price D The estimated net realisable value of inventory has been reduced due to fire damage although this value is greater than its carrying amount (14 marks) 14 IFRS 16 LEASES 14.1 On 1 January 20X7 Melon leased an asset under the following terms: Cash price Deposit Interest (9% for two years) Balance $ 18,000 (6,000) ——— 12,000 2,160 ——— 14,160 ——— The balance is payable in two annual instalments commencing 31 December 20X7. The rate of interest implicit in the contract is approximately 12%. Applying the requirements of IFRS 16 Leases what is the finance charge to profit or loss for the year ended 31 December 20X7? A B C D 14.2 $1,080 $1,440 $1,620 $2,160 IFRS 16 Leases requires a lessee to capitalise a right-of-use asset initially at cost. Which of the following amounts will be included in the initial cost? (1) (2) (3) (4) The amount of the lease liability Total interest expense over the period of the lease Initial direct costs incurred by the lessor Estimated costs of dismantling the asset at the end of the lease term A B C D 1 and 2 1 and 4 2 and 3 3 and 4 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 27 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK 14.3 Alpha enters into a lease with Omega of an aircraft which had a fair value of $240,000 at the inception of the lease. The lease terms require Alpha to pay 10 annual rentals of $36,000 in arrears. Alpha is wholly responsible for the maintenance of the aircraft which has a useful life of approximately 15 years. The present value of the 10 annual rentals of $36,000 discounted at the interest rate implicit in the lease is $220,000. Applying the requirements of IFRS 16 Leases to this agreement what is the increase in Alpha’s non-current assets? A B C D 14.4 Nil $220,000 $240,000 $360,000 Acor leases a new machine. The interest rate implicit in the lease is 13% per annum. The initial amount recognised for the right-of-use asset is $1,750,000. The lease is for four years and Acor is required to make four annual payments of $520,000, with the first payment due on commencement of the lease agreement. Acor’s policy is to depreciate similar machinery over five years on the straight line basis. What is the correct total charge to profit or loss for the first year of the lease? A B C D 14.5 $509,900 $577,500 $597,400 $665,000 Z entered into a lease agreement on 1 November 20X2. The lease was for five years, the initial amount recognised for the asset was $45,000 and the interest rate implicit in the lease was 7%. The annual payment was $10,975 in arrears. What is the non-current lease liability as at 31 October 20X3? A B C D 14.6 $27,212 $28,802 $29,350 $37,175 During the year ended 30 September 20X4 Hyper entered into two lease transactions: On 1 October 20X3, a payment of $90,000 being the first of five equal annual payments of a lease for an item of plant. The lease has an implicit interest rate of 10% and the leased asset was initially measured at $340,000. On 1 January 20X4, a payment of $18,000 for an eight month lease of an item of excavation equipment. What amount in total would be charged to Hyper’s statement of profit or loss for the year ended 30 September 20X4 in respect of the above transactions? A B C D $108,000 $111,000 $106,500 $115,500 (12 marks) 28 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) 15 IAS 37 PROVISIONS, CONTINGENT LIABILITIES AND CONTINGENT ASSETS 15.1 TY is the main contractor employing sub-contractors to assist it when required. TY has recently completed a contract replacing a roof on the local school. Despite this, the roof has been leaking and some sections are now unsafe. The school is suing TY for $20,000 to repair the roof. TY used a sub-contractor to install the roof and regards the sub-contractor’s work as faulty. TY has raised a court action against the sub-contractor claiming the cost of the school’s action plus legal fees, a total of $22,000. TY has been informed by legal advisers that it will probably lose the case brought against it by the school and will probably win the case against the sub-contractor. Which of the following is the correct treatment for the above events in TY’s financial statements? 15.2 A Provide for the $20,000 liability and disregard the case against the sub-contractor B Provide for the $20,000 liability and disclose the probable receipt of cash from the case against the sub-contractor as a note C Make no provision but disclose the $20,000 liability as a note D Provide for the $20,000 liability and recognise the probable receipt of cash from the case against the sub-contractor as a current asset MN obtained a government licence to operate a mine from 1 April 20X1. The licence requires that at the end of the mine’s useful life, all buildings must be removed from the site and the site landscaped. MN estimates that the cost of this decommissioning work will be $1,000,000 in 10 years’ time using a discount factor of 8%, a 10 year discount factor at 8% is 0.463. According to IAS 37 Provisions, Contingent Liabilities and Contingent Assets what is the provision which MN should recognise in its statement of financial position as at 31 March 20X2? A B C D 15.3 $100,000 $463,000 $500,000 $1,000,000 Which of the following statements about provisions, contingencies and events after the reporting period is correct? A A company expecting future operating losses should make provision for those losses as soon as it becomes probable that they will be incurred B Details of all adjusting events after the reporting period must be disclosed by note in a company’s financial statements C A contingent asset must be recognised as an asset in the statement of financial position if it is probable that it will arise D Contingent liabilities must be treated as actual liabilities and provided for when it is probable that they will arise, if they can be measured with reliability ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 29 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK 15.4 15.5 Which of the following statements about contingent assets and contingent liabilities are TRUE? (1) A contingent asset should be disclosed by note if an inflow of economic benefits is probable (2) A contingent liability should be disclosed by note if it is probable that a transfer of economic benefits to settle it will be required, with no provision being made (3) No disclosure is required for a contingent liability if it is less than probable that a transfer of economic benefits to settle it will be required A B C D 1 2 only 3 only 2 and 3 IAS 37 Provisions, Contingent Liabilities and Contingent Assets deals with accounting for contingencies. An entity has a present obligation that probably requires the outflow of economic resources and a contingent asset where the inflow of economic benefits is probable. How should the entity treat the present obligation and contingent asset? A B C D 15.6 Present obligation Provided for Provided for Disclosed, but not provided for Disclosed, but not provided for Contingent asset Disclosed Not disclosed Disclosed Not disclosed Porter is finalising its financial statements for the year ended 30 September 20X3. A former employee of Porter has initiated legal action for damages against the company after being summarily dismissed in October 20X3. Porter ’s legal advisors feel that the employee will probably win the case and have given the company a reasonably accurate estimate of the damages which would be awarded. Porter has not decided whether to contest the case. What is the correct classification of the above event in the financial statements of Porter for the year ended 30 September 20X3? A B C D 15.7** 30 A non-adjusting event An adjusting event A contingent liability disclosed by way of note A provision Tynan’s year end is 30 September 20X4 and the following potential liabilities have been identified: (1) The signing of a non-cancellable contract in September 20X4 to supply goods in the following year on which, due to a pricing error, a loss will be made (2) The cost of a reorganisation which was approved by the board in August 20X4 but has not yet been implemented, communicated to interested parties or announced publicly (3) An amount of deferred tax relating to the gain on the revaluation of a property during the current year. Tynan has no intention of selling the property in the foreseeable future (4) The balance on the warranty provision which relates to products for which there are no outstanding claims and whose warranties had expired by 30 September 20X4 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) Which of the above should Tynan recognise as liabilities as at 30 September 20X4? A B C D 15.8 2 and 4 1 and 2 1 and 3 3 and 4 On 1 October 20X3, Xplorer commenced drilling for oil from an undersea oilfield. The extraction of oil causes damage to the seabed which has a restorative cost (ignore discounting) of $10,000 per million barrels of oil extracted. Xplorer extracted 250 million barrels of oil in the year ended 30 September 20X4. Xplorer is also required to dismantle the drilling equipment at the end of its five-year licence. This has an estimated cost of $30 million on 30 September 20X8. Xplorer’s cost of capital is 8% per annum and $1 has a present value of 68 cents in five years’ time. What is the total provision (extraction plus dismantling) which Xplorer would report in its statement of financial position as at 30 September 20X4 in respect of its oil operations? A B C D $34,900,000 $24,532,000 $22,900,000 $4,132,000 (16 marks) 16 IAS 10 EVENTS AFTER THE REPORTING PERIOD 16.1 WDC’s year end is 30 September 20X1. Which of the following should be classified by WDC as a non-adjusting event according to IAS 10 Events after the Reporting Period? A WDC was notified on 5 November 20X1 that one of its customers was insolvent and was unlikely to repay any of its debts. The balance outstanding at 30 September 20X1 was $42,000 B On 30 September WDC had an outstanding court action against it. WDC had made a provision in its financial statements for the year ended 30 September 20X1 for damages awarded against it of $22,000. On 29 October 20X1 the court awarded damages of $18,000 C On 5 October 20X1 a serious fire occurred in WDC’s main production centre and severely damaged the production facility D The year end inventory balance included $50,000 of goods from a discontinued product line. On 1 November 20X1 these goods were sold for a net total of $20,000 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 31 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK 16.2 IAS 10 Events after the Reporting Period distinguishes between adjusting and non-adjusting events. Which of the following gives rise to an adjusting event? 16.3 A A dispute with workers caused all production to cease six weeks after the year end B A month after the year end the directors decided to cease production of one of three product lines and to close the production facility C One month after the year end a court awarded damages of $50,000 to one of the reporting entity’s customers. The entity had expected to lose the case and made a provision of $30,000 at the year end D Three weeks after the year end a fire destroyed the reporting entity’s main warehouse facility and most of its inventory The draft financial statements of Think Co are under consideration. The accounting treatment of the following material events after the reporting period needs to be determined: (1) The bankruptcy of a major customer, with a substantial debt outstanding at the end of the reporting period (2) A fire destroying some of the company’s inventory (the company’s going concern status is not affected) (3) An issue of shares to finance expansion (4) Sale for less than cost of some inventory held at the end of the reporting period According to IAS 10 Events after the Reporting Period, which of the above events require an adjustment to the figures in the draft financial statements? A B C D 16.4** 16.5 Which of the following events between the end of the reporting period and the date the financial statements are authorised for issue must be adjusted in the financial statements? (1) (2) (3) (4) The sale of inventory with a carrying amount of $96,000 for $74,000 The discovery of a fraud affecting the previous three years’ financial statements The announcement of changes in tax rates The announcement of a restructuring involving closure of a major business segment A B C D 1 and 2 2 and 4 3 and 4 1 and 3 Which of the following events occurring after the year end is classified as a nonadjusting event in accordance with IAS 10 Events after the Reporting Period? A B C D 32 1 and 4 1, 2 and 3 2 and 3 only 2 and 4 A property valuation which provides evidence of a permanent diminution in value The renegotiation of amounts owing by credit customers The determination of the amount of bonus payments to be made to employees Government announcing a change in tax rates ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) 16.6 The financial statements of an entity for the year ended 31 March 20X4 were approved by the directors on 31 August 20X4. Which of the following would be classified as an adjusting event in accordance with IAS 10 Events after the Reporting Period/ A A reorganisation of the entity proposed by a director on 31 January 20X4 was agreed by the Board on 10 July 20X4 B A strike by the workforce which started on 1 May 20X4 stopped all production for 10 weeks before working terms and conditions were settled C An insurance claim for damage caused by a fire in a warehouse on 1 January 20X4 for $2.5 million was settled with a receipt of $1.5 million on 1 June 20X4 D On 3 September 20X4 the entity sold some inventory for $100,000 which had a carrying amount at 31 March 20X4 of $122,000 (12 marks) 17 IAS 12 INCOME TAXES 17.1** At 1 October 20X1 DX had the following balances in respect of property, plant and equipment: $ Cost $220,000 Tax written down value $82,500 Statement of financial position: Carrying amount $132,000 DX depreciates all property, plant and equipment over five years using the straight line method and no residual value. All assets were less than five years old at 1 October 20X1. No assets were purchased or sold during the year ended 30 September 20X2. The local tax regime allows tax depreciation of 50% on additions to property, plant and equipment in the accounting period in which they are purchased. In subsequent accounting periods, tax depreciation of 25% per year of the tax written down value is allowed. Income tax on profits is at a rate of 25%. What is the amount for deferred tax in DX’s statement of financial position as at 30 September 20X2 in accordance with IAS 12 Income Taxes? A B C D 17.2 $5,843 $6,531 $12,375 $23,375 DF purchased its only item of plant on 1 October 20X1 for $200,000. depreciation on a straight line basis over five years. DF charges Tax depreciation is allowed as follows: 50% of additions to property, plant and equipment in the accounting period in which they are recorded; 25% per year of the written down value in subsequent accounting periods except that in which the asset is disposed of. Income tax on profits is at a rate of 25%. What is the amount for deferred tax in DM’s statement of financial position as at 30 September 20X3, in accordance with IAS 12 Income Taxes? ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 33 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK A B C D 17.3 $3,750 $11,250 $18,750 $45,000 The following information relating to taxation appears in the records of Stapley: Balance on income tax account on 1 January 20X2 Income tax paid in 20X2 in full settlement for the year ended 31 December 20X1 Estimated income tax for the year ended 31 December 20X2 $ 187,500 194,300 137,600 What is the current tax liability to be included in Stapley’s statement of financial position as at 31 December 20X2? A B C D 17.4 $194,300 $144,400 $137,600 $130,800 DZ recognised a tax liability of $290,000 in its financial statements for the year ended 30 September 20X5. This was subsequently agreed with and paid to the tax authorities as $280,000 on 1 March 20X6. The directors of DZ estimate that the tax due on the profits for the year to 30 September 20X6 will be $320,000. DZ has no deferred tax liability. What is DZ’s profit or loss tax charge for the year ended 30 September 20X6? A B C D 17.5 $310,000 $320,000 $330,000 $600,000 At 30 April 20X3 the non-current assets of Shades have a carrying amount of $365,700 and a tax written down value of $220,000. The balance brought forward on the deferred tax account at 1 May 20X2 was $33,000. The tax rate is 25%. What is the balance on the deferred tax account at 30 April 20X3? A B C D $33,000 $36,425 $55,000 $91,425 (10 marks) 18 FINANCIAL INSTRUMENTS 18.1 TS purchased 100,000 of its own equity shares in the market and classified them as treasury shares. At the end of the accounting period TS still held the treasury shares. Which of the following is the correct presentation of the treasury shares in TS’s closing statement of financial position in accordance with IAS 32 Financial Instruments: Presentation? A B C D 34 As a current asset investment As a non-current liability As a non-current asset As a deduction from equity ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) 18.2** IAS 32 Financial Instruments: Presentation classifies issued shares as either equity instruments or financial liabilities. An entity has the following categories of funding on its statement of financial position: (1) A preference share that is redeemable for cash at a 10% premium in five years’ time (2) An equity share which is not redeemable and has no restrictions on receiving dividends (3) A loan note that is redeemable at par in seven years’ time (4) An irredeemable loan note that pays interest at 7% a year Applying IAS 32, how would each of the above be classified in the statement of financial position? A B C D 18.3 18.4 18.5 As an equity instrument 1 and 2 only 2 and 3 only 2 only 1, 2 and 3 As a financial liability 3 and 4 only 1 and 4 only 1, 3 and 4 4 only How should convertible debt be classified in accordance with IAS 32 Financial Instruments: Presentation? A As either a liability or equity based on an evaluation of the substance of the contractual arrangement B As separate liability and equity components , basing the liability element on the present value of future cash flows C As equity in its entirety, on the presumption that all options to convert the debt into equity will be exercised in the future D As a liability in its entirety, until it is converted into equity How should the proceeds from issuing a compound instrument be allocated between liability and equity components in accordance with IAS 32 Financial Instruments: Presentation? A The liability component is measured at fair value and the remainder is allocated to the equity component B The equity component is measured at fair value and the remainder is allocated to the liability component C The fair values of both the components are estimated and the proceeds allocated proportionately D The equity component is measured at its intrinsic value and the remainder is allocated to the liability component In the current financial year, Natamo has raised a loan for $3m. The loan is repayable in 10 equal half-yearly instalments. The first instalment is due six months after the loan was raised. How should the loan be recognised in Natamo’s next financial statements? A B C D As a current liability As a non-current liability As equity As both a current and a non-current liability ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 35 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK 18.6** On 1 January 20X2 LMN issued $2,000,000 8% convertible debt at par. The debt is repayable, or convertible, at a premium of 10% four years after issue. The effective interest rate for the debt is 14%. The present values $1 receivable at the end of each year, based on discount rates of 8%, 10% and 14% are: 8% 10% 14% End of year 1 0.926 0.909 0.877 2 0.857 0.826 0.769 3 0.794 0.751 0.675 4 0.735 0.683 0.592 What is the finance charge to LMN’s profit or loss for the year ended 31 December 20X3? A B C D 18.7 $160,000 $248,000 $260,000 $274,000 On 1 March 20X2 PQR purchased a debt instrument from the market for $105,000, the par value of the instrument was $100,000. At 31 December 20X2 the fair value of the instrument is $112,000 and the amortised cost has been calculated to be $104,000. PQR does not hold this type of asset for contractual cash flows. At what amount should the investment be included in PQR’s statement of financial position as at 31 December 20X2? A B C D 18.8 $100,000 $104,000 $105,000 $112,000 On 1 January 20X2 XYZ issued $1,000,000 4% convertible loan notes, at a discount of 95. The loan notes are redeemable in five years at a premium of 10%. What are the total finance costs that should be charged to profit or loss over the fiveyear term of the convertible loan notes? A B C D 18.9** $350,000 $345,000 $250,000 $200,000 On 1 October 20X3, Bertrand issued $10 million convertible loan notes which carry a nominal interest (coupon) rate of 5% per annum. The loan notes are redeemable on 30 September 20X6 at par for cash or can be exchanged for equity shares. A similar loan note, without the conversion option, would have required Bertrand to pay an interest rate of 8%. The present value of $1 receivable at the end of each year, based on discount rates of 5% and 8%, can be taken as: End of year 36 1 2 3 5% 0·95 0·91 0·86 8% 0·93 0·86 0·79 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) Which of the following correctly recognises the convertible loan in Bertrand’s statement of financial position on initial recognition (1 October 20X3)? A B C D Equity $000 810 nil 10,000 40 Non-current liability $000 9,190 10,000 nil 9,960 (18 marks) 19 CONCEPTUAL PRINCIPLES OF GROUP ACCOUNTING 19.1 Harwich holds 70,000 $1 “B” shares in Sall. These shares carry one vote each. Felixstowe holds 18,000 $1 “A” shares in Sall. These shares carry 10 votes each. The share capital of Sall is made up of the following: 100,000 “B” shares of $1 each 20,000 “A” shares of $1 each $ 100,000 20,000 ———— 120,000 ———— Of which of the following reporting entities is Sall a subsidiary undertaking? A B C D 19.2 Both Harwich and Felixstowe Harwich only Felixstowe only Neither Harwich nor Felixstowe Sam has share capital of $10,000 split into 2,000 A ordinary shares of $1 each and 8,000 B ordinary shares of $1 each. Each A ordinary share has 10 votes and each B ordinary share has one vote. Both classes of shares have the same rights to dividends and on liquidations. Tom owns 1,500 A ordinary shares in Sam. Dick owns 6,000 B ordinary shares in Sam. All three companies conduct similar activities and there is no special relationship between the companies other than that already stated. The shareholdings in Sam are held as long-term investments and are the only shareholdings of Tom and Dick. Which companies must prepare consolidated financial statements? A B C D 19.3 Neither Tom nor Dick Tom only Dick only Both Tom and Dick During the last three years Harvert had held 400,000 equity shares in Jamee. The issued share capital of Jamee is $500,000 (shares of 50 cents each). The finance director of Harvert is a director of Jamee. What is the correct treatment of the investment in Jamee in the consolidated financial statements of Harvert? A B C D As a non-current asset investment As a current asset investment As an associated undertaking As a subsidiary ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 37 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK 19.4** 19.5** Which of the following statements regarding consolidated financial statements are correct? (1) Only the group’s share of the assets of a subsidiary is reflected on the consolidated statement of financial position (2) Under equity accounting only the group’s share of the net assets of an associate is reflected on the consolidated statement of financial position (3) The value of share capital on a consolidated statement of financial position will include the share capital of both the investor and the investee A B C D 1 only 2 only 3 1 and 2 Which of the following situations would indicate that a parent has control over a subsidiary? (1) The company has a 50% shareholding with the other 50% owned by another company. Both owners must agree on future actions (2) The company owns 100% of preference shares and 10% of the equity shares (3) The company owns 40% of the ordinary shares and also has an agreement with another 40% of the owners of ordinary shares that they will always vote with the company (4) The company owns 30% of the ordinary shares and has the ability to control the board of directors 1 and 2 2 and 3 3 and 4 1 and 4 A B C D 19.6 Petre owns 100% of the share capital of the following companies. The directors are unsure of whether the investments should be consolidated. In which of the following circumstances would the investment NOT be consolidated? 38 A Petre has decided to sell its investment in Alpha as it is loss-making; the directors believe its exclusion from consolidation would assist users in predicting the group’s future profits B Beta is a bank and its activity is so different from the engineering activities of the rest of the group that it would be meaningless to consolidate it C Delta is located in a country where local accounting standards are compulsory and these are not compatible with IFRS used by the rest of the group D Gamma is located in a country where a military coup has taken place and Petre has lost control of the investment for the foreseeable future (12 marks) ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) 20 CONSOLIDATED STATEMENT OF FINANCIAL POSITION 20.1 HX acquired 80% of SA’s 100,000 equity shares on 1 July 20X0 for $140,000. On 1 July 20X0 the fair value of SA’s identifiable net assets was $126,000. The fair value of noncontrolling interest on acquisition is based on SA’s share price, which was $1.70. The trainee accountant has suggested three possible values for goodwill on acquisition: (1) (2) (3) $14,000 $39,200 $48,000 Which of the above values for goodwill is an acceptable valuation in accordance with IFRS 3 Business Combinations? A B C D 20.2 1 and 2 only 1 and 3 only 2 and 3 only 1, 2, and 3 At 1 January 20X1 Barley acquired 100% of the share capital of Corn for $1,400,000. At that date the share capital of Corn consisted of 600,000 ordinary shares of 50 cents each and its retained earnings were $50,000. On acquisition Corn had some assets whose carrying amount was $230,000 but the fair value was $250,000. What was goodwill on acquisition? A B C D 20.3 $730,000 $750,000 $1,030,000 $1,050,000 On 1 January 20X1, Jarndyce acquired 80% of the ordinary share capital of Skimpole for $576,000. The statements of financial position of the two companies at 31 December 20X1 were as follows: Jarndyce Skimpole $000 $000 Net assets 468 432 Investment in Skimpole 576 – ––––– –––– 1,044 432 ––––– –––– Issued share capital 720 180 Retained earnings At 31 December 20X0 144 108 Profit for 20X1 180 144 ––––– –––– 1,044 432 ––––– –––– Non-controlling interest is valued at fair value on acquisition, which was $140,000. There has been no impairment of goodwill since the acquisition took place. What amount of goodwill should be included in the consolidated statement of financial position of Jarndyce as at 31 December 20X1? ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 39 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK A B C D 20.4 $144,000 $230,400 $345,600 $428,000 Vaynor acquired 80,000 ordinary shares in Weeton some years ago. Extracts from the statements of financial position of the two companies as at 30 September 20X7 are as follows: Ordinary shares of $1 each Retained earnings Vaynor $000 500 90 Weeton $000 100 40 On acquisition the retained earnings of Weeton showed a deficit of $10,000. Goodwill has been impaired by $15,000 since acquisition. measured at fair value on acquisition. Non-controlling interest is What were the consolidated retained earnings of Vaynor on 30 September 20X7? A B C D 20.5 $102,000 $115,000 $118,000 $125,000 Gonzo acquired 80% of the share capital of Bamboo a number of years ago. Bamboo has issued 200,000 $1 shares which had a market price of $3.10 on acquisition. The carrying amount of Bamboo’s net assets as at 31 December 20X6 is $650,000, which is $50,000 higher than it was on acquisition. Non-controlling interest was measured at fair value on acquisition. At what amount should the non-controlling interest in Bamboo be included in the consolidated statement of financial position of Gonzo as at 31 December 20X6? A B C D 20.6 $120,000 $124,000 $130,000 $134,000 HW sold goods to SD, its 100% owned subsidiary on 1 February 20X1. The goods were sold to SD for $48,000. HW made a profit of 33.33% on the original cost of the goods. At the year-end, 30 June 20X1, 40% of the goods had been sold by SD; the remainder was still in SD’s inventory and SD had not paid for any of the goods. Which of the following states the correct adjustments required in the HW group’s consolidated statement of financial position at 30 June 20X1? 40 A Reduce inventory and retained earnings by $7,200 Reduce payables and receivables by $7,200 B Reduce inventory and retained earnings by $9,600 Reduce payables and receivables by $9,600 C Reduce inventory and retained earnings by $7,200 Reduce payables and receivables by $48,000 D Reduce inventory and retained earnings by $9,600 Reduce payables and receivables by $48,000 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) 20.7** Salt owns 100% of Pepper. During the year Salt sold goods to Pepper for a sales price of $1,044,000, generating a margin of 25%. 40% of these goods had been sold on by Pepper to external parties at the end of the reporting period. What adjustment for unrealised profit should be made in preparing Salt’s consolidated financial statements? A B C D 20.8 $83,520 $104,400 $125,280 $156,600 On 1 April 20X6, Woolwich paid $816,000 for 80% of Malta’s $408,000 share capital. Malta’s retained earnings at that date were $476,000. At 31 March 20X1 the retained earnings of the companies are: $000 Woolwich 1,224 Malta 680 Woolwich’s inventory includes goods purchased from Malta for $18,000. Malta makes a profit at 20% on the cost of all goods sold to Woolwich. What is the amount of retained earnings in the consolidated statement of financial position of Woolwich as at 31 March 20X1? A B C D 20.9 $1,384,320 $1,384,800 $1,387,200 $1,439,200 During the year Subway invoiced $200,000 to its parent company for transfers of goods in inventory. Transfers were made at a 25% mark-up. At the end of the year the parent still held 60% of the goods in inventory. What adjustment should be made for unrealised profit in preparing the consolidated financial statements for the year? A B C D 20.10 $16,000 $24,000 $30,000 $40,000 Which of the following statements apply when producing a consolidated statement of financial position? (1) (2) (3) All intra-group balances should be eliminated Intra-group profit in year-end inventory should be eliminated Closing inventory held by subsidiaries needs to be included at fair value A B C D 1 only 1 and 2 2 and 3 3 only ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 41 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK 20.11 Milton owns all the share capital of Keynes. The following information is extracted from the individual company statements of financial position as at 31 December 20X1: Current assets Current liabilities Milton $ 500,000 220,000 Keynes $ 200,000 90,000 Included in Milton purchase ledger is a balance in respect of Keynes of $20,000. The balance on Milton account in the sales ledger of Keynes is $22,000. The difference between those figures is accounted for by cash in transit. If there are no other intra-group balances, what is the carrying amount of the net current assets in the consolidated statement of financial position of Milton? A B C D 20.12 $368,000 $370,000 $388,000 $390,000 A parent company sold goods to its wholly owned subsidiary for $1,800 representing cost plus 20%. At the year-end two-thirds of the goods were still in inventory. What is the amount of unrealised profit at the year end? A B C D 20.13 $360 $300 $240 $200 Bass acquired its 70% holding in Miller many years ago. At 31 December 20X7 Miller had inventory with a book value of $15,000 purchased from Bass at cost plus 25%. What are the effects on non-controlling interest and retained earnings in the consolidated statement of financial position after dealing with the consolidation adjustment required for inventory? A B C D 20.14 Non-controlling interest No effect No effect Reduce by $900 Reduce by $1,125 Retained earnings Reduce by $3,000 Reduce by $3,750 Reduce by $2,100 Reduce by $2,625 Rugby has a 75% subsidiary, Stafford, and is preparing its consolidated statement of financial position as at 31 December 20X6. The carrying amount of non-current assets in the two companies at that date is as follows: $ Rugby 260,000 Stafford 80,000 On 1 January 20X6 Stafford had transferred an item of equipment to Rugby for $40,000. At the date of transfer the equipment, which had cost $42,000, had a carrying amount of $30,000 and a remaining useful economic life of five years. The group accounting policy is to depreciate non-current assets on a straight-line basis down to a nil residual value. It is also group policy not to revalue non-current assets. 42 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) What is the carrying amount of non-current assets in the consolidated statement of financial position of Rugby as at 31 December 20X6? A B C D 20.15 $340,000 $332,000 $330,000 $312,000 Tazer, a parent company, acquired Lowdown, an unincorporated entity, for $2·8 million. A fair value exercise performed on Lowdown’s net assets at the date of purchase showed: Property, plant and equipment Identifiable intangible asset Inventory Trade receivables less payables $000 3,000 500 300 200 –––––– 4,000 –––––– How should the purchase of Lowdown be reflected in Tazer’s consolidated statement of financial position? A Record the net assets at their values shown above and credit profit or loss with $1·2 million B Record the net assets at their values shown above and credit Tazer’s consolidated goodwill with $1·2 million C Write off the intangible asset ($500,000), record the remaining net assets at their values shown above and credit profit or loss with $700,000 D Record the purchase as a financial asset investment at $2·8 million (30 marks) 21 CONSOLIDATION ADJUSTMENTS 21.1 Huge acquired 60% of Small’s 500,000 shares on 1 January 20X2. The purchase consideration consisted of an immediate cash payment of $3.45 per share plus a share exchange of three shares in Huge for every two shares in Small. At the acquisition date the market prices of each share in Huge and each share in small were $6.50 and $4.20, respectively. What purchase consideration should be included in Huge’s statement of financial position in respect of its investment in Small? A B C D 21.2 $3,960,000 $2,925,000 $2,335,000 $1,875,000 In relation to accounting for positive purchased goodwill, what is the correct accounting treatment in accordance with IFRS 3 Business Combinations? A B C D Carry as an asset and amortise goodwill over its useful economic life Carry as an asset and test annually for impairment Value each year to fair value Write off immediately against consolidated retained earnings ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 43 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK 21.3 Tom has purchased all the share capital of Jerry during the year. Which of the following items would Tom take into account when calculating the fair value of the net assets acquired in accordance with IFRS 3 Business Combinations? 21.4 (1) A contingent liability dependent on the outcome of a legal case which has been provided for in Jerry’s books (2) A provision required to cover costs of reorganising Jerry’s departments to fit in with Tom’s structure (3) A warranty provision in Jerry’s books to cover costs of commitments made to customers A B C D 3 only 2 and 3 1 and 3 1 only The books of Tiny contain a provision for reorganisation. The reorganisation is under way and the provision is to cover costs to be incurred in the next six months to complete the reorganisation. Huge is considering acquiring Tiny. If it does so, the reorganisation of Tiny will continue. In assessing the fair value of net assets the directors of Huge wish to make a provision for future trading losses, and include the existing provision for reorganisation costs. In accordance with IFRS 3 Business Combinations which provisions may be included? A B C D 21.5 21.6 Provision for trading losses Include Exclude Include Exclude Provision for reorganisation costs Include Include Exclude Exclude Which of the following are required when assessing fair values on acquisition in accordance with IFRS 3 Business Combinations? (1) Valuation of non-current assets at market value where this exceeds carrying amount (2) Discounting trade receivables to present values where debt is not due to be recovered for two years (3) Inclusion of a contingent liability which is a present obligation of the acquired company A B C D 1 only 2 only 1 and 2 only 1, 2 and 3 Leeds acquired the whole of the issued share capital of Cardiff for $12 million in cash. In arriving at the purchase price Leeds had taken into account in respect of Cardiff future reorganisation costs of $1 million and anticipated future losses of $2 million. The fair value of the net assets of Cardiff before taking into account these matters was $7 million. In accordance with IFRS 3 Business Combinations, what is the amount of goodwill on the acquisition? 44 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) A B C D 21.7 $8 million $7 million $6 million $5 million On 1 January 20X2 Harry purchased 75% of the equity shares of Sally. The purchase consideration consisted of an immediate cash payment of $2 per share plus an additional payment of $3 per share on 1 January 20X4. Harry’s cost of capital is 6% and Sally’s equity shares consist of $100,000 (shares of 50 cents each). What is the cost of investment in Harry’s statement of financial position at 31 December 20X2 and how should the deferred consideration be presented? A B C D 21.8 Cost of investment $700,000 $724,000 $700,000 $724,000 Presented as Current liability Current liability Non-current liability Non-current liability Mungo acquired 80% of the equity share capital of Jerry on 1 January 20X2, paying cash of $1,200,000. Mungo has agreed to make a further cash payment of $600,000 if Jerry’s share price increases by at least 10% each year for the next three years. The fair value of this contingent consideration on 1 January 20X2 was measured at $320,000. At 31 December 20X2 the fair value of the contingent consideration was remeasured to $345,000, but market expectations for the next 12 months are very poor and the market as a whole is expected to fall by 15%. If the market reacts as expected then the estimated fair value of the contingent consideration on 31 December 20X3 would be $180,000. At what amount will Mungo include the contingent consideration in its statement of financial position as at 31 December 20X2? A B C D 21.9 $600,000 $345,000 $320,000 $180,000 Debbie incurred $1,000,000 of transaction costs in respect of the recent purchase of a controlling stake in Harry. These costs consist of $800,000 legal fees associated with the acquisition and $200,000 of issue costs relating to the equity shares issued by Debbie as part of the purchase consideration. Which of the following is the correct treatment of these transaction costs in Debbie’s financial statements? A Expense $800,000 legal fees immediately and off-set the share issue costs of $200,000 against share premium B Expense the full amount of $1,000,000 immediately C Include the full amount of $1,000,000 in the cost of investment in Harry D Expense $800,000 legal fees immediately and add the share issue costs of $200,000 to the cost of investment (18 marks) ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 45 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK 22 CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME 22.1 Constable owns 40% of Turner which it treats as an associated undertaking. Constable also owns 60% of Whistler. Constable has held both of these shareholdings for more than one year. Revenue of each company for the year ended 30 June 20X2 was as follows: $m 400 200 100 Constable Turner Whistler What is the revenue which will be reported in Constable’s CONSOLIDATED statement of profit or loss for the year ended 30 June 20X2? A B C D 22.2 $460 million $500 million $580 million $700 million Barley has owned 100% of the issued share capital of Oats for many years. Barley sells goods to Oats at cost plus 20%. The companies’ revenues for the year were: Barley Oats $460,000 $120,000 During the year Barley sold goods to Oats for $60,000, of which $18,000 were still held in inventory by Oats at the year end. What is the amount of revenue to appear in the consolidated statement of profit or loss? A B C D 22.3 $520,000 $530,000 $538,000 $562,000 Ufton is the sole subsidiary of Walcot. The cost of sales figures for 20X1 for Walcot and Ufton were $11 million and $10 million respectively. During 20X1 Walcot sold goods which had cost $2 million to Ufton for $3 million. Ufton has not yet sold any of these goods. What is the consolidated cost of sales figure for 20X1? A B C D 22.4 $16 million $18 million $19 million $20 million Patience has a wholly owned subsidiary, Bunthorne. During 20X1 Bunthorne sold goods to Patience for $40,000 which was cost plus 25%. At 31 December 20X1 $20,000 of these goods remained unsold. By what amount will revenue be reduced in the consolidated statement of profit and loss for the year ended 31 December 20X1? A B C D 46 $20,000 $30,000 $32,000 $40,000 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) 22.5 Patience has a wholly owned subsidiary, Bunthorne. During 20X1 Bunthorne sold goods to Patience for $40,000 which was cost plus 25%. At 31 December 20X1 $20,000 of these goods remained unsold. By what amount will profit be reduced in the consolidated statement of profit or loss for the year ended 31 December 20X1? A B C D 22.6 $4,000 $6,000 $8,000 $10,000 The following figures related to Sanderstead and its subsidiary Croydon for the year ended 31 December 20X9: Sanderstead Croydon $ $ Revenue 600,000 300,000 Cost of sales (400,000) (200,000) Gross profit 200,000 100,000 During the year Sanderstead sold goods to Croydon for $20,000, making a profit of $5,000. These goods were all sold by Croydon before the year end. What are the amounts for revenue and gross profit in the consolidated statement of profit and loss of Sanderstead for the year ended 31 December 20X9? A B C D 22.7 Revenue $900,000 $900,000 $880,000 $880,000 Gross profit $300,000 $295,000 $300,000 $295,000 Chicken owns 80% of Egg. Egg sells goods to Chicken at cost plus 50%. The total invoiced sales to Chicken by Egg in the year ended 31 December 20X1 were $900,000 and, of these sales, goods which had been invoiced at $60,000 were held in inventory by Chicken at 31 December 20X1. What is the adjustment for unrealised profit in the consolidated profit or loss for the year ended 31 December 20X1? A B C D 22.8 $20,000 $24,000 $30,000 $40,000 Fosters in 20X7 invoiced $120,000 of goods to its 75% subsidiary, Stella, at cost plus 30%. Stella had 25% of these in goods in inventory at the year end. At the start of the year Stella had $15,000 worth of inventory invoiced from Fosters, all of which was sold in 20X7. What is the amount of unrealised profit adjustment to consolidated gross profit? A B C D $3,461 $4,500 $6,923 $9,000 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 47 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK 22.9** Cherry owned 75% of Plum. For the year ended 31 December 20X1 Plum reported a net profit of $118,000. During 20X1 Plum sold goods to Cherry for $36,000 at cost plus 50%. At the year-end these goods are still held by Cherry. What is the non-controlling interest in the consolidated statement of profit or loss for the year ended 31 December 20X1? A B C D 22.10 $25,000 $26,500 $27,250 $29,500 Hot owns 80% of the issued share capital of Warm and 40% of the issued share capital of Cold. In the individual company financial statements the tax charges for the year are: $ 40,000 36,000 20,000 Hot Warm Cold What is the tax charge in the consolidated statement of profit or loss? A B C D 22.11 $68,800 $76,000 $76,800 $84,000 Cornish Co purchased 80% of Pasty Co a number of years ago for $164,000. During the year ended 31 December 20X6 Cornish Co disposed of its entire investment in Pasty Co for $275,000. On disposal, the net assets of Pasty Co were valued at $186,000 and noncontrolling interest amounted to $37,000. Goodwill remaining at the disposal date, in respect of the purchase, was $29,000. What is the profit on disposal which will be recorded in Cornish Co’s CONSOLIDATED statement of profit or loss for the year ended 31 December 20X6? A B C D $111,000 $97,000 $23,000 $89,000 (22 marks) 23 INVESTMENTS IN ASSOCIATES 23.1 The HC group acquired 30% of the equity share capital of AF on 1 July 20X0 paying $25,000. AF made a profit for the year to 31 March 20X1 (prior to dividend distribution) of $6,500 and paid a dividend of $3,500 to its equity shareholders. Profits accrue evenly throughout the year. What is the amount of income from associate to be included in the consolidated statement of profit or loss for the year ended 31 March 20X1 (to the nearest $)? A B C D 48 $675 $900 $1,463 $1,950 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) 23.2** The HY group acquired 35% of the equity share capital of SX on 1 July 20X0 paying $70,000. This shareholding enabled HY group to exercise significant influence over SX. SX made a profit for the year ended 30 June 20X1 (prior to dividend distribution) of $130,000 and paid a dividend of $80,000 to its equity shareholders. What is the amount for the investment in associate recognised in HY’s consolidated statement of financial position at 30 June 20X1? A B C D 23.3 23.4** 23.5 $115,500 $98,000 $87,500 $70,000 Which of the following statements regarding the equity method of accounting are TRUE? (1) (2) An investment in an associate is always carried at cost An investor recognises its share of the associate’s profit or loss in consolidated profit or loss A B C D Neither statement Statement 1 only Statement 2 only Both statements Which of the following could provide evidence of “significant influence”? (1) (2) (3) (4) 51% of the voting power of the investee Interchange of management personnel Participation in decisions about dividends Provision of essential technical information A B C D 1, 2 and 3 1, 2 and 4 1, 3 and 4 2, 3 and 4 Inveresk has equity shareholdings in three other companies, as shown below, and has a seat on the board of each: Raby Inveresk 40% Other shareholders No other holdings larger than 10% Seal 30% Another company holds 60% of Seal’s equity Toft 15% Two other companies hold respectively 50% and 35% of Toft’s equity, and each has a seat on its board. Inveresk exerts significant influence over Toft Which of the above shareholdings are associated undertakings of Inversk? A B C D Raby only Raby and Seal only Raby and Toft only Raby, Seal and Toft ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 49 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK 23.6 Holly has a 30% holding in Johnson which allows Holly to exert significant influence over Johnson. During the current year Holly sold goods to Johnson for $15,000; Holly applies a mark-up of 25% on cost. Johnson still held half of these goods in inventory at the year end. What is the amount of unrealised profit that will be reflected in Holly’s consolidated financial statements for the current year (to the nearest $)? A B C D 23.7** $450 $562 $1,500 $3,000 Vaynor acquired 100,000 ordinary shares in Weeton and 20,000 ordinary shares in Yarlet some years ago. The investment in Yarlet gives Vaynor significant influence. Extracts from the statements of financial position of the three companies as at 30 September 20X7 are as follows: Vaynor Weeton Yarlet $000 $000 $000 Ordinary shares of $1 each 500 100 50 Retained earnings 90 40 70 At acquisition the retained earnings of Weeton showed a deficit of $10,000 and of Yarlet a surplus of $30,000. What were the consolidated retained earnings of Vaynor on 30 September 20X7? A B C D $136,000 $156,000 $200,000 $210,000 (14 marks) 24 FOREIGN CURRENCY TRANSACTIONS 24.1** Which of the following may be classified as a monetary item in accordance with IAS 21 The Effects of Changes in Foreign Exchange Rates? 24.2 (1) (2) (3) (4) Inventory due to be exported in the following period A foreign currency denominated payable A dividend due from the holding of a foreign equity investment A provision for the settlement of a foreign currency debt that is to be settled with the delivery of an item of machinery A B C D 1 and 2 2 and 3 1 and 4 3 and 4 Fargone currently uses the Krown as its functional currency. Fargone has grown substantially and for the last two years ending 31 December 20X6 has exported most of its goods, with a large growth in dollar sales, more than 90% of its trade being denominated in dollars. In accordance with IAS 21 The Effects of Changes in Foreign Exchange Rates which of the following applies to the functional currency of Fargone as at 31 December 20X6? 50 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) A B C D 24.3 It should be changed to the dollar if underlying business conditions have changed It should be changed, retrospectively, to the dollar as at 1 January 20X5 It remains the Krown because a functional currency does not change It remains the Krown but the presentation currency should be the dollar On 28 November Patter purchased some goods for Krown 220,000. On 17 December Patter made a payment of Krown 110,000. At 31 December, Patter’s year end, all of the goods remain in inventory and Krown 110,000 is still outstanding. Exchange rates are as follows: 28 November 17 December 31 December $1 = Krown 5.50 $1 = Krown 5.30 $1 = Krown 5.60 What is the exchange gain or loss to be included in Patter’s profit or loss for the current year? A B C D 24.4 $11,000 gain $398 loss $11,000 loss $398 gain Belltop has received Krown 2,300,000 as a prepayment on an item of machinery which is to be delivered to the customer in the following period. The prepayment is a non-monetary item. Belltop’s functional currency is the dollar. The exchange rate on receipt of the cash was $1 = Krown 4.8 and at the year-end $1 = Krown 5.1. What is the exchange gain or loss to be included in Belltop’s profit or loss for the current year? A B C D 24.5 $28,187 gain $28,187 loss No gain or loss is recognised $690,000 gain On 1 January 20X6 Dodge took out a loan of Krown 1 million. Dodge’s functional currency is the dollar. The loan is to be repaid in 10 equal instalments of Krown 100,000 on 31 December each year. Exchange rates are as follows: 1 January 20X6 31 December 20X6 Krown 1 = $2.42 Krown 1 = $2.46 What is the carrying amount of the non-current liability in Dodge’s statement of financial position as at 31 December 20X6 in respect of the loan? A B C D $2,178,000 $2,214,000 $1,936,000 $1,968,000 (10 marks) ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 51 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK 25 ANALYSIS AND INTERPRETATION 25.1 An entity that fixes prices by adding 50% to cost actually achieved a mark-up of 45%. Which of the following factors could account for the shortfall? A B C D 25.2 25.3 Sales were lower than expected Opening inventories had been overstated Closing inventories were higher than opening inventories Purchases were higher than expected Which of the following factors could cause a company’s gross profit percentage on sales to fall below the expected level? A Overstatement of closing inventories B The incorrect inclusion in purchases of invoices relating to goods supplied in the following period C The inclusion in sales of the proceeds of sale of non-current assets D Trade discounts offered to customers were lower than expected Gormenghast’s current ratio has been calculated as 1.2:1. However, it has now been discovered that closing inventory has been understated by $24,000 and opening inventory has been overstated by $24,000. How did these misstatements affect the calculations of Gormenghast’s current ratio and inventory days? A B C D 25.4 Current ratio Too high Too high Too low Too low Inventory days Too high Too low Too high Too low The following are extracts from the financial statements of Lamas for the year ended 31 December 20X2: Statement of financial position Issued share capital Retained earnings 12% Loan notes 20X8 Statement of profit or loss $ 2,000 1,000 ——— 3,000 1,000 ——— 4,000 ——— Operating profit Loan note interest $ 795 (120) —— 675 —— What is the return on capital employed at the end of the year? A B C D 52 22.5% 19.9% 16.9% 16.6% ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) 25.5 Welwyn buys and sells a single product. The following is an extract from its statement of financial position at 31 December 20X7: 20X7 20X6 $ $ Inventories 50 40 Trade receivables 16 24 Sales and purchases during 20X7 were $200,000 and $120,000 respectively. 20% of sales were for cash. What were the average receivables collection period and gross profit percentage for the year ended 31 December 20X7? A B C D 25.6 Average receivables collection period 37 days 37 days 46 days 46 days Gross profit percentage 35% 45% 35% 45% Marple has a current ratio of 2:1. Which of the following transactions will cause the current ratio to decrease? A B C D 25.7 Receives cash in respect of a long-term loan Receives cash in respect of a short-term loan Pays an existing creditor Writes off an existing trade receivable against the loss allowance for trade receivables Which of the following statements about a not-for-profit entity is valid? A There is no requirement to calculate an earnings per share figure as it is not likely to have shareholders who need to assess its earnings performance B The current value of its property, plant and equipment is not relevant as it is not a commercial entity C Interpretation of its financial performance using ratio analysis is meaningless D Its financial statements will not be closely scrutinised as it does not have any investors (14 marks) 26 IAS 7 STATEMENT OF CASH FLOWS 26.1 IAS 7 Statement of Cash Flows sets out the three main headings to be used in a statement of cash flows. Items that may appear on a statement of cash flows include: (1) (2) (3) (4) Tax paid Purchase of investments Loss on disposal of machinery Purchase of equipment Which of the above items would be included under the heading “Cash flows from operating activities” according to IAS 7? ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 53 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK A B C D 26.2 Which of the following would be shown in a statement of cash flow using the direct method but not in a statement of cash flow using the indirect method of calculating cash generated from operations? A B C D 26.3** 1 and 2 1 and 3 2 and 4 3 and 4 Cash payments to employees Increase/(decrease) in receivables Depreciation Finance costs An extract from a statement of cash flows prepared by a trainee accountant is shown below: $m 28 Profit before taxation Adjustments for: Depreciation Operating profit before working capital changes Decrease in inventories Increase in receivables Increase in payables Cash generated from operations (9) –– 19 3 (4) (8) –– 10 — Which of the following criticisms of this extract are correct? 26.4 (1) (2) (3) (4) Depreciation charges should have been added, not deducted Decrease in inventories should have been deducted, not added Increase in receivables should have been added, not deducted Increase in payables should have been added, not deducted A B C D 1 and 3 1 and 4 2 and 3 2 and 4 At 1 January 20X0 Casey had property, plant and equipment with a carrying amount of $250,000. In the year ended 31 December 20X0 the company disposed of assets with a carrying amount of $45,000 for $50,000. The company revalued a building from $75,000 to $100,000 and charged depreciation for the year of $20,000. At the end of the year the carrying amount of property, plant and equipment was $270,000. What amount will be reported in the statement of cash flows for the year ended 31 December 20X0 under the heading “cash flows from investing activities”? A B C D 54 $10,000 outflow $10,000 inflow $35,000 outflow $50,000 inflow ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) 26.5 A company sold a building at a profit. How should this transaction be treated in the company’s statement of cash flows? Proceeds of sale Cash inflow under Financing activities Profit on sale Added to profit in calculating cash flow from operating activities B Cash inflow under Investing activities Deducted from profit in calculating cash flow from operating activities C Cash inflow under Investing activities Added to profit in calculating cash flow from operating activities D Cash inflow under Financing activities Deducted from profit in calculating cash flow from operating activities A 26.6** The non-current assets of Ealing were as follows: Cost Aggregate depreciation Carrying amount Start of year $ 180,000 (120,000) ––––––– 60,000 ––––––– End of year $ 240,000 (140,000) ––––––– 100,000 ––––––– During the year non-current assets which had cost $80,000 and had a carrying amount of $30,000 were sold for $20,000. What is the net cash flow in respect of non-current assets for the year? A B C D 26.7 $60,000 $40,000 $120,000 $140,000 On comparing the components of net assets of Deep on 31 December 20X2 and 31 December 20X1 the following movements were noted: (1) (2) A decrease in the warranty provision of $12,000 due to a change in estimate An increase in tangible non-current assets of $98,000 due to a revaluation in the year Which movements should be included in the notes to the cash flow statement of Deep as part of the reconciliation of operating profit to net cash flow from operating activities? A B C D 26.8 Neither 1 nor 2 1 only 2 only Both 1 and 2 A company incurs expenditure on development during the year which is capitalised. What is the correct treatment of this expenditure in the statement of cash flows? A As an operating cash flow B As an investing cash flow C As an item in the reconciliation of operating profit and net cash inflow from operating activities D It will not appear at all ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 55 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK 26.9 The following items have been extracted from the statement of cash flows of Gresham for the year ended 31 December 20X1: $ Depreciation 30,000 Profit on sale of non-current assets 5,000 Proceeds from sale of non-current assets 20,000 Purchase of non-current assets 25,000 If the carrying amount of non-current assets was $110,000 on 31 December 20X0, what was it on 31 December 20X1? A B C D 26.10 $70,000 $80,000 $85,000 $90,000 Waterloo acquired a building by issuing $400,000 8% loan notes at par. The market rate of interest at the time of the issue was also 8%. How should the acquisition be presented in the statement of cash flows for the period? A B C D 26.11 Investing activities $(400,000) $(400,000) Nil Nil Financing activities $400,000 Nil $400,000 Nil At 1 October 20X0, BK had an accrued interest payable balance of $12,000 in its statement of financial position. During the year ended 30 September 20X1, BK charged interest payable of $41,000 to its statement of profit or loss. Accrued interest payable at 30 September20X1 was $15,000. Included in the interest charged to profit or loss for the year was an unwinding of the discount on a decommissioning provision of $5,000 and lease interest of $3,000. The lease rental is paid in cash annually in arrears. What is the cash flow in respect of interest paid that will appear in BK’s statement of cash flows for the year ended 30 September 20X1? A B C D 26.12 $30,000 $33,000 $36,000 $38,000 The following information is available for the property, plant and equipment of Fry as at 30 September: 20X4 20X3 $000 $000 Carrying amounts 23,400 14,400 The following items were recorded during the year ended 30 September 20X4: (i) (ii) (iii) (iv) 56 Depreciation charge of $2·5 million An item of plant, with a carrying amount of $3 million, was sold for $1·8 million A property was revalued upwards by $2 million Environmental provisions of $4 million relating to property, plant and equipment were capitalised during the year ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) What amount would be shown in Fry’s statement of cash flows for purchase of property, plant and equipment for the year ended 30 September 20X4? A B C D $8·5 million $12·5 million $7·3 million $10·5 million (24 marks) 27 IAS 33 EARNINGS PER SHARE 27.1 A company currently has 10 million $1 shares in issue with a market value of $3 per share. The company wishes to raise new funds using a 1-for-4 rights issue. The theoretical ex rights price per share is $2·80. How much new finance was raised by the rights issue? A B C D 27.2 $2,500,000 $4,000,000 $5,000,000 $7,000,000 A company makes a 2-for-3 rights issue at an issue price of $2. The cum-rights price is $4. What is the theoretical ex rights price? A B C D 27.3** $2·50 $2·80 $3·00 $3·20 Chartwell has in issue $120,000 of equity share capital (shares of 50 cents each) and 10,000 6% Preference shares of $3 each. Extracts from the financial statements for the year to 31 March 20X3 are shown below: Profit before interest and tax Interest paid Preference dividend Taxation Ordinary dividend $ 528,934 6,578 1,800 125,860 10,800 In accordance with IAS 33 Earnings per Share, what is Chartwell’s basic earnings per share for the year ended 31 March 20X3? A B C D 27.4 $1.60 $1.64 $3.20 $3.29 In the year to 30 September 20X3, Wexam reported a retained profit of $4·8m after paying preference dividends of $200,000 and dividends of $800,000 to the holders of the ordinary shares in issue at the year end. On 1 October 20X2 Wexam had three million shares in issue. On 1 April 20X3 the company had made a bonus issue of one share for every three held. In accordance with IAS 33 Earnings per Share, what is Wexam’s basic earnings per share for the year ended 30 September 20X3? ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 57 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK A B C D 27.5 $1.20 $1.40 $1.45 $1.60 In the year to 30 November the retained profit of Dale was $3,640,500. This was after paying dividends as follows: Ordinary: Preference: $0.05 per share on 1·5 million shares $0.07 per share on 600,000 shares In accordance with IAS 33 Earnings per Share, what is Dale’s basic earnings per share? A B C D 27.6 $1.73 $1.77 $2.43 $2.48 Reploy has reported a profit before interest and tax of $728,654 for the last financial year. The company’s profit or loss statement reports an interest charge of $45,860, a tax charge of $158,740 whilst the statement of changes in equity shows that an ordinary dividend of $50,000 was paid. The company’s issued ordinary share capital is $500,000 in $1 shares. In accordance with IAS 33 Earnings per Share, what is Reploy’s basic earnings per share? A B C D 27.7 $0.95 $1.05 $1.37 $1.46 The financial statements of Epic showed that retained earnings had increased in the year by $689,424. The following items were presented by Epic in either the statement of profit or loss for the year or in the statement of changes in equity: Interest Taxation Non-controlling interest Ordinary dividend ($0.10 per share) $ 84,441 227,553 47,338 65,000 In accordance with IAS 33 Earnings per Share, what is Epic’s basic earnings per share? A B C D 27.8 $0.10 $1.13 $1.16 $1.23 The most recent statement of profit or loss of Waylor reported a profit before tax of $1,258,000 and a tax expense of $224,000. Half way through the year the company had issued 40,000 bonus shares which brought the total number of shares in issue to 440,000. In accordance with IAS 33 Earnings per Share, what is Waylor’s basic earnings per share? 58 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) A B C D 27.9 $2.35 $2.47 $2.86 $2.99 Jubilee reported profit after tax for the period of $1,600,000 and it had 1,000,000 ordinary shares in issue for the whole year. Jubilee had a number of exercisable share options outstanding at the year end. Holders of the options were entitled to buy 50,000 new shares for $1.60. The average market price of Jubilee’s shares for the previous 12 months was $2. In accordance with IAS 33 Earnings per Share, what is Jubilee’s diluted earnings per share? A B C D 27.10 $1.52 $1.54 $1.58 $1.60 Mork has disclosed basic EPS figure for the year of $0.32, this is based on 500,000 ordinary shares being in issue for the whole year. Mork also has $100,000 8% convertible debt in issue at the year end. The conversion rights allow the holders to convert their debt into equity on a basis of 5 shares for every $4 of debt. Mork pays income tax at a rate of 30%. In accordance with IAS 33 Earnings per Share, what is Mork’s diluted earnings per share? A B C D $0.265 $0.269 $0.285 $0.289 27.11** Aqua has correctly calculated its basic earnings per share (EPS) for the current year. Which of the following items need to be additionally considered when calculating Aqua’s diluted EPS for the year? (1) A 1 for 5 rights issue of equity shares during the year at $1·20 when the market price of the equity shares was $2·00 (2) The issue during the year of a convertible (to equity shares) loan note (3) The granting during the year of directors’ share options exercisable in three years’ time (4) Equity shares issued during the year as the purchase consideration for the acquisition of a new subsidiary company A B C D 1, 2, 3 and 4 1 and 2 only 2 and 3 only 3 and 4 only (22 marks) ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 59 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK Question 1 WARDLE The following scenario relates to questions 1–5. Wardle’s activities include the production of maturing products which take a long time before they are ready to retail. Details of one such product are that on 1 April 20X5 it had a cost of $5 million and a fair value of $7 million. The product would not be ready for retail sale until 31 March 20X8. On 1 April 20X5 Wardle entered into an agreement to sell this product to Easyfinance for $6 million. The agreement gave Wardle the right to repurchase the product at any time up to 31 March 20X8 at a fixed price of $7,986,000, at which date Wardle expected the product to retail for $10 million. The compound interest Wardle would have to pay on a three-year loan of $6 million would be: $000 600 660 726 Year 1 Year 2 Year 3 This interest is equivalent to the return required by Easyfinance. 1 Based on the substance of the transaction what will be the outstanding liability at the end of year 2? A B C D 2 If Wardle accounted for the legal form of the transaction what would be the finance costs charged to profit or loss in year 3? A B C D 3 60 Nil $1,986,000 $726,000 $7,986,000 What will be the effect on Wardle’s return on capital employed (ROCE) and gearing if the transaction is accounted for based on its substance rather than its legal form? A B C D 4 Nil $6,600,000 $7,260,000 $7,986,000 ROCE Higher Higher Lower Lower Gearing Higher Lower Lower Higher Which of the following are examples of transactions which could be used to create “offbalance sheet finance”? (1) (2) (3) (4) Sale and repurchase arrangements Factoring of debts Warranty provisions Consignment inventories A B C D 1, 2 and 3 2, 3 and 4 1, 3 and 4 1, 2 and 4 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) 5 Wardle has received a request from a customer to buy 1,000 units of MGA; the customer has asked Wardle to hold the product and also to be billed for the sale. Which of the following criteria must be met before Wardle can recognise revenue in respect of this bill-and-hold transaction? (1) Wardle plans to manufacture the product two weeks before delivery is due to the customer (2) The customer has requested that the goods be held until they are ready to take delivery A B C D 1 only 2 only Both 1 and 2 Neither 1 or 2 (10 marks) Question 2 DEXON Below is the summarised draft statement of financial position of Dexon, a publicly listed company, as at 31 March 20X7: $000 $000 Assets Non-current assets Property at valuation (land $20,000; buildings $165,000 (note (ii)) Plant (note (ii)) Investments at fair value through profit or loss at 1 April 20X6 (note (iii)) 185,000 180,500 12,500 ––––––– 378,000 Current assets Inventory Trade receivables (note (iv)) Bank 84,000 52,200 3,800 ––––––– Total assets Equity and liabilities Equity Ordinary shares of $1 each Share premium Revaluation surplus Retained earnings – at 1 April 20X6 – for the year ended 31 March 20X7 Non-current liabilities Deferred tax – at 1 April 20X6 (note (v)) Current liabilities Total equity and liabilities ©2017 DeVry/Becker Educational Development Corp. All rights reserved. $000 140,000 ––––––– 518,000 ––––––– 250,000 40,000 18,000 12,300 96,700 ––––––– 109,000 ––––––– 167,000 ––––––– 417,000 19,200 81,800 ––––––– 518,000 ––––––– 61 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK The following information is relevant: (i) Dexon’s profit or loss includes $7.8 million of revenue for credit sales made in March. Dexon applied a mark-up on cost of 30% on all sales. In April the auditors stated that the contract does not have commercial substance and revenue should not be recognised for this contract. (ii) The non-current assets have not been depreciated for the year ended 31 March 20X7. Dexon has a policy of revaluing its land and buildings at the end of each accounting year. The values in the above statement of financial position are as at 1 April 20X6 when the buildings had a remaining life of 15 years. A qualified surveyor has valued the land and buildings at 31 March 20X7 at $180 million. Plant is depreciated at 20% on the reducing balance basis. (iii) The investments at fair value through profit or loss are held in a fund whose value changes directly in proportion to a specified market index. At 1 April 20X6 the relevant index was 1,200 and at 31 March 20X7 it was 1,296. (iv) In late March 20X7 the directors of Dexon discovered a material fraud perpetrated by the company’s credit controller that had been continuing for some time. Investigations revealed that a total of $4 million of the trade receivables as shown in the statement of financial position at 31 March 20X7 had in fact been paid and the money had been stolen by the credit controller. An analysis revealed that $1·5 million had been stolen in the year to 31 March 20X6 with the rest being stolen in the current year. Dexon is not insured for this loss and it cannot be recovered from the credit controller, nor is it deductible for tax purposes. (v) During the year the company’s taxable temporary differences increased by $10 million of which $6 million related to the revaluation of the property. The deferred tax relating to the remainder of the increase in the temporary differences should be taken to the profit or loss. The applicable income tax rate is 20%. (vi) The above figures do not include the estimated provision for income tax on the profit for the year ended 31 March 20X7. After allowing for any adjustments required in items (i) to (iv), the directors have estimated the provision at $11·4 million (this is in addition to the deferred tax effects of item (v)). (vii) On 1 September 20X6 there was a fully subscribed rights issue of one new share for every four held at a price of $1·20 each. The proceeds of the issue have been received and the issue of the shares has been correctly accounted for in the above statement of financial position. (viii) In May 20X6 a dividend of $0.04 per share was paid. In November 20X6 (after the rights issue in item (vii) above) a further dividend of $0.03 per share was paid. Both dividends have been correctly accounted for in the above statement of financial position. Required: Taking into account any adjustments required by items (i) to (viii) above: (a) Prepare a statement showing the recalculation of Dexon’s profit for the year ended 31 March 20X7. (8 marks) (b) Prepare the statement of changes in equity of Dexon for the year ended 31 March 20X7. (4 marks) (c) Redraft the statement of financial position of Dexon as at 31 March 20X7. (8 marks) Note: Notes to the financial statements are NOT required. (20 marks) 62 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) Question 3 SANDOWN The following trial balance relates to Sandown at 30 September 20X6: $000 Revenue (note (i)) Cost of sales Distribution costs Administrative expenses (note (ii)) Loan interest paid (note (iii)) Investment income Profit on sale of investments (note (iv)) Current tax (note (v)) Property – at cost 1 October 20W6 (note (vi)) – accumulated depreciation – 1 October 20X5 Plant and equipment – at cost (note (vi)) – accumulated depreciation – 1 October 20X5 Brand – at cost 1 October 20X1 (note (vi)) – accumulated amortisation – 1 October 20X5 Financial asset investments (note (iv)) Inventory at 30 September 20X6 Trade receivables Bank Trade payables Equity shares of 20 cents each Equity option Other reserve (note (iv)) 5% Convertible loan note 20X9 (note (iii)) Retained earnings at 1 October 20X5 Deferred tax (note (v)) $000 380,000 246,800 17,400 50,500 1,000 1,300 2,200 2,100 63,000 8,000 42,200 19,700 30,000 9,000 26,500 38,000 44,500 8,000 ––––––– 570,000 ––––––– 42,900 50,000 2,000 5,000 18,440 26,060 5,400 ––––––– 570,000 ––––––– The following notes are relevant: (i) Sandown’s revenue includes $16 million for goods sold to Pending on 1 October 20X5. The terms of the sale are that Sandown will incur on-going service and support costs of $1·2 million per annum for three years after the sale. Sandown normally makes a gross profit of 40% on such servicing and support work. Ignore the time value of money. (ii) Administrative expenses include an equity dividend of 4·8 cents per share paid during the year. (iii) The 5% convertible loan note was issued for proceeds of $20 million on 1 October 20X4. It has an effective interest rate of 8% due to the value of its conversion option. (iv) The financial asset investments included in the trial balance are equity investments and have been classified as “Fair value through other comprehensive income” by Sandown. During the year Sandown sold an investment for $11 million. At the date of sale it had a carrying amount of $8·8 million and had originally cost $7 million. Sandown has recorded the disposal of the investment. The remaining investments (the $26·5 million in the trial balance) have a fair value of $29 million at 30 September 20X6. The other reserve in the trial balance represents the net increase in the value of the investments as at 1 October 20X5. Ignore deferred tax on these transactions. (v) The balance on current tax represents the under/over provision of the tax liability for the year ended 30 September 20X5. The directors have estimated the provision for income tax for the year ended 30 September 20X6 at $16·2 million. At 30 September 20X6 the carrying amounts of Sandown’s net assets were $13 million in excess of their tax base. The income tax rate of Sandown is 30%. ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 63 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK (vi) Non-current assets: The property has a land element of $13 million. The building element is being depreciated on a straight-line basis. Plant and equipment is depreciated at 40% per annum using the reducing balance method. The brand is being depreciated using the straight-line method over a 10-year life. No depreciation/amortisation has yet been charged on any non-current asset for the year ended 30 September 20X6. Depreciation and amortisation are charged to cost of sales. Required: (a) Prepare the statement of profit or loss and other comprehensive income for Sandown for the year ended 30 September 20X6. (11 marks) (b) Prepare the statement of financial position of Sandown as at 30 September 20X6. (9 marks) Note: Notes to the financial statements are not required. (20 marks) Question 4 CAVERN The following trial balance relates to Cavern as at 30 September 20X6: $000 Equity shares of 20 cents each (note (i)) 8% Loan note (note (ii)) Retained earnings – 30 September 20X5 Other equity reserve Revaluation surplus Share premium Land and buildings at valuation – 30 September 20X5: Land ($7 million) and building ($36 million) (note (iii)) 43,000 Plant and equipment at cost (note (iii)) 67,400 Accumulated depreciation plant and equipment – 30 September 20X5 Fair value through other comprehensive income investments (note (iv)) 15,800 Inventory at 30 September 20X6 19,800 Trade receivables 29,000 Bank Deferred tax (note (v)) Trade payables Revenue Cost of sales 128,500 Administrative expenses (note (i)) 25,000 Distribution costs 8,500 Loan note interest paid 2,400 Bank interest 300 Investment income Current tax (note (v)) 900 ––––––– 340,600 ––––––– 64 $000 50,000 30,600 12,100 3,000 7,000 11,000 13,400 4,600 4,000 21,700 182,500 700 ––––––– 340,600 ––––––– ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) The following notes are relevant: (i) Cavern has accounted for a fully subscribed rights issue of equity shares made on 1 April 20X6 of one new share for every four in issue at $0.42 each. The company paid ordinary dividends of $0.03 per share on 30 November 20X5 and $0.05 per share on 31 May 20X6. The dividend payments are included in administrative expenses in the trial balance. (ii) The 8% loan note was issued on 1 October 20X4 at its nominal (face) value of $30 million. The loan note will be redeemed on 30 September 20X8 at a premium which gives the loan note an effective finance cost of 10% per annum. (iii) Non-current assets: Cavern revalues land and building at the end of each accounting year. At 30 September 20X6 the value to be incorporated into the financial statements is $41·8 million. The building’s remaining life at the beginning of the current year (1 October 20X5) was 18 years. Cavern does not make an annual transfer from the revaluation surplus to retained earnings in respect of the realisation of the revaluation surplus. Ignore deferred tax on the revaluation surplus. Plant and equipment includes an item of plant bought for $10 million on 1 October 20X5 that will have a 10-year life (using straight-line depreciation with no residual value). Production with this plant uses toxic chemicals which will cause decontamination costs to be incurred at the end of its life. The present value of these costs at a discount rate of 10% at 1 October 20X5 was $4 million. Cavern has not provided any amount for the decontamination cost. All other plant and equipment is depreciated at 12·5% per annum using the reducing balance method. No depreciation has yet been charged on any non-current asset for the year ended 30 September 20X6. All depreciation is charged to cost of sales. (iv) The fair value through other comprehensive income investments are equity investments. Their fair value at 30 September 20X6 was $13·5 million. There were no acquisitions or disposals of these investments during the year ended 30 September 20X6. (v) A provision for income tax for the year ended 30 September 20X6 of $5·6 million is required. The balance on current tax represents the under/over provision of the tax liability for the year ended 30 September 20X5. At 30 September 20X6 the tax base of Cavern’s net assets was $15 million less than their carrying amounts. The movement on deferred tax should be taken to profit or loss. The income tax rate of Cavern is 25%. Required: (a) Prepare the statement of profit or loss and other comprehensive income for Cavern for the year ended 30 September 20X6. (11 marks) (b) Prepare the statement of financial position of Cavern as at 30 September 20X6. (9 marks) (20 marks) ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 65 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK Question 5 FRESCO The following trial balance relates to Fresco at 31 March 20X7: $000 Equity shares of 50 cents each (note (i)) Share premium (note (i)) Retained earnings at 1 April 20X6 Property – at cost (note (ii)) Plant and equipment – at cost (note (ii)) Accumulated depreciation of property at 1 April 20X6 Accumulated depreciation of plant and equipment at 1 April 20X6 Inventory at 31 March 20X7 Trade receivables (note (iii)) Bank Deferred tax (note (iv)) Trade payables Revenue Cost of sales Lease payments (note (ii)) Distribution costs Administrative expenses Bank interest Current tax (note (iv)) Suspense account (note (i)) $000 45,000 5,000 5,100 48,000 47,500 16,000 33,500 25,200 28,500 1,400 3,200 27,300 350,000 298,700 8,000 16,100 26,900 300 800 ––––––– 500,000 ––––––– 13,500 ––––––– 500,000 ––––––– The following notes are relevant: (i) The suspense account represents the corresponding credit for cash received for a fully subscribed rights issue of equity shares made on 1 January 20X7. The terms of the share issue were one new share for every five held at a price of $0.75 each. The price of the company’s equity shares immediately before the issue was $1·20 each. (ii) Non-current assets: Property had a 12-year useful life on acquisition. To reflect a marked increase in property prices, Fresco decided to revalue it on 1 April 20X6. The directors accepted an independent surveyor’s report which valued the property at $36 million on that date. Fresco has not yet recorded the revaluation. The remaining life of the property is eight years at the date of the revaluation. Fresco makes an annual transfer to retained profits to reflect the realisation of the revaluation surplus. In Fresco’s tax jurisdiction the revaluation does not give rise to a deferred tax liability. On 1 April 20X6, Fresco acquired an item of plant under a lease agreement that had an implicit finance cost of 10% per annum. The lease payments in the trial balance represent an initial deposit of $2 million paid on 1 April 20X6 and the first annual rental of $6 million paid on 31 March 20X7. The lease agreement requires further annual payments of $6 million on 31 March each year for the next four years. The plant was initially measured at $25 million on 1 April 20X6. Plant and equipment (other than the leased plant) is depreciated at 20% per annum using the reducing balance method. No depreciation has yet been charged on any non-current asset for the year ended 31 March 20X7. Depreciation is expensed to cost of sales. 66 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) (iii) In March 20X7, Fresco’s internal audit department discovered a fraud committed by the company’s credit controller who did not return from a foreign business trip. The outcome of the fraud is that $4 million of the company’s trade receivables have been stolen by the credit controller and are not recoverable. Of this amount, $1 million relates to the year ended 31 March 20X6 and the remainder to the current year. Fresco is not insured against this fraud. (iv) Fresco’s income tax calculation for the year ended 31 March 20X7 shows a tax refund of $2·4 million. The balance on current tax in the trial balance represents the under/over provision of the tax liability for the year ended 31 March 20X6. At 31 March 20X7, Fresco had taxable temporary differences of $12 million (requiring a deferred tax liability). The income tax rate of Fresco is 25%. Required: (a) Prepare the statement of profit or loss and other comprehensive income for Fresco for the year ended 31 March 20X7. (9 marks) (b) Prepare the statement of changes in equity for Fresco for the year ended 31 March 20X7. (4 marks) (c) Prepare the statement of financial position of Fresco as at 31 March 20X7. (7 marks) Notes to the financial statements are not required. (20 marks) Question 6 ATLAS The following trial balance relates to Atlas at 31 March 20X7: $000 Equity shares of 50 cents each (note (v)) Share premium Retained earnings at 1 April 20X6 Land and buildings – at cost (land $10 million) (note (ii)) 60,000 Plant and equipment – at cost (note (ii)) 94,500 Accumulated depreciation at 1 April 20X6: – buildings – plant and equipment Inventory at 31 March 20X7 43,700 Trade receivables 42,200 Bank Deferred tax (note (iv)) Trade payables Revenue (note (i)) Cost of sales 411,500 Distribution costs 21,500 Administrative expenses 30,900 Dividends paid 20,000 Bank interest 700 Current tax (note (iv)) ––––––– 725,000 ––––––– ©2017 DeVry/Becker Educational Development Corp. All rights reserved. $000 50,000 20,000 11,200 20,000 24,500 6,800 6,200 35,100 550,000 1,200 ––––––– 725,000 ––––––– 67 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK The following notes are relevant: (i) Revenue includes the sale of $10 million of maturing inventory made to Xpede on 1 October 20X6. The cost of the goods at the date of sale was $7 million and Atlas has an option to repurchase these goods at any time within three years of the sale at a price of $10 million plus accrued interest from the date of sale at 10% per annum. At 31 March 20X7 the option had not been exercised, but it is highly likely that it will be before the time period lapses. (ii) Non-current assets: On 1 October 20X6, Atlas terminated the production of one of its product lines. From this date, the plant used to manufacture the product has been actively marketed at an advertised price of $4·2 million which is considered realistic. It is included in the trial balance at a cost of $9 million with accumulated depreciation (at 1 April 20X6) of $5 million. On 1 April 20X6, the directors of Atlas decided that the financial statements would show an improved position if the land and buildings were revalued to market value. At that date, an independent valuer valued the land at $12 million and the buildings at $35 million and these valuations were accepted by the directors. The remaining life of the buildings at that date was 14 years. Atlas does not make a transfer to retained earnings for excess depreciation. Ignore deferred tax on the revaluation surplus. Plant and equipment is depreciated at 20% per annum using the reducing balance method and time apportioned as appropriate. All depreciation is charged to cost of sales, but none has yet been charged on any non-current asset for the year ended 31 March 20X7. (iii) At 31 March 20X7, a provision is required for directors’ bonuses equal to 1% of revenue for the year. (iv) Atlas estimates that an income tax provision of $27·2 million is required for the year ended 31 March 20X7 and at that date the liability to deferred tax is $9·4 million. The movement on deferred tax should be taken to profit or loss. The balance on current tax in the trial balance represents the under/over provision of the tax liability for the year ended 31 March 20X6. (v) On 1 July 20X6, Atlas made and recorded a fully subscribed rights issue of 1 for 4 at $1·20 each. Immediately before this issue, the stock market value of Atlas’s shares was $2 each. Required: (a) Prepare the statement of profit or loss and other comprehensive income for Atlas for the year ended 31 March 20X7. (8 marks) (b) Prepare the statement of changes in equity for Atlas for the year ended 31 March 20X7. (4 marks) (c) Prepare the statement of financial position of Atlas as at 31 March 20X7. (8 marks) Note: Notes to the financial statements are not required. (20 marks) 68 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) Question 7 EMERALD The following scenario relates to questions 1–5. Emerald Co is preparing financial statements for the year ended 31 March 20X7. The following issues are relevant: 1. Development expenditure Below is the qualifying development expenditure for Emerald: Year ended 31 March 20X6 Year ended 31 March 20X7 $000 1,000 400 All capitalised development expenditure is deemed to have a four year life. Assume amortisation commences at the beginning of the accounting period following capitalisation. 2. Properties Emerald owned the following properties at 1 April 20X6: Property A: An office building used by Emerald for administrative purposes with a depreciated historical cost of $2 million. At 1 April 20X6 it had a remaining life of 20 years. After a reorganisation on 1 October 20X6, the property was let to a third party and reclassified as an investment property applying Emerald’s policy of the fair value model. An independent valuer assessed the property to have a fair value of $2·3 million at 1 October 20X6, which had risen to $2·34 million at 31 March 20X7. Property B: Another office building let to a subsidiary of Emerald. At 1 April 20X6, it had a fair value of $1·5 million which had risen to $1·65 million at 31 March 20X7. At 1 April 20X6 the office building had a remaining useful life of 30 years. 1 At what amount should development expenditure be valued in Emerald’s statement of financial position as at 31 March 20X7? A B C D 2 What is the net gain/loss which will be recorded in Emerald’s profit or loss for the year ended 31 March 20X7 in respect of property A? A B C D 3 $1,150,000 $1,400,000 $1,300,000 $1,050,000 $340,000 net gain $390,000 net gain $50,000 net loss $10,000 net loss What is the carrying amount of Property B in Emerald’s CONSOLIDATED statement of financial position as at 31 March 20X7? A B C D $1,450,000 $1,500,000 $1,595,000 $1,650,000 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 69 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK 4 IAS 8 Accounting Policies, Changes in Accounting Estimate and Errors specifies the definition and treatment of a number of different items. Which of the following is outside the scope of IAS 8? A B C D 5 Notification that a credit customer has just gone bankrupt owing debts of $250,000 Identification of fraud relating to the current and prior years Moving from first-in first-out to weighted average inventory valuation model Recognition of a decommissioning provision Which of the following should be treated as development expenditure in accordance with IAS 38 Intangible Assets? (1) (2) The construction of a scale model of a pilot plant The search for alternative uses of products that are already manufactured A B C D 1 only 2 only Both 1 and 2 Neither 1 or 2 (10 marks) Question 8 DERRINGDO The following scenario relates to questions 1–5. Derringdo sells goods supplied by Gungho. Goods are classed as A-grade (perfect quality) or B-grade (having slight faults). Derringdo sells A-grade goods as an agent for Gungho at a price that gives a gross profit margin of 50%. Derringdo receives a commission of 12·5% on these sales. Derringdo sells B-grade goods as a principal at a gross profit margin of 25%. Derringdo provides the following information: $000 Inventory held on premises 1 April 20X6 – A grade 2,400 – B grade 1,000 Goods from Gungho year to 31 March 20X7 – A grade 18,000 – B grade 8,800 Inventory held on premises 31 March 20X7 – A grade 2,000 – B grade 1,250 Derringdo also sells carpets through several retail outlets, only recognising revenue once the carpets had been fitted. Customers pay for the carpets at the time they are ordered. From 1 April 20X6 Derringdo changed its method of trading by sub-contracting the fitting to approved contractors. Under this policy the sub-contractors are paid by Derringdo and the sub-contractors are liable for any errors made in the fitting. Details of the relevant sales figures are: Sales made in retail outlets for the year to 31 March 20X7 Sales value of carpets fitted in the 14 days to 14 April 20X6 Sales value of carpets fitted in the 14 days to 14 April 20X7 $000 23,000 1,200 1,600 The sales value of carpets fitted in the 14 days to 14 April 20X6 are not included in the annual sales figure of $23 million, but those for the 14 days to 14 April 20X7 are included. During the current year Derringdo also changed the method of depreciating plant from straight line to reducing balance. 70 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) 1 What will be the value of inventory included in Derringdo’s statement of financial position as at 31 March 20X7 in respect of the grade A and B goods? A B C D 2 What is the amount of revenue which Derringdo should recognise in its statement of profit or loss for the year ended 31 March 20X7 relating to the supply of A grade goods? A B C D 3 $36,800 $4,600 $18,400 $3,067 What is the amount of revenue which Derringdo should recognise in its statement of profit or loss for the year ended 31 March 20X7 relating to the sale of carpets? A B C D 4 $1,250 $3,250 $1,667 $4,333 $23.0 million $22.6 million $24.2 million $25.8 million IAS 8 Accounting Policies, Changes in Accounting Estimate and Errors states that any change in accounting policy should be accounted for by a retrospective adjustment to the financial statements whilst a change in estimate is accounted for prospectively. How will Derringdo treat the new method for selling carpets and the change in method of depreciation? A B C D 5 Carpet Prospective Prospective Retrospective Retrospective Depreciation Prospective Retrospective Prospective Retrospective Which of the following factors would indicate that Derringdo has transferred carpets to another party as part of a consignment arrangement in accordance with IFRS 15 Revenue from Contracts with Customers? (1) (2) Derringdo can require the other party to transfer the carpets to a third party The carpets are controlled by Derringdo until the other party sells them or six months have passed, whichever is earlier A B C D 1 only 2 only Both 1 and 2 Neither 1 or 2 (10 marks) Question 9 LINNET Linnet is a large public listed company involved in the construction industry. IFRS 15 Revenue from Contracts with Customers requires that contracts of this nature are assessed to determine whether the performance obligations are satisfied at a point in time or over a period of time. This could lead to revenue being recognised on completion of the contract or as the contract progresses. ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 71 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK Required: (a) Discuss how the performance obligations of Linnet may be satisfied over time or at a point in time. (7 marks) (b) Linnet is part way through a contract to build a new football stadium at a contract price of $300 million. The performance obligations under the contract will be satisfied over time. Details of the progress of this contract at 1 April 20X6 are shown below: $m 150 112 38 Cumulative sales revenue invoiced Cumulative cost incurred to date Profit to date The following information has been extracted from the accounting records at 31 March 20X7: $m Total progress payment received for work certified at 28 February 20X7 Total costs incurred to date (excluding rectification costs below) Rectification costs 180 195 17 Linnet has received progress payments of 90% of the work certified at 28 February 20X7. Linnet’s surveyor has estimated that the sales value of the further work completed during March 20X7 was $20 million. At 31 March 20X7 the estimated remaining costs to complete the contract were $45 million. The rectification costs are the costs incurred in widening access roads to the stadium. This was the result of an error by Linnet’s architect when he made his initial drawings. Linnet calculates the percentage of completion of its contracts as the proportion of sales value earned to date compared to the contract price. All estimates can be taken as being reliable. Required: Prepare extracts of the financial statements for Linnet for the above contract for the year to 31 March 20X7. (8 marks) (15 marks) Question 10 DEARING The following scenario relates to questions 1–5. On 1 October 20X5 Dearing acquired a machine under the following terms: Manufacturer’s base price Trade discount (applying to base price only) Freight charges Electrical installation cost Staff training in use of machine Pre-production testing Purchase of a three-year maintenance contract Estimated residual value 72 $000 1,050 20% 30 28 40 22 60 20 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) On the same date Dearing purchased an excavator for $1,260,000 with an estimated residual value of $60,000; details relating to the excavator are as follows: Estimated life in machine hours Hours used – year ended 30 September 20X6 – year ended 30 September 20X7 – year ended 30 September 20X8 Hours 6,000 1,200 1,800 850 Dearing held a property that at 1 October 20X5 had a carrying amount of $2,620,000 and a remaining useful life of 40 years. At 30 September 20X6 the property was revalued to $2,800,000. This property had previously suffered a fall in value of $125,000 which had been expensed to profit or loss. 1 In accordance with IAS 16 Property, Plant and Equipment, what is the cost of the machine purchased on 1 October 20X5? A B C D 2 In respect of the excavator, what amount of depreciation should be charged to profit or loss for the year ending 30 September 20X7? A B C D 3 $252,000 $240,000 $360,000 $600,000 In respect of the property, what amount should be credited to revaluation surplus at 30 September 20X6? A B C D 4 $840,000 $920,000 $960,000 $1,020,000 $245,500 $120,500 $180,000 $55,000 Which of the following items of subsequent expenditure on a non-current asset should Dearing capitalise in accordance with IAS 16 Property, Plant and Equipment? A When Dearing purchased a furnace five years ago, the furnace lining was separately identified in the accounting records. The furnace now requires relining at a cost of $200,000. Once relined the furnace will be usable for a further five years B Dearing’s office building has been badly damaged by a fire. Dearing intends to restore the building to its original condition at a cost of $250,000 C Dearing’s delivery vehicle broke down. When it was inspected by the garage it was found to be in need of a new engine. The engine and associated labour costs are estimated to be $5,000 D Dearing closes its factory for two weeks every year. During this time, all plant and equipment has an annual maintenance check and any necessary repairs are carried out. The cost of the current year’s maintenance check and repairs was $75,000 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 73 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK 5 How will a bearer plant, such as an apple tree, be accounted for in an entity’s statement of financial position? A B C D At cost in accordance with IAS 16 Property, Plant and equipment At fair value less costs to sell in accordance with IAS 41 Agriculture At cost in accordance with IAS 2 Inventories At fair value in accordance with IAS 40 Investment Property (10 marks) Question 11 SHAWLER The following scenario relates to questions 1–5. Shawler is a small manufacturing company specialising in making alloy castings. Its main item of plant is a furnace which was purchased on 1 October 20X3. The furnace has two components: the main body (cost $60,000 including an environmental provision – see below) which has a 10-year life, and a replaceable lining (cost $10,000) with a five-year life. Shawler received a government grant of $12,000 relating to the cost of the main body of the furnace only. The manufacturing process produces toxic chemicals which pollute the nearby environment. Legislation requires that a clean-up operation must be undertaken by Shawler on 30 September 20Y3 at the latest. The following carrying amounts have been extracted from Shawler’s statement of financial position as at 30 September 20X5 (two years after the acquisition of the furnace): Non-current assets Furnace: main body replaceable lining Current liabilities Government grant Non-current liabilities Government grant Environmental provision 1 (present value discounted at 8% per annum) $18,000 $16,667 $15,432 $19,440 $9,600 $7,200 $1,200 $8,400 What is the depreciation expense which should be charged to profit or loss in the year ended 30 September 20X6? A B C D 74 8,400 18,000 What is the carrying amount of the government grant in the statement of financial position as at 30 September 20X6? A B C D 3 1,200 What was the original amount of the environmental provision on 1 October 20X3? A B C D 2 $ 48,000 6,000 $6,000 $8,000 $5,400 $6,800 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) 4 5 Which of the following disclosures for government grants is required under IAS 20 Accounting for Government Grants and Disclosure of Government Assistance? (1) (2) (3) The accounting policy adopted for government grants The nature and extent of government grants recognised in the financial statements Unfulfilled conditions and other contingencies attached to government assistance that have been recognised A B C D 1 and 2 only 2 and 3 only 1 and 3 only 1, 2 and 3 On 1 April 20X6, the government introduced further environmental legislation which requires Shawler to fit anti-pollution filters to its furnace within two years. An environmental consultant has calculated that fitting the filters will reduce Shawler’s environmental costs for which provision has been made by 33%. At 30 September 20X6 Shawler had not yet fitted the filters. Which of the following explains the effect of the new environmental legislation? A B C D A provision should be made immediately A provision should be made within the next two years A provision should be made immediately and current environmental costs reduced There is no effect (10 marks) Question 12 DEXTERITY The following scenario relates to questions 1–5. On 1 October 20X6 Dexterity acquired Temerity, a small company that specialises in pharmaceutical drug research and development. The purchase consideration was by way of a share exchange and valued at $35 million. The fair value of Temerity’s net assets was $15 million excluding the following: (a) Temerity owns a patent for an established successful drug that has a remaining life of eight years. A firm of specialist advisors, Leadbrand, has estimated the current value of this patent to be $10 million; however the company is awaiting the outcome of clinical trials where the drug has been tested to treat a different illness. If the trials are successful, the value of the drug is then estimated to be $15 million. (b) Temerity’s statement of financial position includes $2 million for medical research that has been conducted on behalf of a client. Dexterity has developed and patented a new drug which has been approved for clinical use. The costs of developing the drug were $12 million. Based on early assessments of its sales success, Leadbrand have estimated its market value at $20 million. Dexterity had previously expensed research costs of $3 million in respect of the new drug. In the current accounting period, Dexterity has spent $3 million sending its staff on specialist training courses. Whilst these courses have been expensive, they have led to a marked improvement in production quality and staff now need less supervision. This in turn has led to an increase in revenue and cost reductions. The directors of Dexterity believe these benefits will continue for at least three years. ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 75 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK 1 What is the goodwill arising on the acquisition of Temerity? A B C D 2 In accordance with IAS 38 Intangible Assets what is the cost of the patented new drug? A B C D 3 $8 million $10 million $20 million $18 million $Nil $12 million $15 million $20 million Which of the following treatments of the training costs is correct? A B C D 4 5 Capitalise $3 million and test annually for impairment Capitalise $3 million and amortise over three years Expense $3 million as incurred Capitalise $3 million and amortise to profit or loss based on cost savings and increased revenue Which of the following types of expenditure must be recognised in the statement of profit or loss when it is incurred? A Tangible non-current assets acquired in order to provide facilities for research and development activities B Legal costs in connection with registration of a patent C Costs of searching for possible alternative products D Costs of research work which are to be reimbursed by a customer Which of the following intangible assets could be revalued in accordance with IAS 38 Intangible Assets? (1) (2) An intangible asset that has not previously been recognised An intangible asset for which there is no active market A B C D 1 only 2 only Both 1 and 2 Neither 1 or 2 (10 marks) Question 13 DARBY (a) An assistant of yours has been criticised over a piece of assessed work that he produced for his study course for giving the definition of a non-current asset as “a physical asset of substantial cost, owned by the company, which will last longer than one year”. Required: Provide an explanation to your assistant of the weaknesses in his definition of noncurrent assets when compared to the International Accounting Standards Board’s (IASB) view of assets. (4 marks) 76 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) (b) The same assistant has encountered the following matters during the preparation of the draft financial statements of Darby for the year ending 30 September 20X6. He has given an explanation of his treatment of them. (i) Darby spent $200,000 sending its staff on training courses during the year. This has already led to an improvement in the company’s efficiency and resulted in cost savings. The organiser of the course has stated that the benefits from the training should last for a minimum of four years. The assistant has therefore treated the cost of the training as an intangible asset and charged six months’ amortisation based on the average date during the year on which the training courses were completed. (3 marks) (ii) During the year the company started research work with a view to the eventual development of a new processor chip. By 30 September 20X6 it had spent $1·6 million on this project. Darby has a past history of being particularly successful in bringing similar projects to a profitable conclusion. As a consequence the assistant has treated the expenditure to date on this project as an asset in the statement of financial position. Darby was also commissioned by a customer to research and, if feasible, produce a computer system to install in motor vehicles that can automatically stop the vehicle if it is about to be involved in a collision. At 30 September 20X6, Darby had spent $2·4 million on this project, but at this date it was uncertain as to whether the project would be successful. As a consequence the assistant has treated the $2·4 million as an expense in the statement of profit or loss. (4 marks) (iii) Darby signed a contract, for an initial three years, in August 20X6 with Media Today to install a satellite dish and cabling system to a newly-built group of residential apartments. Media Today will provide telephone and television services to the residents via the satellite system and pay Darby $50,000 per annum commencing in December 20X6. Work on the installation commenced on 1 September 20X6 and the expenditure to 30 September 20X6 was $58,000. The installation is expected to be completed by 31 October 20X6. Previous experience with similar contracts indicates that Darby will make a total profit of $40,000 over the three years. The assistant correctly recorded the costs to 30 September 20X6 of $58,000 as a non-current asset, but then wrote this amount down to $40,000 (the expected total profit) because he believed the asset to be impaired. Note: Ignore discounting. (4 marks) Required: For each of the above items (i) to (iii) comment on the assistant’s treatment of them in the financial statements for the year ended 30 September 20X6 and advise him how they should be treated under International Financial Reporting Standards. Note: the mark allocation is shown against each of the three items above. (15 marks) ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 77 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK Question 14 ESP The following scenario relates to questions 1–5. ESP acquired an item of equipment at a cost of $800,000 on 1 April 20X5 that is used to produce and package medicines. The equipment had an estimated residual value of $50,000 and an estimated life of five years, neither of which has changed. ESP uses straight-line depreciation. On 31 March 20X7, ESP was informed by a major customer (who buys products produced by the equipment) that it would no longer be placing orders with ESP. Even before this information was known, ESP had been having difficulty finding work for this equipment. It now estimates that net cash inflows earned from the equipment for the next three years will be: Year ended: 31 March 20X8 31 March 20X9 31 March 20Y0 $000 220 180 170 On 31 March 20Y0, the equipment is still expected to be sold for its estimated residual value. ESP has confirmed that there is no market in which to sell the equipment at 31 March 20X7. ESP’s cost of capital is 10% and the following values should be used: 1 Value of $1 at: End of year 1 End of year 2 End of year 3 What is the value in use of the item of equipment as at 31 March 20X7? A B C D 2 $620,000 $570,000 $514,600 $477,100 What is the carrying amount of the equipment in ESP’s statement of financial position immediately prior to the impairment test at 31 March 20X7? A B C D 3 $ 0·91 0·83 0·75 $480,000 $500,000 $450,000 $650,000 ESP has a wholly-owned subsidiary, Tilda, which is a cash generating unit. On 31 March 20X7, an explosion damaged some of Tilda’s plant. Tilda’s assets immediately before the explosion were: $000 Goodwill 1,800 Factory building 4,000 Plant 3,500 Trade receivables and cash 1,500 –––––– 10,800 –––––– As a result of the explosion, the recoverable amount of Tilda is $5.5 million. The explosion completely destroyed an item of plant that had a carrying amount of $500,000. 78 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) What is the carrying amount (to the nearest $000) of Tilda’s plant after accounting for the impairment loss? A B C D 4 5 $1,714,000 $1,786,000 $3,000,000 $1,867,000 Which of the following assets must be tested annually for impairment in accordance with IAS 36 Impairment of Assets? (1) A footballer acquired by a football club on an initial contract of four years (2) Software that has met the capitalisation criteria but has yet to be fully completed (3) An operating license for an international air route granted by government which is stated to have an indefinite life while the current government is in power (4) A patent registered in a jurisdiction under which all patents are granted for five years A B C D 1 and 2 2 and 3 3 and 4 1 and 4 Which of the following cash flows will not be included in the calculation of an asset’s value in use in accordance with IAS 36 Impairment of Assets? (1) (2) The cost of adding solar panels to the factory roof to reduce heating and power costs The annual maintenance costs relating to the machinery located in the factory A B C D 1 only 2 only Both 1 and 2 Neither 1 or 2 (10 marks) Question 15 BOROUGH The following scenario relates to questions 1–5. The following items have arisen during the preparation of Borough’s draft financial statements for the year ended 30 September 20X6: (i) On 1 October 20X5, Borough commenced the extraction of crude oil from a new well on the seabed. The cost of a 10-year licence to extract the oil was $50 million. At the end of the extraction, Borough intends to make good the damage the extraction has caused to the seabed. The cost of this will be a fixed amount of $20 million and a variable amount of $0.02 per barrel extracted. Both amounts are present values as at 1 October 20X5 (discounted at 8%) of the estimated costs in 10 years’ time. In the year to 30 September 20X6 Borough extracted 150 million barrels of oil. (ii) Borough owns the whole of the equity share capital of its subsidiary Hamlet. Hamlet’s statement of financial position includes a loan of $25 million that is repayable in five years’ time. $15 million of this loan is secured on Hamlet’s property and the remaining $10 million is guaranteed by Borough in the event of a default by Hamlet. The current value of its property is estimated at $12 million and there are concerns over whether Hamlet can survive the recession and therefore repay the loan. ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 79 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK 1 What is the carrying amount of the licence in the statement of financial position as at 30 September 20X6? A B C D 2 What is the carrying amount of the environmental provision in the statement of financial position as at 30 September 20X6? A B C D 3 5 $24.84 million $20 million $23 million $21.6 million How should the loan of $25 million be treated in Borough’s single entity financial statements? A B C D 4 $70 million $63 million $50 million $65.7 million Disclosed as a contingent liability of $10 million Recognised as a provision of $10 million Disclosed as a contingent liability of $25 million Recognised as a provision of $25 million Which of the following would require a provision to be recognised by Borough as at 30 September 20X6? A New data protection laws come into force on 1 December 20X6 that will require a large number of staff to be retrained. The training costs have not yet been finalised B Borough is negotiating with its insurance provider about the amount of an insurance claim. On 20 October 20X6, the insurance provider agreed to pay $200,000 C Borough makes refunds to customers for any goods returned within 30 days of sale, and has done so for many years D A customer is suing Borough for damages. Borough is contesting the claim and legal advisers consider that Borough is very unlikely to lose the case Borough entered into a “take or pay” contract to purchase goods for $400 or pay $50 not to take the goods. The fair value of the goods has now fallen to $320 and the contract has become onerous. How should an onerous contract be accounted for in accordance with IAS 37 Provisions, Contingent Liabilities and Contingent Assets? A B C D 80 Recognise all future payments as a liability immediately Account for any costs associated with the contract only when, and as, they fall due Recognise the least net cost option of exiting the contract Disclose the full costs associated with the rental contract as a note to the financial statements (10 marks) ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) Question 16 RADAR The following scenario relates to questions 1–5. At a board meeting on 1 July 20X5, Radar’s directors made the decision to close down one of its factories on 31 March 20X6. The factory and its related plant would then be sold. On 1 January 20X6, a formal plan was formulated and the factory’s 250 employees were given three months’ notice of redundancy. Customers and suppliers were also informed of the closure at this date. The directors of Radar have provided the following information: Fifty of the employees would be retrained and deployed to other subsidiaries within the group at a cost of $125,000; the remainder will accept redundancy and be paid an average of $5,000 each. Factory plant has a carrying amount of $2·2 million, but is only expected to sell for $500,000 incurring $50,000 of selling costs; however, the factory itself is expected to sell for a profit of $1·2 million. The company rents a number of machines that are classified as short-term rentals under IFRS 16 Leases. The terms of the leases are as follows: Machine 1 Machine 2 Machine 3 1 $1,250,000 $nil $1,125,000 $1,000,000 $500,000 $1,750,000 $1,700,000 $550,000 What is the lease rental expense which Radar would report in its statement of profit or loss for the year ended 31 March 20X6 in respect of the leased machines? A B C D 4 Monthly rent $500 $1,400 $800 What is the loss that will be recognised in Radar’s profit or loss for the year ended 31 March 20X6 in respect of the plant? A B C D 3 Term 5 months 6 months 8 months What is the provision which Radar would report in its statement of financial position as at 31 March 20X6 in respect of the redundancy? A B C D 2 Commencement date 1 June 20X5 1 December 20X5 31 January 20X6 $nil $12,500 $9,700 $10,500 The following describe potential provisions: (1) A provision to cover refunds. The company is in the retail sector and has a reputation for a “no questions asked” policy on refunds (2) An obligation to restore damage caused by oil spills due to drilling activities. The oil rig has been sited but drilling for oil has not yet commenced ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 81 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK In accordance with IAS 37 Provisions, Contingent Liabilities and Contingent Assets in which of the above situations would a company be required to recognise a provision in its financial statements? A B C D 5 Neither situation Both situations Situation 1 only Situation 2 only Which of the following give rise to constructive obligations in accordance with IAS 37 Provisions, Contingent Liabilities and Contingent Assets? (1) An oil spillage; there is no legislation requiring clean up but the entity has always cleaned up any pollutants in the past (2) An entity has published a statement that it will refund the cost of any faulty products returned, even after the product warranty has expired (3) Repairs of faulty goods free of charge if returned within six months of sale in accordance with the sale contract A B C D 1 and 2 only 1 and 3 only 2 and 3 only 1, 2 and 3 (10 marks) Question 17 WAXWORK The following scenario relates to questions 1–5. Waxwork’s current year end is 31 March 20X7. Its financial statements were authorised for issue by its directors on 6 May 20X7 and the annual general meeting (AGM) will be held on 3 June 20X7. The following matters have been brought to your attention: (i) On 12 April 20X7 a fire completely destroyed the company’s largest warehouse and the inventory it contained. The carrying amounts of the warehouse and the inventory were $10 million and $6 million respectively. It appears that the company has not updated the value of its insurance cover and only expects to be able to recover a maximum of $9 million from its insurers. (ii) A product PeBo held at another warehouse was valued at its cost of $460,000 at 31 March 20X7. In April 20X7, 70% of this inventory was sold for $280,000 on which Waxworks’ sales staff earned a commission of 15% of the selling price. (iii) At 31 March 20X7, the carrying amount of the non-current assets of Waxwork was $80,000 greater than the tax written down value, and the balance brought forward on the deferred tax account was $24,800. The company accountant calculated that the corporation tax charge on the reported profit for the year to 31 March 20X7 would be $53,960, based on the tax rate of 24%. On 18 May 20X7 the government announced tax changes which have the effect of increasing Waxwork’s deferred tax liability to $65,000 as at 31 March 20X7. 82 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) 1 Which of the following is the correct accounting treatment in respect of the fire in the financial statements for the year ended 31 March 20X7? A B C D 2 What is the carrying amount of the inventory of PeBo in the statement of financial position as at 31 March 20X7? A B C D 3 Adjust the tax liability and expense only Adjust the tax liability and expense and disclose the future financial effects Neither adjust the financial statements nor disclose the financial effects Disclose the financial effects on the current and future tax expense and liability What is the total charge for taxation in the statement of profit and loss for the year to 31 March 20X7, prior to notification of the change in tax rates? A B C D 5 $376,000 $340,000 $460,000 $400,000 How should the change in tax rates announced by the government be accounted for in the financial statements for the year ended 31 March 20X7? A B C D 4 Recognise a provision of $16 million and disclose a contingent asset of $9 million Do not include any reference to the fire, as it was in the next period Disclose as a non-adjusting event Recognise a provision of $16 million and an asset of $9 million $48,360 $59,560 $73,160 $78,760 Which of the following items does IAS 41 Agriculture NOT apply to? A B C D Biological assets Land related to agricultural activity Agricultural produce at the point of harvest Government grants related to agricultural activity (10 marks) Question 18 PINGWAY The following scenario relates to questions 1–5. Pingway issued a $10 million 3% convertible loan note at par on 1 April 20X5 with interest payable annually in arrears. On 31 March 20X8 the loan note holder can choose between conversion into 20 equity shares for each $100 of loan note or redemption at par in cash. The nominal value of an equity share is $0.50. The effective rate of interest for this loan is 8%. The present value of $1 receivable at the end of the year, based on discount rates of 3% and 8% can be taken as: 3% 8% $ $ End of year 1 0·97 0·93 2 0·94 0·86 3 0·92 0·79 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 83 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK 1 How many equity shares will be issued if all of the convertible loan note holders convert the notes into equity on the conversion date? A B C D 2 At what amount will the convertible loan notes be recognised in the statement of financial position as at 1 April 20X5? A B C D 3 $8.674 million $10 million $9.368 million $7.9 million Which of the following cost behaviour patterns best describes how the finance costs will be expensed to profit or loss over the three year term of the convertible loan notes? A B C D 4 100,000 2,000,000 1,000,000 4,000,000 Low in year one, increasing in years two and three High in year one, decreasing in years two and three On a straight line basis over the three years Only charge profit or loss on conversion of the loan notes Pingway has a number of loan assets classified as at fair value through other comprehensive income. It intends to sell these assets in the next financial year and hopes to make a gain on the sale of the investments. How should any gain on the disposal of the equity investments be accounted for when they are sold? 5 A Recognise any gain immediately in profit or loss B Recognise any gain in other comprehensive income and reclassify any cumulative gain to profit or loss C Recognise any gain in other comprehensive income but do not reclassify any cumulative gain to profit or loss D Recognise any gain directly in equity In accordance with IFRS 9 Financial Instruments, under what circumstances must a loan asset be classified at fair value through other comprehensive income? A B C D The entity’s business model is to hold the asset to collect contractual cash flows To eliminate an accounting mismatch using the “fair value option” The asset is expected to be held until its maturity The entity’s business model is to hold the asset to collect contractual cash flows and sell the asset (10 marks) 84 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) Question 19 PATRONIC On 1 August 20X5 Patronic purchased 18 million of a total of 24 million equity shares in Sardonic. The acquisition was through a share exchange of two shares in Patronic for every three shares in Sardonic. Both companies have shares with a par value of $1 each. The market price of Patronic’s shares at 1 August 20X5 was $5·75 per share. Patronic will also pay in cash on 31 July 20X7 (two years after acquisition) of $2·42 per acquired share of Sardonic. Patronic’s cost of capital is 10% per annum. The reserves of Sardonic on 1 April 20X5 were $69 million. Patronic has held an investment of 30% of the equity shares in Acerbic for many years. The summarised statements of profit or loss for the three companies for the year ended 31 March 20X6 are: Patronic Sardonic Acerbic $000 $000 $000 Revenue 150,000 78,000 80,000 Cost of sales (94,000) (51,000) (60,000) ––––––– ––––––– ––––––– Gross profit 56,000 27,000 20,000 Distribution costs (7,400) (3,000) (3,500) Administrative expenses (12,500) (6,000) (6,500) Finance costs (note (ii)) (2,000) (900) nil ––––––– ––––––– ––––––– Profit before tax 34,100 17,100 10,000 Income tax expense (10,400) (3,600) (4,000) ––––––– ––––––– ––––––– Profit for the period 23,700 13,500 6,000 ––––––– ––––––– ––––––– The following information is relevant: (i) The fair values of the net assets of Sardonic at the date of acquisition were equal to their carrying amounts with the exception of property and plant. Property and plant had fair values of $4·1 million and $2·4 million respectively in excess of their carrying amounts. The increase in the fair value of the property would create additional depreciation of $200,000 in the consolidated financial statements in the post-acquisition period to 31 March 20X6 and the plant had a remaining life of four years (straight-line depreciation) at the date of acquisition of Sardonic. All depreciation is treated as part of cost of sales. The fair values have not been reflected in Sardonic’s financial statements. No fair value adjustments were required on the acquisition of Acerbic. (ii) The finance costs of Patronic do not include the finance cost on the deferred consideration. (iii) Prior to its acquisition, Sardonic had been a good customer of Patronic. In the year to 31 March 20X6, Patronic sold goods at a selling price of $1·25 million per month to Sardonic both before and after its acquisition. Patronic made a profit of 20% on the cost of these sales. At 31 March 20X6 Sardonic still held inventory of $3 million (at cost to Sardonic) of goods purchased in the post-acquisition period from Patronic. (iv) Non-controlling interest are valued at fair value on acquisition, the fair value of noncontrolling interest on 1 August 20X5 was $34 million. An impairment test on the goodwill of Sardonic conducted on 31 March 20X6 concluded that it should be written down by $2 million. The value of the investment in Acerbic was not impaired. (v) All items in the above statements of profit or loss are deemed to accrue evenly over the year. (vi) Ignore deferred tax. ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 85 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK Required: (a) Prepare the consolidated statement of profit or loss for the Patronic Group for the year ended 31 March 20X6. Note: Assume that the investment in Acerbic has been accounted for using the equity method since its acquisition. (15 marks) (b) At 31 March 20X6 the other equity shares (70%) in Acerbic were owned by many separate investors. Shortly after this date Spekulate (a company unrelated to Patronic) accumulated a 60% interest in Acerbic by buying shares from the other shareholders. In May 20X6 a meeting of the board of directors of Acerbic was held at which Patronic lost its seat on Acerbic’s board. Required: Explain, with reasons, the accounting treatment Patronic should adopt for its investment in Acerbic when it prepares its financial statements for the year ending 31 March 20X6. (5 marks) (20 marks) Question 20 PEDANTIC On 1 April 20X6, Pedantic acquired 60% of the equity share capital of Sophistic in a share exchange of two shares in Pedantic for three shares in Sophistic. The issue of shares has not yet been recorded by Pedantic. At the date of acquisition shares in Pedantic had a market value of $6 each. Below are the summarised draft financial statements of both companies. Sophistic made profit for the year of $3,000,000, this profit accrued evenly throughout the year. Statements of financial position as at 30 September 20X6 Assets Non-current assets Property, plant and equipment 40,600 Current assets 16,000 –––––– Total assets 56,600 –––––– Equity and liabilities Equity shares of $1 each 10,000 Retained earnings 35,400 –––––– 45,400 Non-current liabilities 10% Loan notes 3,000 Current liabilities 8,200 –––––– Total equity and liabilities 56,600 –––––– 12,600 6,600 –––––– 19,200 –––––– 4,000 6,500 –––––– 10,500 4,000 4,700 –––––– 19,200 –––––– The following information is relevant: (i) 86 At the date of acquisition, the fair values of Sophistic’s assets were equal to their carrying amounts with the exception of an item of plant, which had a fair value of $2 million in excess of its carrying amount. It had a remaining life of five years at that date [straight-line depreciation is used]. Sophistic has not adjusted the carrying amount of its plant as a result of the fair value exercise. ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) (ii) Sales from Sophistic to Pedantic in the post-acquisition period were $8 million. Sophistic made a mark-up on cost of 40% on these sales. Pedantic had sold $5·2 million (at cost to Pedantic) of these goods by 30 September 20X6. (iii) Other than where indicated, profit or loss items are deemed to accrue evenly on a time basis. (iv) Sophistic’s trade receivables at 30 September 20X6 include $600,000 due from Pedantic which did not agree with Pedantic’s corresponding trade payable. This was due to cash in transit of $200,000 from Pedantic to Sophistic. Both companies have positive bank balances. (v) Pedantic has a policy of accounting for any non-controlling interest at fair value. For this purpose the fair value of the goodwill attributable to the non-controlling interest in Sophistic is $1·5 million. Consolidated goodwill was not impaired at 30 September 20X6. Required: (a) Prepare the consolidated statement of financial position for Pedantic as at 30 September 20X6. (16 marks) (b) Pedantic is considering purchasing a 30% stake in Arkright. This shareholding would give Pedantic significant influence over the strategic and operational decision making processes in Arkright. Required: Explain the method that Pedantic would use to account for the shareholding in Arkright and compare and contrast this with the method used to account for Sophistic. (4 marks) (20 marks) Question 21 PANDAR On 1 April 20X6 Pandar purchased 80% of the equity shares in Salva. The acquisition was through a share exchange of three shares in Pandar for every five shares in Salva. The market prices of Pandar’s and Salva’s shares at 1 April 20X6 were $6 per share and $3.20 respectively. On the same date Pandar acquired 40% of the equity shares in Ambra paying $2 per share. The summarised statements of profit or loss for the three companies for the year ended 30 September 20X6 are: Pandar Salva Ambra $000 $000 $000 Revenue 210,000 150,000 50,000 Cost of sales (126,000) (100,000) (40,000) ––––––– ––––––– ––––––– Gross profit 84,000 50,000 10,000 Distribution costs (11,200) (7,000) (5,000) Administrative expenses (18,300) (9,000) (11,000) Investment income (interest and dividends) 9,500 Finance costs (1,800) (3,000) nil ––––––– ––––––– ––––––– Profit (loss) before tax 62,200 31,000 (6,000) Income tax (expense) relief (15,000) (10,000) 1,000 ––––––– ––––––– ––––––– Profit (loss) for the year 47,200 21,000 (5,000) ––––––– ––––––– ––––––– ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 87 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK The following information for the equity of the companies at 30 September 20X6 is available: Equity shares of $1 each Share premium Retained earnings 1 October 20X5 Profit (loss) for the year ended 30 September 20X6 Dividends paid (26 September 20X6) 200,000 300,000 40,000 47,200 nil 120,000 nil 152,000 21,000 (8,000) 40,000 nil 15,000 (5,000) nil The following information is relevant: (i) The fair values of the net assets of Salva at the date of acquisition were equal to their carrying amounts with the exception of an item of plant which had a carrying amount of $12 million and a fair value of $17 million. This plant had a remaining life of five years (straight-line depreciation) at the date of acquisition of Salva. All depreciation is charged to cost of sales. In addition Salva owns the registration of a popular internet domain name. The registration, which had a negligible cost, has a five year remaining life (at the date of acquisition); however, it is renewable indefinitely at a nominal cost. At the date of acquisition the domain name was valued by a specialist company at $20 million. The fair values of the plant and the domain name have not been reflected in Salva’s financial statements. No fair value adjustments were required on the acquisition of the investment in Ambra. (ii) Immediately after its acquisition of Salva, Pandar invested $50 million in an 8% loan note from Salva. All interest accruing to 30 September 20X6 had been accounted for by both companies. Salva also has other loans in issue at 30 September 20X6. (iii) Pandar has credited the whole of the dividend it received from Salva to investment income. (iv) After the acquisition, Pandar sold goods to Salva for $15 million on which Pandar made a gross profit of 20%. Salva had one third of these goods still in its inventory at 30 September 20X6. There are no intra-group current account balances at 30 September 20X6. (v) The non-controlling interest in Salva is to be valued at its (full) fair value at the date of acquisition. For this purpose Salva’s share price at that date can be taken to be indicative of the fair value of the shareholding of the non-controlling interest. (vi) The goodwill of Salva has not suffered any impairment; however, due to its losses, the value of Pandar’s investment in Ambra has been impaired by $3 million at 30 September 20X6. (vii) All items in the above statements of profit or loss are deemed to accrue evenly over the year unless otherwise indicated. Required: (a) Calculate the goodwill arising on the acquisition of Salva at 1 April 20X6. (5 marks) (b) Prepare the consolidated statement of profit or loss for the Pandar Group for the year ended 30 September 20X6. (15 marks) (20 marks) 88 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) Question 22 PRODIGAL On 1 October 20X5 Prodigal purchased 75% of the equity shares in Sentinel. The acquisition was through a share exchange of two shares in Prodigal for every three shares in Sentinel. The stock market price of Prodigal’s shares at 1 October 20X5 was $4 per share. The summarised statements of profit or loss and other comprehensive income for the two companies for the year ended 31 March 20X6 are: Prodigal Sentinel $000 $000 Revenue 450,000 240,000 Cost of sales (260,000) (110,000) ––––––– ––––––– Gross profit 190,000 130,000 Distribution costs (23,600) (12,000) Administrative expenses (27,000) (23,000) Finance costs (1,500) (1,200) ––––––– ––––––– Profit before tax 137,900 93,800 Income tax expense (48,000) (27,800) ––––––– ––––––– Profit for the year 89,900 66,000 ––––––– ––––––– Other comprehensive income Gain on revaluation of land (note (i)) 2,500 1,000 Loss on fair value of equity financial asset investment (700) (400) ––––––– ––––––– 1,800 600 ––––––– ––––––– Total comprehensive income 91,700 66,600 ––––––– ––––––– The following information for the equity of the companies at 1 April 20X5 (i.e. before the share exchange took place) is available: $000 Equity shares of $1 each 250,000 Share premium 100,000 Revaluation surplus (land) 8,400 Other equity surplus (re equity financial asset investment) 3,200 Retained earnings 90,000 $000 160,000 nil nil 2,200 125,000 The following information is relevant: (i) Prodigal’s policy is to revalue the group’s land to market value at the end of each accounting period. Prior to its acquisition Sentinel’s land had been valued at historical cost. During the post-acquisition period Sentinel’s land had increased in value over its value at the date of acquisition by $1 million. Sentinel has recognised the revaluation within its own financial statements. (ii) Immediately after the acquisition of Sentinel on 1 October 20X5, Prodigal transferred an item of plant with a carrying amount of $4 million to Sentinel at an agreed value of $5 million. At this date the plant had a remaining life of two and half years. Prodigal had included the profit on this transfer as a reduction in its depreciation costs. All depreciation is charged to cost of sales. ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 89 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK (iii) After the acquisition Sentinel sold goods to Prodigal for $40 million. These goods had cost Sentinel $30 million. $12 million of the goods sold remained in Prodigal’s closing inventory. (iv) Prodigal’s policy is to value the non-controlling interest of Sentinel at the date of acquisition at its fair value which the directors determined to be $100 million. (v) The goodwill of Sentinel has not suffered any impairment. (vi) All items in the above statements of profit or loss and other comprehensive income are deemed to accrue evenly over the year unless otherwise indicated. Required: (a) Prepare the consolidated statement of profit or loss and other comprehensive income of Prodigal for the year ended 31 March 20X6. (14 marks) (b) Prepare the equity section (including the non-controlling interest) of the consolidated statement of financial position of Prodigal as at 31 March 20X6. (6 marks) Note: You are not required to calculate consolidated goodwill or produce the statement of changes in equity. (20 marks) Question 23 VIAGEM On 1 January 20X6, Viagem acquired 90% of the equity share capital of Greca in a share exchange in which Viagem issued two new shares for every three shares it acquired in Greca At the date of acquisition, shares in Viagem and Greca had a stock market value of $8·50 and $2·50 each, respectively. Statements of profit or loss for the year ended 30 September 20X6 Revenue Cost of sales Gross profit Distribution costs Administrative expenses Investment income Finance costs Profit before tax Income tax expense Profit for the year Equity as at 1 October 20X5 Equity shares of $1 each Retained earnings 90 Viagem $000 64,600 (51,200) ––––––– 13,400 (1,600) (3,800) 500 (420) ––––––– 8,080 (2,800) ––––––– 5,280 ––––––– Greca $000 38,000 (26,000) ––––––– 12,000 (1,800) (2,400) nil nil ––––––– 7,800 (1,600) ––––––– 6,200 ––––––– 30,000 54,000 10,000 35,000 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) The following information is relevant: (i) At the date of acquisition, the fair values of Greca’s assets were equal to their carrying amounts with the exception of an item of plant had a fair value of $1·8 million above its carrying amount. The remaining life of the plant at the date of acquisition was three years. Depreciation is charged to cost of sales. Greca has not incorporated the related fair value changes into its financial statements. (ii) Viagem’s policy is to value the non-controlling interest at fair value at the date of acquisition. For this purpose, Greca’s share price at that date can be deemed to be representative of the fair value of the shares held by the non-controlling interest. (iii) Viagem’s investment income is a dividend received from its investment in a 40% owned associate which it has held for several years. The underlying earnings for the associate for the year ended 30 September 20X6 were $2 million. (iv) Although Greca has been profitable since its acquisition by Viagem, the market for Greca’s products has been badly hit in recent months and Viagem has calculated that the goodwill has been impaired by $2 million as at 30 September 20X6. Required: (a) Calculate the consolidated goodwill at the date of acquisition of Greca. (5 marks) (b) Prepare the consolidated statement of profit or loss for Viagem for the year ended 30 September 20X6. (10 marks) (c) Due to the market for Greca’s products falling Viagem is considering disposing of its shareholding in Greca on 1 October 20X6. Viagem would hope to sell the investment for $55 million; the fair value of Greca’s net assets on that date would be $52.550 million and fair value of non-controlling interest would be $2.720 million. Required: Briefly explain how the disposal should be accounted for in the consolidated financial statements. Your answer should include the profit on disposal that should be recognised in Viagem’s profit or loss and the profit to be recognised in the consolidated profit or loss for the year ended 30 September 20X7. (5 marks) (20 marks) ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 91 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK Question 24 PARADIGM The following scenario relates to questions 1–5. On 1 October 20X5, Paradigm acquired 75% of Strata’s equity shares by means of a share exchange of two new shares in Paradigm for every five acquired shares in Strata. In addition, Paradigm issued to the shareholders of Strata a $100 10% loan note for every 1,000 shares it acquired in Strata. The market value of Paradigm’s shares at 1 October 20X5 was $2 each share, and the market value of Strata’s share on the same date was $1.20 each share. Extracts of the statements of financial position of the two companies as at 31 March 20X6 are: Non-current assets Property, plant and equipment Paradigm $000 Strata $000 47,400 –––––– 25,500 –––––– Equity Equity shares of $1 each 40,000 Retained earnings/(losses) – at 1 April 20X5 19,200 – for year ended 31 March 20X6 7,400 –––––– 66,600 –––––– 20,000 (4,000) 8,000 –––––– 24,000 –––––– At the date of acquisition, Strata produced a draft statement of profit or loss which showed it had made a net loss after tax of $2 million at that date. Paradigm conducted a fair value exercise on Strata’s net assets which showed that they were equal to their carrying amounts with the exception of an item of plant which had a fair value of $3 million below its carrying amount. The plant had a remaining economic life of three years at 1 October 20X5. Paradigm’s policy is to value the non-controlling interest at fair value at the date of acquisition, using Stata’s market price per share as an indicator of fair value. 1 What is the cost of investment to be included in Paradigm’s statement of financial position as at 1 October 20X5? A B C D 2 What is the value of non-controlling interest as at 1 October 20X5? A B C D 3 $2,750,000 $10,000,000 $3,500,000 $6,000,000 What is the carrying amount of property, plant and equipment in Paradigm’s statement of financial position as at 31 March 20X6? A B C D 92 $13.5 million $12 million $14 million $8.2 million $72,900,000 $70,400,000 $75,500,000 $70,900,000 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) 4 On acquisition of an 80% subsidiary a bargain purchase (“negative goodwill”) of $200,000 is calculated. What adjustment is required to the non-controlling interest in the consolidated financial statements? A B C D 5 Credit non-controlling interest with $40,000 Debit non-controlling interest with $40,000 No adjustment as a non-controlling interest does not share in a bargain purchase It depends on the choice of basis for measuring non-controlling interest Which of the following formulae will give the correct calculation of the profit or loss on disposal of a subsidiary to be included in consolidated profit or loss? A Proceeds on disposal – Original cost of shares B Proceeds on disposal – Net assets of subsidiary on disposal – Any remaining goodwill – Non-controlling interest C Net assets of subsidiary on disposal + Remaining goodwill – Proceeds on disposal – Non-controlling interest D Non-controlling interest + Proceeds on disposal + Remaining goodwill – Net asset of subsidiary (10 marks) Question 25 POLESTAR On 1 April 20X6, Polestar acquired 75% of the equity share capital of Southstar. Southstar had been experiencing difficult trading conditions and making significant losses. In allowing for Southstar’s difficulties, Polestar made an immediate cash payment of only $1·50 per share. In addition, Polestar will pay a further amount in cash on 30 September 20X7 if Southstar returns to profitability by that date. The value of this contingent consideration at the date of acquisition was estimated to be $1·8 million, but at 30 September 20X6 in the light of continuing losses, its value was estimated at only $1·5 million. The contingent consideration has not been recorded by Polestar. Overall, the directors of Polestar expect the acquisition to be a bargain purchase leading to negative goodwill. At the date of acquisition shares in Southstar had a listed market price of $1·20 each. Below are the summarised draft financial statements of both companies. Statements of profit or loss for the year ended 30 September 20X6 Revenue Cost of sales Gross profit (loss) Distribution costs Administrative expenses Finance costs Profit (loss) before tax Income tax (expense)/relief Profit (loss) for the year ©2017 DeVry/Becker Educational Development Corp. All rights reserved. Polestar $000 110,000 (88,000) ––––––– 22,000 (3,000) (5,250) (250) ––––––– 13,500 (3,500) ––––––– 10,000 ––––––– Southstar $000 66,000 (67,200) ––––––– (1,200) (2,000) (2,400) nil ––––––– (5,600) 1,000 ––––––– (4,600) ––––––– 93 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK Statements of financial position as at 30 September 20X6 Assets Non-current assets Property, plant and equipment Financial asset: equity investments (note (ii)) Current assets Total assets Equity and liabilities Equity Equity shares of 50 cents each Retained earnings Current liabilities Total equity and liabilities 41,000 16,000 ––––––– 57,000 16,500 ––––––– 73,500 ––––––– 21,000 nil ––––––– 21,000 4,800 ––––––– 25,800 ––––––– 30,000 28,500 ––––––– 58,500 15,000 ––––––– 73,500 ––––––– 6,000 12,000 ––––––– 18,000 7,800 ––––––– 25,800 ––––––– The following information is relevant: (i) At the date of acquisition, the fair values of Southstar’s assets were equal to their carrying amounts with the exception of a property. This had a fair value of $2 million above its carrying amount and a remaining useful life of 10 years at that date. All depreciation is included in cost of sales. (ii) Polestar has recorded its investment in Southstar at the cost of the immediate cash payment; other equity investments are carried at fair value through profit or loss as at 1 October 20X5. The other equity investments have fallen in value by $200,000 during the year ended 30 September 20X6. (iii) Polestar’s policy is to value the non-controlling interest at fair value at the date of acquisition. For this purpose, Southstar’s share price at that date can be deemed to be representative of the fair value of the shares held by the non-controlling interest. (iv) All items in the above statements of profit or loss are deemed to accrue evenly over the year unless otherwise indicated. Required: (a) Prepare the consolidated statement of profit or loss for Polestar for the year ended 30 September 20X6. (b) Prepare the consolidated statement of financial position for Polestar as at 30 September 20X6. Note: Ignore taxation. The following mark allocation is provided as guidance for this question: (a) (b) 11 marks 9 marks (20 marks) 94 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) Question 26 RANGOON The following scenario relates to questions 1–5. Rangoon has a financial year end of 31 December. Rangoon has entered into a number of foreign currency transactions during the last two years, including the following: Transaction 1 On 1 January 20X5 Rangoon purchased a financial asset for Krown 7,650,000 which is classified as at fair value through profit or loss. Its fair value at 31 December 20X5 had fallen to Krown 7,430,000 and at 31 December 20X6 it had increased to Krown 8,100,000. Transaction 2 On 28 November 20X6 Rangoon purchased raw materials from a foreign company for Krown 528,000. The materials were to be used in the construction of an asset for Rangoon’s own use. At 31 December 20X6 Rangoon had not paid for these raw materials. Exchange rates are as follows: 1 January 20X5 31 December 20X5 28 November 20X6 31 December 20X6 Average for 20X6 1 2 In accordance with IAS 21 The Effects of Changes in Foreign Exchange Rates which of the following factors will determine an entity’s functional currency? (1) (2) (3) (4) The currency that mainly influences the selling price of goods and services The currency of the country in which the head office of the entity is located The currency that the majority of an entity’s input costs are denominated in The currency that is voted on by shareholders at an entity’s annual general meeting A B C D 1 and 2 1 and 3 2 and 4 3 and 4 What gain or loss will be recognised in Rangoon’s statement of profit or loss and other comprehensive income for the year ended 31 December 20X6 in respect of the financial asset? A B C D 3 $1 = Krown 5.12 $1 = Krown 4.99 $1 = Krown 5.88 $1 = Krown 6.02 $1 = Krown 5.66 $143,463 gain $5,163 gain $5,163 loss $143,463 loss What is Rangoon’s trade payable as at 31 December 20X6 in respect of the purchase of raw materials? A B C D $89,796 $87,708 $93,283 $3,178,560 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 95 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK 4 Where in the statement of profit or loss and other comprehensive income will gains of losses for the two transactions be recognised? A B C D 5 Transaction 1 Profit or loss Profit or loss Other comprehensive income Other comprehensive income Transaction 2 Profit or loss Other comprehensive income Profit or loss Other comprehensive income When must an entity change its functional currency? A B C D When shareholders vote for a change at annual general meeting The functional currency can never be changed When the underlying conditions that led to the original classification change When the currency suffers from a devaluation (10 marks) Question 27 WITTON WAY The following information has been extracted from the draft consolidated financial statements of Witton Way Co: Statements of profit or loss for the year to 30 April Revenue Cost of sales Gross profit Other expenses Profit on disposal of subsidiary Finance costs Profit before taxation Income tax expense Profit for the year Non-controlling interest’s share of consolidated profit 96 20X7 $000 25,060 (16,190) –––––– 8,870 (2,780) 1,400 (400) –––––– 7,090 (1,810) –––––– 5,280 –––––– 96 20X6 $000 26,140 (18,730) –––––– 7,410 (2,810) – (260) –––––– 4,340 (2,060) –––––– 2,280 –––––– 150 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) Statements of financial position at 30 April Assets Non-current assets Tangible assets Current assets Inventories Trade receivables Cash Total assets Equity and liabilities Equity Equity shares of $1 each Retained earnings Non-controlling interest Total equity Non-current liabilities Current liabilities Trade payables Other Total equity and liabilities 20X7 $000 20X6 $000 34,060 –––––– 39,800 –––––– 8,420 5,470 40 –––––– 13,930 –––––– 47,990 –––––– 5,270 3,900 1,600 –––––– 10,770 –––––– 50,570 –––––– 12,000 25,820 –––––– 37,820 – –––––– 37,820 12,000 25,690 –––––– 37,690 1,260 –––––– 38,980 4,600 7,100 3,760 1,810 –––––– 5,570 –––––– 47,990 –––––– 2,460 2,060 –––––– 4,520 –––––– 50,570 –––––– Additional information On 31 October 20X6 Witton Way Co sold its only subsidiary, Brew4Two Co. The results of Brew4Two Co for the six months to 31 October 20X6, included in the consolidated profit or loss for year ended 30 April 20X7, are as follows: $000 Revenue 4,110 Cost of sales (2,800) –––––– Gross profit 1,310 Other expenses (520) Income tax expense (310) –––––– Profit for the year 480 –––––– At the disposal date, the assets and liabilities of Brew4Two Co amount to $7,620,000 and $1,850,000, respectively. Brew4Two Co conducts business independently from Witton Way Co. The CEO of Witton Way Co was extremely happy with the results for the current year, commenting on the fact that profits had more than doubled during the year and it is hoped that this trend can continue into the foreseeable future. ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 97 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK Required: (a) Comment on how the disposal of Brew4Two would be presented in the consolidated financial statements for the year ended 30 April 20X7. (4 marks) (b) Calculate appropriate ratios and comment on the results of the Witton Way group, making reference to the CEO’s comments regarding the profitability for the current period. Note: Six marks are available for the ratio calculations. (16 marks) Note: Ignore taxation on profit on disposal of Brew4Two. (20 marks) Question 28 IONA Iona is the listed parent of a group of companies which operate in the engineering industry. The Chief Executive Officer of Iona has initiated an aggressive growth strategy to increase market share. During the current year this has included the acquisition of Arran, another engineering company. The following is an extract from a recent press release of Iona: “Iona announces strong results. The group has produced excellent results for the year ended 31 March 20X7. Revenue grew by 19% and profit before taxation and goodwill impairment charges increased by 33%. We are now delivering our growth strategy.” You are the finance director of Lundy, a company operating in the same business sector as Iona. Your fellow directors have asked you to review the financial performance, financial position and liquidity of Iona as part of the annual review of companies operating within the same business sector. The following information has been provided: Statements of profit or loss for year ended 31 March Revenue Cost of sales Gross profit Operating expenses Profit from operations Finance costs Profit before tax Tax Profit for period 98 20X7 $000 23,460 (16,780) –––––– 6,680 (3,410) –––––– 3,270 (1,110) –––––– 2,160 (810) –––––– 1,350 –––––– 20X6 $000 19,710 (14,200) –––––– 5,510 (2,530) –––––– 2,980 (1,210) –––––– 1,770 (590) –––––– 1,180 –––––– ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) Extract from statement of changes in equity for year ended 31 March 20X7 Retained earnings $000 Balance at 1 April 20X6 6,650 Total comprehensive income 1,350 Final 20X6 dividend on ordinary shares ($0.08 per ordinary share) (800) –––––– Balance at 31 March 20X7 7,200 –––––– A final dividend in respect of the year ended 31 March 20X7 of $960,000 ($.08 per share) was declared in April 20X7. Statements of financial position at 31 March 20X7 $000 ASSETS Non-current assets Property, plant and equipment Intangibles (including customer base) Current assets Inventories Trade and other receivables Cash and cash equivalents 20X6 $000 22,010 2,570 –––––– 24,580 4,340 2,350 100 –––––– Total assets EQUITY AND LIABILITIES Equity Equity shares of $1 each Share premium Retained earnings Non-current liabilities Borrowings ©2017 DeVry/Becker Educational Development Corp. All rights reserved. $000 22,190 1,200 –––––– 23,390 3,250 2,210 20 –––––– 6,790 –––––– 31,370 –––––– 5,480 –––––– 28,870 –––––– 12,000 4,020 7,200 –––––– 23,220 10,000 2,000 6,650 –––––– 18,650 5,500 8,000 Current liabilities Trade payables and other liabilities 1,900 Taxation 750 –––––– Total equity and liabilities $000 1,640 580 –––––– 2,650 –––––– 31,370 –––––– 2,220 –––––– 28,870 –––––– 99 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK Extract from notes to the financial statements Acquisition during the year Two million $1 ordinary shares were issued on 1 January 20X7 to acquire 100% of the share capital of Arran. Details of the consideration and net assets acquired were as follows: $000 Fair value of assets acquired: Property, plant and equipment Customer base Inventories Other net current assets 1,480 720 570 400 –––––– 3,170 Goodwill 850 –––––– Fair value of consideration 4,020 –––––– The statement of profit or loss includes revenue of $1,550,000 and profit from operations of $380,000 in relation to Arran since the date of acquisition. If the acquisition had been made on 1 April 20X6, the statement of profit or loss would have included revenue of $5,840,000 and profit from operations of $1,280,000. Additional information Gearing (net debt/equity) Operating margin Inventory turnover Trade receivables collection period Trade payables payment period Return on capital employed (ROCE) Average number of employees Market average ROCE Market revenue growth rate (industry estimate) 20X7 23.7% 13.9% 3.9 times 36.6 days 41.3 days 11.6% 1,250 10.1% 12.0% 20X6 42.8% 15.1% 4.4 times 40.9 days 42.2 days 11.2% 1,300 8.2% 9.0% Required: (a) Comment on the performance, financial position and liquidity of Iona, calculating five additional relevant ratios to assist in your analysis. (17 marks) (b) Comment on the usefulness to investors of the disclosure information in respect of acquisitions required by IFRS 3 Business Combinations. (3 marks) (20 marks) 100 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) Question 29 HARBIN Shown below are the recently issued (summarised) financial statements of Harbin, a listed company, for the year ended 30 September 20X6, together with comparatives for 20X5 and extracts from the Chief Executive’s report that accompanied their issue. Statement of profit or loss Revenue Cost of sales Gross profit Operating expenses Finance costs Profit before tax Income tax expense (at 25%) Profit for the period Statement of financial position Non-current assets Property, plant and equipment Goodwill Current assets Inventory Trade receivables Bank Total assets Equity and liabilities Equity shares of $1 each Retained earnings Non-current liabilities 8% Loan notes Current liabilities Bank overdraft Trade payables Current tax payable Total equity and liabilities ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 20X6 $000 250,000 (200,000) ––––––– 50,000 (26,000) (8,000) ––––––– 16,000 (4,000) ––––––– 12,000 ––––––– 20X5 $000 180,000 (150,000) ––––––– 30,000 (22,000) nil ––––––– 8,000 (2,000) ––––––– 6,000 ––––––– 20X6 $000 210,000 10,000 ––––––– 220,000 ––––––– 20X5 $000 90,000 nil ––––––– 90,000 ––––––– 25,000 13,000 nil ––––––– 38,000 ––––––– 258,000 ––––––– 15,000 8,000 14,000 ––––––– 37,000 ––––––– 127,000 ––––––– 100,000 14,000 ––––––– 114,000 ––––––– 100,000 12,000 ––––––– 112,000 ––––––– 100,000 ––––––– nil ––––––– 17,000 23,000 4,000 ––––––– 44,000 ––––––– 258,000 ––––––– nil 13,000 2,000 ––––––– 15,000 ––––––– 127,000 ––––––– 101 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK Extracts from the Chief Executive’s report: “Highlights of Harbin’s performance for the year ended 30 September 20X6: an increase in sales revenue of 39% gross profit margin up from 16·7% to 20% a doubling of the profit for the period. “In response to the improved position the Board paid a dividend of $0.10 per share in September 20X6 an increase of 25% on the previous year.” You have also been provided with the following further information. On 1 October 20X5 Harbin purchased the whole of the net assets of Fatima (previously a privately owned entity) for $100 million. The contribution of the purchase to Harbin’s results for the year ended 30 September 20X6 was: $000 Revenue 70,000 Cost of sales (40,000) –––––– Gross profit 30,000 Operating expenses (8,000) –––––– Profit before tax 22,000 –––––– There were no disposals of non-current assets during the year. The following ratios have been calculated for Harbin for the year ended 30 September 20X5: Return on year-end capital employed (profit before interest and tax over total assets less current liabilities) Net asset (equal to capital employed) turnover Net profit (before tax) margin Current ratio Closing inventory holding period (in days) Trade receivables’ collection period (in days) Gearing (debt over debt plus equity) 7·1% 1·6 4·4% 2·5 37 16 nil Required: (a) Calculate ratios for Harbin for the year ended 30 September 20X6 equivalent to those calculated for the year ended 30 September 20X6 (showing your workings). (7 marks) (b) Assess the financial performance and position of Harbin for the year ended 30 September 20X6 compared to the previous year. Your answer should refer to the information in the Chief Executive’s report and the impact of the purchase of the net assets of Fatima. (13 marks) (20 marks) 102 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) Question 30 VICTULAR Victular is a public company that would like to acquire (100% of) a suitable private company. It has obtained the following draft financial statements for two companies, Grappa and Merlot. They operate in the same industry and their managements have indicated that they would be receptive to a takeover. Statements of profit or loss for the year ended 30 September 20X6 Revenue Cost of sales Gross profit Operating expenses Finance costs – loan – overdraft – lease interest Profit before tax Income tax expense Profit for the year Grappa $000 12,000 (10,500) –––––– 1,500 (240) (210) nil nil ––––– 1,050 (150) ––––– 900 ––––– Merlot $000 20,500 (18,000) –––––– 2,500 (500) (300) (10) (290) ––––– 1,400 (400) ––––– 1,000 ––––– Extract from the statement of changes in equity: Dividends paid during the year ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 250 –––– 700 –––– 103 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK Statements of financial position as at 30 September 20X6 $000 Grappa $000 Assets Non-current assets Factory (note (i)) Owned plant (note (ii)) Leased plant (note (ii)) Current assets Inventory Trade receivables Bank 4,400 5,000 nil ––––– 9,400 2,000 2,400 600 ––––– Total assets Equity and liabilities Equity shares of $1 each Property revaluation surplus Retained earnings Non-current liabilities Lease liability (note (iii)) 7% Loan notes 10% Loan notes Deferred tax Government grants Current liabilities Bank overdraft Trade payables Government grants Lease liability (note (iii)) Taxation $000 5,000 –––––– 14,400 –––––– nil 2,200 5,300 ––––– 7,500 3,600 3,700 nil ––––– 2,000 900 2,600 ––––– 3,500 ––––– 5,500 nil 3,000 nil 600 1,200 ––––– nil 3,100 400 nil 600 ––––– Total equity and liabilities 4,800 4,100 ––––– 14,400 ––––– Merlot $000 7,300 ––––– 14,800 ––––– 2,000 nil 800 ––––– 3,200 nil 3,000 100 nil ––––– 1,200 3,800 nil 500 200 ––––– 800 ––––– 2,800 6,300 5,700 ––––– 14,800 ––––– Notes (i) Both companies operate from similar premises. (ii) Additional details of the two companies’ plant are: Owned plant – cost Leased plant – original fair value Grappa $000 8,000 nil Merlot $000 10,000 7,500 There were no disposals of plant during the year by either company. 104 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) (iii) The interest rate implicit in Merlot’s leases is 7·5% per annum. For the purpose of calculating return on capital employed (ROCE) and gearing, all lease obligations are treated as long-term interest bearing borrowings. (iv) The following ratios have been calculated for Grappa and can be taken to be correct: ROCE (see note (iii) above) Pre-tax return on equity (ROE) Net asset (total assets less current liabilities) turnover Gross profit margin Operating profit margin Current ratio Closing inventory holding period Trade receivables’ collection period Trade payables’ payment period (using cost of sales) Gearing (see note (iii) above) Interest cover Dividend cover 14·8% 19·1% 1·2 times 12·5% 10·5% 1·2:1 70 days 73 days 108 days 35·3% 6 times 3·6 times Required: (a) Calculate for Merlot the ratios equivalent to all those given for Grappa above. (8 marks) (b) Assess the relative performance and financial position of Grappa and Merlot for the year ended 30 September 20X6 to inform the directors of Victular in their acquisition decision. (12 marks) (20 marks) Question 31 HARDY Hardy is a public listed manufacturing company. Its summarised financial statements for the year ended 30 September 20X6 (and 20X5 comparatives) are as follows: Statements of profit or loss for the year ended 30 September Revenue Cost of sales Gross profit Distribution costs Administrative expenses Investment income Finance costs Profit (loss) before taxation Income tax (expense) relief Profit (loss) for the year ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 20X6 $000 29,500 (25,500) ––––––– 4,000 (1,050) (4,900) 50 (600) ––––––– (2,500) 400 ––––––– (2,100) ––––––– 20X5 $000 36,000 (26,000) ––––––– 10,000 (800) (3,900) 200 (500) ––––––– 5,000 (1,500) ––––––– 3,500 ––––––– 105 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK Statements of financial position as at 30 September $000 Assets Non-current assets Property, plant and equipment Investments at fair value through profit or loss Current assets Inventory and work-in-progress 2,200 Trade receivables 2,200 Tax asset 600 Bank 1,200 ––––– Total assets Equity and liabilities Equity Equity shares of $1 each Share premium Revaluation surplus Retained earnings Non-current liabilities Bank loan Deferred tax Current liabilities Trade payables Current tax payable Total equity and liabilities 3,400 nil ––––– 20X6 $000 $000 20X5 $000 17,600 24,500 2,400 –––––– 20,000 4,000 –––––– 28,500 6,200 –––––– 26,200 –––––– 1,900 2,800 nil 100 ––––– 4,800 –––––– 33,300 –––––– 13,000 1,000 nil 3,600 –––––– 17,600 12,000 nil 4,500 6,500 –––––– 23,000 4,000 1,200 5,000 700 3,400 –––––– 26,200 –––––– 2,800 1,800 ––––– 4,600 –––––– 33,300 –––––– The following information has been obtained from the Chairman’s Statement and the notes to the financial statements: “Market conditions during the year ended 30 September 20X6 proved very challenging due largely to difficulties in the global economy as a result of a sharp recession which has led to steep falls in share prices and property values. Hardy has not been immune from these effects and our properties have suffered impairment losses of $6 million in the year.” The excess of these losses over previous surpluses has led to a charge to cost of sales of $1·5 million in addition to the normal depreciation charge. “Our portfolio of investments at fair value through profit or loss has been “marked to market” (fair valued) resulting in a loss of $1·6 million (included in administrative expenses).” There were no additions to or disposals of non-current assets during the year. 106 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) “In response to the downturn the company has unfortunately had to make a number of employees redundant incurring severance costs of $1·3 million (included in cost of sales) and undertaken cost savings in advertising and other administrative expenses.” “The difficulty in the credit markets has meant that the finance cost of our variable rate bank loan has increased from 4·5% to 8%. In order to help cash flows, the company made a rights issue during the year and reduced the dividend per share by 50%.” “Despite the above events and associated costs, the Board believes the company’s underlying performance has been quite resilient in these difficult times.” Required: Analyse and discuss the financial performance and position of Hardy as portrayed by the above financial statements and the additional information provided. Your analysis should be supported by profitability, liquidity and gearing and other appropriate ratios (up to 8 marks available). (20 marks) Question 32 QUARTILE The following scenario relates to questions 1–5. The financial statements of Quartile for the year ended 30 September 20X6 are: Statement of profit or loss $000 Revenue Opening inventory Purchases Closing inventory Gross profit Operating costs Finance costs Profit before tax Income tax expense Profit for the year ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 8,300 43,900 (10,200) ––––––– $000 56,000 (42,000) –––––– 14,000 (9,800) (800) –––––– 3,400 (1,000) –––––– 2,400 –––––– 107 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK Statement of financial position $000 Assets Non-current assets Property and shop fittings Current assets Inventory Bank 30,600 10,200 1,000 –––––– Total assets Equity and liabilities Equity shares of $1 each Retained earnings Non-current liabilities 10% Loan notes Current liabilities Trade payables Current tax payable 8,000 5,400 1,800 ––––––– 0.14 1.56 0.74 1.42 What is Quartile’s trade payables payment period as at 30 September 20X6? A B C D 108 12.8% 9.8% 15.8% 12.1% What is the current ratio for the year ended 30 September 20X6? A B C D 3 7,200 ––––––– 41,800 ––––––– What is the return on capital employed for the year ended 30 September 20X6? A B C D 2 11,200 –––––– 41,800 –––––– 15,000 11,600 –––––– 26,600 Total equity and liabilities 1 $000 60 days 63 days 47 days 45 days ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) 4 5 Which of the following are TRUE of trend analysis? (1) (2) (3) (4) It uses changes in monetary amount and percentage terms to identify patterns It concentrates on the relative size of current assets It examines changes over time It allows the comparison of two companies over a period of time A B C D 1 and 3 1 and 4 2 and 3 2 and 4 The following are possible methods of measuring assets and liabilities other than historical cost: (1) (2) (3) (4) Current cost Realisable value Present value Replacement cost According to the IASB’s Conceptual Framework for Financial Reporting which of the measurement bases above can be used to measure assets and liabilities in the statement of financial position? A B C D 1 and 2 only 1, 2 and 3 only 2 and 3 only 1, 2, 3 and 4 (10 marks) ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 109 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK Question 33 CROSSWIRE The following information relates to Crosswire a publicly listed company: Summarised statements of financial position 30 September 20X6 $000 $000 Assets Non-current assets Property, plant and equipment (note (i)) Development costs (note (ii)) Current assets Total assets Equity and liabilities Equity Equity shares of $1 each Share premium Other equity reserve Revaluation surplus Retained earnings Non-current liabilities 10% convertible loan notes (note (iii)) Environmental provision Lease obligations Deferred tax Current liabilities Lease obligations Trade payables Total equity and liabilities 30 September 20X5 $000 $000 32,500 1,000 –––––– 33,500 8,200 –––––– 41,700 –––––– 13,100 2,500 –––––– 15,600 6,800 –––––– 22,400 –––––– 5,000 6,000 500 2,000 5,700 ––––– 1,000 3,300 5,040 3,360 ––––– 1,760 8,040 ––––– 14,200 –––––– 19,200 12,700 9,800 –––––– 41,700 –––––– 4,000 2,000 500 nil 3,200 ––––– 5,000 nil nil 1,200 ––––– nil 6,500 ––––– 5,700 –––––– 9,700 6,200 6,500 –––––– 22,400 –––––– Information from the statements of profit or loss Revenue Finance costs (note (iv)) Income tax expense Profit for the year (after tax) 110 30 September 20X6 $000 52,000 1,050 1,000 4,000 30 September 20X5 $000 42,000 500 800 3,000 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) The following information is available: (i) During the year to 30 September 20X6, Crosswire embarked on a replacement and expansion programme for its non-current assets. The details of this programme are: On 1 October 20X5 Crosswire acquired a platinum mine at a cost of $5 million. A condition of mining the platinum is a requirement to landscape the mining site at the end of its estimated life of ten years. The present value of this cost at the date of the purchase was calculated at $3 million (in addition to the purchase price of the mine of $5 million). Also on 1 October 20X5 Crosswire revalued its land for the first time. The credit in the revaluation surplus is the net amount of the revaluation after a transfer to deferred tax on the gain. The tax rate applicable to Crosswire for deferred tax is 20% per annum. On 1 April 20X6 Crosswire took out a right-of-use lease for some new plant. The initial amount recognised for the plant was $10 million. The lease agreement provided for an initial payment on 1 April 20X6 of $2·4 million followed by eight six-monthly payments of $1·2 million commencing 30 September 20X6. Plant disposed of during the year had a carrying amount of $500,000 and was sold for $1·2 million. The remaining movement on the property, plant and equipment, after charging depreciation of $3 million, was the cost of replacing plant. (ii) From 1 October 20X5 to 31 March 20X6 a further $500,000 was spent completing the development project at which date marketing and production started. The sales of the new product proved disappointing and on 30 September 20X6 the development costs were written down to $1 million via an impairment charge. (iii) During the year ended 30 September 20X6, $4 million of the 10% convertible loan notes matured. The loan note holders had the option of redemption at par in cash or to exchange them for equity shares on the basis of 20 new shares for each $100 of loan notes. 75% of the loan-note holders chose the equity option. Ignore any effect of this on the other equity reserve. All the above items have been treated correctly according to International Financial Reporting Standards. (iv) The finance costs are made up of: For year ended: 30 September 20X6 $000 lease interest 400 unwinding of environmental provision 300 loan-note interest 350 –––––– 1,050 –––––– 30 September 20X5 $000 nil nil 500 –––––– 500 –––––– Required: (a) Prepare a statement of the movements in the carrying amount of Crosswire’s noncurrent assets for the year ended 30 September 20X6; (8 marks) (b) Calculate the amounts that would appear under the headings of “cash flows from investing activities” and “cash flows from financing activities” in the statement of cash flows for Crosswire for the year ended 30 September 20X6. Note: Crosswire includes finance costs paid as a financing activity. ©2017 DeVry/Becker Educational Development Corp. All rights reserved. (7 marks) 111 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK (c) A shareholder has written to the directors of Crosswire expressing particular concern over the deterioration of the company’s return on capital employed (ROCE). Required: Calculate Crosswire’s ROCE for the two years ended 30 September 20X5 and 20X6 and comment on the apparent cause of its deterioration. (5 marks) Note: ROCE should be calculated as profit before interest on long-term borrowings and tax as a percentage of equity plus loan notes and lease obligations (at the year end). (20 marks) Question 34 MOROCCO (a) Morocco is a public listed company. Its summarised financial statements for the years ended 31 March 20X7 and the comparative figures are shown below: Statements of profit or loss and other comprehensive income for the year ended 31 March Revenue Cost of sales Gross profit Distribution costs Administrative expenses Finance costs Profit before tax Income tax expense Profit for the year Other comprehensive income Total comprehensive income 112 20X7 $m 2,700 (1,890) ––––– 810 (230) (345) (40) ––––– 195 (60) ––––– 135 80 ––––– 215 ––––– 20X6 $m 1,820 (1,092) ––––– 728 (130) (200) (5) ––––– 393 (113) ––––– 280 nil ––––– 280 ––––– ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) Statements of financial position as at 31 March 20X7 Assets $m Non-current assets Property, plant and equipment Intangible asset: manufacturing licence Investment at cost: shares in Raremetal Current assets Inventory Trade receivables Bank 200 195 nil ––––– Total assets Equity and liabilities Equity Equity shares of $1 each Reserves Revaluation Retained earnings Non-current liabilities 5% Loan notes 10% secured loan notes Current liabilities Bank overdraft Trade payables Current tax payable 100 300 –––– 110 210 80 –––– Total equity and liabilities 20X6 $m $m 680 300 230 ––––– 1,210 395 ––––– 1,605 ––––– $m 410 200 nil ––––– 610 110 75 120 ––––– 305 ––––– 915 ––––– 350 250 80 375 ––––– 805 nil 295 ––––– 545 400 400 ––––– 1,605 ––––– 100 nil –––– nil 160 110 –––– 100 270 –––– 915 –––– The following information is relevant: Depreciation/amortisation charges for the year ended 31 March 20X7 were: Property, plant and equipment Intangible asset: manufacturing licence $m 115 25 There were no sales of non-current assets during the year, although property has been revalued. Required: Prepare the statement of cash flows for the year ended 31 March 20X7 for Morocco in accordance with the indirect method in accordance with IAS 7 Statement of cash flows. (11 marks) ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 113 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK (b) Morocco is currently considering the purchase of a foreign subsidiary. concerned about the identification of the functional currency of an entity. Management is Required: Discuss the principles set out in IAS 21 The Effects of Changes in Foreign Exchange Rates that determine the functional currency of an entity. (5 marks) (c) On a separate matter, you have been asked to advise on an application for a loan to build an extension to a sports club which is a not-for-profit organisation. You have been provided with the audited financial statements of the sports club for the last four years. Required: Identify and explain the ratios that you would calculate to assist in determining whether you would advise that the loan should be granted. (4 marks) (20 marks) Question 35 MONTY Monty is a publicly listed company. Its financial statements for the year ended 31 March 20X7 including comparatives are shown below: Statements of profit or loss and other comprehensive income for the year ended 31 March Revenue Cost of sales Gross profit Distribution costs Administrative expenses Finance costs – loan interest – lease interest Profit before tax Income tax expense Profit for the year Other comprehensive income (note (i)) 114 20X7 $000 31,000 (21,800) –––––– 9,200 (3,600) (2,200) (150) (250) –––––– 3,000 (1,000) –––––– 2,000 1,350 –––––– 3,350 –––––– 20X6 $000 25,000 (18,600) –––––– 6,400 (2,400) (1,600) (250) (100) –––––– 2,050 (750) –––––– 1,300 nil –––––– 1,300 –––––– ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) Statements of financial position as at 31 March 20X7 $000 Assets Non-current assets Property, plant and equipment Deferred development expenditure Current assets Inventory Trade receivables Bank 3,300 2,950 50 –––––– Total assets Equity and liabilities Equity Equity shares of $1 each Revaluation surplus Retained earnings Non-current liabilities 8% Loan notes Deferred tax Lease obligation Current liabilities Lease obligation Trade payables Current tax payable 20X6 $000 $000 14,000 1,000 –––––– 15,000 6,300 –––––– 21,300 –––––– 10,700 nil –––––– 10,700 3,800 2,200 1,300 –––––– 8,000 1,350 3,200 –––––– 12,550 1,400 1,500 1,200 –––––– 750 2,650 1,250 –––––– Total equity and liabilities 4,100 4,650 –––––– 21,300 –––––– $000 7,300 –––––– 18,000 –––––– 8,000 nil 1,750 –––––– 9,750 3,125 800 900 –––––– 600 2,100 725 –––––– 4,825 3,425 –––––– 18,000 –––––– Notes: (i) On 1 July 20X6, Monty acquired additional plant under a right-of-use lease, the initial amount recognised for the asset was $1·5 million. On this date it also revalued its property upwards by $2 million and transferred $650,000 of the resulting revaluation surplus this created to deferred tax. There were no disposals of non-current assets during the period. (ii) Depreciation of property, plant and equipment was $900,000 and amortisation of the deferred development expenditure was $200,000 for the year ended 31 March 20X7. Required: (a) Prepare a statement of cash flows for Monty for the year ended 31 March 20X7, in accordance with IAS 7 Statement of Cash flows, using the indirect method. (12 marks) (b) Briefly comment on the comparative performance of Monty in terms of its return on capital employed, profit margins, asset utilisation and gearing. Note: Up to 4 marks are available for the calculation of the ratios. (8 marks) (20 marks) ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 115 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK Question 36 KINGDOM Kingdom is a public listed manufacturing company. Its draft summarised financial statements for the year ended 30 September 20X6 (and 20X5 comparatives) are: Statements of profit or loss and other comprehensive income for the year ended 30 September Revenue Cost of sales Gross profit Distribution costs Administrative expenses Investment properties – rentals received – fair value changes Finance costs Profit before taxation Income tax Profit for the year Other comprehensive income Total comprehensive income 116 20X6 $000 44,900 (31,300) ––––––– 13,600 (2,400) (7,850) 350 (700) (600) ––––––– 2,400 (600) ––––––– 1,800 (1,300) ––––––– 500 ––––––– 20X5 $000 44,000 (29,000) ––––––– 15,000 (2,100) (5,900) 400 500 (600) ––––––– 7,300 (1,700) ––––––– 5,600 1,000 ––––––– 6,600 ––––––– ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) Statements of financial position as at 30 September 20X6 $000 Assets Non-current assets Property, plant and equipment Investment properties Current assets Inventory Trade receivables Bank $000 26,700 4,100 –––––– 30,800 2,300 3,000 nil –––––– Total assets Equity and liabilities Equity Equity shares of $1 each Revaluation surplus Retained earnings Non-current liabilities 12% Loan notes Current liabilities Trade payables Accrued finance costs Bank Current tax payable 20X5 $000 4,200 100 200 500 –––––– Total equity and liabilities 5,300 –––––– 36,100 –––––– $000 25,200 5,000 –––––– 30,200 3,100 3,400 300 –––––– 6,800 –––––– 37,000 –––––– 17,200 1,200 7,700 –––––– 26,100 15,000 2,500 8,700 –––––– 26,200 5,000 5,000 5,000 –––––– 36,100 –––––– 3,900 50 nil 1,850 –––––– 5,800 –––––– 37,000 –––––– The following information is relevant: On 1 July 20X6, Kingdom acquired a new investment property at a cost of $1·4 million. On this date, it also transferred one of its other investment properties to property, plant and equipment at its fair value of $1·6 million as it became owner-occupied on that date. Kingdom adopts the fair value model for its investment properties. Kingdom also has a policy of revaluing its other properties (included as property, plant and equipment) to market value at the end of each year. Other comprehensive income and the revaluation surplus both relate to these properties. Depreciation of property, plant and equipment during the year was $1·5 million. An item of plant with a carrying amount of $2·3 million was sold for $1·8 million during September 20X6. Required: (a) Prepare the statement of cash flows for Kingdom for the year ended 30 September 20X6 in accordance with IAS 7 Statement of Cash Flows using the indirect method. (12 marks) ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 117 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK (b) At a board meeting to consider the results shown by the draft financial statements, concern was expressed that, although there had been a slight increase in revenue during the current year, the profit before tax had fallen dramatically. The purchasing director commented that he was concerned about the impact of rising prices. During the year to 30 September 20X6, most of Kingdom’s manufacturing and operating costs have risen by an estimated 8% per annum. Required: (i) Explain the causes of the fall in Kingdom’s profit before tax. (5 marks) (ii) Describe the main effects which the rising prices may have on the interpretation of Kingdom’s financial statements. You are not required to quantify these effects. (3 marks) (20 marks) Question 37 SAVOIR The following scenario relates to questions 1–5. The issued share capital of Savoir, a publicly listed company, at 31 March 20X4 was $10 million (shares of 25 cents each). Savoir’s earnings attributable to its ordinary shareholders for the year ended 31 March 20X4 were also $10 million. Year ended 31 March 20X5 On 1 July 20X4 Savoir issued eight million ordinary shares at full market value. Earnings attributable to ordinary shareholders for the year ended 31 March 20X5 were $13,800,000. Year ended 31 March 20X6 On 1 October 20X5 Savoir made a rights issue of two new ordinary shares at a price of $1·00 each for every five ordinary shares held. The offer was fully subscribed. The market price of Savoir’s ordinary shares immediately prior to the offer was $2·40 each. Earnings attributable to ordinary shareholders for the year ended 31 March 20X6 were $19,500,000. Year ended 31 March 20X7 On 1 April 20X6 Savoir issued $20 million 8% convertible loan notes at par. The terms of conversion (on 1 April 20X9) are that for every $100 of loan note, 50 ordinary shares will be issued at the option of loan holders. Alternatively, the loan notes will be redeemed at par for cash. The income tax rate is 25%. Earnings attributable to ordinary shareholders for the year ended 31 March 20X7 were $25,200,000. 1 What is the number of shares to be used in the basic earnings per share calculation for the year ended 31 March 20X5? A B C D 118 46 million 16 million 48 million 18 million ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) 2 Which of the following is the bonus factor to be used in the calculation of the comparable earnings per share for the year ended 31 March 20X6? A B C D 3 What amount of earnings should be used in the diluted earnings per share calculation for the year ended 31 March 20X7? A B C D 4 $24,000,000 $23,600,000 $26,800,000 $26,400,000 If a bonus issue took place during the year, what number of shares should be used in the basic earnings per share calculation? A B C D 5 2.4/2.0 1.4/2.0 2.0/2.4 2.0/1.4 The number of share in issue at the end of the year The number of shares in issue at the beginning of the year The weighted average number of shares The weighted average number of shares adjusted by the bonus element Which of the following items must be disclosed in the notes to the financial statements in accordance with IAS 33 Earnings per Share? (1) (2) (3) (4) Interest saved on non-convertible loan notes Number of preference shares currently in issue Instruments that could potentially dilute future EPS Ordinary shares issued after the reporting date A B C D 1 and 2 2 and 4 1 and 3 3 and 4 (10 marks) Question 38 REBOUND The following scenario relates to questions 1–5. The following summarised information is available in relation to Rebound, a publicly listed company: Statement of profit or loss extracts years ended 31 March 20X6 20X5 Continuing Discontinued Continuing Discontinued $000 $000 $000 $000 Profit after tax Existing operations Operations acquired on 1 August 20X5 2,000 450 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. (750) 1,750 600 nil 119 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK Analysts expect profits from the market sector in which Rebound’s existing operations are based to increase by 6% in the year to 31 March 20X7 and by 8% in the sector of its newly acquired operations. On 1 April 20X4 Rebound had: $3 million of equity share capital (shares of 25 cents each); $5 million 8% convertible loan notes 20Y1; the terms of conversion are 40 equity shares for each $100 of loan note if conversion is before 31 March 20X9 and 35 equity shares for each $100 of loan note if conversion is later. Assume an income tax rate of 30%. 1 Based on the above information what will be Rebound’s estimated profit after tax for the year ended 31 March 20X7? A B C D 2 In accordance with IAS 33 Earnings per Share, what is Rebound’s basic earnings per share for the year ended 31 March 20X6? A B C D 3 120 Interest after tax saved is added back to the basic earnings per share profit Interest after tax saved is deducted from the basic earnings per share profit Interest saved is added back to the basic earnings per share profit Interest saved is deducted from the basic earnings per share profit What number of shares should be used in the 20X6 calculation of Rebound’s diluted earnings per share? A B C D 5 $0.14 $0.57 $0.20 $0.82 When calculating the amount of earnings for a diluted earnings per share calculation, what is the adjustment for interest on convertible loan notes? A B C D 4 $2,450,000 $2,849,000 $2,606,000 $2,675,000 12,000,000 14,000,000 13,750,000 12,050,000 Which of the following transactions should be treated as a discontinued operation in accordance with IFRS 5 Non-Current Assets Held for Sale and Discontinued Operations? (1) One of 20 factories used by Rebound is in the process of being closed down; the factory generates 2% of Rebound’s total revenue (2) Ceasing the manufacture of one of Rebound’s three main product lines which creates employment for 40% of the entity’s workforce (3) Subsidiary Gentry which was acquired two months ago; on acquisition it was intended to resell the subsidiary as soon as possible (4) A major item of machinery is to be replaced at an expected cost of $1.1 million which represents 10% of Rebound’s total assets ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) A B C D 1 and 2 2 and 3 3 and 4 1 and 4 (10 marks) Question 39 ERRSEA The following scenario relates to questions 1–5. The following is an extract of Errsea’s balances of property, plant and equipment and related government grants at 1 April 20X5: Accumulated Carrying Cost depreciation amount $000 $000 $000 Property, plant and equipment 240 180 60 Non-current liabilities Government grants 30 Current liabilities Government grants 10 Notes: (i) Included in the above figures is an item of plant that was disposed of on 1 April 20X5 for $12,000 which had cost $90,000 on 1 April 20X2. The plant was being depreciated on a straight-line basis over four years assuming a residual value of $10,000. (ii) An item of plant was acquired on 1 July 20X5 with the following costs: Base cost Modifications specified by Errsea Transport and installation $000 192 12 6 The plant qualified for a government grant of 25% of the base cost of the plant, but this had not been received by 31 March 20X6. The plant is to be depreciated on a straight-line basis over three years with a nil estimated residual value. (iii) All other plant is depreciated by 15% per annum on cost (iv) $11,000 of the $30,000 non-current liability for government grants at 1 April 20X5 should be reclassified as a current liability as at 31 March 20X6. (v) Depreciation is calculated on a time apportioned basis. 1 What is the profit or loss on the disposal of the item of plant that will be recognised in Errsea’s statement of profit or loss for the year ended 31 March 20X6? A B C D $10,500 profit $18,000 profit $10,500 loss $18,000 loss ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 121 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK 2 What is the depreciation expense for the year ended 31 March 20X6 to be recognised in profit or loss? A B C D 3 What is the total carrying amount of the government grant in Errsea’s statement of financial position as at 31 March 20X6? A B C D 4 $66,000 $73,000 $62,000 $36,000 Which of the following assets would NEVER qualify for capitalisation of borrowing costs under IAS 23 Borrowing Costs? A B C D 5 $88,500 $106,000 $75,000 $92,500 Intangible assets Financial assets Manufacturing plants Power generation facilities Which of the following criteria must be met before government grants can be recognised in accordance with IAS 20 Accounting for Government Grants? (1) (2) The entity must comply with any conditions attached to the grant The grant must have been received A B C D 1 only 2 only Both 1 and 2 Neither 1 or 2 (10 marks) Question 40 SKEPTIC The following scenario relates to questions 1–5. The following issues have arisen during the preparation of Skeptic’s draft financial statements for the year ended 31 March 20X6: (i) Presentation From 1 April 20X5, the directors have decided to reclassify research and amortised development costs as administrative expenses rather than its previous classification as cost of sales. They believe that the previous treatment unfairly distorted the company’s gross profit margin. (ii) Potential liabilities Skeptic has two potential liabilities to assess. The first is an outstanding court case concerning a customer claiming damages for losses due to faulty components supplied by Skeptic. The second is the provision required for product warranty claims against 200,000 units of retail goods supplied with a one-year warranty. 122 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) The estimated outcomes of the two liabilities are: Court case 10% chance of no damages awarded 65% chance of damages of $4 million 25% chance of damages of $6 million (iii) Product warranty claims 70% of sales will have no claim 20% of sales will require a $25 repair 10% of sales will require a $120 repair Government grant On 1 April 20X5, Skeptic received a government grant of $8 million towards the purchase of new plant. The plant has an estimated life of 10 years and is depreciated on a straight-line basis. One of the terms of the grant is that the sale of the plant before 31 March 20X9 would trigger a repayment on a sliding scale as follows: Sale in the year ended 31 March 20X6 31 March 20X7 31 March 20X8 31 March 20X9 Amount of repayment 100% 75% 50% 25% Skeptic accounts for government grants as a separate item of deferred credit in its statement of financial position. Skeptic has no intention of selling the plant before the end of its economic life. 1 How is the change in accounting for research and development costs to be accounted for in the financial statements for the year ended 31 March 20X6? A B C D 2 What is the liability to be recognised, in respect of the court case, as at 31 March 20X6? A B C D 3 Nil $6 million $4.1 million $4 million What is the provision which Skeptic would report in its statement of financial position as at 31 March 20X6 in respect of the product warranty claims? A B C D 4 As a change in accounting policy requiring retrospective application As a change in estimate requiring prospective application As a prior period error requiring retrospective application As the adoption of a new accounting policy requiring prospective application $3.4 million Nil $17 $24 million What amount of government grant should be credited to profit or loss for the year ended 31 March 20X6? A B C D $8 million $800,000 $2 million $Nil ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 123 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK 5 Skeptic is about to dispose of an equity investment in another entity which is measured at fair value through other comprehensive income. Skeptic expects to make a gain on disposal; a cumulative fair value gain has already been recognised over the period of holding this asset. What is the accounting treatment of the gains in the year of disposal in accordance with IFRS 9 Financial Instruments? A B C D Gain on disposal Cumulative gain Credit profit or loss Credit other comprehensive income Credit other comprehensive income Credit profit or loss Reclassify to profit or loss Not reclassified to profit or loss Reclassify to profit or loss Transfer to retained earnings (10 marks) Question 41 CANDY The following scenario relates to questions 1–5. The following is an extract of Candy’s trial balance as at 30 September 20X6: $000 Proceeds of 5% loan (note (i)) Land ($5 million) and buildings – at cost (note (ii)) Plant and equipment – at cost (note (ii)) Accumulated depreciation at 1 October 20X5: buildings plant and equipment Deferred tax (note (iii)) Interest payment (note (i)) Current tax (note (iii)) $000 30,000 55,000 60,500 20,000 36,500 2,600 1,500 1,000 The following notes are relevant: (i) The loan note was issued on 1 October 20X5 and incurred issue costs of $1 million which were charged to profit or loss. Interest of $1·5 million ($30 million at 5%) was paid on 30 September 20X6. The effective interest rate of the loan note is 9% per annum. (ii) Non-current assets: The directors revalued the land at $8 million and the buildings at $39 million on 1 October 20X5, based on an independent valuer’s report. The remaining life of the buildings at 1 October 20X5 was 15 years. Plant and equipment is depreciated at 12½% per annum using the reducing balance method. No depreciation has yet been charged on any non-current asset for the year ended 30 September 20X6. (iii) 124 A provision of $2·3 million is required for current income tax on the profit of the year to 30 September 20X6. The balance on current tax in the trial balance is the under/over provision of tax for the previous year. At 30 September 20X6 Candy has taxable temporary differences, impacting profit or loss, of $9.8 million. Candy’s rate of tax is 30%. ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) 1 What is the carrying amount of property, plant and equipment recognised in Candy’s statement of financial position as at 30 September 20X6? A B C D 2 What is the tax expense in Candy’s profit or loss for the year ended 30 September 20X6? A B C D 3 5 $3,640,000 $4,240,000 $1,640,000 $6,240,000 What is the carrying amount of the loan note in Candy’s statement of financial position as at 30 September 20X6? A B C D 4 $65,400,000 $57,400,000 $61,087,000 $59,000,000 $30,110,000 $31,500,000 $30,500,000 $31,110,000 Which of the following financial assets can be classified at fair value through other comprehensive income? (1) (2) (3) (4) Preference shares acquired Equity shares that are not held for trading Loan asset held for contractual cash flows and proceeds from sale Treasury shares purchased from stock market A B C D 1 and 3 1 and 4 2 and 3 2 and 4 Which of the following would lead to a taxable temporary difference in accordance with IAS 12 Income Taxes? (1) (2) (3) (4) Interest receivable where taxation is assessed on a cash basis Financial asset carried at fair value, where fair value has fallen since acquisition Goodwill arising on the acquisition of a subsidiary Convertible loan note where tax authority does not recognise the distinction between debt and equity for accounting purposes A B C D 1 and 3 1 and 4 2 and 3 2 and 4 (10 marks) ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 125 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK Question 42 MOSTON The following scenario relates to questions 1–5. The following trial balance extracts relate to Moston as at 30 June 20X6: $000 Revenue (note (i)) Cost of sales Research and development costs (note (ii)) Revaluation surplus as at 1 July 20X5 Property at valuation 1 July 20X5 (note (iii)) Plant and equipment at cost (note (iii)) Accumulated depreciation plant and equipment 1 July 20X5 Suspense account $000 113,500 88,500 7,800 3,000 28,500 26,100 9,100 3,000 The following notes are relevant: (i) The suspense account represents $3 million received for the sale of maturing goods on 1 January 20X6. Moston still holds the goods but has excluded them from the inventory count. Moston has an unexercised option to repurchase them at any time in the next three years. In three years’ time the goods are expected to be worth $5 million. The repurchase price will be the original selling price plus interest at 10% per annum from the date of sale to the date of repurchase. (ii) Moston commenced a research and development project on 1 January 20X6. It spent $1 million per month on research until 31 March 20X6 when the project passed into the development stage. It then spent $1·6 million per month until the year end when development was completed. However, it was not until 1 May 20X6 that the directors of Moston were confident that the new product would be a commercial success. (iii) Non-current assets: Moston’s property is carried at fair value which at 30 June 20X6 was $29 million. Its remaining life at the beginning of the financial year was 15 years. Moston does not make an annual transfer to retained earnings in respect of the revaluation surplus. Plant and equipment is depreciated at 15% per annum using the reducing balance method. No depreciation has yet been charged for the year ended 30 June 20X6. 1 What adjustments are required to account for the sale of maturing goods in the financial statements for the year ended 30 June 20X6? A B C D 126 CREDIT CREDIT CREDIT DEBIT CREDIT DEBIT Revenue $3,000,000 Liability $3,000,000 Liability $3,300,000 Interest expense $300,000 Liability $3,150,000 Interest expense $150,000 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) 2 What is the carrying amount of research and development expenditure in the statement of financial position as at 30 June 20X6? A B C D 3 What is the total depreciation expense in the statement of profit or loss for the year ended 30 June 20X6? A B C D 4 5 $7,800,000 $4,800,000 $1,800,000 $3,200,000 $2,550,000 $4,450,000 $3,915 $5,815,000 Which of the following would be included in the amount initially recognised for an item of equipment? (1) (2) (3) (4) Dismantling costs at the end of the equipment’s useful life Costs of training staff to use the new equipment Legal fees incurred in the purchase of the equipment Costs of re-painting the equipment in the branded colours of the company A B C D 1 and 3 1 and 4 2 and 3 2 and 4 IFRS 15 Revenue from Contracts with Customers states that the transaction price of contracts with multiple elements must be determined at the inception of the contract and based on the standalone selling prices. What is the best evidence of standalone selling prices? A B C D Unadjusted market price for similar goods Observable price of goods when they are sold separately Expected costs Estimate that maximises the use of observable inputs (10 marks) ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 127 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK Question 43 NOSTOM The following scenario relates to questions 1–5. The following is an extract from the trial balance of Nostom as at 30 June 20X6: Loan note interest and dividends paid (notes (i) and (iii)) Equity shares of $0.50 each (note (iii)) 5% Loan note (note (i)) Under/over provision current tax Deferred tax 1 July 20X5 $000 5,000 $000 30,000 20,000 60 1,010 The following notes are relevant: (i) The 5% loan note was issued on 1 July 20X5 at its nominal value of $20 million incurring direct issue costs of $500,000 which have been charged to administrative expenses. The loan note will be redeemed after three years at a premium which gives the loan note an effective finance cost of 8% per annum. Annual interest was paid on 30 June 20X6. (ii) A provision for current tax for the year ended 30 June 20X6 of $1,200,000 is required. At 30 June 20X6 the financial value of Nostom’s net assets was $2,800,000 higher than the tax base of those net assets. Nostom’s effective tax rate is 30%. (iii) Nostom paid a dividend of $0.10 per share on 30 March 20X6. On 1 April 20X6 Nostom issued 10 million equity shares at their full market value of $1·70. 1 What finance costs should be included in Nostom’s statement of profit or loss for the year ended 30 June 20X6? A B C D 2 What is the income tax expense to be included in Nostom’s statement of profit or loss for the year ended 30 June 20X6? A B C D 3 $1,090,000 $1,980,000 $2,100,000 $1,030,000 In accordance with IAS 33 Earnings per Share, what number of shares will be used to calculate basic earnings per share for the year ended 30 June 20X6? A B C D 128 $1,000,000 $1,560,000 $5,560,000 $1,500,000 52.5 million 62.5 million 22.5 million 32.5 million ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) 4 Which of the following is not a method of valuing financial assets in accordance with IFRS 9 Financial Instruments? A B C D 5 Transaction price Fair value Amortised cost Equity method Which of the following would lead to a deductible temporary difference in accordance with IAS 12 Income Taxes? (1) An upward revaluation of a property; the tax authority does not recognise the revaluation of assets (2) An asset that is depreciated over three years but tax allowable depreciation is 25% (3) Capitalised development expenditure, where the tax authority recognises the expense when paid (4) Interest payable where the tax authority allows interest paid A B C D 1 and 3 1 and 4 2 and 3 2 and 4 (10 marks) ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 129 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK SPECIMEN EXAM Section A – ALL 15 questions are compulsory and MUST be attempted. Each question is worth 2 marks 1 2 Which of the following should be capitalised in the initial carrying amount of an item of plant? (1) (2) (3) (4) Cost of transporting the plant to the factory Cost of installing a new power supply required to operate the plant Cost of a three-year plant maintenance agreement Cost of a three-week training course for staff to operate the plant A B C D 1 and 3 1 and 2 2 and 4 3 and 4 When a parent is evaluating the assets of a potential subsidiary, certain intangible assets can be recognised separately from goodwill, even though they have not been recognised in the subsidiary’s own statement of financial position. Which of the following is an example of an intangible asset of the subsidiary which may be recognised separately from goodwill when preparing consolidated financial statements? 3 A A new research project which the subsidiary has correctly expensed to profit or loss but the directors of the parent have reliably assessed to have a substantial fair value B A global advertising campaign which was concluded in the previous financial year and from which benefits are expected to flow in the future C A contingent asset of the subsidiary from which the parent believes a flow of future economic benefits is possible D A customer list which the directors are unable to value reliably On 1 October 20X4, Flash Co acquired an item of plant under a five-year lease. The plant was initially recognised at an amount of $25m. The agreement specified the interest rate implicit in the lease as 10% per annum and required an immediate deposit of $2m and annual rentals of $6m paid on 30 September each year for five years. What is the current liability for the leased plant in Flash Co’s statement of financial position as at 30 September 20X5? A B C D 130 $19,300,000 $4,070,000 $5,000,000 $3,850,000 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) 4 Financial statements represent transactions in words and numbers. To be useful, financial information must represent faithfully these transactions in terms of how they are reported. Which of the following accounting treatments would be an example of faithful representation? 5 A Charging the rental payments for a right-of-use asset to the statement of profit or loss B Including a convertible loan note in equity on the basis that the holders are likely to choose the equity option on conversion C Treating redeemable preference shares as part of equity in the statement of financial position D Derecognising factored trade receivables sold without recourse to the seller On 1 October 20X4, Kalatra Co commenced drilling for oil from an undersea oilfield. Kalatra Co is required to dismantle the drilling equipment at the end of its five-year licence. This has an estimated cost of $30m on 30 September 20X9. Kalatra Co’s cost of capital is 8% per annum and $1 in five years’ time has a present value of 68 cents. What is the provision which Kalatra Co would report in its statement of financial position as at 30 September 20X5 in respect of its oil operations? A B C D 6 $32,400,000 $22,032,000 $20,400,000 $1,632,000 When a single entity makes purchases or sales in a foreign currency, it will be necessary to translate the transactions into its functional currency before the transactions can be included in its financial records. In accordance with IAS 21 The Effect of Changes in Foreign Currency Exchange Rates, which of the following foreign currency exchange rates may be used to translate the foreign currency purchases and sales? 7 (1) The rate which existed on the day that the purchase or sale took place (2) The rate which existed at the beginning of the accounting period (3) An average rate for the year, provided there have been no significant fluctuations throughout the year (4) The rate which existed at the end of the accounting period A B C D 2 and 4 1 only 3 only 1 and 3 On 1 October 20X4, Hoy Co had $2·5 million of equity share capital (shares of 50 cents each) in issue. No new shares were issued during the year ended 30 September 20X5, but on that date there were outstanding share options which had a dilutive effect equivalent to issuing 1·2 million shares for no consideration. Hoy’s profit after tax for the year ended 30 September 20X5 was $1,550,000. ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 131 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK In accordance with IAS 33 Earnings per Share, what is Hoy’s diluted earnings per share for the year ended 30 September 20X5? A B C D 8 $0·25 $0·41 $0·31 $0·42 Fork Co owns an 80% investment in Spoon Co which it purchased several years ago. The goodwill on acquisition was valued at $1,674,000 and there has been no impairment of that goodwill since the date of acquisition. On 30 September 20X4, Fork Co disposed of its entire investment in Spoon Co, details of which are as follows: $000 Sales proceeds of Fork Co’s entire investment in Spoon Co 5,580 Cost of Fork Co’s entire investment in Spoon Co 3,720 Immediately before the disposal, the consolidated financial statements of Fork Co included the following amounts in respect of Spoon Co: $000 Carrying amount of the net assets (excluding goodwill) 4,464 Carrying amount of the non-controlling interests 900 What is the profit/loss on disposal (before tax) which will be recorded in Fork Co’s CONSOLIDATED statement of profit or loss for the year ended 30 September 20X4? A B C D 9 $1,860,000 profit $2,016,000 profit $342,000 profit $558,000 loss Consolidated financial statements are presented on the basis that the companies within the group are treated as if they are a single economic entity. Which of the following are requirements of preparing consolidated financial statements? 132 (1) All subsidiaries must adopt the accounting policies of the parent in their individual financial statements (2) Subsidiaries with activities which are substantially different to the activities of other members of the group should not be consolidated (3) All entity financial statements within a group should normally be prepared to the same accounting year end prior to consolidation (4) Unrealised profits within the group must be eliminated from the consolidated financial statements A B C D 1 and 3 2 and 4 3 and 4 1 and 2 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) 10 A parent company sells goods to its 80% owned subsidiary during the financial year, some of which remains in inventory at the year end. What is the adjustment required in the consolidated statement of financial position to eliminate any unrealised profit in inventory? A B C D 11 DEBIT CREDIT DEBIT DEBIT CREDIT DEBIT CREDIT DEBIT CREDIT CREDIT Group retained earnings Inventory Group retained earnings Non-controlling interest Inventory Inventory Group retained earnings Inventory Group retained earnings Non-controlling interest Caddy Co acquired 240,000 of Ambel Co’s 800,000 equity shares for $6 per share on 1 October 20X4. Ambel Co’s profit after tax for the year ended 30 September 20X5 was $400,000 and it paid an equity dividend on 20 September 20X5 of $150,000. On the assumption that Ambel Co is an associate of Caddy Co, what would be the carrying amount of the investment in Ambel Co in the consolidated statement of financial position of Caddy Co as at 30 September 20X5? A B C D 12 $1,560,000 $1,395,000 $1,515,000 $1,690,000 Quartile Co is in the jewellery retail business which can be assumed to be highly seasonal. For the year ended 30 September 20X5, Quartile Co assessed its operating performance by comparing selected accounting ratios with those of its business sector average as provided by an agency. Assume that the business sector used by the agency is a meaningful representation of Quartile Co’s business. Which of the following circumstances may invalidate the comparison of Quartile Co’s ratios with those of the sector average? (1) In the current year, Quartile Co has experienced significant rising costs for its purchases (2) The sector average figures are compiled from companies whose year ends are between 1 July 20X5 and 30 September 20X5 (3) Quartile Co does not revalue its properties, but is aware that other entities in this sector do (4) During the year, Quartile Co discovered an error relating to the inventory count at 30 September 20X4. This error was correctly accounted for in the financial statements for the current year ended 30 September 20X5 A B C D 1 and 3 2 and 4 2 and 3 1 and 4 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 133 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK 13 14 Which of the following criticisms does NOT apply to historical cost financial statements during a period of rising prices? A They are difficult to verify because transactions could have happened many years ago B They contain mixed values; some items are at current values and some are at out of date values C They understate assets and overstate profit D They overstate gearing in the statement of financial position The following information has been taken or calculated from Fowler’s financial statements for the year ended 30 September 20X5: Cash cycle at 30 September 20X5 Inventory turnover Year-end trade payables at 30 September 20X5 Credit purchases for the year ended 30 September 20X5 Cost of sales for the year ended 30 September 20X5 70 days six times $230,000 $2 million $1·8 million What is Fowler’s trade receivables collection period as at 30 September 20X5? A B C D 15 106 days 89 days 56 days 51 days On 1 October 20X4, Pyramid Co acquired 80% of Square Co’s 9 million equity shares. At the date of acquisition, Square Co had an item of plant which had a fair value of $3m in excess of its carrying amount. At the date of acquisition it had a useful life of five years. Pyramid Co’s policy is to value non-controlling interests at fair value at the date of acquisition. For this purpose, Square Co’s shares had a value of $3·50 each at that date. In the year ended 30 September 20X5, Square Co reported a profit of $8m. At what amount should the non-controlling interests in Square Co be valued in the consolidated statement of financial position of the Pyramid group as at 30 September 20X5? A B C D $26,680,000 $7,900,000 $7,780,000 $12,220,000 (30 marks) 134 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) Section B – ALL 15 questions are compulsory and MUST be attempted Each question is worth 2 marks. The following scenario relates to questions 16 – 20. Telepath Co has a year end of 30 September and owns an item of plant which it uses to produce and package pharmaceuticals. The plant cost $750,000 on 1 October 20X0 and, at that date, had an estimated useful life of five years. A review of the plant on 1 April 20X3 concluded that the plant would last for a further three and a half years and that its fair value was $560,000. Telepath Co adopts the policy of revaluing its non-current assets to their fair value but does not make an annual transfer from the revaluation surplus to retained earnings to represent the additional depreciation charged due to the revaluation. On 30 September 20X3, Telepath Co was informed by a major customer that it would no longer be placing orders with Telepath Co. As a result, Telepath revised its estimates that net cash inflows earned from the plant for the next three years would be: Year ended 30 September: 20X4 20X5 20X6 $ 220,000 180,000 200,000 Telepath Co’s cost of capital is 10% which results in the following discount factors: Value of $1 at 30 September: 20X4 20X5 20X6 0·91 0·83 0·75 Telepath Co also owns Rilda Co, a 100% subsidiary, which is treated as a cash generating unit. On 30 September 20X3, there was an impairment to Rilda’s assets of $3,500,000. The carrying amount of the assets of Rilda Co immediately before the impairment were: Goodwill Factory building Plant Receivables and cash (at recoverable amount) ©2017 DeVry/Becker Educational Development Corp. All rights reserved. $ 2,000,000 4,000,000 3,500,000 2,500,000 ––––––––– 12,000,000 ––––––––– 135 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK 16 17 In accordance with IAS 36 Impairment of Assets, which of the following explains the impairment of an asset and how to calculate its recoverable amount? A An asset is impaired when the carrying amount exceeds its recoverable amount and the recoverable amount is the higher of its fair value less costs of disposal and its value in use B An asset is impaired when the recoverable amount exceeds its carrying amount and the recoverable amount is the lower of its fair value less costs of disposal and its value in use C An asset is impaired when the recoverable amount exceeds its carrying amount and the recoverable amount is the higher of its fair value less costs of disposal and its value in use D An asset is impaired when the carrying amount exceeds its recoverable amount and the recoverable amount is the lower of its fair value less costs of disposal and its value in use Prior to considering any impairment, what is the carrying amount of Telepath Co’s plant and the balance on the revaluation surplus at 30 September 20X3? A B C D 18 20 $600,000 $450,000 $499,600 $nil Which of the following are TRUE in accordance with IAS 36 Impairment of Assets? (1) A cash generating unit is the smallest identifiable group of assets for which individual cash flows can be identified and measured (2) When considering the impairment of a cash generating unit, the calculation of the carrying amount and the recoverable amount does not need to be based on exactly the same group of net assets (3) When it is not possible to calculate the recoverable amount of a single asset, then that of its cash generating unit should be measured instead A B C D 1 only 2 and 3 3 only 1 and 3 What is the carrying amount of Rilda Co’s plant at 30 September 20X3 after the impairment loss has been correctly allocated to its assets? A B C D 136 Revaluation surplus $000 nil 185 185 nil What is the value in use of Telepath Co’s plant as at 30 September 20X3? A B C D 19 Plant carrying amount $000 480 300 480 300 $2,479,000 $2,800,000 $2,211,000 $3,500,000 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) The following scenario relates to questions 21 – 25. At a board meeting in June 20X3, Neutron Co’s directors made the decision to close down one of its factories by 30 September 20X3 and market both the building and the plant for sale. The decision had been made public, was communicated to all affected parties and was fully implemented by 30 September 20X3. The directors of Neutron Co have provided the following information relating to the closure: Of the factory’s 250 employees, 50 will be retrained and deployed to other subsidiaries within the Neutron group during the year ended 30 September 20X4 at a cost of $125,000. The remainder accepted redundancy at an average cost of $5,000 each. The factory’s plant had a carrying amount of $2·2 million, but is only expected to sell for $500,000, incurring $50,000 of selling costs. The factory itself is expected to sell for a profit of $1·2 million. As at 30 September 20X3 Neutron has a loan secured against the factory. The present value of the loan is $1 million and settlement is due in three years’ time. The lender agreed to the sale of the building subject to receiving $900,000 in full settlement of the loan on 31 October 20X3. Neutron’s directors have agreed to these terms. Penalty payments, due to the non-completion of supply contracts, are estimated to be $200,000, 50% of which is expected to be recovered from Neutron Co’s insurers. 21 22 Which of the following must exist for an operation to be classified as a discontinued operation in accordance with IFRS 5 Non-current Assets Held for Sale and Discontinued Operations? (1) (2) (3) (4) The operation represents a separate major line of business or geographical area The operation is a subsidiary The operation has been sold or is held for sale The operation is considered not to be capable of making a future profit following a period of losses A B C D 2 and 4 3 and 4 1 and 3 1 and 2 IFRS 5 Non-current Assets Held for Sale and Discontinued Operations prescribes the recognition criteria for non-current assets held for sale. For an asset or a disposal group to be classified as held for sale, the sale must be highly probable. Which of the following must apply for the sale to be considered highly probable? (1) (2) (3) (4) A buyer must have been located The asset must be marketed at a reasonable price Management must be committed to a plan to sell the asset The sale must be expected to take place within the next six months A B C D 2 and 3 3 and 4 1 and 4 1 and 2 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 137 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK 23 What is the employee cost associated with the closure and sale of Neutron Co’s factory which should be charged to profit or loss for the year ended 30 September 20X3? A B C D 24 What is the profit or loss on discontinued operations relating to property, plant and equipment for the year ended 30 September 20X3? A B C D 25 $125,000 $1,250,000 $1,125,000 $1,000,000 $1·75 million loss $1·75 million profit $550,000 loss $550,000 profit In respect of the loan and penalty payments, what is the total of the liability and provision required in the statement of financial position of Neutron Co as at 30 September 20X3? A B C D $900,000 $1,200,000 $1,000,000 $1,100,000 The following scenario relates to questions 26 – 30. Speculate Co is preparing its financial statements for the year ended 30 September 20X3. following issues are relevant: (1) The Financial assets Shareholding A – a long-term investment in 10,000 of the equity shares of another company. These shares were acquired on 1 October 20X2 at a cost of $3·50 each. Transaction costs of 1% of the purchase price were incurred. On 30 September 20X3 the fair value of these shares is $4·50 each. Shareholding B – a short-term speculative investment in 2,000 of the equity shares of another company. These shares were acquired on 1 December 20X2 at a cost of $2·50 each. Transaction costs of 1% of the purchase price were incurred. On 30 September 20X3 the fair value of these shares is $3·00 each. Where possible, Speculate Co makes an irrevocable election for the fair value movements on financial assets to be reported in other comprehensive income. (2) Taxation The existing debit balance on the current tax account of $2·4m represents the over/under provision of the tax liability for the year ended 30 September 20X2. A provision of $28m is required for income tax for the year ended 30 September 20X3. The existing credit balance on the deferred tax account is $2·5m and the provision required at 30 September 20X3 is $4·4m. (3) Revenue On 1 October 20X2, Speculate Co sold one of its products for $10 million. As part of the sale agreement, Speculate Co is committed to the ongoing servicing of the product until 30 September 20X5 (i.e. three years after the sale). The sale value of this service has been included in the selling price of $10 million. The estimated cost to Speculate Co of the servicing is $600,000 per annum and Speculate Co’s gross profit margin on this type of servicing is 25%. Ignore discounting. 138 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) 26 27 Which of the following meet the definition of a financial asset in accordance with IFRS 9 Financial Instruments? (1) An equity instrument of another entity (2) A contract to exchange financial instruments with another entity under conditions which are potentially favourable (3) A contract to exchange financial instruments with another entity under conditions which are potentially unfavourable (4) Cash A B C D 1 and 2 only 1, 2 and 4 1, 3 and 4 4 only In respect of the financial assets of Speculate Co, what amount will be included in other comprehensive income for the year ended 30 September 20X3? A B C D 28 What is the total amount which will be charged to the statement of profit or loss for the year ended 30 September 20X3 in respect of taxation? A B C D 29 $28,000,000 $30,400,000 $32,300,000 $29,900,000 What is the amount of deferred income which Speculate Co should recognise in its statement of financial position as at 30 September 20X3 relating to the contract for the supply and servicing of products? A B C D 30 $9,650 $10,650 $10,000 $nil $1,200,000 $1,600,000 $600,000 $1,500,000 Which of the following are TRUE in respect of the income which Speculate Co has deferred at 30 September 20X3? (1) The deferred income will be split evenly between the current and non-current liabilities in Speculate Co’s statement of financial position as at 30 September 20X3 (2) The costs associated with the deferred income of Speculate Co should be recognised in the statement of profit or loss at the same time as the revenue is recognised (3) The deferred income can only be recognised as revenue by Speculate Co when there is a signed written contract of service with its customer (4) When recognising the revenue associated with the service contract of Speculate Co, the stage of its completion is irrelevant ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 139 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK A B C D 1 and 2 3 and 4 2 and 3 1 and 4 (30 marks) Question 31 KANDY CO After preparing a draft statement of profit or loss for the year ended 30 September 20X5 and adding the current year’s draft profit (before any adjustments required by notes (i) to (iii) below) to retained earnings, the summarised trial balance of Kandy Co as at 30 September 20X5 is: $000 Equity shares of $1 each Retained earnings as at 30 September 20X5 Proceeds of 6% loan note (note (i)) Investment properties at fair value (note (ii)) Land ($5 million) and buildings – at cost (note (ii)) Plant and equipment – at cost (note (ii)) Accumulated depreciation at 1 October 20X4: buildings plant and equipment Current assets Current liabilities Deferred tax (notes (ii) and (iii)) Interest paid (note (i)) Current tax (note (iii)) Suspense account (note (ii)) $000 20,000 15,500 30,000 20,000 35,000 58,500 20,000 34,500 68,700 43,400 2,500 1,800 –––––––– 184,000 –––––––– 1,100 17,000 –––––––– 184,000 –––––––– The following notes are relevant: (i) The loan note was issued on 1 October 20X4 and incurred issue costs of $1 million which were charged to profit or loss. Interest of $1·8 million ($30 million at 6%) was paid on 30 September 20X5. The loan is redeemable on 30 September 20X9 at a substantial premium which gives an effective interest rate of 9% per annum. No other repayments are due until 30 September 20X9. (ii) Non-current assets: On 1 October 20X4, Kandy owned two investment properties. The first property had a carrying amount of $15 million and was sold on 1 December 20X4 for $17 million. The disposal proceeds have been credited to a suspense account in the trial balance above. On 31 December 20X4, the second property became owner occupied and so was transferred to land and buildings at its fair value of $6 million. Its remaining useful life on 31 December 20X4 was considered to be 20 years. Ignore any deferred tax implications of this fair value. The price of property has increased significantly in recent years and so the directors decided to revalue the land and buildings. The directors accepted the report of an independent surveyor who, on 1 October 20X4, valued the land at $8 million and the buildings at $39 million on that date. This revaluation specifically excludes the transferred investment property described above. The remaining life of these buildings at 1 October 20X4 was 15 years. Kandy does not make an annual transfer to retained profits to reflect the realisation of the revaluation gain; however, the revaluation will give rise to a deferred tax liability. The income tax rate applicable to Kandy is 20%. 140 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) Plant and equipment is depreciated at 12½% per annum using the reducing balance method. No depreciation has yet been charged on any non-current asset for the year ended 30 September 20X5. (iii) A provision of $2·4 million is required for income tax on the profit for the year to 30 September 20X5. The balance on current tax in the trial balance is the under/over provision of tax for the previous year. In addition to the temporary differences relating to the information in note (ii), Kandy has further taxable temporary differences of $10 million as at 30 September 20X5. Required: (a) Prepare a schedule of adjustments required to the retained earnings of Kandy Co as at 30 September 20X5 as a result of the information in notes (i) to (iii) above. (8 marks) (b) Prepare the statement of financial position of Kandy Co as at 30 September 20X5. (9 marks) Note: The notes to the statement of financial position are not required. (c) Prepare the extracts from Kandy Co’s statement of cash flows for operating and investing activities for the year ended 30 September 20X5 which relate to property, plant and equipment. (3 marks) (20 marks) Question 32 TANGIER GROUP The summarised consolidated financial statements for the year ended 30 September 20X5 (and the comparative figures) for the Tangier group are shown below: Consolidated statements of profit or loss for the year ended 30 September Revenue Cost of sales Gross profit Administrative expense Distribution costs Finance costs Profit before taxation Income tax expense Profit for the year ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 20X5 $m 2,700 (1,890) –––––– 810 (345) (230) (40) –––––– 195 (60) –––––– 135 –––––– 20X4 $m 1,820 (1,092) –––––– 728 (200) (130) (5) –––––– 393 (113) –––––– 280 –––––– 141 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK Consolidated statements of financial position as at 30 September 20X5 $m Non-current assets Property, plant and equipment Intangible asset: manufacturing licences goodwill Current assets Inventory Trade receivables Bank 200 195 nil –––– Total assets Equity and liabilities Equity shares of $1 each Other components of equity Retained earnings Non-current liabilities 5% secured loan notes 10% secured loan notes Current liabilities Bank overdraft Trade payables Current tax payable Total equity and liabilities 20X5 $m 20X4 $m 680 300 230 –––––– 1,210 395 –––––– 1,605 –––––– 310 100 200 –––– 610 110 75 120 –––– 330 100 375 –––––– 805 100 300 –––– 110 210 80 –––– 400 400 –––––– 1,605 –––––– 20X4 $m 305 –––– 915 –––– 250 nil 295 –––– 545 100 nil –––– nil 160 110 –––– 100 270 –––– 915 –––– At 1 October 20X4, the Tangier group consisted of the parent, Tangier Co, and two wholly owned subsidiaries which had been owned for many years. On 1 January 20X5, Tangier Co purchased a third 100% owned investment in a subsidiary called Raremetal Co. The consideration paid for Raremetal Co was a combination of cash and shares. The cash payment was partly funded by the issue of 10% loan notes. On 1 January 20X5, Tangier Co also won a tender for a new contract to supply aircraft engines which Tangier Co manufactures under a recently acquired long-term licence. Raremetal Co was purchased with a view to securing the supply of specialised materials used in the manufacture of these engines. The bidding process had been very competitive and Tangier Co had to increase its manufacturing capacity to fulfil the contract. 142 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) Required: (a) Comment on how the new contract and the purchase of Raremetal Co may have affected the comparability of the consolidated financial statements of Tangier Co for the years ended 30 September 20X4 and 20X5. (5 marks) (b) Calculate appropriate ratios and comment on Tangier Co’s profitability and gearing. Your analysis should identify instances where the new contract and the purchase of Raremetal Co have limited the usefulness of the ratios and your analysis. (12 marks (up to 5 marks for the ratio calculations)) Note: Your ratios should be based on the consolidated financial statements provided and you should not attempt to adjust for the effects of the new contract or the consolidation. Working capital and liquidity ratios are not required. (c) Explain what further information you might require to make your analysis more meaningful. (3 marks) (20 marks) ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 143 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK SEPTEMBER 2016 EXAM Section A – ALL 15 questions are compulsory and MUST be attempted Each question is worth 2 marks. 1 2 3 Which of the following is NOT a duty of the IFRS Interpretations Committee? A To interpret the application of International Financial Reporting Standards B To work directly with national standard setters to bring about convergence with IFRS C To provide guidance on financial reporting issues not specifically addressed in IFRSs D To publish draft interpretations for public comment Which of the following will be treated as a subsidiary of Poulgo Co as at 31 December 20X7? (1) The acquisition of 60% of Zakron Co’s equity share capital on 1 March 20X7. Zakron Co’s activities are significantly different from the rest of the Poulgo group of companies (2) The offer to acquire 70% of Unto Co’s equity share capital on 1 November 20X7. The negotiations were finally signed off during January 20X8 (3) The acquisition of 45% of Speeth Co’s equity share capital on 31 December 20X7. Poulgo Co is able to appoint three of the 10 members of Speeth Co’s board A B C D 1 only 2 and 3 3 only 1 and 2 On 1 January 20X6, Gardenbugs Co received a $30,000 government grant relating to equipment which cost $90,000 and had a useful life of six years. The grant was netted off against the cost of the equipment. On 1 January 20X7, when the equipment had a carrying amount of $50,000, its use was changed so that it was no longer being used in accordance with the grant. This meant that the grant needed to be repaid in full but by 31 December 20X7, this had not yet been done. Which journal entry is required to reflect the correct accounting treatment of the government grant and the equipment in the financial statements of Gardenbugs Co for the year ended 31 December 20X7? A B C D 144 Dr Property, plant and equipment Dr Depreciation expense Cr Liability $10,000 $20,000 Dr Property, plant and equipment Dr Depreciation expense Cr Liability $15,000 $15,000 Dr Property, plant and equipment Dr Depreciation expense Dr Retained earnings Cr Liability $10,000 $15,000 $5,000 Dr Property, plant and equipment Dr Depreciation expense Cr Liability $20,000 $10,000 $30,000 $30,000 $30,000 $30,000 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) 4 The following two issues relate to Spiko Co’s mining activities: Issue 1: Spiko Co began operating a new mine in January 20X3 under a five-year government licence which required Spiko Co to landscape the area after mining ceased at an estimated cost of $100,000. Issue 2: During 20X4, Spiko Co’s mining activities caused environmental pollution on an adjoining piece of government land. There is no legislation which requires Spiko Co to rectify this damage, however, Spiko Co does have a published environmental policy which includes assurances that it will do so. The estimated cost of the rectification is $1,000,000. In accordance with IAS 37 Provisions, Contingent Liabilities and Contingent Assets, which of the following statements is correct in respect of Spiko Co’s financial statements for the year ended 31 December 20X4? A B C D 5 A provision is required for the cost of both issues 1 and 2 Both issues 1 and 2 require disclosure only A provision is required for the cost of issue 1 but issue 2 requires disclosure only Issue 1 requires disclosure only and issue 2 should be ignored Parket Co acquired 60% of Suket Co on 1 January 20X7. The following extract has been taken from the individual statements of profit or loss for the year ended 31 March 20X7: Cost of sales Parket Co $000 710 Suket Co $000 480 Parket Co consistently made sales of $20,000 per month to Suket Co throughout the year. At the year end, Suket Co held $20,000 of this in inventory. Parket Co made a mark-up on cost of 25% on all sales to Suket Co. What is Parket Co’s consolidated cost of sales for the year ended 31 March 20X7? A B C D 6 $954,000 $950,000 $774,000 $766,000 A company has decided to change its depreciation method to better reflect the pattern of use of its equipment. Which of the following correctly reflects what this change represents and how it should be applied? A B C D It is a change of accounting policy and must be applied prospectively It is a change of accounting policy and must be applied retrospectively It is a change of accounting estimate and must be applied retrospectively It is a change of accounting estimate and must be applied prospectively ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 145 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK 7 Included within the financial assets of Zinet Co at 31 March 20X9 are the following two recently purchased investments in publically-traded equity shares: Investment 1 – 10% of the issued share capital of Haruka Co. This shareholding was acquired as a long-term investment as Zinet Co wishes to participate as an active shareholder of Haruka Co. Investment 2 – 10% of the issued share capital of Lukas Co. This shareholding was acquired for speculative purposes and Zinet Co expects to sell these shares in the near future. Neither of these shareholdings gives Zinet Co significant influence over the investee companies. Wherever possible, the directors of Zinet Co wish to avoid taking any fair value movements to profit or loss, so as to minimise volatility in reported earnings. How should the fair value movements in these investments be reported in Zinet Co’s financial statements for the year ended 31 March 20X9? A B C D 8 In profit or loss for both investments In other comprehensive income for both investments In profit or loss for investment 1 and in other comprehensive income for investment 2 In other comprehensive income for investment 1 and in profit or loss for investment 2 Shiba Co entered into a lease for a right-of-use asset on 1 January 20X7; the lease contract is for four years and the useful life of the asset is six years. Information relating to the lease is as follows: Initial lease liability Deposit paid on 1 January 20X7 Direct costs incurred by Shiba Maintenance costs of $2,000 per annum $48,000 $2,000 $5,000 $8,000 What will be the carrying amount of the right-of-use asset at 31 December 20X8? A B C D 9 $27,500 $41,250 $31,500 $36,667 Trasten Co operates in an emerging market with a fast-growing economy where prices increase frequently. Which of the following statements are true when using historical cost accounting compared to current value accounting in this type of market? 146 (1) Capital employed which is calculated using historical costs is understated compared to current value capital employed (2) Historical cost profits are overstated in comparison to current value profits (3) Capital employed which is calculated using historical costs is overstated compared to current value capital employed (4) Historical cost profits are understated in comparison to current value profits ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) A B C D 10 1 and 2 1 and 4 2 and 3 3 and 4 Patula Co acquired 80% of Sanka Co on 1 October 20X5. At this date, some of Sanka Co’s inventory had a carrying amount of $600,000 but a fair value of $800,000. By 31 December 20X5, 70% of this inventory had been sold by Sanka Co. The individual statements of financial position at 31 December 20X5 for both companies show the following: Patula Co Sanka Co Inventories $3,250,000 $1,940,000 What will be the total inventories figure in the consolidated statement of financial position of Patula Co as at 31 December 20X5? A B C D 11 $5,250,000 $5,330,000 $5,130,000 $5,238,000 Top Trades Co has been trading for a number of years and is currently going through a period of expansion. An extract from the statement of cash flows for the year ended 31 December 20X7 for Top Trades Co is presented as follows: $000 Net cash from operating activities 995 Net cash used in investing activities (540) Net cash used in financing activities (200) Net increase in cash and cash equivalents 255 Cash and cash equivalents at the beginning of the period 200 Cash and cash equivalents at the end of the period 455 Which of the following statements is correct according to the extract of Top Trades Co’s statement of cash flows? 12 A The company has good working capital management B Net cash generated from financing activities has been used to fund the additions to non-current assets C Net cash generated from operating activities has been used to fund the additions to non-current assets D Existing non-current assets have been sold to cover the cost of the additions to noncurrent assets Rooney Co acquired 70% of the equity share capital of Marek Co, its only subsidiary, on 1 January 20X6. The fair value of the non-controlling interest in Marek Co at acquisition was $1·1m. At that date the fair values of Marek Co’s net assets were equal to their carrying amounts, except for a building which had a fair value of $1·5m above its carrying amount and 30 years remaining useful life. During the year to 31 December 20X6, Marek Co sold goods to Rooney Co, giving rise to an unrealised profit in inventory of $550,000 at the year end. Marek Co’s profit after tax for the year ended 31 December 20X6 was $3·2m. ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 147 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK What amount will be presented as the non-controlling interest in the consolidated statement of financial position of Rooney Co as at 31 December 20X6? A B C D 13 $1,895,000 $1,495,000 $1,910,000 $1,880,000 When a gain on a bargain purchase (negative goodwill) arises, IFRS 3 Business Combinations requires an entity to first of all review the measurement of the assets, liabilities and consideration transferred in respect of the combination. When the negative goodwill is confirmed, how is it then recognised? A B C D 14 It is credited directly to retained earnings It is credited to profit or loss It is debited to profit or loss It is deducted from positive goodwill On 1 October 20X5, Anita Co purchased 75,000 of Binita Co’s 100,000 equity shares when Binita Co’s retained earnings amounted to $90,000. On 30 September 20X7, extracts from the statements of financial position of the two companies were: Anita Co Binita Co $000 $000 Equity shares of $1 each 125 100 Retained earnings 300 150 –––– –––– Total 425 250 –––– –––– What is the total equity which should appear in Anita Co’s consolidated statement of financial position as at 30 September 20X7? A B C D 15 $125,000 $470,000 $345,000 $537,500 On 1 October 20X1, Bash Co borrowed $6m for a term of one year, exclusively to finance the construction of a new piece of production equipment. The interest rate on the loan is 6% and is payable on maturity of the loan. The construction commenced on 1 November 20X1 but no construction took place between 1 December 20X1 to 31 January 20X2 due to employees taking industrial action. The asset was available for use on 30 September 20X2 having a construction cost of $6m. What is the carrying amount of the production equipment in Bash Co’s statement of financial position as at 30 September 20X2? A B C D $5,016,000 $6,270,000 $6,330,000 $6,360,000 (30 marks) 148 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) Section B – ALL 15 questions are compulsory and MUST be attempted Each question is worth 2 marks. The following scenario relates to questions 16–20. Aphrodite Co has a year end of 31 December and operates a factory which makes computer chips for mobile phones. It purchased a machine on 1 July 20X3 for $80,000 which had a useful life of 10 years and is depreciated on the straight-line basis, time apportioned in the years of acquisition and disposal. The machine was revalued to $81,000 on 1 July 20X4. There was no change to its useful life at that date. A fire at the factory on 1 October 20X6 damaged the machine leaving it with a lower operating capacity. The accountant considers that Aphrodite Co will need to recognise an impairment loss in relation to this damage. The accountant has ascertained the following information at 1 October 20X6: (1) The carrying amount of the machine is $60,750. (2) An equivalent new machine would cost $90,000. (3) The machine could be sold in its current condition for a gross amount of $45,000. Dismantling costs would amount to $2,000. (4) In its current condition, the machine could operate for three more years which gives it a value in use figure of $38,685. 16 In accordance with IAS 16 Property, Plant and Equipment, what is the depreciation charged to Aphrodite Co’s profit or loss in respect of the machine for the year ended 31 December 20X4? A B C D 17 $9,000 $8,000 $8,263 $8,500 IAS 36 Impairment of Assets contains a number of examples of internal and external events which may indicate the impairment of an asset. In accordance with IAS 36, which of the following would definitely NOT be an indicator of the potential impairment of an asset (or group of assets)? 18 A An unexpected fall in the market value of one or more assets B Adverse changes in the economic performance of one or more assets C A significant change in the technological environment in which an asset is employed making its software effectively obsolete D The carrying amount of an entity’s net assets being below the entity’s market capitalisation What is the total impairment loss associated with Aphrodite Co’s machine at 1 October 20X6? A B C D $nil $17,750 $22,065 $15,750 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 149 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK 19 The accountant has decided that it is too difficult to reliably attribute cash flows to this one machine and that it would be more accurate to calculate the impairment on the basis of the factory as a cash-generating unit. In accordance with IAS 36, which of the following is TRUE regarding cash generating units? 20 A A cash-generating unit to which goodwill has been allocated should be tested for impairment every five years B A cash-generating unit must be a subsidiary of the parent C There is no need to consistently identify cash-generating units based on the same types of asset from period to period D A cash-generating unit is the smallest identifiable group of assets for which independent cash flows can be identified On 1 July 20X7, it is discovered that the damage to the machine is worse than originally thought. The machine is now considered to be worthless and the recoverable amount of the factory as a cash-generating unit is estimated to be $950,000. At 1 July 20X7, the cash-generating unit comprises the following assets: Building Plant and equipment (including the damaged machine at a carrying amount of $35,000) Goodwill Net current assets (at recoverable amount) $000 500 335 85 250 –––––– 1,170 –––––– In accordance with IAS 36, what will be the carrying amount of Aphrodite Co’s plant and equipment when the impairment loss has been allocated to the cash-generating unit? A B C D $262,500 $300,000 $237,288 $280,838 The following scenario relates to questions 21–25. During 20X5, Blocks Co entered into new lease agreements as follows: Agreement one This right-of-use lease relates to a new piece of machinery. The fair value of the machine is $220,000. The agreement requires Blocks Co to pay a deposit of $20,000 on 1 January 20X5 followed by five equal annual instalments of $55,000, starting on 31 December 20X5. The implicit rate of interest is 11·65%. Agreement two This is a two-year agreement, commencing on 1 July 20X5, for 10 computer tablets to be used by senior management. The purchase price of each tablet is $1,000. Blocks Co will make 24 monthly payments of $550 and legally own the tablets when the final payment has been made. The present value of the future cash flows is $11,000. 150 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) Agreement three This sale and leaseback relates to a cutting machine purchased by Blocks Co on 1 January 20X4 for $300,000. The carrying amount of the machine as at 31 December 20X4 was $250,000. On 1 January 20X5, it was sold to Cogs Co for $370,000, the fair value of the asset was $320,000, and Blocks Co will lease the machine back for five years. The sale meets the revenue recognition requirements of IFRS 15 Revenue from Contracts with Customers. The financial liability is measured at $300,000 on 1 January 20X5, of which $50,000 relates to the additional financing. Blocks Co has elected not to apply the recognition exemptions permitted by IFRS 16 Leases. 21 22 According to IFRS 16 Leases, which of the following gives the measurement of a rightof-use asset at the commencement of a lease? A Sum of all rental payments to be paid to the lessor less any initial direct costs and dismantling costs B The amount of the initial measurement of the lease liability less any initial direct costs and dismantling costs C Sum of all rental payments to be paid to the lessor plus any initial direct costs and dismantling costs D The amount of the initial measurement of the lease liability plus any initial direct costs and dismantling costs For agreement one, what is the finance cost charged to profit or loss for the year ended 31 December 20X6? A B C D 23 $23,300 $12,451 $19,607 $16,891 The following calculations have been prepared for agreement one: Year 31 December 20X7 31 December 20X8 31 December 20X9 Interest Annual payment Balance $ $ $ 15,484 (55,000) 93,391 10,880 (55,000) 49,271 5,729 (55,000) 0 How will the lease liability be presented in the statement of financial position as at 31 December 20X7? A B C D 24 $44,120 as a non-current liability and $49,271 as a current liability $49,271 as a non-current liability and $44,120 as a current liability $93,391 as a non-current liability $93,391 as a current liability For agreement two, what amount of asset would be initially recognised on commencement of the lease? A B C D Nil $10,000 $5,500 $11,000 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 151 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK 25 For agreement three, what profit should be recognised for the year ended 31 December 20X5 as a result of the sale and leaseback? A B C D $24,000 $120,000 $54,688 $15,312 The following scenario relates to questions 26–30. Mighty IT Co provides hardware, software and IT services to small business customers. Mighty IT Co has developed an accounting software package. The company offers a supply and installation service for $1,000 and a separate two-year technical support service for $500. Alternatively, it also offers a combined goods and services contract which includes both of these elements for $1,200. Payment for the combined contract is due one month after the date of installation. In December 20X5, Mighty IT Co revalued its corporate headquarters. Prior to the revaluation, the carrying amount of the building was $2m and it was revalued to $2·5m. Mighty IT Co also revalued a sales office on the same date. The office had been purchased for $500,000 earlier in the year, but subsequent discovery of defects reduced its value to $400,000. No depreciation had been charged on the sales office and any impairment loss is allowable for tax purposes. Mighty It Co’s income tax rate is 30%. 26 27 In accordance with IFRS 15 Revenue from Contracts with Customers, when should Mighty IT Co recognise revenue from the combined goods and services contract? A Supply and install: on installation Technical support: over two years B Supply and install: when payment is made Technical support: over two years C Supply and install: on installation Technical support: on installation D Supply and install: when payment is made Technical support: when payment is made For each combined contract sold, what is the amount of revenue which Mighty IT Co should recognise in respect of the supply and installation service in accordance with IFRS 15? A B C D 28 $700 $800 $1,000 $1,200 Mighty IT Co sells a combined contract on 1 January 20X6, the first day of its financial year. In accordance with IFRS 15, what is the total amount for deferred income which will be reported in Mighty IT Co’s statement of financial position as at 31 December 20X6? A B C D 152 $400 $250 $313 $200 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) 29 In accordance with IAS 12 Income Taxes, what is the impact of the property revaluations on the income tax expense of Mighty IT Co for the year ended 31 December 20X5? A B C D 30 Income tax expense increases by $180,000 Income tax expense increases by $120,000 Income tax expense decreases by $30,000 No impact on income tax expense In January 20X6, the accountant at Mighty IT Co produced the company’s draft financial statements for the year ended 31 December 20X5. He then realised that he had omitted to consider deferred tax on development costs. In 20X5, development costs of $200,000 had been incurred and capitalised. Development costs are deductible in full for tax purposes in the year they are incurred. The development is still in process at 31 December 20X5. What adjustment is required to the income tax expense in Mighty IT Co’s statement of profit or loss for the year ended 31 December 20X5 to account for deferred tax on the development costs? A B C D Increase of $200,000 Increase of $60,000 Decrease of $60,000 Decrease of $200,000 (30 marks) Section C – BOTH questions are compulsory and MUST be attempted Question 31 TRIAGE After preparing a draft statement of profit or loss (before interest and tax) for the year ended 31 March 20X6 (before any adjustments which may be required by notes (i) to (iv) below), the summarised trial balance of Triage Co as at 31 March 20X6 is: $000 Equity shares of $1 each Retained earnings as at 1 April 20X5 Draft profit before interest and tax for year ended 31 March 20X6 6% convertible loan notes (note (i)) Property (original life 25 years) – at cost (note (ii)) 75,000 Plant and equipment – at cost (note (ii)) 72,100 Accumulated depreciation at 1 April 20X5: property plant and equipment Trade receivables (note (iii)) 28,000 Other current assets 9,300 Current liabilities Deferred tax (note (iv)) Interest payment (note (i)) 2,400 Current tax (note (iv) 700 –––––––– 187,500 –––––––– ©2017 DeVry/Becker Educational Development Corp. All rights reserved. $000 50,000 3,500 30,000 40,000 15,000 28,100 17,700 3,200 –––––––– 187,500 –––––––– 153 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK The following notes are relevant: (i) Triage Co issued 400,000 $100 6% convertible loan notes on 1 April 20X5. Interest is payable annually in arrears on 31 March each year. The loans can be converted to equity shares on the basis of 20 shares for each $100 loan note on 31 March 20X8 or redeemed at par for cash on the same date. An equivalent loan without the conversion rights would have required an interest rate of 8%. The present value of $1 receivable at the end of each year, based on discount rates of 6% and 8%, are: End of year (ii) 1 2 3 6% 0·94 0·89 0·84 8% 0·93 0·86 0·79 Non-current assets: The directors decided to revalue the property at $66·3m on 1 October 20X5. Triage Co does not make an annual transfer from the revaluation surplus to retained earnings to reflect the realisation of the revaluation gain; however, the revaluation will give rise to a deferred tax liability at the company’s tax rate of 20%. The property is depreciated on a straight-line basis and plant and equipment at 15% per annum using the reducing balance method. No depreciation has yet been charged on any non-current assets for the year ended 31 March 20X6. (iii) In September 20X5, the directors of Triage Co discovered a fraud. In total, $700,000 which had been included as receivables in the above trial balance had been stolen by an employee. $450,000 of this related to the year ended 31 March 20X5, the rest to the current year. The directors are hopeful that 50% of the losses can be recovered from the company’s insurers. (iv) A provision of $2·7m is required for current income tax on the profit of the year to 31 March 20X6. The balance on current tax in the trial balance is the under/over provision of tax for the previous year. In addition to the temporary differences relating to the information in note (ii), at 31 March 20X6, the carrying amounts of Triage Co’s net assets are $12m more than their tax base. Required: (a) Prepare a schedule of adjustments required to the draft profit before interest and tax (in the above trial balance) to give the profit or loss of Triage Co for the year ended 31 March 20X6 as a result of the information in notes (i) to (iv) above. (5 marks) (b) Prepare the statement of financial position of Triage Co as at 31 March 20X6. (12 marks) (c) The issue of convertible loan notes can potentially dilute the basic earnings per share (EPS). Calculate the diluted earnings per share for Triage Co for the year ended 31 March 20X6 (there is no need to calculate the basic EPS). (3 marks) Note: A statement of changes in equity and the notes to the statement of financial position are not required. (20 marks) 154 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) Question 32 GREGORY Gregory Co is a listed company and, until 1 October 20X5, it had no subsidiaries. On that date, it acquired 75% of Tamsin Co’s equity shares by means of a share exchange of two new shares in Gregory Co for every five acquired shares in Tamsin Co. These shares were recorded at the market price on the day of the acquisition and were the only shares issued by Gregory Co during the year ended 31 March 20X6. The summarised financial statements of Gregory Co as a single entity at 31 March 20X5 and as a group at 31 March 20X6 are: Gregory Gregory Co group single entity Statements of profit or loss for the year ended 31 March 20X6 31 March 20X5 $000 $000 Revenue 46,500 28,000 Cost of sales (37,200) (20,800) ––––––– ––––––– Gross profit 9,300 7,200 Operating expenses (1,800) (1,200) ––––––– ––––––– Profit before tax (operating profit) 7,500 6,000 Income tax expense (1,500) (1,000) ––––––– ––––––– Profit for the year 6,000 5,000 ––––––– ––––––– Profit for year attributable to: Equity holders of the parent 5,700 Non-controlling interest 300 ––––––– 6,000 ––––––– Statements of financial position as at Assets Non-current assets Property, plant and equipment Goodwill Current assets Total assets Equity and liabilities Equity shares of $1 each Other component of equity (share premium) Retained earnings Equity attributable to owners of the parent Non-controlling interest Current liabilities Total equity and liabilities ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 31 March 20X6 31 March 20X5 54,600 3,000 ––––––– 57,600 44,000 ––––––– 101,600 ––––––– 41,500 nil ––––––– 41,500 36,000 ––––––– 77,500 ––––––– 46,000 6,000 18,700 ––––––– 70,700 3,600 ––––––– 74,300 27,300 ––––––– 101,600 ––––––– 40,000 nil 13,000 ––––––– 53,000 nil ––––––– 53,000 24,500 ––––––– 77,500 ––––––– 155 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK Other information: (i) Each month since the acquisition, Gregory Co’s sales to Tamsin Co were consistently $2m. Gregory Co had chosen to only make a gross profit margin of 10% on these sales as Tamsin Co is part of the group. (ii) The values of property, plant and equipment held by both companies have been rising for several years. (iii) On reviewing the above financial statements, Gregory Co’s chief executive officer (CEO) made the following observations: (1) I see the profit for the year has increased by $1m which is up 20% on last year, but I thought it would be more as Tamsin Co was supposed to be a very profitable company. (2) I have calculated the earnings per share (EPS) for 20X6 at 13 cents (6,000/46,000 × 100) and for 20X5 at 12·5 cents (5,000/40,000 × 100) and, although the profit has increased 20%, our EPS has barely changed. (3) I am worried that the low price at which we are selling goods to Tamsin Co is undermining our group’s overall profitability. (4) I note that our share price is now $2·30, how does this compare with our share price immediately before we bought Tamsin Co? Required: (a) Reply to the four observations of the CEO. (b) Using the above financial statements, calculate the following ratios for Gregory Co for the years ended 31 March 20X6 and 20X5 and comment on the comparative performance: (i) (ii) (iii) (iv) (8 marks) Return on capital employed (ROCE); Net asset turnover; Gross profit margin; Operating profit margin. Note: Four marks are available for the ratio calculations. (12 marks) Note: Your answers to (a) and (b) should reflect the impact of the consolidation of Tamsin Co during the year ended 31 March 20X6. (20 marks) 156 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) Item Answer 1 Justification INTERNATIONAL FINANCIAL REPORTING STANDARDS 1.1 C The supervision of the IFRS organisation is a function of the IFRS Foundation. 1.2 B This is the function of the IFRS Interpretations Committee. 1.3 C By definition of general purpose financial statements. They are aimed at the primary users of financial statements which include current and potential investors, creditors, customers and employees. Other parties may well use the financial statements but they are not primary users. 1.4 A The International Accounting Standards Board (IASB) is the sole body having responsibility and authority to issue IFRS and is overseen by the IFRS Foundation. IFRS IC and the IFRS Advisory Board are separate bodies within the IFRS Foundation framework. 1.5 B This is stated in the IASB’s objectives. Although only certain elements of the public may be users of the financial statements, the members of the public as a whole are affected by the activities of companies and users of financial statements. Reliable financial information underpins the economies of all jurisdictions. 1.6 D IFRSs are not issued to clarify users’ issues concerning application of an IFRS. This is the purpose of an IFRIC. 1.7 D A limited liability partnership is a business form with a profit motive. The primary objectives of the other entities are not-for-profit. 2 CONCEPTUAL FRAMEWORK 2.1 D Since the Framework was revised in 20X0 only going concern is an underlying assumption. 2.2 A The format of financial statements is covered by IAS 1 Presentation of Financial Statements. 2.3 C The recognition criteria require that there is a probable flow of economic benefits and the item has a cost or value that can be measured reliably. 2.4 B (1) is incorrect as concept is economic substance over legal form. Information should not be excluded merely on the grounds of difficulty (3). 2.5 C Historical cost is not the only convention that requires money measurement (e.g. a revaluation model requires money measurement also). 2.6 C The fair value hierarchy gives the highest priority to Level 1 inputs and the lowest priority to Level 3 inputs. Quoted prices (unadjusted) in active markets for identical assets or liabilities that are accessible at the measurement date are Level 1 inputs. 2.7 B Understandability and comparability are enhancing qualitative characteristics. 2.8 C ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 1001 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK 2.9 D The risks and rewards have not been transferred by Tenby as they still bears the default risk. The substance of the contract is that of a financing arrangement and therefore the trade receivables should still be recognised in full. 2.10 B Historical cost annual depreciation = $90,000 ((500,000 × 90%) ÷ 5 years). After two years carrying amount would be $320,000 (500,000 – (2 × 90,000)). Current cost annual depreciation = $108,000 ((600,000 × 90%) ÷ 5 years). After two years carrying amount would be $384,000 (600,000 – (2 × 108,000)). 2.11 D As the receivable is “sold” with recourse it must remain as an asset in the statement of financial position; it is not derecognised. 2.12 D As it is a new type of transaction, comparability with existing treatments is not relevant. 3 IAS 1 PRESENTATION OF FINANCIAL STATEMENTS 3.1 B IAS 1 states that disclosure of the reasons for change is required plus the fact that comparatives may not be comparable. 3.2 B (2) is not a disclosure requirement of IAS 1. 3.3 A Intangible assets must be shown separately. Although the other items may be shown on the face of the statement of financial position, they do not have to be and are usually relegated to a note. 3.4 D None of these items needs further analysis. 3.5 C $000 Property 1 Disposal proceeds Less Carrying amount (1,900,000 × 810 ) Profit on disposal Property 2 Revalued amount Less Historical carrying amount (1,000 – 350) Unrealised gain 3.6 C Profit for the year Unrealised surplus on revaluation of properties (135 – 60) Total comprehensive income 1,550 (1,520) ––––– 30 ––––– 2,000 (650) ––––– 1,350 ––––– $000 183 75 –––– 258 –––– Tutorial note: Dividends are deducted from retained earnings and prior period adjustments are dealt with in the statement of changes in equity. 3.7 B The others would be included using the function of expense format. 3.8 D Dividends are generally accounted for when paid; a disclosure note could be made in the 20X5 financial statements. 1002 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) 3.9 A (2) and (3) are just two of the items that make up a reconciliation of carrying amounts at the beginning and end of period (i.e. (4)). (Other items include additions, disposals and impairment losses.) (1) would be disclosed as an accounting policy. Tutorial note: Even though IAS 16 is not specified in the question disclosure requirements should always be assessed against IFRS. 4 ACCOUNTING POLICIES 4.1 A The others are changes in estimate. 4.2 B This is an error as IAS 23 requires all borrowing costs, relating to qualifying assets, to be capitalised as part of the cost of the asset. All other items are changes in estimate that require prospective adjustment. 4.3 C All other items are changes in estimate. 4.4 B Closing inventory was correct in the 20X5 draft statement of financial position and therefore net assets remain unchanged at $6,957,300 when the error is corrected. Opening inventory (last year’s closing inventory) was valued at selling price and therefore overstated. Opening retained earnings will be reduced by $300,000 to correct the error but profits for 20X5 will be increased by $300,000. Thus closing retained earnings remain unchanged at $1,644,900. 4.5 B Only the fraud relating to the current year should be expensed against profit or loss; the remainder will be a prior period adjustment against retained earnings and will be presented in the statement of changes in equity. 4.6 A A change of classification in presentation in financial statements is a change of accounting policy under IAS 8. 5 IFRS 15 REVENUE FROM CONTRACTS WITH CUSTOMERS 5.1 D The first three statements are all steps in the core principle of recognising revenue. 5.2 B $200 profit per month for 6 months = $1,200 5.3 B Only revenue for 3 months should be recognised; the payment for the second three months is an advanced payment and is presented in current liabilities. 5.4 D The criteria for revenue recognition have not yet been met and so the payment is an advanced payment and should be presented in current liabilities. 5.5 B Bill-and-hold arrangements are where the customer is billed for the goods but the seller holds the goods until the customer requests delivery (e.g. if the customer has limited space to store the goods). 5.6 C $ 2,000 1,200 –––––– 3,200 –––––– Costs to date (1,800 + 200) Estimated costs to completion Costs to profit or loss = 3,200 × 2,520 = $1,920 4,200 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 1003 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK 5.7 D $ 145 (125) ––– 20 ––– Cash received Performance completed Liability 5.8 B As the asset is being repurchased for less than the selling price the transaction must be accounted for as a lease. 5.9 A Whether a customer is likely to reject delivery of the asset is not an indicator that is considered when determining if performance obligations are satisfied at a specific point in time. 5.10 D The contract meets the criteria for revenue recognition. Prompt payment discount is not anticipated; it will be an operating expense in profit or loss. If there is any doubt regarding settlement this should be reflected against the amount receivable from the customer; not the recognition of actual revenue. 5.11 C Although the invoiced amount is $180,000, $30,000 of this has not yet been earned and must be deferred until the servicing work has been completed. 6 INVENTORY AND BIOLOGICAL ASSETS 6.1 A 386,400 – 3,800 (loss on (1)) = $382,600 6.2 C 836,200 – 8,600 + 700 + (14,000 × 70%) = $838,100 6.3 A (2) is a distribution cost and (4) an administration cost; neither are manufacturing costs. 6.4 B Factory management costs are a production overhead and are therefore included in factory overheads. 6.5 C Inventory is only carried at net realisable value where it is less than cost. 6.6 B Settlement discounts are not selling/distribution costs. 6.7 B IAS 2 states that costs of those staff engaged in the service contract and any attributable overheads are included in the cost of inventory. A profit margin and sales staff costs are specifically identified as costs that should be expensed as incurred. 6.8 C IAS 2 allows either first-in first-out or weighted average as a valuation model to be applied to inventories. 6.9 C Inventory should be stated at lower of cost and net realisable value: Cost (on FIFO basis) (20 × 13) Net realisable value (20 × 12) 1004 $260 –––– $240 –––– ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) 6.10 B Product I II III Lower of FIFO and NRV $ 10 13 7 ––– 30 ––– 6.11 C Wine is an example of products that are the result of processing after harvest and IAS 41 does not deal with the processing of agricultural produce after harvest, IAS 2 Inventory would be the relevant standard for wine. 6.12 B A biological asset shall be measured at the end of each reporting period at its fair value less costs to sell. Costs to sell are the incremental costs directly attributable to the disposal of an asset, excluding finance costs and income taxes. $10,500 (Estimated sale price of the biological assets) – $700 (Transportation cost) = $9,800 6.13 D Once crops are harvested IAS 41 is no longer applicable. 6.14 D The normal selling price of damaged inventory is $300,000 (210 ÷ 70%). This will now sell for $240,000 (300,000 × 80%), and have a NRV of $180,000 (240 – (240 × 25%)). The expected loss on the inventory is $30,000 (210 cost – 180 NRV) and therefore the inventory should be valued at $970,000 (1,000 – 30). 7 IAS 16 PROPERTY, PLANT AND EQUIPMENT 7.1 C 48,000 + 400 + 2,200 = $50,600 7.2 B Depreciation: 1/40 × 1,000,000 = $25,000 Revaluation: 1,000,000 – (800,000 – 2% × 10 × 800,000) = $360,000 7.3 D Assets with indefinite lives (e.g. land) are not depreciated. Goodwill cannot be revalued. 7.4 D IAS 16 requires that depreciation is based on the carrying amount of the asset and the full depreciation expense must be charged to profit or loss. IAS 16 does allow the difference between depreciation charged on historical cost and the revalued amount to be transferred from revaluation surplus to retained earnings as a transfer within equity, this would be presented in the statement of changes in equity. 7.5 B 31 March 20X6 20,000 31 March 20X5 20,000 = $25,000 0.8 31 March 20X4 25,000 = $31,250 0.8 31,250 = $39,062 0.8 Accumulated depreciation = $(39,062 – 20,000) = $19,062 (i.e. approximately $19,000) 31 March 20X3 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 1005 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK 7.6 B Selling price Carrying amount (to balance) Profit/(loss) Machine 1 $ 90,000 (60,000) ––––––– 30,000 ––––––– Machine 2 $ 40,000 (60,000) ––––––– (20,000) ––––––– 120,000 (60,000) ––––––– 60,000 ––––––– 100,000 (60,000) –––––– 40,000 = ––––––– Cost Carrying amount Accumulated depreciation 100,000 ––––––– 7.7 D Depreciable amount after six years Depreciation charge in year 7 = (100,000 – 2,000) × 14 20 = 68,600 × 1 25 = $2,744 = 68,600 7.8 B As at 1 January 20X4 carrying amount was $104,000 and remaining useful life was six years. Depreciation charge for 20X4 should be $104,000 ÷ 6 = $17,400. The change to straight line method of depreciation is a change in estimate and is accounted for prospectively; prior period figures are not adjusted. 8 IAS 23 BORROWING COSTS 8.1 B Borrowing costs can only be capitalised in respect of directly attributable assets, all other borrowing costs must be expensed as incurred. 8.2 D (3) and (4) are explicitly mentioned in IAS 23. IAS 23 refers to “interest expense calculated using the effective interest method as described in IFRS 9 Financial Instruments. Premiums (1) and discounts (2) fall to be treated as borrowing costs based on the definition of “effective interest method” given in IFRS 9. 8.3 D Borrowing costs for all three categories (A, B and C) of borrowed funds must be capitalised when used for the acquisition, construction and production of qualifying assets. Funds in respect of the construction of the new office have already been allocated to that qualifying asset and therefore cannot be allocated to other qualifying assets. 8.4 A An entity must be consistent year-on-year in its treatment of borrowing costs. 8.5 C The capitalisation rate to be used is the weighted average capitalisation rate and excludes finance for specific projects. Preference shares Short-term loan Convertible debt Debt $000 500 80 200 –––– 780 –––– Rate 7% 10% 4% Cost $000 35 8 8 –––– 51 –––– Weighted average = $51,000 ÷ $780,000 = 6.54% 1006 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) 9 GOVERNMENT GRANTS 9.1 B IAS 20 allows the grant to be presented as a deduction from the cost of the asset or as a liability. Only government grants relating to income can be credited immediately to profit or loss. 9.2 A A forgivable loan is a loan which the lender undertakes to waive repayment of under certain prescribed conditions. 9.3 A The grant is credited to profit or loss in the same manner as the depreciation expense on the related asset. 9.4 A Free technical or marketing advice is named specifically as a form of government assistance, while B and C are specifically mentioned as being not government assistance. D is a government grant not government assistance. 9.5 B As the grant is offset against the asset the depreciation charge is $180,000 (1/5 × (1,000,000 – 100,000). As management intends to use the asset for five years no provision for repayment is required. 10 IAS 40 INVESTMENT PROPERTY 10.1 C According to IAS 40 investment property is property (land or building or both) held (by the owner or a lessee under a finance lease) to earn rentals or for capital appreciation or both. 10.2 B Both these items are mentioned as examples of investment property in IAS 40. 10.3 A A vacant building held to be rented is an example of investment property. 10.4 B This transfer results in a change from a cost measurement basis before transfer to a fair value measurement basis after transfer. 10.5 D 11 IAS 38 INTANGIBLE ASSETS 11.1 D IAS 38 requires six criteria to be met before development expenditure can be capitalised. The other items have still to meet all the criteria and so their costs must be expensed. 11.2 C This is the purchase of a separate intangible asset that is capable of being recognised in the statement of financial position. Tutorial note: Advertising is an expense that is recognised when it is incurred (so not A). B is a contingent asset that would need to be “virtually certain” rather than merely “probable” to be recognised as an asset. An internally-generated brand cannot be recognised as an asset (so not D). 11.3 C IAS 38 does not specify a maximum period for amortisation, therefore not (A). If the conditions exist, asset recognition is not an option, therefore not (B). Amortisation is an expense in profit or loss, therefore not (D). 11.4 C The others are intangible. ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 1007 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK 11.5 A Payments on account of patents may be shown as an intangible asset. IAS 38 does not allow any of the other three items to be capitalised. 11.6 C $000 Customer list 100 Patents purchased 70 Costs incurred in developing patents 60 –––– 230 –––– Legal fees must be written off as incurred. Internally-generated goodwill can never be carried as an asset. 11.7 C IAS 38 Intangible Assets requires that adequate resources exist to complete the project. 11.8 C Assets held for use under research and development should be presented as tangible non-current assets. 11.9 B The charge to profit or loss will be the research expenditure incurred in year plus the development expenditure amortised in year, this is found by reconciling the movement in development expenditure. $000 Research 267 Development Opening balance 305 Incurred in year 215 Closing balance (375) –––– 145 –––– 412 –––– 12 NON-CURRENT ASSETS HELD FOR SALE AND DISCONTINUED OPERATIONS 12.1 C IFRS 5 does not allow restructuring costs of continuing businesses to be included in the loss from discontinued operations. 12.2 A IFRS 5 requires non-current assets held for sale to be measured at the lower of carrying amount (900) and fair value less costs to sell (800 – 50) 12.3 C The disposal of a component of an entity and also a subsidiary acquired with the intent to resell are both discontinued operations in accordance with IFRS 5. 12.4 C Depreciation for first six months of the year should be charged (i.e. $31,250). At the date the asset is classified as held for sale it is tested for impairment. The carrying amount would be $281,250 and it is expected to realise $254,000 so an impairment loss of $27,250 should also be recognised. Once an asset is classified as held-for-sale it is no longer depreciated. 12.5 1008 A IFRS 5 states that the selling price must be reasonable compared to current fair value (so not (3)) and that the asset must be in a condition that would allow an immediate sale (so not (4)). ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) 12.6 C At 30 September 20X4: Carrying amount = $37·5 million (45,000 – 6,000 b/f – 1,500 for 6 months; no further depreciation when classified as held for sale). Recoverable amount = $36·8 million ((42,000 × 90%) – 1,000). Therefore included at $36·8 million (lower of carrying amount and fair value less cost to sell). 13 IAS 36 IMPAIRMENT OF ASSETS 13.1 C 13.2 B An impairment loss occurs when the recoverable amount is less than the carrying amount. The recoverable amount is the higher of fair value less costs of disposal and value in use. For asset B the recoverable amount is greater and so no impairment loss has occurred. The recoverable amount of asset A is 90, leading to a loss of 10; and the recoverable amount of asset B is 35 leading to a loss of 5. Carrying amount Less Historical cost carrying amount Dr Other comprehensive income (and then Revaluation surplus) Historical cost carrying amount Less Market value Dr Profit or loss 13.3 B Carrying amount Less Recoverable amount Impairment $000 253 (207) –––– 46 –––– $000 207 (180) ––––– 27 ––––– $ 2,750 (1,000) –––––– 1,750 –––––– A revaluation surplus of $1,500 exists for this asset and it will bear any impairment loss up to this amount. Any further impairment loss must be expensed to profit or loss. 13.4 B For a revalued asset an impairment is debited to other comprehensive income to the extent of the revaluation surplus on the asset, with any excess loss expensed to profit or loss. The surplus on any other revalued asset cannot be used for the impairment of a different asset. 13.5 C Recoverable amount is the higher of fair value less costs of disposal and value in use. ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 1009 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK 13.6 A Goodwill should be written off in full and the remaining loss is allocated pro rata to property plant and equipment and the product patent. Property, plant and equipment Goodwill Product patent Net current assets (at NRV) 13.7 14 D B/f $ 200,000 50,000 20,000 30,000 ––––––– 300,000 ––––––– Loss $ (45,455) (50,000) (4,545) nil ––––––– (100,000) ––––––– Post-loss $ 154,545 nil 15,455 30,000 ––––––– 200,000 ––––––– Although the estimated NRV is lower than it was (due to fire damage), the entity will still make a profit on the inventory and thus it is not an indicator of impairment. IFRS 16 LEASES 14.1 B Interest charge for 20X7 = 12% × 12,000 = $1,440 14.2 B Interest expense is not capitalised into the cost of the asset and only the initial direct costs of the lessee are capitalised into the cost of the asset. Statements 1 and 4 are correct. 14.3 B The lease is for the right-of-use of an asset that should be capitalised at the present value of minimum lease payments (i.e. $220,000), as this is the initial amount of lease liability recognised. 14.4 C Initial amount capitalised of asset $1,750,000, less initial payment ($520,000) = $1,230,000 to be financed. Finance charge at 13% = $159,900 Depreciation over four years (shorter of useful life and lease period) $437,500 Therefore, total charge is $597,400. 14.5 B 14.6 B Balance $ 45,000 37,175 Interest at 7% $ 3,150 2,602 Instalment $ 10,975 10,975 Rental of excavation equipment (short-term) Depreciation of leased plant (340 ÷ 5 years) Finance cost ((340 – 90) × 10%) Total 1010 Balance $ 37,175 28,802 $ 18,000 68,000 25,000 ––––––– 111,000 ––––––– ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) 15 IAS 37 PROVISIONS, CONTINGENT LIABILITIES AND CONTINGENT ASSETS 15.1 B The case against TY meets the definition of a provision and therefore should be recognised. The claim against the sub-contractor is a contingent asset and should be disclosed in the financial statements. 15.2 C $1,000,000 × discount rate 0.463 = $463,000 × 1.08 = $500,040; so a provision of $500,000 would meet the requirement of IAS 37. Tutorial note: The $40 rounding is suitable as this is an accounting estimate. 15.3 D No provision can be made for future operating losses. Non-adjusting events are disclosed. Contingents assets are not recognised until virtually certain. 15.4 A A contingent liability with a probable outflow of economic benefits should be accounted and a provision recognised. A contingent liability where flow of economic benefits is not probable should be disclosed. 15.5 A A present obligation is a provision and must be provided for. A contingent asset with a probable flow of economic benefits should be disclosed. 15.6 A The legal action does not relate to conditions existing at the year-end as the cause arose subsequently. 15.7 C (1) is an onerous contract. A provision for (3) is still required if there is no intention to sell. 15.8 B $000 Extraction provision at 30 September 20X4 (250 × 10) Dismantling provision: At 1 October 20X3 (30,000 × 0·68) 20,400 Unwinding of the discount at 8% Total provision 16 $000 2,500 22,032 ––––––– 24,532 ––––––– IAS 10 EVENTS AFTER THE REPORTING PERIOD 16.1 C The three other events are all adjusting events. 16.2 C The three other events are all non-adjusting events. 16.3 A (2) and (3) are non-adjusting events (as conditions did not exist at the end of the reporting period). 16.4 A The announcement of changes in tax rates and major restructuring are both nonadjusting events. 16.5 D A, B and C could all be adjusting events – since they affect conditions existing at the reporting date. 16.6 C If the entity had not recognised a receivable (because a successful claim was only probable rather than “virtually certain”) the adjustment will be an increase in receivables (and profit) of $1.5 million. If the proceeds were recognised as an asset (because a successful claim was “virtually certain”) the adjustment will be $1 million decrease in receivables (and profit) of $1 million ($2.5 – $1.5). ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 1011 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK Tutorial note: A and B are non-adjusting events. If the inventory (D) had been sold before 31 August, when the financial statements were approved, it would have been an adjusting event; but as the transaction was later it cannot be adjusting. 17 IAS 12 INCOME TAXES 17.1 B 17.2 B Carrying amount in the accounting records (132,000 – 44,000) is $88,000. Tax base (82,500 – 20,625) is $61,875. Difference (26,125 × 25%) is $6,531. Accounting $ 200,000 (40,000) Cost Accumulated depreciation First year allowance ––––––– 160,000 (40,000) Depreciation Annual allowance ––––––– 120,000 ––––––– Tax $ 200,000 (100,000) ––––––– 100,000 (25,000) ––––––– 75,000 ––––––– Temporary difference 120,000 – 75,000 = 45,000 Deferred tax 45,000 × 25% = 11,250 17.3 C Income tax Cash C/f 17.4 $ 194,300 A Tax charge B Carrying amount Tax base Taxable temporary difference Tax rate Deferred tax liability balance 1012 B/f ––––––– 331,900 ––––––– 137,600 137,600 ––––––– 331,900 ––––––– Tax due for the year Over provision previous year 17.5 B/f Expense for year $ 187,500 144,400 $ 320 (10) –––– 310 –––– $ 365,700 (220,000) ––––––– 145,700 ––––––– 25% 36,425 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) 18 FINANCIAL INSTRUMENTS 18.1 D IAS 32 requires that treasury shares are presented as a deduction from equity. 18.2 C (1), (3) and 4 all meet the definition of financial liabilities. 18.3 B A convertible loan note must be separated into its liability and equity components on initial issue based on the future cash flows associated with it. 18.4 A The future cash flows are discounted to present value with the difference classified as the equity component. 18.5 D As payments are being made every six months some of the debt will be presented as current and the remainder as non-current. 18.6 C PV of future cash flows using effective interest rate of 14%: Principle ($2,200 × 0.592) Annual interest ($160 × 2.913) Interest expense 20X2 ($1,768 × 14%) Cash flow Balance 31 December 20X2 Interest expense 20X3 ($1,855 × 14%) 18.7 D 18.8 A As PQR’s business model is not to hold this type of asset for contractual cash flows (this is a matter of fact) the asset must be valued at fair value with any changes in fair value being taken through profit or loss. Cash interest $1,000 × 4% × 5 years Discount on issue ($1,000 × 5%) Premium on redemption ($1,000 × 10%) Total finance costs 18.9 $ 1,302 466 –––––– 1,768 248 (160) –––––– 1,855 –––––– 260 $ 200 50 100 –––––– 350 –––––– A Year ended 30 September 20X4 20X5 20X6 Cash flow $000 500 500 10,500 Value of debt component Difference – value of equity option component Proceeds ©2017 DeVry/Becker Educational Development Corp. All rights reserved. Discount Discounted rate cash flows At 8% $000 0·93 465 0·86 430 0·79 8,295 –––––– 9,190 810 –––––– 10,000 –––––– 1013 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK 19 CONCEPTUAL PRINCIPLES OF GROUP ACCOUNTING 19.1 C Control is established by reference to voting shares. Harwich only has 70,000 out of 300,000 votes (100,000 + (10 × 20,000)) whereas Felixstowe has 180,000 votes giving it control over Sall (60%). 19.2 B Voting rights in Sam = (2,000 × 10) + (8,000 × 1) = 28,000 votes. Tom has 1,500 A shares giving a total of 15,000 votes. Dick has 6,000 B shares giving 6,000 votes. Tom has 53.6% of votes and therefore has control over Sam. 19.3 C Jamee has 1 million ($500,000 × 50c per share) shares in issue. Harvert holds 400,000 shares or 40% of the share capital. With a holding of 40% and one nominated director, it is virtually certain that Harvert can exercise a significant influence over the operating and financial policies of Jamee, but cannot exercise control. 19.4 B The consolidated statement of financial position includes 100% of every asset of the subsidiary. Only the parent’s share capital is included in the consolidated statement of financial position. 19.5 C 3 and 4 both give control over a subsidiary. 19.6 D The investment no longer meets the definition of a subsidiary (ability to control) and therefore would not be consolidated. 20 20.1 CONSOLIDATED STATEMENT OF FINANCIAL POSITION C IFRS 3 allows non-current interest to be valued at either fair value on acquisition or at a proportion of the identifiable net assets; this affects the amount of goodwill. Fair value on acquisition Cost of investment Fair value of non-controlling interest (100,000 × 20% × $1.70) Net asset on acquisition $ 140,000 34,000 (126,000) ––––––– 48,000 ––––––– Proportion of identifiable net assets Cost of investment Net assets on acquisition (126,000 × 80%) 20.2 C Cost of investment Fair value of net assets acquired ((600 × 0.5) + 50 + 20)) Goodwill on acquisition 1014 140,000 (100,800) ––––––– 39,200 ––––––– $000 1,400 (370) ––––– 1,030 ––––– ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) 20.3 D (576,000 + 140,000) – (180,000 + 108,000) = 428,000 20.4 C Consolidated retained earnings Vaynor Weeton ((40 + 10) × 80%) Goodwill impaired (15 × 80%) 20.5 D $000 90 40 (12) ––––– 118 ––––– $000 Fair value of non-controlling interest on acquisition (200,000 × 20% × $3.10) Post-acquisition profits (50,000 × 20%) 20.6 C 124 10 ––––– 134 ––––– If none of the goods have been paid for then receivable and payables need to be reduced by the full amount of the intra-group balances, $48,000. The unrealised profit is $48,000 × 331/3 ÷ 1331/3 × 60% = $7,200 20.7 D $000 1,044 783 —— 261 —— Sales value Cost of sales Profit % 100 75 —— 25 —— Tutorial note: Margin is “on sales” therefore sales value is 100%. If margin is 25%, cost is 75%. Unrealised profit in inventory is $261,000 × 60% = $156,600 Alternatively: (60% × $1,044,000) × 25/100 = $156,600 20.8 B $ 1,224,000 Parent as per question Post-acquisition share of Malta (80% × ((680,000 – 3,000) – 476,000)) 160,800 ——–—— 1,384,800 ——–—— Unrealised profit is 20% on cost price, $18,000 is selling price so profit element is 20 /120 = 3,000 20.9 B 60% × (25/125 × $200,000) = $24,000 20.10 B There is no requirement to value assets at fair value. 20.11 D H $000 500 (220) ––––– 280 ––––– Current assets Current liabilities ©2017 DeVry/Becker Educational Development Corp. All rights reserved. S $000 200 (90) ––––– 110 ––––– Adjustment Consolidated $000 $000 –22 + 2 680 +20 (290) ––––– 390 ––––– 1015 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK 20.12 D % 120 (20) –––– 100 –––– Selling price Mark-up Cost 20.13 A $ 1,200 (200) –––––– 1,000 –––––– $ 15,000 (3,000) –––––– 12,000 –––––– Carrying amount Profit element (25/125) Cost Tutorial note: Bass (the parent) is the seller of the goods. adjustment does not affect the non-controlling interest. 20.14 B Is $ 40,000 (8,000) –––––– 32,000 –––––– Cost Accumulated depreciation Carrying amount Therefore the Should be $ 42,000 (18,000) –––––– 24,000 –––––– Adjustment required Cr Non-current assets at carrying amount $8,000. Non-current assets in consolidated statement of financial position: = 260,000 + 80,000 – 8,000 = $332,000 20.15 21 21.1 A Is the correct treatment for a bargain purchase (“negative goodwill”). FURTHER CONSOLIDATION ADJUSTMENTS A Cash element (500,000 × 60% × $3.45) Share exchange (500,000 × 60% × 3/2 × $6.50) $000 1,035 2,925 ––––– 3,960 ––––– 21.2 B IFRS 3 requires that goodwill is carried as an asset and tested annually for impairment. 21.3 C (2) is a post-acquisition implication. 21.4 B Where provision has been made by the company to be acquired, and costs would be incurred whether or not acquisition went ahead, a provision should be included. 21.5 D All are assets or liabilities that existed on which a fair value must be placed. 1016 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) 21.6 D $ 12 (7) ––– 5 ––– Cost of investment Less: Share of net assets acquired Tutorial note: The future operating losses and reorganisation costs are not taken into account when assessing fair value on acquisition. 21.7 C $000 Cash element (200,000 × 75% × $2) Deferred consideration (200,000 × 75% × $3 ÷ 1.062) 300 400 ––– 700 ––– The amount of deferred consideration is determined at the acquisition date; the unwinding of the discount is an expense for the period. The liability will be settled after 12 months and should therefore be presented as a non-current liability. 21.8 B The contingent consideration will be measured based on the fair value at 31 December 20X2; any change in fair value is taken to profit or loss. If the fair value falls in the next period this fall will be accounted for in that period. 21.9 A Transaction costs must be expensed immediately but any costs relating to the issue of shares as part of the purchase consideration are to be treated as a deduction from equity. 22 CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME 22.1 B Consolidated revenue Constable Whistler 22.2 A Revenue = 460,000 + 120,000 – 60,000 = $520,000 22.3 C Cost of sales Unrealised profit $ 400 100 ––––– 500 ––––– Walcot $m (11) Ufton $m (10) Adjustment Consolidated $m $m 3 (19) (1) 22.4 D Reduce revenue by all intra-group sales of $40,000 22.5 A Reduce consolidated profit by provision for unrealised profit. 20,000 × 25/125 = $4,000 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 1017 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK 22.6 C Revenue Cost of sales Sanderstead Croydon $ $ 600,000 300,000 (400,000) (200,000) ––––––– ––––––– Adjustment $ (20,000) 20,000 ––––––– Gross profit Consolidated $ 880,000 (580,000) ––––––– 300,000 ––––––– Tutorial note: The goods have been sold on by Croydon so there is no unrealised profit requiring adjustment. 22.7 A Selling price Cost Gross profit % 150 (100) –––– 50 –––– $ 60,000 (40,000) –––––– 20,000 –––––– Tutorial note: The entire unrealised profit ($20,000) is deducted in arriving at gross profit (control). 22.8 A Unrealised profit Closing (30,000 × 30/130) Opening (15,000 × 30/130) $ 6,923 (3,462) ––––– 3,461 ––––– Increase required 22.9 B Share of consolidated profit (25% × 118,000) Less Share of unrealised profit (25% × 36,000 × 50/150) 22.10 B Hot Warm $ 29,500 (3,000) –––––– 26,500 –––––– $ 40,000 36,000 –––––– 76,000 –––––– Tutorial note: The tax expense of the associate is not included in the consolidated profit or loss. 22.11 B Proceeds on disposal Net assets Goodwill remaining Non-controlling interest Profit on disposal 1018 $000 275 (186) (29) 37 ––– 97 ––– ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) 23 INVESTMENTS IN ASSOCIATES 23.1 C 23.2 C Income from associate = $6,500 × 30% × 3/4 = $1,462.50 (rounded = $1,463) Original investment Share of profit for year Less share of dividend paid Value of investment in SX $000 70 45.5 (28) –––– 87.5 –––– 23.3 C An investment in an associate is only carried at cost initially. (Thereafter the carrying amount is increased or decreased to recognise the investor’s share in profit or loss of the post-acquisition period.) 23.4 D More than half of the voting power constitutes control. The three other items are all indicators of significant influence mentioned in IAS 28 Investment in Associates and Joint Ventures. 23.5 C Raby Seal Toft – over 20%, significant influence demonstrated. – over 20%, but no significant influence. – less than 20%, but has a significant influence. Therefore Raby and Toft are associated undertakings of Inveresk. 23.6 A 23.7 B Profit in inventory (½ × 15,000 × 25/125) Holly’s share (30%) Consolidated retained earnings Vaynor Weeton ((40 + 10) × 100%) Yarlet ((70 – 30) × 40%) $ 1,500 450 ––––– $000 90 50 16 –––– 156 –––– 24 FOREIGN CURRENCY TRANSACTIONS 24.1 B The foreign denominated payable and the dividend receivable are both monetary items which must be retranslated at the reporting date. 24.2 A If the economic environment has changed then the functional currency must be reviewed and changed if necessary. 24.3 B 28 November Krown 220,000 ÷ $5.50 = $40,000. Half is settled on 17 December and half remains outstanding on 31 December. $ 17 December Krown (110,000 ÷ $5.30) = $20,755 755 loss 31 December Krown (110,000 ÷ $5.60) = $19,643 357 gain ––– Profit or loss 398 net loss ––– ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 1019 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK 24.4 C The prepayment is not a monetary item and is therefore not retranslated at the reporting date. No gain or loss is recognised. 24.5 D Non-current liability at 31 December 20X6 is Krown 800,000 × $2.46 = $1,968,000. There will also be a current liability of one instalment of Krown 100,000 ($246,000); however the question only asked for the non-current liability. 25 ANALYSIS AND INTERPRETATION 25.1 B An overstatement in opening inventory will increase cost of goods sold (and reduce gross profit). 25.2 B The amount of the overstatement in closing inventory (A) will reduce cost of sales in the current period, hence gross profit would increase. (B) will charge to profit costs that relate to the next period. (Note that the goods are not in inventory at the period end, hence cost of sales is overstated.) (C) would inflate sales and hence increase profit. (D) would lead to a higher revenue figure and therefore an increase in gross profit. 25.3 D Cost of sales has been overstated by $48,000 ($24,000 of opening inventory valuation was not an expense + carry forward of $24,000 expense in closing inventory valuation). If inventory days is calculated using average inventory there is no error in average inventory but cost of sales in the denominator is overstated so turnover days are lower than they should be. (If closing inventory was used turnover days will have been even lower.) Current assets in the current ratio were understated so this was also lower. 25.4 B ROCE 25.5 D Credit sales Average receivables Receivables turnover Collection period = 795 Operating profit (before loan interest) = = 19.9% Share capital Reserves Loan notes 4,000 = $200 × 80% = $160 = ½ $(16 + 24) = $20 = $160 ÷ $20= 8 = 365 ÷ 8 = 46 days Sales Cost of sales (40 + 120 – 50) Gross profit 25.6 B $ 200 (110) –––– 90 –––– % 100 55 –––– 45 –––– Receiving cash for a long-term loan increases current assets with no change in current liabilities, hence improves the ratio. Payment to an existing trade payable improves the ratio. Writing off a trade receivable against an allowance has no effect on current assets. Therefore receiving cash in respect of a short-term loan must be the correct choice. Tutorial note: Suppose current ratio is 2:1, say loan = $50 Inventory, receivables and bank Current liabilities Current ratio 25.7 1020 A 100 + 50 50 + 50 2:1 150 100 1.5:1 A not-for-profit entity is unlikely to have shareholders or “earnings”. ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) 26 IAS 7 STATEMENT OF CASH FLOWS 26.1 B The other two items will appear as investing cash flows. 26.2 A B and C would be adjustments to profit before tax in the indirect cash flow statement and finance costs are presented after cash generated from operations. 26.3 B Depreciation expense should have been added back to profit and increase in payables should also have been added back. 26.4 A Non-current assets (at carrying amount) B/f Revalued Cash (to balance) $000 250 25 60 —— 335 —— $000 20 45 270 —— 335 —— Depreciation Disposals C/f New additions in the period were $60,000 and cash proceeds on disposal were $50,000, therefore there was a net cash outflow of $10,000. 26.5 B Acquisitions and disposals of non-current assets are investing activities. A profit on disposal is not a cash flow and therefore deducted. 26.6 C Non-current asset cash flows Proceeds on sale of non-current asset Purchase of non-current assets (240 + 80 – 180) Net cash outflow 26.7 B $000 20 (140) –––– 120 –––– A decrease in warranty provision will be credited to operating profit but is not a cash flow. A revaluation of non-current assets does not affect cash and is not included in operating profit. 26.8 B 26.9 D The expenditure is an addition to non-current assets. Non-current assets (Carrying amount) B/f Additions $000 110 25 —— 135 —— 26.10 D Depreciation Disposals (20 – 5) C/f $000 30 15 90 —— 135 —— A note to the cash flow statement should explain this non-cash transaction. ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 1021 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK 26.11 B Interest payable $000 5 33 15 —— 55 —— Provision Cash to balance Bal c/f Bal b/f Expense $000 12 41 —— 55 —— The unwinding of the discount on the decommissioning provision is an interest expense but not a cash flow. The interest on the lease is a correct charge to profit or loss and it was paid in the period. 26.12 27 27.1 A Cash flow is (in $ million): 23·4 – 14·4 b/f + 2·5 depreciation + 3 disposal – 2 revaluation – 4 non-cash acquisition = 8·5 IAS 33 EARNINGS PER SHARE C 4 × $3.00 = $12.00 5 × $2.80 = $14.00 Therefore, the offer would have been $2.00 Finance raised = $2.00 × $10m ÷ 4 = $5,000,000 27.2 D 27.3 B 2 $2 3 $4 5 = $3.20 Profit for year $394,696 (528,934 – 6,578 – 1,800 – 125,860) divided by number of ordinary shares in issue of 240,000 gives $1.64. Tutorial note: The calculation is based on profit for the year (i.e. after interest, which includes the preference dividend, and taxation). 27.4 B The profit figure to be used in the basic EPS calculation is profit for year, which is after payment of preference dividend but before payment of ordinary dividend. The ordinary dividend of $800,000 must therefore be added back to retained profit for year of $4.8 million, leading to a profit for year of $5.6 million. If there is a bonus issue during the year then the number of shares used in the EPS calculation is the number of shares after the bonus issue (i.e. 4 million). 27.5 D Earnings is the amount of profit attributable to ordinary shareholders. This can be calculated by adding the ordinary dividend and retained profit ($3,715,500). Earnings per share is found by dividing earnings by the number of ordinary shares (1·5 million). $3,715,500 ÷ 1,500,000 = $2.48 27.6 B Earnings = $524,054 (i.e. operating profit less interest and taxation). (Although the dividend has been paid to shareholders, it is part of “earnings”.) There are 500,000 shares in issue, so EPS is: $524,054 ÷ 500,000 = $1.05 1022 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) 27.7 C Earnings $ 689,424 65,000 ––––––– 754,424 ––––––– = Retained profit + Ordinary dividend Number of shares = 65,000 ÷ 0·10 EPS (754,424 × 100) ÷ 60,000 27.8 A 650,000 $1.16 Earnings = Operating profit – tax (i.e. $1,034,000) The bonus shares issued during the year should be included in the number of shares. Therefore, EPS = $1,034,000 ÷ 440,000 = $2.35 27.9 C Proceeds on issue of shares (50,000 × $1.60) Divide by average market price Assumed shares issued at average market price Bonus element (50 – 40) 10,000 $80,000 $2 40,000 Earnings Number of shares = 1,000,000 + 10,000 EPS 27.10 A Increase in profit ($100,000 × 6% × 70%) Increase in shares ($100,000 × 5/4) Earnings = $160,000 + $5,600 Number of shares = 500,000 + 125,000 Diluted EPS 27.11 $1,600,000 1,010,000 $1.58 C $5,600 125,000 $165,600 625,000 $0.265 (2) and (3) relate to “potential ordinary shares” and must be reflected in the diluted EPS calculation. (1) and (4) are reflected already in the basic EPS calculation. ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 1023 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK Answer 1 WARDLE Item Answer Justification 1 Outstanding liability C $000 6,000 600 660 ––––– 7,260 ––––– Opening balance Year 1 interest Year 2 interest 2 A Under the legal form of the transaction a sale has taken place followed by a repurchase, therefor there will be no finance costs incurred 3 D Following the substance of the transaction, the debt and asset will be recognised making the capital base in the calculation higher and therefore giving a lower ROCE when compared to following the legal form. As the debt is recognised it will mean there will be more debt in the gearing calculation and therefore result will give a higher gearing ratio, implying greater risk. 4 D Warranty provisions are liabilities that should be provided for in accordance with IAS 37 Provisions, Contingent Liabilities and Contingent Assets. 5 B The goods must already be in inventory and placed to one side ready for delivery to the customer, if they have not been manufactured a bill-and-hold transaction cannot be recognised. Answer 2 DEXON (a) Redraft profit or loss for the year $000 Retained profit for period per question Dividends paid (W1) Draft profit for year ended 31 March 20X7 Discovery of fraud (W2) Goods sold without commercial substance (W3) Depreciation (W4) – buildings (165,000 ÷ 15 years) – plant (180,500 × 20%) Increase in investments ((12,500 × 1,296 ÷ 1,200) – 12,500) Provision for income tax Increase in deferred tax (W5) Recalculated profit for year ended 31 March 20X7 1024 11,000 36,100 ––––– $000 96,700 15,500 ––––––– 112,200 (2,500) (1,800) (47,100) 1,000 (11,400) (800) ––––––– 49,600 ––––––– ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) (b) Statement of changes in equity for the year ended 31 March 20X7 At 1 April 20X6 Prior period adjustment (W2) Ordinary shares $000 200,000 Restated earnings at 1 April 20X6 Rights issue (see below) 50,000 Total comprehensive income (from (a) and (W4) Dividends paid (W1) –––––– At 31 March 20X7 250,000 –––––– Share Revaluation Retained premium reserve earnings $000 $000 $000 30,000 18,000 12,300 (1,500) –––––– 10,800 10,000 4,800 –––––– 40,000 –––––– –––––– 22,800 –––––– 49,600 (15,500) –––––– 44,900 –––––– Total $000 260,300 (1,500) 60,000 54,400 (15,500) –––––– 357,700 –––––– Rights issue: 250 million shares in issue after a rights issue of one for four would mean that 50 million shares were issued (250,000 × 1/5). As the issue price was $1·20, this would create $50 million of share capital and $10 million of share premium. (c) Statement of financial position as at 31 March 20X7 Assets $000 Non-current assets Property (W4) Plant (180,500 – 36,100 depreciation see (a)) Investments at fair value through profit or loss (12,500 + 1,000 see (a)) Current assets Inventory (84,000 + 6,000 (W3)) Trade receivables (52,200 – 4,000 (W2) – 7,800 (W3)) Bank $000 180,000 144,400 13,500 ––––––– 337,900 90,000 40,400 3,800 ––––––– Total assets Equity and liabilities Equity (from (b)) Ordinary shares of $1 each Share premium Revaluation surplus Retained earnings Non-current liabilities Deferred tax (19,200 + 2,000 (W5)) Current liabilities (81,800 + 11,400 income tax) Total equity and liabilities ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 134,200 ––––––– 472,100 ––––––– 250,000 40,000 22,800 44,900 ––––––– 107,700 ––––––– 357,700 21,200 93,200 ––––––– 472,100 ––––––– 1025 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK WORKINGS (amounts in brackets in $000) (1) Dividends paid The dividend in May 20X6 would be $8 million (200 million shares × $0.04) and in November 20X6 would be $7·5 million (250 million shares × $0.03). Total dividends would therefore have been $15·5 million. (2) Fraud The discovery of the fraud means that $4 million should be written off trade receivables. $1·5 million debited to retained earnings as a prior period adjustment (in the statement of changes in equity) and $2·5 million written off in the profit or loss for the year ended 31 March 20X7. (3) Commercial substance Revenue includes $7.8 million of goods sold without commercial substance, the cost of the goods sold was $6 million (7.8 × 100/130); so profit should be reduced by $1.8 million. Trade receivables should be reduced by $7.8 million and inventory increased by $6 million. (4) Property The carrying amount of the property (after the year’s depreciation) is $174 million (185,000 – 11,000). A valuation of $180 million would create a revaluation surplus of $6 million of which $1·2 million (6,000 × 20%) would be transferred to deferred tax. (5) Deferred tax An increase in the taxable temporary differences of $10 million would create a transfer (credit) to deferred tax of $2 million (10,000 × 20%). Of this $1·2 million relates to the revaluation of the property and is debited to the revaluation surplus. The balance, $800,000, is charged to profit or loss. Answer 3 SANDOWN (a) Statement of profit or loss and other comprehensive income for the year ended 30 September 20X6 Revenue (380,000 – 4,000 (W1)) Cost of sales (W2) Gross profit Distribution costs Administrative expenses (50,500 – 12,000 (W3)) Investment income Finance costs (W5) Profit before tax Income tax expense (16,200 + 2,100 – 1,500 (W6)) Profit for the year $000 376,000 (259,800) ––––––– 116,200 (17,400) (38,500) 1,300 (1,475) ––––––– 60,125 (16,800) ––––––– 43,325 ––––––– Other comprehensive income Gain on fair value though other comprehensive income investments (W4) 4,700 ––––––– Total comprehensive income 48,025 ––––––– 1026 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) (b) Statement of financial position as at 30 September 20X6 Assets Non-current assets Property, plant and equipment (W7) Intangible – brand (30,000 – (9,000 + 3,000)) Financial asset investments (at fair value) Current assets Inventory Trade receivables Bank $000 67,500 18,000 29,000 ––––––– 114,500 38,000 44,500 8,000 ––––––– Total assets Equity and liabilities Equity shares of 20 cents each Equity option Other reserve (W9) Retained earnings (W8) Non-current liabilities Deferred tax (W6) Deferred income (W1) 5% convertible loan note (W5) Current liabilities Trade payables Deferred income (W1) Current tax payable Total equity and liabilities $000 90,500 ––––––– 205,000 ––––––– 50,000 2,000 5,700 61,385 ––––––– 119,085 3,900 2,000 18,915 ––––––– 42,900 2,000 16,200 ––––––– 24,815 61,100 ––––––– 205,000 ––––––– WORKINGS (amounts in brackets in $000) (1) Servicing element IFRS 15 Revenue from Contracts with Customers requires that where revenue includes an amount for after sales servicing and support costs it must be allocated between the performance obligations (i.e. the sale of goods and the after-sales service). The allocation should be based on the stand-alone selling prices of the obligations. This will result in a deferral of an element of revenue. The amount deferred should cover the cost and a reasonable profit (in this case a gross profit of 40%) on the services. As the servicing and support is for three years and the date of the sale was 1 October 20X5, revenue relating to two years’ servicing and support provision must be deferred: ($1·2 million × 2/0·6) = $4 million. This is shown as $2 million in both current and non-current liabilities. ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 1027 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK (2) Cost of sales Per question Depreciation Amortisation – building (50,000 ÷ 50 years – see below) – plant and equipment (42,200 – 19,700) × 40%)) – brand 246,800 1,000 9,000 3,000 ––––––– 259,800 ––––––– The cost of the building of $50 million (63,000 – 13,000 land) has accumulated depreciation of $8 million at 30 September 20X5 which is eight years after its acquisition. Thus the life of the building must be 50 years. The brand is being amortised at $3 million per annum (30,000 ÷ 10 years). (3) Dividend A dividend of 4·8 cents per share would amount to $12 million (50 million × 5 (i.e. shares are $0.20 each) × 4·8 cents). This is not an administrative expense but a distribution of profits that should be accounted for through equity. (4) Fair value through other comprehensive income financial assets gain on disposal (11,000 proceeds – 8,800 carrying amount) Increase in fair value of remaining investments: (29,000 – 26,500) Included in other comprehensive income 2,200 2,500 ––––– 4,700 ––––– The gain on the investments disposed of $4,000 (11,000 – 7,000) has now been realised and can be transferred to retained earnings from other equity reserve. As the investments are equity instruments classified at fair value through other comprehensive income the cumulative gain on disposal cannot be reclassified through profit or loss, but it can be transferred within equity. (5) Convertible loan note The finance cost of the convertible loan note is based on its effective rate of 8% applied to $18,440,000 carrying amount at 1 October 20X5 = $1,475,000 (rounded). The accrual of $475,000 (1,475 – 1,000 interest paid) is added to the carrying amount of the loan note giving a figure of $18,915,000 (18,440 + 475) in the statement of financial position at 30 September 20X6. (6) Deferred tax Credit balance required at 30 September 20X6 (13,000 × 30%) Balance at 1 October 20X5 Credit (reduction in balance) to profit or loss 1028 3,900 (5,400) ––––– 1,500 ––––– ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) (7) Non-current assets Property (63,000 – (8,000 + 1,000)) (W2) Plant and equipment (42,200 – (19,700 + 9,000)) (W2) Property, plant and equipment (8) Retained earnings At 1 October 20X5 Profit for year Transfer from other equity reserve ((W4) Dividend paid (W3) (9) 54,000 13,500 –––––– 67,500 –––––– 26,060 43,325 4,000 (12,000) –––––– 61,385 –––––– Other reserve Relating to financial asset investments: At 1 October 20X5 Other comprehensive income for year (W4) Transfer to retained earnings ((W4) 5,000 4,700 (4,000) –––––– 5,700 –––––– Answer 4 CAVERN (a) Statement of profit or loss and other comprehensive income for the year ended 30 September 20X6 Revenue Cost of sales (W1) Gross profit Distribution costs Administrative expenses (25,000 – 18,500 dividends (W3)) Investment income Finance costs (300 + 400 (W2) + 3,060 (W4)) Profit before tax Income tax expense (5,600 + 900 – 250 (W5)) Profit for the year Other comprehensive income Loss on fair value through other comprehensive income investments (15,800 – 13,500) Gain on revaluation of land and buildings (W2) Total other comprehensive losses for the year Total comprehensive income ©2017 DeVry/Becker Educational Development Corp. All rights reserved. $000 182,500 (137,400) ––––––– 45,100 (8,500) (6,500) 700 (3,760) –––––– 27,040 (6,250) –––––– 20,790 –––––– (2,300) 800 –––––– (1,500) –––––– 19,290 –––––– 1029 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK (b) Statement of financial position as at 30 September 20X6 Assets $000 Non-current assets Property, plant and equipment (41,800 + 51,100 (W2)) Fair value through other comprehensive income investments Current assets Inventory Trade receivables 19,800 29,000 ––––––– Total assets Equity and liabilities Equity shares of 20 cents each Share premium 11,000 Other equity reserve 700 Revaluation surplus (7,000 + 800) 7,800 Retained earnings (12,100 + 20,790 per (a) – 18,500 (W3)) 14,390 ––––––– Non-current liabilities Provision for decontamination costs (4,000 + 400 (W2)) 8% Loan note (W4) Deferred tax (W5) Current liabilities Trade payables Bank overdraft Current tax payable Total equity and liabilities 4,400 31,260 3,750 ––––––– 21,700 4,600 5,600 ––––––– $000 92,900 13,500 ––––––– 106,400 48,800 ––––––– 155,200 ––––––– 50,000 33,890 –––––– 83,890 39,410 –––––– 31,900 ––––––– 155,200 ––––––– WORKINGS (amounts in brackets in $000) (1) Cost of sales Per trial balance Depreciation of building (36,000 ÷ 18 years) Depreciation of new plant (14,000 ÷ 10 years) Depreciation of existing plant and equipment ((67,400 – 10,000 – 13,400) × 12·5%) 1030 128,500 2,000 1,400 5,500 ––––––– 137,400 ––––––– ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) (2) Property, plant and equipment The new plant of $10 million should be grossed up by the provision for the present value of the estimated future decontamination costs of $4 million to give a gross cost of $14 million. The “unwinding” of the provision will give rise to a finance cost in the current year of $400,000 (4,000 × 10%) to give a closing provision of $4·4 million. The gain on revaluation and carrying amount of the land and building will be: Valuation – 30 September 20X5 Building depreciation (W1) Carrying amount before revaluation Revaluation – 30 September 20X6 Gain on revaluation The carrying amount of the plant and equipment will be: New plant (14,000 – 1,400) Existing plant and equipment (67,400 – 10,000 – 13,400 – 5,500) (3) 43,000 (2,000) –––––– 41,000 41,800 –––––– 800 –––––– 12,600 38,500 –––––– 51,100 –––––– Rights issue/dividends paid Based on 250 million (50 million × 5 – as shares are $0.20 each) shares in issue at 30 September 20X6, a rights issue of 1 for 4 on 1 April 20X5 would have resulted in the issue of 50 million new shares (250 million – (250 million × 4/5)). This would be recorded as share capital of $10 million (50,000 × $0.20) and share premium of $11 million (50,000 × ($0.42 – $0.20)). The dividend of $0.03 per share paid on 30 November 20X5 would have been based on 200 million shares and been $6 million. The dividend of 5 cents per share paid on 31 May 20X6 would have been based on 250 million shares and been $12·5 million. Therefore the total dividends paid, incorrectly included in administrative expenses, were $18·5 million. (4) Loan note The finance cost of the loan note, at the effective rate of 10% applied to the carrying amount of the loan note of $30·6 million, is $3·06 million. The interest actually paid is $2·4 million. The difference between these amounts of $660,000 (3,060 – 2,400) is added to the carrying amount of the loan note to give $31·26 million (30,600 + 660) for inclusion as a non-current liability in the statement of financial position. (5) Deferred tax Provision required at 30 September 20X6 (15,000 × 25%) Provision at 1 October 20X5 Credit (reduction in provision) to profit or loss ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 3,750 (4,000) ––––– 250 ––––– 1031 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK Answer 5 FRESCO (a) Statement of profit or loss and other comprehensive income Revenue Cost of sales (W1) Gross profit Distribution costs Administrative expenses (26,900 + 3,000 current year fraud) Finance costs (300 + 2,300 (W2)) Loss before tax Income tax relief (2,400 + 200 (W3) – 800) Loss for the year Other comprehensive income Revaluation of leased property (W2) 4,000 ––––––– (3,800) ––––––– Total comprehensive losses (b) $000 350,000 (311,000) ––––––– 39,000 (16,100) (29,900) (2,600) ––––––– (9,600) 1,800 ––––––– (7,800) Statement of changes in equity Balances at 1 April 20X6 Prior period adjustment (fraud) Restated balance Rights share issue (see below) Total comprehensive losses (see (a) above) Transfer to retained earnings Balances at 31 March 20X7 Share capital $000 45,000 9,000 –––––– 54,000 –––––– Share Revaluation Retained premium surplus earnings $000 $000 $000 5,000 nil 5,100 (1,000) –––––– 4,100 4,500 –––––– 9,500 –––––– 4,000 (500) –––––– 3,500 –––––– (7,800) 500 –––––– (3,200) –––––– Total equity $000 55,100 (1,000) 13,500 (3,800) –––––– 63,800 –––––– The rights issue was 18 million shares (45,000 ÷ $0.50 × 1/5) at $0.7 = $13·5 million. This equates to the balance on the suspense account. This should be recorded as $9 million equity shares (18,000 × $0.50) and $4·5 million share premium (18,000 × ($0.75 – $0.50)). The discovery of the fraud represents an error part of which is a prior period adjustment ($1 million) in accordance with IAS 8 Accounting policies, changes in accounting estimates and errors. 1032 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) (c) Statement of financial position Assets Non-current assets Property, plant and equipment (W2) Current assets Inventory Trade receivables (28,500 – 4,000 fraud) Current tax refund $000 62,700 25,200 24,500 2,400 ––––––– Total assets Equity and liabilities Equity (see (b)) Equity shares of 50 cents each Reserves Share premium Revaluation Retained earnings Non-current liabilities Lease obligation (W2) Deferred tax (W3) Current liabilities Trade payables Lease obligation (19,300 – 15,230 (W2)) Bank overdraft $000 52,100 ––––––– 114,800 ––––––– 54,000 9,500 3,500 (3,200) ––––––– 15,230 3,000 27,300 4,070 1,400 ––––––– Total equity and liabilities 9,800 ––––––– 63,800 18,230 ––––––– 32,770 ––––––– 114,800 ––––––– WORKINGS (amounts in brackets are in $000) (1) Cost of sales Per question Amortisation of – property (W2) Amortisation of – leased plant (W2) Depreciation of other plant and equipment ((47,500 – 33,500) × 20%) ©2017 DeVry/Becker Educational Development Corp. All rights reserved. $000 298,700 4,500 5,000 2,800 ––––––– 311,000 ––––––– 1033 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK (2) Non-current assets Carrying amount 1 April 20X6 (48,000 – 16,000) Revaluation surplus 32,000 4,000 ––––––– Revalued amount 1 April 20X7 36,000 Amortisation year to 31 March 20X7 (over 8 years) (4,500) ––––––– Carrying amount 31 March 20X7 31,500 ––––––– $500,000 (4,000 ÷ 8 years) of the revaluation surplus will be transferred to retained earnings (reported in the statement of changes in equity). Leased plant: Fair value 1 April 20X6 Deposit 25,000 (2,000) ––––––– 23,000 2,300 (6,000) ––––––– 19,300 1,930 (6,000) ––––––– 15,230 ––––––– Initial liability Interest at 10% Payment 31 March 20X7 Lease obligation 31 March 20X7 Interest at 10% Payment 31 March 20X8 Lease obligation 31 March 20X8 Amortisation for the leased plant for the year ended 31 March 20X7 is $5 million (25,000 ÷ 5 years). Summarising the carrying amount of property, plant and equipment as at 31 March 20X8: Property Owned plant (47,500 – 33,500 – 2,800) Leased plant (25,000 – 5,000) (3) 31,500 11,200 20,000 ––––––– 62,700 ––––––– Deferred tax Provision required at 31 March 20X7 (12,000 × 25%) Provision at 1 April 20X6 Credit (reduction in provision) to profit or loss 1034 3,000 (3,200) ––––––– 200 ––––––– ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) Answer 6 ATLAS (a) Statement of profit or loss and other comprehensive income for the year ended 31 March 20X7 Revenue (550,000 – 10,000 in substance loan) Cost of sales (W1) Gross profit Distribution costs Administrative expenses (30,900 + 5,400 directors’ bonus of 1% of sales made) Finance costs (700 + 500 (10,000 × 10% × 6/12 in substance loan)) Profit before tax Income tax expense (27,200 – 1,200 + (9,400 – 6,200) deferred tax) Profit for the year Other comprehensive income Revaluation gain on land and buildings (W2) (36,300) (1,200) ––––––– 60,400 (29,200) ––––––– 31,200 7,000 ––––––– 38,200 ––––––– Total comprehensive income for the year (b) $000 540,000 (420,600) ––––––– 119,400 (21,500) Statement of changes in equity for the year ended 31 March 20X7 Balances at 1 April 20X6 Share issue (see below) Total comprehensive income (see (i) above) Dividend paid Balances at 31 March 20X7 Share capital $000 40,000 10,000 Share Revaluation Retained Total premium reserve earnings equity $000 $000 $000 $000 6,000 nil 11,200 57,200 14,000 24,000 7,000 –––––– 50,000 –––––– –––––– 20,000 –––––– –––––– 7,000 –––––– 31,200 38,200 (20,000) (20,000) –––––– –––––– 22,400 99,400 –––––– –––––– The rights issue of 20 million shares (50,000 ÷ $0.50 × 1/5) at $1·20 has been recorded as $10 million equity shares (20 million × $0·50) and $14 million share premium (20 million × ($1·20 – $0·50)). ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 1035 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK (c) Statement of financial position as at 31 March 20X7 Assets Non-current assets Property, plant and equipment (44,500 + 52,800 (W2)) Current assets Inventory (43,700 + 7,000 in substance loan) Trade receivables $000 $000 97,300 50,700 42,200 –––––– Plant held for sale (W2) 92,900 3,600 ––––––– 193,800 ––––––– Total assets Equity and liabilities Equity (see (b) above) Equity shares of 50 cents each Share premium Revaluation surplus Retained earnings 50,000 20,000 7,000 22,400 –––––– Non-current liabilities In substance loan from Xpede (10,000 + 500 accrued interest) Deferred tax 10,500 9,400 –––––– Current liabilities Trade payables Income tax Accrued directors’ bonus Bank overdraft 35,100 27,200 5,400 6,800 –––––– Total equity and liabilities 49,400 ––––––– 99,400 19,900 74,500 ––––––– 193,800 ––––––– WORKINGS (amounts in $000) (1) Cost of sales Per question Closing inventory (in substance loan) Depreciation of buildings (W2) Depreciation of plant and equipment (W2) (2) 411,500 (7,000) 2,500 13,600 ––––––– 420,600 ––––––– Non-current assets Land and buildings Carrying amount at 1 April 20X6 (60,000 – 20,000) Revaluation at that date (12,000 + 35,000) Gain on revaluation Buildings depreciation (35,000 ÷ 14 years) Carrying amount at 31 March 20X7 (47,000 – 2,500) 1036 40,000 47,000 ––––– 7,000 ––––– (2,500) ––––– 44,500 ––––– ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) Plant The plant held for sale should be shown separately and not depreciated after 1 October 20X6. Other plant Carrying amount at 1 April 20X6 (94,500 – 24,500) Plant held for sale (9,000 – 5,000) Depreciation for year ended 31 March 20X7 (20% reducing balance) Carrying amount at 31 March 20X7 Plant held for sale: At 1 April 20X6 (from above) Depreciation to date of reclassification (4,000 × 20% × 6/12) Carrying amount at 1 October 20X6 70,000 (4,000) –––––– 66,000 (13,200) –––––– 52,800 –––––– 4,000 (400) ––––––– 3,600 ––––––– Total depreciation of plant for year ended 31 March 20X7 (13,200 + 400) 13,600 As the fair value of the plant held for sale at 1 October 20X6 is $4·2 million, it should continue to be carried at its (lower) carrying amount (and no longer depreciated). Answer 7 EMERALD Item Answer Justification 1 Capitalised development expenditure Incurred in year to 31 March: 20X6 ($1,000 – 1/4 × 1,000) 20X7 A $000 750 400 ––––– 1,150 ––––– 2 D Depreciation of $50,000 must be expensed for the first six months of the year. As the property is being transferred from IAS 16 property to IAS 40 investment property the gain on remeasurement ($350,000) is taken through other comprehensive income. The increase in fair value of $40,000 in the second six months is credited to profit or loss. 3 A In the consolidated financial statements the asset will fall under IAS 16 and must be measured at depreciated historic cost. Depreciation of $50,000 would have been charged for the year, leaving the asset at a carrying amount of $1,450,000. 4 D The decommissioning provision will fall within the remit of IAS 37 Provisions, Contingent Liabilities and Contingent Assets 5 A The search for alternative uses falls to be treated as research expenditure. ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 1037 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK Answer 8 DERRINGDO Item Answer Justification 1 A Derringdo is acting as an agent for the sale of A grade products and therefore will not recognise any inventory for those goods. B Grade goods belong to Derringdo and will be recognised at cost in the statement of financial position. 2 B A grade – Revenue to be recognised is just the commission earned: Selling price (18,400 × 150/100) Commission (12·5% × 36,800) $000 36,800 4,600 3 C Revenue will include the carpets sold in the current year ($23,000) plus the carpets sold in the previous year ($1,200) on which revenue was not previously recognised. 4 A The change in depreciation method is a change in accounting estimate and is therefore accounted for prospectively. The new method of trading in carpets requires a new accounting policy which can only be applied on a prospective basis. 5 C No revenue would be recognised until the earlier date of the carpets having been sold onwards, or six months, and the carpets would remain as inventory of Derringdo (acting as principal in the agreement). That Derringdo can require transfer indicates that it still controls the carpets. Answer 9 LINNET (a) Recognition principles If an entity transfers control of a good or service over time, it will recognise revenue associated with that contract over a period of time if one of the following criteria is met: The customer simultaneously receives and consumes the good or service provided under the contract; The entity’s performance creates or enhances an asset that is under the customer’s control; or The entity’s performance creates an asset which the entity has no alternative use for and the entity has an enforceable right to payment for performance completed to date. If Linnet is constructing assets to customers’ specific requirements and they cannot otherwise be used by Linnet, Linnet should recognise revenue over the term of the contracts. If a performance contract is not satisfied over time, then the performance obligation will be satisfied at a point in time, when the customer obtains control of the asset. Indicators of the transfer of control may include the following: The entity has a present right to be paid for the asset; The customer has legal title to the asset; The entity has transferred physical possession of the asset; The customer has significant risks and rewards of ownership of the asset; and The customer has accepted the asset. If Linnet is fulfilling construction projects with the aim of selling on the asset at some point in the future then revenue will be recognised at a point in time, and not over the term of the construction project (e.g. if Linnet were constructing houses or apartments to sell to the public on completion. 1038 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) (b) Statement of profit or loss (extract) for the year to 31 March 20X7 $m 70 (81) ––– (11) ––– Sales revenue Cost of sales (64 + 17) Loss for period Statement of financial position extracts – as at 31 March 20X7 Current assets Work in progress (costs incurred (195 + 17)) less costs expensed (112 + 81)) Receivable (W3) 19 40 WORKINGS Sales Cost of sales Rectification costs Profit/(loss) (1) Cumulative Cumulative 1 April 20X6 31 March 20X7 $m $m 150 (W1) 220 (112) (W2) (176) nil (17) –––– –––– 38 (W2) 27 –––– –––– Amounts for year $m 70 (64) (17) –––– (11) –––– Contract sales Progress payments received are $180 million. This is 90% of the work certified (at 28 February 20X7); therefore the work certified at that date was $200 million. The value of the further work completed in March 20X7 is given as $20 million, giving a total value of contract sales at 31 March 20X7 of $220 million. (2) Total estimated profit (excluding rectification costs) Contract price Cost to date Estimated cost to complete Estimated total profit $m 300 (195) (45) –––– 60 –––– The degree of completion (by the method specified) is 220/300. Costs recognised to date are based on total expected cost of $240 million × 220/300 = $176 million less costs recognised in prior period of $112 million to arrive at costs recognised this period of $64 million. However, the rectification costs, of $17 million, are an abnormal cost and must be charged against profits in the year they are incurred; they cannot be spread over the term of the contract. Therefore costs to be recognised this period are $81 million (64 + 17), leading to a loss recognised for this period of $11 million. (3) Contract assets Total contract assets, reported as current assets, are $59 million (actual costs incurred to date (195 + 17) plus cumulative profit (27) less cash received (180)). Of this, $40 million (220 – 180 progress payments received) would be recognised as a receivable asset under IFRS 9 Financial Instruments and $19 million would be recognised as work in progress (costs incurred (195 + 17) less costs expensed (112 + 81)). ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 1039 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK Answer 10 DEARING Item Answer Justification 1 Initial cost B $000 1,050 (210) –––– 840 30 28 22 –––– 920 –––– Manufacturer’s base price Less: Trade discount (20%) Base cost Freight charges Electrical installation cost Pre-production testing Initial capitalised cost 2 C Depreciable amount = $1,260,000 – $60,000 = $1,200,000 Useful life = 6,000 hours Depreciation per depreciable hour = $200 Year 2 usage = 1,800 hours × $200 = $360,000 3 B Carrying amount of asset at 30 September 20X6 ($2,620,000 × 39/40) = $2,554,500 Revalue to $2,800,000, gives increase in value of $245,500. Of which $125,000 will be credited to profit or loss as a reversal of previous loss. Leaving $120,500 as a credit to other comprehensive income (revaluation surplus). 4 A All other expenditure would be classified as revenue-based expenditure and charged to profit or loss in the year incurred. 5 A Under IAS 16 bearer plant assets are initially measured at cost. Answer 11 SHAWLER Item Answer Justification 1 C Initial provision At 30 September 20X5 = $18,000 Discount back 2 years using 8% discount rate = $18,000 ÷ 1.082 = $15,432 2 D Remaining grant Included in non-current liabilities will be $7,200, as $1,200 will have been transferred to current liabilities. The requirement was for the total government grant, so current and non-current elements will be added together 3 B Depreciation Main body = $60,000 ÷ 10 years = $6,000 Replacement liner = $10,000 ÷ 5 years = $2,000 4 D IAS 20 requires all three disclosures in respect of government grants. 5 D There is no effect as there is no present legal obligation to fit the filters at the reporting date. 1040 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) Answer 12 DEXTERITY Item Answer Justification 1 A Goodwill B $m 35 (15) (10) (2) –––– Goodwill (to balance) 8 –––– Only development costs are capitalised; any research costs must remain expensed. Cost of investment Net assets Patent Work in progress 2 Tutorial note: Market value of an intangible asset can only be recognised if an active market for it exist, which is most unlikely for the patented drug. 3 C IAS 38 specifies that training costs cannot be capitalised and must be expensed as incurred. 4 C Under IAS 38 costs incurred in the search for possible alternative products are research expenditure and therefore must be expensed as incurred. 5 D IAS 38 only allows intangible assets that have an active market to be revalued. It does not allow the revaluation of an asset that has not previously been recognised. Answer 13 DARBY (a) Non-current assets definition There are four elements to the assistant’s definition of a non-current asset and he is substantially incorrect in respect of all of them. The term non-current assets will normally include intangible assets and certain investments; the use of the term “physical asset” would be specific to tangible assets only. Whilst it is usually the case that non-current assets are of relatively high value this is not a defining aspect. A waste paper bin may exhibit the characteristics of a non-current asset, but on the grounds of materiality it is unlikely to be treated as such. Furthermore the past cost of an asset may be irrelevant; no matter how much an asset has cost, it is the expectation of future economic benefits flowing from a resource (normally in the form of future cash inflows) that defines an asset according to the IASB’s Conceptual Framework for Financial Reporting. The concept of ownership is no longer a critical aspect of the definition of an asset. It is probably the case that most non-current assets in an entity’s statement of financial position are owned by the entity; however, it is the ability to “control” assets (including preventing others from having access to them) that is now a defining feature. For example: this is an important characteristic in treating a finance lease as an asset of the lessee rather than the lessor. It is also true that most non-current assets will be used by an entity for more than one year and a part of the definition of property, plant and equipment in IAS 16 Property, Plant and Equipment refers to an expectation of use in more than one period, but this is not necessarily always the case. It may be that a non-current asset is acquired which proves unsuitable for the entity’s intended use or is damaged in an accident. In these circumstances assets may not have been used for longer than a year, but nevertheless they were reported as non-current during the time they were in use. ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 1041 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK A non-current asset may be within a year of the end of its useful life but (unless a sale agreement has been reached under IFRS 5 Non-current Assets Held for Sale and Discontinued Operations) would still be reported as a non-current asset if it was still giving economic benefits. Another defining aspect of non-current assets is their intended use (i.e. held for continuing use in the production, supply of goods or services, for rental to others or for administrative purposes). (b) Issues (i) Training course The expenditure on the training courses may exhibit the characteristics of an asset in that they have and will continue to bring future economic benefits by way of increased efficiency and cost savings to Darby. However, the expenditure cannot be recognised as an asset on the statement of financial position and must be charged as an expense as the cost is incurred. The main reason for this lies with the issue of “control”; it is Darby’s employees that have the “skills” provided by the courses, but the employees can leave the company and take their skills with them or, through accident or injury, may be deprived of those skills. Also the capitalisation of staff training costs is specifically prohibited under International Financial Reporting Standards (specifically IAS 38 Intangible Assets). (ii) Research and development expenditure The question specifically states that the costs incurred to date on the development of the new processor chip are research costs. IAS 38 states that research costs must be expensed. This is mainly because research is the relatively early stage of a new project and any future benefits are so far in the future that they cannot be considered to meet the definition of an asset (probable future economic benefits), despite the good record of successes with similar projects. Although the work on the automatic vehicle braking system is still at the research stage, this is different in nature from the previous example as the work has been commissioned by a customer, As such, from the perspective of Darby, it is work in progress (a current asset) and should not be written off as an expense. A note of caution should be added here in that the question says that the success of the project is uncertain which presumably means it may not be completed. This does not mean that Darby will not receive payment for the work it has carried out, but it should be checked to the contract to ensure that the amount it has spent to date ($2·4 million) will be recoverable. In the event that say, for example, the contract stated that only $2 million would be allowed for research costs, this would place a limit on how much Darby could treat as work in progress. If this were the case then, for this example, Darby would have to expense $400,000 and treat only $2 million as work in progress. (iii) Installation contract The question suggests the correct treatment for this kind of contract is to treat the costs of the installation as a non-current asset and (presumably) depreciate it over its expected life of (at least) three years from when it becomes available for use. In this case the asset will not come into use until the next financial year/reporting period and no depreciation needs to be provided at 30 September 20X6. The capitalised costs to date of $58,000 should only be written down if there is evidence that the asset has been impaired. This occurs where the recoverable amount of an asset is less than its carrying amount. The assistant appears to believe that the recoverable amount is the future profit, whereas (in this case) it is the future (net) cash inflows. Thus any impairment test at 30 September 20X6 should compare the carrying amount of $58,000 with the expected net cash flow from the system of $98,000 ($50,000 per annum for three years less future cash outflows to completion the installation of $52,000 (see note below)). As the future net cash flows are in excess of the carrying amount, the asset is not impaired and it should not be written down but shown as a non-current asset (under construction) at cost of $58,000. 1042 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) Tutorial note: As the contract is expected to make a profit of $40,000 on income of $150,000, the total costs must be $110,000; with $58,000 costs to date, completion costs are $52,000. Answer 14 ESP Item Answer Justification 1 Value in use C $000 200.2 149.4 165 –––––– 514.6 –––––– Year 1 = 220 × 0.91 Year 2 = 180 × 0.83 Year 3 = (170 + 50) × 0.75 Tutorial note: Do not forget to include sale proceeds of $50,000 in year 3. 2 B Carrying amount prior to impairment Annual depreciation (800 – 50) ÷ 5years Carrying amount at end of year 2 (800 – (150 × 2)) 3 $000 150 500 A Per question $000 Goodwill 1,800 Factory 4,000 Plant 3,500 Receivables and cash 1,500 –––––– 10,800 –––––– After plant write off $000 1,800 4,000 3,000 1,500 –––––– 10,300 –––––– Write off in full Pro rata loss of 4/7 Pro rata loss of 3/7 Realisable value Value in use After impairment losses $000 – 2,286 1,714 1,500 –––––– 5,500 –––––– Tutorial note: The plant with a carrying amount of $500,000 that has been damaged to the point of no further use should be written off (it no longer meets the definition of an asset). After this: (1) (2) goodwill is written off in full; Any remaining impairment loss is written off the remaining assets pro rata to their carrying amounts, except that no asset should be written down to less than its fair value less costs to sell (net realisable value). That is, after writing off the damaged plant the remaining impairment loss is $4·8m (10.3 – 5.5) of which $1·8m is applied to the goodwill and the remaining $3.0m is apportioned pro rata (3 ÷ (4 + 3)) to the factory and the remaining plant. 4 B IAS 38 requires intangible assets not yet ready for use and intangible assets with an indefinite life to be tested annually for impairment, they are not amortised. 5 A The addition of the solar panels is an enhancing cost and would not be included in cash flows for the calculation of value in use in accordance with IAS 38. ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 1043 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK Answer 15 BOROUGH Item Answer Justification 1 Carrying amount of license Licence for oil extraction (50,000 + 20,000) Amortisation (10 years) B Carrying amount 2 A Environmental provision ((20,000 + (150,000 × $0·02)) × 1·08 finance cost) $000 70,000 (7,000) –––––– 63,000 –––––– 24,840 –––––– 3 A From Borough’s perspective, as a separate entity, the guarantee for Hamlet’s loan is a contingent liability of $10 million. As Hamlet is a separate entity, Borough has no liability for the secured amount of $15 million, not even for the potential shortfall for the security of $3 million. The $10 million contingent liability would normally be described and disclosed in the notes to Borough’s entity financial statements. 4 C A and D are only possible obligations and therefore no provision is required; B is a contingent asset. 5 C IAS 37 requires the least net cost of an onerous contract to be recognised as a provision. Answer 16 RADAR Item Answer Justification 1 D Redundancy provision 200 employees paid $5,000 each $1,000,000 Retraining costs are a cost of the ongoing business and are not provided for in advance. 2 B Loss on property, plant and equipment Carrying amount Net proceeds (500 – 50) 3 C Short-term lease rentals are normally expensed to profit or loss : Machine 1 Machine 2 Machine 3 $ 2,200 (450) ––––– 1,750 ––––– 5 × $500 4 × $1,400 2 × $800 $ 2,500 5,600 1,600 ––––– 9,700 ––––– 4 C Until drilling commences there is no legal or constructive obligation, therefore a provision is not required. 5 A Past actions or statements can be taken as a constructive obligation if a similar event happens in the future. The repair of faulty goods under the terms of a contract is a legal obligation. 1044 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) Answer 17 WAXWORK Item Answer Justification 1 C No adjustment to the current period but the event should be disclosed in current year disclosures 2 B 70% of the inventory amounts to $322,000 (460,000 × 70%) and this was sold for a net amount of $238,000 (280,000 × 85%). Inventory is required to be valued at the lower of cost and net realisable value, thus this is an adjusting event. $280,000 ÷ 70% = $400,000, less commission of 15% = $340,000. 3 C The tax rates were changed after the accounts were authorised for issue so this is not classified as an event after the reporting period. 4 A Tax expense Closing deferred tax liability ($80,000 × 24%) Opening deferred tax liability $ 19,200 24,800 –––––– (5,600) 53,960 –––––– 48,360 –––––– Decrease in liability Current tax Total tax expense 5 B IAS 41 does not apply to land related to agricultural activity (IAS 16 applies) or intangible assets related to agricultural activity (IAS 38 applies). Tutorial note: IAS 2 Inventories applies to agricultural produce after the point of harvest. Answer 18 PINGWAY Item Answer Justification 1 B $10,000,000 ÷ $100 × 20 shares = 2,000,000 shares issued on conversion 2 A Convertible loan notes – discounted using the effective interest rate of 8%: Cash flows Year 1 interest Year 2 interest Year 3 interest and capital Total value of debt component 300 300 10,300 Discount factor at 8% 0·93 0·86 0·79 Present value $000 279 258 8,137 ––––– 8,674 ––––– 3 A On initial recognition the liability recognised is based on the present value of future cash flows discounted using the effective interest rate. Interest will initially be based on this amount and be added to the liability, making the next year’s interest higher. 4 B As the loan assets are classified at fair value through other comprehensive income any changes in fair value plus any profit or loss on disposal is then reclassified to profit or loss. ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 1045 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK 5 D Loan assets that are held in a business model whose objective is achieved through collecting contractual cash flows (i.e. interest and principal repayments) and selling them must be classified as at fair value through other comprehensive income. Answer 19 PATRONIC (a) Consolidated statement of profit or loss for the year ended 31 March 20X6 Revenue (150,000 + (78,000 × 8/12) – (1,250 × 8 months intra group)) Cost of sales (W1) Gross profit Distribution costs (7,400 + (3,000 × 8/12)) Administrative expenses (12,500 + (6,000 × 8/12)) Finance costs (W2) Impairment of goodwill Share of profit from associate (6,000 × 30%) Profit before tax Income tax expense (10,400 + (3,600 × 8/12)) Profit for the year Attributable to: Equity holders of the parent Non-controlling interest (W3) (b) $000 192,000 (119,100) ––––––– 72,900 (9,400) (16,500) (5,000) (2,000) 1,800 –––––– 41,800 (12,800) –––––– 29,000 –––––– 27,400 1,600 –––––– 29,000 –––––– Significant influence An associate is defined by IAS 28 Investments in Associates and Joint Ventures as an investment over which an investor has significant influence. There are several indicators of significant influence, but the most important are usually considered to be a holding of 20% or more of the voting shares and board representation. Therefore it was reasonable to assume that the investment in Acerbic (at 31 March 20X6) represented an associate and was correctly accounted for under the equity accounting method. The current position (from May 20X6) is that although Patronic still owns 30% of Acerbic’s shares, Acerbic has become a subsidiary of Spekulate as it has acquired 60% of Acerbic’s shares. Acerbic is now under the control of Spekulate (part of the definition of being a subsidiary), therefore it is difficult to see how Patronic can now exert significant influence over Acerbic. The fact that Patronic has lost its seat on Acerbic’s board seems to reinforce this point. In these circumstances the investment in Acerbic falls to be treated under IFRS 9 Financial Instruments. It will cease to be equity accounted from the date of loss of significant influence. Its carrying amount at that date will be its initial recognition value under IFRS 9 and thereafter it will be carried at fair value. 1046 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) WORKINGS (1) Cost of sales $000 Patronic Sardonic (51,000 × 8/12) Intra group purchases (1,250 × 8 months) Additional depreciation: plant (2,400 ÷ 4 years × 8/12) property (per question) Unrealised profit in inventories (3,000 × 20/120) 400 200 –––– $000 94,000 34,000 (10,000) 600 500 ––––––– 119,100 ––––––– Tutorial note: For both sales revenues and cost of sales, only the post-acquisition intra group trading should be eliminated. (2) Finance costs Patronic per question Unwinding interest – deferred consideration (36,000 × 10% × 8/12) Sardonic (900 × 8/12) (3) $000 2,000 2,400 600 –––––– 5,000 –––––– Non-controlling interest Sardonic’s post-acquisition profit (13,500 × 8/12) Less post-acquisition additional depreciation (W1) Less goodwill impairment ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 9,000 (600) (2,000) –––––– 6,400 × 25% = 1,600 1047 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK Answer 20 PEDANTIC (a) Consolidated statement of financial position as at 30 September 20X6 Assets Non-current assets Property, plant and equipment (40,600 + 12,600 + 2,000 – 200 depreciation adjustment (W1)) Goodwill (W2) Current assets (W3) Total assets Equity and liabilities Equity attributable to owners of the parent Equity shares of $1 each (10, 000 + 1,600 (W3) Share premium (W2) Retained earnings (W4) 55,000 4,500 –––––– 59,500 21,400 –––––– 80,900 –––––– 11,600 8,000 35,700 –––––– 55,300 6,100 –––––– 61,400 Non-controlling interest (W5) Total equity Non-current liabilities 10% Loan notes (4,000 + 3,000) Current liabilities (8,200 + 4,700 – 400 intra-group balance) 7,000 12,500 –––––– 80,900 –––––– Total equity and liabilities WORKINGS (amounts in brackets in $000) (1) Net assets of Sophistic Share capital Retained earnings Fair value reserve (equipment) Unrealised profit (($8 million – $5·2 million) × 40/140 ) Total Reporting date $000 4,000 6,500 1,800 Date of acquisition $000 4,000 5,000 2,000 Change (800) –––––– 11,500 –––––– – –––––– 11,000 –––––– (800) –––––– 500 –––––– Pre-acquisition reserves: At 30 September 20X6 Earned in the post-acquisition period (3,000 × 6/12) 1048 $000 0 1,500 (200) 6,500 (1,500) –––––– 5,000 –––––– ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) (2) Goodwill in Sophistic Investment at cost (4,000 × 60% × 2/3 × $6) Fair value of non-controlling interest (see below) Cost of the controlling interest Less: Fair value of net assets at acquisition Total goodwill Fair value of non-controlling interest (at acquisition) Share of fair value of net assets (11,000 × 40%) Attributable goodwill per question 9,600 5,900 ––––– 15,500 (11,000) ––––– 4,500 ––––– 4,400 1,500 ––––– 5,900 ––––– The 1·6 million shares (4,000 × 60% × 2/3) issued by Pedantic would be recorded as share capital of $1·6 million and share premium of $8 million (1,600 × $5). (3) Current assets Pedantic Sophistic Unrealised profit in inventory Cash in transit Intra-group balance (4) Retained earnings Pedantic per statement of financial position Sophistic’s post-acquisition profit (500 × 60%) (5) 35,400 300 –––––– 35,700 –––––– Non-controlling interest Fair value on acquisition (W2) = Share of post-acquisition profits (500 × 40%) (b) 16,000 6,600 (800) 200 (600) –––––– 21,400 –––––– 5,900 200 –––––– 6,100 –––––– Accounting for Arkright If Pedantic acquires a 30% shareholding and has significant influence over Arkright, Arkright will be an associate of Pedantic. Pedantic should therefore apply the equity method to account for Arkright’s results in the consolidated financial statements. Consolidated statement of financial position No assets or liabilities of Arkright will be included in the consolidated statement of financial position. Instead Pedantic will include just one line item of “Investment in associate”. The amount of this investment will be the cost of investment plus a share (30%) of postacquisition profits less any impairment losses. ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 1049 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK Consolidated statement of profit or loss and other comprehensive income No revenue or expenses of Arkright will be included in the consolidated statement. Instead Pedantic will include a single line item “Share of profit of associate” as a source of other income above income tax expense in the consolidated statement (i.e. before profit before tax where that is shown). The amount of this will be Pedantic’s share (30%) of Arkright’s profit after tax. The “bottom line” of the acquisition method of accounting for Sophistic and the equity method of accounting for Arkright is the same, in that both methods include a percentage of profits of the investment. What is different is how that is presented: for a subsidiary: 100% of the profit is initially taken and then a deduction is made for the non-controlling interest to leave the parent’s share of the profits (60% in the case of Sophistic); for an associate: only the parent’s share (30% in the case of Arkright) is included as a single line item. Using the acquisition method goodwill relating to the subsidiary is presented separately but under the equity method any goodwill relating to the associate is included in the cost of investment. The acquisition method includes 100% of the assets, liabilities, revenue and expenses of the subsidiary but the equity method does not include any of these items in the consolidated statements. This means that a non-controlling is recognised under the acquisition method (unless the subsidiary is wholly-owned) but never arises when applying the equity method. Answer 21 PANDAR (a) Goodwill in Salva at 1 April 20X6 $000 Controlling interest Shares issued (120 million × 80% × 3/5 × $6) Non-controlling interest (120 million × 20% × $3·20) Equity shares Pre-acquisition reserves: At 1 October 20X5 To date of acquisition (see below) Fair value adjustments (5,000 + 20,000) Goodwill arising on acquisition $000 345,600 76,800 ––––––– 422,400 120,000 152,000 11,500 25,000 ––––––– 308,500 ––––––– 113,900 ––––––– The interest on the 8% loan note is $2 million ($50 million × 8% × 6/12). This is included in Salva’s statement of profit or loss in the post-acquisition period. Thus Salva’s profit for the year of $21 million has a split of $11·5 million pre-acquisition ((21 million + 2 million interest) × 6/12) and $9·5 million post-acquisition. 1050 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) (b) Consolidated statement of profit or loss for the year ended 30 September 20X6 $000 Revenue (210,000 + (150,000 × 6/12) – 15,000 intra-group sales) Cost of sales (W1) Gross profit Distribution costs (11,200 + (7,000 × 6/12)) Administrative expenses (18,300 + (9,000 × 6/12)) Investment income (W2) Finance costs (W3) Share of loss from associate (5,000 × 40% × 6/12) Impairment of investment in associate Profit before tax Income tax expense (15,000 + (10,000 × 6/12)) Profit for the year Attributable to: Owners of the parent Non-controlling interest (W4) (1,000) (3,000) –––––– $000 270,000 (162,500) ––––––– 107,500 (14,700) (22,800) 1,100 (2,300) (4,000) ––––––– 64,800 (20,000) ––––––– 44,800 ––––––– 43,000 1,800 ––––––– 44,800 ––––––– WORKINGS (amounts in brackets in $000) (1) Cost of sales Pandar Salva (100,000 × 6/12) Intra-group purchases Additional depreciation: plant (5,000 ÷ 5 years × 6/12) Unrealised profit in inventories (15,000 ÷ 3 × 20%) 126,000 50,000 (15,000) 500 1,000 ––––––– 162,500 ––––––– As the registration of the domain name is renewable indefinitely (at only a nominal cost) it will not be amortised. (2) Investment income In Pandar’s statement of profit or loss (given) Intra-group interest (50,000 × 8% × 6/12) Intra-group dividend (8,000 × 80%) (3) 9,500 (2,000) (6,400) ––––– 1,100 ––––– Finance costs Pandar Salva post-acquisition ((3,000 – 2,000) × 6/12) 1,800 500 ––––– 2,300 ––––– Tutorial note: $2,000 of Salva interest is intra-group and so is cancelled on consolidation to match the cancelling of the income (W2). ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 1051 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK (4) Non-controlling interest Salva’s post-acquisition profit (see (i) above) Less: post-acquisition additional depreciation (W1) 9,500 (500) –––––– 9,000 × 20% = 1,800 –––––– –––––– Answer 22 PRODIGAL (a) Consolidated statement of profit or loss and other comprehensive income for the year ended 31 March 20X6 6 Revenue (450,000 + (240,000 × /12) – 40,000 intra-group sales) Cost of sales (W1) Gross profit Distribution costs (23,600 + (12,000 × 6/12)) Administrative expenses (27,000 + (23,000 × 6/12)) Finance costs (1,500 + (1,200 × 6/12)) Profit before tax Income tax expense (48,000 + (27,800 × 6/12)) Profit for the year $000 530,000 (278,800) ––––––– 251,200 (29,600) (38,500) (2,100) ––––––– 181,000 (61,900) ––––––– 119,100 ––––––– Other comprehensive income Gain on revaluation of land (2,500 + 1,000) 3,500 Loss on fair value of equity financial asset investments (700 + (400 × 6/12)) (900) ––––––– 2,600 ––––––– Total comprehensive income 121,700 ––––––– Profit attributable to: Owners of the parent 111,600 Non-controlling interest (W2) 7,500 ––––––– 119,100 ––––––– Total comprehensive income attributable to: Owners of the parent 114,000 Non-controlling interest (W2) 7,700 ––––––– 121,700 ––––––– 1052 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) (b) Equity section of consolidated statement of financial position as at 31 March 20X6 Equity attributable to owners of the parent Share capital (250,000 + 80,000) Share premium (100,000 + 240,000) Revaluation surplus (land) (8,400 + 2,500 + (1,000 × 75%)) Other equity reserve (3,200 – 700 – (400 × 6/12 × 75%)) Retained earnings (W3) Non-controlling interest (100,000 at acquisition + 7,700 (per (a)) Total equity 330,000 340,000 11,650 2,350 201,600 ––––––– 885,600 107,700 ––––––– 993,300 ––––––– Tutorial note: The share exchange would result in Prodigal issuing 80 million shares (160,000 × 75% × 2/3) at a value of $4 each (capital 80,000; premium 240,000). WORKINGS (amounts in brackets in $000) (1) Cost of sales $000 Prodigal 260,000 Sentinel (110,000 × 6/12) 55,000 Intra-group purchases (40,000) Unrealised profit on sale of plant 1,000 Depreciation adjustment on sale of plant (1,000 ÷ 2½ years × 6/12) (200) Unrealised profit in inventory (12,000 × 10,000 ÷ 40,000) 3,000 ––––––– 278,800 ––––––– (2) Non-controlling interest in profit or loss and other comprehensive income Sentinel’s post-acquisition profit (66,000 × 6/12) Less: Unrealised profit in inventory (W1) Non-controlling interest in total comprehensive income Profit or loss (30,000 × 25%) Other comprehensive income (1,000 – (400 × 6/12) × 25%) (3) 33,000 (3,000) –––––– 30,000 –––––– 7,500 200 –––––– 7,700 –––––– Retained earnings Prodigal at 1 April 20X5 Per (a) ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 90,000 111,600 ––––––– 201,600 ––––––– 1053 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK Answer 23 VIAGEM (a) Consolidated goodwill on acquisition of Greca as at 1 January 20X6 $000 Investment at cost Shares (10,000 × 90% × 2/3 × $8·50) Non-controlling interest (10,000 × 10% × $2·50) Net assets (based on equity) of Greca as at 1 January 20X6 Equity shares 10,000 Retained earnings b/f at 1 October 20X5 35,000 Earnings 1 October 20X5 to acquisition (6,200 × 3/12) 1,550 Fair value adjustment – plant 1,800 –––––– Net assets at date of acquisition Consolidated goodwill (b) $000 51,000 2,500 –––––– 53,500 (48,350) –––––– 5,150 –––––– Consolidated statement of profit or loss for the year ended 30 September 20X6 Revenue (64,600 + (38,000 × 9/12) Cost of sales (W) Gross profit Distribution costs (1,600 + (1,800 × 9/12)) Administrative expenses (3,800 + (2,400 × 9/12) + 2,000 goodwill impairment) Income from associate (2,000 × 40% based on underlying earnings) Finance costs Profit before tax Income tax expense (2,800 + (1,600 × 9/12)) Profit for the year $000 93,100 (71,150) –––––– 21,950 (2,950) (7,600) 800 (420) –––––– 11,780 (4,000) –––––– 7,780 –––––– Profit for year attributable to: Equity holders of the parent 7,560 Non-controlling interest ((6,200 × 9/12) – 450 depreciation – 2,000 goodwill impairment) × 10%)) 220 –––––– 7,780 –––––– WORKING in $000 Cost of sales Viagem Greca (26,000 × 9/12) Additional depreciation (1,800 ÷ 3 years × 9/12) 1054 51,200 19,500 450 –––––– 71,150 –––––– ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) (c) Profit on disposal If Viagem were to dispose of its shareholding in Greca then the consolidated statement of financial position would no longer recognise the net assets of the subsidiary; non-controlling interest would also no longer be included in the statement. The consolidated profit or loss would include the results of Greca until the date of disposal with non-controlling interest taking their 10% share of those profits. The consolidated profit or loss would also include the profit on disposal of the shareholding. Viagem single entity profit $000 55,000 (51,000) –––––– 4,000 –––––– Proceeds Cost of investment (a) Profit on disposal Viagem consolidated profit $000 Proceeds Greca net assets on disposal Goodwill remaining (5,150 – 2,000) Fair value non-controlling interest 52,550 3,150 (2,720) –––––– Profit on disposal $000 55,000 (52,980) –––––– 2,020 –––––– Tutorial note: The difference 1,980 (4,000 – 2,020) is the group’s share of post-acquisition profit 90% × ((6,200 × 9/12) – (2,000 + 450)). Answer 24 PARADIGM Item Answer 1 Justification A Share exchange ((20,000 × 75%) × 2/5 × $2) 10% Loan notes (15,000 × 100/1,000) Cost of investment $000 12,000 1,500 –––––– 13,500 –––––– 2 D Non-controlling interest is $6,000,000 (20m × 25% × $1·20). 3 B 47,400 (parent) + 25,500 (subsidiary) – 3,000 fair value adjustment + 500 depreciation) = 70,400 ($000) 4 C Negative goodwill arises when the parent acquires shares in subsidiary for less than fair value. The gain belongs entirely to the parent and is credited immediately to consolidated profit or loss. 5 C Consolidated profit or loss on disposal is calculated as: Proceeds – Subsidiary’s net assets – Remaining goodwill + Non-controlling interest. ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 1055 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK Answer 25 POLESTAR (a) Consolidated statement of profit or loss for the year ended 30 September 20X6 6 Revenue (110,000 + (66,000 × /12)) Cost of sales (W1) Gross profit Distribution costs (3,000 + (2,000 × 6/12)) Administrative expenses (5,250 + (2,400 × 6/12) – 3,400 “excess” (W3)) Loss on equity investments Decrease in contingent consideration (1,800 – 1,500) Finance costs Profit before tax Income tax expense (3,500 – (1,000 × 6/12)) Profit for the year Profit for year attributable to: Equity holders of the parent Non-controlling interest losses (see below) $000 143,000 (121,700) ––––––– 21,300 (4,000) (3,050) (200) 300 (250) ––––––– 14,100 (3,000) ––––––– 11,100 ––––––– 11,700 (600) ––––––– 11,100 ––––––– Southstar’s adjusted post-acquisition losses for the year ended 30 September 20X6 are $3 million (4,600 × 6/12 + (100 additional depreciation)). Therefore the non-controlling interest’s share of the losses is $600,000 (2,400 × 25%). Tutorial note: IFRS 3 “Business Combinations” states that any excess of fair value of net assets over consideration (“negative goodwill”) should be credited to the acquirer, thus none is attributed to the non-controlling interest. 1056 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) (b) Consolidated statement of financial position as at 30 September 20X6 $000 Assets Non-current assets Property, plant and equipment (W2) Financial asset: equity investments (16,000 – (13,500 cash consideration) – 200 loss) Current assets (16,500 + 4,800) Total assets Equity and liabilities Equity attributable to owners of the parent Equity shares of 50 cents each Retained earnings (W4) Non-controlling interest (W5) Total equity Current liabilities Contingent consideration Other (15,000 + 7,800) Total equity and liabilities 63,900 2,300 ––––––– 66,200 21,300 ––––––– 87,500 ––––––– 30,000 30,200 ––––––– 60,200 3,000 ––––––– 63,200 1,500 22,800 ––––––– 87,500 ––––––– WORKINGS (amounts in brackets in $000) (1) Cost of sales Polestar Southstar (67,200 × 6/12) Additional depreciation on property (2,000 ÷10 years × 6/12) (2) $000 88,000 33,600 100 ––––––– 121,700 ––––––– Property, plant and equipment Polestar Southstar Fair value adjustment Additional depreciation ©2017 DeVry/Becker Educational Development Corp. All rights reserved. $000 41,000 21,000 2,000 (100) –––––– 63,900 –––––– 1057 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK (3) Goodwill in Southstar $000 Investment at cost Immediate cash consideration (6,000 × 2 (i.e. shares of $0.50) × 75% × $1·50) Contingent consideration Non-controlling interest (12,000 × 25% × $1·20) Net assets (equity) of Southstar at 30 September 20X6 Add back: post-acquisition losses (4,600 × 6/12) Fair value adjustment for property 13,500 1,800 3,600 –––––– 18,900 18,000 2,300 2,000 –––––– Net assets at date of acquisition Bargain purchase – excess credited directly to profit or loss (4) (22,300) –––––– (3,400) –––––– Retained earnings Polestar Southstar’s post-acquisition adjusted losses (2,400 × 75%) Negative goodwill Loss on equity investments Decrease in contingent consideration (5) $000 $000 28,500 (1,800) 3,400 (200) 300 –––––– 30,200 –––––– Non-controlling interest in statement of financial position At date of acquisition Post-acquisition loss from statement of profit or loss $000 3,600 (600) –––––– 3,000 –––––– Answer 26 RANGOON Item Answer Justification 1 B IAS 21 states that functional currency should be determined by the currency in which an entity sells its product and in which it incurs its input costs. 2 D Carrying amount at fair value in accordance with IFRS 9: 1 January (Krown 7,430,000 ÷ $4.99) 31 December (Krown 8,100,000 ÷ $6.02) Change in value $ 1,488,978 1,345,515 –––––––– 143,463 loss –––––––– 3 B Carrying amount 31 December is Krown 528,000 ÷ $6.02 = $87,708 4 A Gains and losses on the translation of foreign denominated monetary balances are presented in profit or loss 5 C Change in functional currency only occurs if the underlying economic conditions change. 1058 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) Answer 27 WITTON WAY (a) Disposal of Brew4Two It is highly likely that Brew4Two would be classified as a component of the group as cash flows and results would be distinguishable from those cash flows and results of other components of the group, namely Witton Way. A component of a group that has been disposed of in the period and represents a separate major line of business, as Brew4Two does, will be classified as a discontinued operation. The consolidated statement of profit or loss of Witton Way must present a single amount, comprising the post-tax operating profit or loss for Brew4Two for the period and the profit or loss made on its disposal. This amount must then be analysed, either in the statement of profit or loss or the notes thereto, between revenue and expenses, the profit or loss on disposal and the tax related to the two components. In the consolidated statement of cash flows the net cash flows relating to operating, investing and financing activities for Brew4Two must also be disclosed separately from those cash flows relating to continuing operations. The disclosures should also be made for all prior period results presented in the financial statements. Therefore the results for 20X6 for Brew4Two must also be presented separately from continuing operations. (b) Ratios and analysis 20X7 20X6 Return on Capital Employed (ROCE) Profit before interest and tax (PBIT) ÷ Long-term capital employed Excluding results of Brew4Two 7,490 ÷ 42,420 = 17.6% 4,600 ÷ 46,050 = 10% 5,300 (W) ÷ 42,420 = 12.5% Working: 7,490 – 1,400 – (480 + 310) = 5,300 Profit margin PBIT ÷ Revenue Excluding results of Brew4Two 7,490 ÷ 25,060 = 29.9% 4,600 ÷ 26,140 = 17.6% 5,300 ÷ 20,950 = 25.3% Asset turnover Revenue ÷ Long-term capital employed 25,060 ÷ 42,420 = 0.59 Excluding results of Brew4Two 20,950 ÷ 42,420 = 0.49 26,140 ÷ 46,050 = 0.57 Tutorial note: Alternatively, asset turnover may be calculated as ROCE ÷ Profit margin (e.g. for 20X6, 10% ÷ 17.6% = 0.57). The formula would usually take Revenue (25,050) and divide by Long-Term Capital Employed (42,420). ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 1059 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK Inventory days Inventory ÷ Cost of sales × 365 (8,420 ÷ 13,390) × 365 = 230 days (5,270 ÷ 18,730) × 365 = 103 days (5,470 ÷ 20,950) × 365 = 95 days (3,900 ÷ 26,140) × 365 = 54 days (3,760 ÷ 13,390) × 365 = 102 days (2,460 ÷ 18,730) × 365 = 48 days 13,390 = 16,190 – 2,800 (group- sub) Receivable days Receivables ÷ Revenue × 365 20,950 = 25,060 – 4,110 (group- sub) Payable days Payables ÷ Cost of sales × 365 13,390 = 16,190 – 2,800 (group- sub) The inventory, receivables and payables day calculations for 20X7 exclude the results of Brew4Two for the period. The payables figures are based on current liabilities less tax payable. Analysis The results of Brew4Two are included for the whole of year ended 30 April 20X6 but only 6 months of results are included for year ended 30 April 20X7; this makes meaningful comparison of the two sets of figures unreliable without additional information. However, the figures can still be analysed and commentary can be made, with the proviso that further investigation would be needed. Some of the calculations above have adjusted the figures to exclude the results of Brew4Two for 20X7. The results for 20X7 do show that profits have more than doubled, but what needs to be taken into consideration is that the results for 20X7 do include the profit on disposal of Brew4Two plus 6 months of revenue and expenses; when adjusting for these figures ROCE has only increased to 12.5%, rather than 17.6% when looking at the reported results for the period. Therefore the comment made by the CEO regarding the increase in profits, although correct, needs to be put into context and must take account of the disposal of the subsidiary during the year. Profit margin is much higher in 20X7, even after adjusting for the results of Brew4Two, this would indicate that the ongoing business was selling goods at a higher margin than Brew4Two which might indicate that the disposal of the company was a good move. However, Brew4Two was still a profitable entity and unless the resources freed up by the disposal are put to good use then Witton Way could see profits begin to decrease in the future. The asset turnover figures indicate that the business is selling high-margin, low-volume goods; it seems that the group is very capital intensive. If demand for the products were to fall this could cause problems for Witton Way as profits would fall and it could take some time for the company to generate new growth, either organically or through acquisitions or mergers. The working capital days do give some worrying results as inventory days have more than doubled, receivable days have nearly doubled and payable days have also more than doubled. This is a very worrying trend and is a sign that Witton Way has lost control of its working capital. It appears that Witton Way may be producing excess goods, and have poor inventory management. It is no good manufacturing goods if they cannot be sold. 1060 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) Once the goods have been sold there is then a further problem of collecting cash as it now takes three months for the customer to pay for their goods, rather than two months previously. This is also shown up by cash balances in the statement of financial position, at the end of the previous year cash balance of $1,600,000 was held, currently the balance is just $40,000. Although profitability is increasing and the CEO is aiming for even further increases in profitability it is worrying that the management of inventory and receivables is resulting in a deteriorating liquidity situation, which if allowed to continue could be a major cause for concern. It is no good making profits if the company is illiquid. It should be noted that gearing levels are low and some long-term debt was repaid during the year, or was part of the liabilities of Brew4Two that were disposed of during the year. However, interest expense has increased even though long-term debt has decreased; this could be due to overdrawn bank balances resulting in higher interest charges. This could tie in with the low cash balance, perhaps for some of the year Witton Way was overdrawn at the bank. Although profit for 20X7 was good it is worrying to see that retained earnings have only increased by $130,000. Some of the difference would be due to the retained earnings of Brew4Two that are no longer included in the consolidated figures; the remainder of the difference is probably due to a large dividend payment. This is further cause for concern especially when linked to the reduced cash balance. For a fair comparison to be made the results of the discontinued operation, Brew4Two, would need to be totally excluded from both years, along with the profit on disposal. It would also be useful to see industry averages, to assess whether Witton Way was performing above or below the industry average. Summarising the main issues from this analysis: Profits are increasing; Liquidity is a cause for concern; Poor working capital management. Answer 28 IONA (a) Performance, financial position and liquidity Introduction The financial statements and ratios provided by the directors appear to show strong growth between 20X6 and 20X7. This is reflected by pre-tax profits increasing by 22% ((2,160 ÷ 1,770) – 1). The strength of the statement of financial position seems to have improved as gearing has reduced and ROCE improved. Tutorial note: Additional ratios are included in an appendix. Profitability ROCE has increased to 11.6%. This is significantly above the market average; it is likely that the acquisition of Arran has contributed to this ROCE. The calculation of ROCE uses the capital employed based on the closing statement of financial position whereas the results of the acquired operations are only included for three months. Therefore the calculation is mismatched and in this situation will understate ROCE. ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 1061 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK Revenue has increased by 19% year on year ((23,460 ÷ 19,710) – 1). However, excluding the acquisition of Arran the organic growth rate is 11.2% (((23,460 – 1,550) ÷ 19,710) – 1). This is below the industry estimate of the growth in the engineering market. While Iona has a stated growth strategy, their above average performance arises from acquisitions. Staff numbers have decreased year on year, which is surprising as Arran was acquired during the year, which would lead to an increase in employee numbers. It may be that as part of the acquisition Iona has rationalised their operations and made employees redundant. This could have led to large redundancy payments being made resulting in an increase in operating expenses and a decrease in the operating margin. The gross profit margin has increased marginally (by half of a percentage point). No details are given for the margin of the acquired company, so no detailed analysis can be undertaken. Arran appears to be more profitable than the existing operations but without a detailed analysis this cannot be confirmed. Operating expenses have increased by 34.8% ((3,410 ÷ 2,530) – 1) and now represent 14.5% of revenue (20X6 – 12.8%). This increase seems unusual given the reductions in employee numbers. It may be that the rationalisation of employees has increased inefficiency in other areas, or as mentioned above has led to high redundancy costs for the period. Profit from operations has increased by 9.7% ((3,270 ÷ 2,980) – 1). However, the operating profit margin has reduced by over one percentage point. As gross profit has increased marginally the marked change is within operating expenses. The acquired operations have an operating margin of 24.5% (380 ÷ 1,550). Excluding the acquired operations, profits from operations have reduced by 3% (((3,270 – 380) ÷ 2,980) – 1) and operating margins to 13.2%. The acquired operations have masked underperformance in the existing operations. Interest cover has increased from 2.5 times to 2.9 times. This is probably due to the issue of share capital for the acquisition of Arran and also the reduction of debt of $2.5 million. Dividend cover has decreased to 1.4 times. The increase in share capital has increased the amount of dividend paid despite the dividend per share remaining unchanged. The new shares issued are entitled to the full annual dividend. However, Arran’s profits are only included for three months and this will distort dividend cover. Financial position The gearing has reduced dramatically from 42.8% to 23.7%. The use of shares to acquire Arran would have positively affected gearing. The combination of the new shares and the retained earnings has contributed positively to the reduction in net debt of over $2.5 million (20X7: 5,500 – 100; 20X6: 8,000 – 20). The non-current asset turnover (1.07 times compared to 0.89 times) and net asset turnover (0.82 times compared to 0.74 times) figures show year on year improvements. This would probably arise from the acquisition as the non-current assets acquired were $1,480,000 and the revenue for the three months was over $1.5 million. The acquisition of Arran generated over $1.5 million of intangible assets, being customer base and goodwill. It is likely that these two intangibles will have to be written off in the near future, especially the customer base, resulting in additional expenses in future years. 1062 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) The finance cost in the statement of profit or loss does not yet appear to reflect the reduced level of borrowing. Net debt at year end is over $2.5 million lower than 20X6. The annual finance cost of this net debt level should be substantially lower than the amount in the statement of profit or loss. Liquidity The current ratio shows no marked change year on year. However, the acid test ratio has fallen to 0.92 times from 1.00 times. Hence inventory levels have changed significantly. Inventory turnover has reduced to 3.9 times (20X6: 4.4 times). This is high but may reflect a long production cycle in the engineering sector. In anticipating further growth Iona may be investing in inventory levels to meet increased customer demand. The trade receivable collection period has decreased from 41 days to 37 days. This may reflect a change in customer mix either from existing customers or as a result of the acquisition. Trade payables payment period has reduced marginally from 42 days to 41 days. No trade payables information was available for Arran. It may be that current supply chain arrangements have been used for the acquired operations. These ratios have been calculated based on the year end statement of financial position. However, only three months results for Arran are included in the statement of profit or loss. This could have a significant effect on the ratios presented. Appendix – Additional ratios 20X7 20X6 Gross profit percentage = Gross profit × 100 Revenue 6,680 × 100 23,460 5,510 × 100 19,710 = 28.5% = 28.0% 3,410 × 100 23,460 2,530 × 100 19,710 = 14.5% = 12.8% Operating cost percentage = Operating costs/overheads × 100 Re venue Operating margin (ex-acquisition) = Profit from operations - acquired Re venue (3,270 - 380) × 100 (23,460 - 1,550) = 13.2% 1 5.1% (no change) 6,790 = 2.56:1 2,650 5,480 = 2.47:1 2,220 Current ratio = ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 1063 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK Acid test ratio = = 6,790 4,340 = 0.92:1 2,650 5,480 3,250 = 1.00:1 2,220 23,460 = 1.07 times 22,010 19,710 = 0.89 times 22,190 23,460 (23,220 5,500 100) 19,710 (18,650 8,000 20) = 0.82 times = 0.74 times 1,350 = 1.41 times 960 1,180 = 1.48 times 800 3,270 = 2.9 times 1,110 2,980 = 2.5 times 1,210 Non-current asset turnover = Revenue Non - current assets Net asset turnover = Revenue Equity + net debt Dividend cover = Profit after tax Dividends payable Interest cover = PBIT + Investment income Interest payable Tutorial note: Only an additional five ratios were required; as an acquisition occurred during the year ratios that excluded the results of the acquired company would generate relevant information. (b) Disclosure of acquisitions The disclosure of information on business combinations during the year allows a user of financial information to evaluate the nature and financial effect of the combination. The disclosures assist in explaining the financial performance and confirming previous estimates. They also have a predictive quality and help formulate judgements about future performance. Business combinations accounted for as acquisitions raise questions about the consistency of financial information and its comparability year on year. Statements of profit or loss only reflect results from the date of acquisition. Statements of financial position reflect the assets at year end. Even rudimentary analysis can be difficult. Providing details of the acquisition, the results included in the statement of profit or loss and proforma information about the whole year assists the user in understanding performance and position. 1064 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) Answer 29 HARBIN (a) Ratios Calculated in $m: 20X6 ROCE 11·2 % Net asset turnover 1·2 times Gross profit margin (given) 20% Net profit (before tax) margin 6·4% Current ratio 0·9:1 Closing inventory holding period 46 days Receivables’ collection period 19 days Gearing 46·7% WORKINGS /(114 + 100) 250 /214 24 16 /250 /44 25 /200 × 365 13 /250 × 365 100 /214 38 20X5 7·1% 1·6 16·7% 4·4% 2·5 37 16 nil 20X5 Fatima (b) 18·9% 0·6 42·9% 31·4% The gross profit margins and relevant ratios for 20X5 are given in the question, and some additional ratios for Fatima are included above to enable a clearer analysis in answering part (b) (references to Fatima should be taken to mean Fatima’s net assets). (b) Analysis Analysis of the comparative financial performance and position of Harbin for the year ended 30 September 20X6. (References to 20X6 and 20X5 should be taken as the years ended 30 September 20X6 and 20X5.) Introduction The figures relating to the comparative performance of Harbin “highlighted” in the Chief Executive’s report may be factually correct, but they take a rather biased and one dimensional view. They focus entirely on the performance as reflected in profit or loss without reference to other measures of performance (notably the ROCE); nor is there any reference to the purchase of Fatima at the beginning of the year which has had a favourable effect on profit for 20X6. Due to this purchase, it is not consistent to compare Harbin’s results in 20X5 directly with those of 20X6 because it does not match like with like. Immediately before the $100 million purchase of Fatima, the carrying amount of the net assets of Harbin was $112 million. Thus the investment represented an increase of nearly 90% of Harbin’s existing capital employed. The following analysis of performance will consider the position as shown in the reported financial statements (based on the ratios required by part (a) of the question) and then go on to consider the impact the purchase has had on this analysis. Profitability The ROCE is often considered to be the primary measure of operating performance, because it relates the profit made by an entity (return) to the capital (or net assets) invested in generating those profits. On this basis the ROCE in 20X6 of 11·2% represents a 58% improvement (i.e. 4·1% on 7·1%) on the ROCE of 7·1% in 20X5. Given there were no disposals of non-current assets, the ROCE on Fatima’s net assets is 18·9% ((22m ÷ 100m) + 16·5m). Tutorial note: The net assets of Fatima at the year-end would have increased by profit after tax of $16·5 million (i.e. 22m × 75% (at a tax rate of 25%)). Put another way, without the contribution of $22 million to profit before tax, Harbin’s “underlying” profit would have been a loss of $6 million which would give a negative ROCE. The principal reasons for the beneficial impact of Fatima’s purchase is that its profit margins at 42·9% gross and 31·4% net (before tax) are far superior to the profit margins of the combined business at 20% and 6·4% respectively. ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 1065 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK The other contributing factor to the ROCE is the net asset turnover and in this respect Fatima’s is actually inferior at 0·6 times (70m ÷ 116·5m) to that of the combined business of 1·2 times. It could be argued that the finance costs should be allocated against Fatima’s results as the proceeds of the loan note appear to be the funding for the purchase of Fatima. Even if this is accepted, Fatima’s results still far exceed those of the existing business. Thus the Chief Executive’s report, which is already criticised for focussing on statement of profit or loss alone, is still highly misleading. Without the purchase of Fatima, underlying sales revenue would be flat at $180 million and the gross margin would be down to 11·1% (20m ÷ 180m) from 16·7% resulting in a loss before tax of $6 million. This sales performance is particularly poor given it is likely that there must have been an increase in spending on property plant and equipment beyond that related to the purchase of Fatima’s net assets as the increase in property, plant and equipment is $120 million (after depreciation). Liquidity The company’s liquidity position as measured by the current ratio has deteriorated dramatically during the period. A relatively healthy 2·5:1 is now only 0·9:1 which is rather less than what one would expect from the quick ratio (which excludes inventory) and is a matter of serious concern. A consideration of the component elements of the current ratio suggests that small increases in both the inventory and trade receivables holding days should have caused the current ration to increase, the opposite of what has actually happened. The real culprit of the current ration falling below 1:1 is the cash position. Harbin has gone from having a bank balance of $14 million in 20X5 to showing short-term bank borrowings of $17 million in 20X6. A cash flow statement would give a better appreciation of the movement in the bank/short term borrowing position. It is not possible to assess, in isolation, the impact of the purchase of Fatima on the liquidity of the company. Dividends A dividend of $0.10 per share in 20X6 amounts to $10 million (100m × $0.10), thus the dividend in 20X5 would have been $8 million (the dividend in 20X6 is 25% up on 20X5). It may be that the increase in the reported profits led the Board to pay a 25% increased dividend, but the dividend cover is only 1·2 times (12m ÷ 10m) in 20X6 which is very low. In 20X5 the cover was only 0·75 times (6m ÷ 8m) meaning previous years’ reserves were used to facilitate the dividend. The low retained earnings indicate that Harbin has historically paid a high proportion of its profits as dividends. However in times of declining liquidity, it is difficult to justify such high dividends. Gearing The company has gone from a position of nil gearing (i.e. no long-term borrowings) in 20X5 to a relatively high gearing of 46·7% in 20X6. This has been caused by the issue of the $100 million 8% loan note which would appear to be the source of the funding for the $100 million purchase of Fatima’s net assets. At the time the loan note was issued, Harbin’s ROCE was 7·1%, slightly less than the finance cost of the loan note. In 20X6 the ROCE has increased to 11·2%, thus the manner of the funding has had a beneficial effect on the returns to the equity holders of Harbin. However, high gearing does not come without risk; any future downturn in the results of Harbin would expose the equity holders to much lower proportionate returns and continued poor liquidity may mean payment of the loan interest could present a problem. Harbin’s gearing and liquidity position would have looked far better had some of the acquisition been funded by an issue of equity shares. 1066 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) Conclusion There is no doubt that the purchase of Fatima has been a great success and appears to have been a wise move on the part of the management of Harbin. However, it has disguised a serious deterioration of the underlying performance and position of Harbin’s existing activities which the Chief Executive’s report may be trying to hide. It may be that the acquisition was part of an overall plan to diversify out of what has become existing loss making activities. If such a transition can continue, then the worrying aspects of poor liquidity and high gearing may be overcome. Answer 30 VICTULAR (a) Equivalent ratios from the financial statements of Merlot (workings in $000) Return on year end capital employed (ROCE) 20·9% (1,400 + 590) ÷ (2,800 + 3,200 + 500 + 3,000) Pre-tax return on equity (ROE) 50% 1,400/2,800 Net asset turnover 2·3 times 20,500 ÷ (14,800 – 5,700) Gross profit margin 12·2% 2,500/20,500 Operating profit margin 9·8% 2,000/20,500 Current ratio 1·3:1 7,300/5,700 Closing inventory holding period 73 days 3,600/18,000 × 365 Trade receivables’ collection period 66 days 3,700/20,500 × 365 Trade payables’ payment period 77 days 3,800/18,000 × 365 Gearing 71% (3,200 + 500 + 3,000) ÷ 9,500 × 100 Interest cover 3·3 times 2,000/600 Dividend cover 1·4 times 1,000/700 As stated, Merlot’s obligations under finance leases (3,200 + 500) have been treated as debt when calculating the ROCE and gearing ratios. (b) Relative performance and financial position of Grappa and Merlot for the year ended 30 September 20X6 Introduction This report is based on the draft financial statements supplied and the ratios shown in (a) above. Although covering many aspects of performance and financial position, the report has been approached from the point of view of a prospective acquisition of the entire equity of one of the two companies. Profitability The ROCE of 20·9% of Merlot is far superior to the 14·8% return achieved by Grappa. ROCE is traditionally seen as a measure of management’s overall efficiency in the use of the finance/assets at its disposal. More detailed analysis reveals that Merlot’s superior performance is due to its efficiency in the use of its net assets; it achieved a net asset turnover of 2·3 times compared to only 1·2 times for Grappa. Put another way, Merlot makes sales of $2·30 per $1 invested in net assets compared to sales of only $1·20 per $1 invested for Grappa. The other element contributing to the ROCE is profit margins. In this area Merlot’s overall performance is slightly inferior to that of Grappa, gross profit margins are almost identical, but Grappa’s operating profit margin is 10·5% compared to Merlot’s 9·8%. In this situation, where one company’s ROCE is superior to another’s it is useful to look behind the figures and consider possible reasons for the superiority other than the obvious one of greater efficiency on Merlot’s part. ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 1067 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK A major component of the ROCE is normally the carrying amount of the non-current assets. Consideration of these in this case reveals some interesting issues. Merlot does not own its premises whereas Grappa does. Such a situation would not necessarily give a ROCE advantage to either company as the increase in capital employed of a company owning its factory would be compensated by a higher return due to not having a rental expense (and vice versa). If Merlot’s rental cost, as a percentage of the value of the related factory, was less than its overall ROCE, then it would be contributing to its higher ROCE. There is insufficient information to determine this. It may be that Merlot’s owned plant is nearing the end of its useful life (carrying amount is only 22% of its cost) and the company seems to be replacing owned plant with leased plant. Again this does not necessarily give Merlot an advantage, but the finance cost of the leased assets at only 7·5% is much lower than the overall ROCE (of either company) and therefore this does help to improve Merlot’s ROCE. The other important issue within the composition of the ROCE is the valuation basis of the companies’ non-current assets. From the question, it appears that Grappa’s factory is at current value (there is a property revaluation surplus) and note (ii) of the question indicates the use of historical cost for plant. The use of current value for the factory (as opposed to historical cost) will be adversely impacting on Grappa’s ROCE. Merlot does not suffer this deterioration as it does not own its factory. The ROCE measures the overall efficiency of management; however, as Victular is considering buying the equity of one of the two companies, it would be useful to consider the return on equity (ROE) – as this is what Victular is buying. The ratios calculated are based on pre-tax profits; this takes into account finance costs, but does not cause taxation issues to distort the comparison. Clearly Merlot’s ROE at 50% is far superior to Grappa’s 19·1%. Again the issue of the revaluation of Grappa’s factory is making this ratio appear comparatively worse (than it would be if there had not been a revaluation). In these circumstances it would be more meaningful if the ROE was calculated based on the asking price of each company (which has not been disclosed) as this would effectively be the carrying amount of the relevant equity for Victular. Gearing From the gearing ratio it can be seen that 71% of Merlot’s assets are financed by borrowings (39% is attributable to Merlot’s policy of leasing its plant). This is very high in absolute terms and double Grappa’s level of gearing. The effect of gearing means that all of the profit after finance costs is attributable to the equity even though (in Merlot’s case) the equity represents only 29% of the financing of the net assets. Whilst this may seem advantageous to the equity shareholders of Merlot, it does not come without risk. The interest cover of Merlot is only 3·3 times whereas that of Grappa is 6 times. Merlot’s low interest cover is a direct consequence of its high gearing and it makes profits vulnerable to relatively small changes in operating activity. For example, small reductions in sales, profit margins or small increases in operating expenses could result in losses and mean that interest charges would not be covered. Another observation is that Grappa has been able to take advantage of the receipt of government grants; Merlot has not. This may be due to Grappa purchasing its plant (which may then be eligible for grants) whereas Merlot leases its plant. It may be that the lessor has received any grants available on the purchase of the plant and passed some of this benefit on to Merlot via lower lease finance costs (at 7·5% per annum, this is considerably lower than Merlot has to pay on its 10% loan notes). 1068 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) Liquidity Both companies have relatively low liquid ratios of 1·2 and 1·3 for Grappa and Merlot respectively, although at least Grappa has $600,000 in the bank whereas Merlot has a $1·2 million overdraft. In this respect Merlot’s policy of high dividend pay-outs (leading to a low dividend cover and low retained earnings) is very questionable. Looking in more depth, both companies have similar inventory days; Merlot collects its receivables one week earlier than Grappa (perhaps its credit control procedures are more active due to its large overdraft), and of notable difference is that Grappa receives (or takes) a lot longer credit period from its suppliers (108 days compared to 77 days). This may be a reflection of Grappa being able to negotiate better credit terms because it has a higher credit rating. Summary Although both companies may operate in a similar industry and have similar profits after tax, they would represent very different purchases. Merlot’s sales revenues are over 70% more than those of Grappa, it is financed by high levels of debt, it rents rather than owns property and it chooses to lease rather than buy its replacement plant. Also its remaining owned plant is nearing the end of its life. Its replacement will either require a cash injection if it is to be purchased (Merlot’s overdraft of $1·2 million already requires serious attention) or create even higher levels of gearing if it continues its policy of leasing. In short although Merlot’s overall return seems more attractive than that of Grappa, it would represent a much more risky investment. Ultimately the investment decision may be determined by Victular’s attitude to risk, possible synergies with its existing business activities, and not least, by the asking price for each investment (which has not been disclosed to us). Answer 31 HARDY Tutorial note: References to 20X5 and 20X6 should be taken as being to the years ended 30 September 20X5 and 20X6 respectively. Financial performance Statement of profit or loss Hardy’s results dramatically show the effects of the downturn in the global economy; revenues are down by 18% (6,500 ÷ 36,000 × 100), gross profit has fallen by 60% and a healthy after tax profit of $3·5 million has reversed to a loss of $2·1 million. These are reflected in the profit (loss) margin ratios shown in the appendix (the “as reported” figures for 20X6). This in turn has led to a 15·2% return on equity being reversed to a negative return of 11·9%. However, a closer analysis shows that the results are not quite as bad as they seem. The downturn has directly caused several additional costs in 20X6: employee severance, property impairments and losses on investments (as quantified in the appendix). These are probably all non-recurring costs and could therefore justifiably be excluded from the 20X6 results to assess the company’s “underlying” performance. If this is done the results of Hardy for 20X6 appear to be much better than on first sight, although still not as good as those reported for 20X5. A gross margin of 27·8% in 20X5 has fallen to only 23·1% (rather than the reported margin of 13·6%) and the profit for period has fallen from $3·5 million (9·7%) to only $2·3 million (7·8%). As well as the fall in the value of the investments, the related investment income has also shown a sharp decline which has contributed to lower profits in 20X6. Given the economic climate in 20X6 these are probably reasonably good results and may justify the Chairman’s comments. The cost saving measures which have helped to mitigate the impact of the downturn could have some unwelcome effects should trading conditions improve; it may not be easy to re-hire employees and a lack of advertising may cause a loss of market share. ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 1069 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK Statement of financial position Perhaps the most obvious aspect of the statement of financial position is the fall in value ($8·5 million) of the non-current assets, most of which is accounted for by losses of $6 million and $1·6 million respectively on the properties and investments. Ironically, because these falls are reflected in equity, this has mitigated the fall in the return of the equity (from 15·2% to 13·1% underlying) and contributed to a perhaps unexpected improvement in asset turnover from 1·6 times to 1·7 times. Liquidity Despite the downturn, Hardy’s liquidity ratios now seem at acceptable levels (though they should be compared to manufacturing industry norms) compared to the low ratios in 20X5. The bank balance has improved by $1·1 million. This has been helped by a successful rights issue (this is in itself a sign of shareholder support and confidence in the future) raising $2 million and keeping customer’s credit period under control. Some of the proceeds of the rights issue appear to have been used to reduce the bank loan which is sensible as its financing costs have increased considerably in 20X6. Looking at the movement on retained earnings (6,500 – 2,100 – 3,600) it can be seen that the company paid a dividend of $800,000 during 20X6. Although this is only half the dividend per share paid in 20X5, it may seem unwise given the losses and the need for the rights issue. A counter view is that the payment of the dividend may be seen as a sign of confidence of a future recovery. It should also be mentioned that the worst of the costs caused by the downturn (specifically the property and investments losses) are not cash costs and have therefore not affected liquidity. The increase in the inventory and work-in-progress holding period and the trade receivables collection period being almost unchanged appear to contradict the declining sales activity and should be investigated. Although there is insufficient information to calculate the trade payables credit period as there is no analysis of the cost of sales figures, it appears that Hardy has received extended credit which, unless it had been agreed with the suppliers, has the potential to lead to problems obtaining future supplies of goods on credit. Gearing On the reported figures debt to equity shows a modest increase due to losses and the reduction of the revaluation surplus, but this has been mitigated by the repayment of part of the loan and the rights issue. Conclusion Although Hardy’s results have been adversely affected by the global economic situation, its underlying performance is not as bad as first impressions might suggest and supports the Chairman’s comments. The company still retains a relatively strong statement of financial position and liquidity position which will help significantly should market conditions improve. Indeed the impairment of property and investments may well reverse in future. It would be a useful exercise to compare Hardy’s performance during this difficult time to that of its competitors – it may well be that its 20X6 results were relatively very good by comparison. Appendix An important aspect of assessing the performance of Hardy for 20X6 (especially in comparison with 20X5) is to identify the impact that several “one off” charges have had on the results of 20X6. These charges are $1·3 million redundancy costs and a $1·5 million (6,000 – 4,500 previous surplus) property impairment, both included in cost of sales and a $1·6 million loss on the market value of investments, included in administrative expenses. Thus in calculating the “underlying” figures for 20X6 (below) the adjusted cost of sales is $22·7 million (25,500 – 1,300 – 1,500) and the administrative expenses are $3·3 million (4,900 – 1,600). These adjustments feed through to give an underlying gross profit of $6·8 million (4,000 + 1,300 + 1,500) and an underlying profit for the year of $2·3 million (–2,100 + 1,300 + 1,500 + 1,600). 1070 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) Tutorial note: it is not appropriate to revise Hardy’s equity (upwards) for the one-off losses when calculating equity-based underlying figures, as the losses will be a continuing part of equity (unless they reverse) even if (or when) future earnings recover. 20X6 20X5 Underlying As reported Gross profit % (6,800 ÷ 29,500 × 100) 23·1% 13·6% 27·8% Profit (loss) for period % (2,300 ÷ 29,500 × 100) 7·8% (7·1)% 9·7% Return on equity (2,300 ÷ 17,600 × 100) 13·1% (11·9)% 15·2% Net asset (taken as equity) turnover (29,500 ÷ 17,600) 1·7 times same 1·6 times Debt to equity (4,000 ÷ 17,600) 22·7% same 21·7% Current ratio (6,200:3,400) 1·8:1 same 1·0:1 Quick ratio (4,000:3,400) 1·2:1 same 0·6:1 Receivables collection (in days) (2,200 ÷ 29,500 × 365) 27 days same 28 days Inventory and work-in-progress holding period (2,200 ÷ 22,700 × 365) 35 days 31 days 27 days Tutorial note: Only the amounts used for the calculations of the “underlying” ratios are shown; “as reported” and the comparative ratios are based on equivalent figures from the summarised financial statements provided. Alternative ratios/calculations would be acceptable (e.g. net asset turnover could be calculated using total assets less current liabilities). Answer 32 QUARTILE Item Answer Justification 1 D Profit before interest and tax = $3,400 + $800 = $4,200 Capital employed = Equity of $26,600 + Debt of $8,000 = $34,600 ROCE = $4,200 ÷ $34,600 = 12.1% 2 B Current assets = $11,200 Current liabilities = $7,200 Current ratio = $11,200 ÷ $7,200 = 1.56 3 D Trade payable = $5,400 Purchases = $43,900 Payment period = $5,400 ÷ $43,900 × 365 days = 45 days 4 A Trend analysis looks at how figures have changed over a period of time, relative to each other. 5 D All four valuation models are included in the Conceptual Framework and are models that could be used to value assets and liabilities. ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 1071 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK Answer 33 CROSSWIRE (a) Non-current assets Property, plant and equipment Carrying amount b/f Mine (5,000 + 3,000 environmental cost) Revaluation (2,000 ÷ 0·8 allowing for effect of deferred tax transfer) Initial amount recognised for leased plant Plant disposal Depreciation Replacement plant (balance) Carrying amount c/f Development costs Carrying amount b/f Additions during year Amortisation and impairment (balance) 2,500 500 (2,000) –––––– 1,000 –––––– Carrying amount c/f (b) $000 13,100 8,000 2,500 10,000 (500) (3,000) 2,400 –––––– 32,500 –––––– Cash flows from investing activities Purchase of property, plant and equipment (W1) Disposal proceeds of plant Development costs Net cash used in investing activities Cash flows from financing activities: Issue of equity shares (W2) Redemption of convertible loan notes ((5,000 – 1,000) × 25%) Lease obligations (W3) Interest paid (400 + 350) Net cash used in financing activities (7,400) 1,200 (500) –––––– (6,700) –––––– 2,000 (1,000) (3,200) (750) –––––– (2,950) –––––– WORKINGS (amounts in brackets in $000) (1) Mine The cash elements of the increase in property, plant and equipment are $5 million for the mine (the capitalised environmental provision is not a cash flow) and $2·4 million for the replacement plant making a total of $7·4 million. (2) Convertible loan notes Of the $4 million convertible loan notes (5,000 – 1,000) that were redeemed during the year, 75% ($3 million) of these were exchanged for equity shares on the basis of 20 new shares for each $100 in loan notes. This would create 600,000 (3,000 ÷ 100 × 20) new shares of $1 each and share premium of $2·4 million (3,000 – 600). As 1 million (5,000 – 4,000) new shares were issued in total, 400,000 must have been for cash. The remaining increase (after the effect of the conversion) in the share premium of $1·6 million (6,000 – 2,000 b/f – 2,400 conversion) must relate to the cash issue of shares, thus cash proceeds from the issue of shares is $2 million (400 par value + 1,600 premium). 1072 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) (3) Lease The initial lease obligation is $7.6 million (initial amount recognised for the plant less deposit paid on 1 April). At 30 September 20X6 total lease obligations are $6·8 million (5,040 + 1,760), thus repayments in the year were $3·2 million (10,000 – 6,800). (c) ROCE for the two years Using the definition of ROCE provided: Year ended 30 September 20X6 Profit before tax and interest on long-term borrowings (4,000 + 1,000 + 400 + 350) Equity plus loan notes and lease obligations (19,200 + 1,000 + 5,040 + 1,760) ROCE $000 27,000 21·3% Equivalent for year ended 30 September 20X5 (3,000 + 800 + 500) (9,700 + 5,000) ROCE 4,300 14,700 29·3% 5,750 To help explain the deterioration it is useful to calculate the components of ROCE i.e. operating margin and net asset turnover (utilisation): 20X6 Operating margin (5,750 ÷ 52,000 × 100) 11·1% Net asset turnover (52,000 ÷ 27,000) 1·93 times 20X5 (4,300 ÷ 42,000) 10·2% (42,000 ÷ 14,700) 2·86 times From the above it can be clearly seen that the 20X6 operating margin has improved by nearly 1% point, despite the $2 million impairment charge on the write down of the development project. This means the deterioration in the ROCE is due to poorer asset turnover. This implies there has been a decrease in the efficiency in the use of the company’s assets this year compared to last year. Looking at the movement in the non-current assets during the year reveals some mitigating points: The land revaluation has increased the carrying amount of property, plant and equipment without any physical increase in capacity. This unfavourably distorts the current year’s asset turnover and ROCE figures. The acquisition of the platinum mine appears to be a new area of operation for Crosswire which may have a different (perhaps lower) ROCE to other previous activities or it may be that it will take some time for the mine to come to full production capacity. The substantial acquisition of the leased plant was half-way through the year and can only have contributed to the year’s results for six months at best. In future periods a full year’s contribution can be expected from this new investment in plant and this should improve both asset turnover and ROCE. In summary, the fall in the ROCE may be due largely to the above factors (effectively the replacement and expansion programme), rather than to poor operating performance, and in future periods this may be reversed. ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 1073 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK It should also be noted that if the ROCE had been calculated on the average capital employed during the year (rather than the year end capital employed), which is arguably more correct, the deterioration in the ROCE would have been less pronounced. Answer 34 MOROCCO (a) Statement of cash flows for the year ended 31 March 20X7 Cash flows from operating activities: Profit before tax Adjustments for: Depreciation/amortisation of non-current assets Finance costs Increase in inventory (200 – 110) Increase in trade receivables (195 – 75) Increase in trade payables (210 – 160) $m 140 40 (90) (120) 50 –––– 215 (40) (90) –––– 85 Cash generated from operations Interest paid Income tax paid (W1) Net cash from operating activities Cash flows from investing activities: Purchase of property, plant and equipment (W2) Purchase of intangibles (300 – 200 + 25) Purchase of investment Net cash used in investing activities Cash flows from financing activities: Shares issued (350 – 250) Issue of 10% loan notes Equity dividends paid (W3) (305) (125) (230) –––– (660) 100 300 (55) –––– Net cash from financing activities Net decrease in cash and cash equivalents Cash and cash equivalents at beginning of period Cash and cash equivalents at end of period $m 195 345 –––– (230) 120 –––– (110) –––– WORKINGS (1) Income tax Provision b/f Profit or loss Tax paid (= balance) Provision c/f 1074 $m (110) (60) 90 –––– (80) –––– ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) (2) Property, plant and equipment Balance b/f Depreciation Revaluation Acquired during year (= balance) Balance c/f (3) Equity dividends Retained earnings b/f Profit for the year Dividends paid (= balance) Retained earnings c/f (b) 410 (115) 80 305 –––– 680 –––– 295 135 (55) –––– 375 –––– Functional currency The functional currency is the currency of the primary economic environment in which the entity operates (IAS 21). The primary economic environment in which an entity operates is normally the one in which it primarily generates and expends cash. An entity’s management considers the following factors in determining its functional currency (IAS 21): the currency that dominates the determination of the sales prices; and the currency that most influences operating costs. The currency that dominates the determination of sales prices will normally be the currency in which the sales prices for goods and services are denominated and settled. It will also normally be the currency of the country whose competitive forces and regulations have the greatest impact on sales prices. Factors other than the dominant currency for sales prices and operating costs are also considered when identifying the functional currency. The currency in which an entity’s finances are denominated is also considered. The focus is on the currency in which funds from financing activities are generated and the currency in which receipts from operating activities are retained. Additional factors include consideration of the autonomy of a foreign operation from the reporting entity and the level of transactions between the two. Consideration is given to whether the foreign operation generates sufficient functional cash flows to meet its cash needs or whether it is dependent on another party for finance. (c) Advice on loan to NFP organisation Although the sports club is a not-for-profit organisation, the request for a loan is a commercial activity that should be decided on according to similar criteria as would be used for other profit-orientated entities. ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 1075 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK The main consideration in making a loan is how secure it would be. A form of capital gearing ratio should be calculated; say existing long-term borrowings to net assets (i.e. total assets less current liabilities). Clearly if this ratio is high, further borrowing would be at an increased risk. Another aspect is the sports club’s ability to repay the interest (and ultimately the principal) on the loan. This may be determined from information in statement of profit or loss. A form of interest cover should be calculated; say the excess of income over expenditure (broadly equivalent to profit) compared to (the forecast) interest payments. The higher this ratio the lower the risk of interest default. Calculations would be made for all four years to ascertain any trends that may indicate a deterioration or improvement in these ratios. As for profit-oriented entities, the nature and trend of the income should be investigated. For example, are the club’s sources of income increasing or decreasing, does reported income include “one-off” donations (which may not be recurring), etc? Also matters such as the market value of, and existing prior charges against, any assets intended to be used as security for the loan would be relevant to the lender’s decision-making process. It may be possible that the sports club’s governing body (perhaps the trustees) may be willing to give a personal guarantee for the loan. Answer 35 MONTY (a) Statement of cash flows for the year ended 31 March 20X7 $000 Cash flows from operating activities: Profit before tax Adjustments for: depreciation of non-current assets amortisation of non-current assets finance costs decrease in inventories (3,800 – 3,300) increase in receivables (2,950 – 2,200) increase in payables (2,650 – 2,100) 3,000 900 200 400 500 (750) 550 –––––– 4,800 (400) (425) –––––– 3,975 Cash generated from operations Finance costs paid Income tax paid (W1) Net cash from operating activities Cash flows from investing activities: Purchase of property, plant and equipment (W2) Deferred development expenditure (1,000 + 200) Net cash used in investing activities Cash flows from financing activities: Redemption of 8% loan notes (3,125 – 1,400) Repayment of lease obligations (W3) Equity dividend paid (W4) (1,725) (1,050) (550) –––––– Net decrease in cash and cash equivalents Cash and cash equivalents at beginning of period 1076 (700) (1,200) –––––– (1,900) Net cash used in financing activities Cash and cash equivalents at end of period $000 (3,325) –––––– (1,250) 1,300 –––––– 50 –––––– ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) WORKINGS $000 (1) Income tax paid Provision b/f – current – deferred Tax charge Transfer from revaluation surplus Provision c/f – current – deferred Balance – cash paid (2) Property, plant and equipment Balance b/f Revaluation New lease Depreciation Balance c/f Balance – cash purchases (3) – current – non-current New finance lease Balances c/f – current – non-current Balance cash repayment (4) 10,700 2,000 1,500 (900) (14,000) –––––– (700) –––––– Lease liabilities Balances b/f (600) (900) (1,500) 750 1,200 –––––– (1,050) –––––– Equity dividend Retained earnings b/f Profit for the year Retained earnings c/f Balance – dividend paid (b) (725) (800) (1,000) (650) 1,250 1,500 –––––– (425) –––––– 1,750 2,000 (3,200) –––––– (550) –––––– Analysis Return on capital employed The most striking feature of Monty’s performance is the increase in its ROCE; although this is 4·7% (21·4% – 16·7%), it represents an increase in return of 28·1% (4·7% ÷ 16·7% × 100) which is an excellent performance during a period of apparent expansion. Indeed, had Monty not revalued its property, the return would have been even higher. Looking at the component parts of the ROCE, it can be seen that most areas contributed to the improvement. ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 1077 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK Profit margins Gross margins improved, means either selling prices increased and/or cost of sales were reduced. Operating margins improved (as a consequence of this) even though overheads actually increased proportionally with revenue. There may be a correlation between the increase in operating cost and increase in sales, such as higher expenditure on advertising may have led to increased sales and higher gross margins. Asset utilisation The other component of ROCE is asset utilisation; here again Monty has had some success increasing sales per $1 invested by 12·1% ((1·95 – 1·74) ÷ 1·74 × 100). Given the new investment in property, plant and equipment (including new finance leased assets that have not been operating for a full year), this is an excellent achievement and bodes well for future periods. Also, it seems likely that some of the improvement is due to the development project coming on stream (as it is being amortised) and generating revenues. These factors have more than overcome the comparatively suppressing effect on ROCE due to the revaluation of the property. Gearing The capital structure changes of repaying $1,725,000 of the 8% loan less a net increase in lease obligations of $450,000 (1,950 – 1,500) have reduced debt by $1,275,000. This, coupled with an increase in equity of $2·8 million (albeit that nearly half of this came from the revaluation surplus of $1·35 million), has acted to reduce gearing markedly from 47·4% last year to only 26·7% in the current year. Many shareholders may be comforted by a reduction in debt; however, debt is not necessarily a bad thing. Monty is borrowing at 8% (on the loan notes, the interest rate of the lease is unknown) yet earning an overall ROCE of 21·4%; this means shareholders are benefiting from the relatively cheap debt. Appendix Calculation of ratios (in $000) 20X6 20X5 Return on capital employed (ROCE) ((3,000 + 150 + 250) ÷ (12,550 + 1,400 + 1,950) × 100) 21·4% 16·7% Margins: Gross profit margin (9,200 ÷ 31,000 × 100) Operating margin (3,400 ÷ 31,000 × 100) 29·7% 11·0% 25·6% 9·6% 1·95 times 1·74 times 26·7% 47·4% Utilisation: Net asset turnover (31,000 ÷ 15,900) Gearing (debt ÷ equity) (1,400 + (1,950 ÷ 12,550)) Tutorial note: The amounts for the calculation of 20X6 ratios are given in brackets; the amounts for 20X5 are similarly derived. Capital employed is taken as equity + loan notes + lease obligations (current and non-current). 1078 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) Answer 36 KINGDOM (a) Statement of cash flows for the year ended 30 September 20X6 $000 Cash flows from operating activities: Profit before tax Adjustments for: depreciation of property, plant and equipment loss on sale of property, plant and equipment (2,300 – 1,800) finance costs investment properties – rentals received – fair value changes decrease in inventory (3,100 – 2,300) decrease in receivables (3,400 – 3,000) increase in payables (4,200 – 3,900) Cash generated from operations Interest paid (600 – 100 + 50) Income tax paid (W1) Net cash from operating activities Cash flows from investing activities: Purchase of property, plant and equipment (W2) Sale of property, plant and equipment Purchase of investment property Investment property rentals received Net cash used in financing activities Net decrease in cash and cash equivalents Cash and cash equivalents at beginning of period Cash and cash equivalents at end of period 2,400 1,500 500 600 (350) 700 ––––– 5,350 800 400 300 ––––– 6,850 (550) (1,950) ––––– 4,350 (5,000) 1,800 (1,400) 350 ––––– Net cash used in investing activities Cash flows from financing activities: Issue of equity shares (17,200 – 15,000) Equity dividends paid (W3) $000 (4,250) 2,200 (2,800) ––––– (600) ––––– (500) 300 ––––– (200) ––––– WORKINGS $000 (1) Income tax Provision b/f Profit or loss charge Provision c/f Tax paid (= balance) ©2017 DeVry/Becker Educational Development Corp. All rights reserved. (1,850) (600) 500 –––––– (1,950) –––––– 1079 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK (2) Property, plant and equipment Balance b/f Depreciation Revaluation (downwards) Disposal (at carrying amount) Transfer from investment properties Balance c/f (25,200) 1,500 1,300 2,300 (1,600) 26,700 –––––– (5,000) –––––– Acquired during year (= balance) (3) Equity dividends Retained earnings b/f Profit for the year Retained earnings c/f 8,700 1,800 (7,700) –––––– 2,800 –––––– Dividends paid (= balance) Tutorial note: The reconciliation of the investment properties is: $000 5,000 1,400 (700) (1,600) ––––– 4,100 ––––– Balance b/f Acquired during year (from question) Loss in fair value Transfer to property, plant and equipment Balance c/f (b) Analysis (i) Causes of fall in profit before tax The fall in the company’s profit before tax can be analysed in three elements: (1) (2) (3) changes at the gross profit level; the effect of overheads; and the relative performance of the investment properties. The absolute effect on profit before tax of these elements are reductions of $1·4 million (15,000 – 13,600), $2·25 million (10,250 – 8,000) and $1·25 million (900 + 350) respectively, amounting to $4·9 million in total. Many companies would consider returns on investment properties as not being part of operating activities; however, these returns do affect profit before tax. Gross profit Despite slightly higher revenue, gross profit fell by $1·4 million. This is attributable to a fall in the gross profit margin (down from 34·1% to 30·3%). Applying the stated 8% rise in the cost of sales, last year’s cost of sales of $29 million would translate to an equivalent figure of $31·32 million in the current year which is almost the same as the actual figure ($31·3 million). This implies that the production activity/volume of sales has remained the same as last year. 1080 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) As the increase in revenue in the current year is only 2%, the decline in gross profitability has been caused by failing to pass on to customers the percentage increase in the cost of sales. This may be due to management’s slow response to rising prices and/or to competitive pressures in the market. Operating costs/overheads The administrative expenses and distribution costs are the main culprit of the fall in profit before tax as these are $2·25 million (or 28%) higher than last year. Even if they too have increased 8%, due to rising prices, they are still much higher than would have been expected, which implies a lack of cost control of these overheads. The profit margin has fallen from 17.9% in 20X5 to 6.7% in 20X6 and although gross profit margin fell slightly the fall in the profit margin ratio does highlight that it is the lack of control of overheads that has been the main cause in the fall in profits. Performance of investment properties The final element of the fall in profit before tax is due to declining returns on the investment properties. This has two elements. First, a reduction in rentals received which may be due to the change in properties under rental (one transferred to owner-occupation and one newly let property) and/or a measure of falling rentals generally. The second element is clearer: there has been a decrease in the fair values of the properties in the current year compared to a rise in their fair values in the previous year. The fall in investment properties mirrors a fall in the value of the company’s other properties within property, plant and equipment (down $1·3 million), which suggests problems in the commercial property market. (ii) Effects of rising prices The term rising prices may relate to specific goods/assets or to average prices (general inflation). Either way, they have two main effects on financial statements: an understatement of operating costs and a potentially greater understatement of asset values. In the statement of profit or loss, input costs tend to be understated in terms of their real cost. The most commonly quoted examples of these are inventory, where the purchase at historical cost would be lower than the cost of replacing them (a form of current cost), and depreciation charges which understate the real value of the benefit consumed by the asset’s use (as the fair value of the non-current assets will have increased). In terms of interpreting financial performance, rising prices distort trend comparisons, meaning that previous years’ results are not directly comparable with the current year’s results. The most obvious example of this is with the return on capital employed (ROCE). When comparing previous years with the current year, using historical cost, the numerator (profit) would be relatively higher or overstated (due to lower operating costs) and the denominator (equal to net assets) would be relatively lower or understated (due to lower reported asset values). The “overstated” profit due to not adjusting for rising prices may also give rise to other problems, such as leading to higher wage demands, higher dividend payments and even higher taxes. ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 1081 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK Answer 37 SAVOIR Item Answer Justification 1 The issue on 1 July at full market value needs to be weighted: A Existing shares New shares 2 C 40m × 3/12 = 8m –––– 48m × 9/12 = 10m 36m –––– 46m –––– The rights issue of two for five on 1 October 20X5 is half way through the year. The theoretical ex rights value can be calculated as: Holder of Subscribes for Now holds 100 shares worth $2·40 = 40 shares at $1 each = ––– 140 worth (in theory) ––– Bonus factor to be used for prior year comparatives 3 D $240 $40 ––––– $280 (i.e. $2·0 each) ––––– 2·0/2·4 Profit for year given as $25.2 million On conversion loan interest of $1·2 million after tax would be saved ($20 million × 8% × (100% – 25%)) Profit for diluted EPS = $26.4 million 4 A The number of shares in issue at the end of the year is used in the basic EPS calculation when a bonus issue takes place during the year. 5 D IAS 33 requires disclosure of (3) any potential ordinary shares that can affect future EPS calculations and (4) any ordinary shares issued after the reporting date but prior to signing off of the accounts. (1) Interest saved is only relevant if it relates to convertible loan notes and (2) preference shares are not used in the EPS calculation. Answer 38 REBOUND Item 1 Answer Justification B Estimated profit after tax for the year ending 31 March 20X7: Existing operations (continuing only) ($2 million × 1·06) Newly acquired operations ($450,000 × 12/8 months × 1·08) 2 A $000 2,120 729 ––––– 2,849 ––––– Basic earnings per share Profit = 2,000 + 450 – 750 = 1,700 Shares = $3,000 ÷ $0.25 = 12,000 EPS = $0.14 1082 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) 3 A Interest after tax is added back to the profit figure as if debt is converted interest will no longer be payable, and interest is tax deductible. 4 B Weighted average number of shares (000) At 1 April 20X4 (3,000 × 4 (i.e. shares of $0.25 each)) Convertible loan note ($5,000 ÷ 100 × 40) 5 B 12,000 2,000 –––––– 14,000 –––––– As the factory only generates 2% of revenue this would not be seen as a major part of the business; although the machine is a material asset it is not a separate line of the business or a geographical area of operations. Answer 39 ERRSEA Item Answer Justification 1 D Annual depreciation on plant is $20,000 (90,000 – 10,000) ÷ 4 years 3 years have passed since acquisition and therefore $60,000 of depreciation has been charged, leaving a carrying amount of the asset of $30,000. Loss on disposal of plant (30,000 – 12,000) is $18,000 2 C Depreciation: On acquired plant ($210,000 ÷ 3 years × 9/12) Other plant (b/f 240,000 – 90,000 (disposed of) × 15%) $ 52,500 22,500 –––––– 75,000 –––––– Tutorial note: The cost of the acquired plant, $210,000, is base cost (192) plus the costs of modification (12) and transport and installation (6). 3 A Grant included in current liabilities ($10,000) will not be there at year end. Grant in non-current liabilities of $30,000 will still be there at year end; $11,000 in current and $19,000 in non-current. Grant on new plant is $48,000 (25% × base cost $192,000). This will be credited to profit or loss on a straight line basis over 3 years, giving annual credit of $16,000. The asset was purchased on 1 July, 3 months into the year, therefore in year 1 only $12,000 ($16,000 × 9/12) is credited to profit or loss, leaving a balance of $36,000. $30,000 + $36,000 = $66,000 4 B A financial asset cannot meet the definition of a qualifying asset; all the others can. 5 A The grant does not necessarily have to be received before it is recognised. As long as the entity is reasonable certain the grant will be received it can recognise it. ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 1083 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK Answer 40 SKEPTIC Item Answer Justification 1 A A change of classification in presentation is a change in accounting policy under IAS 8 and must be applied retrospectively. 2 D For a single possible outcome the best estimate is the most likely outcome. In this case the most likely outcome (with a 65% probability) is damages of $4 million. 3 A Where measurement of a provision involves a large population of items then an “expected value” model should be used. The expected value of repair costs on the sale of a unit is $17 (($0 × 70%) + ($25 × 20%) + ($120 × 10%)) The provision required for the sale of 200,000 units is therefore $3.4 million ($17 × 200,000). 4 B The government grant is credited to profit and loss in the same manner as the depreciation of the related asset. In this case the asset is being depreciated on a straight line basis over 10 years. Therefore the grant is credited to profit or loss at $800,000 each year ($8 million ÷ 10). 5 B As the asset is classified at fair value through other comprehensive income the gain on disposal is taken to other comprehensive income. IFRS 9 does not allow the reclassification of the cumulative gain to profit or loss but a reserve transfer to retained earnings can be made. Answer 41 CANDY Item 1 Answer Justification A Land Buildings ($39m × 14/15 years) Plant and equipment ($60.5m – $36.5m) × 87.5% Total 2 C Estimated expense for current year Over provision prior year Increase in deferred tax (W) WORKING Opening deferred tax Closing deferred tax (9,800 × 30%) Increase in deferred tax 1084 $000 8,000 36,400 21,000 –––––– 65,400 –––––– $000 2,300 (1,000) 340 ––––– 1,640 ––––– 2,600 2,940 ––––– 340 ––––– ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) 3 A Initial amount recognised (30 – 1) Interest at 9% Interest paid at 5% 4 C $000 29,000 2,610 (1,500) –––––– 30,110 –––––– Equity shares that are not held for trading may, on initial recognition, be designated at fair value through other comprehensive income. Loan assets held for their contractual cash flows and selling financial assets must be classified at fair value through other comprehensive income. 5 B Interest receivable, where taxed on a cash basis, will generate a taxable temporary difference. In the financial accounts the liability element of the loan will be less than the tax base of the liability as, under financial accounting, some of the loan is classified as equity. Answer 42 MOSTON Item Answer Justification 1 D Revenue is not recognised as in substance this is a financing transaction. Interest for six months should be expensed and added to the amount of loan liability. 2 D Capitalisation of development expenditure cannot take place until the criteria of IAS 38 have been met, one of those criteria is the commercial success of the project; this does not happen until 1 May and therefore only 2 months of expenditure can be capitalised ($1.6m × 2 months = $3.2 million). 3 B Depreciation Property (28,500 ÷ 15 years) Plant and equipment ((26,100 – 9,100) × 15%) Total depreciation expense for period $ 1,900 2,550 ––––– 4,450 ––––– 4 A Only costs incurred in bringing an asset to its place and condition of use can be capitalised in the cost of the asset. Staff training costs and painting the asset cannot therefore be included in the initial cost and must be expensed. 5 B IFRS 15 states that the best evidence of stand-alone selling prices is to take the observable price of goods when they are sold separately. ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 1085 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK Answer 43 NOSTOM Item Answer Justification 1 Initial amount recognised for loan will be proceeds less issue costs is $19,500,000 ($20m – $500,000). B Applying the effective rate of interest gives interest $1,560,000 (19,500,000 × 8%). 2 A $000 1,200 60 (170) ––––– 1,090 ––––– Estimated expense for current year Under provision prior year Decrease in deferred tax (W) WORKING Opening deferred tax Closing deferred tax (2,800 × 30%) 1,010 840 ––––– 170 ––––– Decrease in deferred tax 3 A When there is an issue of shares at full market price during the year the number of shares used in the basic EPS calculation is time weighted. The issue took place on 31 March which is 9 months into the year. 50,000 shares × 9/12 months = 37,500 shares 60,000 shares × 3/12 months = 15,000 shares Time weighted average = 52,500 shares 4 D The equity method is a valuation method used for an investment of an associate in accordance with IAS 28 Investments in Associates (and Joint Ventures). Transaction price can be used for trade receivables that do not include a significant financing element. 5 D A deductible temporary difference arises if the tax base of an asset is higher than its carrying amount or the tax base of a liability is less than its carrying amount. (2) results in a deductible temporary difference because the carrying amount of the asset is less than the tax base. (4) results in a deductible temporary difference because the tax base of the liability is nil (which is less than the carrying amount of any interest accrual). Where the tax authority allows expenses based on cash flows interest payable will lead to a deductible temporary difference. Tutorial note: (1) and (3) give rise to a taxable temporary differences (i.e. carrying amount exceeds the tax base). 1086 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) SPECIMEN EXAM Section A Item Answer 1 B 2 A 3 B 4 D 5 B 6 D 7 A 8 C Justification 25,000 – 2,000 = 23,000 + 2,300 (10% interest) – 6,000 (payment) = 19,300 19,300 + 1,930 (10% interest) – 6,000 (payment) = 15,230 Current liability = 19,300 – 15,230 = $4,070 Dismantling provision at 1 October 20X4 is $20·4 million (30,000 × 0·68) discounted This will increase by an 8% finance cost by 30 September 20X5 = $22,032,000 (1,550 ÷ (2,500 × 2 + 1,200)) = $0·25 Sales proceeds Net assets at disposal Goodwill at disposal Less: carrying value of NCI 9 C 10 A 11 C $000 5,580 4,464 1,674 (900) –––––– Cost (240,000 × $6) Share of associate’s profit (400 × 240 ÷ 800) Less dividend received (150 × 240 ÷ 800) 12 C 13 A 14 D 15 C (5,238) –––––– 342 –––––– $000 1,440 120 (45) –––––– 1,515 –––––– Inventory turnover is 61 days (365 ÷ 6) Trade payables period is 42 days (230,000 ÷ 2 million × 365) Therefore, receivables collection period is 51 days (70 – 61 + 42) FV of NCI at 1 October 14 (9,000 × 20% × $3·50) Post-acquisition profit (8,000 – (3,000 ÷ 5)) = 7,400 at 20% ©2017 DeVry/Becker Educational Development Corp. All rights reserved. $000 6,300 1,480 –––––– 7,780 –––––– 1087 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK Section B 16 A 17 C Annual depreciation prior to the revaluation is $150,000 (1/5 × 750). At the date of revaluation (1 April 20X3), the carrying amount is $375,000 (750 – (150 × 2·5 years)). Revalued to $560,000 with a remaining life of 3½ years results in a depreciation charge of $160,000 per annum which means $80,000 for six months. The carrying amount at 30 September 20X3 is therefore $480,000 (560 – 80). Tutorial note: Alternatively $560,000 – ($560,000 ÷ 3½ × 6/12) = $480,000. The revaluation surplus has a balance of $185,000 (560,000 – 375,000). 18 C 19 D 20 B Cash flow Discount factor Present value $000 at 10% $000 Year ended: 30 September 20X4 220 0·91 200·2 30 September 20X5 180 0·83 149·4 30 September 20X6 200 0·75 150·0 –––––– 499·6 –––––– Goodwill Property Plant Cash and receivables Carrying Impairment Carrying amount before loss amount after $000 $000 $000 2,000 2,000 Nil 4,000 800 3,200 3,500 700 2,800 2,500 Nil 2,500 ––––––– –––––– –––––– 12,000 3,500 8,500 ––––––– –––––– –––––– 21 C 22 A 23 D 200 employees at $5,000 = $1,000,000 redundancy costs. The retraining costs are a future cost. 24 A Impairment loss on plant is $1,750,000 (2,200,000 – (500,000 – 50,000)). 25 D Penalty payments $200,000 + agreed settlement of loan $900,000 = $1,100,000. Tutorial note: The expected insurance receipt is a contingent asset that would only be disclosed, if material. Even if virtually certain it cannot be netted off against the provision. 26 1088 B ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) 27 A Shareholding A is not held for trading as an election made – FVTOCI. Shareholding B is held for trading and so FVTPL (transaction costs are not included in carrying amount). $ Cost of shareholding A (10,000 × $3·50 × 1·01) 35,350 FV at 30 September 20X3 (10,000 × $4·50) 45,000 –––––– Gain 9,650 –––––– 28 C Deferred tax provision required at 30 September 20X3 Provision at 1 October 20X2 Increase in provision (expense) Write off underprovision at 30 September 20X2 Income tax for the year ended 30 September 20X3 Charge for the year ended 30 September 20X3 $000 4,400 (2,500) ––––––– 1,900 2,400 28,000 ––––––– 32,300 ––––––– Tutorial note: To eliminate the “over/under provision” on deferred tax described as a debit must be current year expense (i.e. prior year was underprovided). 29 B 30 A At 30 September 20X3 there are two more years of servicing work, thus $1·6 million ((2 × 600,000) × 100/75) must be treated as deferred income. ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 1089 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK Section C Answer 31 KANDY CO (a) Schedule of retained earnings as at 30 September 20X5 $000 Retained earnings per trial balance 15,500 Adjustments re: Note (i) Add back issue costs of loan note (W1) 1,000 Loan finance costs (29,000 × 9% (W1)) (2,610) Note (ii) Gain on disposal of investment property (17,000 – 15,000) 2,000 Gain on revaluation of investment property prior to transfer (6,000 – 5,000) 1,000 Depreciation of buildings (W2) (2,825) Depreciation of plant and equipment (W2) (3,000) Note (iii) Income tax expense (W3) (800) ––––––– Adjusted retained earnings 10,265 ––––––– (b) Statement of financial position as at 30 September 20X5 $000 Assets Non-current assets Property, plant and equipment (50,175 + 21,000 (W2)) Current assets (per trial balance) 71,175 68,700 ––––––– 139,875 ––––––– Total assets Equity and liabilities Equity Equity shares of $1 each Revaluation surplus (32,000 – 6,400 (W2 and W3)) Retained earnings (from (a)) Non-current liabilities Deferred tax (W3) 6% loan note (W1) Current liabilities Per trial balance Current tax payable Total equity and liabilities 1090 $000 20,000 25,600 10,265 ––––––– 55,865 8,400 29,810 ––––––– 43,400 2,400 ––––––– 38,210 45,800 ––––––– 139,875 ––––––– ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) WORKINGS (monetary figures in brackets in $000) (1) Loan note The issue costs should be deducted from the proceeds of the loan note and not charged as an expense. The finance cost of the loan note, at the effective rate of 9% applied to the carrying amount of the loan note of $29 million (30,000 – 1,000), is $2,610,000. The interest actually paid is $1·8 million. The difference between these amounts of $810,000 (2,610 – 1,800) is added to the carrying amount of the loan note to give $29,810,000 (29,000 + 810) for inclusion as a non-current liability in the statement of financial position. (2) Non-current assets Land and buildings The gain on revaluation and carrying amount: Carrying amount at 1 October 20X4 (35,000 – 20,000) Revaluation at that date (8,000 + 39,000) Gain on revaluation Buildings depreciation for the year ended 30 September 20X5: Land and buildings existing at 1 October 20X4 (39,000 ÷ 15 years) Transferred investment property (6,000 ÷ 20 × 9/12) Carrying amount at 30 September 20X5 (47,000 + 6,000 – 2,825) $000 15,000 47,000 –––––– 32,000 –––––– 2,600 225 –––––– 2,825 –––––– 50,175 –––––– Plant and equipment Carrying amount at 1 October 20X4 (58,500 – 34,500) Depreciation for year (12½% reducing balance) Carrying amount at 30 September 20X5 (3) 24,000 (3,000) –––––– 21,000 –––––– Taxation Income tax expense Provision for year ended 30 September 20X5 Less over provision in previous year Deferred tax (see below) ©2017 DeVry/Becker Educational Development Corp. All rights reserved. $000 2,400 (1,100) (500) –––––– 800 –––––– 1091 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK Deferred tax Provision required at 30 September 20X5 ((10,000 + 32,000) × 20%) Provision at 1 October 20X4 Increase in provision (expense) Recognised in other comprehensive on revaluation of land and buildings (32,000 × 20%) Balance – credit to profit or loss (c) 8,400 (2,500) –––––– 5,900 (6,400) –––––– (500) –––––– Cash flow statement extracts Cash flows from operating activities: Add back depreciation Deduct gain on revaluation of investment property Deduct gain on disposal of investment property $000 5,825 (1,000) (2,000) Cash flows from investing activities: Investment property disposal proceeds 17,000 Answer 32 TANGIER GROUP (a) Purchase of Raremetal Tutorial note: References to “20X5” are in respect of the year ended 30 September 20X5 and “20X4” refers to the year ended 30 September 20X4. The key matter to note is that the ratios for 20X4 and 20X5 will not be directly comparable because two significant events, the acquisition of Raremetal and securing the new contract, have occurred between these dates. This means that the underlying financial statements are not directly comparable. For example, the 20X4 statement of profit or loss (SOPL) will not include the results of Raremetal or the effect of the new contract. However, the 20X5 SOPL will contain nine months of the results of Raremetal (although intra-group transactions will have been eliminated) and nine months of the effects of the new contract (which may have resulted in either a net profit or loss). Likewise, the 20X4 statement of financial position does not contain any of Raremetal’s assets and liabilities, whereas that of 20X5 contains all of the net assets of Raremetal and the cost of the new licence. This does not mean that comparisons between the two years are not worthwhile, just that they need to be treated with caution. For some ratios, it may be necessary to exclude all of the subsidiaries from the analysis and use the single entity financial statements of Tangier as a basis for comparison with the performance of previous years. Similarly, it may still be possible to compare some of the ratios of the Tangier group with those of other groups in the same sector although not all groups will have experienced similar acquisitions. Assuming there has been no impairment of goodwill, the investment in Raremetal has resulted in additional goodwill of $30 million which means that the investment has cost more than the carrying amount of Raremetal’s net assets. Although there is no indication of the precise cost, it is known to have been achieved by a combination of a share exchange (hence the $180 million new issue of shares) and a cash element (funded from the proceeds of the loan issue and the decrease in the bank balance). Any intra-group sales have been eliminated on consolidation and it is not possible to determine in which individual company any profit on these intra-group sales will be reported; it is therefore difficult to measure any benefits of the investment. Indeed, the benefit of the investment might not be a financial one but merely to secure the supply of raw materials. It would be useful to establish the cost of the investment and the profit (if any) contributed by Raremetal so that an assessment of the benefit of the investment might be made. 1092 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) (b) Relevant ratios Gross profit margin % (810 ÷ 2,700 × 100) Operating profit margin (235 ÷ 2,700 × 100) ROCE (235 ÷ (805 + 400)) Net asset turnover (2,700 ÷ (805 + 400)) Debt/equity (400 ÷ 805) Interest cover (235 ÷ 40) 20X5 30·0% 8·7% 19·5% 2·24 times 49·7% 5·9 times 20X4 40·0% 21·9% 61·7% 2·82 times 18·3% 79·6 times All of the issues identified in part (a) make a comparison of ratios difficult and, if more information was available, then some adjustments may be required. For example, if it is established that the investment is not generating any benefits, then it might be argued that the inclusion of the goodwill in the ROCE and asset turnover is unjustified (it may be impaired and should be written off). Goodwill has not been excluded from any of the following ratios. The increase in revenues of 48·4% (880 ÷ 1,820 × 100) in 20X5 will be partly due to the consolidation of Raremetal and the revenues associated with the new contract. Yet, despite these increased revenues, the company has suffered a dramatic fall in its profitability. This has been caused by a combination of a falling gross profit margin (from 40% in 20X4 to only 30% in 20X5) and markedly higher operating overheads (operating profit margin has fallen from 21·9% in 20X4 to 8·7% in 20X5). Again, it is important to note that some of these costs will be attributable to the consolidation of Raremetal and some to the new contract. It could be speculated that the 73% increase in administrative expenses may be due to one-off costs associated with the tendering process (consultancy fees, etc) and the acquisition of Raremetal and the 77% increase in higher distribution costs could be due to additional freight/packing/insurance cost of the engines, delivery distances may also be longer (even to foreign countries) (although some of the increase in distribution costs may also be due to consolidation). This is all reflected in the ROCE falling from an impressive 61·7% in 20X4 to only 19·5% in 20X5 (though even this figure is respectable). The fall in the ROCE is attributable to a dramatic fall in profit margin at operating level (from 21·9% in 20X4 to only 8·7% in 20X5) which has been compounded by a reduction in the asset turnover, with only $2·24 being generated from every $1 invested in net assets in 20X5 (from $2·82 in 20X4). The information in the question points strongly to the possibility (even probability) that the new contract may be responsible for much of the deterioration in Tangier’s operating performance. For example, it is likely that the new contract may account for some of the increased revenue; however, the bidding process was “very competitive” which may imply that Tangier had to cut its prices (and therefore its profit margin) in order to win the contract. The costs of fulfilling the contract have also been heavy: investment in property, plant and equipment has increased by $370 million (at carrying amount), representing an increase of 61% (no doubt some of this increase will be due to the acquisition of Raremetal). The increase in licence costs to manufacture the new engines has cost $200 million plus any amortisation and there is also the additional goodwill of $30 million. An eight-fold increase in finance cost caused by the increased borrowing at double the interest rate of the borrowing in 20X4 and (presumably) some overdraft interest has led to the dramatic fall in the company’s interest cover (from 79·6 in 20X4 to only 5·9 in 20X5). The finance cost of the new $300 million 10% loan notes to partly fund the investment in Raremetal and other non-current assets has also increased debt/equity (one form of gearing measure) from 18·3% in 20X4 to 49·7% in 20X5 despite also issuing $180 million in new equity shares. At this level, particularly in view of its large increase from 20X4, it may give debt holders (and others) cause for concern as there is increased risk for all Tangier’s lenders. ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 1093 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK If it could be demonstrated that the overdraft could not be cleared for some time, this would be an argument for including it in the calculation of debt/equity, making the 20X5 gearing level even worse. It is also apparent from the movement in the retained earnings that Tangier paid a dividend during 20X5 of $55 million (295,000 + 135,000 – 375,000) which may be a questionable policy when the company is raising additional finance through borrowings and contributes substantially to Tangier’s overdraft. Overall, the acquisition of Raremetal to secure supplies appears to have been an expensive strategy, perhaps a less expensive one might have been to enter into a long-term supply contract with Raremetal. (c) 1094 Further information which would be useful to obtain The cost of the investment in Raremetal, the carrying amount of the assets acquired and whether Tangier has carried out a goodwill impairment test as required under IFRS. The benefits generated from the investment; for example, Raremetal’s individual financial statements and details of sales to external customers (not all of these benefits will be measurable in financial terms). The above two pieces of information would demonstrate whether the investment in Raremetal had been worthwhile. The amount of intra-group sales made during the year and those expected to be made in the short to medium term. The pricing strategy agreed with Raremetal so that the effects on the profits reported in the individual financial statements of Raremetal and Tangier can be more readily determined. More information is needed to establish if the new contract has been detrimental to Tangier’s performance. The contract was won sometime between 1 October 20X4 and 1 January 20X5 and there is no information of when production/sales started, but clearly there has not been a full year’s revenue from the contract. Also there is no information on the length or total value of the contract. ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) SEPTEMBER 2016 EXAM Item Answer Justification 1 B This is one of the roles of the IFRS Foundation. 2 A (2) will not be a subsidiary until the negotiations have been signed off and (3) would be classified as an associate. 3 A The repayment of the grant must be treated as a change in accounting estimate. The carrying amount of the asset must be increased as the netting off method has been used. The resulting extra depreciation must be charged immediately to profit or loss. Cost Grant Depreciation Carrying amount Original As if no grant Adjustment 90,000 90,000 (30,000) –––––– 60,000 (10,000) [1 year] (30,000) [2 year] Dr Depreciation 20,000 –––––– –––––– 50,000 60,000Dr PPE 10,000 [1.1.X7] [31.12.X7] Cr Liability 30,000 4 A Both issues fall to be treated as provisions under IAS 37. (1) is a legal obligation and (2) is a constructive obligation. 5 C 710,000 + (480,000 × 3/12) – (20,000 × 3) + (20,000 × 25/125) = $774,000 6 D According to IAS 8 Accounting Policies, Changes in Accounting Estimates and Errors it is a change in accounting estimate and must be applied prospectively. 7 D As (1) is being held for the long term it can be classified at fair value through other comprehensive income. (2) must be classified at fair value through profit or loss. 8 A The right-of-use asset will initial be measured at $55,000, which is the sum of the deposit ($2,000), the initial lease liability ($48,000) and the direct costs incurred ($5,000). The asset will be depreciated over four years (i.e. the shorter of the lease term and its useful life); therefore the carrying amount at the end of year 2 will be $55,000 × 2/4 = $27,500 Tutorial note: The maintenance costs are expensed over the life of the contract. 9 A Historical asset values will be lower than current values and therefore capital valuations will be understated in times of rising prices. Cost of sales will be based on historical prices and depreciation will also be based on lower historical costs, therefore profit will be overstated. 10 A 3,250 + 1,940 + (800 – 600 × 30%) = 5,250,000 11 C The only statement that can be verified based on the information given is that cash flows from operating activities have been used to finance non-current assets. This is based on positive operating cashflows and negative investing cash flows. ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 1095 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK 12 D FV of NCI at acquisition 1,100 Profit for year × 30% 3,200 Depreciation on fair value adjustment ($1·5m ÷ 30) (50) Unrealised profit (550) –––––– 2,600 × 30% 780 –––––– 1,880 –––––– 13 B IFRS 3 requires that any negative goodwill is immediately credited to profit or loss. 14 B Retained earnings = 300 + ((150 – 90) × 75%) = 345 Total equity = 125 + 345 = 470 15 B Production cost Capitalisation of borrowing costs ($6m × 6% × 9/12) Total cost capitalised (and carrying amount) at 30 September 20X2 $000 6,000 270 ––––– 6,270 ––––– 16 D Depreciation 1 January to 30 June 20X4 (80,000 ÷ 10 × 6/12) = 4,000 Depreciation 1 July to 31 December 20X4 (81,000 ÷ 9 × 6/12) = 4,500 Total depreciation = 8,500 17 D A, B and C are all possible indicators of impairment; D implies a “revaluation” surplus. 18 B Value in use is lower than fair value (less costs to sell), so impairment is 60,750 – 43,000 = $17,750 19 D This is the definition of a cash generating unit in IAS 36. 20 A The impairment loss of $220,000 (1,170 – 950) is allocated $35,000 to damaged plant, $85,000 to goodwill and the remaining $100,000 allocated proportionally to the building and the undamaged plant (i.e. (100 × 300 ÷ 800) = $37,500 against the plant). The carrying amount of the plant will then be $262,500 (335,000 – 35,000 – 37,500). 21 C The initial amount of right-of-use asset is the initial amount of the lease liability plus any initial direct costs and dismantling costs. 22 C Year 1 200,000 × 11·65% = 23,300 Year 2 (200,000 + 23,300 – 55,000) × 11·65% = $19,607 23 B The total lease liability at 31 December 20X7 ($93,391) is $49,271 a year later, making this the non-current portion at 31 December 20X7. 24 A As the assets are of low value (less than $5,000) the rentals will be expensed to profit or loss on a straight line basis over the period of the lease; no asset is recognised in the statement of financial position. 1096 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) 25 D The difference between the selling price and carrying amount is $120,000, but this cannot be recognised as profit (and $24,000 a year over 5 years is also incorrect). The profit to be recognised is based on the rights transferred to the lessor and is calculated as: Gain Fair value of asset - lease liability Fair value of asset = 70,000 (320,000 250,000) = $15,312 320,000 26 A Supply and install is an obligation performed at a point in time; technical support is provided over a period of time. 27 B 1,000 ÷ 1,500 × 1,200 = $800 28 D ½ × (500 ÷ 1,500 × 1,200) = $200 29 C $30,000 (400 – 500 × 30%) Revaluation and deferred tax of headquarters goes through OCI. 30 B $60,000 (200 × 30%) Dr Income tax expense Cr Deferred tax liability Answer 31 TRIAGE (a) Schedule of adjustments to profit for the year ended 31 March 20X6 Draft profit before interest and tax per trial balance Adjustments re: Note (i): Convertible loan note finance costs (W1) Note (ii): Depreciation of property (1,500 + 1,700 (W2)) Depreciation of plant and equipment (W2) Note (iii): Current year loss on fraud (700 – 450 see below) Note (iv): Income tax expense (2,700 + 700 – 800 (W3)) Profit for the year $000 30,000 (3,023) (3,200) (6,600) (250) (2,600) –––––– 14,327 –––––– The $450,000 fraud loss in the previous year is a prior period adjustment (reported in the statement of changes in equity). The possible insurance claim is a contingent asset and should be ignored. ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 1097 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK (b) Statement of financial position as at 31 March 20X6 $000 Assets Non-current assets Property, plant and equipment (64,600 + 37,400 (W2)) Current assets Trade receivables (28,000 – 700 fraud) Other current assets per trial balance 102,000 27,300 9,300 –––––– Total assets Equity and liabilities Equity shares of $1 each Other component of equity (W1) Revaluation surplus (7,800 – 1,560 (W2)) Retained earnings (W4) 36,600 ––––––– 138,600 ––––––– 50,000 2,208 6,240 17,377 ––––––– 75,825 Non-current liabilities Deferred tax (W3) 6% convertible loan notes (W1) 3,960 38,415 –––––– Current liabilities Per trial balance Current tax payable 17,700 2,700 ––––––– Total equity and liabilities (c) $000 42,375 20,400 ––––––– 138,600 ––––––– Earnings per share Diluted earnings per share (W5) 29 cents WORKINGS (monetary figures in brackets in $000) (1) 6% convertible loan notes The convertible loan notes are a compound financial instrument having a debt and an equity component which must both be quantified and accounted for separately: Year ended 31 20X6 20X7 20X8 Debt component Equity component (= balance) Proceeds of issue March outflow $000 2,400 2,400 42,400 8% 0·93 0·86 0·79 present value $000 2,232 2,064 33,496 –––––– 37,792 2,208 –––––– 40,000 –––––– The finance cost will be $3,023,000 (37,792 × 8%) and the carrying amount of the loan notes at 31 March 20X6 will be $38,415,000 (37,792 + (3,023 – 2,400)). 1098 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) (2) Non-current assets Property $000 Carrying amount at 1 April 20X5 (75,000 – 15,000) 60,000 Depreciation to date of revaluation (1 October 20X5) (75,000 ÷ 25 × 6/12) (1,500) –––––– Carrying amount at revaluation 58,500 Gain on revaluation (balancing amount) 7,800 –––––– Revaluation at 1 October 20X5 66,300 6 Depreciation to 31 March 20X6 (66,300 ÷ 19·5 years × /12) (1,700) –––––– Carrying amount at 31 March 20X6 64,600 –––––– Annual depreciation is $3m (75,000 ÷ 25 years); therefore the accumulated depreciation at 1 April 20X5 of $15m represents five years’ depreciation. At the date of revaluation (1 October 20X5), there will be a remaining life of 19·5 years. Of the revaluation gain, $6·24m (80%) is credited to the revaluation surplus and $1·56m (20%) is credited to deferred tax. Plant and equipment Carrying amount at 1 April 20X5 (72,100 – 28,100) Depreciation for year ended 31 March 20X6 (15% reducing balance) Carrying amount at 31 March 20X6 (3) Deferred tax Provision required at 31 March 20X6: Revalued property and other assets ((7,800 + 12,000) × 20%) Provision at 1 April 20X5 Increase in provision Revaluation of land and buildings (7,800 × 20%) Balance credited to profit or loss (4) $000 44,000 (6,600) –––––– 37,400 –––––– 3,960 (3,200) –––––– 760 (1,560) –––––– (800) –––––– Retained earnings Balance at 1 April 20X5 Prior period adjustment (fraud) Adjusted profit for year (from (a)) Balance at 31 March 20X6 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 3,500 (450) 14,327 –––––– 17,377 –––––– 1099 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK (5) Diluted earnings per share The maximum additional shares on conversion is 8 million (40m × 20 ÷ 100), giving total shares of 58 million. The loan interest “saved” is $2·418m (3,023 (from (W1) above × 80% (i.e. after tax)), giving adjusted earnings of $16·745m (14,327 + 2,418). Therefore diluted EPS is $16,745,00 0 × 100 = 29 cents 58 million Answer 32 GREGORY (a) Four observations Tutorial note: References to 20X6 and 20X5 are to the years ending 31 March 20X6 and 20X5 respectively. Comment (1): I see the profit for the year has increased by $1m which is up 20% on last year, but I thought it would be more as Tamsin was supposed to be a very profitable company. There are two issues with this statement: first, last year’s profit is not comparable with the current year’s profit because in 20X5 Gregory was a single entity and in 20X6 it is now a group with a subsidiary. A second issue is that the consolidated statement of profit or loss for the year ended 31 March 20X6 only includes six months of the results of Tamsin, and, assuming Tamsin is profitable, future results will include a full year’s profit. This latter point may, at least in part, mitigate the CEO’s disappointment. Comment (2): I have calculated the EPS for 20X6 at 13 cents (6,000/46,000 × 100 shares) and at 12·5 cents for 20X5 (5,000/40,000 × 100) and, although the profit has increased 20%, our EPS has barely changed. The stated EPS calculation for 20X6 is incorrect for two reasons: (1) it is the profit attributable to only the equity shareholders of the parent which should be used; and (2) the 6m new shares were only in issue for six months and should be weighted by 6/12. Thus, the correct EPS for 20X6 is 13·3 cents (5,700 ÷ 43,000 × 100). This gives an increase of 6% (13·3 – 12·5) ÷ 12·5) on 20X5 EPS which is still less than the increase in profit. The reason why the EPS may not have increased in line with reported profit is that the acquisition was financed by a share exchange which increased the number of shares in issue. Thus, the EPS takes account of the additional consideration used to generate profit, whereas the trend of absolute profit does not take additional consideration into account. This is why the EPS is often said to be a more accurate reflection of company performance than the trend of profits. Comment (3): I am worried that the low price at which we are selling goods to Tamsin Co is undermining our group’s overall profitability. Assuming the consolidated financial statements have been correctly prepared, all intra-group trading has been eliminated, thus the pricing policy will have had no effect on these financial statements. The comment is incorrect and reflects a misunderstanding of the consolidation process. 1100 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. REVISION QUESTION BANK – FINANCIAL REPORTING (F7) Comment (4): I note that our share price is now $2·30, how does this compare with our share price immediately before we bought Tamsin Co? The increase in share capital is 6m shares, the increase in the share premium is $6m, thus the total proceeds for the 6m shares was $12m giving a share price of $2·00 at the date of acquisition of Tamsin. The current price of $2·30 presumably reflects the market’s favourable view of Gregory’s current and future performance. (b) Ratios and comments 20X6 10·1% 20X5 11·3% (i) Return on capital employed (ROCE) (7,500 ÷ 74,300 × 100) (ii) Net asset turnover (46,500 ÷ 74,300) (iii) Gross profit margin (9,300 ÷ 46,500 × 100) 20·0% 25·7% (iv) Operating profit margin (7,500 ÷ 46,500 × 100) 16·1% 21·4% 0·63 times 0·53 times Looking at the above ratios, it appears that the overall performance of Gregory has declined marginally; the ROCE has fallen from 11·3% to 10·1%. This is has been caused by a substantial fall in the gross profit margin (down from 25·7% in 20X5 to 20% in 20X6); this is more than a 22% (5·7% ÷ 25·7%) decrease. The group/company have relatively low operating expenses (at around 4% of revenue), so the poor gross profit margin feeds through to the operating profit margin. The overall decline in the ROCE, due to the weaker profit margins, has been mitigated by an improvement in net asset turnover, increasing from 0·53 times to 0·63 times. Despite the improvement in net asset turnover, it is still very low with only 63 cents of sales generated from every $1 invested in the business, although this will depend on the type of business Gregory and Tamsin are engaged in. On this analysis, the effect of the acquisition of Tamsin seems to have had a detrimental effect on overall performance, but this may not necessarily be the case; there could be some distorting factors in the analysis. As mentioned above, the 20X6 results include only six months of Tamsin’s results, but the statement of financial position includes the full amount of the consideration for Tamsin. Tutorial note: The consideration has been calculated (see (4) above) as $12m for the parent’s 75% share plus $3·3m (3,600 – 300 share of post-acquisition profit) for the noncontrolling interest’s 25%, giving total consideration of $15·3 m. The above factors disproportionately increase the denominator of ROCE which has the effect of worsening the calculated ROCE. This distortion should be corrected in 20X7 when a full year’s results for Tamsin will be included in group profit. Another factor is that it could take time to fully integrate the activities of the two companies and more savings and other synergies may be forthcoming such as bulk buying discounts. The non-controlling interest share in the profit for the year in 20X6 of $300,000 allows a rough calculation of the full year’s profit of Tamsin at $2·4m (300,000 ÷ 25% × 12/6, i.e. the $300,000 represents 25% of 6/12 of the annual profit). This figure is subject to some uncertainty such as the effect of probable increased post-acquisition depreciation charges. However, a profit of $2·4m on the investment of $15·3m represents a return of 16% (and would be higher if the profit was adjusted to a pre-tax figure) which is much higher than the current year ROCE (at 10·1%) of the group. This implies that the performance of Tamsin is much better than that of Gregory (as a separate entity) and that Gregory’s performance in 20X6 must have deteriorated considerably from that in 20X5 and this is the real cause of the deteriorating performance of the group. ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 1101 FINANCIAL REPORTING (F7) – REVISION QUESTION BANK Another issue potentially affecting the ROCE is that, as a result of the consolidation process, Tamsin’s net assets, including goodwill, are included in the statement of financial position at fair value, whereas Gregory’s net assets appear to be based on historical cost (as there is no revaluation surplus). As the values of property, plant and equipment have been rising, this effect favourably flatters the 20X5 ratios. This is because the statement of financial position of 20X5 only contains Gregory’s assets which, at historical cost, may considerably understate their fair value and, on a comparative basis, overstate 20X5 ROCE. In summary, although on first impression the acquisition of Tamsin appears to have caused a marginal worsening of the group’s performance, the distorting factors and imputation of the non-controlling interest’s profit in 20X6 indicate the underlying performance may be better than the ratios portray and the contribution from Tamsin is a very significant positive. Future performance may be even better. Without information on the separate financial statements of Tamsin, it is difficult to form a more definite view. 1102 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. Financial Reporting Tuesday 6 December 2016 Time allowed: 3 hours 15 minutes This question paper is divided into three sections: Section A – ALL 15 questions are compulsory and MUST be attempted Section B – ALL 15 questions are compulsory and MUST be attempted Section C – BOTH questions are compulsory and MUST be attempted Do NOT open this question paper until instructed by the supervisor. Do NOT record any of your answers on the question paper. This question paper must not be removed from the examination hall. Paper F7 Fundamentals Level – Skills Module The Association of Chartered Certified Accountants Section A – ALL 15 questions are compulsory and MUST be attempted Please use the grid provided on page two of the Candidate Answer Booklet to record your answers to each multiple choice question. Do not write out the answers to the MCQs on the lined pages of the answer booklet. Each question is worth 2 marks. 1 Which of the following is a possible advantage of a rules-based system of financial reporting? A B C D 2 It It It It encourages the exercise of professional judgement prevents a fire-fighting approach to the formulation of standards offers accountants more protection in the event of litigation ensures that no standards conflict with each other IFRS 10 Consolidated Financial Statements states that ‘A parent shall prepare consolidated financial statements using uniform accounting policies for like transactions and other events in similar circumstances’. Which of the following situations requires an adjustment because of this constraint? A B C D 3 A subsidiary has been acquired and its land is to be included in the consolidated financial statements at fair value A subsidiary carries its assets at historical cost but the parent’s assets are carried at revalued amounts There have been intra-group transactions during the year which have resulted in unrealised profit in inventory at the year end There has been intra-group trading which has resulted in intra-group balances for receivables and payables at the year end The following trial balance extract relates to Topsy Co as at 30 April 20X6: Land at cost Building: Valuation at 1 May 20X2 Accumulated depreciation at 30 April 20X5 Revaluation surplus at 30 April 20X5 $’000 800 $’000 1,500 90 705 On 1 May 20X2, when the carrying amount of the building was $750,000, it was revalued for the first time to $1·5m and its remaining useful life at that date was estimated to be 50 years. Topsy Co has correctly accounted for this revaluation in the above trial balance. However, Topsy Co has not yet charged depreciation for the year ended 30 April 20X6 or transferred the excess depreciation from the revaluation surplus to retained earnings at 30 April 20X6. In February 20X6, the land, but not the building, was independently valued at $950,000. This adjustment has yet to be made for the year ended 30 April 20X6. What is the balance on the revaluation surplus of Topsy Co as at 30 April 20X6 after the required adjustments have been made? A B C D $555,000 $690,000 $840,000 $870,000 2 4 Plow Co purchased 3,500 of the 10,000 $1 equity shares of Styre Co on 1 August 20X4 for $6·50 per share. Styre Co’s profit after tax for the year ended 31 July 20X5 was $7,500. Styre Co paid a dividend of $0·50 per share on 31 December 20X4. What is the carrying amount of the investment in Styre Co in the consolidated statement of financial position of Plow Co as at 31 July 20X5? A B C D 5 6 Which of the following are correct when calculating the impairment loss of an asset? (1) (2) (3) (4) Assets should be carried at the lower of their carrying amount and recoverable amount Assets should be carried at the higher of their carrying amount and recoverable amount The recoverable amount of an asset is the higher of value in use and fair value less costs of disposal The recoverable amount of an asset is the lower of value in use and fair value less costs of disposal A B C D 1 1 2 2 and and and and 3 4 3 4 Which of the following statements is NOT true? A B C D 7 $25,375 $22,750 $27,125 $23,625 In some countries, accounting standards can be a detailed set of rules which companies must follow Local accounting standards can be influenced by the tax regime within a country Accounting standards on their own provide a complete system of regulation Accounting standards are particularly important where a company’s shares are publicly traded A company had issued share capital on 1 January 20X9 of 2,000,000 equity $1 shares. On 1 October 20X9, a rights issue was made on a one for four basis which was fully taken up. On 30 September 20X9, each share had a market value of $3·25, giving a theoretical ex-rights value of $2·84 per share. In accordance with IAS 33 Earnings Per Share, what is the weighted average number of shares in issue for the year ended 31 December 20X9? A B C D 8 2,341,549 1,935,769 2,125,000 2,431,778 shares shares shares shares Which of the following would result in a credit to the deferred tax account? (1) (2) (3) (4) Interest receivable, which will be taxed when the interest is received A loan, the repayment of which will have no tax consequences Interest payable, which will be allowable for tax when paid Prepaid expenses, which have been deducted to calculate the taxable profits of the previous year A B C D 1 3 1 2 and and and and 2 4 4 3 3 [P.T.O. 9 IFRS 15 Revenue from Contracts with Customers states that, where performance obligations are satisfied over time, entities should apply an appropriate method of measuring progress. Which of the following are appropriate OUTPUT methods of measuring progress? (1) (2) (3) (4) Total costs to date of the contract as a percentage of total contract revenue Physical milestones reached as a percentage of physical completion Surveys of performance completed to date as a percentage of total contract revenue Labour hours expended as a percentage of total expected labour hours A B C D 1 3 1 2 and and and and 2 4 4 3 10 Fifer Co has a current ratio of 1·2:1 which is below the industry average. Fifer Co wants to increase its current ratio by the year end. Which of the following actions, taken before the year end, would lead to an increase in the current ratio? A B C D Return some inventory which had been purchased for cash and obtain a full refund on the cost Make a bulk purchase of inventory for cash to obtain a large discount Make an early payment to suppliers, even though the amount is not due Offer early payment discounts in order to collect receivables more quickly 11 On 1 October 20X8, Picture Co acquired 60% shares in Frame Co. At 1 April 20X8, the credit balances on the revaluation surpluses relating to Picture Co and Frame Co’s equity financial asset investments stood at $6,400 and $4,400 respectively. The following extract was taken from the financial statements for the year ended 31 March 20X9: Other comprehensive income: loss on fair value of equity financial asset investments Picture Co $ (1,400) Frame Co $ (800) Assume the losses accrued evenly throughout the year. What is the amount of the revaluation surplus in the consolidated statement of financial position of Picture Co as at 31 March 20X9? A B C D $4,520 $4,760 $5,240 $9,160 12 A local authority department is responsible for waste collections. They have an annual budget to provide a regular collection service from households in the local area. The budget was increased to enable the department to increase the percentage of waste disposed of in an environmentally friendly manner. Which of the following is the best measurement to justify the increase in the budget? A B C D An increase in the number of collections made during the period The percentage of waste recycled rather than being placed in landfill sites The fair value of the machinery used in making the collections A breakdown of expenditure between the cost of making collections and the cost of processing waste 4 13 Panther Co owns 80% of Tiger Co. An extract from the companies’ individual statements of financial position as at 30 June 20X8 shows the following: Panther Co $’000 370 Property, plant and equipment (carrying amount) Tiger Co $,000 285 On 1 July 20X7, Panther Co sold a piece of equipment which had a carrying amount of $70,000 to Tiger Co for $150,000. The equipment had an estimated remaining life of five years when sold. What is the carrying amount of property, plant and equipment in the consolidated statement of financial position of Panther Co as at 30 June 20X8? A B C D $591,000 $575,000 $671,000 $534,000 14 On 1 July 20X7, Lime Co acquired 90% of Soda Co’s equity share capital. On this date, Soda Co had an internally generated customer list which was valued at $35m by an independent team of experts. At 1 July 20X7, Soda Co was also in negotiations with a potential new major customer. If the negotiations are successful, the new customer will sign the contract on 15 July 20X7 and the value of the total customer base would then be worth $45m. What amount would be recognised for the customer list in the consolidated statement of financial position of Lime Co as at 1 July 20X7? A B C D $0 $10m $35m $45m 15 Which of the following statements relating to goodwill is correct? A B C D Goodwill is amortised over its useful life with the charge expensed to profit or loss On the investment in an associate, any related goodwill should be separately identified in the consolidated financial statements The testing of goodwill for impairment is only required when circumstances exist which indicate potential impairment If the fair value of a subsidiary’s contingent liabilities can be reliably measured at the date of acquisition, they should be included in consolidated net assets and will increase goodwill (30 marks) 5 [P.T.O. Section B – ALL 15 questions are compulsory and MUST be attempted Please use the grid provided on page two of the Candidate Answer Booklet to record your answers to each multiple choice question. Do not write out the answers to the MCQs on the lined pages of the answer booklet. Each question is worth 2 marks. The following scenario relates to questions 16–20. Artem Co prepares financial statements to 30 June each year. During the year to 30 June 20X5, the company spent $550,000 on new plant as follows: $’000 525 3 12 2 8 Plant cost Delivery to site Building alterations to accommodate the plant Costs of initial testing of the new plant Plant operator training costs Artem Co’s fixtures and fittings were purchased on 1 July 20X2 at a cost of $50,000. The directors have depreciated them on a straight line basis over an estimated useful life of eight years assuming a $5,000 residual value. At 1 July 20X4, the directors realise that the remaining useful life of the fixtures is five years. There is no change to the estimated residual value. Artem Co began a research project in October 20X3 with the aim of developing a new type of machine. If successful, Artem Co will manufacture the machines and sell them to customers as well as using them in their own production processes. During the year ended 30 June 20X4, costs of $25,000 were incurred on conducting feasibility studies and some market research. During the year ended 30 June 20X5, a further $80,000 was incurred on constructing and testing a prototype of the machine. 16 In accordance with IAS 16 Property, Plant and Equipment, what is the value of additions to plant for Artem Co for the year ended 30 June 20X5? A B C D $525,000 $542,000 $550,000 $540,000 17 Which of the following is TRUE in relation to the change in the remaining useful life of the fixtures and fittings? A B C D It It It It is is is is a a a a change change change change of of of of accounting accounting accounting accounting policy which should be retrospectively applied policy which should be disclosed in the notes to the financial statements estimate which should be retrospectively applied estimate which should be prospectively applied 18 In accordance with IAS 16, what is the depreciation charge for the fixtures and fittings for Artem Co for the year ended 30 June 20X5? A B C D $7,500 $9,000 $7,750 $6,750 6 19 In accordance with IAS 38 Intangible Assets, what is the correct treatment of the $25,000 costs incurred on the research project by Artem Co during the year ended 30 June 20X4? A B C D They should be recognised as an intangible non-current asset as future economic benefits are expected from the use and sale of the machinery They should be written off to profit or loss as an expense as they are research costs at this date They should be included in tangible non-current assets as machinery which will be put into use once completed They should be set against a provision made for the estimated total cost of the project which was set up at the start of the research 20 In accordance with IAS 38, which of the following is true when Artem Co moves to the production and testing stage of the prototype during the year ended 30 June 20X5? A B C D The project has moved to the development stage. If the IAS 38 development expenditure criteria are met, Artem Co can choose whether or not to recognise the $80,000 costs as an intangible non-current asset The project is still in its research stage and the $80,000 costs incurred by Artem Co cannot be recognised as an intangible non-current asset until a product is ready for sale The project has moved to the development stage. If the IAS 38 development expenditure criteria are met, Artem Co must recognise the $80,000 costs as an intangible non-current asset The project is still in its research stage and so Artem Co must expense the $80,000 costs to profit or loss 7 [P.T.O. The following scenario relates to questions 21–25. Maykorn Co prepares its financial statements to 30 September each year. Maykorn Co’s draft financial statements were finalised on 20 October 20X3. They were authorised for issue on 15 December 20X3 and the annual general meeting of shareholders took place on 23 December 20X3. On 30 September 20X3, Maykorn Co moved out of one of its properties and put it up for sale. The property met the criteria as held for sale on 30 September 20X3. On 1 October 20X2, the property had a carrying amount of $2·6m and a remaining life of 20 years. The property is held under the revaluation model. The property was expected to sell for a gross amount of $2·5m with selling costs estimated at $50,000. Maykorn Co decided to sell an item of plant during the year ended 30 September 20X3. On 1 October 20X2, the plant had a carrying amount of $490,000 and a remaining useful life of seven years. The plant met the held for sale criteria on 1 April 20X3. At 1 April 20X3, the plant had a fair value less costs to sell of $470,000, which had fallen to $465,000 at 30 September 20X3. 21 In accordance with IAS 10 Events after the Reporting Period, which of the following statements is/are CORRECT for Maykorn Co? (1) All events which occur between 30 September 20X3 and 15 December 20X3 should be considered as events occurring after the reporting period (2) An event which occurs between 30 September 20X3 and 15 December 20X3 and which provides evidence of a condition which existed at 30 September 20X3 should be considered as an adjusting event A B C D 1 only Both 1 and 2 2 only Neither 1 nor 2 22 In accordance with IAS 10, which of the following events would be classed as a non-adjusting event in Maykorn Co’s financial statements for the year ended 30 September 20X3? A B C D During October 20X3, there was evidence of a permanent diminution in the carrying amount of a property held at 30 September 20X3 On 1 December 20X3 the acquisition of a subsidiary was completed, following lengthy negotiations which began in September 20X3 The sale of inventory during October 20X3 at a value less than its cost. This inventory was included in the financial statements at cost on 30 September 20X3 The insolvency of a major customer during October 20X3, whose balance was included within receivables at 30 September 20X3 23 What is the total amount charged to Maykorn Co’s profit or loss in respect of the property for the year ended 30 September 20X3? A B C D $130,000 $180,000 $150,000 $100,000 24 In accordance with IFRS 5 Non-current Assets Held for Sale and Discontinued Operations, what is the carrying amount of the plant in Maykorn Co’s statement of financial position as at 30 September 20X3? A B C D $420,000 $470,000 $455,000 $465,000 8 25 Which of the following items should be classed as an asset held for sale under IFRS 5? A B C D Maykorn Co’s head office building is to be demolished, at which point the land will be put up for sale. A number of prospective bidders have declared an interest and the land is expected to sell within a few months of the demolition An item of plant was put up for sale at the start of the year for $500,000. Six parties have made a bid to Maykorn Co for the plant but none of these bids have been above $200,000 A chain of retail outlets are currently advertised for sale. Maykorn Co has provisionally accepted a bid, subject to surveys being completed. The surveys are not expected to highlight any problems. The outlets are currently empty A brand name which Maykorn Co purchased in 20X2 is associated with the sale of potentially harmful products. Maykorn Co has decided to stop producing products under this brand, which is currently held within intangible assets 9 [P.T.O. The following scenario relates to questions 26–30. Vitrion Co issued $2m 6% convertible loan notes on 1 April 20X2. The convertible loan notes are redeemable on 31 March 20X5 at par for cash or can be exchanged for equity shares in Vitrion Co on that date. Similar loan notes without the conversion option carry an interest rate of 9%. The following table provides information about discount rates: 6% 0·943 0·890 0·840 Year 1 Year 2 Year 3 9% 0·917 0·842 0·772 On 1 April 20X3, Vitrion Co purchased 50,000 $1 equity shares in Gowhizzo Co at $4 per share, incurring transaction costs of $4,000. The intention is to hold the shares for trading. By 31 March 20X4 the shares are trading at $7 per share. In addition to the gain on investment, Vitrion Co also received a dividend from Gowhizzo Co during the year to 31 March 20X4. 26 In accordance with IAS 32 Financial Instruments: Presentation, which of the following describes an equity instrument? A B C D A A A A contractual obligation to deliver cash or another financial asset to another entity contract which is evidence of a residual interest in the assets of an entity after deducting all of its liabilities contractual right to exchange financial instruments with another entity under potentially favourable conditions contract which gives rise to both a financial asset of one entity and a financial liability of another 27 In accordance with IAS 32, how should the issue of the convertible loan notes be recognised in Vitrion Co’s financial statements? A B C D As debt. Interest should be charged at 6% because it cannot be assumed that loan note holders will choose the equity option As equity because the loan notes are convertible to equity shares As debt and equity because the convertible loan notes contain elements of both As debt. Interest should be charged at 9% to allow for the conversion of the loan notes 28 What amount in respect of the loan notes will be shown under non-current liabilities in Vitrion Co’s statement of financial position as at 1 April 20X2 (to the nearest $’000)? A B C D $2,000,000 $1,848,000 $1,544,000 $2,701,000 29 In accordance with IFRS 9 Financial Instruments, at what amount will the Gowhizzo Co shares be shown under ‘investments in equity instruments’ in Vitrion Co’s statement of financial position as at 31 March 20X4? A B C D $204,000 $354,000 $346,000 $350,000 10 30 Where should the gain on the investment in Gowhizzo Co and its dividend be recognised in Vitrion Co’s financial statements for the year ended 31 March 20X4? A B C D Both Gain Gain Both in profit or loss on investment in other comprehensive income and the dividend in profit or loss on investment in profit or loss and the dividend in other comprehensive income in other comprehensive income (30 marks) 11 [P.T.O. Section C – BOTH questions are compulsory and MUST be attempted Please write your answers to all parts of these questions on the lined pages within the Candidate Answer Booklet. 31 On 1 January 20X6, Laurel Co acquired 60% of the equity share capital of Rakewood Co in a share exchange in which Laurel Co issued three new shares for every five shares it acquired in Rakewood Co. The share issue has not yet been recorded by Laurel Co. Additionally, on 31 December 20X6, Laurel Co will pay to the shareholders of Rakewood Co $1·62 per share acquired. Laurel Co’s cost of capital is 8% per annum. At the date of acquisition, shares in Laurel Co and Rakewood Co had a market value of $7·00 and $2·00 each respectively. Statements of profit or loss for the year ended 30 September 20X6 Revenue Cost of sales Gross profit Distribution costs Administrative expenses Investment income (note (iv)) Finance costs Profit before tax Income tax expense Profit for the year Laurel Co $’000 84,500 (58,200) ––––––– 26,300 (2,000) (4,100) 500 (300) ––––––– 20,400 (4,800) ––––––– 15,600 ––––––– Rakewood Co $’000 52,000 (34,000) ––––––– 18,000 (1,600) (2,800) 400 nil ––––––– 14,000 (3,600) ––––––– 10,400 ––––––– $’000 20,000 72,000 $’000 15,000 25,000 Equity as at 1 October 20X5 Equity shares of $1 each Retained earnings The following information is relevant: (i) At the date of acquisition, Laurel Co conducted a fair value exercise on Rakewood Co’s net assets which were equal to their carrying amounts with the following exceptions: – an item of plant had a fair value of $4m above its carrying amount. At the date of acquisition it had a remaining life of two years. – inventory of $800,000 had a fair value of $1m. All of this inventory had been sold by 30 September 20X6. (ii) Laurel Co’s policy is to value the non-controlling interest at fair value at the date of acquisition. For this purpose Rakewood Co’s share price at 1 January 20X6 can be deemed to be representative of the fair value of the shares held by the non-controlling interest. (iii) Laurel Co had traded with Rakewood Co for many years before the acquisition. Sales from Rakewood Co to Laurel Co throughout the year ended 30 September 20X6 were consistently $1·2m per month. Rakewood Co made a mark-up on cost of 20% on these sales. Laurel Co had $1·8m of these goods in inventory as at 30 September 20X6. (iv) Laurel Co’s investment income consists of: – its share of a dividend of $500,000 paid by Rakewood Co in August 20X6. – a dividend of $200,000 received from Artic Co, a 25% owned associate which it has held for several years. The profit after tax of Artic Co for the year ended 30 September 20X6 was $2·4m. (v) Assume, except where indicated otherwise, that all items of income and expense accrue evenly throughout the year. (vi) There were no impairment losses within the group during the year ended 30 September 20X6. 12 Required: (a) Calculate the consolidated goodwill at the date of acquisition of Rakewood Co. (7 marks) (b) Prepare the consolidated statement of profit or loss for Laurel Co for the year ended 30 September 20X6. (13 marks) (20 marks) 13 [P.T.O. 32 Landing Co is considering the acquisition of Archway Co, a retail company. The summarised financial statements of Archway Co for the year ended 30 September 20X6 are: Statement of profit or loss $’000 94,000 (73,000) ––––––– 21,000 (4,000) (6,000) (400) ––––––– 10,600 (2,120) ––––––– 8,480 ––––––– Revenue Cost of sales Gross profit Distribution costs Administrative expenses Finance costs Profit before tax Income tax expense (at 20%) Profit for the year Statement of financial position $’000 Assets Non-current assets Property, plant and equipment Current assets Inventory Bank 29,400 10,500 100 ––––––– Total assets Equity and liabilities Equity Equity shares of $1 each Retained earnings Current liabilities 4% loan notes (redeemable 1 November 20X6) Trade payables Current tax payable $’000 10,600 ––––––– 40,000 ––––––– 10,000 8,800 ––––––– 18,800 10,000 9,200 2,000 ––––––– Total equity and liabilities 21,200 ––––––– 40,000 ––––––– From enquiries made, Landing Co has obtained the following information: (i) Archway Co pays an annual licence fee of $1m to Cardol Co (included in cost of sales) for the right to package and sell some goods under a well-known brand name owned by Cardol Co. If Archway Co is acquired, this arrangement would be discontinued. Landing Co estimates that this would not affect Archway Co’s volume of sales, but without the use of the brand name packaging, overall sales revenue would be 5% lower than currently. (ii) Archway Co buys 50% of its purchases for resale from Cardol Co, one of Landing Co’s rivals, and receives a bulk buying discount of 10% off normal prices (this discount does not apply to the annual licence fee referred to in note (i) above). This discount would not be available if Archway Co is acquired by Landing Co. (iii) The 4% loan notes have been classified as a current liability due to their imminent redemption. As such, they should not be treated as long-term funding. However, they will be replaced immediately after redemption by 8% loan notes with the same nominal value, repayable in ten years’ time. 14 (iv) Landing Co has obtained some of Archway Co’s retail sector average ratios for the year ended 30 September 20X6. It has then calculated the equivalent ratios for Archway Co as shown below: Annual sales per square metre of floor space Return on capital employed (ROCE) Net asset (total assets less current liabilities) turnover Gross profit margin Operating profit (profit before interest and tax) margin Gearing (debt/equity) Sector average $8,000 18·0% 2·7 times 22·0% 6·7% 30·0% Archway Co $7,833 58·5% 5·0 times 22·3% 11·7% nil A note accompanying the sector average ratios explains that it is the practice of the sector to carry retail property at market value. The market value of Archway Co’s retail property is $3m more than its carrying amount (ignore the effect of any consequent additional depreciation) and gives 12,000 square metres of floor space. Required: (a) After making adjustments to the financial statements of Archway Co which you think may be appropriate for comparability purposes, restate: (i) (ii) (iii) (iv) Revenue; Cost of sales; Finance costs; Equity (assume that your adjustments to profit or loss result in retained earnings of $2·3 million at 30 September 20X6); and (v) Non-current liabilities. (5 marks) (b) Recalculate comparable sector average ratios for Archway Co based on your restated figures in (a) above. (6 marks) (c) Comment on the performance and gearing of Archway Co compared to the retail sector average as a basis for advising Landing Co regarding the possible acquisition of Archway Co. (9 marks) (20 marks) End of Question Paper 15 Answers Fundamentals Level – Skills Module, Paper F7 Financial Reporting December 2016 Answers Section A 1 C 2 B 3 C $ At 30 April 20X5 Increase in value of land in the year ($900,000 – $750,000) Annual transfer to retained earnings Depreciation based on revalued amount ($1,500,000/50 years) Depreciation based on historic cost ($750,000/50 years) 30,000 (15,000) ––––––– At 30 April 20X6 4 $ 705,000 150,000 –––––––– 855,000 (15,000) –––––––– 840,000 –––––––– D Cost of investment Share of post acq profit Less dividend received 5 A 6 C 7 A 1 January X9–30 September X9 1 October X9–31 December X9 8 C 9 D 3,500 x 6·50 35% x 7,000 3,500 x $0·50 22,750 2,625 (1,750) ––––––– 23,625 2,000,000 x 3·25/2·84 x 9/12 2,500,000 x 3/12 1,716,549 625,000 –––––––––– 2,341,549 10 C 11 B (6,400 – 1,400 loss – (800 loss x 60% x 6/12)) = 4,760 12 B 13 A Carrying amount 370,000 + 285,000 – 64,000 (see below) = 591,000 The unrealised profit on the sale is 80,000 (150,000 – 70,000) of which 64,000 (80,000 x 4 years/5 years) is still unrealised at 30 June 20X8. 19 14 C 15 D Section B 16 B Correct answer does not include training costs. 17 D 18 D Carrying amount at date of revised remaining life is (50,000 – (50,000 – 5,000)/8 years x 2 years) = 38,750 Depreciation year ended 30 June 20X5 is therefore 38,750 – 5,000/5 years = 6,750 pa 19 B 20 C 21 B 22 B 23 B Property is depreciated by $130,000 ($2,600,000/20) giving a carrying amount of $2,470,000. When classed as held for sale, property is revalued to its fair value of $2,500,000 (as it is carried under the revaluation model, $30,000 would go to revaluation surplus). Held for sale assets are measured at the lower of carrying amount (now $2,500,000) and fair value less costs to sell ($2,500,000 – $50,000 = $2,450,000), giving an impairment of $50,000. Total charge to profit or loss is $130,000 + $50,000 = $180,000. 24 C Carrying amount at 1 April is $455,000 (490 – (490/7 x 6/12)). 25 C 26 B 27 C 28 B 120,000 x 0·917 120,000 x 0·842 2,120,000 x 0·772 110,040 101,040 1,636,640 –––––––––– 1,847,720 rounded to 1,848,000 29 D 50000 shares at $7 each 30 A 20 Section C 31 (a) Laurel Co: Consolidated goodwill on acquisition of Rakewood Co $’000 $’000 Investment at cost Shares (15,000 x 60% x 3/5 x $7·00) Deferred consideration (9,000 x $1·62/1·08) Non-controlling interest (15,000 x 40% x $2·00) 37,800 13,500 12,000 ––––––– 63,300 Net assets (based on equity) of Rakewood Co as at 1 January 20X6 Equity shares Retained earnings at 1 October 20X5 Earnings 1 October 20X5 to acquisition (10,400 x 3/12) Fair value adjustments: plant inventory 15,000 25,000 2,600 4,000 200 ––––––– Net assets at date of acquisition (46,800) ––––––– 16,500 ––––––– Consolidated goodwill (b) Laurel Co: Consolidated statement of profit or loss for the year ended 30 September 20X6 Revenue (84,500 + (52,000 x 9/12) – (1,200 x 9 months) intra-group sales) Cost of sales (working) Gross profit Distribution costs (2,000 + (1,600 x 9/12)) Administrative expenses (4,100 + (2,800 x 9/12)) Investment income (400 x 9/12) Income from associate (2,400 x 25% based on underlying earnings) Finance costs (300 + (13,500 x 8% x 9/12 re deferred consideration)) Profit before tax Income tax expense (4,800 + (3,600 x 9/12)) Profit for the year Profit for year attributable to: Equity holders of the parent Non-controlling interest ((10,400 x 9/12) – 200 re inventory – 1,500 depreciation – 300 URP) x 40%)) $’000 112,700 (74,900) –––––––– 37,800 (3,200) (6,200) 300 600 (1,110) –––––––– 28,190 (7,500) –––––––– 20,690 –––––––– 18,370 2,320 –––––––– 20,690 –––––––– Working in $’000 Cost of sales Laurel Co Rakewood Co (34,000 x 9/12) Intra-group purchases (1,200 x 9 months) Fair value inventory adjustment URP in inventory at 30 September 20X6 (1,800 x 20/120) Additional depreciation (4,000/2 years x 9/12) 21 $’000 58,200 25,500 (10,800) 200 300 1,500 ––––––– 74,900 ––––––– 32 (a) Archway Co’s restated figures On the assumption that Landing Co purchases Archway Co, the following adjustments relate to the effects of notes (i) to (iii) in the question and the property revaluation: $’000 89,300 76,000 800 15,300 10,000 Revenue (94,000 x 95%) Cost of sales (see below) Loan interest (10,000 x 8%) Equity (10,000 + 2,300 RE + 3,000 revaluation) Non-current liabilities: 8% loan notes The cost of sales should be first adjusted for the annual licence fee of $1m, reducing this to $72m. Half of these, $36m, are net of a discount of 10% which equates to $4m (36,000/90% – 36,000). Adjusted cost of sales is $76m (73,000 – 1,000 + 4,000). (b) These figures would give the following ratios: Annual sales per square metre of floor space (89,300/12,000) ROCE (13,300 – 10,000)/(15,300 + 10,000) x 100) Net asset turnover (89,300/(15,300 + 10,000)) Gross profit margin ((89,300 – 76,000)/89,300 x 100) Operating profit margin ((13,300 – 10,000)/89,300 x 100) Gearing (debt/equity) (10,000/15,300) (c) $7,442 13% 3·5 times 15% 3·7 % 65·4% Performance Archway Co as reported $7,833 58·5% 5·0 times 22·3% 11·7% nil Annual sales per square metre of floor space ROCE Net asset turnover Gross profit margin Operating profit margin Gearing (debt/equity) Archway Co as adjusted $7,442 13% 3·5 times 15% 3·7% 65·4% Sector average $8,000 18·0% 2·7 times 22·0% 6·7% 30·0% A comparison of Archway Co’s ratios based upon the reported results compares very favourably to the sector average ratios in almost every instance. ROCE is particularly impressive at 58·5% compared to a sector average of 18%; this represents a return of more than three times the sector average. The superior secondary ratios of profit margin and asset utilisation (net asset turnover) appear to confirm Archway Co’s above average performance. It is only sales per square metre of floor space which is below the sector average. The unadjusted figure is very close to the sector average, as too is the gross profit margin, implying a comparable sales volume performance. However, the reduction in selling prices caused by the removal of the brand premium causes sales per square metre to fall marginally. As indicated in the question, should Archway Co be acquired by Landing Co, many figures particularly related to the statement of profit or loss would be unfavourably impacted as shown above in the workings for Archway Co’s adjusted ratios. When these effects are taken into account and the ratios are recalculated, a very different picture emerges. All the performance ratios, with the exception of net asset turnover, are significantly reduced due to the assumed cessation of the favourable trading arrangements. The most dramatic effect is on the ROCE, which, having been more than three times the sector average, would be 27·8% (18·0 – 13·0)/18·0 x 100) below the sector average (at 13% compared to 18·0%). Analysing the component parts of the ROCE (net asset turnover and profit margins), both aspects are lower when the reported figures are adjusted. The net asset turnover (although adjusted to a lower multiple) is still considerably higher than the sector average. The fall in this ratio is due to a combination of lower revenues (caused by the loss of the branding) and the increase in capital employed (equal to net assets) due to classifying the loan notes as debt (non-current). Gross margin deteriorates from 22·3% to only 15·0% caused by a combination of lower revenues (referred to above) and the loss of the discount on purchases. The distribution costs and administrative expenses for Archway Co are less than those of its retail sector in terms of the percentage of sales revenue (at 11·3% compared to 15·3%), which mitigates (slightly) the dramatic reduction in the profit before interest and tax. The reduction in sales per square metre of floor space is caused only by the reduced (5%) volume from the removal of the branded sales. Gearing The gearing ratio of nil based on the unadjusted figures is not meaningful due to previous debt being classified as a current liability because of its imminent redemption. When this debt is replaced by the 8% loan notes and (more realistically) classified as a non-current liability, Archway Co’s gearing is much higher than the sector average. There is no information as to how the increased interest payable at 8% (double the previous 4%) compares to the sector’s average finance cost. If such a figure were available, it may give an indication of Archway Co’s credit status although the doubling of the rate does imply a greater degree of risk in Archway Co seen by the lender. 22 Summary and advice Based upon Archway Co’s reported figures, its purchase by Landing Co would appear to be a good investment. However, when Archway Co’s performance is assessed based on the results and financial position which might be expected under Landing Co’s ownership, the recalculated ratios are generally inferior to Archway Co’s retail sector averages. In an investment decision such as this, an important projected ratio would be the return on the investment (ROI) which Landing Co might expect. The expected net profit after tax can be calculated as $2m ((3,300 before interest and tax – 800 interest) x 80% post-tax), however, there is no information in the question as to what the purchase consideration of Archway Co would be. That said, at a (probable) minimum purchase price based on Archway Co’s net asset value (with no goodwill premium), the ROI would only be 7·9% (2,000/25,300 x 100) which is very modest and should be compared to Landing Co’s existing ROI. A purchase price exceeding $25·3m would obviously result in an even lower expected ROI. It is possible that under Landing Co’s management, Archway Co’s profit margins could be improved, perhaps coming to a similar arrangement regarding access to branded sales (or franchising) as currently exists with Cardol Co, but with a different company. If so, the purchase of Archway Co may still be a reasonable acquisition. 23 Fundamentals Level – Skills Module, Paper F7 Financial Reporting December 2016 Marking Scheme This marking scheme is given as a guide in the context of the suggested answers. Scope is given to markers to award marks for alternative approaches to a question, including relevant comment, and where well-reasoned conclusions are provided. This is particularly the case for written answers where there may be more than one acceptable solution. Section A Marks 30 ––– 2 marks per question Section B 30 ––– 3 cases (5 questions each) 2 marks per question Section C 31 (a) (b) 32 (a) Maximum marks Consolidated goodwill: consideration – share exchange – deferred consideration – NCI net assets – equity shares – retained earnings at acquisition – fair value adjustments 1 1 1 ½ 1½ 2 ––– 7 ––– Consolidated statement of profit or loss: revenue cost of sales distribution costs administrative expenses investment income finance costs income tax expense NCI 1½ 4½ ½ ½ 1½ 1½ 1 2 ––– 13 ––– 20 ––– revenue cost of sales loan interest equity non-current liabilities ½ 2 ½ 1½ ½ ––– 5 ––– (b) 1 mark per ratio 6 ––– (c) 1 mark per relevant comment up to 9 ––– 20 ––– 25 Awarded ACCA F7 FINANCIAL REPORTING OBJECTIVE TEST QUESTION PRACTICE For Computer Based Examinations from September 2017 to June 2018 ® ©2017 DeVry/Becker Educational Development Corp. All rights reserved. (i) No responsibility for loss occasioned to any person acting or refraining from action as a result of any material in this publication can be accepted by the author, editor or publisher. This training material has been prepared and published by Becker Professional Development International Limited: www.becker.com/acca Copyright ©2017 DeVry/Becker Educational Development Corp. All rights reserved. The trademarks used herein are owned by DeVry/Becker Educational Development Corp. or their respective owners and may not be used without permission from the owner. No part of this training material may be translated, reprinted or reproduced or utilised in any form either in whole or in part or by any electronic, mechanical or other means, now known or hereafter invented, including photocopying and recording, or in any information storage and retrieval system without express written permission. Request for permission or further information should be addressed to the Permissions Department, DeVry/Becker Educational Development Corp. Acknowledgement Past ACCA examination questions are the copyright of the Association of Chartered Certified Accountants and have been reproduced by kind permission. (ii) ©2017 DeVry/Becker Educational Development Corp. All rights reserved. OBJECTIVE TEST QUESTION PRACTICE – FINANCIAL REPORTING (F7) CONTENTS Question Page Page Answer Marks Date worked COMPUTER BASED EXAMINATIONS Introduction (iv) OBJECTIVE TEST QUESTIONS 1 Multiple response 1 1001 14 2 Pull-down list 3 1002 14 3 Number entry 5 1003 14 4 Hot area 7 1004 12 5 Hot spot 9 1006 4 6 Enhanced matching 11 1008 10 14 16 18 19 21 1010 1011 1012 1013 1014 10 10 10 10 10 OT CASES 1 2 3 4 5 ESP Rangoon Rebound Skeptic Candy This question practice includes OT question types that will appear only in a computer-based exam, but provides valuable practice for all students whichever version of the exam they are sitting. ACCA’s CBE Specimen can be accessed under exam resources at www.accaglobal.com/uk/en/student/exam-support-resources/fundamentals-exams-studyresources/f7.html ©2017 DeVry/Becker Educational Development Corp. All rights reserved. (iii) FINANCIAL REPORTING (F7) – OBJECTIVE TEST QUESTION PRACTICE Introduction “Multiple choice – single answer” – is the standard OT type in paper-based examinations. In CBE this type is presented with radio bullets instead of A B, C, D options. Illustration Recognition is the process of including within the financial statements items which meet the definition of an element according to the IASB’s Conceptual Framework for Financial Reporting. Which of the following items should be recognised as an asset in the statement of financial position of a company? o A skilled and efficient workforce which has been very expensive to train. Some of these staff are still in the employment of the company o A highly lucrative contract signed during the year which is due to commence shortly after the year end o A government grant relating to the purchase of an item of plant several years ago which has a remaining life of four years o A receivable from a customer which has been sold (factored) to a finance company. The finance company has full recourse to the company for any losses How to answer? Click on a radio button to select an answer from the choices provided. You can select only one. If you want to change your answer, click on your new choice and the original choice will be removed automatically. Answer A receivable from a customer which has been sold (factored) to a finance company. The finance company has full recourse to the company for any losses As the receivable is “sold” with recourse it must remain as an asset in the statement of financial position; it is not derecognised. OTHER OT TYPES The following OT types appear only in CBE: (1) (2) (3) (4) (5) (6) Multiple response Pull down list Number entry Hot area Hot spot Enhanced matching These are illustrated below. (iv) ©2017 DeVry/Becker Educational Development Corp. All rights reserved. OBJECTIVE TEST QUESTION PRACTICE – FINANCIAL REPORTING (F7) (1) Multiple response Description – candidates are required to select more than one response from the options provided by clicking the appropriate tick boxes. Illustration 1 Which TWO of the following should Tynan recognise as liabilities as at 30 September 20X4, Tynan’s year end? The signing of a non-cancellable contract in September 20X4 to supply goods in the following year on which, due to a pricing error, a loss will be made The cost of a reorganisation which was approved by the board in August 20X4 but has not yet been implemented, communicated to interested parties or announced publicly An amount of deferred tax relating to the gain on the revaluation of a property during the current year. Tynan has no intention of selling the property in the foreseeable future The balance on the warranty provision which relates to products for which there are no outstanding claims and whose warranties had expired by 30 September 20X4 How to answer? Two is the maximum you are permitted to select. You can deselect a chosen answer to clear it. When you have chosen the required number, deselecting an answer will allow you to select another answer. Answer The signing of a non-cancellable contract in September 20X4 to supply goods in the following year on which, due to a pricing error, a loss will be made An amount of deferred tax relating to the gain on the revaluation of a property during the current year. Tynan has no intention of selling the property in the foreseeable future Tutorial note: The non-cancellable agreement is an onerous contract. A liability for deferred tax arises even if there is no intention to sell. (2) Pull down list Description – candidates are required to select one answer from a list of choices within a drop down list. Illustration 2 Constable owns 40% of Turner which it treats as an associated undertaking. Constable also owns 60% of Whistler. Constable has held both of these shareholdings for more than one year. Revenue of each company for the year ended 30 June 20X2 was as follows: $m Constable 400 Turner 200 Whistler 100 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. (v) FINANCIAL REPORTING (F7) – OBJECTIVE TEST QUESTION PRACTICE What is the revenue which will be reported in Constable’s CONSOLIDATED statement of profit or loss for the year ended 30 June 20X2? Select... $460 million $500 million $580 million $700 million Answer Consolidated revenue Constable Whistler $m 400 100 ––––– 500 ––––– Tutorial note: Turner is an associate of Constable; under equity accounting revenue of the associate is not included in consolidated profit or loss. (3) Number entry Description – candidates are required to key in a numerical response. Illustration 3 The HY group acquired 35% of the equity share capital of SX on 1 July 20X0 paying $70,000. This shareholding enabled HY group to exercise significant influence over SX. SX made a profit for the year ended 30 June 20X1 (prior to dividend distribution) of $130,000 and paid a dividend of $80,000 to its equity shareholders. What is the amount for the investment in associate recognised in HY’s consolidated statement of financial position at 30 June 20X1? $000 How to answer? Enter a numerical value in the answer box. The only permitted characters for numerical answer are: One full stop as a decimal point (if required); One minus symbol at the front of the figure if the answer is negative. For example: -10234.35 (vi) No other characters, including commas, are accepted. You can change your answer by adding permitted characters or deleting one or more highlighted characters. ©2017 DeVry/Becker Educational Development Corp. All rights reserved. OBJECTIVE TEST QUESTION PRACTICE – FINANCIAL REPORTING (F7) Answer $000 70 45.5 (28) –––––– 87.5 –––––– Original investment Share of profit for year Less share of dividend paid Value of investment in SX (4) Hot area Description – candidates are required to select one or more areas in an image as their answer(s). Illustration 4 Inveresk has equity shareholdings in four other companies, as shown below, and has a seat on the board of each: Raby Inveresk 40% Other shareholders No other holdings larger than 10% Seal 30% Another company holds 60% of Seal’s equity Toft 15% Two other companies hold respectively 50% and 35% of Toft’s equity, and each has a seat on its board. Inveresk exerts significant influence over Toft Unad 19% Inveresk provides technical support to Unad and also has regular interchanges of management personnel Which of the above shareholdings are associated undertakings of Inversk? Raby ASSOCIATE NO Seal ASSOCIATE NO Toft ASSOCIATE NO Unad ASSOCIATE NO How to answer? Click on a hotspot area to select an answer from the hotspot choices provided. You can select only one per line. The selected area will be highlighted. If you want to choose a different answer click on an alternative area. Answer Raby ASSOCIATE Seal NO Toft ASSOCIATE Unad ASSOCIATE ©2017 DeVry/Becker Educational Development Corp. All rights reserved. (vii) FINANCIAL REPORTING (F7) – OBJECTIVE TEST QUESTION PRACTICE (5) Hot spot Description – candidates are required to select one or more points by clicking on an image. Illustration 5 In October 20X4, Hoy Co had $2.5 million of equity shares ($0.50 each) in issue. No new shares were issued during the year ended 30 September 20X5, but on that date there were outstanding share options which had a dilutive effect equivalent to issuing 1.2 million shares for no consideration. Hoy Co’s profit after tax for the year ended 30 September 20X5 was $1,550,000. The graph below represents a trend in both basic and diluted earnings per share (EPS) since 20X3. Complete the EPS trend analysis by calculating the diluted EPS for the year ended 30 September 20X5 for Hoy Co and click on graph to identify its position. Cents 34 33.5 33 32.5 32 31.5 31 30.5 30 29.5 29 28.5 28 27.5 27 26.5 26 25.5 25 24.5 24 23.5 23 (viii) Basic EPS Diluted 20X3 20X4 20X5 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. OBJECTIVE TEST QUESTION PRACTICE – FINANCIAL REPORTING (F7) Answer 000 5,000 1,200 –––––– 6,200 –––––– $1,550 –––––– Current shares ($2,500 ÷ 0.50) Dilutive effect Number of shares Profit ($000) Diluted earnings per share ($1,550 ÷ 6,200) $0.25 Click the point on the 20X5 line on the graph corresponding to 25 cents. Cents 34 33.5 33 32.5 32 31.5 31 30.5 30 29.5 29 28.5 28 27.5 27 26.5 26 25.5 25 24.5 24 23.5 23 Basic EPS Diluted 20X3 20X4 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 20X5 (ix) FINANCIAL REPORTING (F7) – OBJECTIVE TEST QUESTION PRACTICE (6) Enhanced matching Description – candidates are required to select and drag their chosen answers to other areas of the screen. Illustration 6 The IASB’s Conceptual Framework for Financial Reporting identifies qualitative characteristics of financial statements. In accordance with the Framework, which of the following characteristics are fundamental qualitative characteristics and which are enhancing characteristics? Characteristic Relevance Fundamental Enhancing Fundamental Enhancing Relevance Understandability Faithful representation Verifiability Understandability Faithful representation Neutrality Completeness Comparability Answer Tutorial note: Neutrality and completeness are aspects of the fundamental characteristic of faithful representation. (x) ©2017 DeVry/Becker Educational Development Corp. All rights reserved. OBJECTIVE TEST QUESTION PRACTICE – FINANCIAL REPORTING (F7) OBJECTIVE TEST QUESTIONS 1 MULTIPLE RESPONSE 1.1 DT’s final dividend for the year ended 31 October 20X5 of $150,000 was declared on 1 February 20X6 and paid in cash on 1 April 20X6. The financial statements were approved on 31 March 20X6. Which of the following TWO statements reflect the correct treatment of the dividend in the financial statements of DT? The payment settles an accrued liability in the statement of financial position as at 31 October 20X5 The dividend is shown as a deduction in the statement of profit or loss for the year ended 31 October 20X6 The dividend is shown as an accrued liability in the statement of financial position as at 31 October 20X6 The $150,000 dividend was shown in the notes to the financial statements at 31 October 20X5 The dividend is shown as a deduction in the statement of changes in equity for the year ended 31 October 20X6 1.2 In accordance with IAS 40 Investment Property, which THREE of the following are classified as investment property? Property held for long-term capital appreciation Owner-occupied property Land held for an undetermined future use Property occupied by employees 1.3 Which TWO of the following would be classified as “a change in accounting policy” as determined by IAS 8 Accounting Policies, Changes in Accounting Estimates and Errors? Increasing the loss allowance for trade receivables for 20X6 from 5% to 10% of outstanding balances Changing the depreciation of plant and equipment from straight line depreciation to reducing balance depreciation Changing the valuation method of inventory from first-in first-out to weighted average Changing the useful economic life of its motor vehicles from six years to four years Classifying rental income as a deduction from cost of sales in the statement of profit or loss, having previously classified it as other operating income ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 1 FINANCIAL REPORTING (F7) – OBJECTIVE TEST QUESTION PRACTICE 1.4 Which TWO of the following statements regarding consolidated financial statements are correct? Only the group’s share of the assets of a subsidiary is reflected on the consolidated statement of financial position Under equity accounting only the group’s share of the net assets of an associate is reflected on the consolidated statement of financial position The value of share capital on a consolidated statement of financial position will include the share capital of both the investor and the investee An entity has a choice when it comes to valuing the non-controlling interest of a subsidiary 1.5 Which THREE of the following could provide evidence of “significant influence”? 51% of the voting power of the investee Interchange of management personnel Participation in decisions about dividends Provision of essential technical information Owning 40% of the equity shares and having agreement with another 20% of the equity shareholders that they will cast their votes as directed by you 1.6 Which TWO of the following may be classified as a monetary item in accordance with IAS 21 The Effects of Changes in Foreign Exchange Rates? A provision for the settlement of a foreign currency debt that is to be settled with the delivery of an item of machinery A foreign currency denominated payable A dividend due from the holding of a foreign equity investment Inventory due to be exported in the following period 1.7 Aqua has correctly calculated its basic earnings per share (EPS) for the current year. Which TWO of the following items need to be additionally considered when calculating Aqua’s diluted EPS for the year? A 1 for 5 rights issue of equity shares during the year at $1.20 when the market price of the equity shares was $2.00 The issue during the year of a convertible (to equity shares) loan note The granting during the year of directors’ share options exercisable in three years’ time Equity shares issued during the year as the purchase consideration for the acquisition of a new subsidiary company (14 marks) 2 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. OBJECTIVE TEST QUESTION PRACTICE – FINANCIAL REPORTING (F7) 2 PULL-DOWN LIST 2.1 Bell made a profit of $183,000 for the year ended 30 June 20X7 and paid a dividend during the year of $18,000. During the year the company wrote off development costs of $45,000 directly to retained earnings as a prior period adjustment and revalued a property with a carrying amount of $60,000 to $135,000. What was total comprehensive income for period ended 30 June 20X7? Select... $195,000 $240,000 $258,000 $318,000 2.2 In 20X3 Falkirk identified that a fraud had been perpetrated by an employee who had been making payments to himself amounting to $6,200,000. $1,400,000 million were payments made in 20X3, $1,800,000 in 20X2 and $3,000,000 prior to 20X2; the double entry to the payments had created false assets. What is the amount of fraud to be recognised as an expense in the statement of profit or loss for 20X3? Select... $nil $1,400,000 $3,200,000 $6,200,000 2.3 Digger commenced contract X47 on 1 July 20X3. Performance obligations under the contract are to be satisfied over time and the stage of completion is regularly assessed. Details for the first year of the contract were as follows: Amounts invoiced Costs incurred at date of last assessment Costs incurred since last assessment Amounts received Total contract price Estimated costs to complete Survey of performance completed $ 2,400 1,800 200 2,100 4,200 1,200 2,520 The company invoices the customer immediately it receives an assessment of the value of the work done. What amount should Digger include as cost of sales for the X47 contract for the year ended 30 June 20X4, assuming revenue is based on performance completed? Select... $1,800,000 $1,828,000 $1,920,000 $2,000,000 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 3 FINANCIAL REPORTING (F7) – OBJECTIVE TEST QUESTION PRACTICE 2.4 On 31 December 20X3 Tenby sold $100,000 of trade receivables to a factoring company, for $90,000. If the factor has not collected the debt by 28 February 20X4 they can return the debt to Tenby. What is the current asset for the trade receivables in Tenby’s statement of financial position as at 31 December 20X3? Select... $0 $10,000 $90,000 $100,000 2.5 At 1 October 20X1 DX had the following balances in respect of property, plant and equipment: $ Cost $220,000 Tax written down value $82,500 Statement of financial position: Carrying amount $132,000 DX depreciates all property, plant and equipment over five years using the straight line method and no residual value. All assets were less than five years old at 1 October 20X1. No assets were purchased or sold during the year ended 30 September 20X2. The local tax regime allows tax depreciation of 50% on additions to property, plant and equipment in the accounting period in which they are purchased. In subsequent accounting periods, tax depreciation of 25% per year of the tax written down value is allowed. Income tax on profits is at a rate of 25%. What is the amount for deferred tax in DX’s statement of financial position as at 30 September 20X2 in accordance with IAS 12 Income Taxes? Select... $5,843 $6,531 $12,375 $23,375 2.6 The non-current assets of Ealing were as follows: Cost Aggregate depreciation Carrying amount Start of year $ 180,000 (120,000) ––––––– 60,000 ––––––– End of year $ 240,000 (140,000) ––––––– 100,000 ––––––– During the year non-current assets which had cost $80,000 and had a carrying amount of $30,000 were sold for $20,000. 4 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. OBJECTIVE TEST QUESTION PRACTICE – FINANCIAL REPORTING (F7) What is the net cash flow in respect of non-current assets for the year? Select... $60,000 $40,000 $120,000 $140,000 2.7 The HY group acquired 35% of the equity share capital of SX on 1 July 20X0 paying $70,000. This shareholding enabled HY group to exercise significant influence over SX. SX made a profit for the year ended 30 June 20X1 (prior to dividend distribution) of $130,000 and paid a dividend of $80,000 to its equity shareholders. What is the amount for the investment in associate recognised in HY’s consolidated statement of financial position at 30 June 20X1? Select... $115,500 $98,000 $87,500 $70,000 (14 marks) 3 NUMBER ENTRY 3.1 At 30 September 20X1 the closing inventory of a company has been incorrectly stated at $386,400. The following items were included in this total at cost: (1) 1,000 items which had cost $18 each. These items were all sold in October 20X1 for $15 each, and the company incurred $800 of costs to sell the goods. (2) Five items which had been purchased for $100 each eight years ago. These items were sold in October 20X1 for $1,000 each, net of selling expenses. What is the correct carrying amount of inventory in the company’s statement of financial position at 30 September 20X1? $ 3.2 BN has an asset that was classified as held for sale at 31 March 20X2. The asset had a carrying amount of $900 and a fair value of $800. The cost of disposal was estimated to be $50. In accordance with IFRS 5 Non-current Assets Held for Sale and Discontinued Operations, at what amount should the asset be stated in BN’s statement of financial position as at 31 March 20X2? $ ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 5 FINANCIAL REPORTING (F7) – OBJECTIVE TEST QUESTION PRACTICE 3.3 On 1 January 20X2 LMN issued $2,000,000 8% convertible debt at par. The debt is repayable, or convertible, at a premium of 10% four years after issue. The effective interest rate for the debt is 14%. The present values $1 receivable at the end of each year, based on discount rates of 8%, 10% and 14% are: 8% 10% 14% End of year 1 0.926 0.909 0.877 2 0.857 0.826 0.769 3 0.794 0.751 0.675 4 0.735 0.683 0.592 What is the finance charge to LMN’s profit or loss (to the nearest $000) for the year ended 31 December 20X3? $000 3.4 Salt owns 100% of Pepper. During the year Salt sold goods to Pepper for a sales price of $1,044,000, generating a margin of 25%. 40% of these goods had been sold on by Pepper to external parties at the end of the reporting period. What adjustment for unrealised profit should be made in preparing Salt’s consolidated financial statements? $ 3.5 Cherry owned 75% of Plum. For the year ended 31 December 20X1 Plum reported a net profit of $118,000. During 20X1 Plum sold goods to Cherry for $36,000 at cost plus 50%. At the year-end these goods are still held by Cherry. What is the non-controlling interest in the consolidated statement of profit or loss for the year ended 31 December 20X1? $ 3.6 Vaynor acquired 100,000 ordinary shares in Weeton and 20,000 ordinary shares in Yarlet some years ago. The investment in Yarlet gives Vaynor significant influence. Extracts from the statements of financial position of the three companies as at 30 September 20X7 are as follows: Vaynor Weeton Yarlet $000 $000 $000 Ordinary shares of $1 each 500 100 50 Retained earnings 90 40 70 At acquisition the retained earnings of Weeton showed a deficit of $10,000 and of Yarlet a surplus of $30,000. What were the consolidated retained earnings of Vaynor on 30 September 20X7? $000 6 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. OBJECTIVE TEST QUESTION PRACTICE – FINANCIAL REPORTING (F7) 3.7 Chartwell has in issue $120,000 of equity share capital (shares of 50 cents each) and 10,000 6% Preference shares of $3 each. Extracts from the financial statements for the year to 31 March 20X3 are shown below: Profit before interest and tax Interest paid Preference dividend Taxation Ordinary dividend $ 528,934 6,578 1,800 125,860 10,800 In accordance with IAS 33 Earnings per Share, what is Chartwell’s basic earnings per share for the year ended 31 March 20X3? $ (14 marks) 4 HOT AREA 4.1 Identify, by clicking on the relevant box in the table whether each statement regarding non-current assets is true or false. 4.2 All non-current assets must be depreciated TRUE FALSE If goodwill is revalued, the revaluation surplus appears in the statement of changes in equity TRUE FALSE If a tangible non-current asset is revalued, all tangible assets of the same class should be revalued TRUE FALSE In a company’s published statement of financial position, tangible assets and intangible assets must be shown separately TRUE FALSE An extract from a statement of cash flows prepared by a trainee accountant is shown below: $m 28 Profit before taxation Adjustments for: Depreciation (9) –– 19 3 (4) (8) –– 10 — Operating profit before working capital changes Decrease in inventories Increase in receivables Increase in payables Cash generated from operations Identify which of the following criticisms of this extract are correct. Depreciation charges should have been added, not deducted CORRECT INCORRECT Decrease in inventories should have been deducted, not added CORRECT INCORRECT Increase in receivables should have been added, not deducted CORRECT INCORRECT Increase in payables should have been added, not deducted CORRECT INCORRECT ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 7 FINANCIAL REPORTING (F7) – OBJECTIVE TEST QUESTION PRACTICE 4.3 4.4 4.5 Identify, by clicking on the relevant box in the table whether each statement regarding financial information is true or false. Faithful representation means that the legal form of a transaction must be reflected in financial statements, regardless of the economic substance TRUE FALSE Under the recognition concept only items capable of being measured in monetary terms can be recognised in financial statements TRUE FALSE It may sometimes be necessary to exclude information that is relevant and reliable from financial statements because it is too difficult for some users to understand TRUE FALSE Information is material if it exceeds a quantitative threshold; any transaction that does not exceed that threshold does not need to be disclosed TRUE FALSE Indicate which of the following items should be included in the cost of inventory of a service provider and which items excluded. Salary of staff engaged in the service contract INCLUDED EXCLUDED Profit margin factored into the contract price INCLUDED EXCLUDED Depreciation of office computer used by staff engaged on contract INCLUDED EXCLUDED Salary of sales staff who negotiated the service contract INCLUDED EXCLUDED Identify, by clicking on the relevant box in the table the correct purposes of holding investment properties in accordance with IAS 40 Investment Property is true or false. For administrative purposes CORRECT INCORRECT For use in the supply of services CORRECT INCORRECT For use in the production of goods CORRECT INCORRECT To earn rental income CORRECT INCORRECT For capital appreciation CORRECT INCORRECT (10 marks) 8 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. OBJECTIVE TEST QUESTION PRACTICE – FINANCIAL REPORTING (F7) 5 HOT SPOT 5.1 The following information relate to Cookie for the year ended 31 March 20X6. Profit before tax $127,000 Increase in receivables $29,200 Depreciation $16,000 Decrease in payables $7,100 Proceeds on disposal of machinery Loss on disposal $24,000 $5,000 Decrease in inventory $18,500 Investment income $3,200 Interest paid $8,400 Finance costs $7,800 Tax paid $26,400 The graph below represents the trend in Cookie’s cash generated from operations since 20X3. Calculate the cash generated from operations for the year ended 31 March 20X6 and click on the graph to identify its position. $000 160 120 80 40 X3 X4 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. X5 X6 9 FINANCIAL REPORTING (F7) – OBJECTIVE TEST QUESTION PRACTICE 5.2 The following information relates to Broady’s trade receivables, sales revenue and cost of sales for the year ended 31 March 20X6. $000 $100 $2,528 $1,650 $166 Opening receivables Sales revenue (of which 80% are credit sales) Cost of sales (all on credit) Closing receivables The graph below represents the trend in Broady’s average trade receivable collection period since 20X3. Calculate the average trade receivable collection period for the year ended 31 March 20X6 and click on the graph to identify its position. Days 60 50 40 30 20 10 X3 X4 X5 X6 (4 marks) 10 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. OBJECTIVE TEST QUESTION PRACTICE – FINANCIAL REPORTING (F7) 6 ENHANCED MATCHING 6.1 In 20X3 Angry revalued at $360,000 a plot of land which had been purchased in 20X1 for $300,000 and recognised a revaluation gain of $60,000. In 20X4 Angry revalued to $130,000 a second plot of land which had been purchased for $100,000 in 20X2 and recognised a further revaluation gain of $30,000. In 20X5 Angry wishes to write down the value of the first plot of land from $360,000 to $260,000 because of an impairment in its value due to changes in market prices. There have been no other movements on the revaluation surplus. Match the amounts to be recognised in profit or loss and other comprehensive income for 20X5 for the impairment loss. Amount Profit or loss Nil Other comprehensive income $10,000 $40,000 $60,000 $90,000 $100,000 6.2 On 1 October 20X3, Bertrand issued $10 million convertible loan notes which carry a nominal interest (coupon) rate of 5% per annum. The loan notes are redeemable on 30 September 20X6 at par for cash or can be exchanged for equity shares. A similar loan note, without the conversion option, would have required Bertrand to pay an interest rate of 8%. The present value of $1 receivable at the end of each year, based on discount rates of 5% and 8%, can be taken as: End of year 1 2 3 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 5% 0.95 0.91 0.86 8% 0.93 0.86 0.79 11 FINANCIAL REPORTING (F7) – OBJECTIVE TEST QUESTION PRACTICE Match the amounts that will be recognised as equity and non-current liability in respect of the convertible loan in Bertrand’s statement of financial position on initial recognition (1 October 20X3). Amount Equity Nil Non-current liability $40,000 $810,000 $9,190,000 $9,960,000 $10,000,000 6.3 Indicate which of the following events between the end of the reporting period and the date the financial statements are authorised for issue are adjusting events and which are non-adjusting events. Events The sale of inventory with a carrying amount of $96,000 for $74,000 The discovery of a fraud affecting the previous three years’ financial statements The identification of an amount to be paid to employees as part of a profit sharing scheme The announcement of changes in tax rates Changes in foreign exchanges rates relating to foreign currency monetary balances held The announcement of a restructuring involving closure of a major business segment Adjusting 12 Non-adjusting ©2017 DeVry/Becker Educational Development Corp. All rights reserved. OBJECTIVE TEST QUESTION PRACTICE – FINANCIAL REPORTING (F7) 6.4 IAS 32 Financial Instruments: Presentation classifies issued shares as either equity instruments or financial liabilities. Match the following instruments to their correct classification in the statement of financial position. Instrument A preference share that is redeemable for cash at a 10% premium in five years’ time An equity share which is not redeemable and has no restrictions on receiving dividends A loan note that is redeemable at par in seven years’ time An irredeemable loan note that pays interest at 7% a year Equity 6.5 Non-current liability Identify which of the following situations would indicate that an entity has control or has significant influence over another entity. Situations The company has a 40% shareholding and shares any technical expertise with the other company The company owns 100% of preference shares and 10% of the equity shares The company owns 40% of the ordinary shares and also has an agreement with another 40% of the owners of ordinary shares that they will always vote with the company The company owns 30% of the ordinary shares and has the ability to control the board of directors Control Significant influence (10 marks) ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 13 FINANCIAL REPORTING (F7) – OBJECTIVE TEST QUESTION PRACTICE OT CASES Question 1 ESP The following scenario relates to questions 1–5. ESP acquired an item of equipment at a cost of $800,000 on 1 April 20X5 that is used to produce and package medicines. The equipment had an estimated residual value of $50,000 and an estimated life of five years, neither of which has changed. ESP uses straight-line depreciation. On 31 March 20X7, ESP was informed by a major customer (who buys products produced by the equipment) that it would no longer be placing orders with ESP. Even before this information was known, ESP had been having difficulty finding work for this equipment. It now estimates that net cash inflows earned from the equipment for the next three years will be: Year ended: 31 March 20X8 31 March 20X9 31 March 20Y0 $000 220 180 170 On 31 March 20Y0, the equipment is still expected to be sold for its estimated residual value. ESP has confirmed that there is no market in which to sell the equipment at 31 March 20X7. ESP’s cost of capital is 10% and the following values should be used: Value of $1 at: End of year 1 End of year 2 End of year 3 1 $ 0.91 0.83 0.75 What is the value in use of the item of equipment as at 31 March 20X7? Select... $620,000 $570,000 $514,600 $477,100 2 What is the carrying amount of the equipment immediately prior to the impairment test at 31 March 20X7? A B C D 14 $480,000 $500,000 $450,000 $650,000 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. OBJECTIVE TEST QUESTION PRACTICE – FINANCIAL REPORTING (F7) 3 ESP has a wholly-owned subsidiary, Tilda, which is a cash generating unit. On 31 March 20X7, an explosion damaged some of Tilda’s plant. Tilda’s assets immediately before the explosion were: $000 Goodwill 1,800 Factory building 4,000 Plant 3,500 Trade receivables and cash 1,500 –––––– 10,800 –––––– As a result of the explosion, the recoverable amount of Tilda is $5.5 million. The explosion completely destroyed an item of plant that had a carrying amount of $500,000. What is the carrying amount of Tilda’s plant after accounting for the impairment loss? $000 4 Which of the following assets must be tested annually for impairment in accordance with IAS 36 Impairment of Assets? A footballer acquired by a football club on an initial contract of four years Software that has met the capitalisation criteria but has yet to be fully completed An operating license for an international air route granted by government which is stated to have an indefinite life while the current government is in power A patent registered in a jurisdiction under which all patents are granted for five years 5 Which of the following cash flows will not be included in the calculation of an asset’s value in use in accordance with IAS 36 Impairment of Assets? (1) (2) The cost of adding solar panels to the factory roof to reduce heating and power costs The annual maintenance costs relating to the machinery located in the factory. A B C D 1 only 2 only Both 1 and 2 Neither 1 or 2 (10 marks) ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 15 FINANCIAL REPORTING (F7) – OBJECTIVE TEST QUESTION PRACTICE Question 2 RANGOON The following scenario relates to questions 1–5. Rangoon has a financial year end of 31 December. Rangoon has entered into a number of foreign currency transactions during the last two years, including the following: Transaction 1 On 1 January 20X5 Rangoon purchased an investment property in a foreign country for Krown 7,650,000. The property has an expected useful life of 40 years and Rangoon has adopted a policy that reflects the current valuation of the asset, in accordance with IAS 40 Investment Property. The fair value of the property at 31 December 20X5 had fallen to Krown 7,430,000 and at 31 December 20X6 it had increased to Krown 8,100,000. Transaction 2 On 28 November 20X6 Rangoon purchased raw materials from a foreign company for Krown 528,000. The materials were to be used in the construction of an asset for Rangoon’s own use. At 31 December 20X6 Rangoon had not paid for these raw materials. Exchange rates are as follows: 1 January 20X5 31 December 20X5 28 November 20X6 31 December 20X6 Average for 20X6 1 $1 = Krown 5.12 $1 = Krown 4.99 $1 = Krown 5.88 $1 = Krown 6.02 $1 = Krown 5.66 In accordance with IAS 21 The Effects of Changes in Foreign Exchange Rates which of the following factors will determine an entity’s functional currency? The currency that mainly influences the selling price of goods and services The currency of the country in which the head office of the entity is located The currency that the majority of an entity’s input costs are denominated in The currency that is voted on by shareholders at an entity’s annual general meeting 2 What gain or loss will be recognised in Rangoon’s statement of profit or loss and other comprehensive income for the year ended 31 December 20X6 in respect of the investment property? A B C D 16 $143,463 gain $5,163 gain $5,163 loss $143,463 loss ©2017 DeVry/Becker Educational Development Corp. All rights reserved. OBJECTIVE TEST QUESTION PRACTICE – FINANCIAL REPORTING (F7) 3 What is Rangoon’s trade payable as at 31 December 20X6 in respect of the purchase of raw materials? Select... $89,796 $87,708 $93,283 $3,178,560 4 Where in the statement of profit or loss and other comprehensive income will gains of losses for the two transactions be recognised? A B C D 5 Transaction 1 Profit or loss Profit or loss Other comprehensive income Other comprehensive income Transaction 2 Profit or loss Other comprehensive income Profit or loss Other comprehensive income Identify in which of the following circumstances an entity must change its functional currency. When shareholders vote for a change at annual general meeting CHANGE NO CHANGE The functional currency can never be changed CHANGE NO CHANGE When the underlying conditions that led to the original classification changes CHANGE NO CHANGE When the currency suffers from a devaluation CHANGE NO CHANGE (10 marks) ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 17 FINANCIAL REPORTING (F7) – OBJECTIVE TEST QUESTION PRACTICE Question 3 REBOUND The following scenario relates to questions 1–5. The following summarised information is available in relation to Rebound, a publicly listed company: Statement of profit or loss extracts years ended 31 March 20X6 20X5 Continuing Discontinued Continuing Discontinued $000 $000 $000 $000 Profit after tax Existing operations Operations acquired on 1 August 20X5 2,000 (750) 450 1,750 600 nil Analysts expect profits from the market sector in which Rebound’s existing operations are based to increase by 6% in the year to 31 March 20X7 and by 8% in the sector of its newly acquired operations. On 1 April 20X4 Rebound had: $3 million of equity share capital (shares of 25 cents each); $5 million 8% convertible loan notes 20Y1; the terms of conversion are 40 equity shares in exchange for each $100 of loan notes. Assume an income tax rate of 30%. On 1 October 20X5 the directors of Rebound were granted options to buy 2 million shares in the company for $1 each. The average market price of Rebound’s shares for the year ending 31 March 20X6 was $2.50 each. 1 Based on the above information what will be Rebound’s estimated profit after tax for the year ended 31 March 20X7? $000 2 In accordance with IAS 33 Earnings per Share, what is Rebound’s basic earnings per share for the year ended 31 March 20X6? Select... $0.14 $0.57 $0.20 $0.82 3 What is the adjustment to the basic earnings per share profit for interest on convertible loan notes for the calculation of diluted earnings per share? A B C D 18 Interest after tax saved is added back Interest after tax saved is deducted Interest before tax saved is added back Interest before tax saved is deducted ©2017 DeVry/Becker Educational Development Corp. All rights reserved. OBJECTIVE TEST QUESTION PRACTICE – FINANCIAL REPORTING (F7) 4 What number of shares should be used in the calculation of Rebound’s diluted earnings per share for 20X6? A B C D 5 12,000,000 14,000,000 14,600,000 12,600,000 Which of the following transactions should be treated as a discontinued operation in accordance with IFRS 5 Non-Current Assets Held for Sale and Discontinued Operations? One of 20 factories used by Rebound is in the process of being closed down; the factory generates 2% of Rebound’s total revenue Ceasing the manufacture of one of Rebound’s three main product lines which creates employment for 40% of the entity’s workforce Subsidiary Gentry which was acquired two months ago; on acquisition it was intended to resell the subsidiary as soon as possible A major item of machinery is to be replaced at an expected cost of $1.1 million which represents 10% of Rebound’s total assets (10 marks) Question 4 SKEPTIC The following scenario relates to questions 1–5. The following issues have arisen during the preparation of Skeptic’s draft financial statements for the year ended 31 March 20X6: (i) Presentation From 1 April 20X5, the directors have decided to reclassify research and amortised development costs as administrative expenses rather than its previous classification as cost of sales. They believe that the previous treatment unfairly distorted the company’s gross profit margin. (ii) Potential liabilities Skeptic has two potential liabilities to assess. The first is an outstanding court case concerning a customer claiming damages for losses due to faulty components supplied by Skeptic. The second is the provision required for product warranty claims against 200,000 units of retail goods supplied with a one-year warranty. The estimated outcomes of the two liabilities are: Court case 10% chance of no damages awarded 65% chance of damages of $4 million 25% chance of damages of $6 million ©2017 DeVry/Becker Educational Development Corp. All rights reserved. Product warranty claims 70% of sales will have no claim 20% of sales will require a $25 repair 10% of sales will require a $120 repair 19 FINANCIAL REPORTING (F7) – OBJECTIVE TEST QUESTION PRACTICE (iii) Government grant On 1 April 20X5, Skeptic received a government grant of $8 million towards the purchase of new plant. The plant has an estimated life of 10 years and is depreciated on a straight-line basis. One of the terms of the grant is that the sale of the plant before 31 March 20X9 would trigger a repayment on a sliding scale as follows: Sale in the year ended 31 March 20X6 31 March 20X7 31 March 20X8 31 March 20X9 Amount of repayment 100% 75% 50% 25% Skeptic accounts for government grants as a separate item of deferred credit in its statement of financial position. Skeptic has no intention of selling the plant before the end of its economic life. 1 How is the change in accounting for research and development costs to be accounted for in the financial statements for the year ended 31 March 20X6? A B C D 2 As a change in accounting policy requiring retrospective application As a change in estimate requiring prospective application As a prior period error requiring retrospective application As the adoption of a new accounting policy requiring prospective application What is the liability to be recognised, in respect of the court case, as at 31 March 20X6? $ million 3 What is the provision which Skeptic would report in its statement of financial position as at 31 March 20X6 in respect of the product warranty claims? Select... $3.4 million Nil $17 $24 million 4 What amount of government grant should be credited to profit or loss for the year ended 31 March 20X6? A B C D 20 $8 million $800,000 $2 million $Nil ©2017 DeVry/Becker Educational Development Corp. All rights reserved. OBJECTIVE TEST QUESTION PRACTICE – FINANCIAL REPORTING (F7) 5 Skeptic is about to dispose of an equity investment in another entity which is measured at fair value through other comprehensive income. Skeptic expects to make a gain on disposal; a cumulative fair value gain has already been recognised over the period of holding this asset. What is the accounting treatment of the gains in the year of disposal in accordance with IFRS 9 Financial Instruments? Accounting treatment Credit profit or loss Gain on disposal Cumulative gain Credit other comprehensive income Credit retained earnings Reclassify to profit or loss Do not reclassify to profit or loss Transfer to separate component of equity (10 marks) Question 5 CANDY The following scenario relates to questions 1–5. The following is an extract of Candy’s trial balance as at 30 September 20X6: $000 Proceeds of 5% loan (note (i)) Land ($5 million) and buildings – at cost (note (ii)) Plant and equipment – at cost (note (ii)) Accumulated depreciation at 1 October 20X5: buildings plant and equipment Deferred tax (note (iii)) Interest payment (note (i)) Current tax (note (iii)) $000 30,000 55,000 60,500 20,000 36,500 2,600 1,500 1,000 The following notes are relevant: (i) The loan note was issued on 1 October 20X5 and incurred issue costs of $1 million which were charged to profit or loss. Interest of $1.5 million ($30 million at 5%) was paid on 30 September 20X6. The effective interest rate of the loan note is 9% per annum. (ii) Non-current assets: The directors revalued the land at $8 million and the buildings at $39 million on 1 October 20X5, based on an independent valuer’s report. The remaining life of the buildings at 1 October 20X5 was 15 years. Plant and equipment is depreciated at 12½% per annum using the reducing balance method. No depreciation has yet been charged on any non-current asset for the year ended 30 September 20X6. ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 21 FINANCIAL REPORTING (F7) – OBJECTIVE TEST QUESTION PRACTICE (iii) A provision of $2.3 million is required for current income tax on the profit of the year to 30 September 20X6. The balance on current tax in the trial balance is the under/over provision of tax for the previous year. At 30 September 20X6 the provision for deferred tax is $2.94 million. 1 What is the depreciation expense in respect of property, plant and equipment that is recognised in Candy’s statement of profit or loss for the year ended 30 September 20X6? A B C D 2 $5,600,000 $6,133,333 $10,162,500 $6,333,333 What is the tax expense in Candy’s profit or loss for the year ended 30 September 20X6? $000 3 What is the carrying amount of the loan note in Candy’s statement of financial position as at 30 September 20X6? A B C D 4 $30,110,000 $31,500,000 $30,500,000 $31,110,000 Which of the following financial assets can be classified at fair value through other comprehensive income? Preference shares acquired Equity shares that are not held for trading Loan asset held for contractual cash flows and proceeds from sale Treasury shares purchased from stock market 5 Match each of the following to the correct classification of temporary differences in accordance with IAS 12 Income Taxes. Temporary difference Interest receivable where taxation is assessed on a cash basis Financial asset carried at fair value, where fair value has fallen since acquisition Provision for warranty charges where tax authority gives benefit only when cash is paid Convertible loan note where tax authority does not recognise the distinction between debt and equity for accounting purposes Taxable temporary difference Deductible temporary difference (10 marks) 22 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. OBJECTIVE TEST QUESTION PRACTICE – FINANCIAL REPORTING (F7) OBJECTIVE TEST ANSWERS 1 MULTIPLE RESPONSE 1.1 The $150,000 dividend was shown in the notes to the financial statements at 31 October 20X5 The dividend is shown as a deduction in the statement of changes in equity for the year ended 31 October 20X6 Tutorial note: Dividends are generally accounted for when paid; a disclosure note could be made in the 20X5 financial statements. 1.2 Property held for long-term capital appreciation Land held for an undetermined future use Tutorial note: The items are mentioned as examples of investment property in IAS 40. 1.3 Changing the valuation method of inventory from first-in first-out to weighted average Classifying rental income as a deduction from cost of sales in the statement of profit or loss, having previously classified it as other operating income Tutorial note: All other items are changes in estimate. 1.4 Under equity accounting only the group’s share of the net assets of an associate is reflected on the consolidated statement of financial position An entity has a choice when it comes to valuing the non-controlling interest of a subsidiary Tutorial note: The consolidated statement of financial position includes 100% of every asset of the subsidiary. Only the parent’s share capital is included in the consolidated statement of financial position. 1.5 Interchange of management personnel Participation in decisions about dividends Provision of essential technical information Tutorial note: More than half of the voting power constitutes control; as does other parties agreeing to use their votes in your favour. The three other items are all indicators of significant influence mentioned in IAS 28 Investment in Associates and Joint Ventures. ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 1001 FINANCIAL REPORTING (F7) – OBJECTIVE TEST QUESTION PRACTICE 1.6 A foreign currency denominated payable A dividend due from the holding of a foreign equity investment Tutorial note: The foreign denominated payable and the dividend receivable are both monetary items which must be retranslated at the reporting date. 1.7 The issue during the year of a convertible (to equity shares) loan note The granting during the year of directors’ share options exercisable in three years’ time Tutorial note: The issue of the convertible loan note and the granting of share options need to be reflected in the diluted EPS calculation; the other two items would have been reflected already in the basic EPS calculation. 2 PULL-DOWN LIST 2.1 Profit for the year Unrealised surplus on revaluation of properties (135 – 60) Total comprehensive income $000 183 75 –––– 258 –––– Tutorial note: Dividends are deducted from retained earnings; prior period adjustments are dealt with in the statement of changes in equity. 2.2 $1,400,000. Only the fraud relating to the current year should be expensed against profit or loss; the remainder will be a prior period adjustment against retained earnings and will be presented in the statement of changes in equity. 2.3 $000 2,000 1,200 –––––– 3,200 –––––– Costs to date (1,800 + 200) Estimated costs to completion Costs to profit or loss = 3,200,000 × 2,520 = $1,920,000 4,200 2.4 $100,000. The risks and rewards have not been transferred by Tenby as it still bears the risk of default. The substance of the contract is that of a financing arrangement and therefore the trade receivables should still be recognised in full. 2.5 Carrying amount in the accounting records (132,000 – 44,000) is $88,000. Tax base (82,500 – 20,625) is $61,875. Difference (26,125 × 25%) is $6,531. 1002 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. OBJECTIVE TEST QUESTION PRACTICE – FINANCIAL REPORTING (F7) 2.6 Non-current asset cash flows Proceeds on sale of non-current asset Purchase of non-current assets (240 + 80 – 180) $000 20 (140) –––– 120 –––– Net cash outflow 2.7 $000 70 45.5 (28) –––––– 87.5 –––––– Original investment Share of profit for year Less share of dividend paid Value of investment in SX 3 NUMBER ENTRY 3.1 386,400 – 3,800 (loss on (1)) = $ 3.2 IFRS 5 requires non-current assets held for sale to be measured at the lower of carrying 382600 750 amount (900) and fair value less costs to sell (800 – 50) = $ 3.3 PV of future cash flows using effective interest rate of 14%: $000 1,302 466 –––––– 1,768 248 (160) –––––– 1,855 –––––– Principle ($2,200 × 0.592) Annual interest ($160 × 2.913) Interest expense 20X2 ($1,768 × 14%) Cash flow Balance 31 December 20X2 Interest expense 20X3 ($1,855 × 14%) 260 3.4 $000 1,044 783 —— 261 —— Sales value Cost of sales Profit $000 % 100 75 —— 25 —— Tutorial note: Margin is “on sales” therefore sales value is 100%. If margin is 25%, cost is 75%. Unrealised profit in inventory is $261,000 × 60% = $156,600 Alternatively: (60% × $1,044,000) × 25/100 = $ ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 156600 1003 FINANCIAL REPORTING (F7) – OBJECTIVE TEST QUESTION PRACTICE 3.5 $ 29,500 (3,000) –––––– Share of consolidated profit (25% × 118,000) Less Share of unrealised profit (25% × 36,000 × 50/150) 26500 –––––– 3.6 3.7 Consolidated retained earnings Vaynor Weeton ((40 + 10) × 100%) Yarlet ((70 – 30) × 40%) $000 90 50 16 –––– 156 –––– Profit for year $394,696 (528,934 – 6,578 – 1,800 – 125,860) divided by number of ordinary shares in issue of 240,000 gives $ 1.64 Tutorial note: The calculation is based on profit for the year (i.e. after interest, which includes the preference dividend and taxation). 4 HOT AREA 4.1 All non-current assets must be depreciated FALSE If goodwill is revalued, the revaluation surplus appears in the statement of changes in equity FALSE If a tangible non-current asset is revalued, all tangible assets of the same class should be revalued TRUE In a company’s published statement of financial position, tangible assets and intangible assets must be shown separately TRUE Tutorial note: There is no requirement to depreciate land and goodwill cannot be revalued. 4.2 Depreciation charges should have been added, not deducted Decrease in inventories should have been deducted, not added INCORRECT Increase in receivables should have been added, not deducted INCORRECT Increase in payables should have been added, not deducted 1004 CORRECT CORRECT ©2017 DeVry/Becker Educational Development Corp. All rights reserved. OBJECTIVE TEST QUESTION PRACTICE – FINANCIAL REPORTING (F7) 4.3 Faithful representation means that the legal form of a transaction must be reflected in financial statements, regardless of the economic substance Under the recognition concept only items capable of being measured in monetary terms can be recognised in financial statements FALSE TRUE It may sometimes be necessary to exclude information that is relevant and reliable from financial statements because it is too difficult for some users to understand FALSE Information is material if it exceeds a quantitative threshold; any transaction that does not exceed that threshold does not need to be disclosed FALSE 4.4 Salary of staff engaged in the service contract INCLUDED Profit margin factored into the contract price EXCLUDED Depreciation of office computer used by staff engaged on contract INCLUDED Salary of sales staff who negotiated the service contract EXCLUDED Tutorial note: IAS 2 states that costs of those staff engaged in the service contract and any attributable overheads are included in the cost of inventory. A profit margin and sales staff costs are specifically identified as costs that should be expensed as incurred. 4.5 For administrative purposes INCORRECT For use in the supply of services INCORRECT For use in the production of goods INCORRECT To earn rental income CORRECT For capital appreciation CORRECT ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 1005 FINANCIAL REPORTING (F7) – OBJECTIVE TEST QUESTION PRACTICE 5 HOT SPOT 5.1 Cash generated from operations $000 160 120 80 40 X3 X4 X5 X6 WORKING Profit before tax Depreciation Loss on disposal of machinery Investment income Finance costs Increase in receivables Decrease in payable Decrease in inventory Interest paid Tax paid $ 127,000 16,000 5,000 (3,200) 7,800 (29,200) (7,100) 18,500 (8,400) (26,400) ———— 100,000 ———— Tutorial note: The sale proceeds are irrelevant in cash generated from operations 1006 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. OBJECTIVE TEST QUESTION PRACTICE – FINANCIAL REPORTING (F7) 5.2 Average trade receivables collection period Days 60 50 40 30 20 10 X3 X4 X5 X6 WORKING Average trade receivable days = ½ ($100,000 + $166,000) = $133,000 Credit sales = $2,528,000 × 80% = $2,022,400 Collection period = ($133,000 ÷ $2,022,400) × 365 = 24 days ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 1007 FINANCIAL REPORTING (F7) – OBJECTIVE TEST QUESTION PRACTICE 6 ENHANCED MATCHING 6.1 Profit or loss Other comprehensive income $40,000 $60,000 Tutorial note: For a revalued asset an impairment is debited to other comprehensive income to the extent of the revaluation surplus on the asset, with any excess loss expensed to profit or loss. The surplus on any other revalued asset cannot be used for the impairment of a different asset. 6.2 Equity Non-current liability $810,000 $9,190,000 WORKING Year ended 30 September Cash flow $000 500 500 10,500 20X4 20X5 20X6 Value of debt component Difference – value of equity option component Proceeds Discount Discounted rate cash flows At 8% $000 0·93 465 0·86 430 0·79 8,295 –––––– 9,190 810 –––––– 10,000 –––––– 6.3 Adjusting events 1008 Non-adjusting events The sale of inventory with a carrying amount of $96,000 for $74,000 The announcement of changes in tax rates The discovery of a fraud affecting the previous three years’ financial statements Changes in foreign exchanges rates relating to foreign currency monetary balances held The identification of an amount to be paid to employees as part of a profit sharing scheme The announcement of a restructuring involving closure of a major business segment ©2017 DeVry/Becker Educational Development Corp. All rights reserved. OBJECTIVE TEST QUESTION PRACTICE – FINANCIAL REPORTING (F7) 6.4 Equity An equity share which is not redeemable and has no restrictions on receiving dividends Non-current liability A preference share that is redeemable for cash at a 10% premium in five years’ time A loan note that is redeemable at par in seven years’ time An irredeemable loan note that pays interest at 7% a year 6.5 Control Significant influence The company owns 40% of the ordinary shares and also has an agreement with another 40% of the owners of ordinary shares that they will always vote with the company The company has a 40% shareholding and shares any technical expertise with the other company The company owns 30% of the ordinary shares and has the ability to control the board of directors The company owns 100% of preference shares and 10% of the equity shares ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 1009 FINANCIAL REPORTING (F7) – OBJECTIVE TEST QUESTION PRACTICE OT CASES Answer 1 ESP Item Answer Justification 1 Value in use $000 200.2 149.4 165 –––––– 514.6 –––––– Year 1 = 220 × 0.91 Year 2 = 180 × 0.83 Year 3 = (170 + 50) × 0.75 Tutorial note: Do not forget to include sale proceeds of $50,000 in year 3. 2 B Carrying amount Annual depreciation (800 – 50) ÷ 5years Carrying amount at end of year 2 (800 – (150 × 2)) $000 150 500 3 Goodwill Factory Plant Receivables and cash Per question $000 1,800 4,000 After plant write off $000 1,800 4,000 3,500 1,500 –––––– 10,800 –––––– 3,000 1,500 –––––– 10,300 –––––– Write off in full Pro rata loss of 4/7 Pro rata loss of 3/7 Realisable value Value in use After impairment losses $000 – 2,286 1714 1,500 –––––– 5,500 –––––– Tutorial note: The plant with a carrying amount of $500,000 that has been damaged to the point of no further use should be written off (it no longer meets the definition of an asset). After this: (1) (2) goodwill is written off in full; Any remaining impairment loss is written off the remaining assets pro rata to their carrying amounts, except that no asset should be written down to less than its fair value less costs to sell (net realisable value). That is, after writing off the damaged plant the remaining impairment loss is $4·8m (10.3 – 5.5) of which $1·8m is applied to the goodwill and the remaining $3.0m is apportioned pro rata (3 ÷ (4 + 3)) to the factory and the remaining plant. 1010 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. OBJECTIVE TEST QUESTION PRACTICE – FINANCIAL REPORTING (F7) 4 Software that has met the capitalisation criteria but has yet to be fully completed An operating license for an international air route granted by government which is stated to have an indefinite life while the current government is in power Tutorial note: IAS 38 requires intangible assets not yet ready for use and intangible assets with an indefinite life to be tested annually for impairment, they are not amortised. 5 A The addition of the solar panels is an enhancing cost and would not be included in cash flows for the calculation of value in use in accordance with IAS 38. Answer 2 RANGOON Item Answer Justification 1 The currency that mainly influences the selling price of goods and services The currency that the majority of an entity’s input costs are denominated in Tutorial note: IAS 21 states that functional currency should be determined by the currency in which an entity sells its product and in which it incurs its input costs. 2 D Carrying amount at fair value in accordance with IAS 40: 1 January 20X6 (Krown 7,430,000 ÷ $4.99) 31 December 20X6 (Krown 8,100,000 ÷ $6.02) Change in value 3 4 $ 1,488,978 1,345,515 –––––––– 143,463 loss –––––––– Carrying amount 31 December 20X6 = Krown 528,000 ÷ $6.02 = $87,708 A Gains and losses on the translation of foreign denominated monetary balances are presented in profit or loss 5 When shareholders vote for a change at annual general meeting NO CHANGE The functional currency can never be changed NO CHANGE When the underlying conditions that led to the original classification changes When the currency suffers from a devaluation CHANGE NO CHANGE Tutorial note: A change in functional currency only occurs if the underlying economic conditions change. ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 1011 FINANCIAL REPORTING (F7) – OBJECTIVE TEST QUESTION PRACTICE Answer 3 REBOUND Item Answer Justification 1 Estimated profit after tax for the year ending 31 March 20X7: Existing operations (continuing only) ($2 million × 1·06) Newly acquired operations ($450,000 × 12/8 months × 1·08) $000 2,120 729 ––––– 2849 ––––– 2 Basic earnings per share Profit = 2,000 + 450 – 750 = 1,700 Shares = $3,000 ÷ $0.25 = 12,000 EPS = $0.14 3 A Interest after tax is added back to the profit figure as if debt is converted interest will no longer be payable, and interest is tax deductible. 4 C Weighted average number of shares (000) At 1 April 20X4 (3,000 × 4 (i.e. shares of $0.25 each)) Convertible loan stock ($5,000 ÷ 100 × 40) Share options (see tutorial note) 12,000 2,000 600 –––––– 14,600 –––––– Tutorial note: Exercising the options would create proceeds of $2m. At the market price of $2·50 each this would buy 800,000 shares ($2m ÷ $2·50). The diluting number of shares is therefore 1·2 million. This would be weighted for 6/12 in 20X6 as the grant was half way through the year. 5 Ceasing the manufacture of one of Rebound’s three main product lines which creates employment for 40% of the entity’s workforce Subsidiary Gentry which was acquired two months ago; on acquisition it was intended to resell the subsidiary as soon as possible Tutorial note: As the factory only generates 2% of revenue this would not be seen as a major part of the business; although the machine is a material asset it is not a separate line of the business or a geographical area of operations. 1012 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. OBJECTIVE TEST QUESTION PRACTICE – FINANCIAL REPORTING (F7) Answer 4 SKEPTIC Item 1 Answer Justification A 2 A change of classification in presentation is a change in accounting policy under IAS 8 and must be applied retrospectively. For a single possible outcome the best estimate is the most likely outcome. In this case the most likely outcome (with a 65% probability) is damages of 4 $ million. 3 Where measurement of a provision involves a large population of items then an “expected value” model should be used. The expected value of repair costs on the sale of a unit is $17 (($0 × 70%) + ($25 × 20%) + ($120 × 10%)) The provision required for the sale of 200,000 units is therefore $3.4 million ($17 × 200,000). 4 B The government grant is credited to profit and loss in the same manner as the depreciation of the related asset. In this case the asset is being depreciated on a straight line basis over 10 years. Therefore the grant is credited to profit or loss at $800,000 each year ($8 million ÷ 10). 5 Gain on disposal Credit other comprehensive income Cumulative gain Do not reclassify to profit or loss Tutorial note: As the asset is classified at fair value through other comprehensive income the gain on disposal is taken to other comprehensive income. IFRS 9 does not allow the reclassification of the cumulative gain to profit or loss but a reserve transfer to retained earnings can be made. ©2017 DeVry/Becker Educational Development Corp. All rights reserved. 1013 FINANCIAL REPORTING (F7) – OBJECTIVE TEST QUESTION PRACTICE Answer 5 CANDY Item 1 Answer Justification A Land Buildings ($39m × 1/15 years) Plant and equipment ($60.5m – $36.5m) × 12.5% Total 2 $000 nil 2,600 3,000 –––––– 5,600 –––––– $000 2,300 (1,000) 340 ––––– Estimated expense for current year Over provision prior year Increase in deferred tax (2,940 – 2,600) 1640 ––––– 3 A $000 29,000 2,610 (1,500) –––––– 30,110 –––––– Initial amount recognised (30 – 1) Interest at 9% Interest paid at 5% 4 Equity shares that are not held for trading Loan asset held for contractual cash flows and proceeds from sale Tutorial note: Equity shares that are not held for trading may, on initial recognition, be designated at fair value through other comprehensive income. Loan assets held for their contractual cash flows and selling financial assets must be classified at fair value through other comprehensive income. 5 Taxable temporary difference Deductible temporary difference Interest receivable where taxation is assessed on a cash basis Financial asset carried at fair value, where fair value has fallen since acquisition Provision for warranty charges where tax authority gives benefit only when cash is paid Convertible loan note where tax authority does not recognise the distinction between debt and equity for accounting purposes Tutorial note: Interest receivable, where taxed on a cash basis, will generate a taxable temporary difference. In the financial accounts the liability element of the loan will be less than the tax base of the liability as, under financial accounting, some of the loan is classified as equity. 1014 ©2017 DeVry/Becker Educational Development Corp. All rights reserved. ABOUT BECKER PROFESSIONAL EDUCATION Becker Professional Education provides a single solution for students and professionals looking to advance their careers and achieve success in: • Accounting • International Financial Reporting • Project Management • Continuing Professional Education • Healthcare For more information on how Becker Professional Education can support you in your career, visit www.becker.com/acca. Becker Professional Education has 60 years of experience delivering courses and learning tools for Professional Qualifications. Today we offer ACCA candidates high-quality approved study materials to maximise their chances of success. This ACCA Revision Question Bank has been reviewed by ACCA's examining team and includes: • The most recent ACCA examinations with suggested answers • Past examination questions, updated where relevant • Model answers and suggested solutions • Tutorial notes This edition is valid for the September 2017, December 2017, March 2018 and June 2018 exam sessions. For more information contact us at: www.becker.com/ACCA | acca@becker.com ©2017 DeVry/Becker Educational Development Corp. All rights reserved.