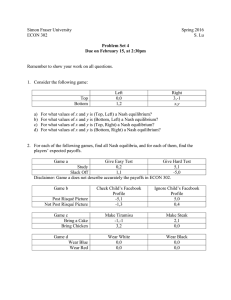

Vanessa Jaya Hertford College Explain the role of subgame perfection in models of (a) collusion and (b) strategic entry deterrence. What factors make collusion more or less sustainable in a particular industry? Subgame perfect equilibria (SPE) form a subset of Nash equilibria, particularly used within extensive form games; subgames in these contexts can be described as a “game within a game” or a subset of the game. A strategy profile is said to be subgame-perfect if every subgame of the overarching game represents a Nash equilibrium – this means that at any point, regardless of what happened prior to this point, the players’ strategic actions should represent a Nash equilibrium of the continuation game. Particularly, this strategy profile can be determined by using backward induction in a sequential-moves game, holding the assumption that information is perfect (i.e. all earlier moves are observed by the players) and complete (i.e. other players’ payoffs are known). These “game plans” should be sequentially rational, meaning that SPEs exclude Nash equilibria which are upheld by non-credible threats. SPEs can be used to understand organisational behaviour, particularly in models such as collusion and strategic entry deterrence, using the example of duopolies to demonstrate a simplified representation of how the profits (or other forms of outcomes) of firms can be interdependent on the actions of other players within the market. Collusion To begin with, competitors within a market may agree to engage in collusion if doing so would enable them to generate greater profits. Within a competitive market with only two firms (i.e. the duopoly as aforementioned), both players would be incentivised to produce at the competitive price and quantity, namely at p0 and q0 where demand is equal to marginal cost (as the marginal cost function represents the supply function for a competitive firm). This is because a firm’s deviation from this competitive equilibrium in an attempt to increase profits (namely in favour of the profit-maximising price and quantity p1 and q1 where MC = MR) would instead generate losses if its competitor chooses to remain at the competitive equilibrium with a lower price, as consumers would simply opt to buy goods from the competing firm instead, assuming that products are homogeneous. Vanessa Jaya Hertford College However, this outcome could be avoided if both firms decide to collude, such that both of them would generate supernormal profits. It should be taken into consideration that for there to be an incentive to collude, post-collusion profits should be greater than what each firm’s individual profits would be without the agreement. Firms can do this by forming an agreement to increase prices to p1 or restrict output to q1. Doing this would enable them to both generate more profits, at the expense of reduced consumer surplus. Nevertheless, it could be taken into consideration that even with collusive agreements, there is still the risk that either firm would cheat and continue to produce at the competitive price level, such that most consumers would buy products from the cheating firm setting this lower price level. Such incentives would arise if there is a net increase in profits from the number of added demands from buyers who switch over from the competing firm, such that the firm who cheats on the collusive agreement would view a greater increase in profits but would retain a higher market share than its competitor. This brings rise to a game, such that the concept of SPE can be used to analyse the firms’ strategy profiles. Assume that there are two firms in the duopoly with the following payoff profiles: Firm B Firm A Collude Compete Collude 5, 5 2, 7 Compete 7, 2 3, 3 As described in the aforementioned scenario, colluding would enable both firms to increase profits from 3 to 5. However, each firm would also see a greater increase in profits from 3 to 7 (relative to profits under competition) if they cheat out of the agreement and start a price war, in order to claim market share and potentially force their competitor to exit the market. This payoff matrix shows that (3, 3) is the Nash equilibrium, as this is the outcome where each player would have no incentive to deviate from their initial strategy given that their opponent’s action remains unchanged. Assume that both firms initially decide to collude. In subsequent periods, either firm can decide whether to continue colluding or to start a price war. This is illustrated within the chart below: if Firm A is the first to start the price war, it would gain a greater market share, and Firm B would be able to choose whether it would also compete to achieve payoffs of (3, 3) or continue setting Vanessa Jaya Hertford College prices or quantities at the collusive level to achieve payoffs of (7, 2). Since 3 > 2, Firm B’s best response here would be to compete as well. However, if Firm A decides to continue colluding, Firm B would have to choose to either continue colluding as well – achieving payoffs of (5, 5), or start a price war – achieving payoffs of (2, 7). If this was a one-shot game, Firm B’s best response would be to collude. However, within this example, it is also important to note that both collusion and competition would occur over multiple time periods – resulting in an extensive-form game with multiple subgames. The diagram above shows that (3, 3) – where both firms compete – is a subgame-perfect Nash equilibrium, as it is sequentially rational. Thus, taking into consideration the fact that this is an extensive-form game, assessing these multiple subgames is necessary to determine how collusion can be sustained. Sustainability of Collusion Understanding these strategy profiles, as well as which outcomes would be sequentially rational, would also provide firms with insights into how collusion can be sustained by “punishing” any deviations from the initial agreement. Rees (1993) highlights three such punishments: Nash reversion, mini-max punishments and simple penal codes. The example highlighted above has two equilibria – both at competitive and profit-maximising price & quantity levels. However, some other payoff matrices – particularly those where the cheating firm’s payoffs would exceed those that it would receive if it continued to collude alongside its counterpart – may result in only one Nash equilibrium. Nevertheless, in both cases, the outcome where both firms compete would always be a Nash equilibrium. As it generates Vanessa Jaya Hertford College lower payoffs than the outcome where both firms collude, reverting back to this Nash equilibrium could serve as a punishment for firms who deviate from collusive agreements. For instance, if Firm B chooses to compete even though Firm A has chosen to collude previously, Firm A could “punish” Firm B by choosing to compete as well in the subsequent time periods, generating lower payoffs for B that could cancel out the gains it received from reneging after some periods. This is known as a trigger strategy – any deviation would be instantly “punished” as both firms would subsequently deviate from their agreement to return to the Nash equilibrium where both firms compete. Additionally, this punishment would hold as it is subgame-perfect – playing the Nash equilibrium in each subgame would make this strategy profile a Nash equilibrium of the overarching stage game. Another form of punishment that could sustain collusion would be imposing a mini-max punishment. For each individual firm, there would always be a best response action that they would take given the actions of all other firms. The mini-max payoff would be one where the actions of all other firms would ensure that an individual firm’s best response payoff would be as small as possible. This would be the firm’s “security level”, such that they would not accept a punishment where their payoffs would be lower than this level. Therefore, a mini-max punishment would be one where the cheating firm would be forced to take the value of their “security level” – either permanently or until the firm experiences a net loss from cheating. It should be taken into consideration that the mini-max punishment’s capabilities of sustaining collusion are dependent on the value of interest rates. Let security level payoffs be denoted by π0, collusion payoffs to be denoted by π𝐶, and payoffs from cheating to be denoted by π𝐷, where π0 < π𝐶 < π𝐷. In order to calculate the net effect of reneging, the firm planning on deviating from the collusive agreement must compare the one-off gain within the current period, π𝐷 − π𝐶, with the sum of its future losses in profits from the mini-max punishment, (π𝐶 − π0)/𝑟, with r being the interest rate for each period. Therefore, the firm would be disincentivised from cheating on the collusive agreement if the following inequality is satisfied: π𝐷 − π𝐶 ≤ (π𝐶 − π0)/𝑟, such that 𝑟 ≤ (π𝐶 − π0)/π𝐷 − π𝐶. However, it should be taken into consideration that this punishment would not be subgame-perfect. Assume that Firm B cheats on the collusive agreement, and Firm A is now Vanessa Jaya Hertford College faced with the decision of either producing at the profit-maximising level or at the level that would mini-max Firm B. If Firm B believes that it will receive this mini-max punishment, it will produce at an output level that would leave Firm A with lower payoffs than it would have if it were to profit-maximise. Consequently, Firm A’s best response would be to continue to profit-maximise and not follow through with Firm B’s mini-max punishment. This means that the mini-max punishment is not sequentially rational, and is held up by non-credible threats. The third punishment refers to Abreu’s simple penal codes, involving “stick and carrot” incentives. This would entail a “punishment path” being formed where the firm that deviates from the collusive agreement would be punished for a certain number of periods until they make a net loss from cheating (i.e. the “stick”), followed by a reversion to collusion (i.e. the “carrot”). If the firm deviates again within the first “punishment” phase, the firm would have to restart this punishment phase. This punishment is subgame-perfect because the threat of punishment is credible: if Firm B cheats, it would have reason to believe that Firm A would punish it because not following through with the punishment could lead to Firm A getting punished as well for not adhering to the collusive agreement. Apart from these punishments, other factors may also influence the stability of collusion – or, alternatively, whether the firms would be incentivised to collude in the first place. For instance, the aforementioned scenarios assume that information is perfect (such that each firm knows what the other firms have done in previous stages) and complete (such that each firm knows all other firms’ payoffs as well as its own). In cases where there are information asymmetries or a lack of transparency within the market, these assumptions may not hold, making it more difficult to arrive at a collusive agreement as firms would be unsure of what their opponents’ expected responses would be, and what punishments would be appropriate to disincentivise deviations from the deal. The previous scenarios also assume homogeneity between the firms; however, this may not hold in practical cases. Firms may have different cost structures – for instance – such that lowering prices would benefit a firm with low costs but would harm a firm with higher costs, making it less feasible for the two firms to arrive at an agreement. Additionally, the number of firms in the market would play a role as well – in highly concentrated industries with fewer players, there would be a greater incentive to collude as profits would be distributed amongst fewer agents. This brings rise to the question of how entry deterrence could be analysed in assessing competitive dynamics within an industry. Vanessa Jaya Hertford College Strategic Entry Deterrence The problem of entry deterrence can also be modelled as a game with several subgames, as outlined by Dixit (1982). Assume that there is an industry with an incumbent monopolist. A potential entrant would like to choose whether to enter this market or not, taking into consideration the fact that if it chooses to enter, the incumbent could either share the market or fight by initiating a price war. The game would have the following payoffs: Incumbent Entrant No Price War Price War Entry pd, pd pw, pw No Entry 0, pm 0, p0 The concept of subgame-perfect equilibrium can be used to understand how the incumbent should formulate its strategy profile to deter entry and retain its market share. To begin with, the strategy [No Entry, Price War] is not sequentially rational – the incumbent would have no reason to start a price war if the new firm didn’t enter the market. Therefore, even if (0, p0) is a Nash equilibrium, it would not be subgame-perfect and adjusting p0 would not be a feasible strategy as it would be upheld by non-credible threats. In the aforementioned example, it would be assumed that pm > pd > 0 > pw. Within this example, it is evident that the incumbent’s profits would be maximised if the entrant stays out, but the former’s best response if the entrant decides to enter would still be to share since pd > pw. Therefore, even though pw < 0, the outcome [Entry, Price War] would not pose a sustainable threat to the entrant. Assuming all agents are rational, using backward induction, the entrant would know that the incumbent would be better off sharing the market instead of starting a price war, incentivising it to enter – this means that the subgame-perfect Nash equilibrium would be [Entry, No Price War]. Thus, in order for [Entry, Price War] to be a credible threat, it should be the case that the incumbent’s payoffs from fighting would exceed those of sharing the market. This can be done in Vanessa Jaya Hertford College the case that the incumbent would make an initial investment of c to prepare for a price war. If a price war does happen, the incumbent would not have to account for any further costs and would still have the same payoffs as the initial case (i.e. pw); however, if the price war does not occur, its payoffs would be reduced by c. Therefore, the threat of fighting would be made credible if pw > pd - c. The chart below illustrates this new game: Under this scenario, the entrant would decide not to enter, resulting in the final outcome being [No Entry, No Price War] with payoffs of (0, pm - c). However, it should also be taken into consideration that for the incumbent to make this investment, its expected payoffs should exceed those that it would expect in the initial case where no investment was made and the two firms end up sharing the market. In other words, the condition pm - c > pd should be fulfilled. Hence, the concept of subgame perfection enables the incumbent to decide on an appropriate level of investment to make – the incumbent’s investment c should fulfil the following condition: pm - pw < c < pm - pd. Taking into consideration both examples of collusion and strategic entry deterrence, it is hence evident that the concept of subgame perfection can be utilised to analyse organisational behaviour and shape the strategic profiles of firms engaging in competitive markets. Nevertheless, it should also be noted that the scenarios previously outlined rely on assumptions that may not hold true in practice, particularly the assumption that information is perfect and complete. Bearing this in mind, firms (and all other agents engaging in similar situations) should avoid solely relying on the outcomes of subgame-perfect equilibria when establishing competitive strategies. Vanessa GAME THEORY . 2 Pure Mixed & Hertford College Strategies equilibrium Nash - gain by switching strategies unchanged participant no remain Right Left 3 up [Up Left) -> 1 5 -- 03 O Row (Down -> Mixed = , I - 5 Down Left -> w Row indifferent . p (5 , 3) column 530 ; : 371 : , Column : 5 0 : equilibria Nash , - 44 + -> up w . p 9 . 3p 5 = >p strategy strategy : -> (470 + e p · dominant no . = . p . = (i 79 . e no . expected Mixed payoff payoffs : those strategy payoffs D 511-p)+p & U sp & 5 (1-5/z) 5/7 15/7(= 3 5/7 : 39 & ( 3(5/7) agent x = : & 511-g) 15/7) 5/7 q = + = (15/7 15/7) = 157) R + 5x27 = 15/7) , strategies from mixed take into : (5 ** ) would 14 4) = , strategies consideration to pure strategy payoffs only other Column) ; : accounting for weighted averages whereas for 5/7R) + , expected payoff than strategy + Average Payoffs from pure higher dominant 5/7 = + column's Row) strategy for 5/7 1-q 39 9 + 511-9) w 79 5 5/7U 47D 474 472 expected Row's . p = = Row's (i . 34 = Down , indifferent if column = = W 2/7L+ 5/7R strategy Column's Right . 511-p)+p if 7p the 3 3, 1 : 13 5) Right]= , RON 11-p) . 5 ↳ others' Strategies : column => if can strategies : Pure Row Jaya estimate take definitely play . probability the into players' distributions, expected consideration payoffs what S . 3 Simultaneous Sequential & Strategies [Up Left) 16 4) Moves Pure = , [Down [Down (5 , 3) Left]= , Right]= , Tup Right1= -> 12 2) 5) , -> by both better off Nash pure switching if cannot other the Down to be doesn't 1574) Right to by switching agent an , switching by switching off better Row -> , 13 , better off column -> , (675) (372) made switch better 1372 , off by 574) E first : plays RON Left 6 up Down Right 4 5 ⑧ 3 32 5 Row Given dominant Row's -> strategy regardless of 2 plays up plays Right column , what column plays (5>4) RON U D L - column column R L L 13, 5) (6 4) , R L L ↓ (5 , 3) they 12 , 2) Column knows Row's decision the node at are backward induction Row -> will Payoffs 4 => (If for column 2 574 , of what column play up regardless plays So < 2) plays if Row or 5 plays up lif C plays R column L R S L RON RON W ↳ (6 4) , => & plays first : column Use Cassume ↓ same D U B 153) 13 5) . outcome as <2 . cassume 2) there is a unique perfect informations Nash equilibrium are RS plays either 6 . Repeated a) Prisoner's · 8 [c D) (D C1 <1 = , O 44 I (5 , 5) = , 108 255 D ic 2) D C Dilemma ⑧ , (4 4) = pure Strategy (8751 1431 by switching by switching (471) Column better off -> , off by switching better off Row -> , [D D) , 8) , 18 1) = -> better both -> Nash backwards induction : b) & Nth node actions : -@ (N-1th node : · affect can't players are future decisions upcoming outcomes mutual defection & of aware there is so I , (D D) so , next Nash) /pure strategy . round & can't affect incentive to deviate from Nash no ↳ (D D7 , I 2nd logic applies would play (D D) No other Nash equilibrium If a player chooses to deviate to deviate their counterpart would not have any incentive 1st , - => , .... N-29th node same : . would have knowing this equilibrium c) players if ↳ are players -> -> , & payoff . patient would (i e . value . payoffs choosing (first payoffs when choosing would have lower switches to if player 1 player next 2 made round D worse 8 : 58 + payoffs = off 582 (574) , + 483+ So payoff of 8 . Nash 8 . /more than present ones) in earlier . 583+ + as , stages) ... ... would play (for a while 18 , 13 are would be so , + 48 + 482 + payoffs future D 5 : first (lesp choose to much as point unique regardless of to deviate , future payoffs incentivised be incentivised is player no , a stage the former as would have latter each any at mind that the final outcome is the in bearing (D D) whereas the of when = ↳ a at , , incentivised to to play D in the generate payoffs of 14 4) same argument applies if player 2 switches to D first as if defection has been triggered previously outlined no incentive for . => · -> trigger strategy constitutes & current node critical 8 , Nash -> : : equilibrium Payoffs if payoffs => Cooperate if 5 + 58 + 5 82 + ( if infinity , 5 : D 583 , sum to deviation : + + 8 + 58 48 ... 8 + + + 582 482 48 + + + 583+ 483+ ... ... 4827483+ sum to ... I infinity (cont'd) to ( 6 . C) rlS 5 58 + g 5 5 592 + 8 = - 8 = 48 if 8 , .. . 5 8 %4 3/4 = -> => strategy critical S is player a players' Both 4 from action (or A minmax "punish" number best response would is have value is the the to rational is to 1 to 4) D player no can the outcomes given : any point (being to period the first to 5 to 8) as well do so I . , they would . be to then make them continue worse to play D . off Idecrease from : or or to based , when all on other a player i's profit-maximising the actions of all other players force this agent response profit , either for a players . (or certain forever . individually incentive take minimum best strategy greater value that minimum take this periods strategy , current . them) equal would C to response) can "punishment" occurs of above shift (increase from from best individually A the at achieved if single stage responds by switching d) Minmax/minimax punishment The minmax C to D is strategy the in (increase back switching to 17 SPE . a at shift the profit from as player strategy holds profit from 2) If the other 3) This . their in 18 the discount being factor & the defect Will - switches would they cooperate & will subgame perfect equilibrium a deviation If + + players more patient players impatient & => profit from a of previous stages 1) ... 48 482 463+ = ; 48 + = if 824 This + 45 - 3 = 583 + 8(1 8) = + : rational than deviate the if each minimax from their agent's payoff strategy payoffs , . such at that Nash neither equilibrium would , 6 . d) Feasible A payoff pair payoff pair for the potential repeated In on a repeated sets of games Folk Theorem : are payoffs for infinite than greater exist an in the outcome those , where there is . is (since a combination convex the of payoff pairs for . gigantic a set of equilibria expected utilities for all players stage game's Nash equilibrium the under the infinite game where , players through alternative strategy profiles that agents are sufficiently patient enough) subgame it games : - is each weighted averages) infinitely repeated games If there feasible if is game . This (i . e. would achieve relies the on the . are an SPE would this outcome assumption discount factor & is high