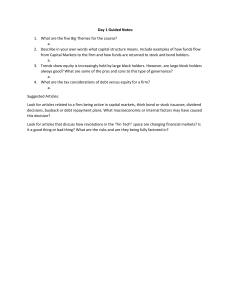

MyFinanceLab -- for Fundamentals of Corporate Finance, 4e ( etc.) (Z-Library)

advertisement