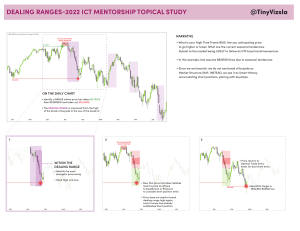

Market Maker Model PDF BY : Day Trading Rauf Guide Introduction…………………………………………………………………………….[1] Sell Model…………………………………………………………………………………[2] Buy Model…………………………………………………………………………………[3] OA to ND……………………………………………………………………………………[4] Example………………………………………………………………………………………[5] Overview………………………………………………………………………………………[6] End………………………………………………………………………………………………[7] Introduction Before we begin, I want to give a shout to @InnerCircleTrader for his concepts & these models. This PDF we will cover a basic understanding of these models plus some extra gems. If you have NOT watched the YouTube 2022 mentorship, I would recommend you before attempting to learn these models. YouTube Mentorship Understanding : Buy & Sell stops – (Buyside liquidity & Sell side) Premium & discount Killzone's Fair Value Gaps Order Blocks Understanding ICT’s core content will help further understand the models. [1] Market Maker Sell Model @Daytradingrauf “Model Breakdown” “Original consolidation” : The market will go into a consolation because orders are being built up above and below the consolidation for ”breakout artists” usually it trades into the opposing direction here you do NOTHING. “Accumulation” : Trading out of the consolidation this is our expansion leg, where buy orders will be accumulated for anticipation of price trading to higher levels. “Smart Money Reversal” : Market structure wise this is viewed as an LTH, we trade into a premium PDA paired with time and a CSD occurs allowing bearish order flow. ”Distribution legs” : Once in a sell program the distribution legs can be utilized the 1st and 2nd are the highest probability entry opportunity, the 2nd distribution usually clears the original consolidation. EVERYTHING TO THE LEFT IS BUYSIDE ORIENTED AND RIGHT IS SELLSIDE. [2] @Daytradingrauf Market Maker Buy Model @Daytradingrauf “Model Breakdown” “Original consolidation” : The market will go into a consolation because orders are being built up above and below the consolidation for ”breakout artists” usually it trades into the opposing direction here you do NOTHING. “Accumulation” : Trading out of the consolidation this is our expansion leg, where sell orders will be accumulated for anticipation of price trading to lower levels. “Smart Money Reversal” : Market structure wise this is viewed as an LTL; we trade into a discounted PDA paired with time and a CSD occurs allowing bullish order flow. ”Distribution legs” : Once in a buy program the distribution legs can be utilized the 1st and 2nd are the highest probability entry opportunity, the 2nd distribution usually clears the original consolidation. EVERYTHING TO THE LEFT IS SELLSIDE ORIENTED AND RIGHT IS BUYSIDE. [3] @Daytradingrauf Templates @Daytradingrauf @Daytradingrauf @Daytradingrauf @Daytradingrauf Old accumulation = New distribution Using old areas of accumulation from the sell side of the curve on to the buyside of the curve can increase ethe probability of the buyside of the curves PDA. At these areas we can look to pair the PDA’s with mitigation blocks. Let's look at template then examples : @Daytradingrauf @Daytradingrauf [4] @Daytradingrauf Chart Examples Covering a market maker buy model chart example with execution annotations : HTF CHART @Daytradingrauf @Daytradingrauf LTF CHART [5] @Daytradingrauf Overview In this PDF I went over the models in more details explaining what they are and where you can look to enter. The second leg statistically is the highest probability entry technique. As you develop as a trader and your understanding you will be able take bits from this model and begin to create your own using the ideas. I have made a YouTube video covering this topic with various other video regarding IICTs concepts and trading in general. - I want you to understand that not every MMXM will be as clear however the process and the mechanics of the model is still transparent and applicable. - More work you put in the more you will begin to understand. [6] End Thanks for taking the time to read this PDF, if you want more regarding a certain topics don’t hesitate to contact me either by Twitter or Telegram. This is the basic understanding to these models more is to come which I will cover keep an eye out for the next PDF I do release. LINKS TO MY ACCOUNTS. @Daytradingrauf [7]