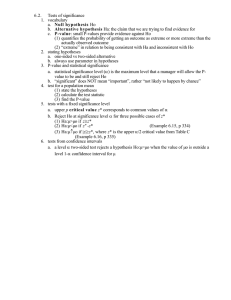

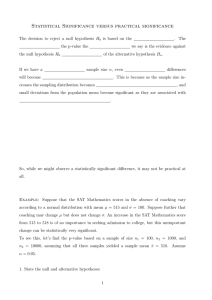

Faculty of Business & Economic Sciences BED3332/ECO3022 LECTURE 5:RECAP OF HYPOTHESIS TESTING DR QABHOBHO Outline of the lecture This lecture will provide a recap of hypothesis testing Take note that hypothesis testing can be done using three ways: 1. 2. 3. T-test P-value approach Confidence interval approach Introduction Hypothesis testing is used to test whether a result is in accordance with the expectation of a particular theory Introduction Recall 1. 2. 3. 4. 5. 6. the following: Type I error Type II error Null hypothesis Alternative hypothesis One tail test Two-tail test Test of significance The hypothesis that is tested in empirical economic research is the test of significance In other words, is there a relationship between the dependent and the independent variable(s)? Test of significance A test of significance can be specified as follows: 𝐻0 : 𝛽𝑘 = 0 𝐻1 : 𝛽𝑘 ≠ 0 The null hypothesis states that there is no relationship between the variables The alternative hypothesis states that there is a relationship between the variables Test of significance If a variable has a t-statistic that is greater than 1.96 in absolute value and the degrees of freedom are greater than 20 then its significant at 5% The p-value The p-value is known as the exact level of significance or the exact probability of committing type ɪ error Most computer software packages used in statistical analysis produce the p-value (prob) The p-value The p-value is compared to the chosen level of significance The p-values that is reported by computer software such as Eviews are two-sided The p-value The p-value rule for a two-sided test is: Reject the null hypothesis when the p-value is less than or equal to the level of significance 𝜶 𝒑 ≤ 𝜶 𝐭𝐡𝐞𝐧 𝐫𝐞𝐣𝐞𝐜𝐭 𝑯𝟎 𝒑 > 𝜶 𝐭𝐡𝐞𝐧 𝐝𝐨 𝐧𝐨𝐭 𝐫𝐞𝐣𝐞𝐜𝐭 𝑯𝟎 The p-value Rejecting the null hypothesis means that the variables are related and the relationship is statistically significant Not rejecting the null hypothesis means that the relationship is not statistically significant or its insignificant The p-value If the p-value is less than 0.01 then the variable is significant at 1% level of significance If the p-value is greater than 0.01 but less than 0.05 then the variable is significant at 5% level of significance If the p-value is greater than 0.05 but less than 0.1 then the variable is significant at 10% level is significance If the p-value is greater than 0.1 then the variable is insignificant The p-value 𝑝 𝑣𝑎𝑙𝑢𝑒=0.001 (Significant at 1%) 𝑝 𝑣𝑎𝑙𝑢𝑒=0.02 (Significant at 5%) 𝑝 𝑣𝑎𝑙𝑢𝑒=0.07 (Significant at 10%) Example We will conduct the following test of significance 𝐻0 : 𝛽1 = 0 𝐻1 : 𝛽1 ≠ 0 In other words does income have a statistically significant impact on food expenditure? And if so at what level of significance? Example 1 Dependent Variable: WEEKLY_FOOD_EXPENDITURE Method: Least Squares Date: 07/11/16 Time: 11:25 Sample: 1973 2012 Included observations: 40 Variable Coefficient Std. Error t-Statistic Prob. WEEKLY_INCOME C 10.20964 83.41600 0.020933 43.41016 4.877381 1.921578 0.0000 0.0622 R-squared Adjusted R-squared S.E. of regression Sum squared resid Log likelihood F-statistic Prob(F-statistic) 0.385002 0.368818 89.51700 304505.2 -235.5088 23.78884 0.000019 Mean dependent var S.D. dependent var Akaike info criterion Schwarz criterion Hannan-Quinn criter. Durbin-Watson stat 283.5735 112.6752 11.87544 11.95988 11.90597 1.893880 Example Another way in which a question can be asked is as follows: Test the following hypothesis at 1% level of significance 𝐻0 : 𝛽1 = 0 𝐻1 : 𝛽1 ≠ 0 Example 2 Dependent Variable: INVESTMENT Method: Least Squares Date: 07/31/16 Time: 00:37 Sample: 1985 2012 Included observations: 28 Variable Coefficient Std. Error t-Statistic Prob. REAL_INTEREST_RATE C -0.236778 18.88577 0.126821 0.757203 -1.867015 24.94150 0.0732 0.0000 R-squared Adjusted R-squared S.E. of regression Sum squared resid Log likelihood F-statistic Prob(F-statistic) 0.118218 0.084303 2.337967 142.1183 -62.47265 3.485745 0.073215 Mean dependent var S.D. dependent var Akaike info criterion Schwarz criterion Hannan-Quinn criter. Durbin-Watson stat 17.73769 2.443220 4.605189 4.700347 4.634280 0.597497 Example 2 Based on the regression output on the previous slide, test the following hypothesis: 𝐻0 : 𝛽1 = 0 𝐻1 : 𝛽1 ≠ 0 In other words does the real interest rate have a statistically significant impact on investment? And if so at what level of significance? Example 2 Another way in which a question can be asked is as follows: Test the following hypothesis at 5% level of significance 𝐻0 : 𝛽1 = 0 𝐻1 : 𝛽1 ≠ 0 Example 3 Dependent Variable: GDP Method: Least Squares Date: 07/10/16 Time: 23:01 Sample: 1985 2012 Included observations: 28 Variable Coefficient Std. Error t-Statistic Prob. INVESTMENT C -0.169750 5.408087 0.171730 3.073840 -0.988465 1.759391 0.3320 0.0903 R-squared Adjusted R-squared S.E. of regression Sum squared resid Log likelihood F-statistic Prob(F-statistic) 0.036218 -0.000850 2.180177 123.5825 -60.51614 0.977063 0.332035 Mean dependent var S.D. dependent var Akaike info criterion Schwarz criterion Hannan-Quinn criter. Durbin-Watson stat 2.397122 2.179251 4.465439 4.560596 4.494529 0.882228 Example 3 Test the following hypothesis 𝐻0 : 𝛽1 = 0 𝐻1 : 𝛽1 ≠ 0 In other words, does Investment have a statistically significant impact on GDP? And if so at what level of significance?