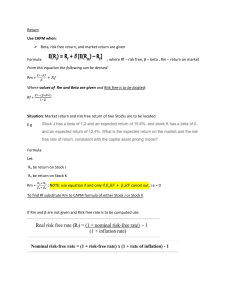

FINC5001 Module 5: The Capital Asset Pricing Model Written by Mike Shin The University of Sydney Business School The University of Sydney Page 1 Purpose of the Slides 1. These are supplementary slides to the modules. 2. Keep these as a reference and do not rely solely on them. The University of Sydney Page 2 Beta – Before we continue where we left off in Module 4 on Portfolio Theory, it is useful to introduce the concept of beta. – Beta - Beta is a measure of a stock's market risk. It measures how sensitive the stock is to market movements. – We measure systematic risk or market risk with beta. – The risk of a well-diversified portfolio depends on the market risk of the stocks in the portfolio. The University of Sydney Page 3 Beta – The formula for beta is: 𝐶𝑜𝑣 𝑅𝑚 , 𝑅𝑖 β𝑖 = σ2𝑚 – – – – β𝑖 = Beta for stock i 𝑅𝑚 = Returns for the market 𝑅𝑖 = Returns for stock i σ2𝑚 = Variance for the market The University of Sydney Page 4 Beta – We interpret beta like this: – Stocks with beta > 1 tend to amplify the overall movements of the market – Stocks with beta < 1 tend to dampen the overall movements of the market – Stocks with beta = 1 tend to move 1-1 with the market The University of Sydney Page 5 Beta – We spent a lot of time on portfolios so can we use the same concept for portfolios? – Portfolio Beta - Portfolio beta measures the systematic risk of a portfolio, just as beta for an individual stock measures the systematic risk of the stock. The University of Sydney Page 6 Beta – Portfolio Beta (2 stocks) β𝑝 = ω1 β1 + ω2 β2 – – – – – β𝑝 = Portfolio beta ω1 = Weight on stock 1 ω2 = Weight on stock 2 β1 = Beta of stock 1 β2 = Beta of stock 2 The University of Sydney Page 7 Beta – Portfolio Beta (2 stocks) β𝑝 = ω1 β1 + ω2 β2 + ⋯ + ω𝑛 β𝑛 – β𝑝 = Portfolio beta – ω𝑖 = Weight on stock i – β𝑖 = Beta of stock i – That is, the portfolio beta is just the weighted average of all the individual betas. The University of Sydney Page 8 CAPM – The capital market line (CML) turns out to lead to the CAPM. – The CAPM equation is: 𝐸𝑅𝑖 = 𝑟𝑓 + β𝑖 𝐸𝑅𝑚 − 𝑟𝑓 – – – – 𝐶𝑜𝑣 𝑅𝑚 , 𝑅𝑖 β𝑖 = σ2𝑚 𝐸𝑅𝑖 = Expected return of stock i 𝑟𝑓 = Risk-free rate β𝑖 = Beta for stock i 𝐸𝑅𝑚 = Expected return of market The University of Sydney Page 9 CAPM – The CAPM is a complete formula for finding the required rate of return. – Why? Because we know 𝑟𝑓 , β𝑖 , 𝐸𝑅𝑚 . – Because it prices any asset, we call it the capital asset pricing model (CAPM). – Another interpretation of CAPM is: 𝑟𝑖𝑠𝑘 𝑐𝑜𝑟𝑟𝑒𝑐𝑡𝑖𝑜𝑛 𝑓𝑜𝑟 𝑠𝑡𝑜𝑐𝑘 = β𝑖 ∗ 𝑚𝑎𝑟𝑘𝑒𝑡 𝑟𝑖𝑠𝑘 𝑝𝑟𝑒𝑚𝑖𝑢𝑚 𝑅𝑒𝑞𝑢𝑖𝑟𝑒𝑑 𝑟𝑎𝑡𝑒 𝑜𝑓 𝑟𝑒𝑡𝑢𝑟𝑛 = 𝑟𝑓 + 𝑟𝑖𝑠𝑘 𝑐𝑜𝑟𝑟𝑒𝑐𝑡𝑖𝑜𝑛 𝑓𝑜𝑟 𝑠𝑡𝑜𝑐𝑘 The University of Sydney Page 10 CAPM – What does this mean for the expected returns for a stock? – Beta = 1 means 𝐸𝑅𝑖 = 𝐸𝑅𝑚 – Beta = 0 means 𝐸𝑅𝑖 = 𝑟𝑓 – Beta > 1 means 𝐸𝑅𝑖 > 𝐸𝑅𝑚 – Beta < 1 means 𝐸𝑅𝑖 < 𝐸𝑅𝑚 The University of Sydney Page 11 CAPM – We graph this relationship: – The line is called the security market line (SML). The University of Sydney Page 12 CAPM – Investors are rewarded for taking beta risk. – If a stock has a higher beta that means the stock should return more on average than a lower beta stock. – The difference between the expected return implied by the CAPM and the actual return of the stock is called alpha. The University of Sydney Page 13 Alpha – How do we know how good a fund manager is? – Alpha - Alpha is a measure of the skill or performance of an investment. It is the difference between the expected return predicted by the CAPM and the actual return of the investment. – Alpha is also called abnormal return. – When related to CAPM, it is also sometimes called Jensen's alpha. The University of Sydney Page 14 Alpha – The formula for alpha is: α = 𝐸𝑅 − 𝑟𝑓 + β 𝐸(𝑅𝑚 ) − 𝑟𝑓 – – – – – α = Alpha 𝐸𝑅 = Expected return of stock (or portfolio) 𝑟𝑓 = Risk-free rate β = Beta of the stock (or portfolio) 𝐸𝑅𝑚 = Expected return of market The University of Sydney Page 15 Alpha – It is important to note that ER here is not the same as the CAPM expected return but our best estimate using the actual returns of the investment. – Thus, alpha is always calculated after returns have been realised. The University of Sydney Page 16 Alpha – Alpha can also be positive, negative, or zero. – Then a positive alpha implies that the investment is doing better than the CAPM predicts. That is, the investment is generating more expected returns while taking less risk. – Similarly, a negative alpha implies that the investment is doing worse than the CAPM predicts. The University of Sydney Page 17 Performance Evaluation – A simple manner to evaluate the performance of an investment is to consider its arithmetic and geometric average rate of return. – The average return can be compared to a benchmark, such as an appropriate market index or the median return of funds in a comparison group. – Risk-adjusted performance evaluation methods were proposed soon after the Capital Asset Pricing Model (CAPM) theory was developed. The University of Sydney Page 18 Performance Evaluation 𝐸(𝑅𝑝 ) − 𝑟𝑓 𝑆ℎ𝑎𝑟𝑝𝑒 𝑅𝑎𝑡𝑖𝑜 = σ𝑝 – 𝐸(𝑅𝑝 ) = Expected return of portfolio – 𝑟𝑓 = Risk-free rate – σ𝑝 = Standard deviation of portfolio 𝑇𝑟𝑒𝑦𝑛𝑜𝑟 𝑅𝑎𝑡𝑖𝑜 = 𝐸(𝑅𝑝 ) − 𝑟𝑓 𝛽𝑝 – 𝛽𝑝 = Beta of portfolio The University of Sydney Page 19 Performance Evaluation 𝐽𝑒𝑛𝑠𝑒𝑛′ 𝑠 𝑎𝑙𝑝ℎ𝑎 = 𝐸𝑅 − 𝑟𝑓 + β 𝐸(𝑅𝑚 ) − 𝑟𝑓 – – – – 𝐸𝑅 = Average return of portfolio 𝑟𝑓 = Risk−free rate β = Beta of the portfolio 𝐸(𝑅𝑚 ) = Expected return of market The University of Sydney Page 20 Performance Evaluation Which measure is appropriate? The University of Sydney Page 21 CAPM in Practice – Does the CAPM work? We can check using statistical techniques. – Here, we will not require you to know how to run a regression, but just to know the empirical facts about CAPM. – Regression - Regression is a statistical tool to determine the best linear fit between the data. The University of Sydney Page 22 CAPM in Practice – The way we test CAPM is the following regression equation: 𝑟𝑖 = α𝑖 + β𝑖 𝑟𝑚 + ϵ𝑖 – – – – – 𝑟𝑖 = Excess return of stock (or portfolio) i α𝑖 = Alpha for stock (or portfolio) i β𝑖 = Beta for stock (or portfolio) i 𝑟𝑚 = Excess market return ϵ𝑖 = Idiosyncratic risk for stock (or portfolio) i The University of Sydney Page 23 CAPM in Practice – Investors are rewarded for taking beta risk. – If a stock has a higher beta that means the stock should return more on average than a lower beta stock. – The difference between the expected return implied by the CAPM and the actual return of the stock is called alpha. The University of Sydney Page 24 CAPM in Practice – Because CAPM says that a stock's beta determines the expected return, a test of the CAPM is to say that alpha is zero. – Another graphical way to test the CAPM is to use portfolios. That is, we put stocks with similar betas into a portfolio and see how well the portfolios do in terms of average annual returns. The University of Sydney Page 25 CAPM in Practice Beta-Sorted Portfolios from 1960-2017 The University of Sydney Page 26 CAPM in Practice – Here we see that while the CAPM is not perfect, portfolios do seem to line up around the SML and that higher beta stocks tend to have higher expected returns, which is exactly the prediction of the CAPM. – To summarise the main facts on testing the CAPM: – 1. CAPM seems to do fairly well – 2. Other factors besides market beta seem to matter (like size and book value) – 3. There are measurement problems with testing the CAPM The University of Sydney Page 27 CAPM in Practice – – – – Practical Issues with CAPM: 1. Estimating beta is very difficult 2. Finding the market portfolio is difficult 3. Determining expected returns is difficult – – – – CAPM Assumptions: 1. Risk-free rate is actually risk-free 2. Investors can borrow and lend at the same rate 3. Markets and in equilibrium and are efficient The University of Sydney Page 28 APT – Arbitrage Pricing Theory (APT) - APT is a model that relates a stock's return to many different influences or "factors". – APT makes different assumptions than the CAPM. The University of Sydney Page 29 APT – – – – CAPM is derived through: Investor preferences Portfolio theory Equilibrium condition – APT: – Assumes factors matter – No-arbitrage condition The University of Sydney Page 30 APT – Equilibrium - Equilibrium means that supply equals demand. This is a theoretical concept that cannot be verified in real life. – While we did not explicitly assume equilibrium, the theory behind CAPM depends on equilibrium. We will not go too deep into the theory here, but equilibrium can sometimes be a strong assumption. – No Arbitrage Condition - The no-arbitrage condition just means that you cannot make arbitrage profits. The University of Sydney Page 31 APT – Factors are anything that may influence an asset's expected returns. – Some examples of factors are (1) market factor, (2) size factor, (3) GDP factor, and (4) book value factor. The University of Sydney Page 32 APT – For 2 factors, the APT model is: 𝐸𝑅 = 𝑟𝑓 + β1 𝑟1 + β2 𝑟2 𝐸𝑅 = Expected return of the stock 𝑟𝑓 = Risk-free rate β1 = Beta for factor 1 β2 = Beta for factor 2 𝑟1 = Risk premium for factor 1 𝑟2 = Risk premium for factor 2 The University of Sydney Page 33 APT – For n-factors, the APT model is: 𝐸𝑅 = 𝑟𝑓 + β1 𝑟1 + β2 𝑟2 + ⋯ + β𝑛 𝑟𝑛 𝐸𝑅 = Expected return of the stock 𝑟𝑓 = Risk-free rate β𝑖 = Beta for factor i 𝑟𝑖 = Risk premium for factor i The University of Sydney Page 34 APT – APT is not necessarily better or worse than CAPM. Like any model, it has its advantages and disadvantages. – Advantages: – 1. Does not require equilibrium – 2. Allows multiple sources of systematic risk – Disadvantages: – 1. No theoretical justification for factors – 2. Having a linear relationship is restrictive The University of Sydney Page 35 The End The University of Sydney Page 36