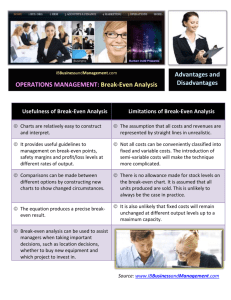

STUDENT/TEAM Thomas McClure Break-Even Analysis To: Marketing Assistant Trainees From: Porter Gamble, Vice President of Marketing RE: Understanding the Operating Performance and Profitability Turn your attention to the operating performance of Allstar Brands. In this exercise, you will look at break-even analysis for the purpose of evaluating marketing activities, which varies from the traditional approach used in accounting courses. When making decisions about investing in product changes, increasing or decreasing prices, investing in distribution channel activities, or increasing promotional activities, marketing managers need to understand how these changes will affect company profitability and what risk will be associated with these actions. Break-even analysis provides information that will help you understand the impact of proposed changes. Break-even is the point at which the company generates enough revenue to cover all of its variable and fixed costs. It is at this point that no profit is made (profit = 0). Refer to your Income Statement for fixed costs. Refer to your Sales Report or the “What If…” analysis for unit sales. These instruments will help you obtain figures for the break-even analysis. The break-even formula tells you how many units need to be sold in order to cover all expenses. The formula is relatively simple and is shown below: Company Break-Even (Units): = Total Fixed Costs / (Selling Price per unit - Variable Cost per unit) While this formula is fine for the overall company, marketing managers may be more interested to learn how their marketing budgets affect the break-even point. So you may want to use the following formula: Marketing Budget Break-Even (Units): = (Total Fixed Costs + Total Marketing Expense) / (SP per unit – VC per unit) 14B14B Note: SP = Manufacturer Sales / units or: SP = MSRP x (1 – vol. disc%) VC = Variable Cost VC = (PA+COGS) / units or: VC = Unit Cost + SP x PA% PA = Promotional Allowance SP = Selling Price Break-Even in Sales Dollars: = (Break-Even Unit Sales) x (Selling Price per Unit) Complete the tables on the next page. (continued on next page…) STUDENT/TEAM Thomas McClure Use the data from the research provided in your current period of the MarketShare simulation to complete the tables below. The information you need comes from the COMPANY Income and Performance Summary reports. You will need to calculate the UNIT selling price (SP), all UNIT variable costs (VC), marketing expenses, and fixed costs. List the required information in the chart below. Break-Even Data Description $ Unit Volume 55.8 M Unit Selling Price (SP) 3.84 Promotional Allowance (PA) 27.9 Cost of Goods Sold (COGS) Unit Variable Cost (VC) Total Marketing Expenses (Promo., Adv., Sales Force, Admin.) Total Fixed Costs 54 1.47 25.8 M$ 56 M$ Use the data you just calculated and the break-even formulas (provided on the front page of this exercise) to fill in the information below. Company Break-Even (Units) 2 pts Total Fixed Costs (FC) – Unit Selling Price (SP) $56 M 3.84 – 1.47 Variable Costs per Unit (VC) = $56 M $2.37/unit = Break-Even (Units) = 23.6 M Units (continued on next page…) STUDENT/TEAM Thomas McClure Marketing Budget Break-Even (Units) 2 pts Total Fixed Costs (FC) Selling Price per Unit (SP) $56 M $3.84 + Total Marketing Expenses – Variable Costs per Unit (VC) + $25.8 M – $1.47 = $81.8 M = Break-Even (Units) = 34.5 M Units $2.37 Sensitivity Analysis Use the information provided below to understand how your company’s break-even point changes and the implications for market share: 1. You have requested an additional $8,000,000 from Senior Management to run an advertising campaign promoting Allround. What is the new break-even level of sales? 2pts (56+25.8+8)/(3.84-1.47)= 37.9 M units 2. A competitor has dropped its price by $0.50 causing you to consider matching their price cut. What would be your new break-even? 2 pts (56+25.8)/((3.84-0.5)-1.47)= 43.7 M Units