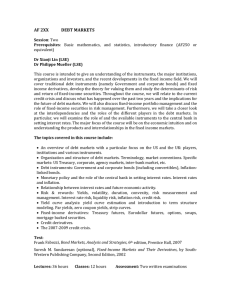

Capital Markets: Intro to Financial Markets

advertisement

CAPITAL MARKET 1. INTRODUCTION TO FINANCIAL MARKET Households are paid for production factors with which enterprises (przedsiębiorstwa) produce (to sell) goods and services A financial system enables households to channel excess funds to enterprises, so that they can produce goods and services Does size or complexity really matter? Studies show that developed financial systems are conducive to economic growth, but beyond a certain threshold further expansion thereof may be detrimental to social welfare. Ideally, the complexity of a financial system should correspond to market participants' needs and stand ready to satisfy them but in real life financial innovation is often pursued to inflate profits (zawyżać zyski) and circumvent (obejść) regulations or supervision Models of financial systems Market-oriented and bank-oriented financial systems The most important factors shaping the model of a financial system include, history, legal system, stage of financial development. Countries with bank-based systems tend to feature somewhat lower long-run growth, but there is no optimal structure of the financial system that would ensure effective performance of its functions in all economic conditions. Bank credit supply is more volatile (zmienne, niestabilne) than supply from debt capital markets (which amplifies financial and real instability). What are Debt Capital Markets? Debt capital markets (DCM), also known as fixed-income markets, are a low-risk, capital market where investors are lenders to a company in exchange for debt securities. These markets are also used by companies to finance themselves through debt, which helps diversify their funding Structure of the financial system Financial markets – one of the major components of a financial system. The importance of intersections (przecięcie, punkt wspólny) with other components. Towards the definition capital market - a marketplace for financial instruments Two basic building blocks: - money market (liquidity) - capital market (investing/financing: equity + debt (kapitał własny + zadłużenie)) Two additional dimensions on top of that: - derivatives (risk management) - foreign exchange (wymiana walutowa) Each market segment features specific instruments, attracts certain market participants who all have their individual objectives, abide by specific rules and operate using particular infrastructure... Financial statements Balance sheet basics: ”snapshot”, assets (aktywa), liabilities (pasywa, zobowiązania), profit and loss, leverage sensitivity leverage - It is when one uses borrowed funds (debt) for funding the acquisition of assets in the hopes that the income of the new asset or capital gain would surpass the cost of borrowing is known as financial leverage. Bank balance sheet (bilans banku) vs non-financial corporation balance sheet (jednostki, których główna ̨ działalnościa ̨ jest produkcja i obró t dobrami lub świadczenie usług niefinansowych np. osoby fizyczne, państwowe) Profit and loss, cash flow statement A smattering (odrobina) of behavioural finance Prospect theory of choosing between probabilistic alternatives that involve risk, where the probabilities of outcomes are known: people make decisions based on the potential value of losses and gains rather than the outcome, people evaluate these losses and gains using certain heuristics, a psychologically more accurate description of decision making (comparing to the expected value and expected utility theories) Examples of heuristics: misperception of randomness, availability, anchoring (kotwiczenie) Risk awareness, risk seeking and risk aversion – asymmetries in market participants' behaviour: - 95% chance to win $10,000 or 100% chance to obtain $9,499 (fear of disappointment-risk averse) - 95% chance to lose $10,000 or 100% chance to lose $9,499 (hope to avoid loss-risk seeking) - 5% chance to win $10,000 or 100% chance to obtain $501 (hope of large gain-risk seeking) - 5% chance to lose $10,000 or 100% chance to lose $501 (fear of large loss-risk averse) Market efficiency Markets are efficient if the market prices reflect all available information Three basic forms of the efficient-market hypothesis: - weak (the market is efficient, reflecting all market information, i.e. the record of past prices; rates of return on the market should be independent; past rates of return have no effect on future rates) - semi-strong (incorporates the weak-form hypothesis: the market is efficient, reflecting all publicly available information; prices adjust quickly to absorb new information; an investor cannot benefit over and above the market by trading on new publicly available information) - strong (incorporates both the weak-, and semi-strong-form hypotheses; the market is efficient, reflecting all information both public and private; no investor is able to profit above the average investor even if he or she were given new information, be they public or private) In other words: - if the market is weakly efficient, it is no good looking for patterns in price movements to predict future movements (technical analysis) - if the market is semi-strongly efficient, it is no good looking at fundamental factors to compare them with current market prices (fundamental analysis) - if the market is strongly efficient, the only way to ”beat” it is by access to insider information not yet fully incorporated in the market prices Market liquidity people are trading on the market; portfolio is liquid when you can easily sell your assets (quickly find a buyer and price should be close to the market price) (the role of market makers and speculation) Law of One Price: if two assets are equivalent in all economically relevant aspects, they should have the same market price (otherwise there will be arbitrage opportunities) Arbitrage - is the practice of taking advantage of a difference in prices in two or more markets; striking a combination of matching deals to capitalize on the difference, the profit being the difference between the market prices at which the unit is traded. There is the possibility to instantaneously buy something for a low price and sell it for a higher price. Bid-ask spread - A bid-ask spread is the difference between the highest price that a buyer is willing to pay for an asset and the lowest price that a seller is willing to accept. The spread is the transaction cost. Price takers buy at the ask price and sell at the bid price, but the market maker buys at the bid price and sells at the ask price. The bid represents demand and the ask represents supply for an asset. The bid-ask spread is the de facto measure of market liquidity. Financing decision The basic objective: maximise (market) value of a firm Which projects to undertake ‒ investment or capital budgeting decision (corporate finance – choose highest positive NPV) A financial manager is responsible for: raising funds from investors in the financial markets (by selling financial assets), investing those funds in operations to purchase real assets, collecting cash generated by those operations, returning cash acquired from investors + reinvesting Dilemma 1: internal or external financing ‒ how much earnings to retain ‒ how much earnings to reinvest (dividend policy) Internal source of finance - refer to fundraising options that exist within the business itself. This includes all your day-to-day profit-boosting operations, such as the sale of stock or services. It can also involve the sale of business assets External source of finance - External sources of finance are those that come from outside your business. This can mean money that comes from loans or investors through stocks and shares as well as lines of credits that can be opened with banks or financial institutions. Dilemma 2: debt or equity ‒ borrow (increase debt) or share ownership (issue equity) ‒ in what proportion As a rule, firms use internal financing first, then debt, equity is usually the last resort Equity represents ownership interest in a corporation in the form of stock (shares) Two basic types: common shares and preferred shares Common (ordinary) shares/stock (akcja zwykła) ownership + voting power, residual claim on profits, valuation changes, no maturity Common shares are issued to business owners and other investors as proof of the money they have paid into a company. Of all shareholders, common shareholders have the least claim on a company’s assets Preferred shares/stock (akcja uprzywilejowana) usually senior to common shares, but junior to bonds, different types of privileges: dividends, liquidation; convertibility (wymienialne), callability (obligacja na żądanie - bonds that can be redeemed or paid off by the issuer prior to the bonds' maturity dat), non-voting Preferred shareholders have priority over common stockholders when it comes to dividends, which generally yield more than common stock and can be paid monthly or quarterly. These dividends can be fixed or set in terms of a benchmark interest rate like the London InterBank Offered Rate (LIBOR), and are often quoted as a percentage in the issuing description Capital structure A quick glance at a balance sheet ‒ assets generate profits from operating activity ‒ liabilities are sources of financing this activity Debt in the structure of liabilities results in financial leverage ‒ debt allows to generate earning without having to increase capital... ‒ ...but it also increases shareholders' risk Financial leverage of a firm - jest to bezpośredni wpływ struktury kapitału, a w konsekwencji kosztów finansowych, na efektywność wykorzystania kapitałów Measures of leverage ‒ debt / total liabilities ‒ debt / (debt+market value of equity) ‒ EBITDA (earnings before interest, taxes, depreciation and amortization) / interest ROA – Return on assets - the ratio of the company's net profit to the value of its assets ROE – Return on equity – net income/ equity capital ROI – Return on investments – (sales revenue – total cost)/ total costs The Modigliani-Miller theorem: capital structure irrelevance, under the classical random walk, in the absence of taxes, bankruptcy costs, agency costs and asymmetric information, and in an efficient market (no arbitrage), the market value of a firm is unaffected by how that firm is financed If the expected ROA is constant, the expected ROE increases along with the debt / equity (leverage) ratio The Modigliani-Miller theorem (M&M) states that the market value of a company is correctly calculated as the present value of its future earnings and its underlying assets and is independent of its capital structure. At its most basic level, the theorem argues that, with certain assumptions in place, it is irrelevant whether a company finances its growth by borrowing, by issuing stock shares, or by reinvesting its profits. It is true if markets are completely efficient, there are no taxes and no costs of bankruptcy. In our world M&M theory demonstrates that firm using only assets financing is less valuable that firm that also uses debt-financing. The choice of capital structure Trade-off between greater interest tax shield (when issuing debt) and lower costs of financial distress (when issuing shares) Tax shield: single tax on interest payments, double tax on dividends and capital gains Costs of financial distress: ‒ Present value of financial distress costs lowers the value of the leveraged entity ‒ Bankruptcy costs: direct – related to the legal process of reorganization indirect – moral hazard to engage in actions which are harmful to debt holders Indirect bankruptcy costs: Potential consequences of equity holders' moral hazard and the resulting conflicts of interest: excessive risk appetite: taking on too risky projects short-term investment horizon: preferring projects that pay off quickly, even if less profitable underinvestment: passing on profitable projects if the existing debt would capture most of the benefits reluctance to liquidate: keeping an entity alive even if liquidation value is greater than operating value All the above can be minimized by i.a.: management compensation schemes, protective covenants, choosing bank debt or short-term debt Dividend policy Dividend payout = dividend / earnings ‒ the percentage of earnings paid out as dividends Dividend yield = dividends / stock price ‒ the return an investor makes on dividends alone Dividend policy is the time pattern of dividend payouts (Polityka dywidendowa to schemat czasowy wypłat dywidendy) ‒ signaling role to market participants Alternative to dividends: repurchasing own shares (buy back) in the open market, by a tender offer or through private negotiations shareholders who sell may pay only capital gains taxes (and not income taxes) signaling role A stock buyback occurs when the issuing company pays shareholders the market value per share and re-absorbs that portion of its ownership that was previously distributed among public and private investors Companies do buybacks for various reasons, including company consolidation, equity value increase, and looking more financially attractive. The downside to buybacks is they are typically financed with debt, which can strain cash flow. Stock buybacks can have a mildly positive effect on the economy overall. Issuing shares – primary market New securities are issued in the primary market ‒ IPO (Initial public offer) vs SPO (Secondary public offer) IPO often few alternatives for start-ups (scarce own resources, short, credit history, underdeveloped VC/PE), giving up part or control and profits in exchange for funding, financing, and signaling functions is the first sale of a company’s shares to the public, which leads to a market listing. Its also known as a stock market launch or a flotation in the United Kingdom. Through this process of selling shares to the general public, a private company transforms into a public company. increase its owner base, gain access to cheaper capital, raise money to finance growth opportunities or rebalance the balance sheet, generate publicity and reputation for the company, attracting and attaining better management and employment, to monetize the investments of early private investors. Secondary market SPO is an excellent way to generate rapid capital for a business. This refers to the sale of all or most of the securities by one major stockholder or a group of top stockholders of a particular company. The proceeds from the sales benefit the company itself. Usually, the company is in possession of most of its own stocks. Already existing shares sold and bought (ownership changes), Even though market value of shares fluctuates, no new capital created. Trading often conducted in organised markets (securities exchanges or MTF (multilateral trading facility - examples in Poland: Warsaw Stock Exchange, NewConnect). Also, possible to trade in shares OTC (over the counter – nieregulowany rynek pozagiełdowy) via a system of interconnected dealers or directly (off the market) Securities exchanges (giełdy papierów wartościowych) They have admission to trading dematerialised, standardised, bearer securities; the role of securities depository (KDPW in Poland) Stock exchanges – centralised marketplace for trading shares usually digital (only few stock exchanges, such as CME, CBOE, CBoT, still operate in form of open outcry) investment firms (intermediaries): brokerage houses and offices brokers and dealers clearing houses settlement Types of orders Market order buy or sell immediately at the current market price Limit order buy or sell at a price equal or better than a given threshold all or part of the order Stop-loss order sell if the current market price falls below a given threshold Stop-buy order buy if the current market price falls below a given threshold Time-based orders day, open (until executed), fill-or-kill Price setting – basic rules For each security, buy and sell orders submitted to the stock exchange are aggregated by prices and ranked (automatically) for buy orders prices are intepreted as maximum for sell orders prices are interpreted as minimum Each buy and sell order is for a particular number of shares A simple algorithm matches both sides of the market and picks the price at which most shares can change owners therefore, the objective is to maximise market liquidity (volume!) This works for single/double fixings, as well as for continuous quotes Approaches to equity valuation Balance sheet valuation Book value ‒ net worth as shown on the balance sheet, i.e. total assets minus intangible assets and liabilities Market value to book value ‒ ratio of stock price to book value per share Liquidation cost ‒ total worth of physical assets if a company were to go out of business Replacement cost ‒ estimated cost to obtain equivalent assets minus liabilities Tobin's q ‒ ratio of the market value of assets to their replacement cost, when above 1, companies have an incentive to invest Dividend discount model The intrinsic value of a share is the PV of all payments to the shareholder: dividends plus the proceeds from the ultimate sale of the share, discounted at a risk-adjusted interest rate if the market price is lower than the intrinsic value, the company is underpriced if the market price is greater than the intrinsic value, the company is overpriced • Problem 1: what is the right discount rate? • Problem 2: how to forecast dividend payouts? • Problem 3: how to forecast the share price? - Problem 3 becomes irrelevant, once we assume that shares will be held for some time The risk-adjusted discount rate (stopa skorygowana o ryzyko) is the required rate of return for holding the company's risk (z tytułu utrzymania ryzyka przedsiębiorstwa) Dividends: ‒ assume they grow at a constant rate (Gordon model) ‒ assume the capital structure is constant (dividends are earnings minus investment) ‒ allow dividends per share to vary over time (multistage growth models) Price to earnings ratio The P/E ratio is the relation of stock price to earnings per share • In theory: ‒ high P/E should imply high growth opportunities ‒ P/E should increase along with an increase of ROE ‒ P/E should increase along with an increase of the plowback rate (The plowback ratio is a fundamental analysis ratio that measures how much earnings are retained (zatrzymane) after dividends are paid out - it is an indicator of how much profit is retained in a business rather than paid out to investors) (only if ROE is greater than the discount rate) ‒ P/E should decrease along with an increase of the discount rate • In practice: ‒ the ratio may fluctuate significantly over the business cycle and the denominator may be negative ‒ the denominator reflects past earnings, rather than the trend value of future earnings ‒ earnings management makes it difficult to compare ratios across companies ‒ the numerator (licznik) is a stock, whereas the denominator (mianownik) is a flow ‒ the ratio tends to be high during the times of high inflation Free cash flows Free cash flows (FCF) are the after-tax cash flows that accrue from company's operations, net of investment and net working capital which are available to both debt and equity holders To obtain (uzyskać) FCF for equity holders, after-tax interest expenditures and cash flows associated with net issuance/repurchase of debt need to be subtracted • The FCF model is similar to the dividend discount model, but it discount potential, rather than actual dividends Depreciation is a cost, but not an actual expense, so it adds to free cash flows CAPITAL MARKET REGULATIONS What is the invisible hand of the market? When can the market be efficient? Main reasons for market regulations in general: monopolies / oligopolies, asymmetry of information, externalities Main reasons for the regulation of the IPO process: scam IPOs / frauds, very significant asymmetry of information Prospectus directive – prospekt emisyjny Prospectus: A prospectus is a legal disclosure document that provides information about an investment offering to the public, and that is required to be filed (zgłoszony) with local regulator Prospectus is a single document or a set of documents containing all information which is necessary to enable investors to make an informed assessment of the rights attached to the securities being issued, and of the issuers’: − assets and liabilities − financial position − profits and losses − prospects Supplemented with Prospectus Regulation Step towards the Capital Markets Union (CMU): CMU: set of measures to strengthen the role of market-based finance in the European economy, a key objective of the Capital Markets Union is to facilitate raising capital on capital markets Key element: approved prospectus is needed for public offer or admission to trading on a regulated market MTF – multilateral trading facility, RM – regulated market Prospectus includes: − risk factors − description of issuer’s business − review of the current business situation − financial statements − other important information (e.g. dividend policy, terms of the offer, current shareholder structure) − summary! Prospectus should be approved by the competent authority in... 10 days After approval it is valid for 12 months Public offer is presenting sufficient information on the terms of the offer and the securities to be offered, to enable an investor to decide to purchase or subscribe to these securities • IPO General waivers: − offer to only qualified investors, and/or − offer to less than 150 persons, and/or − denomination per unit at least EUR 100,000 / minimum investment of EUR 100,000, and/or − offer of total consideration less than... For SPOs, a prospectus is also needed, but there are many waivers, e.g.: − shares representing, over a period of 12 months, less than 10% of the number of shares of the same class already admitted to trading on the same regulated market − securities offered in connection with a takeover, merger, or division MiFID/MiFIR Markets in Financial Instruments Directive/ R-report (rozporządzenie) Markets in Financial Instruments Directive, applicable across the EU since November 2007, is a cornerstone of the EU's regulation of financial markets seeking to improve their competitiveness by creating a single market for investment services and activities and to ensure a high degree of harmonised protection for investors in financial instruments MiFID sets out, among others: − business conduct and requirements for investment firms − rules on the admission of financial instruments to trading − authorisation requirements for regulated markets − regulatory reporting to avoid market abuse − trade transparency obligation for shares − list of financial instruments Main goals of the review − ensuring financial products are traded on regulated venues − increasing transparency − adapting rules to new technologies − reinforcing investor protection − limiting speculation on commodities The provision of the following investment services (or activities) requires authorisation: (Świadczenie następujących usług (lub działalności) inwestycyjnych wymaga zezwolenia) − reception and transmission of orders in relation to one or more financial instruments − execution of orders on behalf of clients − dealing on own account − portfolio management − investment advice − underwriting of financial instruments and/or placing of financial instruments − operation of Multilateral Trading Facilities (MTF) − operation of Organised Trading Facilities (OTF) Market structure under MiFID/MiFIR: − multilateral trading (trading venues): regulated markets (RM) multilateral trading facilities (MTF) organised trading facilities (OTF) − bilateral trading: systematic internalisers (SI) other OTC Key elements of investor protection: − tests of suitability (knowledge and experience, financial situation, investment objectives) and appropriateness (knowledge and experience) of investment products − other important elements: record keeping, best execution policy, inducements and remuneration (zachęty i wynagrodzenia) product intervention, reporting to clients Selected other areas regulated by MiFID/MiFIR: − access to market infrastructure − pre- and post-trade transparency − algorithmic trading and high frequency trading (HFT) EXCHANGE-TRADED DERIVATIVES Derivative: Financial instruments whose value depends on the value of an underlying asset and whose settlement takes place in the future. The initial capital outlays are usually significantly lower than the nominal value. price derived (lined) from different assets term transactions (when transction is concluded they are fixing the price in the future) and a lot may happen in between high risk profile Fundamental applications: − hedging − speculation (stabilising and destabilising, the use of leverage) − arbitrage Additional applications: − information on market expectations − risk transfer and capital release − lowering cost of capital − asset diversification − investment Financial derivatives are used for two main purposes to speculate and to hedge investments. (Hedgers and speculators - two contrary things) A derivative is a security with a price that is dependent upon or derived from one or more underlying assets. The derivative itself is a contract between two or more parties based upon the asset or assets. Its value is determined by fluctuations in the underlying asset. The most common underlying assets include stocks, bonds, commodities, currencies, interest rates and market indexes. Features of organized and regulated markets: - rules and regulations (direct members) − standardisation of instruments (liquidity) − centralisation (trading, matching, clearing, settlement) How to agree on the price? -> arbitrage 1. Assume that the fair price follows the formula 𝐹 = 𝑆0𝑒rT, and check the market price 2. If the market price is greater (𝐹𝑚 > 𝐹), promise to sell in the future -> (A) If the market price is lower (𝐹𝑚 < 𝐹), promise to buy in the future -> (B) 3. In (A), borrow and buy the underlying asset now In (B), short sell the underlying asset now 4. Settle the forward deal, repay the debt, and enjoy the risk-free profit! F – forward price, S0 – spot price, e – euler number, rT – maturity Types of derivatives − forwards, futures, swaps, options, combinations of the above Settlement method − physical, cash Baseline instrument − FX, equity commodities, interest rates, creditworthiness... Transaction place − regulated markets, organized markets, over-the-counter (OTC)(OTC – bez pośrednictwa giełdy) FUTURES - - Futures are derivative financial contracts obligating the buyer to purchase an asset or the seller to sell an asset at a predetermined future date and set price. A futures contract allows an investor to speculate on the price of a financial instrument or commodity. Futures are used to hedge the price movement of an underlying asset to help prevent losses from unfavorable price changes. When you engage in hedging, you take a position opposite to the one you hold with the underlying asset; if you lose money on the underlying asset, the money you make on the futures contract can mitigate that loss. Futures contracts trade on a futures exchange and a contract's price settles after the end of every trading session. Like the farmer-miller forward, but traded on a regulated market In a futures contract: − buyers and sellers never meet (intermediation) − contractual terms are standardised − either party can close their position at any time (reverse contracts) − counterparty credit risk is of the exchange, not market participants − margin accounts are used to reduce the risk of default Standardisation of contracts: − essential for promoting liquidity and managing pre-settlement risk − usually involves quantity (size), quality of baseline instruments, maturities (settlement dates) They use leverage – can be advantageous or disadvantageous – margin can be double-edged Example of WIG20 futures: (do zrobienia) (lecture 5) Inwestor uważając, że w ciągu najbliższych dwóch miesięcy indeks WIG 20 ma szansę wzrosnąć o 5%, przy aktualnym kursie 3300 punktów. Zakup opcji kupna wiąże się z zapłaceniem premii dla jej wystawcy. Premia ta wynosi 100 punktów. Jeden punkt wyceniany jest na giełdzie na 10 zł. Inwestor dobrze przewidział kierunek, w którym "pójdzie" rynek i w dniu wygaśnięcia opcji WIG 20 osiągnął poziom 3465 punktów. Przychód inwestora wyniósł 1650 zł, a zysk po odjęciu premii (100 ptk. razy 10 zł każdy) wyniósł 650 zł. Zakup opcji kupna przyniósł w przeciągu 2 miesięcy stopę zwrotu w wysokości 65% zainwestowanego kapitału (tj. 1000 zł premii), gdy instrument bazowy w tym czasie zmienił swą wartość zaledwie o 5%. Margin calls and closing position Margin accounts The term margin account refers to a brokerage account in which a trader's broker-dealer lends them cash to purchase stocks or other financial products. The margin account and the securities held within it are used as collateral for the loan. It comes with a periodic interest rate that the investor must pay to keep it active. Borrowing money from a broker-dealer through a margin account allows investors to increase their purchasing and trading power. Investing with margin accounts means using leverage, which increases the chance of magnifying an investor's profits and losses. Cleared on a daily basis to limit the risk of default: − marking to market Can be posted in cash, but not necessarily The role of volatility in determining the levels of initial and maintenance margins ‒ why do investors restock to the level of the initial, rather than maintenance margin? ‒ what are the risks of setting too high and too low levels? Margin call (margin account - depozyt zabezpieczający) - A margin call occurs when the percentage of an investor’s equity in a margin account falls below the broker’s required amount. An investor’s margin account contains securities bought with a combination of the investor’s own money and money borrowed from the investor’s broker In response to a margin call, you either restock to the level of the initial margin... ... or your position is immediately closed and whatever is left on the margin account is returned In the futures market, closing an open position is taking an opposite position: (ex. one short one long) − can be done unilaterally − can be done automatically (in case of failure to restock) Prices fluctuate, so reversing typically is not costless Calculations for short positions are the same as for long positions, but money is earned when prices drop FIXED INCOME SECURITIES BOND MARKET Bond is a security obligating a borrower to return the borrowed money to the lender, usually accompanied by an obligation to periodically pay interest on outstanding debt, based on an indenture (and legal covenants included therein) Pricing of bonds − sum of all discounted cash flows related to the security (NPV) While the timing and the nominal value of cash flows are basically specified in the contract (even if coupons are floating-rate) ... the discount rate, and ultimately the price, is market-determined PV = CFn/(1+r)n Important: ‒ clean price (without intrest – zero-coupon) vs dirty price (with intrest) ‒ trading at par (po cenie nominalnej), a premium or a discount Yield to maturity YTM − There are different sources of potential income from holding a bond − Different bonds, different: notional amounts, day-count conventions, coupon payments (nominal interest rate, frequency) − How to compare them in terms of investment alternatives? Yield curve − The relationship between YTM and maturity of interest rate instruments (ceteris paribus) term structure of interest rates − Typically constructed (or estimated) based on market prices of similar bonds in terms of the currency of denomination, credit risk etc. without embedded options also estimated for instruments similar to bonds, e.g. IRS (interest rate swap) − There may be more than one yield curve at a given point in time Expectations theory − instruments with different maturities are perfect substitutes − LT interest rates reflect expectations of changes in ST interest rates − may explain different shapes Liquidity preference hypothesis − higher liquidity of short-term instruments is always preferred − investment in longer-term instruments requires a premium − any deviance from a positive yield curve temporary Segmented market hypothesis (preferred habitats) − instruments with different maturities are not perfect substitutes − different investors in certain maturity segments When interest rates rise, bond prices will fall, but by how much exactly...? Duration – a measure of interest rate sensitivity −” weighted average” of cash flows expressed in years − determinants of duration − mind the second derivative! Duration is affected by the bond's coupon rate, yield to maturity, and the amount of time to maturity. Duration is inversely related to the bond's coupon rate. Duration is inversely related to the bond's yield to maturity (YTM) Modified duration – informs about the percentage change of bond prices in reaction to a 100 bp change in interest rates − modified duration=(MD)/(1+YTM) Basis Point Value (BPV) – nominal equivalent of modified duration for a 1 bp change in interest rates (per a nominal value of 100) − e.g. BPV of +1000 PLN means that we lose 100 000 PLN if interest rates rise by 1 percentage point (100 bp) COLLECTIVE INVESTMENT SCHEMES What are investment funds? Gather investors’ capital. Invest that capital collectively through a portfolio of financial instruments (equities, bonds etc.) and other assets. Offer shares/units which represent a proportion of the fund’s investments. Assets: equities, bonds, cash. Liabilities: unit capital, payables. Market value of assets – payables = NAV (net asset value); NAV / number of units outstanding = unit value Benefits: − professionalism, diversification, affordability, variety Costs: - management fees, performance fees, distributions fees, other expenses Management fees Fees for services provided by asset managers Usually calculated as a percentage of funds’ assets Included in the valuation of funds’ assets Paid out regardless of performance Usually depend on investment strategy Often shared with distributors Substantially affect wealth accumulation (in a non-linear way) Higher expense funds do not, on average, perform better than lower expense funds Distribution fees Entry fee − paid when purchasing units − deducted from the amount being invested − can depend on the amount of investment Exit fee − paid when redeeming units − calculated based on the amount being redeemed (or initially invested) − can depend on how long units are held Performance fees and other expenses Performance fee − charged for success, e.g. positive returns, returns higher than benchmark − usually calculated as a percentage of profits Other expenses − paid from funds’ assets or covered by management company − e.g. custodian, transfer agent, accounting, legal expenses, administrative expenses Open-end funds (clearly prevalent type in the euro area): (Otwarty fundusz jest zbiorowym programem inwestycyjnym, który może emitować i odkupywać akcje w dowolnym momencie) An open-end fund is an investment vehicle that uses pooled assets (aktywa wspólne), which allows for ongoing new contributions and withdrawals from investors of the pool. As a result, open-ended funds have a theoretically unlimited number of potential shares outstanding − units bought and sold on demand − unlimited number of units issued constant creation − generally units sold and redeemed directly out of funds ’ assets − no secondary market Closed-end funds (in some countries, like Poland, ca. 50% of the market): (Fundusz zamknięty to fundusz, który pozyskuje kapitał poprzez emisję ustalonej liczby akcji, które nie podlegają umorzeniu, a następnie inwestuje ten kapitał w aktywa finansowe, takie jak akcje i obligacje) A closed-end fund is a type of mutual fund that issues a fixed number of shares through a single initial public offering (IPO) to raise capital for its initial investments. Its shares can then be bought and sold on a stock exchange but no new shares will be created and no new money will flow into the fund Closed-end funds are considered a riskier choice because most use leverage. That is, they invest using borrowed money in order to multiply their potential returns − units bought and sold from a fund during set periods − fixed number of units issued (shareholders have to buy or sell existing shares to enter or leave the fund) − units can be traded on secondary market, often on stock exchange − market price of units can vary from the NAV due to demand and supply factors UCITS Undertakings for collective investment in transferable securities: Have a sole object of collective investment in transferable securities or in other liquid financial assets of capital raised from the public. Their units are, at the request of holders, repurchased or redeemed out of those undertakings’ assets. This refers to a regulatory framework that allows for the sale of cross-Europe mutual funds. UCITS funds are perceived as safe and well-regulated investments and are popular among many investors looking to invest across Europe AIF Alternative investment funds: Raise capital from a number of investors, with a view to investing it in accordance with a defined investment policy for the benefit of those investors, are not UCITS funds Investment strategies in IFs Equity funds Fixed income funds Cash funds (incl. money market funds) Commodity funds Real estate funds Hedge funds Private equity / venture capital funds Funds with compartments / sub-funds (umbrella funds) Funds of funds Index funds (index trackers) Exchange traded funds (ETFs): passive vs active, physical vs synthetic Active investment management: make deliberate choices selecting securities in their portfolio; look for ”alpha”, trying to outperform the market; on average fail to beat their benchmarks Passive investment management: seek to match the risk and return of a benchmark, mirror its composition; offer ”beta”, exposure to the overall market; charge lower fees In the long run investors cannot beat the market Theory behind passive management: − efficient market hypothesis − random walk theory Very little evidence of performance persistence in asset management industry Before-cost returns of average active and passive managers are equal... ... but active managers charge higher costs, so... ... after-cost return from active management must be lower than that from passive management Closet indexing: funds largely passively managed, but charge fees as if they were active. Closet Indexing refers to the practice of promoting an investment fund as actively managed, whereas in fact the fund closely tracks a benchmark index CREDIT RISK, CREDIT DERIVATIVES, OTC DERIVATIVES MARKET REFORM Credit risk Materialises when a debtor fails to deliver on obligations: failure to honour commitments is often called default, in financial markets typically manifests itself as counterparty risk Taking up credit risk is fairly easy ... shedding is not − sell or call securities, sell or call a loan, demand collateral (guarantee) Risk appetite All economic activity involves risk, and credit risk is almost impossible to avoid: − some financial institutions make their living out of risk taking Good risk management is about − stating objectives, being aware of risk, quantifying risk, being aware of the tools, applying the right tools Managing risk does not always mean avoiding or even minimizing risk Basic futures of credit derivatives For a given source of credit risk exposure (e.g. bonds, loans), credit derivatives allow to: - limit credit risk without having to remove its original source, - take on credit risk without having to actually acquire its original source Credit derivatives vs insurance contracts: similarities and differences Linear credit derivatives - Total Return Swap: − temporary switching off of an investment: mechanics Applications: − credit portfolio diversification − bank-client relationship − limited access to markets Non-linear credit derivatives - Credit Default Swap: − insurance against credit events: mechanics Applications: − credit risk transfer (portfolio diversification) − capital release − bank-client relationship − limited access to markets − neat way of measuring creditworthiness (of sovereigns, corporations etc.) Pricing of credit derivatives Premium reflects the expected payout by the protection seller: − probability of default − loss given default Probability of default: − typically based on historical conditional likelihood of default for individual buckets (according to e.g. credit ratings) • Loss given default (alternatively: recovery rate): − either assumed or market-implied The market for baseline instruments affects the credit derivatives market, but in some cases the opposite may also be true Very high concentration of the derivatives market is due to i.a information asymmetry Probability of default is often implied from market prices of CDS Any protection is only as good as the protection seller There are more! (credit spread options, CDO, CLN...) INTEREST RATE DERIVATIVES FORWARD (FRA – forward rate agreement) FRA is an OTC transaction obligating both parties to pay interest on an agreed notional amount for a pre-determined period of time starting in future, where the amount of interest is calculated as the difference between a floating, future market interest rate and the fixed FRA rate agreed upon at inception In other words, FRA is a bet on the future changes of market interest rates, not reflected in the currently prevailing market expectations According to market convention, a ”buyer” is the counterparty agreeing to pay fixed and receive floating rate payments; settlement is on net basis FRA transactions are settled in cash Normally done by reference rate Example: Bank A believes interest rates will go up soon and this increase has not been reflected in the market prices yet. Bank B is convinced otherwise: interest rates are bound to fall. They decide to wager some money on their expectations... They agreed upon: − what is meant by ”soon” -> 6 months from now − what is meant by ”interest rates” -> 3M WIBOR − how to determine the actual rise of fall -> a threshold of 5.5% is set – if 6 months from now the actual 3M WIBOR is above the threshold, A gets the difference; if it is below, B gets the difference − how much money is at stake -> PLN 100 million Banks really entered intro a forward rate agreement (6x9 type) Kontrakty FRA oznaczane są w następujący sposób: "FRA NxM" N - różnica pomiędzy datą zawarcia kontraktu a datą jego rozpoczęcia (w miesiącach) trade date – fixing date M - różnica pomiędzy datą rozpoczęcia kontraktu a datą jego wygaśnięcia (w miesiącach) effective date – maturity rate Analogicznie do w/w przykładu wartości te wynoszą odpowiednio: N=6, M=9 If Bank A made the bet with Bank B on September 7, 2021: − 07-09-2021 is the trade date − 09-09-2021 is the effective date (data wejścia w życie) − 07-03-2022 is the fixing date (data, w której obliczana jest różnica między przeważającym rynkowym kursem kasowym a uzgodnionym kursem) − 09-03-2022 is the settlement date (data rozliczenia to data, do której płatność różnicy jest należna stronie otrzymującej płatność) − 09-06-2022 is the maturity date (data wygaśniecia) How would A and B establish the 5.5% threshold (FRA rate)? Borrowing today for 9 months is the same as borrowing today for 6 months and then for another 3 months so the cost of both ways of funding should be the same! (otherwise arbitrage opportunities would exist) Solving a simple equation yields the fair price − if the prevailing market price is different, then market participants must be expecting some changes in interest rates − valuation is not a forecast (the actual market interest rates in future may be completely different!) Forward vs Futures Both forward and futures contracts involve the agreement to buy or sell a commodity at a set price in the future. But there are slight differences between the two. While a forward contract does not trade on an exchange, a futures contract does. Settlement for the forward contract takes place at the end of the contract, while the futures contract settles on a daily basis. Most importantly, futures contracts exist as standardized contracts that are not customized between counterparties What if a one-time bet became a long-term deal? - IRS − take the original bet between Banks A and B... − ...pick 6M WIBOR instead of the 3M WIBOR... − ...agree upon 10 identical bets in a row, one right after another... − ...adjust the threshold (the fixed rate) accordingly... − ...and get a 5Y IRS (interest rate swap)! – even 50 years swaps exist SWAPS INTEREST RATE SWAPS – IRS (swap procentowy) IRS is an OTC transaction obligating both parties to periodically, over a pre-determined period of time, exchange interest payments on an agreed notional amount calculated according to different interest rates: the ”buyer” (long position) pays a fixed rate agreed upon at inception (IRS rate) (stałe oprocentowanie), whereas the ”seller” (short position) pays a floating rate (zmienne oprocentowanie) (usually a money market reference rate ex. WIBOR, LIBOR) Just like FRA, IRS can be a tool for speculation, but are often used (much more often than FRA) for hedging against interest rate risk The value of the forthcoming floating leg payment is determined upfront (at the beginning of each period), but the settlement is after each period, always on a net basis W przypadku tej transakcji można mówić o dwóch „nogach” – uzależnionej od zmiennej stopy procentowej i uzależnionej od stałej stopy procentowej (stawki IRS). Z warunku braku arbitrażu wynika, że żadna ze stron nie może zaczynać transakcji z jej niezerową wartością Valuation of IRS Establish cash flows for each of the two legs, discount them and sum them up − use a 6M forward curve to plug in the values for the floating leg At inception, the NPV of the fixed leg has to be equal to the NPV of the floating leg − otherwise arbitrage opportunities would exist − one equation with one unknown: the IRS rate (fixed) Another way to determine the fair value of an IRS is by referring to a similar instrument we are already familiar with... − how to create a synthetic IRS without using derivatives? – bond CIRS – cross currency rate swap An interest rate swap whose legs are denominated in different currencies is a cross-currency interest rate swap (CIRS), or a currency swap in short − NOT an fx swap! CIRS is an OTC transaction obligating both parties to periodically, over a pre-determined period of time, exchange interest payments on an agreed notional amount calculated according to different interest rates and denominated in different currencies In terms of interest rate payments CIRS can be: − float-float (basis swap) − fixed-float − fixed-fixed The notional amount can be exchanged as well Like in single-currency IRS, the NPVs of both legs at inception are identical CIRS are usually used for hedging, rather than speculation, as they use up a lot of credit limits Example Fundusz inwestycyjny kupił stałokuponowe obligacje polskiego przedsiębiorstwa nominowane w CHF. Zidentyfikuj główne rodzaje ryzyka takiej inwestycji i podaj sposób, w jaki fundusz może zabezpieczyć się przed tymi rodzajami ryzyka? SECURITIZATION Securitisation is the process of: − pooling (illiquid) individual loans and other debt instruments − converting them into liquid tradable securities (usually called asset-backed securities, ABS) Securitization is the pooling (łączenie) of assets to repackage them into interest-bearing securities. The investors that purchase the repackaged securities receive the principal and interest payments of the original assets. The securitization process begins when an issuer designs a marketable financial instrument by merging or pooling various financial assets, such as multiple mortgages, into one group. The issuer then sells this group of repackaged assets to investors. Securitization offers opportunities for investors and frees up capital for originators, both of which promote liquidity in the marketplace. In theory, any financial asset can be securitized—that is, turned into a tradeable, fungible item of monetary value. In essence, this is what all securities are. In securitization, the company holding the assets—known as the originator—gathers the data on the assets it would like to remove from its associated balance sheets. For example, if it were a bank, it might be doing this with a variety of mortgages and personal loans it doesn't want to service anymore. This gathered group of assets is now considered a reference portfolio. The originator then sells the portfolio to an issuer who will create tradable securities. Created securities represent a stake in the assets in the portfolio. Investors will buy the created securities for a specified rate of return. Traditional credit instruments Origination: − the bank finds a borrower and conducts a credit check Funding: − the bank loans the funds to the borrower Allocation of credit risk: − the bank carries the loan on its balance sheet and bears the credit risk of the loan Securitisation - separates origination from funding Credit derivatives - separate the funding from the allocation of credit risk Financial institutions securitise assets: − to get access to capital market funding − to obtain regulatory capital relief − to increase the liquidity and thereby the market valuation of the underlying asset pool (pula aktywów bazowych) Special purpose vehicle - SPV Securitisation is about the transfer of credit risk to a special purpose vehicle (SPV) The SPV owns the original individual securities The SPV issues the asset-backed securities to legally separate the institution or agent that originated the individual loans or securities from the ABS issuing institution or entity Pass-through securitisations: only one class of investors Funded securitisation: ownership of assets is transferred to the SPV Mechanics od founded securitizations 1. A financial institution (the originator) sells part of its portfolio to a SPV 2. In turn, the SPV issues securities that are used to fund the acquisition of the assets 3. The SPV is structured so that it is bankruptcy-remote from the originator (SPV jest skonstruowany w taki sposób, że jest oddalony od inicjatora pod względem upadłościowym) 4. A key feature is that the rating agencies assess the creditworthiness of the securitised loan portfolio independently of the creditworthiness of the originating banks Advantages of FSPV - form of secured borrowing/lending, the credit risk is based on the performance of the underlying asset pool and the originator - the newly issued securities will not be affected by the bankruptcy of the originator (the SPV is bankruptcy-remote) - the credit risk of the asset pool is often lower than the credit risk of the originator, giving the originator access to cheaper funding - securitisation frees up capital (and reduces capital requirements), thereby reducing funding costs - diversification of relatively homogenous underlying assets (e.g. mortgages) yields considerable benefits for investors Disadvantages - funded securitisation alters (changes) the relationships between banks and their borrowers This can be avoided by synthetic securitisations! Synthetic securitization Transactions replicating the cash flow of securitisation through credit derivatives: 1. the originating bank retains (zatrzymać) the assets on its balance sheet, but it transfers the associated credit risk to an SPV via CDS (credit default swap) 2. the SPV, in turn, issues credit-linked notes (CLN) that carry the default risk of the CDS sold by the SPV - is a security with an embedded credit default swap permitting the issuer to shift specific credit risk to credit investors 3. the SPV invests the proceeds from the CLN issues in high-quality securities (usually government bonds) 4. the SPV uses the interest income from these government bonds together with the CDS premia, to make payments on the CLNs Structured finance Structured finance is a financial instrument available to companies with complex financing needs, which cannot be ordinarily solved with conventional financing Structured finance: several classes of investors with different seniority Three key characteristics: - pooling of assets (either cash-based or synthetically created) - de-linking of the credit risk of the collateral pool from the credit risk of the originator - tranching, i.e. issuance of claims with different seniority-> unlike pass-through securitisation! Collateralized Debt Obligation (CDO) collateralized – zabezpieczony/ collateral-based – oparty na zabezpieczeniu CDOs are asset-backed securities issued by a SPV whose underlying collateral is typically a portfolio of bonds or bank loans, but the SPV issues securities with varying degrees of seniority (tranches) Usually at least three tranches: senior, mezzanine, first-loss (equity) tranche Transactions are often structured so that the senior tranches receive a AAA-rating and the mezzanine tranches receive a BBB rating SPV BALANCE SHEET IN A CDO CENTRAL COUNTERPARTY CLEARING What Is a Central Counterparty Clearing House (CCP)? A central counterparty clearing house (CCP) is an entity that helps facilitate trading in various European derivatives and equities markets. Typically operated by the major banks in each country, CCPs strive to introduce efficiency and stability into various financial markets. It reduces counterparty, operational, settlement, market, legal, and default risk for traders. Understanding a Central Counterparty Clearing House (CCP) Central counterparty clearing houses (CCPs) perform two primary functions as the intermediary in a transaction: clearing and settlement. As counterparties to the buyers and the sellers, CCPs guarantee the terms of a trade—even if one party defaults on the agreement. CCPs bear the lion's share of the buyers' and sellers' credit risk when clearing and settling market transactions. The CCP collects enough money from each buyer and seller to cover potential losses incurred by failing to follow through on an agreement. In such cases, the CCP replaces the trade at the current market price. Monetary requirements are based on each trader’s exposure and open obligations. Functions of a Central Counterparty Clearing House (CCP) As a means of privacy protection, CCPs shield the associated traders’ identities from one another. CCPs also protects trading firms against default from buyers and sellers who are matched by an electronic order book and whose creditworthiness is unknown. Furthermore, CCPs reduce the number of transactions that are being settled. This helps smooth operations while reducing the value of the obligations, which helps money move more efficiently among traders.