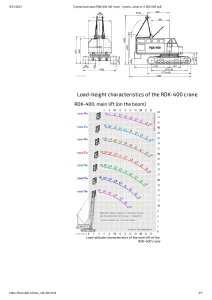

Corporate Finance Semester Project BLAER Investment Decision Introduction BLAER ltd. is a construction company. It constructs large industrial buildings and also provides maintenance services. It has almost 150 employees and has an annual sales of around £35 Million. The company has been using a crane that is 10 years old and has 5 years remaining useful life. But it is getting unreliable with time. A proposal has been put forth to buy a new advanced crane. The Decision Now the management has to decide whether they should continue using the old crane till its end of useful life or they should switch to the new crane now. Data Old crane New crane Purchase price £195,000 £345,000 Scrap value £5,000 £30,000 Current Market value £20,000 Book value after WDA £10,981 Useful life 5 Years remaining Maintenance cost £40,000 Running cost £40,000 10 Years £60,000 Running the old crane The cost of break down = £ 15,000 productivity loss + £10,000 fixing cost = £ 25,000 50% chance of breakdown = 50% × 25000 = £ 12500 Incremental revenue 60% chance of getting two contracts = 60% * (40000 × 2 ) = 48000 20% chance of getting four contracts = 20% * (40000 × 4 ) = 32000 Total revenue every year = 48000 + 32000 = 80000 Annual Running costs Depreciation (Using the straight-line method of depreciation) Depreciation of old crane = 195000−5000 15 Depreciation of old crane = 12667 per annum Depreciation of new crane = 345000−30000 10 Depreciation of new crane = 31500 per annum Depreciation Terminal CF at end of 10 years Initial Investment Net Present Value Internal rate of return IRR 14% Payback Period Accounting rate of return Merits and demerits of new crane Merits Demerits i. i. A higher running cost ii. A much higher price than the old crane New crane is technological more advanced. ii. Suits the firm’s image as innovative and advanced construction firm. iii. Will help reduce costs and win new contracts 1. Financial analysis required by BLAER CE The capital expenditure is presented in any of the 3 categories: 1. 2. 3. Essential replacement of existing asset (Category 1) Strategic expansion (Category 2) Safety and regulations (Category 3) The Bush Lift purchase falls under the category 1, as it will replace an old crane that is getting unreliable with time. Net Present Value (NPV) and Payback Period of the Capital Expenditure project were calculated. If the project gave a positive NPV an d its Payback period was less than 5 Years, then the projects were approved. 1. Financial analysis required by BLAER CE The Bush Lift purchase falls under the category 1, as it will replace an old crane that is getting unreliable with time. Net Present Value (NPV) and Payback Period of the Capital Expenditure project were calculated. If the project gave a positive NPV and its Payback period was less than 5 Years, then the projects were approved. 2. Real Vs. Nominal Rate Real Interest rate Nominal interest rate • The real interest rate has the element • Nominal interest rate refers to the of inflation adjusted in it. interest rate before taking into • It is calculated by subtracting the account the inflation factor. inflation rate from the nominal • It is calculated by adding the interest rate inflation rate and the real interest • Investors tend to use real discount rate. rate to also consider the risk of • They are generally advertised by inflation. banks, debt issuers for loans and various investments. Why 21% maybe too risky The firms tend to keep this figure within single digits. The 21% rate is very high return rate fro judging the return of any investment. It is also stated that 21% is the nominal interest rate that does not have effect of inflation adjusted to it. 3. The revised NPV The revised NPV of BL crane investment is around (60,151). Although the NPV suggests that BL crane should not be purchased but we can’t just rely on the verdict of a single number. 4. IRR Internal rate of return is used to calculate the exact rate of return of an investment taking into account the time value of money as well. It gives better understanding of the cash flows of the project. Company should use IRR to calculate the overall profitability of the projects. 5. Risk and uncertainty Analyzing risk and uncertainty is one of the key factors for making successful investments. Company can use the following methods to analyze and visualize the risk and uncertainty of the project: Decision-tree method SWOT analysis SWIFT analysis Key variables in BL investment The main variable in BL investment are: The advance technology used in the BL crane. The new contracts that it will attract. The BL crane suits the innovative image of firm. The unreliability and break down of old crane. Any further useful information The company should include calculating IRR in its capital expenditure manual. SWOT analysis in its proposal too rather than relying on just material facts and figures. Because the successful Conclusion The company should go for the new crane. We cannot just rely on NPV and figures for some decisions. The old crane is making company miss out contracts and