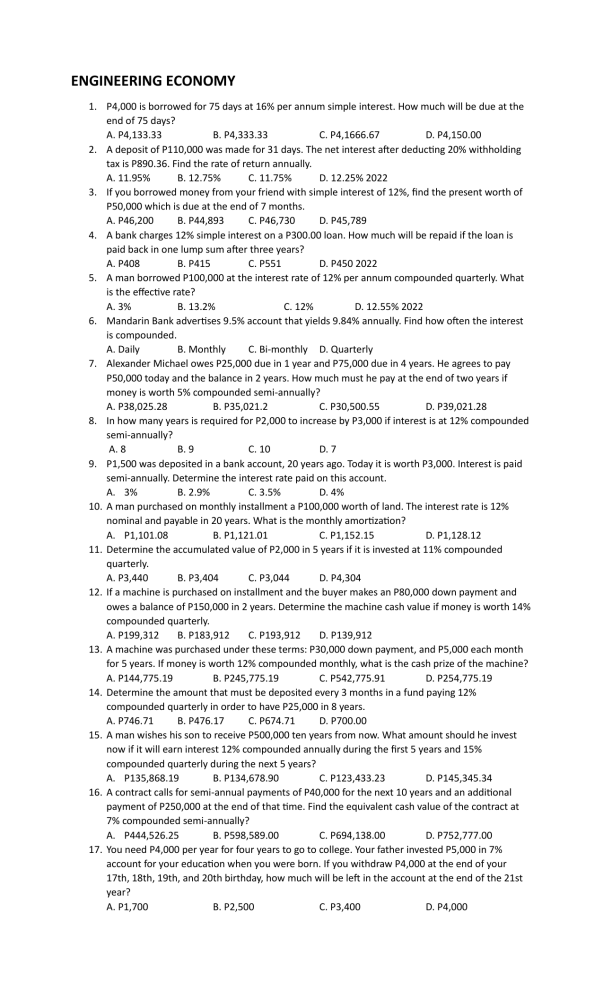

ENGINEERING ECONOMY 1. P4,000 is borrowed for 75 days at 16% per annum simple interest. How much will be due at the end of 75 days? A. P4,133.33 B. P4,333.33 C. P4,1666.67 D. P4,150.00 2. A deposit of P110,000 was made for 31 days. The net interest after deducting 20% withholding tax is P890.36. Find the rate of return annually. A. 11.95% B. 12.75% C. 11.75% D. 12.25% 2022 3. If you borrowed money from your friend with simple interest of 12%, find the present worth of P50,000 which is due at the end of 7 months. A. P46,200 B. P44,893 C. P46,730 D. P45,789 4. A bank charges 12% simple interest on a P300.00 loan. How much will be repaid if the loan is paid back in one lump sum after three years? A. P408 B. P415 C. P551 D. P450 2022 5. A man borrowed P100,000 at the interest rate of 12% per annum compounded quarterly. What is the effective rate? A. 3% B. 13.2% C. 12% D. 12.55% 2022 6. Mandarin Bank advertises 9.5% account that yields 9.84% annually. Find how often the interest is compounded. A. Daily B. Monthly C. Bi-monthly D. Quarterly 7. Alexander Michael owes P25,000 due in 1 year and P75,000 due in 4 years. He agrees to pay P50,000 today and the balance in 2 years. How much must he pay at the end of two years if money is worth 5% compounded semi-annually? A. P38,025.28 B. P35,021.2 C. P30,500.55 D. P39,021.28 8. In how many years is required for P2,000 to increase by P3,000 if interest is at 12% compounded semi-annually? A. 8 B. 9 C. 10 D. 7 9. P1,500 was deposited in a bank account, 20 years ago. Today it is worth P3,000. Interest is paid semi-annually. Determine the interest rate paid on this account. A. 3% B. 2.9% C. 3.5% D. 4% 10. A man purchased on monthly installment a P100,000 worth of land. The interest rate is 12% nominal and payable in 20 years. What is the monthly amortization? A. P1,101.08 B. P1,121.01 C. P1,152.15 D. P1,128.12 11. Determine the accumulated value of P2,000 in 5 years if it is invested at 11% compounded quarterly. A. P3,440 B. P3,404 C. P3,044 D. P4,304 12. If a machine is purchased on installment and the buyer makes an P80,000 down payment and owes a balance of P150,000 in 2 years. Determine the machine cash value if money is worth 14% compounded quarterly. A. P199,312 B. P183,912 C. P193,912 D. P139,912 13. A machine was purchased under these terms: P30,000 down payment, and P5,000 each month for 5 years. If money is worth 12% compounded monthly, what is the cash prize of the machine? A. P144,775.19 B. P245,775.19 C. P542,775.91 D. P254,775.19 14. Determine the amount that must be deposited every 3 months in a fund paying 12% compounded quarterly in order to have P25,000 in 8 years. A. P746.71 B. P476.17 C. P674.71 D. P700.00 15. A man wishes his son to receive P500,000 ten years from now. What amount should he invest now if it will earn interest 12% compounded annually during the first 5 years and 15% compounded quarterly during the next 5 years? A. P135,868.19 B. P134,678.90 C. P123,433.23 D. P145,345.34 16. A contract calls for semi-annual payments of P40,000 for the next 10 years and an additional payment of P250,000 at the end of that time. Find the equivalent cash value of the contract at 7% compounded semi-annually? A. P444,526.25 B. P598,589.00 C. P694,138.00 D. P752,777.00 17. You need P4,000 per year for four years to go to college. Your father invested P5,000 in 7% account for your education when you were born. If you withdraw P4,000 at the end of your 17th, 18th, 19th, and 20th birthday, how much will be left in the account at the end of the 21st year? A. P1,700 B. P2,500 C. P3,400 D. P4,000 18. A person buys a piece of lot for P100,000 down payment and 10 deferred semi-annual payments of P8,000 each, starting three years from now. What is the present value of the investment if the rate of interest is 12% compounded semi-annually? A. P134,666.80 B. P143,999.08 C. P154,696.80 D. P164,969.80 19. Find the present value in pesos, of a perpetuity of P15,000 payable semi-annually if money is worth 8% compounded quarterly. A. P371,287 B. P386,227 C. P392,422 D. P358,477 20. A house and lot can be acquired by a downpayment of P500,000 and a yearly payment of P100,000 at the end of each year for a period of 10 years, starting at the end of 5 years from the date of purchase. If money is worth 14% compounded annually, what is the cash price of the property? A. 810,000 B. 808,811 C. 801,900 D. 805,902 21. A parent on the day the child is born wishes to determine what lump sum would have to bed paid into an account bearing interest at 5% compounded annually, in order to withdraw P20,000 each on the child’s 18th, 19th, 20th, and 21st birthdays. How much is the lump sum amount? A. P35,941.73 B. P33,941.73 C. P30,941.73 D. P25,941.73 22. An instructor plans to retire in exactly one year and wants an account that will pay him P25,000 a year for the next 15 years. Assuming a 6% annual effective interest rate, what is the amount he would need to deposit now? A. P249,000 B. P242,806 C. P248,500 D. P250,400 23. A young engineer borrowed P10,000 at 12% interest and paid P2,000 per annum for the last 4 years. What does he have to pay at the end of the fifth year in order to pay off his loan? A. P6,919.28 B. P5,674 C. P6,074 D. P3,296 24. Mr. Cruz plans to deposit for the education of his 5 yr old son, P500 at the end of each month for 10 years at 12% annual interest compounded monthly. The amount that will be available in two years is A. P13,000 B. P14,500 C. P13,500 D. P14,000 25. A person buys a piece of lot for P100,000 downpayment and 10 deferred semi-annual payments of P8,000 each, starting three years from now. What is the present value of the investment if the rate of interest is 12% compounded semi-annually? A. P134,666.80 B. P143,999.08 C. 154,696.80 D. 164,969.80 26. A man loans P187,400 from a bank with interest at 5% compounded annually. He agrees to pay his obligations by paying 8 equal annual payments, the first being due at the end of 10 years. Find the annual payments. A. P44982.04 B. P56143.03 C. P62334.62 D. P38,236.04 27. What is the present worth of a P500 annuity starting at the end of the third year and continuing to the end of the fourth year, if the annual interest rate is 10%? A. P727.17 B. P717.17 C. P714.71 D. P731.17 28. A factory operator bought a diesel generator set for P10,000.00 and agreed to pay the dealer uniform sum at the end of each year for 5 years at 8% interest compounded annually, that the final payment will cancel the debt for principal and interest. What is the annual payment? A. P2,500.57 B. P2,540.56 C. P2,544.45 D. P2,504.57 29. John secured a home improvement loan in the amount of P10,000 from a local bank at an interest rate of 9.0% compounded monthly. He agreed to pay the loan in 60 equal monthly installments. Right after the 24th payment, John wishes to pay off the remainder of the loan in lump sum amount. What is the payment size? A. P7,473 B. P6,000 C. P6,528 D. P7,710 30. A contract has been signed to lease a building at P20,000 per year with an annual increase of P1,500 for 8 years. Payments are to be made at the end of each year, starting one year from now. The prevailing interest rate is 7%. What lump sum paid today would be equivalent to the 8year lease-payment plan? A. P147,609 B. P154,677 C. P233,654 D. P123,543 31. The Manila Highway Department expects the cost of maintenance for a particular piece of heavy equipment to be P5000 in year 1, P5,500 in year 2, and amounts increasing by P500 through year 10. At an interest rate of 10% per year, the present worth of the maintenance cost is nearest to: A. P38,220 B. P46,660 C. P42,170 D. P51,790 32. A mechanical contractor is trying to calculate the present worth of personnel salaries over the next five years. He has four employees whose combined salaries thru the end of this year are P150,000. If he expects to give each employee a raise of 5% each year, the present worth of his employees' salaries at an interest rate of 12% per year is nearest to: A. P591,000 B. P702,900 C. P816,100 D. P429,300 33. The worth of property which is equal to the original cost less depreciation A. Scrap value B. Earning value C. Book value D. Face value 34. Work-in-process is classified as? A. Asset B. Liability C. Expense D. Owner’s equity 35. A company issued 50 bonds of P1,000 face value each, redeemable at par at the end of 15 years to accumulate the funds required for redemption. The firm established a sinking fund consisting of annual deposits, the interest rate of the fund being 4%. What was the principal in the fund at the end of the 12th year? A. P35,983 B. P38,378 C. P41,453 D. P37,519 36. A unit of welding machine costs P45,000 with an estimated life of 5 years. Its salvage value is P2,500. Find its depreciation rate by straight-line method. A. 17.75% B. 19.88% C. 18.89% D. 15.56% 37. A machine has an initial cost of P50,000 and a salvage value of P10,000 after 10 years. Find the book value after 5 years using straight-line method. A. P12,500 B. P30,000 C. P16,400 D. P22,300 38. The initial cost of a paint sand mill, including its installation is P800,000. The BIR approved life of this machine is 10 years for depreciation. The estimated salvage value of the mill is P50,000 and the cost of dismantling is estimated to be P15,000. Using straight-line depreciation, what is the annual depreciation charge and what is the book value of the machine at the end of six years? A. P74,500, P340,250 B. P76,500, P341,000 C. P76,500, P342,500 D. P77,500, P343,250 39. An equipment costs P10,000 with a salvage value of P500 at the end of 10 years. Calculate the annual depreciation cost by sinking fund method at 4% interest. A. P791.26 B. P950.00 C. P971.12 D. P845.32 40. A machine costing P720,000 is estimated to have a book value of P40,545.73 when retired at the end of 10 years. Depreciation cost is computed using a constant percentage of the declining book value. What is the annual rate of depreciation in %? A. 28 B. 25 C. 16 D. 30 41. Cash money credit necessary to establish and operate an enterprise A. Funds B. Capital C. Liabilities D. Assets 42. ABC corporation makes it a policy that for any new equipment purchased, the annual depreciation cost should not exceed 20% of the first cost at any time with no salvage value. Determine the length of the service life necessary if the depreciation used is the SYD method. A. 9 years B. 10 years C. 12 years D. 19 years 43. A company purchases an asset for P10,000 and plans to keep it for 20 years. If the salvage value is zero at the end of the 20th year, what is the depreciation in the third year? Use SYD method. A. P1,000 B. P857 C. P937 D. P747 44. An asset is purchased for P9,000. Its estimated life is 10 years after which it will be sold for P1,000. Find the book value during the first year if SYD depreciation is used. A. P8,000 B. P6,500 C. P7,545 D. P6,000 45. 55 A machine costing P45,000 is estimated to have a salvage value of P4,350 when retired at the end of 6 years. Depreciation cost is computed using a constant percentage of the declining book value. What is the annual rate of depreciation in %? A. 33.25 B. 32.25 C. 35.25 D. 34.25 46. An asset is purchased for P500,000. The salvage value in 25 years is P100,000. What is the total depreciation in the first three years using straight line method? A. P48,000 B. P32,000 C. P24,000 D. P16,000 47. The recorded current value of an asset is known as A. scrap value B. book value C. salvage value D. present worth 48. A company must relocate one of its factories in three years. Equipment for the loading duck is being considered for purchase. The original cost is P20,000, the salvage value after three years is P8,000. The company’s ROR on money is 10%. Determine the capital recovery rate per year. A. 5987.67 B. 5897.56 C. 5625.38 D. 5578.35 49. A fixture that costs P700 will save P0.06 per item produced. Maintenance will be P40 annually, 3500 units are produced yearly. What is the POP at 10%? A. 4.12 yrs B. 4.65 yrs C. 5.57 yrs D. 4.85 yrs 50. The annual maintenance cost of a machine shop is P69,994. If the cost of forging is P56 per unit and its selling price is P135 per unit, find the number of units to be forged too breakeven. A. 886 B. 885 C. 688 D. 668 51. The length of time during which a property is capable of performing the function for which it was designed and manufactured A. Economic life B. Life span C. Eternal life D. Physical life 52. Determine the capitalized cost of an equipment costing P2M with an annual maintenance of P200,000 if money is worth 20% per annum. A. P2.5M B. P2.75M C. P3M D. P3.5M 53. At 6%, find the capitalized cost of a bridge whose cost is P200M and life is 20 years, if the bridge must be partially rebuilt at a cost of P100M at the end of each 20 years. A. 245.3M B. 215M C. 210M D. 220M 54. A P100,000, 6% bond, pays dividend semi-annually and will be redeemed at 110% on July 1, 2026. Find its price if bought on July 1, 2023, to yield an investor 4% compounded semi-annually. A. P100,000 B. P112,786.65 C. P113,456.98 D. P114,481.14 55. A community wishes to purchase an existing utility valued at P500,000 by selling 5% bonds that will mature in 30 years. The money to retire the bond will be raised by paying equal annual amounts into a sinking fund that will earn 4%. What will be the total annual cost of the bonds until they mature? A. P44,667.98 B. P37,345.78 C. P34,515.05 D. P33,915.05 56. A company produces transmission gears used by several farm tractor manufacturers. The base cost of operation is P596,700 per year. The cost of manufacturing is P18.40 per gear. If the company sells the gears at an average price of P37.90 each, how many gears must be sold each year to break even? A. 15,740 B. 18,400 C. 30,60. D. 32,430 57. You purchase 1,000 shares of stock at P15.00 per share. The stock pays quarterly dividends of P125 for two years at which time you sell the stock at the trading price of P16.50 per share. The yearly return on your investment is most nearly A. 2% B. 4% C. 6% D. 8% 58. A company purchases a piece of construction equipment for rental purposes. The expected income is P3,100 annually for its useful life of 15 years. Expenses are estimated to be P355 annually. If the purchase price is P25,000 and there is no salvage value, what is the internal rate or return, neglecting taxes? A. 5.2% B. 6.4% C. 6.8% D. 7.0% 59. Grinding mills M and N are being considered for a 12-year service in a chemical plant. The minimum attractive rate of return is 10%. What are the equivalent uniform annual costs of both mills, and which is the more economic choice? A. P3,840, P3,620, mill N B. P3,850, P3,730, mill N C. P4,330, P3,960, mill N D. P3,960, P5,000, mill M 60. A manufacturing company is considering two types of industrial projects which require the same level of initial investment, but provide different levels of operating cash flows. The following data related to the project have been recorded. At a MARR of 12%, which project will be selected? A. Project A B. Project B C. either one D. neither 61. A method of depreciation whereby the amount to recover is spread over the estimated life of the asset in terms of periods or units of output is called A. SYD method B. declining balance method C. straight line method D. sinking fund method 62. The ration of the interest payment to the principal for a given unit of time and is usually expressed as a percentage of the principal is known as A. Investment B. Nominal Interest C. Interest D. Interest Rate 63. The interest rate at which the present worth of cash flow on a project is zero, or the interest earned by the investment. A. rate of return B. effective rate C. nominal rate D. yield 64. As applied to capitalized asset, the distribution of the initial cost by periodic changes to operation as in depreciation or the reduction of the debt by either periodic or irregular prearranged program is called A. amortization B. annuity C. depreciation D. capital recovery 65. These are product or services that are desired by humans and will be purchased if money is available after the required necessities have been obtained. A. utilities B. necessities C. luxuries D. producer goods and services 66. This occurs in a situation where a commodity or service is supplied by a number of vendors and there is nothing to prevent additional vendors entering the market. A. perfect competition B. monopoly C. oligopoly D. elastic demands 67. 79 It is the amount that a willing buyer will pay to a willing seller for a property where each has equal advantage and is under no compulsion to buy or sell. A. fair value B. use value C. market value D. book value 2022 68. The amount received from the sale of an additional unit of product is termed as A. marginal cost B. marginal utility C. marginal unit D. marginal revenue 69. A mine is purchased for P1M and it is anticipated that it will be exhausted at the end of 20 years. If the sinking fund rate is 4%, what must be the annual return from the mine to realize a return of 7% on the investment? A. P108,350 B. P150,832 C. P130,850 D. P103,582 70. Instead of paying P10,000 in annual rent for office space at the beginning of each year for the next 10 years, an engineering firm has decided to take out a 10-year, P100,000 loan for a new building at 6% interest. The firm will invest P10,000 of the rent saved and earn 18% annual simple interest on that amount. What will be the difference between the firm’s annual revenue and expenses? A. The firm will need P3,300 extra. B. The firm will need P1,800 extra. C. The firm will break even. D. The firm will have P1,600 left over. 71. A machine has an initial cost of P40,000 and an annual maintenance cost of P5,000. Its useful life is 10 years. The annual benefit from purchasing the machine is P18,000. The effective annual interest rate is P10%. What is the machine’s benefit-cost ratio? A. 1.51 B. 1.56 C. 1.73 D. 2.24 72. 73.