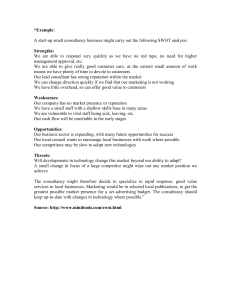

An lntroduction to

MANAGEMENT

CONSU LTANCY

Marc G. Baaij

Osncr

Los Angeles I London I New Delhi

Singapore I Washington DC

the mana$ement consultant as a doctor; and the consultant as a facilitator

(providing a process for problem solving).

The criticol perspective

The critical perspective acknowledges that management consultants solve

problems. In addition, this view distinguishes various informal roles. Clients

may hire mana$ement consultants to provide temporary capacity (hired

hand), to legitimize clients'solutions which other stakeholders oppose (legiti

mator), to support clients in political fights (political weapon), and to take the

blame for clients' solutions that are not in the interests of some other stakeholders (scapegoat). These reasons differ in terms of the effect of management

consultancy. Management consultancy is defined as providin{ independent

advice (see Chapter 1); however, the consultant depends on the client for

their payment. Therefore, the consultant may be vulnerable to opportunistic

clients who hire a consultant as a le$itimator, political weapon, or scape$oat.

In each of these situations, we can no lon$er qualify the consultant's advice

as

independent.

'

manufacturer, Ten years ago the com-

The efbct of qdvice

The following case study illustrates how

management consultants may have a positive effect on their clients' performance.

between components and final products.

This is a stylized case based on a synthesis of disguised real world situations.

When the final product manufacturer,

Target Corporation, one of its main cus-

The case also illustrates the importance of

independent advice.

tomers, came up for sale, Blivet acquired

it. The integrated company, however, did

ln seorch of synergies

Blivet Corporation is a vertically integrated

company. The company has positions in

the manufacturing of components and

final products (based on these components). Blivet was originally a component

84

pany decided to enter into manufacturing of final products. The management

of Blivet regarded manufacturing as an

attractive industry. Moreover, that management saw substantial synergies

not perform as was expected. On the

contrary, its revenues diminished and

its profitability declined even more. The

stock market responded negatively: the

company's stock halved. At that time,

five years ago, the management of Blivet

decided to hire one of the world's top

management consultancy firms, Brain

AN INTRODUCTION TO MANAGEMENT CONSULTANCY

& Company,

to help Blivet improve

its

shareholder value.

The odvice

Based

on three months of

rigorous

research, Brain & Company came to the

conclusion that Blivet should exit the component business and focus its resources

on the final product manufacturing. This

advice came as a shockto Blivet's management as the company had been founded

as a component producer. Moreover, the

component business represented B0 per

cent of Blivet's revenues. Divesting the

component business implied shrinking

the company to a fifth of its original size.

However, when Blivet publicly. announced

its retreat from component manufacturing,

its stock price soared. After the divestiture

of the component division, the remaining final product division was renamed

was one of their competitors. Moreover,

Target could no longer buy components

from competitors of Blivet, but was forced

to source all its components from its new

owner. However, Blivet was not the most

competitive provider. Brain & Company

showed that final product manufacturing

was an attractive industry, Economies of

scale were decisive in final product manufacturing. Blivet's scale was too small and

the company lacked the capital to invest in

its scale. By selling the unattractive component activities and reinvesting the receipts of

the sale in the final product manufacturing

business, Focus Corporation could reach

a competitive scale. Moreover, by breaking

up the relationship with components, Focus

could purchase components from the best

sources available, Finally, by pruning the

company's portfolio to final products only,

management could focus their attention on

a single core business. The rise of Focus

Focus Corporation. ln the following five

years, Focus has tripled the revenues of

its final product business while increasing

its already high profitability. Although the

company is currently about 60 per cent of

its original size, its stock market value has

increased fivefold since the announcement

of its withdrawal from components.

Corporation's stock price reflected investors' expectations about the new strategy

1

What was/were the main reason(s) why

Blivet hired an external management

consultancy? Elaborate on your answer.

Ihe logic

2

Should Brain & Company have based

its consultancy fee on the performance

effect that its advice generated? Why,

or why not? Explain your answer.

3

lf you were the chief executive officer

of Blivet, would you have accepted a

performance-based consultancy fee for

Brain & Company? What are the pros

and cons of performance-based fees

for clients? Explain your answer,

developed by Brain & Company,

Discussion queslions

The consultancy project by Brain &

Company revealed that the component

industry was no longer attractive for Blivet.

Moreover, the expected positive synergies

and final products

did not exist. ln contrast, the synergies

proved to be negative. Other customers

between components

from Blivet's

their orders

component business withdrew

when it took over Target, which

REASONS, RISKS, AND RESULTS OF MANAGEMENT CONSULTANCY

8s