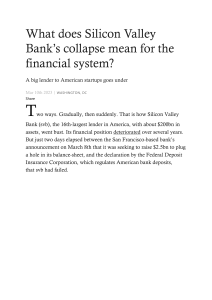

Case Study: The Collapse of Silicon Valley Bank and Risk Management Failures Introduction Silicon Valley Bank (SVB) was a $200 billion institution and the go-to bank for tech boom startups. However, on March 10, 2023, SVB collapsed after a run on deposits doomed its plans to raise fresh capital. Factors Leading to the Collapse There were several factors that led to the collapse of SVB, including: • • Concentration risk: SVB was heavily concentrated in the tech sector, which made it vulnerable to changes in the tech industry. In 2023, the tech sector experienced a significant downturn, which led to a decline in SVB's business. Liquidity risk: SVB had a high proportion of short-term liabilities and a low proportion of liquid assets, which made it vulnerable to a run on deposits. In March 2023, SVB experienced a run on deposits after rumors of its financial difficulties spread. SVB was unable to meet the withdrawal requests of its depositors, and the bank collapsed. • Risk management failures: SVB's risk management process failed to identify, assess, and mitigate the risks it faced. For example, SVB failed to adequately identify the risk of a run on deposits, and the bank did not have adequate liquidity reserves to meet the withdrawal requests of its depositors. Risk Management Failures: SVB's risk management process failed in several ways, including: • • • • Risk identification: SVB failed to identify the full range of risks it faced, particularly the risk of a run on deposits. Risk assessment: SVB underestimated the severity of the risks it faced, particularly the risk of a run on deposits. Risk mitigation: SVB failed to implement adequate risk mitigation measures, such as diversifying its portfolio and increasing its liquidity reserves. Risk review and reporting: SVB's risk management process failed to adequately review and report on the risks it faced. Lessons for Islamic Banks The collapse of SVB provides a number of lessons for Islamic banks, including: • • The importance of a robust risk management process: Islamic banks should have a robust risk management process in place to identify, assess, mitigate, and review the risks they face. This process should be tailored to the specific risks faced by Islamic banks, such as concentration risk and liquidity risk. The need to diversify their portfolios: Islamic banks should diversify their portfolios to reduce their concentration risk. This means investing in a variety of different sectors and asset classes. • The importance of maintaining adequate liquidity reserves: Islamic banks should maintain adequate liquidity reserves to meet the withdrawal requests of their depositors. This is important because Islamic banks are typically more reliant on deposits than conventional banks. In addition to these general lessons, Islamic banks can also learn from the specific risk management failures of SVB. For example, Islamic banks should ensure that their risk management processes adequately identify and assess the risk of a run on deposits. Islamic banks should also ensure that they have adequate liquidity reserves in place to meet the withdrawal requests of their depositors, even in the event of a run on deposits. Recommendations for Islamic Banks Based on the lessons from the collapse of SVB, the following recommendations are made for Islamic banks: • • • Review and strengthen their risk management processes: Islamic banks should review and strengthen their risk management processes to ensure that they are adequately identifying, assessing, mitigating, and reviewing the risks they face. This review should be conducted by an independent expert. Diversify their portfolios: Islamic banks should diversify their portfolios to reduce their concentration risk. This means investing in a variety of different sectors and asset classes. Maintain adequate liquidity reserves: Islamic banks should maintain adequate liquidity reserves to meet the withdrawal requests of their depositors. This is • • important because Islamic banks are typically more reliant on deposits than conventional banks. Stress test their risk management processes: Islamic banks should regularly stress test their risk management processes to assess their ability to withstand adverse shocks. Improve their risk reporting: Islamic banks should improve their risk reporting to ensure that the board of directors and senior management have a clear understanding of the risks the bank faces. By following these recommendations, Islamic banks can reduce their risk of failure and protect their depositors. Reflective Questions for Students • What are your thoughts on the collapse of SVB? • What do you think are the main lessons that can be learned from the collapse of SVB? • How can Islamic banks strengthen their risk management processes in light of the collapse of SVB? Conclusion The collapse of SVB is a cautionary tale for all banks, including Islamic banks. It is important for banks to have a robust risk management process in place to identify, assess, mitigate, and review the risks they face. Islamic banks should also be aware of the unique risk management challenges they face, such as concentration risk and liquidity risk. The collapse of SVB is a complex event with many lessons to be learned. It is important to reflect on the factors that led to the collapse of SVB and to identify steps that can be taken to prevent future bank failures. Islamic banks play an important role in the global financial system, and it is essential that they have robust risk management processes in place By following the recommendations outlined in this case study, Islamic banks can reduce their risk of failure and protect their depositors. Additional Reflective Questions • What are the ethical implications of the collapse of SVB? • How did the collapse of SVB impact the broader financial system? • What role did regulators play in the collapse of SVB? • What changes can be made to prevent future bank failures?.