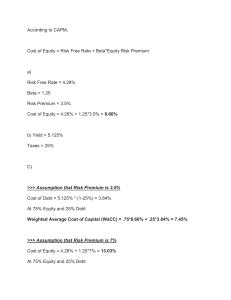

COST OF CAPITAL Prof. Dr. Mehmet Şükrü Tekbaş COST OF CAPITAL From a company’s point of view "the cost of using funds of owners and creditors". From an investor's point of view "the shareholder's required return on a portfolio company's existing securities”. COST OF CAPITAL Similar terms: • Minimum required rate of return: • Hurdle rate • Cut-off rate • Opportunity cost COST OF CAPITAL • Explicit cost: directly borne cost, cost at the time of source • Implicit cost: opportunity cost, cost at the time of use COST OF CAPITAL The cost of capital for firm A is 10%, which is explicit cost. A is looking for projects having IRR above 10%. There are several projects. Project IRR X 14% Y 12% Z 9% Projects X and Y are acceptable. However a new project with an IRR above 12% will replace Y. In this case 12% is implicit rate. COST OF CAPITAL Where do we use cost of capital: • Valuation of a company or equity (share), • Evaluation of investment projects (Capital budgeting) • Working capital decisions (sales and credit policy…) WEIGHTED AVERAGE COST OF CAPITAL (WACC) ki = wd kd + we ke • w = Weights • k = Cost of each source of capital WEIGHTS Book Value or Market Value can be used as weights • Weights by book value: Balance sheet of Company A Assets 100 Debt 40 Paid in capital 25 Retained earnings 35 Total assets 100 Total liabilities 100 Weights by using book value: wd = 40/100 = 40% we = (25 + 35)/ 100 = 60% WEIGHTS • Weights by market value: Market of price of debt (bond) = 105 Price of stock = 2,50 Weights by using market value: Market value of debt = 40 * 105/100 = 42 Market value of equity = 25 * 2,50 = 62,50 (Retained earnings are counted within the share price) Total value of debt and equity = 42 + 62,50 = 104,50 wd = 42/ 104,50 = 40,20% we = 62,50 / 104,50 = 59,80% COST OF EACH SOURCE: DEBT • Cost of debt: it is an after tax cost: kd = i (1 – t) where: i = interest rate t = corporate tax rate COST OF PREFERRED STOCK Preferred stocks are in between stocks and bonds. Technically, they are equity securities, but they share many characteristics with debt instruments. Cost of preferred stock (kps) can be calculated as follows: kps = Dps / Pps COST OF EQUITY Cost of equity can be found by: • • CAPM Dividend Discount Model CAPM Required rate of return by CAPM (Security Market Line, SML) . ri = rf + ( r m – rf ) bi Where: rf = rm = bi = risk free rate return on market portfolio sensitivity to changes in market return, a measure of systematic risk ( rm – rf ) = equity premium or market risk premium ( rm – rf ) bi = risk premium for the asset, or company CAPM ri = rf + ( rm – rf ) b i Risk free rate, rf should be consistent with the length of the project. For valuation purposes usually the return on the government bond with 10 years maturity, For market return, rm the return of broad market or benchmarket index is used. bi , a measure of asset’s sensivity to market return. CAPM • Example: rf = 6% rm = 9% b = 1,25 ri =6% + (9% - 5%) * 1,25 = 11% BETA (b) b is computed by the linear regression between company return and market return. It is the slope of this regression line which is called Security Characteristic Line. ri = a + bi Rm + ei b also be found by the formula: bi = Covi,m / sm2 or bi = ri,m si sm / sm2 Characteristic Line and Beta y = 0,3585x + 0,0082 R² = 0,0188 Characteristic Line 0,08 0,06 0,04 Ri 0,02 -0,02 -0,01 0,00 0,00 0,01 0,02 -0,02 -0,04 -0,06 Rm 0,03 0,04 BETA (b) The companies which are not publicly traded do not have betas; for them industry betas can be used with some adjustment according to leverage, D/E. Firms in the same industry face similar business risks and should have similar asset betas. When the information on betas from a peer group is used, the business risk, which is common to all firms in the industry, can be separated from the financial risk that will be specific to each firm given its financial leverage. This can be done by converting the equity betas (levered betas) into asset betas (unlevered betas) through the so called Hamada equation. BETA Beta which is found by Characteristic Line or by the formula bi = Covi,m / sm2 is called equity beta or levered beta, bL There is also an asset beta or unlevered beta, bU. LEVERING AND UNLEVERING BETAS To find asset beta or unlevered beta the formula (Hamada equation): bU = bL ( 1 / ( 1 + (1 – t ) D / E ) To convert the asset beta into equity beta: bL = bU / ( 1 + (1 – t ) D / E ) t = corp. income tax rate D = debt E = equity LEVERING AND UNLEVERING BETAS: EXAMPLE We want to find the cost of capital of a non listed company. Since the company is not trading on the stock exchange it does not have a share price and therefore not a beta. Here we can use industry beta to find beta for Company A. With following information for the industry and company A: Industry Company A Debt 40 % 50 % Equity 60 % 50 % Equity beta 1,5 ? Tax rate = 30 % Asset beta = bU = 1,50 /( 1 + ( 1-30%) (40/60)) = 1,02 Equity beta = bL = 1,02 ( 1 + (1-30%) (50/50)) = 1,73 We can find equity beta for company A as 1,73, and we can use it finding the cost of equity and WACC. BETA Factors Affecting Beta: • Leverage • Liquidity • Asset growth rate • Size • Dividend payout ratio • Volatility in earnings • Accounting Beta BETA Beta of a company is not stable over time. It changes because of: - Change in product line, - Change in technology, - Deregulation, - Change in financial leverage DIVIDEND DISCOUNT MODEL ki = (D1 / P0) + g where: D1 = dividend for the coming year P0 = current share price g = growth rate in EPS, or dividend Assumptions: Stable growth rate P0 = D1 / (k-g) WAAC AND OPTIMAL CAPITAL STRUCTURE The cost of debt is cheaper than cost of equity. Debt is less risky than equity, as the payment of interest is often a fixed amount and compulsory in nature, and it is paid in priority to the payment of dividends. Also in the event of a liquidation, debt holders would receive their capital repayment before shareholders as they are higher in the creditor hierarchy as shareholders are paid out last. As debt is less risky than equity, the required return needed to compensate the debt investors is less than the required return needed to compensate the equity investors. WAAC AND OPTIMAL CAPITAL STRUCTURE There are two counterbalancing forces in capital structure. Initially, using debt can lower the firm’s cost of capital by taking advantage of the lower-cost characteristics of debt financing (relative to equity). However, too much debt, on the other side increases the risk of the firm and causes the cost of equity and the cost of debt to rise. Therefore, the optimal mix of debt and equity is the level at which the cost of capital is minimized. At this level the value of the firm will be maximized. This level varies from industry to industry. OPTIMAL CAPITAL STRUCTURE Optimal capital structure is the best mix of debt and equity financing that maximizes a company’s market value while minimizing its weighted average cost of capital. OPTIMAL CAPITAL STRUCTURE MARGINAL COST OF CAPITAL Marginal cost of capital is the weighted average cost of the last dollar of new capital raised by a company. Companies can raise new capital from: • retained earnings, • issuing new stock, • issuing new debt Retained earnings are the only source of financing to maintain the target capital structure without issuing new stock. Therefore, the marginal cost of capital remains the same if new capital is raised through retained earnings. Raising new funds by issuing new stocks will be more costly. MARGINAL COST OF CAPITAL Firm A has 1000 TL assets, they are financed by debt=400 TL, and equity=600 TL. Paid in capital is 300 TL and retained earnings are 300 TL. The share price of A is 2 TL, market return is expected as 10%, risk free rate is 6% and Beta of firm A is 1,25. Tax rate is 30%. The interest rate for debt is 9%. The expected market return is 10%. Firm A is expecting a level of 150 TL as retained earnings for next year’s investment. - What is level of optimal level of investments (optimal investment budget) for next year without issuing new stock? - What is the marginal cost of capital for an investment budget 400 TL? MARGINAL COST OF CAPITAL The WACC for firm A: kd = 9% * (1-30%) = 6,30 % ke = 6% + (10% - 6%) * 1,25 = 11 % WACC = k = 6,3% * 0,4 + 9% * 0,6 = 9,12% The optimal investment budget without issuing new stock is 250 TL (with wd = 40% and we= 60%). With an investment budget above 250 TL new share issue is required. The cost of new share issue will push MCC above 9,12% MARGINAL COST OF CAPITAL For a level of investment budget at 400 TL, the source of funds and MCC will be: - 40% of 400 TL will come from new borrowing, 160 TL. - 60% of 400 TL will come from equity, 240 TL. 150 TL of equity portion will come from retained earnings and for 90 TL new shares will be issued. FLOTATION COST Flotation costs are the costs incurried by a company when issuing new securities. The costs can be various expenses including, underwriting, legal, registration, audit, etc. fees. Flotation expenses are expressed as a percentage of the issue price. Flotation costs increase the cost of capital. FLOTATION COST Because of floatation costs, the firm will have to raise more than the amount it needs. Flotation cost adjusted initial outlay = 𝐹𝑖𝑛𝑎𝑛𝑐𝑖𝑛𝑔 𝑛𝑒𝑒𝑑𝑒𝑒𝑑 (1−𝐹𝑙𝑜𝑡𝑎𝑡𝑖𝑜𝑛 𝑐𝑜𝑠𝑡 𝑖𝑛 %) = P/(1-f) WACC and FLOTATION COST Example If a firm needs $100 million to finance its new project and the floatation cost is expected to be 5%, how much should the firm raise by selling securities? Flotation cost adjusted initial outlay = $100 million ÷ (1-0,05) = $105,26 million MARGINAL COST OF CAPITAL WACC and PROJECT RISK Suppose a Company has a cost of capital, based on the CAPM, of 13,4%. The risk-free rate is 5%; the market return is 12%, and the firm’s beta is 1,2 Required rate of return for the company = 5% + [12% – 5%] * 1,2 = 13,4% The breakdown of the company’s investment projects: 1/3 Automotive retailer, b = 1.7 1/3 Computer Mfr. , b = 1.3 1/3 Energy, b = 0.6 average b of assets = 1.2 When evaluating a new investment in automobile division, which cost of capital should be used? WACC and PROJECT RISK The required rate of return for the projects related to three divisions will be different. Automobile retailer: 5% + (12% - 5%) * 1,7 = 16,9 % Computer: 5% + (12% - 5%) * 1,3 = 14,1 % Energy: 5% + (12% - 5%) * 0,6 = 9,2 % WACC and PROJECT RISK