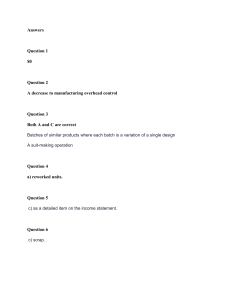

ReSA -The Review School of Accountancy Advanced Financial Accounting and Reporting MAY 2022 Batch AFAR Quiz 3 COVERAGE - Week 13 to Week 16 Lecture AFAR-13: Joint Arrangements AFAR-14: Jointly Controlled Entity, Joint Venture - SMEs AFAR-15: Job Order Costing AFAR-16: Process Costing AFAR-17: Joint & By-Product Costing AFAR-18: Backflush Costing, ABC & Service Cost Allocation 1. job-order costing and process costing have which of the following characteristics? a. b. c. d. job-order Costing homogeneous products and large quantities homogeneous products and small quantities heterogeneous products and large quantities heterogeneous products and small quantities Process Costing heterogeneous products and small quantities heterogeneous products and large quantities homogeneous products and small quantities homogeneous products and large quantities 2. If a company obtains two salable products from the refining of one ore, the refining process should be accounted for as a(n) a. mixed cost process. b. joint process. c. extractive process. d. reduction process. 3. Which of the following is/are synonyms for joint products? Main products Co-products a. no no b. yes yes c. yes no d. no yes 4. By-products are a. allocated a portion of joint production cost. b. not sufficient alone, in terms of sales value, for management to justify undertaking the joint process. c. also known as scrap. d. the primary reason management undertook the production process. 5. Which of the following has sales value? By-products Waste a. no no b. yes no c. yes yes d. no yes 6. Reducing setup time is a major aspect of a. all push inventory systems. b. the determination of safety stock quantities. c. a JIT system. d. an EOQ system. Page 1 of 13 pages ReSA - The Review School of Accountancy Coverage: AFAR – 13 to 18 (ReSA Batch 43 – May 2022 Batch) AFAR Quiz 3 7. Just-in-time (JIT) inventory systems a. result in a greater number of suppliers for each production process. b. focus on a "push" type of production system. c. can only be used with automated production processes. d. result in inventories being either greatly reduced or eliminated. 8. In a standard cost system, Work in Process Inventory is ordinarily debited with a. actual costs of material and labor and a predetermined overhead cost for overhead. b. standard costs based on the level of input activity (such as direct labor hours worked). c. standard costs based on production output. d. actual costs of material, labor, and overhead. 9. A standard cost system may be used in a. job order costing, but not process costing. b. process costing, but not job order costing. c. either job order costing or process costing. d. neither job order costing nor process costing. 10. The overhead allocation method that allocates service department costs without consideration of services rendered to other service departments is the a. step method. b. direct method. c. reciprocal method. d. none of the above. 11. Which service department cost allocation method utilizes a "benefits-provided" ranking? a. algebraic method b. indirect method c. step method d. direct method 12. Which service department cost allocation method assigns indirect costs to cost objects after considering interrelationships of the cost objects? Algebraic method Step method a. no no b. no yes c. yes yes d. yes no 13. Hartwell Company distributes its service department overhead costs directly to producing departments without allocation to the other service departments. Information for January is presented here. Maintenance Utilities Overhead costs incurred P18,700 P9,000 Service provided to: Maintenance Dept. 10% Utilities Dept. 20% Producing Dept. A 40% 30% Producing Dept. B 40% 60% The amount of Utilities Department costs distributed to Dept. B for January should be (rounded to the nearest peso) a. P3,600 b. P4,500. c. P5,400. d. P6,000. 14. Hartwell Company distributes distributes the service department's overhead costs based on the step method. Maintenance provides more service than does Utilities. Which of the following is true? Page 2 of 13 pages AFAR Quiz 3 ReSA - The Review School of Accountancy Coverage: AFAR – 13 to 18 (ReSA Batch 43 – May 2022 Batch) Overhead costs incurred Service provided to: Maintenance Dept. Utilities Dept. Producing Dept. A Producing Dept. B a. b. c. d. Maintenance P18,700 20% 40% 40% Utilities P9,000 10% 30% 60% Allocate maintenance expense to Departments A and B. Allocate maintenance expense to Departments A and B and the Utilities Department. Allocate utilities expense to the Maintenance Department and Departments A and B. None of the above. Bobcat Company. uses a job-order costing system. During April, the following costs appeared in the Work in Process Inventory account: Beginning balance P 24,000 Direct material used 70,000 Direct labor incurred 60,000 Applied overhead 48,000 Cost of goods manufactured 185,000 15. Bobcat Company applies overhead on the basis of direct labor cost. There was only one job left in Work in Process at the end of April which contained P5,600 of overhead. What amount of direct material was included in this job? a. P4,400 b. P4,480 c. P6,920 d. P8,000 16. West Company is a print shop that produces jobs to customer specifications. During January, Job #3051 was worked on and the following information is available: Direct material used P2,500 Direct labor hours worked 15 Machine time used 6 Direct labor rate per hour P 7 Overhead application rate per hour of machine time P18 What was the total cost of Job #3051 for January? a. P2,713 b. P2,770 c. P2,812 d. P3,052 Items 17 and 18 are based on the following information: Gamma Co. uses a job-order costing system. At the beginning of January, the company had two jobs in process with the following costs: Job #456 Job #461 Direct Material P 3,400 1,100 Direct Labor P 510 289 Overhead P 255 ? Gamma pays its workers P8.50 per hour and applies overhead on a direct labor hour basis. 17. Refer to Gamma Company. How much overhead was included in the cost of Job #461 at the beginning of January? a. P 144.50 b. P 153.00 c. P2,200.00 d. P2,456.50 Page 3 of 13 pages AFAR Quiz 3 ReSA - The Review School of Accountancy Coverage: AFAR – 13 to 18 (ReSA Batch 43 – May 2022 Batch) 18. Refer to Gamma Company. During January, Gamma’s employees worked on Job #649. At the end of the month, P714 of overhead had been applied to this job. Total Work in Process at the end of the month was P6,800 and all other jobs had a total cost of P3,981. What amount of direct material is included in Job #649? a. P 677.00 b. P1,391.00 c. P2,142.00 d. P4,658.00 Items 19 to 21 are based on the following information: Williams Company uses a job-order costing system and the following information is available from its records. The company has three jobs in process: #6, #9, and #13. Raw material used Direct labor per hour Overhead applied based on direct labor cost P120,000 P 8.50 120% Direct material was requisitioned as follows for each job respectively: 30 percent, 25 percent, and 25 percent; the balance of the requisitions was considered indirect. Direct labor hours per job are 2,500; 3,100; and 4,200; respectively. Indirect labor is P33,000. Other actual overhead costs totaled P36,000. 19. Refer to Williams Company. What is the prime cost of Job #6? a. P42,250 b. P57,250 c. P73,250 d. P82,750 20 Refer to Williams Company. If Job #13 is completed and transferred, what is the balance in Work in Process Inventory at the end of the period if overhead is applied at the end of the period? a. P 96,700 b. P 99,020 c. P139,540 d. P170,720 21. Refer to Williams Company. Assume the balance in Work in Process Inventory was P18,500 on June 1 and P25,297 on June 30. The balance on June 30 represents one job that contains direct material of P11,250. How many direct labor hours have been worked on this job (rounded to the nearest hour)? a. 751 b. 1,324 c. 1,653 d. 2,976 22 . The following information pertains to Sigma Company for September: Job #323 Job #325 Job #401 Direct Material P 3,200 ? 5,670 Direct Labor P 4,500 5,000 ? Overhead ? ? P5,550 Sigma Company applies overhead for Job #323 at 140 percent of direct labor cost and at 150 percent of direct labor cost for Jobs #325 and #401. The total cost of Jobs #323 and #325 is identical. Refer to Sigma Co. Assume that Jobs #323 and #401 are incomplete at the end of September. What is the balance in Work in Process Inventory at that time? a. P18,920 b. P22,620 c. P28,920 d. P30,120 Page 4 of 13 pages AFAR Quiz 3 ReSA - The Review School of Accountancy Coverage: AFAR – 13 to 18 (ReSA Batch 43 – May 2022 Batch) Items 23 and 24 are based on the following information: Trenton Company has two departments (Processing and Packaging) and uses a job-order costing system. Baker applies overhead in Processing based on machine hours and on direct labor cost in Packaging. The following information is available for July: Machine hours Direct labor cost Applied overhead Processing 2,500 P44,500 P55,000 Packaging 1,000 P23,000 P51,750 23. Refer to Trenton Company. What is the overhead application rate per machine hour for Processing? a. P 0.81 b. P 1.24 c. P17.80 d. P22.00 24. Refer to Trenton Co. What is the overhead application rate for Packaging? a. P 0.44 b. P 2.25 c. P23.00 d. P51.75 Items 25 and 26 are based on the following information: Treacy Company uses a job-order costing system. Assume that Job #504 is the only one in process. The following information is available: Budgeted direct labor hours 65,000 Budgeted machine hours 9,000 Budgeted overhead P350,000 Direct material P110,500 Direct labor cost P 70,000 25. Refer to Treacy Company. What is the overhead application rate if Treacy uses a predetermined overhead application rate based on direct labor hours (rounded to the nearest whole peso)? a. P 0.20 b. P 5.00 c. P 5.38 d. P38.89 26. Refer to Treacy Company. What is the total cost of Job #504 assuming that overhead is applied at the rate of 135% of direct labor cost (rounded to the nearest whole peso)? a. P192,650 b. P268,250 c. P275,000 d. P329,675 27. At the end of the last fiscal year, Hilton Company had the following account balances: Overapplied overhead P 6,000 Cost of Goods Sold P980,000 Work in Process Inventory P 38,000 Finished Goods Inventory P 82,000 If the most common treatment of assigning overapplied overhead were used, the final balance in Cost of Goods Sold is: a. P974,000. b. P974,660. c. P985,340. d. P986,000. Page 5 of 13 pages AFAR Quiz 3 ReSA - The Review School of Accountancy Coverage: AFAR – 13 to 18 (ReSA Batch 43 – May 2022 Batch) 28. Rigby Products has no Work in Process or Finished Goods inventories at the close of business on December 31, 20x9. The balances of Strong Products’ accounts as of December 31, 20X9, are as follows: Cost of goods sold--unadjusted P2,040,000 Selling & administrative expenses 900,000 Sales 3,600,000 Manufacturing overhead control 700,000 Manufacturing overhead applied 648,000 Pretax income for 20X9 is: a. P608,000. b. P660,000. c. P712,000. d. undeterminable from the information given. Items 29 and 30 are based on the following information: For Job Order No. 369, Escalera Company incurred the following costs for the manufacture of 200 units of a novelty gadget: Original cost accumulation: Direct materials………………………………………………………………………… P 13,200 Direct labor……………………………………………………………………………… 16,000 Factory overhead (150% of direct labor)………………………………………………… 24,000 Total……………………………………………………………………………………… P 53,200 Direct costs of ten reworked units: Direct materials………………………………………………………………………… P 2,000 Direct labor……………………………………………………………………………… 3,200 Total………………………………………………………………………………………P 5,200 29. The rework cost was attributable to exacting specifications required by the job and was charged to the specific order. The units cost of Job Order No. 369 is: a. P266 c. P292 b. P280 d. P316 30. The rework costs were attributable to internal failure (to all production) or charged to factory overhead, what is the cost per finished unit of Job 1992? a. P266 c. P292 b. P280 d. P316 Items 31 and 32 are based on the following information: Kuchen Manufacturing uses backflush costing to account for an electronic meter it makes. During August 20X8, the firm produced 16,000 meters of which it sold 15,800. The standard cost for each meter is: Direct material P 20 Conversion costs 44 Total P 64 Assume that the company had no inventory on August 1. The following event took place in August: 1. Purchased P320,000 of direct materials. 2. Incurred P708,000 of conversion costs. 3. Applied P704,000 of conversion costs to Raw and In Process Inventory. 4. Finished 16,000 meters. 5. Sold 15,800 meters for P100 each. 31. Compute the Finished Goods, ending a. P0 b. P12,800 c. P1,011,200 d. P1,015,200 32. Amount of Cost of Goods Sold after the adjustment of over-under applied conversion cost: a. P1,011,200 c. P1,024,000 b. P1,015,200 d. P1,028,000 Page 6 of 13 pages AFAR Quiz 3 ReSA - The Review School of Accountancy Coverage: AFAR – 13 to 18 (ReSA Batch 43 – May 2022 Batch) 33. Duke Company transferred 5,500 units to Finished Goods Inventory during September. On September 1, the company had 300 units on hand (40 percent complete as to both material and conversion costs). On September 30, the company had 800 units (10 percent complete as to material and 20 percent complete as to conversion costs). The number of units started and completed during September was: a. 5,200. b. 5,380. c. 5,500. d. 6,300. 34. Carter Company uses a weighted average process costing system. Material is added at the start of production. Dixie Company started 13,000 units into production and had 4,500 units in process at the start of the period that were 60 percent complete as to conversion costs. If Dixie transferred out 11,750 units, how many units were in ending Work in Process Inventory? a. 1,250 b. 3,000 c. 3,500 d. 5,750 Items 35 and 36: Perry Company Perry Company. has the following information for November: Beginning Work in Process Inventory (70% complete as to conversion) Started Ending Work in Process Inventory (10% complete as to conversion) Beginning WIP Inventory Costs: Material Conversion Current Period Costs: Material Conversion 6,000 units 24,000 units 8,500 units P23,400 50,607 P31,500 76,956 All material is added at the start of the process and all finished products are transferred out. 35. Refer to Perry Company. Assume that weighted average process costing is used. What is the cost per equivalent unit for material? a. P0.55 b. P1.05 c. P1.31 d. P1.83 36. Refer to Perry Company. Assume that FIFO process costing is used. What is the cost per equivalent unit for conversion? a. P3.44 b. P4.24 c. P5.71 d. P7.03 Items 37 and 38: Harris Company has the following information for July: Units started Beginning Work in Process: (35% complete) Normal spoilage (discrete) Abnormal spoilage Ending Work in Process: (70% complete) Transferred out Beginning Work in Process Costs: Material Conversion Page 7 of 13 pages 100,000 20,000 3,500 5,000 14,500 97,000 P15,000 10,000 units units units units units units ReSA - The Review School of Accountancy Coverage: AFAR – 13 to 18 (ReSA Batch 43 – May 2022 Batch) AFAR Quiz 3 All materials are added at the start of the production process. Harris Company inspects goods at 75 percent completion as to conversion. 37. Refer to Harris Company. What are equivalent units of production for material, assuming FIFO? a. 100,000 b. 96,500 c. 95,000 d. 120,000 38. Refer to Harris Company. Assume that the costs per EUP for material and conversion are P1.00 and P1.50, respectively. Using FIFO, what is the total cost assigned to the transferred-out units (rounded to the nearest peso)? a. P245,750 b. P244,438 c. P237,000 d. P224,938 39. Previtz Company produces two products from a joint process: X and Z. Joint processing costs for this production cycle are P8,000. Disposal Sales price cost per Further Final sale per yard at yard at processing price per Yards split-off split-off per yard yard X 1,500 P6.00 P3.50 P1.00 P 7.50 Z 2,200 9.00 5.00 3.00 11.25 If X and Z are processed further, no disposal costs will be incurred or such costs will be borne by the buyer. Using approximated net realizable value at split-off, what amount of joint processing cost is allocated to X (round to the nearest peso)? a. b. c. d. P3,090 P5,204 P4,000 P2,390 Furhmann Company manufactures products X and Y from a joint process that also yields a by-product, Z. Revenue from sales of Z is treated as a reduction of joint costs. Additional information is as follows: Products X Y Z Total Units produced 20,000 20,000 10,000 50,000 Joint costs ? ? ? P262,000 Sales value at split-off P300,000 P150,000 P10,000 P460,000 Joint costs were allocated using the sales value at split-off approach. 40. The joint costs allocated to product X were a. P 84,000 b. P100,800. c. P150,000. d. P168,000. Good luck and GOD BLESS!!! There are only two things in the world to worry over; the things you can control, and the things you can’t control. Fix the first, forget the second. The invariable mark of wisdom is to see the miraculous in the common. No one knows what he can do until he tries There’s no traffic jam on the extra mile. Worry is like a rocking chair – it will give you something to do, but it won’t get you anywhere. If you haven’t all things you want, be grateful for the things you don’t have that you didn’t want. Page 8 of 13 pages AFAR Quiz 3 ReSA - The Review School of Accountancy Coverage: AFAR – 13 to 18 (ReSA Batch 43 – May 2022 Batch) Suggested Answers and Solutions 1. D 2. B 3. B 4. B 5. B 6. C 7. D 8. C 9. C 10. B 11. C 12. C DIF: 1 13. D (P9,000 x 6/9) 14. B 15. A Total Costs Incurred Less: Cost of Goods Manufactured Costs remaining in WIP Overhead Direct Labor (5,600/.80) Direct Materials 5,600 7,000 16. A Direct Materials Direct Labor (15 hours * P7/hour) Factory Overhead (6 hrs machine time * P18 / machine hr 202,000 (185,000) 17,000 (12,600) 4,400 P P 17. A Direct Labor Hours: P289/P8.50 Overhead Application Rate: BFOH Rate: P255 / 60 hrs 34 hrs * P4.25/hr 2,500 105 108 2,713 34 hrs P P Page 9 of 13 pages 4.25 144.50 AFAR Quiz 3 ReSA - The Review School of Accountancy Coverage: AFAR – 13 to 18 (ReSA Batch 43 – May 2022 Batch) 18. A Direct Materials--Job 649 Total Work in Process Other Work in Process Costs remaining in WIP Overhead Direct Labor (OH x 2) $714 * 2 Direct Materials P P 714 1,428 19. B Direct Materials (P120,000 * 30%) Direct Labor (2,500 hrs * P8.50) Total Prime Costs P 6,800 (3,981) 2,819 P (2,142) 677 P 36,000 21,250 57,250 P 20. D Step 1: Compute Total Cost of Job #6 DM: P120,000 * .30 DL: 2,500 * P8.50 FOH: P21,250 * 120% Step 2: Compute Total Cost of Job #9 DM: P120,000 * .25 DL: 3,100 * P8.50 FOH: 26,350 * 120% P 36,000 21,250 25,500 P 82,750 P 30,000 26,350 31,620 87,970 P 170,720 Total Costs of Jobs 6 and 9 21. A Step 1: Determine DL and FOH WIP at June 30: Less DM in WIP Step 2: Separate DL and FOH Let x = DL; 1.2x = FOH x + 1.2x = 14,047 2.2x = 14,047 x = P6,385 Step 3: Compute DL Hours P6,385 ÷ 8.50 P 25,297 11,250 14,047 751 hours 22. C Step 1: Determine DL for Job 401 P5,550 ÷ 150% Step 2: Compute Total Cost of Job 401 DM DL FOH DM DL FOH Step 2: Compute Total Cost of Job 323 Total Costs of Jobs 323 and 401 23. D Total Applied Overhead P55,000 Machine Hours 2,500 Rate per Hour P22.00 Page 10 of 13 pages P P 5,670 3,700 5,550 3,200 4,500 6,300 P 3,700 14,920 14,000 P 28,920 AFAR Quiz 3 ReSA - The Review School of Accountancy Coverage: AFAR – 13 to 18 (ReSA Batch 43 – May 2022 Batch) 24. B Total Applied Overhead P51,750 Total Direct Labor P23,000 Rate per Peso of DL P2.25 25. C Budgeted Overhead P350,000 Budgeted Direct Labor Hours 65,000 Overhead Application Rate P5.38 26. C Direct Materials Direct Labor Factory Overhead (P70,000 * 135%) Total Cost of Job #504 110,500 70,000 94,500 275,000 27. A Unadjusted COGS P980,000 less: Overapplied OH P6,000 Adjusted COGS P974,000 28. A Sales Less: Cost of Goods Sold Add: Factory Overhead Underapplied (700,000-648,000) Selling, General and Administrative Expenses Pretax Income P2,040,000 ___52,000 P 3,600,000 (2,092,000) (900,000) P 608,000 29. D Original costs charged to Work-in-Process Add: Rework Costs Direct Materials Direct Labor Applied Overhead (150% of P3,200) Total Costs of Job No. 369 Divided by: Good Units P 53,200 P 2,000 3,200 4,800 10,000 P 63,200 _____200 P 316 30. A - P53,200 / 200 units = P266 PAS 21 par. 23 (a) requires the foreign currency monetary items, such as trade payables, of an entity to be retranslated at the closing rate at the end of a reporting period. 31. D Raw and In Process (RIP) Finished Goods Cost of Goods Sold 320,000 320,000 Actual Conversion Cost 708,000 704,000 4,000 4,000 Applied Conversion Cost 704,000 704,000 320,000 704,000 1,024,000 1,011,200 4,000 1,011,200 *12,800 Unit Cost : P1,024,000 / 16,000 = P64 * P64 x (16,000 – 15,800) = P12,800 32. B – refer to No. 31 Page 11 of 13 pages 1,015,200 AFAR Quiz 3 ReSA - The Review School of Accountancy Coverage: AFAR – 13 to 18 (ReSA Batch 43 – May 2022 Batch) 33. A 34. D 35. D Units Transferred Out Less: Units in Beginning Inventory Units Started and Completed 5,500 (300) 5,200 Beginning Work in Process Add: Units Started Deduct: Units Transferred Out Ending Work in Process 4,500 13,000 ( 11,750) 5,750 Material Costs: Beginning Current Period P 23,400 31,500 54,900 36. B Conversion Costs: Beginning (Ignored for FIFO) Current Period P P Equivalent Units Beginning Inventory (6,000 * 30%) Started and Completed (15,500) Ending Inventory (8,500 * 10%) ÷ 30,000 = units P 1.83 76,956 76,956 1,800 15,500 850 18,150 equivalent units P 4.24 Cost per equivalent unit 37. A Materials: FIFO Beginning Work in Process + Units Started and Completed + Normal Spoilage—Discrete + Abnormal Spoilage + Ending Work in Process Equivalent Units of Production 38. B Transferred Out Units: FIFO Beginning Work in Process + Completion of Beginning Inventory + Units Started and Completed +Normal Spoilage--Discrete-Materials +Normal Spoilage--Discrete-Conversion Equivalent Units of Production 77,000 3,500 5,000 14,500 0% 100% 100% 100% 100% (20,000 * 65%) Page 12 of 13 pages 77,000 3,500 5,000 14,500 100,000 13,000 77,000 3,500 2,625 1.50 2.50 1.00 1.50 25,000 19,500 192,500 3,500 3,938 244,438 AFAR Quiz 3 ReSA - The Review School of Accountancy Coverage: AFAR – 13 to 18 (ReSA Batch 43 – May 2022 Batch) 39. A X Y Yards 1,500 2,200 Final Sales Price P 7.50 P11.25 Separate Cost per Yard P4.50 P8.00 Net Sales Price P3.00 P3.25 P(4,500/P11,650) * P8,000 = P3,090 Approximated NRV P 4,500 7,150 P11,650 40. D P262,000 * P(300,000/450,000) = P174,667 preliminary allocation to Product X P10,000 * P(300,000/450,000) = P6,667 reduction in joint cost from sales of Product Z P(174,667 - P6,667) = P168,000 Good luck and GOD BLESS!!! There are only two things in the world to worry over; the things you can control, and the things you can’t control. Fix the first, forget the second. The invariable mark of wisdom is to see the miraculous in the common. No one knows what he can do until he tries There’s no traffic jam on the extra mile. Worry is like a rocking chair – it will give you something to do, but it won’t get you anywhere. If you haven’t all things you want, be grateful for the things you don’t have that you didn’t want. Page 13 of 13 pages