OF

CLASSIFICAT

- - T~

..... ---•___ION

....,-

- ----·

~ --· .- · -· · · .~nt (e 9 Income tax, estate

ry stamp tax)

a. Jj/jJ[oaa/J. ·imposed by the t(~na~.~ ~.!! ltu~ ~ts

,r c,,.,.

·.---_ _•

..;

~ ~; ,~ ,JO t lax, donor's tax, VAT othe.f..Pj)~ge ~ i

,,..~ r\t units such as municipal

,,, · ·

~ fa SCOPE_ '

1.

_ _ ..

, .,

· • 1~1 urt

l t ()i • 1~ b.

ii, ~,,Ji cYI I

_

....... - -

.r ,

-

-

). The local

Imposed by r~ 9..~ ~l~ slonal tax~

8nd

grofe! .-- - sUtutional grant that

corporations (e.g: ~ 1~ tate..fax.

n ment Code of th

government unit's power to tax Is based on aGco

e

ovem

l

paved the way for the enactment of the Loca

rent.

Inhe

not

Is

Philippines. Hence, the local government's power to taX

LtXal--1

- ~

- - - - - -- - -

ed

-IJSlOQ.

pas

a.76(§Q.nsDJo.lt-orcaT!.@Jion - -~

ory

territ

~ wheuiercitizens or not, resJdLng wl__!p.!!!.. a s~lfhied

1~

he may~

~g ar d to their property or the occupation In whic

,,

.,. . . .

·-

<

2. AS TO SUBJECT MATIER OR OBJEGt

~ .~:•'4•·

engaged (e.g.

b.

.>

Um

,.amaun

~un!~

0

iJl

_f!roP!!!JX - ~ on- property, wbather_real . r pe~ al,._

some _otber

_Eroportion either to Its value, oL tn· acc.9~ ~ __with

reasonable method of apportionment (e.~~ )

i9n...9f a P,.Olpax

c. Excise - any tax..w.bicb does not fall within the classifiAA!

and

@Uax, _I!ij$ Js a laX·o11 the ~xer&l~ of certain rights also

Qf ~~-mARA

tax?--e. ~~ or's~ ). Excise tax may ntial

privileges {e.g:--i~

non-esse

refer to the Pax levfe d or Imposed onsm products and

Transfer and

goods such as cigars and liquors (Discussed in volume 2 applicable to

Business Taxes). Excise taxes of this nature are taxes

pines for

certain specified articles or products manufactured in the Philip

to specified

domestic sale or consumption or any other disposition and

specific or ad

thing~ or goods imported into the Philippines. It may be

valorem

111< \_1111"

, 1 lr,k

-¼110, J

-

., ,.,.-------- --- 3. AS ro W~Q_BEARS THE_B.URD@P

peg;@_wJ!P_als_o shoulders ttw

_r,,~.. a. (Rirect ➔ tax which is demanded from the

oth the

a er nnot shift

hurcren of tax or tax •

as we as the impact or

11

'>l"ll'litt 'l'l'!.r

~,. a

I-' .

.,· , . !

inc1 ence (liability for the payment of the

burden of the tax falls on the same person (e.g~

do~

-

----

~

")

In the.·expectation and

, · b. lndi~ - tax wh!ch is demanded from one person

er. These

lntention that he shall indemnify himself at the expense of anoth

ent of the

are taxes wherein the incidence of or the liability for the paym

-~ ,. .(<

... ..

'

,,

i

1

1

1

j

'

!

.

4

:

J

J

1

16

t

I

ll

__ __ __ ,

rwv/4mMllll n-,1(.,t

~

tax falls on one person

ttae-~fd~r, !~~f..~tted Of.,~ ~- ,

to another pe,aon ~.g. ~Af;TpefQentage ~. ef(dse Jal. on-ex~_!!-,

'artiaesr. 1n·m1fcase of Maceda v. ·Macirafg (197 SCRA 771), an iriafrid

tax is defined as one paid by a person whO is not dJtectJy liable therefor,

and who may therefore shift or pass on the tax to another person Of

entity, which ultlmately assumes the tax burden.

4. ~AS JO DF[Ea_MINATfON OF AMOUNT:

~; <,11 ff:>'~ __!!5-;tax

il_!!IO_li_i)l;;jrn~sed

stand§! welgllrof measur~nt (e.g.

mime

b.

~-~ M ~~lorem~

~

!>J!J!l~.!:'!811.(l[_lll!Ol!!!"._Of' by

~~_c::!l!?rs..M.Jd

;-va~l!~~ - ~he prqpe_rty~ ~

r~~-to ~!£']..!tie tax..&S.assess~ (e.g.Gat, ~i;;~ e ~. dprlor's laund

tax of

@y~t;;>of ~

e~~Af,:f'~

'""---- -~ · "· ---

_ __::__::.:;..r

.....

::r:: -

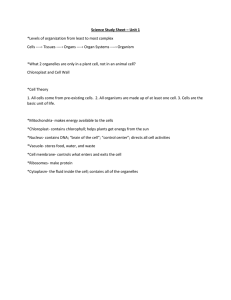

TABLE 1-5: SAMPLE COMPUTATION OF AD-Valorem and Specific Tax

DISTILLED SPIRITS (based on Republic Act No. 10351)

2013

AO.VALOREM TAX RATE

- Based on the Net Retail

Price (NRP) per proof

(excluding the excise and

15%

value-added taxes)

SPECIAC TAX _Pee proof liter

?20

2014

15%

?20

2015

20%

P20

2016

20%

P20.80

2017

20%

P2L63

RETTES, PER PACK (based on Republic Act No. 10351}

2013

SPECIFIC TAX ON

CfgareU.S packed by

machine where the NRP

(excluding excise and VAT)

per pack is

• 1211.50 and below

• More than 1211 .50

P12

P25

2014

?17

?27

17

2015

µi1

12'28

A

?25

?29

P30

5230

5. AS TO PURPOSE

gene,,

..se;- tax imposed~~ for_ttle rnment

a. Primary, Fiscal. or Revenue Pum9

--. . t raise nwenw ,or gove

--- ,.e., o -~

.. - ····_ _ _.

nt.

mme

".m._go~.

..Yl- nu.

e tax.- d<>OQrt tax &OQ.~ ~Il!.X1·

purposes (e.g. Incom....--~ ~·-

'NimA IIMi' ":I~~

---

e - t a x ~_!.or

b. .~ng filY ., 8egula1Qry,,_Su.eg~ O!..SU.IJlJ)~rY.-..Pu~

or econuunC

,....,,ial

.flc

c:,._.

- - - · - :· "''I\.IS

~

~

ve.

acNe

to

a--~ ""' purpose, l.e.,

o1 wnelher revenue Is actually raised or not (e.g..-~~ff_~nd·

I~

Aft,if• -·

.,.-- -~--··- ~-- ~- ··-··- - ~

1

son

dutle

ll",

u..lf\'#

..

-! -

l"Art6 in

~ --~

6. AS TO GRADUATION OR RATE .

·;.

~ amount of the

a. e,opartional .- tax ·based on a fixed percentage~

1-5 above

property, feeefpts, or other basis iobe laxef[e.g. ~ Table

(~~ ~ Q1'1 dis~ ~ s[>!ritsJl. __

· - · - · - . 1 ~1 rs~

1

Rlt1Jl_~sfve or graduB.,t.e.d-~ tax the. rate

l}.t• ~ · b.

~ffeif!l lflCt88S8~ as the tax

(e.g. ~} ixon indMdual taxpayeri) -·

QIH~

"

R_~f!16Si'!P -

tax the rate of whlch__~~ ~~as lfl8 ~~-~~ or_bracket

1~

t"Rf Tn

c. ,;_,

,

i -·-

7. AS TO TAXING AUTHORJTY

eoua Code

a. .Nstionsl - taxes ifT1)0Sed under the NatlonalJnlemaJ Rav. national ~lected Jy the

foommonly known as the Tax

and other

goverrvnent through _the_!3ur_efilL_ofJntema! f3~y_enu~JB!B)

than those

national government agencies. Other national taxes other

de but

collected by the BIR as provided for under special laws Inclu

not Omtted to:

s ·

• CUstoms

~--~

---- dutie

Code,-

·~

• UWll 9f..l.@rco~c ~ 9~~

•

1

Spedaf education fund taxes

·

ric

• ~Y_!,axes ori air._coc.ft..Jmlorued. wmerga.!, and elect

~

r~m pU on

*stmen~

• ~~!

• rJYtUax

t~

~

• Rdvate motor 'lehlde tfJ!

by local govemment units

b. .. local -;~ . - -imposed

.

.

18