Candlestick Trading Guide: Patterns, Levels, & Strategies

advertisement

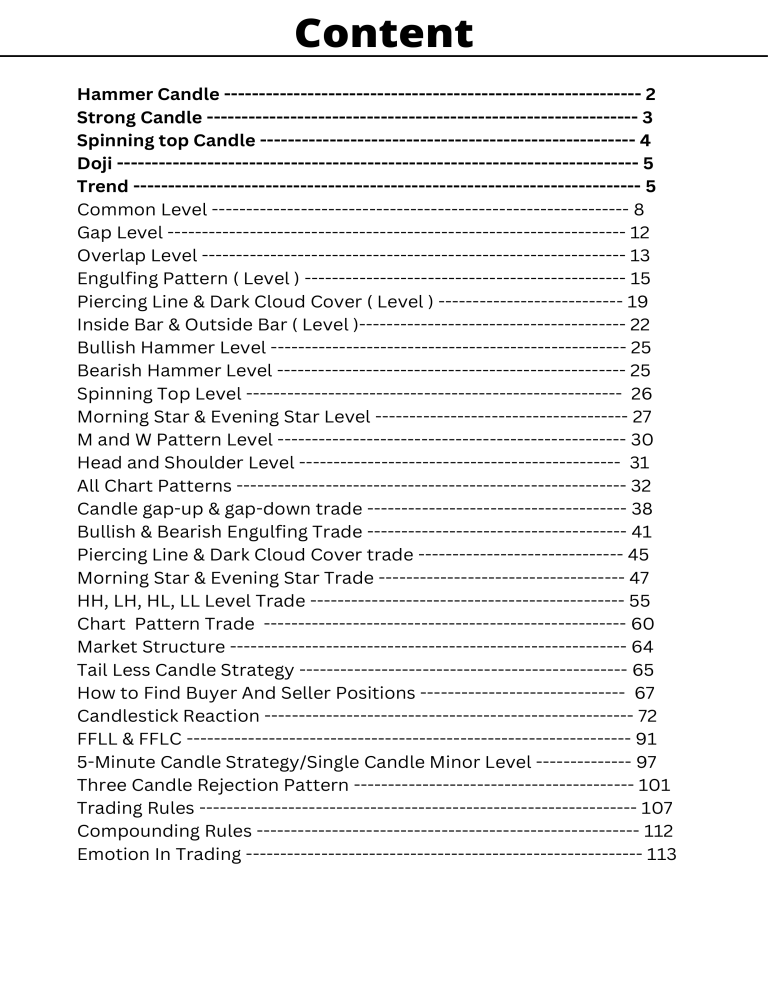

Content Hammer Candle ------------------------------------------------------------ 2 Strong Candle -------------------------------------------------------------- 3 Spinning top Candle ------------------------------------------------------ 4 Doji --------------------------------------------------------------------------- 5 Trend ------------------------------------------------------------------------- 5 Common Level ------------------------------------------------------------- 8 Gap Level ------------------------------------------------------------------- 12 Overlap Level -------------------------------------------------------------- 13 Engulfing Pattern ( Level ) ----------------------------------------------- 15 Piercing Line & Dark Cloud Cover ( Level ) --------------------------- 19 Inside Bar & Outside Bar ( Level )--------------------------------------- 22 Bullish Hammer Level ---------------------------------------------------- 25 Bearish Hammer Level --------------------------------------------------- 25 Spinning Top Level ------------------------------------------------------- 26 Morning Star & Evening Star Level ------------------------------------- 27 M and W Pattern Level --------------------------------------------------- 30 Head and Shoulder Level ----------------------------------------------- 31 All Chart Patterns --------------------------------------------------------- 32 Candle gap-up & gap-down trade -------------------------------------- 38 Bullish & Bearish Engulfing Trade -------------------------------------- 41 Piercing Line & Dark Cloud Cover trade ------------------------------ 45 Morning Star & Evening Star Trade ------------------------------------ 47 HH, LH, HL, LL Level Trade ---------------------------------------------- 55 Chart Pattern Trade ----------------------------------------------------- 60 Market Structure ---------------------------------------------------------- 64 Tail Less Candle Strategy ------------------------------------------------ 65 How to Find Buyer And Seller Positions ------------------------------ 67 Candlestick Reaction ------------------------------------------------------ 72 FFLL & FFLC ----------------------------------------------------------------- 91 5-Minute Candle Strategy/Single Candle Minor Level -------------- 97 Three Candle Rejection Pattern ----------------------------------------- 101 Trading Rules ---------------------------------------------------------------- 107 Compounding Rules -------------------------------------------------------- 112 Emotion In Trading ---------------------------------------------------------- 113 Day #1 * THERE ARE FOUR TYPES OF CANDLES IN THE MARKET 1. Hammer Candle 2. Strong Candle 3. Spinning Top Candle 4. Doji Candle 1. Hammer Candle Important Levels NOTE: - The opening and closing of any candle is a level Type of Hammer Candle 2. Strong Candle Compare Last Candle 50% Strong Level Type Of Strong Candle Marubozu Candle 50% Strong Level NOTE: - 50% level of a strong candle is a strong level Type Of Marubozu Candle 3. Spinning Top Candle Important Strong Level Type Of Spinning Top Candle 3. Doji Candle Strong Level Type of Doji Candle Doji Gravestone Dragonfly Four Price NOTE: In any doji, the party making the wick can be strong if the trend is towards the party making the wick. * TREND Uptrend Downtrend LL NOTE: When a level breakout from the body of the candle, then that level will be considered a breakout. Day #2 1. Common Levels 2. Gap Level 3. Overlapping Levels 1. Common Levels A. Horizontal Level NOTE: There should be maximum touch points for the common level and there should not be body break of any candle. Common Level B. Trendline Common Level NOTE: Instead of a 45 to 90-degree trendline, the trendline between 0 to 45 degrees will respect any levels more. Common Level 2. Gap Levels Gap Level NOTE: The gap level is only in the candle of the same color NOTE: If there is a gap level in the market without any reason, then that level will work less. NOTE: The gap and Overlap level is a strong level. CLICK HERE TO WATCH THE VIDEO OF THE GAP & OVERLAP LEVEL 2. Overlap Levels Overlap Level NOTE: The Overlap level is only in the candle of the same color Day #3 1. Engulfing Pattern 2. Piercing Line & Dark Cloud Cover 3. OutSide Bar & Inside Bar NOTE: If the market is in an uptrend and if the market is coming by creating HL, then the first target of the market will be to break HH similarly, after creating the market LH in a downtrend, its first target will be to break the LL. NOTE: For more accuracy, trade should always be done in impulsive waves only. NOTE: If a pattern is created on the top of the corrective wave and the market is coming without retesting that pattern, then that corrective wave can come only up to 50% of the impulsive wave or will reverse before that. But if the market is coming after retesting the pattern, then the market can reach the lower support and can also break the support. 1. Engulfing Pattern NOTE: This is a continuation pattern. A. Bullish Engulfing This level is only useful for retest. Power Of Level ( 50% ) ( 75% ) 50% Strong Level ( 100% ) Market Support Level B. Bearish Engulfing Market Resistance Level 50% Strong Level ( 100% ) ( 75% ) ( 50% ) Power Of Level NOTE: Although the 50% level is the strongest level, you can ignore the other levels if you wish. NOTE: Other Engulfing Type Candle. Gap Engulfing NOTE: Gap up and gap down should not be too much. and candles should be healthy. NOTE: If we consider the previous candle of the engulfing candle as 100%, then the closing of the engulfing candle should be between 101% to 149% of the previous candle, only then the engulfing pattern will be valid. NOTE: If the engulfing candle engulfs the body of the previous candle then also this pattern will be engulfing pattern, it is not necessary to engulf the wicks of the previous candle to be engulfing pattern NOTE: These engulfing patterns will not be valid 2. Piercing Line & Dark Cloud Cover NOTE: This is a fake breakout pattern A. Piercing Line 50% level of the red candle 50% level of the green candle ( Strong Level ) Market Support Level NOTE: For this pattern to be valid, it is necessary that the second candle closes above the level broken by the previous candle and also above the 50% level of the previous candle. NOTE: The 50% level of the 2nd candle is the strongest level in this pattern. And the 2nd candle can form from 51% to 100% of the previous candle B. Dark Cloud Cover Market Resistance Level 50% level of the Red candle ( Strong Level ) 50% level of the Green candle NOTE: For this pattern to be valid, it is necessary that the second candle closes below the level broken by the previous candle and also below the 50% level of the previous candle. NOTE: In Piercing Line and Dark Cloud Cover patterns, the market does not require retest, the market goes without retest. NOTE: Other Piercing Line & Dark Cloud Cover. Market Level 50% of previous candle A. Piercing Line B. Dark Cloud Cover 3. Inside Bar & OutSide Bar A. Inside Bar B. Outside Bar Candle Level Zone NOTE: By the way, this level zone is no trade zone because the market reverses from anywhere in this zone. Candle Level Zone NOTE: We will consider Inside Bar & Outside Bar only when there is momentum of at least three healthy candles after the formation of this pattern, and in uptrend the closing of that momentum should be below the low of the previous candle, and in a downtrend, The closing of that momentum should be above the high of the previous candle. NOTE: Three Candle Rejection Pattern Level Day #4 Single Candlestick Level 1. Bullish Hammer Level 2. Bearish Hammer Level 3. Spinning Top Level NOTE: The 5-minute trend will be important for 1-minute trade. 1. Bullish Hammer Level C Single Candlestick Important Retest Level O Double Candlestick Important Level Hammer 50% Level C O Inverted Hammer 2. Bearish Hammer Level O C 50% Level Hammer Double Candlestick Important Level O Single Candlestick Important Retest Level C Inverted Hammer NOTE: Single candlestick levels work more in a sideways markets. 1. Spinning Top Level C O C Important Level Important Level O O C O C Important Level Important Level Day #5 Multiple Candlestick Level 1. Morning Star & Evening Star Level 2. Inside bar & Outside bar Level NOTE: The 5-minute trend will be important for 1-minute trade. Power Of Level :HH, HL, LH, LL Level Chart Pattern Level Triple Candlestick Level Level Power Increase Double Candlestick Level Single Candlestick Level NOTE: gap up, gap down and overlap levels will be in between. 1. Morning Star & Evening Star Level Morning Star Level Importance Level Importance (3) (1) (2) (1) NOTE: The 50% level of the green candle is to be taken only when this candle is an averagely stronger candle than the previous 10 candles, but if the green candle is weak then its 50% level is not to be taken. (2) NOTE: When the market comes back from above, it can take a reversal from these levels. NOTE: The wick side of the middle candle should not be above the body of both candles, only then this pattern will be valid. NOTE: If the middle candle in this pattern is green then the accuracy of this pattern will increase slightly. NOTE: When a strong candle appears in any pattern, the 50% level of the strong candle will always be an important strong level. Evening Star 50% Level 1. Inside bar & Outside bar Level Levels of this pattern are given on page 22. NOTE: If two-three patterns are formed in the market simultaneously, then there the market will mostly follow the trend or else the market will turn sideways. NOTE: Gap level and overlap level always work in the market, even after going far away. Green Candle 50% Level Morning Star NOTE: The green 50% level is more important than the gap level in this above chart because the gap level is formed on the left side of the green candle and the level of the green candle is a newer level than the gap level. NOTE: When immediately after the closing of a candle, another candle starts forming on the opposite side, then the first candle can be an Exhaustion candle. NOTE: If a candle does not reach the target in the first 30 seconds of opening, then the candle will try to touch the target for sure in the next 30 seconds, but if the candle has touched the target in the first 30 seconds, then the candle may form the opposite. If a candle has not been able to achieve the target the first time, then it will try to achieve that target next time. NOTE: The market never completes " V and FFLL " against the trend (full feel last leg -FFLL ). NOTE: If there is a gap down after a strong candle, then that gap down is done by the opposite party because the party of the strong candle does not need to gap down because the party of the strong candle is already very strong. Day #6 Chart Pattern Level 1. M - Pattern & W - Pattern 2. Head and Shoulder & Inverted Head and Shoulder 1. M - Pattern & W - Pattern NOTE: For the M and W pattern to be valid, it is necessary that this pattern should consist of at least 5 or more candles. M Pattern Common Level B Neckline Common Level A( 1 ) A( 2 ) Level Importance NOTE: In the M pattern, when the market moves from top to bottom, its target is to break the neckline (A) and when the market moves from bottom to top, its target is to break the neckline (B). W Pattern Level Importance A( 2 ) Neckline Common Level Common Level A( 1 ) B 1. Head and Shoulder & Inverted Head and Shoulder Head and Shoulder Common Level Body Neckline Common Level Neckline NOTE: In This pattern, when the market moves from top to bottom, its target is to break the Wick Common Level neckline and when the market moves from bottom to top, its target is to break the Candle Body neckline. all same as the M pattern. Inverted Head and Shoulder Common Level Neckline Body Neckline Common Level W NOTE: HH, HL, LH, LL, and the neckline level of the chart pattern are a reversal level, the rest are continuation levels. Because whenever the market breakouts or skips these levels, a reversal candle appears. NOTE: Continuation happens whenever a candle without a tail appears in the market. And if the trend is with you then the accuracy increases NOTE: A breakout of round number levels ( ex.775, 770, 700 ) can result in a reversal in the market, but trading in round numbers is a bit risky because there are breakouts of round number levels many times in the market, so trade every time should not be taken. Day #8 Gap up and Gap down trade 1. Green candle gap down Trade 2. Green candle gap up Trade 3. Red candle gap up Trade 4. Red candle gap down Trade 1. Green candle gap down Trade Entry Candle (C) Level (B) 50% Of Green Candle Wick Level (A) Entry is to be taken below these levels NOTE: It is necessary to reject the B candle from the level. It is necessary that the wick touch of the B candle from the level. NOTE: Candle B should not be a Doji candle. NOTE: Candle C should not be the last candle of 5 minutes. NOTE: If candle B is a strong candle, then entry is to be taken below its 50% level or below the rejection point of the wick of the previous candle. This means entry has to be taken below some support level. NOTE: The first momentum of candle-C should be below its opening. If the first momentum of candle-C is above its opening, then candle-C can touch the level and come down and form a red candle. NOTE: This setup can be risky on round numbers. NOTE: If the market gap up, gap down without any reason, then most of the time it reverses. 2. Green candle gap up Trade (C) Entry Candle Level (B) Entry is to be taken below these levels (A) Entry NOTE: The gap-up level should not be a reversal level (HH, HL, LH, LL, Chart pattern neckline). The candle can reverse when the gapup level is the reversal level. NOTE: It is not necessary for the B-candle to be rejected from the level. NOTE: Here sellers have gap-up and gap-down because here buyers did not need to gap-up and gap-down. Here buyers did not need to gap up and gap-down after level breakout NOTE: If the opening of the gap-up and gap-down candle is done at the fixed level, then avoid the trade because there will be market indecision. 3. Red candle gap up Trade Wick Level 50% Of Red Candle Level Entry Candle 3. Red candle gap down Trade Level Entry Candle Day #9 Two Candlestick Level Trading 1. Bullish Engulfing Trade 2. Bearish Engulfing Trade 3. Piercing Line Trade 4. Dark Cloud Cover Trade 1. Bullish Engulfing Trade Pattern #1 Trade Candle (D) Wick Level 50% Level (C) Trade Entry Retest Level 50% Level (A) ( B) Level NOTE: The entry candle ( D-candle ) should not be the last candle of five minutes. NOTE: The retracement candle (C-candle) should not be doji. NOTE: Trade on the next candle (D-candle) only when the Retracement candle has broken the high of the B-candle. NOTE: While placing the trade, it is important to note that there should not be any resistance level near the top, nor should the previous candle touch that level. NOTE: If the trend is up then you can trade on candle opening at your own risk. NOTE: If this pattern is formed in the middle of the impulsive wave, then this pattern does not require retracement, the market moves without retracement. Pattern #2 Trade Candle (E) Wick Level 50% Level (C) Trade Entry (D) Retest Level 50% Level (A) ( B) Level NOTE: D-candle should not be a doji candle NOTE: The closing of the D-candle should be above the high of the wick of the B and C candles. Retest Level (C) 50% Level (A) ( B) NOTE: If the retracement candle (C-candle) closes above the level of 50% of the engulfing candle with rejection instead of the retest level, then the next candle may break the level of 50%, so do not trade here. Do not trade if the candle closes between the retest level and the 50% level of the engulfing candle, retracement candle should close above the retest level NOTE: If the D-candle fails to break the high of the previous candles and its next candle is a tailless candle that breaks the highs of all the previous candles, then we can take a little risk if the trend is with us. ( in Pattern #2 ) NOTE: (Pattern #1) If the C-candle does not retest in the uptrend and the C-candle is a tailless candle that breaks the highs of all previous candles, we can enter a trade here. (C) Retest Level 50% Level (A) NOTE: If there is a gap from the retest level of the C-candle then the next candle can retest. so don't trade here ( B) Wick Level (C) Gap Up Retest Level 50% Level (A) NOTE: Gap up below the level, do not trade here. ( B) NOTE: Whenever Engulfing is in between two levels, do not trade there. Because here the market can get stuck. NOTE: Whenever a strong candle has a big wick, then that candle is not to be considered a strong candle.. do not trade here (D) (C) Retest Level 50% Level (A) ( B) NOTE: If the market does not meet the target in the direction of the trend but completes the target in the opposite direction of the trend, then there can be a trend change. 2. Bearish Engulfing Trade Pattern #1 Level (A) Trade Entry (B) 50% Level Retest Level (C) 50% Level Wick Level (D) Trade candle Pattern #2 Level (A) (B) Trade Entry 50% Level Retest Level (C) (D) 50% Level Wick Level (E) Trade candle 3. Piercing Line Trade Trade Candle (C) 50% Level (A) ( B) Level NOTE: In this, the accuracy of the trade in candle opening remains up to 80%.. NOTE: Entry is to be taken below the level of 50% of B-candle only when buyers' entry (rejection) is seen there. Because if this does not happen, the C-candle can also become a big red candle. NOTE: If the C-candle gap-up gapdown, then the rule of gap-up gap-down will apply here. NOTE: Generally retest is not required in this pattern but for safety, you can take entry if you see a rejection of buyers below the 50% level. NOTE: There should not be any resistance level near the entry candle. NOTE: If a pattern forms in the middle of an impulsive wave, the market can move from there without retesting the pattern. 3. Dark Cloud Cover Trade Level (A) ( B) 50% Level (C) Trade Candle Day #10 Three Candlestick Level Trading 1. Morning Star Trade 2. Evening Star Trade 1. Morning Star Trade Pattern #1 Trade Candle Safety Entry (E) 50% Level (D) Wick Level Retest Level 50% Level (A) (C) Wick Level (B) NOTE: The trade candle should not be the last candle of five minutes. NOTE: The continuation candle (D-candle) should not be a doji candle and there should not be any strong level nearby. NOTE: The market does not need to retest in the middle of an impulsive wave. NOTE: The closing of the D-candle should be above the high of the wick of the C-candle. NOTE: For more safety, you can take the trade below the 50% level of the D-candle or below the high of the wick of the Ccandle. NOTE: The accuracy of this pattern comes up to 90-95%. For more accuracy, you can trade at the beginning of the impulsive wave. Pattern #2 Trade Candle Safety Entry (F) (D) (E) 50% Level Retest Level 50% Level (A) (C) Wick Level (B) NOTE: ( Pattern #2 ) The E-candle should close above the high of the D-candle. But it is even better if the E-candle closes above the high of both the C and D candles. NOTE: ( Pattern #2 ) The continuation candle ( E-candle ) should not have a doji or spinning top. NOTE: ( Pattern #2 ) For safety, the trade can be taken below the 50% level of the continuation candle ( E-candle ). NOTE: Trading the one-minute charts with a five-minute market target can give you some help with your trading setup. NOTE: If the continuation candle is of tail less then the trade can also be a sureshot NOTE: If ever a tailless candle comes into the market which fulfills or engulfs the previous candle, then whenever a tailless candle comes in the subsequent momentum, the market mostly does continuation. And if the trend is with it then it mostly becomes a sureshot. It is necessary to have the head of the tailless candle. NOTE: If the continuations. tailless candle hits the target, most do Pattern #3 Trade Candle Safety Entry (F) (D) (E) 50% Level Retest Level 50% Level (A) Wick Level (C) (B) NOTE: If you look at pattern #3, there are two patterns being formed, Morning Star and Engulfing, so you can trade according to both patterns. Trade Candle Safety Entry (F) (D) (E) 50% Level 50% Level (A) (C) (B) Wick Level GapUp if there is a level ******************************************************** (D) (E) Retest Level 50% Level (A) (C) (B) GapDown if there is a level ******************************************************** (D) (E) Retest Level 50% Level (A) (C) (B) NOTE: If there is no level below the gap-up opening, then this gapup is done by the sellers. But if there is a level below the gapup which has been skipped, then it is done by the gapup buyers. NOTE: If there is no level above the E-candle, then this gap-down is done by the sellers. But if there is a level above the Ecandle, then gap-down buyers have done this to break that level. Here trade entry for safety can be taken below 50% of Ecandle Trade Candle (G) (D) (E) (F) Retest Level 50% Level (A) (C) (B) Two Retracement Candles NOTE: Retracement can happen from two candles but not from three candles. Trade Candle Trade Candle Two Retracement Candles This W will be considered to be made up of four candles. Market Target this candle should have been green. This can also be an exhaustion candle (A) Engulfing Key Level Uptrend Key Level Common Level Market Target Trade Candle (E) (D) (C) (A) (B) Retest Level 50% Level Wick Level NOTE: A-candle has not even broken the key level of engulfing level and the target of the market is also pending and the market is also in an uptrend. So you can take entry from the opening in the next candle or from below any level. NOTE: If a candle in this pattern breaks the key levels but does not break the common level, then this pattern will not be considered failed. This pattern will be considered failed only when the common level of this pattern is broken. If the common level is not broken, the market can move according to the pattern. NOTE: The D-candle is a weak candle but this candle has broken the high of both the A and C candles, the market target is also far away. So we can take a trade on E-Candle here. If the D-candle is a strong candle and the high of the A-candle has not been broken, we can still enter the trade here, because the Dcandle is a strong candle. NOTE: Do not trade here because the D-candle has not been able to break the high of the A-candle and the D-candle is also a weak candle. But if the Dcandle being a weak candle breaks the high of the A-candle then we can enter the trade here. Trade Candle Opening Retest Level (D) 50% Level (C) (A) (B) Wick Level 1. Evening Star Trade Pattern #1 (B) (A) (C) Wick Level 50% Level Retest Level (D) Wick Level 50% Level (E) Trade Candle Safety Entry Pattern #2 (B) (A) (C) Wick Level 50% Level (D) Retest Level 50% Level (E) (F) Safety Entry Trade Candle Pattern #3 (B) (A) (C) Wick Level 50% Level Retest Level (D) 50% Level (E) (F) Safety Entry Trade Candle NOTE: When a candle does not have a head, the next candle is likely to reverse. Even if it is a retracement candle of a strong pattern. But if a candle has a big head and a small tail, then there are more chances of continuation. Day #10 Trend Level Trading 1. HH, LH Trade 2. HL, LL Trade 1. HH, LH Trade Trade Candle (D) (A) (B) Wick Level (C) HH, LH Level Safety Entry Uptrend NOTE: The continuation candle (C-candle) should close above the high of the A and B candles. NOTE: The continuation candle should be healthy. And there should not be any trendline and level on the upward side. Continuation candles should not be doji and hammer. Continuation candle rules will remain the same everywhere. NOTE: Usually, one candle should be left after the HH, HL, LH, and LL level is broken. Because from here the market can reverse. But if the market is coming from behind with a lot of momentum then the market will first continue from there and then reverse after that. (D) Trade Candle (C) Wick High (B) (A) HH, LH Level Safety Entry NOTE: Don't trade here because the B-candle is a headless candle and it is also a weak candle. But if there is a head of B-candle then you can trade here and if another green candle comes after the hammer candle (B-candle) then you can take a trade on the next candle. By the way, when a hammer candle comes on top, it becomes a hanging main candle. Trade Candle (C) (B) HH, LH Level (A) NOTE: The continuation candle ( B-candle ) should close above the high of the A-candle Safety Entry NOTE: The continuation candle should not be gap-up gap-down. Gap Up Opening HH, LH Level NOTE: This gap-up buyer has done, but due to the reversal level, there is a high possibility of the formation of a red candle, so do not trade here. Gap Down Opening HH, LH Level NOTE: Here this gap-down has been done by the buyers and there is a high possibility of this gap-down candle becoming green. You can take trade here. Gap Up Opening NOTE: do not trade here HH, LH Level Trade Candle NOTE: You can trade here. HH, LH Level Gap Down Opening If there is a level ********************************************************* HH, LH Level Gap Down Opening NOTE: If there is no level on the upside then do not trade here. But if there is a level on the upside, even if that level is a round number, you can take the trade here. But take entry according to the gap-up gap-down trade rule. Trade Candle Trade Candle HH, LH Level HH, LH Level Gap Up Opening Trade Candle New HH Level HH Level Uptrend Trade Candle NOTE: There are two-morning star patterns made here. There is no need for a retracement here, the market will go on without retracement. And here the pattern of two red and two green candles is also formed. 2. HL, LL Trade nd tre wn Do HL LL Level Safety Entry (A) (B) (C) (D) Trade Candle Wick Level nd tre wn Do HL LL Level Safety Entry (A) (B) Wick Level Trade Candle (C) NOTE: If you want to take an up trade and are using the safety margin, the candle should come down first. If first go up and then come down and you have clicked for up then there will be 90% chance of loss. NOTE: If you want to be successful in trading then get mastery on any one setup don't try to trade on every setup, Day #11 Chart Pattern Trading 1. M Trade 2. W Trade 1. M Trade NOTE: Chart patterns are generally used for long term trading. NOTE: There are three types of chart patterns – Reversal, Continuation, and Neutral. M Pattern Common Level Neckline Level Trade Candle NOTE: When the market moves from top to bottom in the M pattern, the neckline of the lowest wick will be the target of the market. The common level will also be an important level. M Neckline Level Trade Candle NOTE: Continuation candles should not be a hammer, doji etc. NOTE: When this M pattern is formed, some or the other pattern will be formed on its right top. If the market goes down without retesting this pattern, then it is less likely to reach the neckline, and the market may reverse from the middle itself. To break the neckline, it is necessary that the market retests that pattern. M Body Neckline M Wick Neckline Trade Candle NOTE: If the market is going without retesting the neckline, then the market can reverse from anywhere. M Neckline NOTE: Do not trade here because the market has become indecision. NOTE: The trading rules for all patterns are the same as for the M pattern. NOTE: You can take a trade on candle opening in M pattern but if you take it with safety margin then it will be better. NOTE: There should always be a break of the previous candle's low (in M pattern) by a continuation candle. This rule will be applicable in every setup NOTE: The levels keep on shifting in the market, so the levels should keep on changing according to the movement of the market. NOTE: If the market retests the second HL break, then the downtrend is fully confirmed. Sometimes after retesting the first HL break, the market makes it back to HH, so after the second HL break, the market is more likely to go into a confirmed downtrend. NOTE: This will be the neckline in this head and shoulder M Neckline Level Trade Candle NOTE: This pattern is neutral. Because the sellers have kept their positions in the uptrend. Common Level Gap Down NOTE: This M pattern will still be valid. NOTE: Take the first 2-3 trades of the day with the minimum amount on your preferred setup. If that trade becomes lose, then be a little cautious on that day. Because your favorite setup has lost 2-3 consecutive trades, then other setups may lose more. 2. W Trade Trade Candle Neckline Level Common Level Day #12 Market Structure NOTE: Here the market has not made a new high and has broken the previous low, which means that the structure of the market has changed here. And the market is not yet in the mood to make new highs. character change breakout CLICK HERE TO STRUCTURE WATCH THE VIDEO OF THE MARKET NOTE: D, E, and F levels are weak levels, so avoid trading here, the market can easily go down by breaking these levels. NOTE: Market structure is used for long-term trading. NOTE: Whenever the market comes to the demand zone, it will try to go up. NOTE: In internal price action, when the market will break the Chigh from the demand zone, then from there the market will go to break the HH. NOTE: There is no need to retest the market after breaking the Chigh as the market is still in an uptrend. After breaking the Chigh, the market may suddenly go up NOTE: Trading on the one-minute chart by observing the market structure, levels, and targets on the five-minute chart can increase your accuracy. For example, you can see the target of the five-minute running candle. Demand Zone Example NOTE: When the market is unable to establish a new HH and breaks its previous low (D-Low), it means that the structure of the market has changed. And the market is not in the mood to install a new HH. Now the market can go up to HL. If the structure changes after coming to HL, then we can take trades from there. NOTE: If the market will not be able to break HH, then the structure of the market will start changing from there. Tail Less Candle Strategy Trade Candle (3) Tail Less Candle (2) (1) Uptrend Safety Entry NOTE: Do not trade against the trend in a tailless candle NOTE: The tailless candle should be the second candle and we have to trade on the third candle. For example, if a red candle is followed by a green tailless candle in an uptrend, do not trade there, but if the second green tailless candle comes, then you can trade on the next third candle. If a tailless candle is the only candle in its party, then the next candle can be reversed, so whenever a tailless candle comes, the previous candle of that tailless candle should also belong to that tailless candle's party. NOTE: Tailless candles must have a head. Do not trade tailless candles without a head. NOTE: There should not be any level near the tailless candle. NOTE: You can take a trade in the opening but it will be better if you enter below 50% of the previous candle. NOTE: Continuation happens whenever a candle without a tail appears in the market. And if the trend is with you then the accuracy increases NOTE: If ever a tailless candle comes into the market which fulfills or engulfs the previous candle, then whenever a tailless candle comes in the subsequent momentum, the market mostly does continuation. And if the trend is with it then it mostly becomes a sureshot. It is necessary to have the head of the tailless candle. NOTE: If the tailless candle hits the target, most do continuations NOTE: Do not enter the trade when the tailless candle breaks the reversal level NOTE: If a strong candle is the only candle in its party, its 50% level is the weak level. But if there is a strong candle in any momentum then 50% of it will be a strong level. NOTE: Avoid taking trades on the first and last candle of five minutes in the tailless candle strategy NOTE: While taking a trade on the tailless candle, it is important to keep in mind that the wick of a tailless candle has not been rejected by any strong level. Day #13 How to Find Buyer And Seller Position NOTE: When the market breaks the positions of buyers and sellers, it usually reverses from there. NOTE: The accuracy of this setup is 70 to 75%. NOTE: Sellers and buyers positions are generally used to avoid trades. This means that whenever the market breaks the positions of buyers or sellers, avoid continuation there as there can be a candle reverse. But many people trade with filters on this setup. So if you want to trade on this setup, you can do so by taking the help of other filters. Seller Position Reversal Candle Buyer Position (2) (1) Buyer Position NOTE: There must be 2 to 3 candles after the candles of buyers and sellers positions, only then those levels will be considered as positions of strong buyers or sellers. The candles of buyers and sellers should not be single candles. Sellers Position Momentum NOTE: The last wick of any momentum would be the positions of sellers and buyers. NOTE: The level of buyers position in uptrend and sellers position in downtrend will be stronger. NOTE: Once the positions of buyers or sellers have been broken, irrespective of whether there has been a reversal or not, then those positions have no value. NOTE: If by stopping any strong momentum, the opposite party has created sellers or buyers position, then this position will be the strongest position. NOTE: If after the weakness of any momentum, the opposing party comes and creates positions of sellers or buyers, then that position level will be weak. Because the opposition party did not have to work hard to come. So if the market breaks such a position level then there is less possibility of reversal, the market can exit from there even without giving reversal. Weak Sellers Position Strong Sellers Position Momentum Weakness Strong Momentum NOTE: Positions of buyers and sellers have to be seen in the direction of the trend, opposite to the trend the accuracy will be less. NOTE: Avoid reversing strong momentum NOTE: If there is a strong level near the breakout candle, which shows the possibility of reverse, then you can reverse from there. NOTE: When the market breaks a level for the third time, the chances of a reversal will be high from there. Because it will be a strong level for the positions of buyers or sellers. Or when the market breaks the common level with two touches, then the market is more likely to reverse from there. NOTE: In chart (1), the buyers are going up by creating their pressure, from here the buyers have to work hard to go up, so when the buyers position created by this momentum is broken, a reversal candle will appear there. Big Red Candles Reversal Candle Weak Red Candles Big Green Candles Strong Buyer Position Weak Buyer Position Weak Green Candles (1) (2) NOTE: The strength of the buyers and sellers positions is determined by the market momentum. If there is a lot of momentum after a buyers or sellers position, then that position will be a strong position. NOTE: HH, HL, LH, and LL is a strong buyers and sellers position levels. NOTE: If a pattern is formed on any HH, HL, LH, LL and the market is going to break any of these levels, then the market can react on the key levels of the pattern. Therefore, if a pattern is formed at any level, then one should be careful with the key levels of the pattern. Day #14 Candlestick Reaction 1. Bullish Hammer 2. Inverted Bearish Hammer 3. Inverted Bullish Hammer 4. Bearish Hammer 5. Strong Candle 6. Spinning Top 7. Doji 1. Bullish Hammer Up Most of the reaction has happened in the wick NOTE: If there is no level above then the next candle is most likely to be green. Down Exhaustion has happened Down Level Create Most of the reaction has happened in the body Indecision Touching this level the market can go up NOTE: If the reaction of a candle is more inside the wick, then the probability of continuation of the next candle is high. But if the reaction of a candle is more inside the body then the next candle is more likely to reverse NOTE: If there is no level around the candle then the next candle will come according to the reaction Continuation can happen if there is buyers dominance Down Indecision NOTE: This is all reaction without level. But if there is a level around, then trade according to the level Gap Up Opening Up Down Level Create Touching this level the market can go up 2. Inverted Bearish Hammer Most of the reaction has happened in the wick Down Touching this level the market can go Down Up Indecision Touching this level the market can go Down Up Up Indecision Indecision The continuation can happen if there is sellers dominance Up Exhaustion has happened 3. Inverted Bullish Hammer Most of the reaction has happened in the wick Up this is a tailless candle Here the entry of buyers is necessary in the last time. NOTE: But if the sellers have made the last entry here, then be a little cautious. But if there is an uptrend, then even if the last entry was made by the sellers, the next candle will be most likely to go up. Touching this level the market can go Up Down Indecision Touching this level the market can go Up Down Indecision Touching this level the market can go Up Indecision Down 4. Bearish Hammer this is a tailless candle Here the entry of sellers is necessary in the last time. Down Most of the reaction has happened in the wick Touching this level the market can go Down Indecision Up If there is a trend, it is more likely to go with the trend NOTE: If most of the reaction of a candle is in the body, then the next candle can be a reversal, so one should be a little cautious while doing continuation there. But if most of the reaction of a candle is in the wick, then the probability of continuation of the next candle is high. 5. Strong Candle Up Buyers' dominance is visible in this candle, so the probability of continuation of this candle will be more than 90%. Touching this level the market can go Up Indecision Down Exhaustion has also happened in this candle and the reaction has also created a level, so the next candle can also reverse. Up Gap-Up Opening Gap-up also occurs due to buyers dominance, in such a situation the next candle is made green. Exhaustion has happened Down Down Exhaustion has happened Down Exhaustion has happened Down Exhaustion has happened Up NOTE: If the reaction is happening for a long time at any place in the candle, then a level is formed there. Up Down Exhaustion has happened It can also do the continuation Down It can also do the continuation Down Down 6. Spinning Top NOTE: Closing is important in a Spinning Top candle C Down O C Up Here closing buyers have done O O C O C Here closing sellers have done Here closing sellers have done Down Up Here closing buyers have done NOTE: In the spinning top candle, whether more reaction has happened in the body or in the wick, it does not matter, the only thing that matters is who has done the closing. The party which closes, the next candle is more likely to be formed by the same party. NOTE: There should not be any level around the spinning top candle otherwise the next candle can reverse by touching that level. NOTE: All these candlestick reaction predictions are given for the situation without level. Prediction candle can also be opposite if there is a level around, so it is very important to pay attention to the levels while trading on candle reaction. 7. Doji NORMAL PREDICTION Down Neutral Up Neutral Down Up NOTE: Never trade on Doji. Because usually doji is always neutral. The place where the doji is formed in the market is important. According to the place where doji comes in the market, it is more likely to react. Up exhaustion NOTE: Whenever a candle exhausts, there should not be a head of that candle. When the head of the exhaustion candle is there, the chances of the next candle reversing are less. Dow n Level Up Level this is the real breakout candle 70% Level 30% NOTE: If 70% of the body of the candle that breakouts a level is above the level, then it is a real breakout. And if the next candle reverse also comes, then it will definitely respect the breakout level and the reverse candle will most likely close above the breakout level. And apart from this, you can also detect real and fake breakouts from candle reactions. Level Down NOTE: Do level trading where you do not understand the candle reaction at all. Main Level Minor Level (B) (A) The reaction of the B-candle at the minor level can be like this. Target Level 50% Level Trade Entry Point Candle reaction in first 30 seconds Target Level NOTE: Reversal should never be done without a level, because if there is no level, the exhaustion candle can also do continuation. That's why always trade should be taken at the level and should be strong level, the minor level cannot reverse the momentum Down Trade Entry Point Level This is an exhaustion candle but the level is a bit far from the candle closing. NOTE: If in any momentum a candle closes inside the wick of the previous candle, then continuation should be avoided there. NOTE: If the reaction of the candle is according to the trend then the next candle will continue. NOTE: Out of reaction and level, the level is to be given more importance. NOTE: If you are not able to understand where the market will go in the 1-minute chart, then you can understand where the market can go by looking at the 5-minute chart. NOTE: The market will complete the target of the opposite trend only when the market is going towards the opposite target by retesting a pattern. NOTE: The common level will act as an average level and HH, HL, LH and LL levels will act as sellers and buyers positions. NOTE: If the market is coming from behind in strong momentum and after that, an exhaustion-type candle comes with strong pressure, then that candle can be a real pressure of the market instead of an exhaustion candle. And if the market is coming from behind an exhaustion-type candle with momentum weakness, then that candle can be an exhaustion candle. NOTE: If a green candle is forming in the 5-minute chart, then the chances of winning the Up trade in the one-minute chart are high. But if the opposite candle is being formed in the 5-minute chart, then you can wait a bit. Day #15 Market Target 1. FFLL ( Full fill last leg ) 2. FFLC ( Full fill last candle ) 1. FFLL ( Full fill last leg ) NOTE: FFLL is always complete with the trend, not the opposite of the trend. NOTE: Most of the time whenever the market completes the FFLL a reversal candle occurs. NOTE: The market always completes the target of the impulsive wave. HH Next FFLL Target FFLL Target Here the target of the market will be to reach the high of the wick of the last opposite candle. NOTE: Whenever the market completes FFLL, there is a possibility of consolidation. NOTE: FFLL can be completed only if the corrective wave is coming after retesting a pattern, otherwise it will reverse up to 50% of the impulsive wave. NOTE: Whenever a target is completed, the strength of the market goes out there. And there can be a reversal so one should wait there. But there can be continuation if there is dominance. Domination has happened or not, it will be known by the candle reaction NOTE: When the market is going to complete FFLL, there should not be any strong level in between, otherwise the market may reverse from there. NOTE: You can take long trade in FFLL for safety. For example, you can take a trade of 2-3-5 minutes in a 1-minute chart. 2. FFLC ( Full fill last candle ) NOTE: FFLC concept is used in stuck areas. NOTE: As long as the candles are full-fill each other, the market will remain in the sideways zone and when it stops full-fill, the continuation will begin. NOTE: If the market is not dominating then usually the market moves to the FFLC zone after the FFLL is complete. When the candle starts to full fill each other after the FFLL is complete, it means that the stuck area has started. NOTE: It doesn't matter whether a candle's wick is full fill or not. But the body of the candle should be full fill whether it full fills with the wick or with the body. NOTE: By the way FFLC is not very important, you can focus more on FFLL only. full filled with wick full filled with body NOTE: If a candle has not been able to full fill the previous candle completely, then the next candle can come to full fill. Candles that full fill each other The full Fill zone has been broken as soon as this candle is formed, now the market will continue NOTE: Usually, if three consecutive candles come of the same color, then the market breaks the FFLC zone and exits and continues. NOTE: FFLC area is always formed near the level. NOTE: Retest is not necessary for breaking the FFLC zone. Usually when the FFLC zone breaks, the market does continuation In FFLL there should not be a head-to-head match of any candle, otherwise, the next candle may reverse. FFLL Target Trade Candle Confirmation Candle NOTE: When the market is starting to move into an impulsive wave, then the FFLC area can be formed there. These two candles have completely filled the previous candle, so will wait for a confirmation candle and then trade. NOTE: Here the confirmation candle should not be hammer, doji, or spinning top candle. NOTE: Doji is also a strong level. NOTE: If a candle closes inside the wick of the previous candle, then the next candle may reverse. Be careful. Resistance Level single candle levels Support level Single red candle closing target NOTE: Support is important in an uptrend and resistance is important in a downtrend. 50% Opening level Wick level NOTE: This level will be important for the closing of the red candle and the 50% level of the strong candle will also be an important level. NOTE: The buyers will not let the sellers go below the opening but if the sellers go below the opening of the buyers then the buyers will not let the sellers go below the low of the wick. Buyers will try to close sellers above the low of the wick Common Level Right Level Wrong Level Right Level NOTE: If you have 2-3 consecutive losing trades, then just observe the chart for 10-15 minutes and understand the movement of the market and then take the trade on the tailless candle on the confirmation setup. Because a tailless candle is a sureshot in itself and if another setup is also found with it, then its accuracy will increase further. Day #16 5-Minute Candle Strategy/Single Candle Target/ Single Candle Closing Target/Market Minor Target NOTE: The high and low of a 5-minute candle are also a target of the market. NOTE: Any candle always closes near the body or wick of the left side candles. Next red candle closing possibility 50% The target of the next candle will be to break the low of the wick of this candle. These are all 5-minute candles. NOTE: Who entered the last of this candle is important, and if there is a level in the rejection area, the next candle may reverse. If the candle reaction is of reverse and there is also a level then the next candle may reverse. Trade Candle (C) (B) (A) NOTE: To trade on C-candle it is necessary that B-candle should close above the high of the Acandle's wick only then we have to trade. Because for the market to go up and to sustain it, it is necessary that the B-candle closes above the high of the Acandle. If the B-candle closes inside the wick of the A-candle, the next candle is likely to reverse. NOTE: The high and low of the last 5 minutes candle is an important level. NOTE: Whichever candle breakouts the high and low of the previous 5-minute candle on the 1-minute chart, the next candle does 99% continuation. Trade Candle 5-minute candle high 5-minute candle Low NOTE: There should not be any nearby levels after the breakout candle. NOTE: Always trade with the trend. NOTE: The candle that breaks the high and low of the 5-minute candle should not be too large. NOTE: Every candle has its own work, if any candle is not able to do its work then the opposition party will come. NOTE: You can also consider the closing and opening of the 5minute candle as an important level, but the high and low will always be the most important levels. NOTE: Whenever the market breaks the high or low of the 5minute candle, then whichever is the next target of the market in the 1-minute chart, the probability of the market going to that target is up to 90%. If there is no strong level in the middle then the market will not reverse from the middle. NOTE: This "5-minute candle breakout" strategy is suitable for trendy markets and does not work for sideways markets. NOTE: The trade candle should not be the last candle of 5 minutes. NOTE: Usually most of the candles close near the wick level of the left side candles or their 50% level. It hardly happens on the body. NOTE: If the market has come down from a high by making a big and strong candle, then when the market again goes near the level of that high, then there is a possibility of a reversal candle at that level. NOTE: The 5-minute candle should not be a doji candle. This means do not trade at the level of a 5-minute doji candle. NOTE: The high and low of the 5-minute doji candle are also small targets of the market, after breaking the high or low of the 5-minute doji, the market can continue in 1 minute, but it will be better for you that you always follow the 5-minute Trade only on healthy candles. 5-minute candle high Trade Candle 5-minute candle Low NOTE: The high and low of any candle is always a target for the next candle, whether the candle is of 1 minute time or 5 minutes. Trade Candle 5-minute candle high Gap Down opening 1 Minute Candles Market Target Trade Candle 5-minute candle high 1 Minute Candles Market Target Trade Candle 5-minute candle high Target 1 Minute Candles 5 Minute Candles 5-minute candle Low target ( body ) NOTE: Do not trade against the trend. Market Target Trade Candle 5-minute candle high 1 Minute Candles 5-minute candle Low NOTE: In this setup, the market will do a continuation most of the time. Three Candle Rejection Pattern Common Level Safe Entry Point Trade Candle NOTE: In this, you can take trade in opening also. The accuracy of this pattern comes up to 90%. Common Level Trade Candle NOTE: All three rejection candles should be of the same color in this pattern. Common Level Do not trade here, the pattern has now failed. NOTE: This pattern wins even when the trend is the opposite. NOTE: When a pattern is formed at the end of the corrective wave and the market retests that pattern and starts moving towards HH or LL, then the impulsive wave starts from there. And sometimes the market may move without retesting the pattern because the market is trendy at that time. NOTE: Sometimes due to the pressure of buyers or sellers also gap level is formed where you are not even able to find any skipped level around. NOTE: This is not a piercing line pattern. Here there is market indecision because according to 2 Minutes, the doji candle is formed here. NOTE: On the day the market is bad, on that day the trade candle mostly becomes a doji candle, so in such a situation safety margin entry is important. Trade Candle NOTE: The morning star pattern works very well if the middle candle in the morning star pattern is a doji or a hammer. Trade Candle NOTE: When the market reverses from above and comes back to the key levels of the Morning Star, the buyers will try to keep the market above the key levels of the Morning Star. NOTE: A reversal candle usually comes after the break of the neckline of the chart pattern, but if there is momentum from behind, the market may continue without giving a reversal. Neckline LL NOTE: Here the target of the market was to break the LL but the market could not break the LL and the market has reversed from the LL itself, so now the new target of the market is to reach the Neckline. Neckline Piercing Line Pattern NOTE: Don't go for Up here because there is pressure (momentum) of sellers behind. And buyers have created a piercing line pattern by breaking the neckline, so now sellers will come back and sellers can make a red candle here, so wait for a confirmation candle here. Red Candle Opening ( High ) (C) M Neckline (A) (D) (B) (E) Trade Candle NOTE: Here we should not take a down trade on C-candle because C-candle should have been a confirmation candle for us which breaks the low of the A-candle but it did not happen and the reason for D-candle becoming red is that C-candle, failed to close above the high of the A-candle, so sellers made a D-candle, which has become a confirmation candle, so we will trade the E-candle. M Neckline NOTE: 1st buyers position has been broken by the sellers, now next buyers position is far away so can trade here. 1st Buyers Position 2nd Buyers Position Trade Candle NOTE: The high and low of a 5-minute candle are always a market target. They come in the small target of the market. NOTE: In such a situation, the trade should be taken with some caution. In such a situation, the trade candle will become a weak candle or a doji candle. This can lead to the next candle being a big candle. M Neckline Wick Low Trade Candle (A) Pattern Retest Level (B) (C) (D) (E) NOTE: Do not trade on E-candle here because C-candle (Retracement candle) has closed above the retest level of Engulfing. Here C-candle has not retested properly so do not trade on E-candle here. NOTE: Usually the market gets stuck there when the market does not continue for 2-3 candles after completing the FFLL. After completing FFLL the market needs continuation as soon as possible but if it does not happen then the market will get stuck there. Trading Rules NOTE: You cannot be successful in trading until you follow the rules and discipline in trading. Rules ( 1 ) Always trade with the trend. NOTE: Trade to complete the target or trade to start the target. ( 2 ) Do not make any trade of more than 2%. The first trade should always be less than 2%. ( 3 ) Always trade on that setup that you have mastered. And until you recover all your losses and make a full profit, always trade on your mastered setup. NOTE: In case of loss in any trade, do not take the next trade without knowing the reason for the loss. NOTE: Till the time you do not come in daily or all-time profit, it is always necessary to do it with trading discipline. ( 4 ) Always trade on your 4-5 favorite charts. Trade on your favorite charts which you understand more easily, like - USDINR, USDBRL, etc. NOTE: If you have 100$ on the first day and you have lost 10$, then on the second day you have to trade with the amount up to 2% of the 90$, which means always trade with the amount up to 2% of the total funds of the trading account. NOTE: Stop trading if you have 3 consecutive losses on your favorite setup. NOTE: If you want, you can keep a profit target according to the session. If you keep four sessions a day and keep a target of 5% in each session. So your daily profit will be 20%. NOTE: Trade after waiting for some time in case of loss of any trade. ( 5 ) Fix trades per day or for each session. Like per day or per session only 5 trades have to be done. NOTE: If you keep a profit target of 10%, then you can keep a stop-loss target of up to 20%. NOTE: If you keep a daily profit target of 10%, then don't try to achieve the full 10%. Stop trading whenever the target is achieved by 7-8-9%. (A) (B) 5 Minute Candles NOTE: Do not trade on the breakout of the A-candle (5-minute candle) on the one-minute chart because the breakout 5-minute candle should match the color of the previous candle. And here the 5-minute red candle is being breakout by the 5minute green candle. Therefore, whenever you enter a trade on a breakout of a 5-minute candle, the 5minute breakout candle should also match the color of the previous candle. NOTE: In the 5-minute strategy, you should trade by looking at the target of the 5-minute chart, which will slightly increase the accuracy of your setup. NOTE: If you want to do compounding, always do it on your favorite setup and go with the trend. NOTE: Never trade with the expectation that all your trades will win. Always assume that 3 out of 10 trades will be your losses. Due to this even if you lose 1-2 trades, you will not get emotions. NOTE: In a 5-minute strategy, the 5-minute chart should also be trending. The 5-minute chart should not be sideways. NOTE: If the reference is on the left side of the market, then the round number is not to be given any importance. NOTE: Trading in a 5-minute strategy Avoid trading on the 4th and 5th-minute candles. In this strategy, you have only 5-minute 1st, 2nd, and 3rd-minute candles to trade. Trade Candle 5-minute candle high ( This is a sureshot because the previous candle is a tailless candle and there is also a tailless candle head. ) 5-minute candle NOTE: When the breakout candle is a tailless candle and there is also a head of that candle, the next candle will be 99% Sureshot and the trend must be UP and the previous 5-minute candle must also be green. NOTE: The breakout candle in the 5-minute strategy should not be too large. The breakout candle should be a normal candle. NOTE: Don't trade in the tailless candle after 3rd candle means trade only if 1st and 2nd candle comes tailless in any momentum don't trade on 4th candle when 3rd candle comes tailless. Do not trade on this candle. (E) (D) Tradable Candle (C) (A) (B) NOTE: When the B-candle engulfs the A-candle and the B-candle becomes a tailless candle. Only then the trade is to be taken on Ccandle. No Tradable Candle Trade Candle NOTE: Always trade with the trend on tailless candles. Market Target Trade Candle Tailless Candle NOTE: Generally, in case of a gap-up, or gap-down in Strong Momentum, only the same party comes because sometimes gapup, and gap-down also happen due to the pressure of the market (Buyers and Sellers). 5-Minute Candle High Entry Point 1-Minute Candle 5-Minute Candle High Do not trade this candle Three Candle Rejection Pattern Entry Point Common Level Trade Candle NOTE: This pattern may also have to do 1step martingale in OTC. Common Level Market Target Trade Candle NOTE: If the market creates an SNR on a smaller timeframe and the pending target of the market is further away, you can enter a continuation trade when the market breaks the SNR. But the accuracy of this setup is less (70%) this setup is not that special. Compounding Rules NOTE: Compounding should always be done with extra profit only. After doing 5-step compounding properly for 5 consecutive times in the demo, you can do 3-step compounding in a real account. NOTE: This means on the day you win 25 consecutive trades, you can do 3-step compounding in a real account. NOTE: Compounding trade is always to be done with Sureshot and trend. NOTE: Do not trade on the 1st and last 5-minute candles for compounding. NOTE: Do compounding with the amount of extra profit in such a way that you get 4 chances for compounding. NOTE: Patience is most important for success in trading. Reasons for emotions while trading NOTE: take a trade that is too large. NOTE: Don't know why the loss is happening. NOTE: You have taken a trade even when you do not know about the market. lack of patience. NOTE: There is already some pressure to make a profit, that is, there is pressure to make a fixed profit daily or per month. Or there is pressure to recover the losses already done. NOTE: On breaking your trading rules. Ways to Avoid Emotion in Trading NOTE: Whatever loss or profit has happened earlier, forget it. That is, whatever has happened before in life, consider it as over and start completely new in the market. NOTE: The daily profit target is to be kept at 10% and compounding should always be done with extra profit. NOTE: Never take a trade bigger than your capacity. NOTE: Always be patient while taking a trade, do not take a trade just for the sake of taking a trade, no matter how much time it takes, do not trade until a proper setup is found. NOTE: Never break your trading rules. Tailless Candle Downtrend If you want to trade, take it here 50% Level (C) (A) (B) Tradeble Candle Piercing Line level ( LL Level ) Market Main Target NOTE: Here the market has completed the key level (minor level) target of the piercing line pattern and has also completed the hammer low target (minor level). That's why buyers have come in the next candle despite the tailless candle and downtrend. NOTE: The tailless candle has not broken the level of the piercing line. So if we take a trade on the next candle (B-candle) of the tailless candle, there is a possibility of reversal from the level of the piercing line of the B-candle. Therefore, if there is a reversal level nearby, do not trade there. NOTE: Here B-candle has not been able to close above 50% of the A-candle, so you can take a down trade on the next candle (Ccandle). Level Gap-Down Opening by sellers Wick Level 50% Level (C) (B ) (A ) Uptrend NOTE: Here buyers have not felt any level in C-candle. This means the C-candle level has not been touched. That's why the buyers have not yet felt any level here. That's why the buyers here have not felt the need to do a gap-down, so this gap-down has been done by the sellers. But the sellers have not been able to gapdown below the wick level and 50% of the previous candle (Ccandle). Buyers have stopped sellers from gapping below the wick level and 50% level of C-candle so green candle can also be formed here. Sellers have done this gap-down, so sellers will try to make a red candle here, but due to the uptrend and dominance of buyers, a green candle can also be formed here. Downtrend Strong Level and 50% Level (A ) (B ) Do not trade here NOTE: Don't trade down here because B-candle has not touched the level means B-candle has not felt the level. By the time the Bcandle touches the level, the time of the B-candle was over, so now the buyers can come in the next candle to touch the level, but if the B-candle was rejected by touching the level, we would have Down trade could be taken on the next candle of the Bcandle. Downtrend Safe Entry Strong Level and 50% Level (A ) (B ) (C) Trade Candle NOTE: If a continuation candle is headless and a healthy candle in a bullish pattern or setup, you can enter trades below 50% of the headless candle or below its opening. (B ) Trade Candle Entry Point (A ) Retest Level 50% Level Body Level NOTE: By the way, if you want, you can also take trade on Acandle. NOTE: The target of the market is always to breakout the strong level or to close till that level. Therefore, rejection trade should always be taken at the nearest other level instead of the target level. Wick High Level Hammer 50% Level Trade Entry Level Common Level NOTE: If you have to trade on rejection, then you should not trade at the level which is the target of breaking the market but should trade at the level ahead of it. NOTE: The first target of the market is to break the common level, then after that the HH, HL, LH, and LL levels have to be broken, so the entry of the rejection trade should be taken at another level close to the common level. NOTE: Never trade on single candle analysis. This means never trade by analyzing only one candle. NOTE: One should take a break from trading on the day when there are 3-4 consecutive trade losses. And on the day when your setup is working well, you can do aggressive trading with extra profits. Due to this, you will avoid big losses on the day the market is bad and on the day the market is going well, you will be able to make a big profit. NOTE: If you do not learn from your mistakes in trading, then in the future you will never be able to make a profit in trading. NOTE: Target can also be completed with the market wick. Trade Candle Common Level Market Pattern Uptrend (2) (1) Level HL NOTE: In an uptrend, level ( 1 ) is more important than level ( 2 ) before HL. Because level (1) is the key level of the pattern. Trade Candle Wick Level Entry Point HH Level NOTE: Here you can take a trade with some caution. But the entry candle should fall below the 50% level of the previous candle in the first 30 seconds. Because the trade candle can also reverse from the high of the wick of the previous candle, it is necessary to have the head of the continuation candle. Downtrend Evening Star do not trade up here Gap-Up Opening common level of the market Gap-Down Opening Morning Star NOTE: Here usually the buyers did not need to gap-up because the buyers had already broken the common level with the gapdown candle. But if the gap-up is above the key level of the evening star, then we can consider an up trade here. But the gapup is below the key level of the evening star and there is also a downtrend, so a red candle can also be formed here and the trend is down anyway, so we do not go for the up. Sellers Position Trade Candle Common Level Common Level Uptrend NOTE: reasons to trade here ( 1 ) is an uptrend. ( 2 ) The previous candle has formed an engulfing pattern. (3) Sellers position is also far away. With this type of thinking, you can take a trade here. NOTE: The next candle may reverse if there is a breakout of sellers' positions. NOTE: After the buyers position breakout, if the reversal candle closes inside the buyers position, then buyers can come again. Buyers Position NOTE: Buyers can come in this candle because after the breakout of the buyers position, the buyers have closed the next candle above the buyers position. So it means that the buyers have been able to cover their positions. That's why buyers can come again in the next candle to save their positions. And the sellers will again have to exert more power to break the buyers position. NOTE: But if the buyers are not able to close the reversal candle above the buyers position then the next candle is likely to be red.