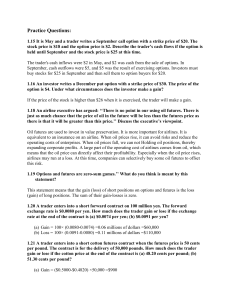

1. What is a derivative? A derivative is an agreement to enter into a future transaction. Its value depends on (or derives from) other more basic variables. 2. Explain the two main ways that derivatives trade? Derivatives trade on exchanges and in the over-the-counter (OTC) market) 3. What are the changes that have taken place in the regulation of the OTC market since the 2008 financial crisis? Standardized derivatives between two financial institutions trade on swap execution facilities and are cleared through central counterparties. All trades must be reported to a central repository. 4. Which is bigger, the exchange-traded market or the OTC market? The OTC market is much bigger. 5. What is the difference between a long forward position and a short forward position? In a long forward, the trader is agreeing to buy an asset for a certain price at a certain future time. In a short forward, contract the trader is agreeing to sell an asset for a certain price at a certain future time. 6. How do (a) forward and (b) futures contracts trade? Forward contracts trade in the over-the-counter market. Futures contracts trade on exchanges. 7. Explain carefully the difference between hedging, speculation, and arbitrage. Hedging involves reducing an existing risk. Speculation involves having a view on the market and taking a risk. Arbitrage involves locking in a profit by trading in two different markets. 8. Explain why a futures contract can be used for either speculation or hedging. If a trader has an exposure to the price of an asset, a hedge with futures contracts can be used. If the trader will gain when the price decreases and lose when the price increases, a long futures position will hedge the risk. If the trader will lose when the price decreases and gain when the price increases, a short futures position will hedge the risk. Thus, either a long or a short futures position can be entered into for hedging purposes. If the trader has no exposure to the price of the underlying asset, entering into a futures contract is speculation. If the trader takes a long position, there is a gain when the asset’s price increases and a loss when it decreases. If the trader takes a short position, there is a loss when the asset’s price increases and a gain when it decreases. 9. Explain the meaning of bid and ask quotes. Bid is the price at which a market maker is prepared to buy. Ask is the price at which the market maker is prepared to sell. 10. List the differences between forward and futures contracts. (see class slides) 11. Which of the following is the best example of a derivative? A. A global equity mutual fund B. A non-callable government bond C. A contract to purchase Apple Computer at a fixed price 12. Which of the following is not a characteristic of a derivative? A. An underlying B. A low degree of leverage C. Two parties—a buyer and a seller 13. Which of the following statements about derivatives is not true? A. They are created in the spot market. B. They are used in the practice of risk management. C. They take their values from the value of something else. 14. Which of the following characteristics is not associated with exchange-traded derivatives? A. Margin or performance bonds are required. B. The exchange guarantees all payments in the event of default. C. All terms except the price are customized to the parties’ individual needs. 15. Which of the following characteristics is associated with over-the-counter derivatives? A. Trading occurs in a central location. B. They are more regulated than exchange-listed derivatives. C. They are less transparent than exchange-listed derivatives. 16. Market makers earn a profit in both exchange and over-the-counter derivatives markets by: A. Charging a commission on each trade. B. A combination of commissions and markups. C. Buying at one price, selling at a higher price, and hedging any risk. 17. Which of the following statements most accurately describes exchange-traded derivatives relative to over-the-counter derivatives? Exchange-traded derivatives are more likely to have: A. Greater credit risk. B. Standardized contract terms. C. Greater risk management uses. 18. Which of the following characterizes forward contracts but not futures? A. They are customized. B. They are subject to daily price limits. C. Their payoffs are received on a daily basis. 19. Which of the following occurs in the daily settlement of futures contracts? A. Initial margin deposits are refunded to the two parties. B. Gains and losses are reported to other market participants. C. Losses are charged to one party and gains credited to the other. 20. An investor enters into a short forward contract to sell 100,000 British pounds for U.S. dollars at an exchange rate of 1.3000 USD per pound. How much does the investor gain or lose if the exchange rate at the end of the contract is (a) 1.2900 and (b) 1.3200? a) The investor is obligated to sell pounds for 1.3000 when they are worth 1.2900. The gain is (1.3000−1.2900) ×100,000 = $1,000. b) The investor is obligated to sell pounds for 1.3000 when they are worth 1.3200. The loss is (1.3200−1.3000)×100,000 = $2,000 21. A trader enters into a short cotton futures contract when the futures price is 50 cents per pound. The contract is for the delivery of 50,000 pounds. How much does the trader gain or lose if the cotton price at the end of the contract is (a) 48.20 cents per pound and (b) 51.30 cents per pound? a) The trader sells for 50 cents per pound something that is worth 48.20 cents per pound. Gain = ($05000 - $04820) * 50000 = $900 b) The trader sells for 50 cents per pound something that is worth 51.30 cents per pound. Loss = ($05130- $05000) * 50000 = $650 22. A U.S. company expects to have to pay 1 million Canadian dollars in 6 months. Explain how the exchange rate risk can be hedged using a forward contract The company could enter into a long forward contract to buy 1 million Canadian dollars in six months. This would have the effect of locking in an exchange rate equal to the current forward exchange rate. 23. A trader enters into a short forward contract on 100 million yen. The forward exchange rate is $0.0090 per yen. How much does the trader gain or lose if the exchange rate at the end of the contract is (a) $0.0084 per yen and (b) $0.0101 per yen? a) The trader sells 100 million yen for $0.0090 per yen when the exchange rate is $0.0084 per yen. The gain is 100 * 0.0006 millions of dollars or $60,000. b) The trader sells 100 million yen for $0.0090 per yen when the exchange rate is $0.0101 per yen. The loss is 100 * 0.0011 millions of dollars or $110,000. 24. The CME Group offers a futures contract on long-term Treasury bonds. Characterize the traders likely to use this contract. Most investors will use the contract because they want to do one of the following: a) Hedge an exposure to long-term interest rates. b) Speculate on the future direction of long-term interest rates. c) Arbitrage between the spot and futures markets for Treasury bonds. 25. What is arbitrage? Explain the arbitrage opportunity when the price of a dually listed mining company stock is $50 (USD) on the New York Stock Exchange and $60 (CAD) on the Toronto Stock Exchange. Assume that the exchange rate is such that 1 U.S. dollar equals 1.21 Canadian dollars. Explain what is likely to happen to prices as traders take advantage of this opportunity. Arbitrage involves carrying out two or more different trades to lock in a profit. In this case, traders can buy shares on the TSX and sell them on the NYSE to lock in a USD profit of 50- (60/1.21) =0.4132 per share. As they do this, the NYSE price will fall and the TSX price will rise so that the arbitrage opportunity disappears.