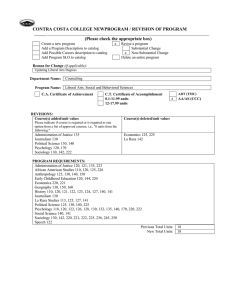

02-648-2018-1 SAROH INVESTMENT ADVISORY It was Fall of 2018 when Abbas Raza, CEO of Saroh Investment Advisory was reviewing some files for the annual meeting with his team on investment planning. He had been contemplating on what advice each of the team members should receive, as they had unique challenges and the advice and solutions had to be customized. It was not a matter of dishing out standard advice, which had unfortunately become part of the advisory landscape in Pakistan. The clients had to be advised with a deeper understanding of their financial security, risk appetite, investment horizon and personal preferences. Raza had established SAROH Investment Advisory in January, 2017, with the stated goal of providing customized and comprehensive investment advisory services. In Pakistan, till now investment advisory was a limited business focused primarily on three categories only: the first and the oldest was the real estate broker, who advised clients on the viability of real-estate deals; the stockbroker came under the second category and advised clients about potential investments in stocks and bonds, and the third and latest category comprised financial institutions and insurance companies which focused on fund management catering to various investment needs of clients. Investment advisory services, a rarity in Pakistan, were focused on needs of individual investors, and advising them on a choice of investing using various available products. The clients were usually high net-worth individuals who sought advice on how to build a portfolio of assets to cater for their long term plans. However, services focusing on middle and upper-middle income groups were almost non-existent. Financially savvy people usually helped their friends and family with such advice. Raza’s motivation for starting the investment advisory service was based on feedback from his family and friends, who had been complaining that all financial institutions were purely pushing their products, without any regard for individual needs. This situation was typically caused because the financial institutions had incentivized their teams to sell investment products with the sole objective of increasing customer numbers, often without detailed financial planning tailored to client needs. Low financial literacy in the country and bombardment of advertisements resulted in people with spare funds sometimes succumbing to persistent sales agents. Raza felt the need for an investment advisory service with a vision which s concentrated primarily on the needs of the clients and helping them find appropriate financial products. New clients usually came to Raza having heard of his services from someone they knew. As a rule, all new clients spent their first session defining their financial objectives. In Raza’s view, this was the most important meeting and a unique idea which he provided. In the first meeting he wouldn’t discuss any products, but try to understand what kind of financial goals the customer was thinking about. Raza would also discuss the capacity and timings of future investments the clients could make and any constraints or obligations on such investments. Once the financial needs and future cash flow constraints were identified, Raza and his team would try to devise the most appropriate investment scheme for his clients. They would usually have more than one option for the clients to consider and finalize. Sometimes, the clients would request Raza to manage the funds for them in exchange for a small fee. This case was written by Dr Omair Haroon and Dr Syed Aun Raza Rizvi at the Lahore University of Management Sciences to serve as basis for class discussion rather than to illustrate either effective or ineffective handling of an administrative situation. This material may not be quoted, photocopied or reproduced in any form without the prior written consent of the Lahore University of Management Sciences. © 2018 Suleman Dawood School of Business, Lahore University of Management Sciences Saroh Investment Advisory 02-648-2018-1 The clients would usually look at a wide range of investments, namely: stocks, bonds, modarba (Islamic equity funds) certificates, National Savings Schemes, mutual funds, real estate investments, etc. This list would gradually be narrowed down to suit the needs and inclinations of the clients. In the coming week, Raza had three meetings scheduled with clients he had already met once, and had jotted notes on their needs and financial objectives. He began reviewing his notes to come up with sound solutions for his clients. The Syed Family Mr. Syed had recently called Raza and talked about how one of his neighbors was making good money investing in Pakistan Stock Exchange. He was wondering if this could be a good avenue of investment for accumulating his children’s education fund. Raza then met Mr. and Mrs. Syed, both government employees, whose major concern was to provide quality education to their 3 kids, aged seven, five and two. With the rising trend of private sector education systems, the couple was concerned about the immense costs attached with quality. Raza and Mr. and Mrs. Syed concluded that they should consider private schools for A-levels before they choose a suitable private university. Generally they expected their kids to start A-levels at the age of 16, followed by four years of university for an undergraduate degree. After doing a survey of schools in their vicinity, and calculating an annual increase of around 5% in fees, they estimated that A-levels expenses for their two older kids would be PKR 500,000 per year, and 4 years of university would cost PKR 1,000,000 per year; whereas for the youngest child, the costs would be 10% higher. Mr. and Mrs. Syed knew that with their limited source of income, they would need to initiate a savings plan very soon. They intended to accumulate enough funds by the time the eldest child started A-levels. Raza began contemplating whether Mr. and Mrs. Syed should enter into a savings plan for 8 years for all 3 kids together, or a staggered plan for each child. A staggered plan would involve starting investments and accumulating funds for each child separately. Such plans can reduce the burden of cash outflows in the early years but would continue for a longer term until the needs for the youngest kid’s education started. Raza had talked to a bank about their saving plans and they had offered an interest rate of 8% on savings plans specifically designed for such purposes. Dr. Fahad Mehmood Dr. Fahad Mehmood, a 32-year old was working at a leading private university in the country. While he enjoyed his job, he was concerned about his post-retirement life since his private sector job did not offer housing or pension benefits. After much contemplation, he had approached Raza, a couple of weeks ago, for guidance on how to manage his finances. Dr. Fahad had always wished for early retirement in order to be able to spend some quality time with his family. He had recently inherited a small fortune, and his dream of retiring early seemed more achievable now. He planned to invest his money in relatively safe assets, so as to be able to have enough funds for a comfortable retirement. He was intrigued by his some of his friends boasting about fantastic returns they had recently made by investing in stocks. He was wondering how much of his fortune he should save and how much could be invested in suitable assets. In this regard, he had informed Raza during their meeting that he had ideally planned to work till the age of 50. Following retirement, he wanted to build a house in Rawalpindi, for which he has already made a down payment in Bahria Town worth PKR 5 million for 2 plots of 500 square yards each. He had to pay another PKR 8 million over the next 5 years in equal installments, and expected the construction of his house to cost around PKR 30 million at that time. Upon his retirement, he planned to sell 500 square yards of his land for PKR 15 million, and use the proceeds towards funding construction of his house. Dr. Fahad had recently come across advertisements for increased profit rates offered through Behbood Certificates. 2 Saroh Investment Advisory Figure 1: 02-648-2018-1 Increase in the Profit Rates of National Savings Schemes Source: National Savings, Twitter post, September 5th, 2018, 4:55 p.m., https://twitter.com/savingsgovpk/status/1037308280979300353, accessed October 2018 With no pensionable job, Dr. Fahad was considering investment in the National Savings Scheme’s Behbood Saving Certificate for meeting his living expenses after retirement. These certificates paid monthly profits in perpetuity. Fahad estimated his monthly expense would be around PKR450,000. He was also going to receive Rs.300,000 per month as his share of profit from a family business. Raza had calculated that using several investment options for Fahad, the relevant discount rate would be 10%. Kamran Ali Kamran Ali, a famous surgeon in Lahore, volunteered quite a bit at charity hospitals in low income neighbourhoods of the city. However, he had started feeling disillusioned with these charity hospitals, and wanted to establish a model trust hospital. After discussing the idea with some of his friends from medical school, he planned to establish his trust hospital project within five years. On the advice of one of his childhood friends, Kamran approached Raza to discuss financial planning for his dream project. Kamran had appraised Raza in the previous meeting that he and his friends estimated the hospital would start with a 2 room outdoor patients' service. This would cost PKR 20 million for construction, and the land would be donated by Kamran. In addition to that, it would cost PKR 1 million per annum to maintain the outdoor centre. After two years, the hospital was to be expanded to include a surgical ward, which would cost another PKR50 million for building and equipment, and an additional PKR 5 million per annum for running expenses. Kamran and his friends had decided to set up a foundation to support this project for 10 years and wanted to start a fundraising campaign. Raza opined that these funds should be invested in fixed income generating products which would generate a 9% discount rate. 3