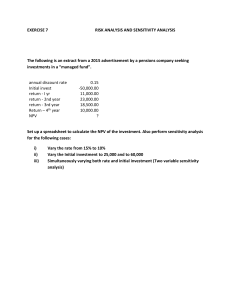

DS235 INTRODUCTION TO DECISION SCIENCE LUIZ BRANDAO Visiting Associate Professor, The University of Texas at Austin AGENDA • Instructor and TA introductions • Course overview • Key policies and procedures • Excel modeling and DADM software • Eldorado Wind Farm example • Sensitivity analysis • Class exercise: Data tables in Excel • Homework Assignment LUIZ BRANDAO • BS, Civil Engineer, PUC-Rio, Brazil • MSc. Civil Engineering, Stanford University • MBA, Stanford Graduate School of Business • PhD Industrial Engineering, PUC-Rio • Visiting Scholar, McCombs, UT Austin (2001-2004) • Associate Professor, PUC-Rio (2005 - ) • Visiting Associate Professor, UT Austin (2021-2023) • IAG Business School of PUC-Rio - (https://iag.puc-rio.br/en/home_en/) • Graders: Darren Huang, Mark Hatanpaa and Sia Shah • Support: Gregory Molina, Jeffery Tran, Luke Morgan 3 SOFTWARE • There are many software packages that help analyze data. • DADM_Tools Add-In • This Excel add-in tool implements decision trees and simulation, as well as forecasting and several basic data analysis tools. • While less powerful than the Palisade software, which may not be available in your place of employment, this add-in is freely available • Palisade DecisionTools Suite: • @RISK, that can run multiple replications of a spreadsheet simulation and perform sensitivity analysis • PrecisionTree, used to built decision tree models used to analyze decisions with uncertainty. COURSE TOPICS Risk Analysis • Measuring and modeling uncertainty • Sensitivity analysis over model inputs • Many uncertainties • Few decisions up-front Decision Trees • Supports the decisionmaking process • Decisions and uuncertainties • Sequential events • Future decisions Optimization • Problems where there is no uncertainty • Many decisions • Many potential solutions • Which is the best one? COURSE TOPICS Risk Analysis Decision Trees ▪ Sensitivity Analysis ▪ Decision Trees ▪ Monte Carlo Simulation ▪ Value of Information and Correlated Inputs ▪ Multi-period Models ▪ Optimization with Excel Solver ▪ Applications in Control ▪ Monte Carlo with Optimization ▪ Bayes´s Rule ▪ Valuing Options Operations & Finance ▪ Integer Programming ▪ Nonlinear programming EXCEL DADM Structuring Decision Problems Solver INTRODUCTION • Living in the age of technology has implications for everyone entering the business world. • Technology makes it possible to collect large amounts of data. • Ex: Google, Facebook, Youtube, Netflix, Online shopping, IOT • Technology has given people and firms the power to analyze data and use it to make corporate decisions. • A large amount of data already exists and will only increase in the future. • This has led to the development of business analytics, also known as data analytics or Big Data. BETTER DECISIONS WITH DATA • Business Analytics involves the analysis of data to help solve business problems and make better decisions. • By using quantitative methods to uncover the information in these data sets and then acting on this information—again guided by quantitative analysis—companies are able to gain a competitive advantage. • The goal of this course is to teach you how to use a variety of quantitative methods to analyze data and make decisions in a very hands-on way. KEY POLICIES AND PROCEDURES • Attendance: you are expected to attend class in person unless excused for extenuating circumstances • Bring your laptop to class • 9 Homeworks, can drop 2. To be submitted to Canvas. Homework will be released on Thursdays at 4PM and must be submitted by Monday 10AM • 3 group case studies. Each group member must submit a Powerpoint and a Spreadsheet to Canvas • 3 in-class exams, one for each section of the course • Re-grading requests: you have 7 days from the date an assignment is returned (grades/answers posted) to request a review and potential regrade KEY POLICIES AND PROCEDURES • No classes or homework assignments on exam week. • Group Chat: there is only one group chat allowed for this course – a GroupMe has been created and managed by the TA’s • Contact the TA’s using the course email ds235brandao@utexas.edu RISK ANALYSIS WHY DO PROJECTS FAIL? FAILED PROJECTS 65% of megaprojects with investment over 1 billion USD failed to deliver the expected returns*. Some examples: • Ford Edsel (1957) • Crescent Dune Solar (2010) • Sony Betamax (1975) • Google Glass (2013) • DeLorean DMC-12 (1981) • Chevron Gorgon Project (2014) • New Coke (1985) • Amazon Fire Phone (2015) • Motorola Iridium (1992) • Galaxy Note 7 (2016) • Apple Newton (1993) • Boeing 737 Max (2020) • Denver Airport (1995) • Brandenburg Airport Berlin (2021) • Segway (2001) • California High Speed Rail (2022) * Why projects fail (http://calleam.com/WTPF/) “The revolutionary idea that defines the boundary between modern times and the past is the mastery of risk: the notion that the future is more than a whim of the gods and that men and women are not passive about nature. Until human beings discovered a way across that boundary, the future was the murky domain of oracles and soothsayers who held a monopoly over knowledge of anticipated events. Like Prometheus, they defied the gods and probed the darkness in search of the light that converted the future from an enemy into an opportunity.”* *Against the Gods: The remarkable story of risk. Peter Bernstein, John Wiley & Sons, Inc., NY, 1996 King of Troy and his staff planning for the upcoming battle with the Greeks: “I spoke with two farmers today. They saw an eagle flying with a serpent clutched in its talons. This is a sign from Apollo.” “We will win a great victory tomorrow. Troy is the eagle. The Greeks are the serpent” Archeptolemus, High Priest of Troy. “Bird signs! You want to plan our strategy based on bird signs?” Hector, Prince of Troy. SPREADSHEETS • Business analytics tools can are easily modeled in an Excel spreadsheet. • The goal of this section is to get you “up to speed” in using Excel effectively for the rest of the course. • Most spreadsheet models involve inputs, decision variables, and outputs. • The inputs have given fixed values, at least for the purposes of the model. • The decision variables are those a decision maker controls. • The outputs are the ultimate values of interest; they are determined by the inputs and the decision variables. SPREADSHEETS • Spreadsheet modeling is the process of entering the inputs and decision variables into a spreadsheet and then relating them appropriately, by means of formulas, to obtain the outputs. • After this you may • Perform a sensitivity analysis, • Run a simulation model • Maximize or minimize a particular output, • Create charts to show how certain parameters are related. • Care should be taken when building spreadsheets, as errors are easy to make. UK COVID RESULTS LOST IN EXCEL In 2020 the UK government lost track of 16,000 coronavirus cases due to an error in Excel. In order to do contact tracing, test results submitted by commercial firms to discover who has the virus were put in Excel before being uploaded to a central system. The problem is that they used an old file format to do this, known as XLS. As a consequence, each template could handle only about 65,000 rows of data rather than the one million-plus rows that Excel is actually capable of. Whenever that total was reached, additional cases were simply left off. ENRON SPREADSHEET ANALYSIS Felienne Hermans and Emerson Murphy Hill analyzed over 15,000 spreadsheets extracted from the Enron Email Archive. These spreadsheets were used within the Enron Corporation. Their analysis showed that 24% of Enron spreadsheets had at least one formula with an Excel error. Hermans, Felienne (2015): Enron. figshare. Journal contribution. https://doi.org/10.6084/m9.figshare.1222882.v2 European Spreadsheet Risk Interest Group http://www.eusprig.org/horror-stories.htm TWO PHASES OF ANALYSIS Phase I • Analyst tries to envision the possible outcomes from an investment • Analyst prepares estimates and forecast • Analysis forms the basis for estimating an expected value for the investment along with NPV, IRR, and other measures of investment worth Phase II • Analyst details underlying sources of risk • Identify value drivers and uncertainty • Determines probability distribution of uncertainties analysis • Analyst seeks ways to mitigate risks and monitors throughout the life of the project • Sensitivity of value to risks THE ELDORADO WIND FARM ELDORADO WIND FARM • You are analyzing an opportunity to invest in the Eldorado wind farm in West Texas. • The unit will have a capacity of 40MW and a life of ten years and cost $50M to build • Your estimate that the electricity prices will average $100/MWh, fixed costs will be $2.5 million per year, variable costs of energy generation will be $8/MWh, and the load factor, which is the efficiency of the wind turbine relative to its capacity, to be 45%. • The expected tax rate is 25% and the discount rate is 10% • You develop a spreadsheet with this data and determine the NPV and the IRR. PHASE I - EXPECTED NPV Inputs Discount rate Hours of operation Installed capacity 10% per year 8.760 per year 40 MW Load Factor Generation costs Fixed costs Electricity price Taxes Capital investment 45% $8 $2.500 $100 25% $50 per MWh $M/yr per MWh ($MM) Model Year Annual Capacity (MWh) 0 Load Factor Annual Generation (MWh) Eletricity price 1 2 3 4 5 6 7 8 9 10 350.400 350.400 350.400 350.400 350.400 350.400 350.400 350.400 350.400 350.400 45% 45% 45% 45% 45% 45% 45% 45% 45% 157.680 157.680 157.680 157.680 157.680 157.680 157.680 157.680 157.680 100 100 100 100 100 100 100 100 100 45% 157.680 100 Values $1,000 Revenues Generation costs Fixed costs Profit Taxes Capital investment Project Cash Flows -50.000 -50.000 15.768 -1.261 -2.500 12.007 -3.002 15.768 -1.261 -2.500 12.007 -3.002 15.768 -1.261 -2.500 12.007 -3.002 15.768 -1.261 -2.500 12.007 -3.002 15.768 -1.261 -2.500 12.007 -3.002 15.768 -1.261 -2.500 12.007 -3.002 15.768 -1.261 -2.500 12.007 -3.002 15.768 -1.261 -2.500 12.007 -3.002 15.768 -1.261 -2.500 12.007 -3.002 15.768 -1.261 -2.500 12.007 -3.002 9.005 9.005 9.005 9.005 9.005 9.005 9.005 9.005 9.005 9.005 Result NPV $5.331 $MM IRR 12,4% RISK ANALYSIS • Phase I is complete: We have an NPV estimate of the Eldorado Wind Farm investment • How confident can we be that the project will unfold as we expect? • What are the key value drivers of the project that the firm should monitor over the life of the investment to ensure its success? • For Phase II we use a variety of tools to address these concerns • Scenario analysis • Sensitivity analysis • Simulation analysis MODELING UNCERTAINTY Variable Min Most Likely Max Unit Load Factor 40% 45% 50% % Electricity Price $60 $100 $140 $/MWh Variable Min Max Unit Taxes Fixed costs 20% $2,400 30% $2,600 % $M/ano Variable Value1 Value2 Value3 Unit $7 $8 $9 $/MWh 30% 40% 30% Prob Mean Std Deviation Unit $50 $5 $MM Generation costs Variable Capital Investment SCENARIO ANALYSIS • What would happen to the Eldorado project NPV if we applied a pessimistic estimate of electricity price of $60? • NPV value drops to -$23.7 million • Negative NPV investment • We could also analyze scenarios involving multiple sets of changes in assumptions and forecasts. • Evaluate the project using optimistic and pessimistic estimates for the value drivers SENSITIVITY ANALYSIS IN EXCEL • Changes in 1 or 2 Value Drivers? • Use Data Tables • Changes in multiple Value Drives • Use Scenario Manager DATA TABLES Price 140 130 120 110 100 90 80 70 60 5.331 Link to calculated NPV RESULTS OF DATA TABLE Price 140 130 120 110 100 90 80 70 60 NPV 5.331 34.398 27.131 19.864 12.598 5.331 -1.935 -9.202 -16.468 -23.735 NPV 40.000 30.000 20.000 10.000 0 ‐10.000 ‐20.000 ‐30.000 140 130 120 110 100 90 80 70 60 TWO-WAY DATA TABLE $5.331 140 130 120 110 100 Price 90 80 70 60 Load Factor 40% 43% 45% 48% 50% TWO-WAY DATA TABLE $5.331 140 130 120 110 100 Price 90 80 70 60 40% 23.740 17.281 10.822 4.362 -2.097 -8.556 -15.015 -21.474 -27.933 Load Factor 43% 29.069 22.206 15.343 8.480 1.617 -5.246 -12.108 -18.971 -25.834 45% 34.398 27.131 19.864 12.598 5.331 -1.935 -9.202 -16.468 -23.735 48% 39.726 32.056 24.386 16.716 9.045 1.375 -6.295 -13.965 -21.636 50% 45.055 36.981 28.907 20.833 12.759 4.685 -3.389 -11.463 -19.536 TWO-WAY DATA TABLE $5.331 140 130 120 110 100 Price 90 80 70 60 40% 23.740 17.281 10.822 4.362 -2.097 -8.556 -15.015 -21.474 -27.933 Load Factor 43% 29.069 22.206 15.343 8.480 1.617 -5.246 -12.108 -18.971 -25.834 45% 34.398 27.131 19.864 12.598 5.331 -1.935 -9.202 -16.468 -23.735 48% 39.726 32.056 24.386 16.716 9.045 1.375 -6.295 -13.965 -21.636 50% 45.055 36.981 28.907 20.833 12.759 4.685 -3.389 -11.463 -19.536 SENSITIVITY ANALYSIS • Sensitivity analysis provides us the possible outcomes for a particular range of values of a variable • On the other hand, it assumes the other variables remain static and provides no information on the probability of each outcome occurring. • For this, we need to use another tool, known as Monte Carlo Simulation • Unlike sensitivity analysis, Simulation considers the impact of changes of all variables simultaneously TIME VALUE OF MONEY • In the Eldorado project, the net result was measured as the project NPV • But what is a NPV? • NPV is the value of the sum of all project free cash flows taking into account the time that they occur • It is used as an indication of the amount of money a project will contribute to the firm net of taxes after all operational and capital costs are taken into account • Basically, if a project earns a positive NPV it should be accepted. TIME VALUE OF MONEY • Most business investment decisions are based on the net result of the forecasted investment costs and expected future revenues • But money earned in the future is less valuable than money earned today, since money earned today can be invested to earn interest. • Similarly, costs incurred in the future are less “costly” than costs incurred today. • This is why revenues and costs cannot be simply summed up in a multiperiod model. • You instead discount future revenues and costs for a fair comparison with revenues and costs incurred today. • The sum of these discounted cash flows is known as the Net Present Value (NPV) is the cornerstone of much of financial theory TIME VALUE OF MONEY • NPV • The NPV function takes two arguments, the discount rate (entered as a decimal, such as 0.075 for 7.5%) and a stream of cash flows. • These cash flows are assumed to occur in consecutive years, starting at the end of year 1. • If there is an initial cash flow at the beginning of year 1, such as an initial investment, it must be entered outside the NPV function. • Decision Criteria with NPV • NPV calculations are typically used to decide whether a project should be undertaken. • If the NPV is positive, the project is worth pursuing. • If the NPV is negative, the company should look for other places to invest its money DS235 INTRODUCTION TO DECISION SCIENCE LUIZ BRANDAO Visiting Associate Professor, The University of Texas at Austin