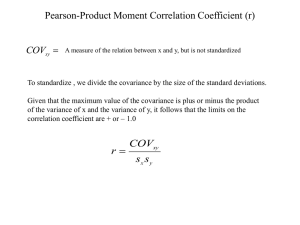

SAMPLE UNIVERSITY COLLEGE OF THE CARIBBEAN A Member of the Commonwealth & OAS Consortia of Universities School of Business & Management Department of Professional Studies Bachelor of Science Degree in Business Administration End of Module Examination FALL SPRING SUMMER CENTRE : WORTHINGTON AVENUE MODULE : FINANCIAL MARKETS AND ANALYSIS [FIN303] DATE : DECEMBER 15, 2014 TIME : 2:00 PM DURATION : 3 Hours INSTRUCTIONS: 1. 2. 3. 4. 5. 6. 7. 8. 9. Please read all instructions carefully before attempting any question. This paper consists of EIGHT (8) printed pages and two (2) Sections A & B Answer all of Section A and any TWO (2) questions from Section B. The total marks for this Paper is 60 percent. All questions must be answered in the answer booklet provided Please ensure that you number your questions correctly. Clearly write the number of the question on each of the relevant pages. Where questions have multiple parts, all parts must be answered. Start the response to each question on a new page. Write your REGISTRATION NUMBER clearly on each page of your answer booklet. DO NOT WRITE YOUR NAME. NB. Your script will not be marked if it has your name. DO NOT TURN OVER UNTIL YOU ARE TOLD TO DO SO 1 SAMPLE Section A- Multiple Choice Questions- 1 Mark each (40%) MULTIPLE CHOICE QUESTIONS REMOVED. Section B (Answer any two (2) questions-30% each) 1. Describe the term investment and discuss the principal types of investment vehicles that exist, also show how the steps in the investment process works and the different types of investors, with reference to the investing life cycle in different economic environments. (30 Marks) 2. Identify the basic types of securities markets and describe the IPO process in relation to the stock market, also explain the characteristics of broker markets, dealer markets, alternative trading systems, and the general conditions of stock market markets. What are the difference with the Junior Stock Market and the Main Stock Market. (30 Marks) 3. Discuss the key sources of risk and the concept of return that might affect potential investment vehicles, eg. Bonds and dipicting the risk of a single asset, risk assessment, and the steps that combine return and risk. How does the role of time value of money measures return with defining a satisfactory investment. (30 Marks) END OF QUESTION PAPER 2 SAMPLE IMPORTANT EQUATIONS 1) Expected Portfolio Return E(RPortfolio ) = w1 E(R1) + w2E(R2) 2) Investment Variance and Standard Deviation Variance= σ ²investment =∑[Ri –E(Ri)] ²Pi COVxy ²investment =√ σ ²investment 3) Calculating Covariance (for a sample) COVxy = ∑ [Rx –E(Rx)] [Ry –E(Ry)] n-1 4) Calculating Correlation and Covariance rxy = COVxy σxσx COVxy = rxy σ x σ x 5) Calculating Variance and Standard Deviation for a Two-Asset Portfolio Variance= σ ²p = w1² σ 1² + w2² σ 2² +2 w1w2 COV1,2 Variance= σ ²p = w1² σ 1² + w2² σ 2² +2 w1w2 r1,2 σ 1 σ 2 Standard Deviation = σp =√ σ ²p 6) Security Market Line (SML) E(Ri ) = RF + βi (RM – RF) βP = w1β1 + w2β2 + w3β3 7) βI = COVi σ ²M 10) P = __K___ E1 rCE – gE 8) priceB = DIV 1 RB - gdiv 9) Return = V end - V begin - INT 11) rf = rff + E (Infl) 12) r ERP = r CE - r ff VBegin – VBorrowing 13) Current Yield = Dn Pn 3