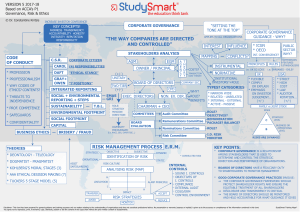

CHAPTER 1 Corporation: A mechanism that allows multiple parties to contribute to and exchange capital, labour, and expertise for mutual benefit. Types of corporations: Sole proprietorship Partnerships Benefits of Sole Proprietorship: Benefits of Partnerships: - Simplicity - Shared Decision-Making - Full Control - Access to Capital and Resources - Direct Taxation - Shared Workload - Flexibility - Tax Benefits - Minimal Start-up Costs - Diverse Skills and Expertise - Privacy - Easier Business Formation Disadvantages of Sole Proprietorship: Disadvantages of Partnerships: - Unlimited Liability - Unlimited Liability - Limited Resources - Disagreements and Conflict - Limited Expertise - Shared Profits - Limited Growth Potential - Shared Control - Dependency - Potential for Partner Mismanagement - Difficulty in Raising Capital - Limited Life of the Partnership - Lack of Continuity - Limited Tax Benefits - Competitive Disadvantages Public vs Private partnerships Characteristics of public corporations: o Limited liability for investors o Transferability of investor ownership Through the trading of shares of stock on exchanges o Legal personality Has legal rights and obligations? o Separation of legal ownership and management control Public corporations Advantages Disadvantages Access to Public Capital Markets Regulatory Compliance Costs Greater Liquidity for Shares Shareholder Activism Enhanced Visibility and Prestige Loss of Control Potential for Higher Valuation Reporting Requirements Easier to Attract Top Talent Short-Term Focus Acquisition Currency Competitive Scrutiny Private corporations: Advantages Disadvantages More Control Limited Access to Capital Less Regulatory Compliance Limited Liquidity for Shares Greater Privacy Difficulty Attracting Investors Long-Term Focus Limited Exit Options Flexible Decision-Making Less Visibility and Prestige Lower Reporting Requirements Limited Ability for Employee Stock-Based Compensation Top of Form Separation of ownership and control: Historically, firms managed by founder-owners & descendants. Small firms’ managers own large share of stock, which implies little separation between ownership and management control. What issues do these firms face? o As they grow, they may not have access to all needed skills to manage the growing firm and maximize its returns, so may need outsiders to improve management. o May need to seek outside capital (whereby they give up some ownership control) The thousands, or more, investors who own public corporations could not collectively make the daily decisions needed to operate a business. Therefore: o The shareholders elect directors to act as their agents in supervising the firm o The directors appoint officers (or executives) to actually run the firm on a day-to-day basis. Problems arise in corporations because the agents (top management) are not willing to bear responsibility for their decisions unless they own a substantial amount of stock in the corporation. “The directors of such companies, however, being the managers rather of other people's money than of their own, it cannot well be expected that they should watch over it with the same anxious vigilance with which the partners in a private copartnery frequently watch over their own.” Adam Smith, The Wealth of Nations 1776 No one spends other people’s money as carefully as they spend their own. Milton Friedman Principal-Agent problem Conflict of interests between principal and agent Lack of trust on the good faith of agents Different objectives: Shareholders: Increase value of the firm Managers: Own utility, e.g., nice offices, luxury car, empire building, avoid unpopular decisions, etc. Agency costs: Monitoring the activities of agents is costly - hence, full monitoring is not optimal. The value forgone due to imperfect optimal monitoring is an explicit agency cost. Both caused by information asymmetry. Agents are generally better informed than the principals. Adverse Selection Increases the likelihood of selecting inferior alternatives. Moral Hazard Increases the incentive of one party to take undue risks or shirk other responsibilities. The costs incur to another party. Agency problem examples: 1. Free cash flow - Resources remaining after the company reaches a net present value or a profit with its current business. - Managers: Would like to diversify - Shareholders: Would like to be paid out as dividends for instant cash grab, rather than risking future growth. 2. Diversification - Managers: personal benefits of career growth, more job security (because multiple products), increased compensation, extra hiring of managerial staff diversifying their risks (decreases their chance of managerial reputation) - Managers: risk related to uncertainty of future growth. 3. Building empires – Mergers and Acquisitions - Managers: Similar benefits to diversifications - When mergers happen, stock prices of the bidding firm tends to decline reduce profits for shareholders. Studies also show that if not managed properly (majority of the cases), firms tends to sink and result in reversing of the acquisition. 4. LEARN / UNDERSTAND THE HP model. 5. Refusing to sell - Managers: Often bad because they can’t experience the growth of their personal benefits - Shareholders depends on case-to-case tbh. - Yahoo example: managers plus shareholders but drowned. - Value gets created then destructed. 6. Other Agency costs - Consuming excessive perks - Managers with fixed salary will not put extra effort, shirking. - Hiring friends - Taking no risks or chances to avoid being fired. - Taking excessive risk to earn large bonuses. - Having a short-run horizon if the managers are near retirement. - Managing earnings and self-dealing - “CEO and COO Disappeared, Most of the Company’s Cash Missing.” Ultrasonic. September 12, 2014. Valeant Pharmaceuticals • Once (July 2015) the most valuable company on the TSX, it has been repeatedly embroiled in scandals. • Company was the result of a merger between Canadian company Biovail and US company Valeant in 2010. • Biovail itself was during the litigation with the SEC, having been accused of overstating earnings, hiding losses, and misleading investors. • Valeant hit an all-time stock high of $95.82 in May 2013 after buying Bausch & Lomb for $8.7 billion. • The company is dogged by US prosecutors’ investigations into fraud by the former CEO and CFO, allegations of price fixing, and an executive being arrested and charged for running a fraud and kick-back scheme. Research more about SNC Lavalin or some other company Transparency international ranks perceived corruption ranking -> Canada dropped to 9th to 12th in one year shit high. WeWork • The nine-year old company had $47 billion valuation prior to IPO filing in 2019. The filing included unusual provisions: • High number of senior positions held by family and friends. • Contractor owned by family members-built company office space. • Company paid founder $6 million to purchase the trademark “We.” • The company issued the founder $760 million personal loan, backed by his shares. • Founder had 20 voting rights per share, giving him near-total control. • The company granted founder’s wife sole authority to name his successor. • Following this disclosure, the company reduced IPO price then pulled filing. • WeWork negotiated emergency infusion, valuing the company at $8 billion. • The founder sold a stake for $1.7 billion and left the company. Evidence of self – interested behaviour. 1. Bankruptcy 2. Financial restatements 3. Class action Lawsuits 4. Violations of the foreign corrupt practises act? 5. Massaging / changing earnings -> senior financial executives are highly likening to chance financial reports to hit quarterly forecasts 6. All above leads to severe loss of capital for shareholders and significant loss for creditors Quantifiying agency costs - Dyck, Morse, and Zingales (2013) estimate a 14.5% chance that an average company engages in fraud in a given year and that, when uncovered, fraud costs investors 22% of the firm’s enterprise value. Red Flags: Association of Certified Fraud Examiner: Living beyond one’s means (46% of fraud cases) Financial difficulties (30%) Unusually close association with vendors (20%) Control issues and lack of willingness to share duties (15%) A “wheeler-dealer” attitude (15%) Divorce or family problems (13%), irritability or suspiciousness (12%), and addiction problems (10%). Other red flags include complaints about inadequate pay; previous employment problems; refusal to take vacations; excessive organizational pressure; social isolation; and other financial, legal, or personal stresses Prevention of stealing 1. Legislation - Legal structure (common versus civil law) and financial structure (market versus bank-based) have been shown to be important in protecting investor rights - A functioning legal system that allows shareholders to file lawsuits against directors for breach of fiduciary duty - Enforcement of accounting laws, conflict of interest laws, reporting regulations 2. Securities and company law protection may help, but not enough - The costs of meeting legal requirements often exceed the benefits - Laws always have unintended consequences - In general, laws tend to be blunderbusses that penalize good companies more than they punish the bad companies. 3. You cannot legislate good corporate governance. 4. Corporate Governance supplements the legal framework 5. Corporate governance definition: In short, good corporate governance prevents expropriation of outside investors (controlling & minority shareholders, debt holders, financial markets, employees, customers, supplier, and society at large). Cadbury report: • The Cadbury Report: titled Financial Aspects of Corporate Governance, is a report that sets out recommendations on the arrangement of company boards and accounting systems to lessen corporate governance risks and failures. • The report's recommendations have been adopted in varying degree by the European Union, the United States, the World Bank, and others. Its recommendations: 1. Wider use of independent directors: Encouraged more impartial, non-conflicted directors on corporate boards for effective oversight. 2. Introduction of audit committee: Called for the creation of a committee to oversee financial transparency and internal controls. 3. Separation between Chairman and CEO: Recommended splitting the roles to prevent excessive power concentration. 4. Loyalty to detailed code of best practices: Emphasized adherence to a detailed code for clear governance standards. 5. Protect rights of Shareholders: Ensured shareholders' access to information and voting rights. 6. Recognize the rights of Stakeholders: Acknowledged the importance of considering the interests of employees, customers, suppliers, and the community. 7. Timely and accurate Disclosure: Urged companies to provide transparent and timely information. 8. Responsibility of the Board of directors: Placed the board in charge of implementing and upholding good governance practices. Principals of corporate governance: • Accountability. • Ensure that management is accountable to the Board of Directors. • Ensure that the Board of Directors is accountable to shareholders. • Fairness. • Protect Shareholders rights. • Treat all shareholders including minorities, equitably. • Provide effective redress for violations. • Transparency. • Ensure timely, accurate disclosure on all material matters, including the financial situation, performance, ownership and corporate governance. • Independence. • Independent Directors and Advisers i.e. free from the influence of others. Why is corporate governance important: 1. Better access to external finance: Good corporate governance makes a company more attractive to investors and lenders, increasing its ability to raise funds from external sources. 2. Lower costs of capital – interest rates on loans: Strong governance reduces the perceived risk for lenders, leading to lower interest rates on loans, which can result in significant cost savings for the company. 3. Improved company performance – sustainability: Effective governance encourages long-term planning and sustainability, which can lead to improved overall company performance. 4. Higher firm valuation and share performance: Companies with good governance tend to have higher valuations and better stock performance due to increased investor confidence. 5. Reduced risk of corporate crisis and scandals: Good governance practices help identify and mitigate risks, reducing the likelihood of corporate crises and scandals. 6. Higher valuation of human capital in companies that are well governed: Employees in well-governed companies often enjoy a better working environment, job security, and opportunities for growth, increasing the value of human capital. 7. Avoidance of costly litigation through adherence to laws and regulations: Adhering to laws and regulations, a key aspect of governance, helps companies avoid legal troubles and costly litigation. 8. In general terms, the consequences of the lack of appropriate governance, oversight and supervision is reduced shareholder value, job reductions and reputational damage, along with reduced morale amongst employees and anger amongst users and lawmakers. 9. Promote the efficient use of scarce resources. 10.Promote the trust of investors. 11.Good corporate governance has a positive link to economic development and good corporate performance. 12.Funds will flow to countries which are seen to have internationally accepted standards of corporate governance. 13.Good corporate governance, therefore, becomes a prerequisite for national economic development. Are there best practises in governance? • The New York Stock Exchange rules require a majority of independent directors and an independent audit committee. • Enron was compliant with independence standards, yet collapsed. • In 2002, Sarbanes-Oxley in the U.S. enhanced the penalties for misrepresentations. • Fannie Mae overstated earnings by $6.3 billions and needed government bailout. • In 2010, Dodd-Frank allowed shareholders to “approve” executive pay. • CEO pay grew at twice the rate of inflation over the subsequent decade. • ISS gave HealthSouth a governance rating in the top 8% of its industry. • The next year, HealthSouth officials were charged with fraud. Is there a payoff to better corporate governance? • In the most comprehensive study of the effect of corporate governance on value, a governance index was created for each of 1500 firms based upon 24 distinct corporate governance provisions. • Buying stocks that had the strongest investor protections while simultaneously selling shares with the weakest protections generated an annual excess return of 8.5%. • Every one point increase in the index towards fewer investor protections decreased market value by 8.9% in 1999 • Firms that scored high in investor protections also had higher profits, higher sales growth and made fewer acquisitions. Concluding remarks: • Corporate governance is an important device for controlling self-interested executives. • However, what attributes are required for a company to have good governance? • Governance is a controversial topic. The debate is characterized by considerable opinion but few hard facts. • To get the story straight, we must look at the evidence. Sometimes the evidence is inconclusive. • Still, it is important for investors, directors, and regulators to understand the data so they can make informed decisions.