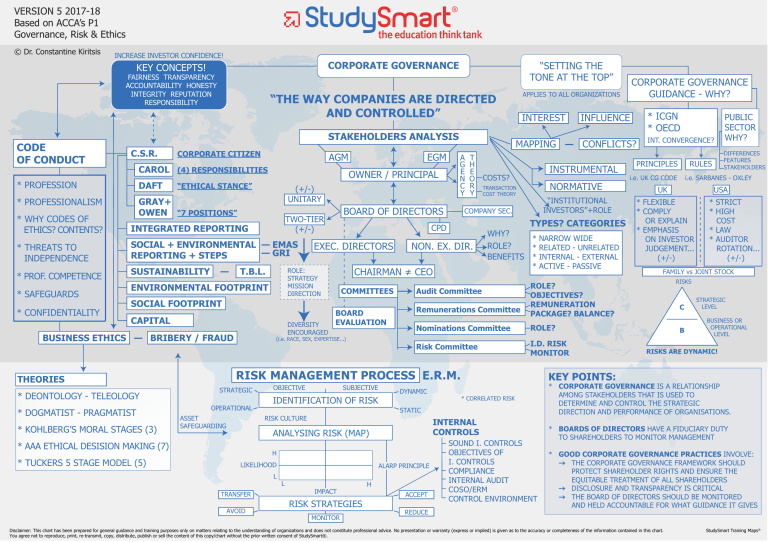

VERSION 5 2017-18 Based on ACCA’s P1 Governance, Risk & Ethics © Dr. Constantine Kiritsis INCREASE INVESTOR CONFIDENCE! CORPORATE GOVERNANCE KEY CONCEPTS! FAIRNESS TRANSPARENCY ACCOUNTABILITY HONESTY INTEGRITY REPUTATION RESPONSIBILITY CODE OF CONDUCT STAKEHOLDERS ANALYSIS C.S.R. CORPORATE CITIZEN AGM CAROL (4) RESPONSIBILITIES DAFT * PROFESSIONALISM GRAY+ OWEN “7 POSITIONS” OWNER / PRINCIPAL “ETHICAL STANCE” (+/-) UNITARY * WHY CODES OF ETHICS? CONTENTS? INTEGRATED REPORTING * THREATS TO INDEPENDENCE SOCIAL + ENVIRONMENTAL — EMAS — GRI REPORTING + STEPS * SAFEGUARDS * CONFIDENTIALITY SUSTAINABILITY — SOCIAL FOOTPRINT CAPITAL DIVERSITY ENCOURAGED * DOGMATIST - PRAGMATIST * KOHLBERG’S MORAL STAGES (3) BOARD EVALUATION (i.e. RACE, SEX, EXPERTISE...) STRATEGIC OPERATIONAL ASSET SAFEGUARDING COSTS? NORMATIVE TRANSACTION COST THEORY “INSTITUTIONAL INVESTORS”+ROLE COMPANY SEC. TYPES? CATEGORIES NON. EX. DIR. WHY? * NARROW WIDE ROLE? * RELATED - UNRELATED BENEFITS * INTERNAL - EXTERNAL * ACTIVE - PASSIVE Audit Committee Remunerations Committee OBJECTIVE SUBJECTIVE ROLE? Risk Committee I.D. RISK MONITOR IDENTIFICATION OF RISK DYNAMIC LIKELIHOOD L TRANSFER AVOID * CORRELATED RISK INTERNAL CONTROLS H ALARP PRINCIPLE L IMPACT RISK STRATEGIES MONITOR H ACCEPT REDUCE PRINCIPLES DIFFERENCES FEATURES STAKEHOLDERS RULES i.e. UK CG CODE PUBLIC SECTOR WHY? i.e. SARBANES - OXLEY UK USA * FLEXIBLE * COMPLY OR EXPLAIN * EMPHASIS ON INVESTOR JUDGEMENT... (+/-) * STRICT * HIGH COST * LAW * AUDITOR ROTATION... (+/-) FAMILY vs JOINT STOCK RISKS C Β STRATEGIC LEVEL BUSINESS OR OPERATIONAL LEVEL RISKS ARE DYNAMIC! KEY POINTS: STATIC ANALYSING RISK (MAP) INT. CONVERGENCE? ROLE? OBJECTIVES? REMUNERATION PACKAGE? BALANCE? Nominations Committee RISK CULTURE * AAA ETHICAL DESISION MAKING (7) * TUCKERS 5 STAGE MODEL (5) COMMITTEES * ICGN * OECD INFLUENCE INSTRUMENTAL RISK MANAGEMENT PROCESS E.R.M. THEORIES * DEONTOLOGY - TELEOLOGY T H E O R Y CHAIRMAN ≠ CEO ROLE: STRATEGY MISSION DIRECTION ENVIRONMENTAL FOOTPRINT A G E N C Y CPD EXEC. DIRECTORS INTEREST MAPPING — CONFLICTS? BOARD OF DIRECTORS TWO-TIER (+/-) T.B.L. BUSINESS ETHICS — BRIBERY / FRAUD EGM CORPORATE GOVERNANCE GUIDANCE - WHY? APPLIES TO ALL ORGANIZATIONS “THE WAY COMPANIES ARE DIRECTED AND CONTROLLED” * PROFESSION * PROF. COMPETENCE “SETTING THE TONE AT THE TOP” SOUND I. CONTROLS OBJECTIVES OF I. CONTROLS COMPLIANCE INTERNAL AUDIT COSO/ERM CONTROL ENVIRONMENT * CORPORATE GOVERNANCE IS A RELATIONSHIP AMONG STAKEHOLDERS THAT IS USED TO DETERMINE AND CONTROL THE STRATEGIC DIRECTION AND PERFORMANCE OF ORGANISATIONS. * BOARDS OF DIRECTORS HAVE A FIDUCIARY DUTY TO SHAREHOLDERS TO MONITOR MANAGEMENT * GOOD CORPORATE GOVERNANCE PRACTICES INVOLVE: THE CORPORATE GOVERNANCE FRAMEWORK SHOULD PROTECT SHAREHOLDER RIGHTS AND ENSURE THE EQUITABLE TREATMENT OF ALL SHAREHOLDERS DISCLOSURE AND TRANSPARENCY IS CRITICAL THE BOARD OF DIRECTORS SHOULD BE MONITORED AND HELD ACCOUNTABLE FOR WHAT GUIDANCE IT GIVES Disclaimer: This chart has been prepared for general guidance and training purposes only on matters relating to the understanding of organizations and does not constitute professional advice. No presentation or warranty (express or implied) is given as to the accuracy or completeness of the information contained in this chart. You agree not to reproduce, print, re-transmit, copy, distribute, publish or sell the content of this copy/chart without the prior written consent of StudySmart®. StudySmart Training Maps®