Sample Narrative Appraisal Report - Christjohn King Delos Santos

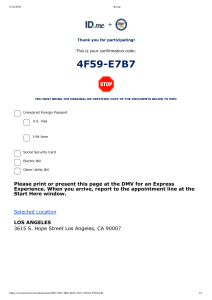

advertisement