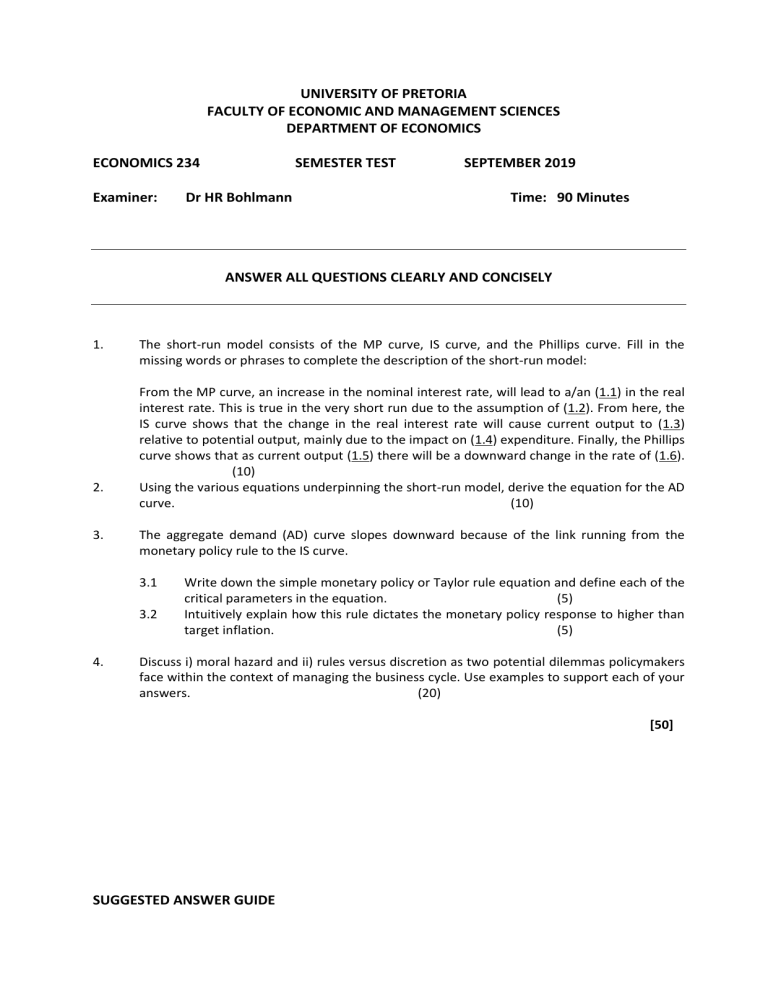

UNIVERSITY OF PRETORIA FACULTY OF ECONOMIC AND MANAGEMENT SCIENCES DEPARTMENT OF ECONOMICS ECONOMICS 234 Examiner: SEMESTER TEST Dr HR Bohlmann SEPTEMBER 2019 Time: 90 Minutes ANSWER ALL QUESTIONS CLEARLY AND CONCISELY 1. 2. 3. The short-run model consists of the MP curve, IS curve, and the Phillips curve. Fill in the missing words or phrases to complete the description of the short-run model: From the MP curve, an increase in the nominal interest rate, will lead to a/an (1.1) in the real interest rate. This is true in the very short run due to the assumption of (1.2). From here, the IS curve shows that the change in the real interest rate will cause current output to (1.3) relative to potential output, mainly due to the impact on (1.4) expenditure. Finally, the Phillips curve shows that as current output (1.5) there will be a downward change in the rate of (1.6). (10) Using the various equations underpinning the short-run model, derive the equation for the AD curve. (10) The aggregate demand (AD) curve slopes downward because of the link running from the monetary policy rule to the IS curve. 3.1 3.2 4. Write down the simple monetary policy or Taylor rule equation and define each of the critical parameters in the equation. (5) Intuitively explain how this rule dictates the monetary policy response to higher than target inflation. (5) Discuss i) moral hazard and ii) rules versus discretion as two potential dilemmas policymakers face within the context of managing the business cycle. Use examples to support each of your answers. (20) [50] SUGGESTED ANSWER GUIDE 1.1 1.2 1.3 1.4 1.5 1.6 increase sticky prices fall investment falls inflation 2. Substitute the policy rule into the IS curve Policy rule: 𝑅𝑡 − 𝑟̅ = 𝑚 ̅ (𝜋𝑡 − 𝜋̅) ̅ ̃ IS curve: 𝑌𝑡 = 𝑎̅ − 𝑏(𝑅𝑡 − 𝑟̅ ) To get the aggregate demand (AD) curve AD curve: 𝑌̃𝑡 = 𝑎̅ − 𝑏̅𝑚 ̅ (𝜋𝑡 − 𝜋̅) Short-run output is a function of the inflation rate 3.1 Define each of the variables and parameters of the simple monetary policy rule 3.2 Taking into consideration the set of exogenous variables, the monetary policy rule suggests by how much the central bank should change the nominal interest rate (which in turn affects the real interest rate in the short run due to price stickiness) in response to a deviation in inflation (or perhaps more accurately, expected inflation) from the target level of inflation. The magnitude of the suggested change in the interest rate is determined by the size of the inflation deviation and the size of the m parameter which governs how aggressively monetary policy needs to respond to maintain price stability. 4.1 Moral hazard – too big to fail, bailouts, impact on incentives and good governance practices, private gains when excessive risk pays off but public cost when failure occurs, balancing regulation with cost and ease of doing business, etc. 4.2 Rules vs discretion – time consistency problem, understanding of short-run vs long-run trade-offs and intergenerational burdens, impact on uncertainty, winners and losers of discretionary policy use