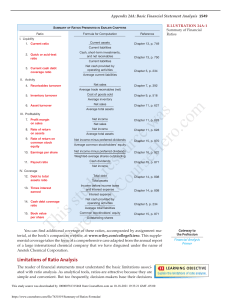

Formulas For Common Ratios Growth Rates Xt −Xt−1 Xt−1 One-year Growth Rate Compound Average Growth Rate (CAGR)1 Xt Xt−n n1 −1 Profitability Ratios Gross Profit Sales Gross Margin EBIT Sales Operating Margin Net Income Sales Net Margin EBIT(1-Tax Rate) Average Total Assets Return on Assets (ROA)2 Net Income Beginning Equity Return on Beginning Equity (ROBE)3 Return on Invested Capital (ROIC)4 EBIT(1-Tax Rate) Interest-bearing Debt + Equity Pretax Return on Invested Capital EBIT Interest-bearing Debt + Equity 1 n denotes the number of periods between observations Xt and Xt−n . Ratios that compare balance sheet and income accounts are often computed using the average of the balance sheet item. The average is computed by averaging beginning and year-end account balances. 3 Some analysts use year-end or average equity when computing ROE. 4 Interest-bearing debt is commonly defined as the sum of long-term debt, current portion long-term debt, and shortterm debt. Analysts may use year-end or average invested capital. 2 HBS Finance Tutorial 1 Ratio Formulas Efficiency Ratios Sales Average Total Assets Asset Turnover Sales Average Net Working Capital Net Working Capital Turnover Sales Net PP&E Fixed Assets Turnover Days in Inventory (Days) Average Inventory COGS/365 Inventory Turnover COGS Average Inventory Collection Period (Days) Average Receivables Sales/365 Receivables Turnover Sales Average Receivables Cash + Securities Sales/365 Days’ Sales in Cash (Days) Accounts Payable Credit Purchases/365 Payables Period (Days)5 Liquidity Ratios Current Ratio Current Assets Current Liabilities Quick Ratio6 Cash + Marketable Securities + Receivables Current Liabilities Cash Ratio Interval Measure7 Cash + Marketable Securities Current Liabilities Cash + Marketable Securities + Receivables Operating Costs/365 5 COGS is often used when credit purchase information is unavailable. This ratio sometimes uses “Current Assets - Inventory” in the numerator. 7 Operating costs are defined as “COGS + SG&A - Depreciation.” 6 HBS Finance Tutorial 2 Ratio Formulas Leverage Ratios Interest-bearing Debt + Leases Interest-bearing Debt + Leases + Equity Debt Ratio Debt to Equity Ratio8 Interest-bearing Debt Equity Equity to Asset Ratio Equity Total Assets Times-interest Earned EBIT Interest EBITDA Interest Times-interest Earned (Cash Flow)9 EBIT Times-burden Covered10 Payments Interest+ Principal (1 - Tax Rate) Risk Ratios Fixed to Variable Costs11 SG&A + Depreciation - Sales Commissions COGS - Depreciation Sales to Fixed Costs Sales SG&A + Depreciation - Sales Commissions Contribution Margin Revenue - Variable Costs Sales 8 Some analysts use “Long-term Debt + Leases” as a measure of debt when computing debt to equity ratios. Equity may be measured on a book-value basis or a market-value basis 9 EBITDA equals earnings before interest, taxes, depreciation, and amortization. 10 Principal payments are defined as “Short-term Debt + Current Portion Long-term Debt.” 11 This is an approximation; more refined definitions may be used when detailed information on costs is available. HBS Finance Tutorial 3 Ratio Formulas