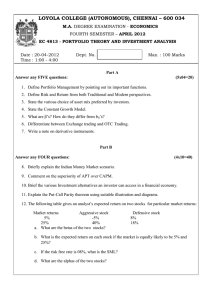

ECM1002 - Econometrics Workshop - Week 03 You are required to study Lecture notes – Week 03 prior to attending this workshop. After attending this workshop, you would be able to: - Understand and perform confidence interval estimation and interpretation, - Understand and perform hypothesis tests (t-test) using critical value and p-value, - Understand and perform least square prediction, - Measure and interpret Goodness of Fit (Coefficient of Determination). - Use Eviews for simple model estimation, Section 1: Theory revision (30 minutes) In this section, main points from Lecture notes - Week 03 will be revised. Section 2: Working with Eviews Download the file “capm5.wf1” from LMS. Refer to Eviews Help on the next page. 1 2 Eviews Instructions: To estimate the CAPM for Disney, Click Quick, Estimate Equation, and write the equation in the box as above. Here dis-riskfree corresponds to rj-rf in the CAPM equation and mkt-riskfree corresponds to rm-rf. The letter c denotes the intercept term αj. Click OK, then you will see the estimation result: Save the results by naming it as Disney, before you save the file. To estimate the model with assumption that the intercept value is 0, remove c in the list for the equation before the model is estimated. 3 Section 3: Calculation and Interpretation (textbook questions) During the 2-hour workshop, you are not required to answer all the questions in this section. Instead, your facilitator will choose random questions to demonstrate and help you understand/apply related econometric theories mentioned in Section 1. Section 4: Further self-practice Again, choose a stock return from capm5.wf1 according to the last digit of your student ID as below: Stock IBM GE XOM Microsoft Disney Last digit of your Student ID 0, 1 2, 3 4, 5 6, 7 8, 9 4 One of the assumptions of the regression model is that the error term shows a conditional homoskedasticty (SR3). That is, the variance of the error term is constant and does not change with the independent variable. This assumption is often violated, and its validity can be checked by using a simple method of data visualisation. When it is violated, the variance of error term shows a pattern as a function of independent variable, and this case is called conditional heteroskedasticity as opposed to conditional homoskedasticty. In this section, we check this assumption in the context of the CAPM you have estimated. Suppose you have fitted a CAPM to the Ford stock return as below: Generate residual series called e by clicking Proc, Make Residual Series, and write e Click OK, then you will see that a new series e appears in the work file. To generate the required plot, click Quick (from the pull-down menu and), Graph and write the series names as above, before you choose Scatter. The first variable in the list goes to the x-axis of the scatter plot, and the second variable to the yaxis. 5 You can also generate a scatter of abs(e) (absolute value of e) against the independent variable (mkt-riskfree) in a similar way as above, which may provide a clearer picture. The above plots show that the variability of residuals is smaller when the market excess return is close to 0, but it gets larger as the market excess return moves further away from 0. This is evidence of heteroskedastic error term, probably a reflection of Ford being an aggressive stock. For your Further practice: • • Generate the above plots for your stock return Provide a one-sentence comment in relation to the evidence of conditional homoskedasticty or heteroskedasticity from the estimated CAPM. 6