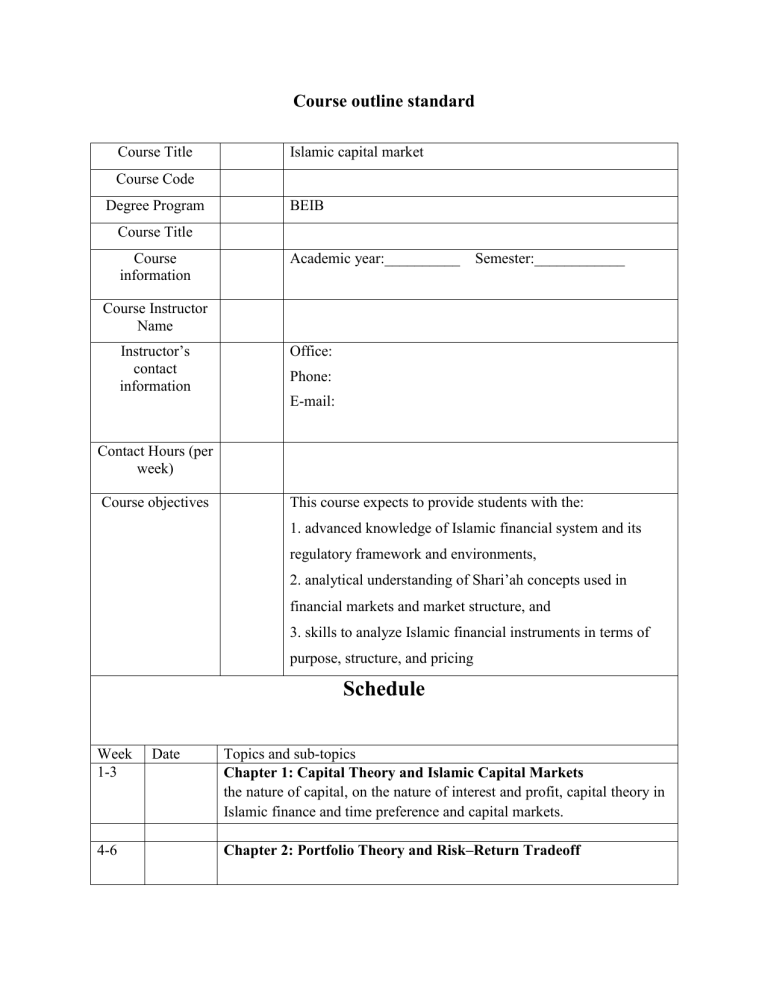

Course outline standard Course Title Islamic capital market Course Code Degree Program BEIB Course Title Course information Academic year:__________ Semester:____________ Course Instructor Name Instructor’s contact information Office: Phone: E-mail: Contact Hours (per week) Course objectives This course expects to provide students with the: 1. advanced knowledge of Islamic financial system and its regulatory framework and environments, 2. analytical understanding of Shari’ah concepts used in financial markets and market structure, and 3. skills to analyze Islamic financial instruments in terms of purpose, structure, and pricing Schedule Week 1-3 4-6 Date Topics and sub-topics Chapter 1: Capital Theory and Islamic Capital Markets the nature of capital, on the nature of interest and profit, capital theory in Islamic finance and time preference and capital markets. Chapter 2: Portfolio Theory and Risk–Return Tradeoff 6-7 7-9 9-12 Teaching and Learning methods Assessment Policy References Market uncertainty, portfolio diversification theory, portfolio diversification in the case of two risky assets and asset pricing based on risk–return tradeoff. Chapter 3: The Analytics of Sukuks Basic methods of valuation of assets with application to sukuks, and defines the notions of yield to maturity, reinvestment of coupons, and par value. Chapter 4: Islamic Stocks The stock yields, stock valuation, stock price forecasting, fundamental and technical analysis, efficiency hypotheses of stock markets, the evaluation of companies, and the mechanics of trading. Chapter 5: The Cost of Capital The cost of capital and its role in corporate finance and capital markets. Cost of capital, or discount rate, is meaningless without a future stream of income, or future net cash flow. Final exam week Classroom contact/Lecture, group work, tutorial, individual work Continues assessment……………………….. 60% Final exam:…………………………………..40% Total………………………………………….100% Attendance: it is compulsory come to class on time and every time. If you are not attained more than 80% of the class, you should not site on exam Assignments: You must do your assignment on time. Late assignments will not be accepted Cheating: you must do your own work and do not copy or get answers from someone else. It leads you to a serious punishment Recommended Book: ISLAMIC CAPITAL MARKET