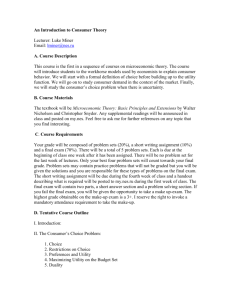

ECO419: INTERNATIONAL MACROECONOMICS Joseph Steinberg Associate Professor Economics Department University of Toronto Today’s agenda • Recap from last time • Developed model of international borrowing and lending in a “small open endowment economy” • Analyzed response of model economy to external shocks, namely to GDP • Uncertainty and international borrowing/lending (Ch 6) • The “Great Moderation” • Risk aversion, prudence, and precautionary saving • Implications of uncertainty for current account/trade balance • Uncertainty and growth Graphical depiction of equilibrium Graphical depiction of equilibrium TB1=Q1-C1<0 Graphical depiction of equilibrium TB2=Q2-C2>0 TB1=Q1-C1<0 The Euler Equation • Solution to model characterized by Euler equation U1 (C1 , C2 ) = (1 + r )U 2 (C1 , C2 ) u '(C1 ) = (1 + r )u '(C2 ) • Intuition: Must be indifferent between marginal reallocation of consumption across time • Could give up one unit of consumption today in exchange for (1+r) units tomorrow • This reallocation would lower lifetime utility by U1 (C1 , C2 ) and raise it by (1 + r )U 2 (C1 , C2 ) • This option is always affordable (satisfies the intertemporal BC), so if the net effect was positive, the household should have chosen that allocation to begin with! The Great Moderation • U.S. macroeconomic volatility fell dramatically after early 1980s • Called “Great Moderation” • Some macroeconomists claimed we had “solved” business cycles • U.S. trade balance/current account started to fall about the same time volatility did • Cross-country data shows similar story • Perri and Fogli (2015) show changes in volatility correlated with changes in NIIP • Countries with increased volatility saw NIIP rise • Countries with reduced volatility saw NIIP fall • Can we make sense of this relationship in our model? YoY growth rate of U.S. GDP per capita Source: IM via U.S. Bureau of Economic Analysis U.S. trade balance as pct. Of GDP Source: IM via U.S. Bureau of Economic Analysis Volatility and NFA across countries Source: Perri and Fogli (2015) Volatility and NFA across countries Source: Perri and Fogli (2015) Uncertainty in a small open economy • Same model structure as last time, with two differences 1. GDP endowment in period 2 is uncertain Q1 = Q, 2. Q + Q2 = Q − with prob 0.5 with prob 0.5 Households have expected utility preferences U (C1 , C2 ) = u (C1 ) + E u (C2 ) • To keep things simple, we assume • no discounting: 𝛽 = 1 • Interest rate is zero: 𝑟 = 0 • initial NFA is zero: 𝐵0 = 0 Uncertainty in a small open economy • The parameter σ is the standard deviation of period-2 output • Increasing σ is analogous to increasing the volatility of the economy’s GDP • Note also that the expected value of period-2 output is E Q2 = 0.5 (Q + ) + 0.5 (Q − ) = Q • So increasing σ does not affect the average level of period- 2 output • Thus, it does not affect the expected present value of period-2 output • If there were no uncertainty, TB1 would be zero because there would be no incentive to borrow or lend… autarky smooths consumption perfectly Uncertainty in a small open economy • We cannot use intertemporal BC approach to solving for this version of the small open economy model because there are two versions of period-2 budget constraint good state : C2 = Q + + B1 bad state : C2 = Q − + B1 • Use period-1 BC to substitute out B1: 𝐵1 = 𝑄 − 𝐶1 ↓ good state: 𝐶2 = 2𝑄 + 𝜎 − 𝐶1 bad state: 𝐶2 = 2𝑄 − 𝜎 − 𝐶1 Equilibrium with uncertainty • Household’s lifetime utility maximization problem: max C1 u (C1 ) + 0.5u (2Q + − C1 ) + 0.5u (2Q − − C1 ) • Solution characterized by Euler equation: u '(C1 ) = 0.5u '(2Q + − C1 ) + 0.5u '(2Q − − C1 ) = E u '(C2 ) • To go further, must put some structure on the period utility function little-u… Solution with quadratic utility • Suppose that 𝑢 𝐶 = −0.5 𝐶ҧ − 𝐶 2 • Then marginal utility given by 𝑢 ′ 𝐶 = 𝐶 − 𝐶ҧ • Euler equation: 𝐶1 − 𝐶ሜ = 0.5 2𝑄 + 𝜎 − 𝐶1 − 𝐶ሜ + 0.5 2𝑄 − 𝜎 − 𝐶1 − 𝐶ሜ • Simplifies to C1 = Q • What does this imply about the trade balance in period 1? • It is balanced! TB1=0 • No borrowing or lending • Autarky allocation • Implies 𝐶2 = 𝑄2 in both good and bad states of the world Solution with quadratic utility • Note that this solution obtains regardless of σ • Suppose that σ is very high… wouldn’t you be willing to save a little bit to insure against the bad state of the world? • Recall that good state : C2 = Q + + B1 bad state : C2 = Q − + B1 • So if we save a little bit in period 1, consumption rises in both states in period 2 • We call this precautionary saving Aside: risk aversion and prudence • Intuitive idea: given two options • 1) certain payoff x • 2) uncertain payoff y with E[y]>x • People may prefer x to y, especially if y is very risky • Decreasing marginal utility: loss from bad outcome larger than gain from good outcome Aside: risk aversion and prudence • You may have seen Arrow-Pratt coefficients of absolute and relative risk aversion: −u ''(C ) −Cu ''(C ) A(C ) = , R(C ) = u '(C ) u '(C ) • Relative risk aversion interpretation: du '(C ) / dC u '(C ) du(C ) / u (C ) = dC / C %u '(C ) = %C = elasticity of MU w.r.t C R(C ) = −C Aside: risk aversion and prudence • Quadratic utility actually does exhibit risk aversion by these measures R(C ) = −Cu ''(C ) −1 C = −C = 0 u '(C ) C −C C −C • Concave function, so has diminishing marginal utility • Thus, risk aversion is not enough to deliver a precautionary saving motive Aside: risk aversion and prudence • Coefficient of relative prudence: −Cu '''(C ) P(C ) = u ''(C ) • Note u '''(C ) = 0 for quadratic utility, hence no prudence, and no precautionary saving! 1− • What about power utility: u (C ) = C / (1 − ) • is coefficient of relative risk aversion, hence “CRRA utility” u '(C ) = C − , u ''(C ) = − C − −1 , u '''(C ) = ( + 1)C − − 2 −C ( + 1)C − − 2 ( + 1)C − −1 P(C ) = = = +1 − −1 − −1 − C C Solution with log utility • Log utility U (c) = log(c) is special case of power utility with = 1 (risk averse AND prudent) • Euler equation: 1 1 1 1 = + C1 2 2Q + − C1 2Q − − C1 • Does not have analytical solution, however we can easily figure out the qualitative implications Solution with log utility, continued • Suppose that, just as with quadratic utility, the household chose not to do any precautionary saving, i.e., C1 = Q • Plug this into the Euler equation: 1 1 1 1 = + Q 2 2Q + − Q 2Q − − Q 1 1 1 = + 2 Q + Q − 1 Q − Q + = + 2 (Q + )(Q − ) (Q + )(Q − ) = 1 2Q 2 Q 2 − 2 Solution with log utility, continued • Simplify further: Q2 1= 2 Q − 2 • Plainly not true as long as 0 : contradiction! Proves C1 Q • Note that in actuality we have Q2 1 2 Q − 2 • LHS less than RHS: marginal util in first period less than expected marginal util in second period • Household would be better off by saving, i.e., setting C1 Q, thereby setting TB1 0 and B1 0 Changing the volatility of Q2 → 0 precautionary saving motive disappears… inequality on previous slide gets closer and closer to equality • Conversely, as → inequality becomes more severe, hinting that more precautionary saving is optimal • If σ fell from a high value to a low value, we would expect to see less precautionary saving, i.e., we would expect the trade balance to fall • Or, if we compared two countries with different values of σ, the higher-σ country should have a higher trade balance, all else equal • And this is what we saw in the data! • Note that as Incorporating growth and uncertainty • Fast-growing countries like China are also more volatile than developed countries Productivity volatility in France and China Incorporating growth and uncertainty • Fast-growing countries like China are also more volatile than developed countries • One on hand, one might expect rapid growth to lead such countries to borrow to smooth consumption • Not what we saw in the data: fast-growing countries tend to lend, not borrow! Fast-growing countries borrow, not lend! Y-axis: sum of current account deficits as pct of 1980 GDP X-axis: Annualized average productivity growth between 1980 and 2000 Incorporating growth and uncertainty • Fast-growing countries like China are also more volatile • • • • than developed countries One on hand, one might expect rapid growth to lead such countries to borrow to smooth consumption Not what we saw in the data: fast-growing countries tend to lend, not borrow! On the other hand, though, more volatility should lead to more precautionary saving Growth and uncertainty have opposing impacts on equilibrium borrowing/lending behavior… could this help resolve the puzzle? Uncertainty AND growth in an SOE • Two-period model • Period 1: Q1 = 1, B0 = 0 2 • Period 2: Q2 ~ N ( , ), 1 • World interest rate r = 0 • CARA (constant absolute risk aversion) preferences: max C1 ,C2 , B1 −e − C1 + E −e − C2 subject to C𝐶11=+1𝐵 +1B= 1 1 c𝐶1 2+ = B1𝑄=2 Q +2 1 Uncertainty AND growth in an SOE • Euler equation: e− C1 = E e− C2 • Substitute budget constraints: C2 = Q2 + 1 − C1 e −C1 = E e − (Q2 +1−C1 ) • Rearrange: e−C1 = E eC1 e −1e − Q2 = eC1 e−1E e − Q2 Uncertainty AND growth in an SOE • Note about normal variables: if X is normally distributed with mean and variance 2 , then E e = e X + 2 / 2 • Noting that −Q2 ~ N ( − , ), we have 2 e − C1 = e e E e C1 −1 − Q2 C1 −1 − + 2 /2 = e e e • Now we can just rearrange: −C1 = C1 − 1 − + 2 / 2 2C1 = 1 + − 2 / 2 1+ 2 C1 = − 2 4 Uncertainty AND growth in an SOE • Solution: 1+ 2 C1 = − , 2 4 1− 2 TB1 = Q1 − C1 = + 2 4 • Deterministic (𝜎 2 ) world mirrors IM Chapter 3 logic: higher μ (faster growth) means more larger trade deficit (more borrowing) • No-growth (𝜇 = 1) world mirrors IM Ch. 6: more volatility (higher σ) means larger trade surplus (more saving) • With growth and uncertainty, it depends on how much uncertainty there is and the speed of growth • Even with very rapid growth in mean income, if income is also very volatile the country may want to save