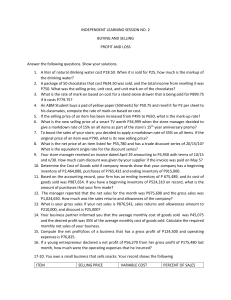

CHAPTER 8: RECEIVABLE FINANCING RECEIVABLE FINANCING – financial capability of the business to raise money out of its receivables FORMS OF RECEIVABLE FINANCING a. Pledge b. Assignment c. Factoring d. Discounting PLEDGE OF ACCOUNTS RECEIVABLE - Accounts receivable may be pledged as security for the payment of loan - Loan is recorded by debiting note payable and crediting cash Illustration: On Nov. 1, 2021, an entity borrowed a P1M from PNB and issued a promissory note. The term is 1 year and discounted at 12%. The entity pledged A/R of P2M to secure the loan. Journal Entry: Cash Discount on N/R Notes Rec. Nov. 1 N/P – Bank 1,000,000 Cash 1,000,000 Interest Income 100,000 Discount on N/P 100,000 ASSIGNMENT OF ACCOUNTS RECEIVABLE - A borrower called the assignor to transfer rights in some A/R to a lender called the assignee - When accounts are assigned on nonnotification basis, they aren’t informed (customers continue to make payments to the assignor) - Notification Basis: Customers are notified to make payments directly to the assignee - Assignee usually charge interest and requires service charge Illustration: (NON-NOTIFICATION) April 1 – Assigned P700K of A/R under non-notification. The bank advances 80% less a service charge of P5K. Promissory note and 1% interest per month 880,000 120,000 1,000,000 STATEMENT PRESENTATION A/R – Assigned A/R 700,000 700,000 On Dec. 31, 2021, the discount on note payable is amortized as interest in two months Cash 555,000 Service Charge 5,000 Notes Payable Interest Expense 20,000 Discount on N/P (120,000 x 2/12) 5 – credit memo for sales return to a customer account assigned, P20,000 Presented as Current Liability: Note Payable – Bank Discount on N/P Carrying Amount - 20,000 1,000,000 (100,000) 900,000 Note to financial statement for pledging of A/R Journal Entry: (Side of Borrower) 2022 Sales Return 20,000 A/R – Assigned 560,000 20,000 10 – collect 300K of the assigned accounts less 2% discount Cash Sales Discount 294,000 6,000 A/R – Assigned 300,000 30 – remitted total collections to the bank plus interest for one month N/P – Assigned Int. Expense Cash 294,000 5,600 299,600 May 7 – Assigned accounts of P15k proved worthless Allowance for D/A 15,000 A/R – Assigned 15,000 20 – collect P300k of the assigned notes Cash 300,000 A/R – Assigned 300,000 30 – remitted total amount due to bank plus interest of one month Cash 266,000 Interest Expense 2,660 N/P – Assigned 268,660 Jul. 1 A/R – Assigned A/R Cash Service Charge N/P 1,000,000 1,000,000 760,000 40,000 800,000 31- Receive notice from bank that P600k was collected less 2% discount. Check was sent for interest due. Jul. 31 N/P 588,000 Sales Discount 12,000 A/R – Assigned 600,000 Interest Expense Cash 8,000 8,000 August 31 – 300k of assigned were collected. Final settlement was made together with uncollected assigned accounts of 100k Aug. 31Cash 85,880 Interest Expense 2,120 N/P – Bank 212,000 A/R – Assigned 300,000 Transfer remaining A/R A/R Total A/R Assigned Less: Collections Sales Discount Sales Return Worthless Account Balance A/R 65,000 A/R – Assigned 700,000 (594,000) (6,000) (20,000) (15,000) 65,000 100,000 A/R – Assigned 100,000 Computation: Loan from Bank Less: July Collection Balance Due 800,000 588,000 212,000 August Collection Less: Loan Bal Excess Collection Less: Interest Remittance from Bank 300,000 212,000 88,000 2,120 85,880 Statement Presentation: A/R – Unassigned 4,000,000 65,000 Illustration: (NOTIFICATION) July 1 – Assigned P1M of A/R. Banks loans 80% less 4% charge. Signed promissory note and 1% interest per month on unpaid loan balance A/R – Assigned ADA N/P – Bank 1,000,000 100,000 400,000 A/R – Unassigned A/R – Assigned Total ADA Net Realizable Value 4,000,000 1,000,000 5,000,000 (100,000) 4,900,000 Equity in Assigned Accounts: A/R – Assigned Note Payable – Bank Equity in Assigned Accounts 1,000,000 (400,000) 600,000 FACTORING - Sale of A/R without a recourse, notification basis - Gain or loss is recognized for difference between the proceeds and net carrying amount of A/R - Actually transfers ownership of A/R to the factor Casual Factoring – forced to factor it’s A/R at a substantial discount to a bank to obtain much needed cash Example: Factored 100k of A/R with an ADA of 5,000 for 80k Entry: Cash ADA Loss on Factoring A/R Entry: Cash Sales Discount Commission Rec. from Factor A/R 80,000 5,000 15,000 365,000 10,000 25,000 100,000 Computation: Gross Amount Less: Sales Discount Commission Factor’s holdback Cash Received 500,000 500,000 10,000 25,000 100,000 365,000 Customer allowed credit of P50k for damaged merchandise Entry: Sales return and allowances 50,000 Sales Discount 1,000 Rec. from Factor 49,000 All factors are collected with no further returns and allowances Entry: Cash 51,000 Rec. from Factor (100,000 – 49,000) 51,000 100,000 Factoring as a Continuing Agreement - Factor may involve continuing agreement where finance entity purchase all A/R of an entity - For compensation, factors usually charges a commission of 5% to 20% for its service of credit approval Illustration: Factored A/R of 500k with credit terms of 2/10, n/30. The factor charged 5% commission based on gross amount. The factor withheld 20% of A/R factored to cover sales return and allowances. Another Illustration: Factored P3M of A/R. The factor of A/R subject to recourse for nonpayment. Fair value is P100k. The factor assessed a fee of 6% and retained holdback equal to 10%. 12% charged interest on a weighted average time to maturity of 50 days. Computation: A/R Factor’s Holdback Factoring Fee 3,000,000 (300,000) (180,000) Interest (3M x 12% x 50/365) Cash Received (49,315) 2,470,685 Credit card sales of P200,000. Minus a service charge of 3%. Factoring Fee Interest Recourse Obligation Total Loss 180,000 49,315 100,000 329,315 Entries: A/R – Diner’s Club Sales 200,000 200,000 Cash Service Charge A/R – Diner’s Club 194,000 6,000 200,000 Journal Entry: Cash 2,470,365 Due from Factor 300,000 Factoring Fee 180,000 Interest Exp. 49,315 Recourse Obligation 100,000 A/R Recourse Liability Another Illustration: Factoring of Accounts Receivable Credit card sale of P200k with a 5% service charge 3,000,000 100,000 Reverse Recourse Obligation assuming accounts are fully collected Recourse Liability 100,000 Loss on Recourse Obligation 100,000 Collect factor’s holdback Cash 300,000 Due from Factor 300,000 Assuming Accounts aren’t Collected Settle Recourse Obligation Recourse Liability 100,000 Cash 100,000 Collect factor’s holdback Cash 300,000 Due from Factor 300,000 CREDIT CARD - Allows holder to obtain credit up to a predetermined limit from the issuer of the card - Two entries are necessary: one entry at the time of the sale and another entry when payment is received from the card issuer Illustration: Entry: Cash Service Charge Sales 190,000 10,000 200,000 CHAPTER 9: RECEIVABLE FINANCING DISCOUNTING OF NOTE RECEIVABLE - Payee may obtain cash before maturity date by discounting the note at a bank Endorsement - Transfer of right to a negotiable instrument by signing at the back of the instrument - Legal parlance: secondary liability - Accounting parlance: contingent liability Terms Related to Discounting of Note 1. Net Proceeds – discounted value of the note received (Maturity – Discount) 2. Maturity value – amount due on the note (principal + interest) 3. Maturity date – note should be paid 4. Principal – face value 5. Interest – principal x rate x time 6. Interest rate – rate on face of the note 7. Time – period when interest shall accrue 8. Discount – interest deducted by the bank in advance (maturity value x discount rate x discount period) 9. Discount rate – if no discount rate is given, the interest rate is assumed to be it 10. Discount period – date of discounting to maturity date Illustration – Discounting without Recourse P1M, 180-day, 12% note dated July 1, discounted without recourse on Aug. 30 at 15% discount rate Computation: Principal 1,000,000 Add: Interest (1M x 12% x 180/360) 60,000 Maturity Date 1,060,000 Maturity Value Multiply: Discount rate Discount Period (180 – 60) Discount Net Proceeds from Discounting Maturity Value Less: Discount Net Proceeds Carrying Amount of the N/R Principal Add: Accrued Interest (1,000,000 x 0.12 x 60/360) Carrying Amount 1,060,000 53,000 1,007,000 1,000,000 20,000 1,020,000 Gain or Loss on Note Discounting Net Proceeds 1,007,000 Less: Carrying Amount 1,020,000 Loss on Discounting 13,000 ACCOUNTING FOR N/R DISCOUNTING Journal Entry: Cash 1,007,000 Loss on N/R Disc. 13,000 Note Receivable 1,000,000 Interest Income 20,000 - Note receivable is credited directly because the sale of the note is without recourse. Interest income is credited on the date of discounting. Illustration: P2.4M, 6 month, 12% note dated Feb. 1, discounted on Mar. 1 at 15% Principal Add: Interest Maturity Value Multiply: Discount Maturity Value Less: Discount Net Proceeds 2,400,000 144,000 2,144,000 0.15 x 5/12 159,000 2,144,000 159,000 2,385,000 Interest (P2.4M x 12% x 1/12) 24,000 Principal Add: Accrued Interest 2,400,000 24,000 1,060,000 0.15 120/360 53,000 Carrying Amount 2,424,000 Net proceeds Less: Carrying Amount Loss on N/R Discount 2,385,000 2,424,000 39,000 Interest Income - 24,000 No gain or loss on discounting if secured borrowing NOTE IS PAID BY MAKER ON MATURITY CONDITIONAL SALE - If it is conditional, contingent liability is recognized on Mar. 1 Entry: Cash (Net Proceeds) Loss on N/R Discount N/R Discounted Interest Income Entry: Liability for N/R Disc. Note Receivable NOTE IS DISHONORED BY MAKER - Dishonored on Aug. 1, maturity value of 2,544,000 plus protest fee and other bank charges of P6,000 2,385,000 39,000 2,400,000 24,000 Entry: 3. Payment of First Bank A/R 2,550,000 Cash 2,550,000 NOTE IS PAID BY MAKER ON MATURITY - Aug. 1, paid by maker, contingent liability is simply extinguished Entry: N/R Discounted Note Receivable 4. Derecognized the liability Liability for N/R Disc. 2,400,000 Note Receivable 2,400,000 2,400,000 2,400,000 NOTE IS DISHONORED BY MAKER - Dishonored on Aug. 1, maturity value of 2,544,000 plus protest fee and other bank charges of P6,000 Entry: 1. Payment of First Bank A/R 2,550,000 Cash 2,550,000 2. Cancel Contingent Liability N/R Discounted 2,400,000 Note Receivable 2,400,000 SECURED BORROWING - Note receivable is not derecognized but instead an accounting liability, recorded at an amount equal to the face amount of N/R discounted Entry: Cash 2,385,000 Interest Expense 39,000 Liability for N/R Disc. 2,400,000 2,400,000 2,400,000 CONDITIONAL BORROWING SALE OR SECURED CHAPTER 10: INVENTORIES INVENTORIES – assets held for sale in the ordinary course of business, in the process of production for such sale or in the form of materials or supplies - - It encompass goods purchased and held for resale such as: o Merchandise purchased by retailer o Land and other property held for resale It also encompass finished goods produced, goods in process and materials and supplies awaiting use in the production process Classes of Inventories - Classified into inventories of a trading concern and inventories of manufacturing concern - - Trading Concern (buys and sells goods in the same form purchased – merchandise inventory) Manufacturing Concern (one that buys goods which are converted into other form) o Consists of finished goods, goods in process, raw materials, factory or manufacturing supplies Definitions - Finished Goods (completed products ready for sale) - Goods in Process (partially completed products which require further process before they can be sold) - Raw Materials (goods to be used in the production process) o Frequently raw materials are restricted to materials that will be physically incorporated in the production of other goods - Factory or Manufacturing Supplies (relationship to end product is indirect) o Indirect materials, not physically incorporated in products, part of manufacturing overhead Goods includible in the Inventory - All goods to which the entity has title shall be included in the inventory, regardless of location - Passing of Title (legal language which means the point of time at which ownership changes) o o Exception to the Legal Test - Installment contracts may provide retention of title by seller until the selling price is fully collected. - Goods sold on installment are still property of the seller, and normally included in the inventory - Goods sold on installment are included in the inventory of the buyer. Who is the owner of goods in transit? - FOB Destination (ownership of goods are transferred upon receipt of goods by buyer at the point of destination) o Goods in transit are still property of the seller o Legally responsible of freight charge - FOB Shipping Point (ownership are transferred upon shipment of goods o Goods in transit are property of the buyer (responsible for freight charges) Freight Terms - Freight Collect (freight charge on the goods shipped is not yet paid) o Charge is paid by buyer - Freight Prepaid o Freight charge on the goods are already paid by the buyer - Legal Test - Items included in the inventory: o Goods owned and on hand o Goods in transit and sold FOB Destination o Goods in transit and purchased FOB Shipping Point o Goods out on consignment to consignee Goods in the hands of salesmen or agents Goods held by customers on approval or on trial - FOB Destination and Shipping Point determines ownership of the goods in transit, and party who is supposed to pay Freight Collect and Prepaid determines the party who actually paid the freight charge Maritime Shipping Terms - FAS or Free Alongside (seller bear all expenses and risks involve in delivering the goods to the dock next to the vessel on which goods are to be shipped) o Buyer bears cost of loading and shipment, title passes to the buyer when carrier takes possession of the goods CIF or Cost, Insurance and Freight (buyer agrees to pay in a lump sum the cost of goods, insurance, and freight charge) o In either case, the seller must pay for the cost of loading, title and risk of loss shall pass to the buyer Ex-ship (seller bears all expenses and risk of loss until the goods are unloaded at which time title and risk of loss shall pass to the buyer running summary of inventory inflow and outflow) o Resulting balance represent the inventory o Book or perpetual inventories o Commonly treated individually represent or relatively large peso investment such as jewelry and cars o Stock cards are used to control both units and costs o Physical count of units on hand should at least be made once a year to confirm balance appearing on stock cards Consigned Goods - Consignment (owner called the consignor transfer physical possession of certain goods to an agent called consignee who sells them on the owner’s behalf) o Consigned goods shall be included in the consignor’s inventory o Freight and other handling charges on goods are part of the cost of goods consigned Illustration – Periodic System 1. Purchase of merchandise on account, P300k Purchases 300,000 A/P 300,000 - - - Example: Consignee sells goods for P100k. amount is remitted to consignor less commission of P15k, and advertising of P2k Entry: Cash 83,000 Commission 15,000 Advertising 2,000 Sales 100,000 Accounting for Inventories - Periodic System (physical counting of the goods on hand at end of accounting period) o Quantities are multiplied by unit costs to get inventory value for balance sheet purpose o Generally use on small peso investment such as groceries, hardware and auto-parts o Actual or physical inventories - Perpetual System (maintenance of records called stock cards that usually offer a 2. Payment of freight, P20k Freight In 20,000 Cash 20,000 3. Return of merchandise, P30k A/P 30,000 Purchase returns 30,000 4. Sale of merchandise on account, P400k at 40% gross profit A/R 400,000 Sales 400,000 5. Return of merch sold from customer, P25k Sales return 25,000 A/R 25,000 6. Adjustment of ending inventory, P65k Inventory - End 65,000 Income Summary 65,000 Illustration – Perpetual System 1. Purchase of merchandise on account, P300k Merch. Inv. 300,000 A/P 300,000 2. Payment of freight, P20k Merch. Inv. 20,000 Cash 20,000 3. Return of merchandise, P30k A/P 30,000 Merch. Inv. 30,000 4. Sale of merchandise on account, P400k at 40% gross profit A/R 400,000 Sales 400,000 COGS Mer. Inv. 240,000 240,000 5. Return of merch sold from customer, P25k Sales Return 25,000 A/R 25,000 Merch. Inv. COGS 15,000 15,000 6. Adjustment of ending inventory, P65k Inventory Shortage or Overage - In the illustration, the merch inv account has debit balance of P65k, if at the end of the accounting period, a physical count indicates a different amount, an adjustment is necessary to recognize any inventory shortage or overage. For example, the physical count shows inventory on hand of P55k. Entry: Inventory Shortage Merch. Inv. 10,000 10,000 Trade Discounts and Cash Discounts - Trade Discounts (deductions from list or catalog price in order to arrive at the invoice price which actually charged to the buyer) o not recorded o encourage increase sales - Cash Discounts (deductions from invoice price when payment is made within the discount period) o Recorded as purchase discount o Deducted from purchases to arrive at net purchases and sales discount from sales to arrive at net sales revenue Illustration: List price of merch purchased is P500k less 20% and 10% with credit terms of 5/10, n/30 List Price First Trade Discount Second Trade Discount Invoice Price Cash Discount Payment (Discount Period) Entry: Purchases A/P 500,000 (100,000) 400,000 (40,000) 360,000 (18,000) 342,000 360,000 360,000 Payment within discount period entry: A/P 360,000 Cash 342,000 Purchase Discount 18,000 Methods of Recording Purchases - Gross Method (purchases and A/P are recorded at gross amount) - Net Method (purchases and A/P are recorded at net amount) Illustration – Gross Method 1. Purchase on account, P200k, 2/10, n/30 Purchases 200,000 A/P 200,000 2. Payment within discount period A/P 200,000 Cash 196,000 Purchase Discount 4,000 3. Payment beyond discount period A/P Cash 200,000 200,000 Illustration – Net Method 1. Purchase on account, P200k, 2/10, n/30 Purchases 196,000 A/P 196,000 declining prices, it would result to lowest net income Illustration – FIFO 01/01 01/08 01/18 01/22 01/31 2. Payment within discount period A/P 196,000 Cash 196,000 3. Payment beyond discount period A/P 196,000 Purchase Discount Loss 4,000 Cash 200,000 4. No payment is made, discount period is expired Purchase Discount Loss 4,000 A/P 4,000 - Bal. Sale Pur. Sale Pur. Unit 800 Cost 200 Total 160k 700 210 147k 500 220 110k Sales 500 800 Ending Inventory is 700 units. FIFO – Periodic Unit 01/18 01/31 Total Pur. Pur. Cost 200 500 700 210 220 Total 42,000 110,000 152,000 Cost of Goods Sold Inventory – Jan. 01 Purchases (147k + 110k) Goods Available for Sale Inventory – Jan. 31 Cost of Goods Sold 160,000 257,000 417,000 (152,000) 265,000 FIFO – Perpetual Date CHAPTER 11: INVENTORY COST FLOW Cost Formulas - PAS 2, Par. 25 – cost of inventories shall be identified using either: o First in, First out o Weighted Average FIRST IN, FIRST OUT (FIFO) - Goods first purchased are first sold, goods remaining in the inventory are most recently purchased or produced - Inventory is stated at current replacement cost - Objection in this method is that it is improper matching of cost against revenue resulting in understatement of cost of sales - In period of inflation, FIFO method will result to the highest net income, deflation or Jan. 1 8 18 Purchases # P Sales = 700 210 147k 500 200 110k 22 31 Balance # P = 500 200 100k 300 500 200 210 60k 105k # 800 300 300 700 P 200 200 200 210 = 160k 60k 60k 147k 200 200 500 210 210 220 42k 42k 110k Nota Bene - Under FIFO periodic and perpetual, the inventory costs is same. The costs of good sold is determined from the stock card as follows: Jan. 8 Sale 100,000 22 Sale (60k + 105k) 165,000 Costs of Goods Sold 265,000 Weighted Average – Periodic Unit 01/01 01/18 Bal. Pur. Cost 800 700 200 210 Total 160,000 147,000 01/31 Pur. Goods Available 500 2,000 220 110,000 417,000 Weighted Average Unit Cost (417k/2k) 208.5 Inventory Cost (700 x 208.5) 145,950 Date Jan. 1 8 18 160,000 257,000 417,000 (145,950) 271,050 Weighted Average – Perpetual (Moving Average Method) - Keeping of inventory stock card in order to monitor the moving unit cost after every purchase Jan 1 8 18 22 31 Total Unit Balance Sale Balance Purchase Total Sale Balance Purchase Cost 800 (500) 300 700 1000 (800) 200 500 700 200 200 200 210 207 207 207 220 216 Total 160,000 (100,000) 60,000 147,000 207,000 (165,600) 41,400 110,000 151,400 Cost of Goods Sold from the Stock Card Jan. 8 Sale 100,000 Jan. 22 Sale 165,600 Cost of Goods Sold 265,600 700 210 147k 500 200 Balance # P = 500 200 100k 700 100 210 200 147k 20k 110k # 800 300 300 700 P 200 200 200 210 = 160k 60k 60k 147k 200 200 500 200 200 220 40k 40k 110k Another Illustration Balance Purchase Sale Sale Return Purchase Pur. Return Ending Bal. Unit 5,000 5,000 (7,000) 1,000 16,000 (2,000) 18,000 Cost 200 250 Total 1,000,000 1,250,000 150 150 2,400,000 300,000 FIFO – whether periodic or perpetual Jan 10 30 Purchase Purchase Unit 4,000 14,000 18,000 Cost 250 150 Total 1,000,000 2,100,000 3,100,00 Moving Average – Perpetual Jan 1 10 15 30 31 Balance Purchase Balance Sale Balance Sale Return Balance Purchase Balance Pur. Return Balance Unit 5,000 5,000 10,000 (7,000) 3,000 1,000 4,000 16,000 20,000 (2,000) 18,000 Cost 200 250 225 225 225 225 225 150 165 150 167 Total 1,000,000 1,250,000 2,250,000 (1,575,000) 675,000 225,000 900,000 2,400,000 3,300,000 (300,000) 3,000,000 Weighted Average – Periodic LIFO – Periodic Unit From Jan. 1 Bal. Cost 700 200 Total 140,000 Cost of goods sold under LIFO - periodic Inventory – Jan. 1 Purchases Goods Available for Sale Inventory – Jan. 31 Cost of goods Sold LIFO – Perpetual = Jan 1 10 15 16 30 31 16 LAST IN, FIRST OUT (LIFO) - Goods last purchased are first sold, cost of goods sold is representative of recent or new prices Sales P 22 31 Costs of Goods Sold Inventory – Jan. 1 Purchases Goods available for sale Inventory – Jan. 31 Cost of Goods Sold Purchases # 160,000 257,000 417,000 (140,000) 277,000 Jan 1 10 30 31 Balance Purchase Purchase Pur. Return Unit 5,000 5,000 16,000 (2,000) 24,000 Cost Wei. Ave. Unit Cost (4.350M/24k) Cost of End. Inv. (18k x 181.25) 200 250 150 150 Total 1,000,000 1,250,000 2,400,000 (300,000) 4,350,000 181.25 3,262,500 CHAPTER 12: LOWER OF COST AND NET REALIZABLE VALUE LOWER OF COST AND NET REALIZABLE VALUE - PAS 2, Par. 9, inventory shall be measured at lower cost and net realizable value Net Realizable Value - Estimated selling price in the ordinary course of business less estimated cost of completion and estimated cost of disposal - Cost of inventories may not be recoverable under: o Damaged o Wholly or partially obsolete o Selling price have declined o Estimated cost of completion or estimated cost of disposal has increased Determination of Net Realizable Value - Inventories are usually written down on an item by item or individual basis - Materials held for use in production are not written down below cost if the finished product are expected to be sold at higher cost Accounting for Inventory Writedown - If cost is lower than NRV, there is no accounting problem because the increase in value is not recognized - If NRV is lower than cost, inventory is measured at NRV, and decreased in value is recognized Methods of Accounting for the Inventory Writedown - Direct Method or COGS Method - Allowance Method or Loss Method Direct Method - Any loss on inventory writedown or gain on reversal of inventory writedown is not accounted for separately but buried in the cost of goods sold Allowance Method - Any loss on inventory writedown is accounted for separately. This method is also known as ‘loss method’ because a loss account “loss on inventory writedown” is debited and a valuation account “allowance for inventory writedown” is credited. - If the required allowance decreases, a “gain on reversal of inventory writedown” is recorded. - PAS 2, Par. 36, disclosure of amount of inventory writedown and amount of reversal of inventory writedown Illustration – Inventory Data on Dec. 31, 2021 Cost Categ. 1 A B C Subtotal Categ. 2 D E Subtotal Categ. 3 F G Subtotal Grand Total NRV 110,000 690,000 600,000 1,400,000 100,000 750,000 640,000 1,490,000 100,000 690,000 600,000 2,000,000 1,500,000 3,500,000 1,900,000 1,560,000 3,460,000 1,900,000 1,500,000 1,500,000 1,600,000 3,100,000 8,000,000 1,460,000 1,690,000 3,150,000 8,100,000 1,460,000 1,600,000 LCNRV Item by Item Categ. 1 Categ. 2 Categ. 3 By Category LCNRV by Total - LCNRV Cost 1,400,000 3,500,000 3,100,000 Cost 8,000,000 7,850,000 7,850,000 NRV 1,490,000 3,460,000 3,150,000 LCNRV 1,400,000 3,460,000 3,100,000 7,960,000 NRV 8,100,000 LCNRV 8,000,000 The inventory is measured at lower cost and NRV applied on an item by item Cost – Dec. 31 NRV Inventory Writedown 8,000,000 (7,850,000) 150,000 Direct Method - Inventory is recorded at lower of cost or NRV - Loss on inventory writedown is not accounted for separately - Effect of increase in COGS because NRV is lower than cost Entry: Inventory – Dec. 31 7,850,000 Income Summary 7,850,000 Gain on Rev. of Inv. WD Allowance Method - Inventory is recorded at cost Entry: Inventory – Dec. 31 8,000,000 Income Summary 8,000,000 - Loss on inventory writedown is accounted for separately Entry: Loss on inv. writedown 150,000 Allowance for inv. Writedown 150,000 50,000 Another Illustration Inventory – Jan. 1 Cost NRV Net Purchases Inventory – Dec. 31 Cost NRV 5,000,000 4,500,000 20,000,000 6,000,000 5,300,000 Direct Method Inventory – Jan. 1 Net Purchases Goods Available for Sale Inventory – Dec. 31 Cost of Goods Sold 4,500,000 20,000,000 24,500,000 (5,300,000) 19,200,000 Allowance Method - Loss of inventory writedown is included in the computation of COGS. Allowance for inventory writedown is presented as a deduction from the inventory. Inventory – Dec. 31, at cost Allowance for Inv. Writedown NRV 8,000,000 (150,000) 7,850,000 Continuing Illustration - Assume on Dec. 31, 2022, the total of inventory is 8,500,000 and the NRV is 8,400,000 Direct Method - Inventory is simply recorded at the lower amount Entry: Inventory – Dec. 31, 2022 8,400,000 Income Summary 8,400,000 Inventory – Jan. 1, at cost Net Purchases Goods Available for Sale Inventory – Dec. 31, at cost Cost of Goods Sold before inv. WD Loss on Inv. WD for current year Cost of Goods Sold after inv. WD Required Allowance – Dec. 31 (6M – 5.3M) Required Allowance – Jan. 1 (5M – 4.5M) Increase in Allowance – Loss on WD 5,000,000 20,000,000 25,000,000 (6,000,000) 19,000,000 200,000 19,200,000 700,000 (500,000) 200,000 Purchase Commitments - Obligations of the entity to acquire certain goods sometime in the future at a fixed price and fixed quantity Illustration Contract purchase price is P500,000 and the replacement cost at year-end is P450,000. The market decline of P50,000 is recorded: Entry: Loss on Purchase Com. 50,000 Est. Liab for Purchase Com. 50,000 Allowance Method Cost – Dec. 31, 2022 Net Realizable Value Req. Allowance – Dec. 31, 2022 Allowance Bal. – Dec. 31, 2022 Decrease in Allowance - 8,500,000 (8,400,000) 100,000 (150,000) (50,000) Decrease in allowance is reversal of previous inventory writedown and recorded as: Entry: Allowance for Inv. WD 50,000 - When actual purchase is made in the subsequent period and the current replacement cost drops further to P420,000, the entry is: Entry: Purchases 420,000 Loss on Purchase Com. 30,000 Est. Liab for Purchase Com. 50,000 Accounts Payable 500,000 o LCNVR Adaptation - If marker price rises, a gain on purchase commitment would be recorded - In the preceeding illustration, replacement cost of the purchase commitment is P600,000 when actual purchase is made, the journal entry to record the actual purchase is: Entry: Purchases 500,000 Est. Liab for Purchase Com. 50,000 Accounts Payable 500,000 Gain on Purchase Com. 50,000 - If the replacement cost of the purchase commitment is P480,000 when the actual purchase is made, the journal entry to record the actual purchase is: Journal: Purchases 480,000 Est. Liab for Purchase Com. 50,000 Accounts Payable 500,000 Gain on Purchase Com. 30,000 - The purchase is recorded at P480,000 only because the replacement cost is lower than the purchase commitment of P500,000. o Physical count is made to prove the correctness Gross profit test Interim financial statements are made and not possible to physical count GROSS PROFIT METHOD - Rate of gross profit remains approximately the same from period to period, ratio of costs of good sold and net sales is relatively constant Basic Formula under the Gross Profit Method Goods Available for Sale xxx Less: COGS xxx Ending Inventory xxx Goods Available for Sale Usual Items Affecting the Goods Available for Sale Beginning Inv. Purchases Add: Freight In Total Less: Pur. Return, Allow, Disc. Goods Available for Sale xxx xxx xxx xxx xxx xxx xxx COST OF GOODS SOLD - COGS is computed as follows: o (net sales) (cost ratio) – based on sales o (net sales) / (sales ratio) – based on cost CHAPTER 13: GROSS PROFIT METHOD Illustration: Estimate in Inventory Valuation - Know approximate value if it is not possible to take a physical count - Two procedures in approximating value of inventory: o Gross Profit Method o Retail Inventory Method - Common reasons for making an estimate: o Inventory is destroyed by fire and other catastrophe or theft of merch Beg. Inventory Net Purchases Net Sales Gross Profit rate based on sales - 100,000 500,000 700,000 40% The ending inventory is computed as follows: Beg. Inventory Net Purchases Goods Available for Sale Less: COGS Net Sales Multiply by cost ratio Ending Inventory 100,000 500,000 600,000 700,000 60% 420,000 180,000 - Cost ratio is simply computed as 100% minus gross profit rate on sales Net Sales COGS Gross profit on Sales Amount 700,000 420,000 280,000 Percent 100% 60% 40% Net Sales Cost of Goods Sold Gross Profit on sales Gross Profit on cost (20/80) 100% 80% 20% 25% Another Illustration: Beg. Inventory Net Purchases Net Sales Gross Profit rate based on cost - The ending inventory is computed as follows: Beg. Inventory Net Purchases Goods Available for Sale Less: COGS Net Sales Divided by Sales ratio Ending Inventory - 200,000 1,000,000 1,260,000 40% 200,000 1,000,000 1,200,000 700,000 140% 900,000 300,000 Illustration: Beg. Inventory Purchases Purchases Return Purchase Allowance Purchase Discount Freight In Sales Sales Return Sales Allowance Sales Discount - Gross profit rate is based on cost, COGS would be 100%, and therefore the sales ratio or percent of sales is 140% Net Sales COGS Gross profit on Cost Amount 1,260,000 900,000 360,000 Percent 140% 100% 40% COMPUTATION OF GROSS PROFIT RATE Net Sales Cost of Goods Sold Gross Profit 1,000,000 750,000 250,000 Gross Profit Rate: o Cost: Gross Profit / COGS o Sale: Gross Profit / Net Sales Common way of quoting gross margin GROSS PROFIT RATE ON COST TO GROSS PROFIT ON SALES - Convert gross profit rate from one basis to another, if gross profit on cost is 25%, the gross profit rate on sales is computed: Net Sales Cost of Goods Sold Gross Profit on cost Gross Profit on sales (25/125) 125% 100% 25% 20% GROSS PROFIT RATE ON SALES TO GROSS PROFIT ON COST - if gross profit on sale is 20%, the gross profit rate on cost is computed: Ending inventory is computed under each of the following assumptions: o Gross profit rate is 25% on sales o Gross profit rate is 25% on cost Gross Profit Rate based on Sales Goods Avail. Less: COGS Sales Sales Return Net Sales Divide: End. Inven. - 600,000 2,530,000 15,000 5,000 10,000 50,000 3,100,000 100,000 50,000 150,000 3,150,000 Sales ratio 3,100,000 (100,000) 3,000,000 125% 2,400,000 750,000 Cost ratio is determined by deducting the gross profit of 25% from the sales of 100% or 75% Amount 3,000,000 2,250,000 750,000 (750K/3M) Net Sales COGS Gross Profit Gross Profit on Sales Percent 100% 75% 25% 25% Gross Profit Rate based on Cost Beg. Inv Purchases Add: Freight In Total Less: Pur. Ret. Pur. Allowance Pur. Discount Goods Avail. Less: COGS Sales Sales Return Net Sales Multiply: 600,000 2,530,000 50,000 2,580,000 15,000 5,000 10,000 30,000 Cost Ratio 3,100,000 (100,000) 3,000,000 75% 2,550,000 3,150,000 2,250,000 End. Inven. - 900,000 Sales ratio is determined by adding the COGS of 100% and the gross profit of 25% or 125% Amount 3,000,000 2,400,000 600,000 (600K/2.4M) Net Sales COGS Gross Profit Gross Profit on Cost Percent 125% 100% 25% 25% Illustration Goods Avail. Less: COGS Sales Sales Return Sales Allow. Sales Disc. Net Sales COGS Ending Inv. 3,150,000 3,100,000 100,000 50,000 150,000 75% x 2.8M - xxx xxx xxx xxx xxx Cost Ratio: Goods available for sale at cost divided by goods available for sale at retail 300,000 2,800,000 2,100,000 1,050,000 1,000,000 700,000 300,000 Assuming that the goods available for sale amount to P700,000. Following the gross method, the ending inventory: Goods Available for Sale COGS Ending Inventory Goods Available for Sale at retail price Less: Net Sales (Gross Sales - Sales Return Only) Ending Inventory at selling price Multiply: cost ratio Ending Inventory at Cost - Corollary Illustration Sales COGS Gross Profit Basic Formula - Very similar to the gross profit method o Difference: gross profit is stated at cost while retail inventory method is at selling price 700,000 (700,000 - CHAPTER 14: RETAIL INVENTORY METHOD Retail Inventory Method – other method of estimating the value of inventory o Generally employed by department stores, supermarkets etc. o Selling price or retail price is tagged to them Information Required: - beginning inventory at cost at retail price - Purchases during period at cost and at retail - Adjustments to original retail price such as markups - Other adjustments such as breakage, shrinkage, damage goods, and employee discount Illustration: Beg. Inv Purchases Freight In Purchase Return Purchase Allowance Purchase Discount GOODS AVAIL. FOR SALE Cost Ratio (480k/800k) = 0.6 Less: (Sales – Sales return) End. Inventory at Retail End. Inventory at Cost (200 x 0.6) Cost 150,000 400,000 10,000 (55,000) (5,000) (20,000) 480,000 Retail 230,000 650,000 (80,000) 800,000 600,000 200,000 120,000 Treatment of Items: - Purchase Discount (deducted from purchase at cost only) - Purchase Return (deducted from purchase at cost and at retail) - Purchase Allowance (deducted from purchase at cost only) - Freight In (addition to purchases at cost only) - Departmental Transfer In or Debit ((addition to purchases at cost and at retail) - Sales Discount and Allowance (disregarded) - Sales Return (deducted from sales) - Employee Discount (added to sales) - Normal shortage, shrinkage, spoilage, breakage (deducted from goods available for sale at retail) - Abnormal shortage, shrinkage, spoilage, breakage (deducted from goods available for sale at retail and at cost) Items related to retail method - Initial markup (original markup of cogs) - Original retail (sales price) - Additional markup (increase in sales price above original sales price) - Markup cancellation (decrease in sales price that does not decrease the sales price below the original sales price) - Net markup (markup minus markup cancellation) - Markdown (decrease in sales price below original price) - Markdown cancellation (increase in sales price that does not increase the sales price above the original sales price - Net markdown (markdown minus markdown cancellation) - Maintained markup (difference between cost and sales price) (markon) Illustration: Cost Initial Markup Original Retail Additional Markup New Sales Price Markup Cancelation New Sales Price Net Markup (260 -240) Markup cancelation Markdown New Sales Price Markdown cancelation New Sales Price Net Markdown (30-20) Maintained Markup 200 40 240 60 300 (40) 260 60 20 30 (50) 210 20 230 10 30 Approaches in the use of retail method - Conservative or conventional or lower cost and NRV approach - Average cost approach - FIFO approach Beg. Inv Net Purchases Additional Markup Markup Cancelation Markdown Markdown Cancelation Sales Sales return Sales allowance Sales discount Employee discount Spoilage and breakage Cost 180,000 1,020,000 Retail 250,000 1,575,000 200,000 25,000 140,000 15,000 1,450,000 50,000 10,000 20,000 40,000 35,000 Conservative and Average Cost Beg. Inv Net Purchases Additional Markup Markup Cancelation GAS – Conservative Cost Ratio (1.2M/2M) = 0.6 Markdown Markdown Cancelation GAS - Average Cost Ratio (1.2M/1.875M) = 0.64 Less: Sales Sales return Employee discount Spoilage and breakage Ending Inventory at Retail Conservative Cost (400K x 0.6) Average Cost (400K x 0.64) - Cost 180,000 1,020,000 1,200,000 Retail 250,000 1,575,000 200,000 (25,000) 2,000,000 1,200,000 (140,000) 15,000 1,875,000 1,450,000 (50,000) 40,000 35,000 1,475,000 400,000 240,000 256,000 Ending inventory at retail is same at either conservative or average approach Computation of COGS Goods Avail. For Sale Ending Inventory COGS Conservative 1,200,000 (240,000) 960,000 Average 1,200,000 (256,000) 940,000 FIFO Retail Approach - Considers both net markup and net markdown on computing cost ratio - Current cost ratio is determined every year considering the net purchases during the year and excluding the beginning inventory Beg. Inv Purchases Net Markup Net Markdown Net Sales Cost 495,000 1,800,000 Retail 900,000 3,300,000 300,000 600,000 2,700,000 Computation using the FIFO Retail Illustration: Beg. Inv Cost 495,000 Retail 900,000 Purchases Net Markup Net Markdown Net Purchases Current Cost Ratio (1.8M/3M) = 0.6 GAS Less: Net Sales Ending Inventory at Retail FIFO Cost (1.2M x 0.6) 1,800,000 1,800,000 2,295,000 3,300,000 300,000 (600,000) 3,000,000 3,900,000 2,700,000 1,200,000 720,000 Computation of COGS Goods Available for Sale Ending Inventory at FIFO Cost COGS 2,295,000 (720,000) 1,575,000