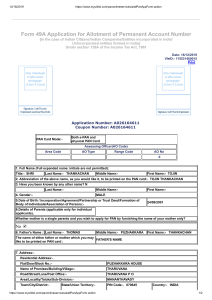

Form 49A Under section 139A of the Income-Tax Act, 1961 PAN Application Acknowledgment Receipt For Form 49A ( Physical Application ) Received Rs. 107.00/- (incl of taxes) from Application No./Coupon No. Name to be printed on PAN card Gender Date of Birth/Incorporation Father's Name Aadhaar Number/EID Number Name as per Aadhaar Applicant's Contact details Communication Address Residence State Proof of Identity Proof of Address Proof of DOB Date of Receipt Mode of Pancard Payment Ref No Payment Date SMT AASHA DEVI U-A075822587 AASHA DEVI FEMALE 01/01/1984 KRIPAL MUKHIYA xxxx-xxxx-9735 (MENTIONED, MATCHED)* AASHA DEVI 9113809356 / erchaturanan@gmail.com RESIDENCE BIHAR AADHAAR Card issued by UIDAI (In Copy) AADHAAR Card issued by UIDAI (In Copy) AADHAAR Card issued by UIDAI (In Copy) 12/06/2023 08:32:54 Both physical PAN and e-PAN Card 3191083724265766 / PY0104788178 12/06/2023 08:37:44 *AADHAAR MATCHED USING DEMOGRAPHIC DETAILS - WILL BE LINKED WITH PAN. PAN Service Center Code 216515130018 PAN Service Center Name CHATURANAN CHOUDHARY Centre Contact Details: ARYAN71006@gmail.com /9971343515 CHATURANAN CHOUDHARY (Sign/Stamp) Received for submission to UTIITSL To know your PAN Application status, you may visit our website: https://www.utiitsl.com. As per instruction from Income Tax Department, an authorized agency's agent may visit you for your identity and address verification as per the documents submitted by you with the PAN application form. You are requested to ask authorization letter/ID card from the agent before verification.Your cooperation is solicited in this regard. Download PDF Form Print Close