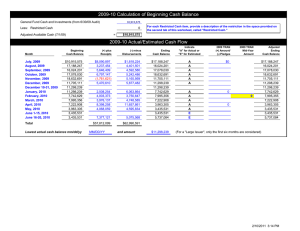

INTERMEDIATE FINANCIAL ACCOUNTING 1 6.2 Cash and Cash Equivalents Recognition, Measurement, and Disclosure Cash is the most liquid of the financial assets and is the standard medium of exchange for most business transactions. Cash meets the definition of a monetary, financial asset. Cash is usually classified as a current asset and includes unrestricted : Coins and currency, including petty cash funds Bank accounts funds and deposits Negotiable instruments such as money orders, certified cheques, cashiers’ cheques, personal cheques, bank drafts, and money market funds with chequing privileges. Cash can be classified as a long-term asset if they are designated for specific purposes such as a plant expansion project, or a long-term debt retirement, or as collateral. Certificates of Deposits (CD’s) are usually recorded as short-term investments. Petty cash funds are classified as cash because these funds are used to meet current operating expenses and to pay current liabilities as they come due. Even though petty cash has been set aside for a particular purpose, its balance is not material, so it is included in the cash balance in the financial statements. Excluded from cash are: Post-dated cheques from customers and IOUs (informal letters of a promise to pay a debt), which are classified as receivables Travel advances granted to employees, which are classified as either receivables or prepaid expenses Postage stamps on hand, which are classified as either office supplies (asset) or prepaid expenses (asset) Restricted Cash and Compensating Balances Restricted cash and compensating balances are reported separately from regular cash if the amount is material. Any legally restricted cash balances are to be separately disclosed and reported as either a current asset or a long-term asset, depending on the length of time the cash is restricted and whether the restricted cash offsets a current or a long-term liability. In general, cash should not be classified in current assets if there are restrictions that prevent it from being used for current purposes. However, in practice, many companies do not segregate restricted cash but disclose the restrictions through note disclosures. A compensating balance is a minimum cash balance in a company’s chequing or savings account as support for a loan borrowed from a bank (or other lending institution). By requiring a compensating balance, the bank can use the restricted funds that must remain on deposit to invest elsewhere resulting in a better rate of return to the bank than the stated interest rate (also called a face rate) of the loan itself. Foreign Currencies Many companies have foreign bank accounts or have bank accounts in other countries, especially if they are doing a lot of business in those countries. A company’s foreign currency is translated and reported in Canadian dollars at the exchange rate at the date of the balance sheet. For example, if a company had cash holdings of US $85,000 during the year at a time when the exchange rate was US $1.00 = Cdn $1.05, at the end of the year when the exchange rate had changed to US $1.00 = Cdn $1.11, the US cash balance would be reported on the balance sheet in Canadian funds as $94,350 ($85,000 × $1.11). Since the original transaction would have been recorded at Cdn $1.05, the adjusting entry would be for the difference in exchange rates since that time, or $5,100 ($85,000 × ($1.11 − $1.05)): In contrast, if the rate decreased, there would be a loss on foreign exchange recorded. For example, if a company had cash holdings of US $85,000 during the year at a time when the exchange rate was US $1.00 = Cdn $1.05, at the end of the year when the exchange rate had changed to US $1.00 = Cdn $1.02, the US cash balance would be reported on the balance sheet in Canadian funds as $86,700 ($85,000 × $1.02). Since the original transaction would have been recorded at Cdn $1.05, the adjusting entry would be for the difference in exchange rates since that time (from reporting period to reporting period), or $2,550 ($85,000 × ($1.05 − $1.02)): Usually, this cash is included in current assets, since for most foreign currencies satisfy the concept of being readily convertible. However, if the cash flow out of the country is restricted, the cash is treated in the accounts as restricted and reported separately. Bank Overdrafts Bank overdrafts occur when cheques are written for more than the amount in the bank account. Bank overdrafts (a negative bank balance) can be netted and reported with cash on the balance sheet if the overdraft is repayable on demand and there are other positive bank balances in the same bank for which the bank has legal right of access to settle the overdraft. Otherwise, bank overdrafts are to be reported separately as a current liability. Cash Equivalents Cash is often reported within the asset category called cash equivalents. Cash equivalents are short-term, highly liquid assets that can readily be converted into known amounts of cash and with little risk of price fluctuations. An example of a short- term cash equivalent asset would be one that matures in three months or less from the acquisition date. They may be considered as “near-cash,” but are not treated as cash because they can include a penalty to convert back to cash before they mature. Examples are treasury bills (T-bills), money market funds, short-term notes receivable, and guaranteed investment certificates (GICs). For companies using ASPE, equities investments are usually not reported as cash equivalents. For IFRS, preferred shares that are acquired within three months of their specified redemption date can be included as cash equivalents. Disclosures of Cash and Cash Equivalents Cash equivalents can be reported at their fair value, together with cash on the balance sheet. Fair value will be their cost at acquisition plus accrued interest to the date of the balance sheet. Below is a partial balance sheet from Orange Inc. that shows cash and cash equivalents as at December 31, 2020 along with the corresponding notes: Consolidated Balance Sheets (in millions) December 31 2020 December 31 2019 Assets Current assets: Cash and cash equivalents $18,050 $12,652 Short-term marketable securities $36,800 $27,000 Remember that all items should be recorded in Canadian dollars on the balance sheet. Foreign currency amounts should be “translated” at the balance sheet date. Restricted cash items should be included on the balance sheet (in cash and cash equivalents) however, in the notes to the financial statements, restricted cash should be separated with detailed explanations. Financial Instruments Cash Equivalents and Marketable Securities All highly liquid investments with maturities of three months or less at the date of purchase are classified as cash equivalents and are combined and reported with Cash. Management determines the appropriate classification of its investments at the time of purchase and reevaluates the designations at each balance sheet date. For example, the Company classifies its marketable debt (bonds) securities as either short term or long term based on each instrument’s underlying contractual maturity date. If they have maturities of 12 months or less, they are classified as short term. Marketable debt (bonds) securities with maturities greater than 12 months are classified as long term. The Company classifies its marketable equity (common or preferred shares) securities, including mutual funds, as either short term or long term based on the nature of each security and its availability for use in current operations. The Company’s marketable debt and equity securities are carried at fair value, with the unrealized gains and losses, reported either as net income or, net of taxes, as a component of shareholders’ equity (IFRS 9). The cost of securities sold is based on the specific identification model. Effective cash management includes strong internal controls and a strategy to invest any excess cash into short-term instruments that will provide a reasonable return in interest income but still be quickly convertible back into cash, if required. The chart on the following page is very important as it provides additional detail of how cash related items should be classified. Summary of Cash, Cash Equivalents, and Other Negotiable Elements Asset Classification Description and Examples Cash (current asset) Unrestricted: coins, currency, foreign currencies, petty cash, bank funds, money orders, cheques, and bank drafts Cash equivalent (current asset) Short-term commercial paper, maturing three months or less at acquisition, such as T-bills, money markets funds, short-term notes receivable, GICs Cash (long-term asset) Cash funding set aside for plant expansion, or long-term debt retirement, or collateral Summary of Cash, Cash Equivalents, and Other Negotiable Elements Asset Classification Description and Examples Cash (current or long-term asset) Separate reporting for legally restricted cash and compensating bank balances Receivables (current or long-term asset) Post-dated cheques, IOUs, travel advances Office supplies inventory (current asset) Postage on hand Bank indebtedness (current liability) Bank overdraft accounts not offset by same bank positive balances 6.2.1 Internal Control of Cash A key part of effective cash management is the internal control of cash. This topic was introduced in the introductory accounting course. Below are some highlights regarding internal control. The purpose of effective financial controls is to: Protect assets Ensure reliable recognition, measurement, and reporting Promote efficient operations Encourage compliance with company policies and practices The control of cash includes implementing internal controls over: The physical custody of cash on hand, including adequate levels of authority required for all cash-based transactions and activities The separation of duties regarding cash Maintaining adequate cash records, including petty cash and the preparation of regular bank reconciliations. Controlling the physical custody of cash plays a key role in effective cash management. In the opening story, Apple consolidated its bank accounts to a more manageable number, converted its idle cash into less accessible commercial paper that earned interest, and implemented a robust financial reporting system that would provide reliable and timely information about its cash position. Restricted Cash What is Restricted Cash? Restricted cash refers to cash that is held onto by a company for specific reasons and is, therefore, not available for immediate ordinary business use. It can be contrasted with unrestricted cash, which refers to cash that can be used for any purpose. Quick Summary: Restricted cash refers to cash that is held by a company for specific reasons and not available for immediate business use. Restricted cash is commonly found on the balance sheet with a description of why the cash is restricted in the accompanying notes to the financial statements. Reasons for cash being restricted include bank loan requirements, payment deposits, and collateral pledges. Restricted Cash on the Balance Sheet Restricted cash can be commonly found on the balance sheet as a separate line item. For example, the balance sheet may look as follows: The reason for any restriction is generally revealed in the accompanying notes to the financial statements. Additionally, depending on how long the cash is restricted for, the line item may appear under current assets or non-current assets. Cash that is restricted for one year or less is categorized under current assets, while cash restricted for more than a year is categorized as a noncurrent asset. Reasons for Restrictions There are several reasons why cash can be restricted: 1. Bank loan requirements When a company receives a bank loan, the bank may require that the company reserves (or maintains) a certain amount of cash that will be unavailable for spending. 2. Payment deposits A company may receive cash from a customer prior to providing services or shipping goods. The customer may require, through a clause in the agreement, that the company cannot spend the cash until the service or order is fulfilled. 3. Collateral pledge A company may be required by an insurance company to pledge a certain amount of cash as collateral against risk. 4. Paying off debt A company may set aside a certain amount of cash each quarter to make a payment on long-term debt. Financial Ratios Due to the cash not being readily available for use, cash that is restricted is generally excluded in several liquidity ratios. Failure to exclude the cash in the calculation of liquidity ratios will make the company look more liquid than it is and, thereby, be misleading. Examples of liquidity ratios that exclude restricted cash include the cash ratio and the quick ratio.