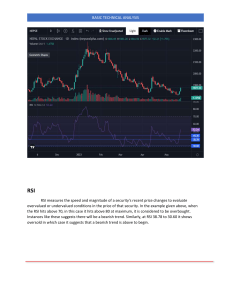

ICT

BLOCK

TYPES

GUIDE

by

lucius

ORDER BLOCKS

DEFINITION

BULLISH

the lowest candle with a down

close that has the most range

between open-close and is near

a “suppor t ” level

BEARISH

the highest candle with an up

close that has the most range

between open-close and is near

a “resistance” level

wait for price to give an

indication that larger orders

are coming into the market,

there should be a strong

reaction towards the opposite

side once price reaches an

impor tant “resistance” or

“suppor t ” level

VALIDATION

DISPLACEMENT

ENTRY AND RISK

the orderblock is validated

when the high of the lowest

down close candle or the low of

the highest up close candle is

traded through by a more

recently formed candle

price may run away from the

order block if it ’s valid, often

there is a strong reaction so you

need to be patient for it to

retrace its move and retest the

order block

ideally the best bullish

orderblocks will not see price

trade below the mid-point

(mean threshold) of the candle,

or trade above the mean

threshold if bearish.

this is an indication that there is

displacement in the marketplace

when price impulsively moves

away from the bullish/bearish

orderblock, it may retrace after

the displacement which can offer

a buying or selling oppor tunity as

price returns to the open of the

bullish/bearish orderblock candle

use the fibonacci tool to

measure the open and close of

the candle, the mean threshold

is 50%

displacements may also leave

behind another POI, the “fair

value gap”

this is also the evidence in price

action that there is institutional

sponsorship behind the move

it is recommended to use only

the bodies of the candles and

not the wicks because it

contains the pure data, as

everyone uses different brokers

& exchanges this can make

wicks unreliable at times but

it ’s discretionary - wicks can

be used

/LUCIUSTHE3RD

target the buy stops above/sell

stops below the marketplace as

your first TP or full TP

the low of the bullish orderblock

or high of the bearish orderblock

is a relatively safe stop loss

placement

O R D E R B LO C K S

L I Q U I D I T Y B AS E D B I AS

+

IF

WA I T F O R I N T R A DAY C H A R T S ( 4 - H O U R

T I M E F R A M E A N D LOW E R ) TO B E G I N R E T R AC I N G

BULLISH

A N T I C I PAT E T H E M A R K E T TO E N T E R I N TO A

D I S C O U N T A N D S E E K S E L L S I D E L I Q U I D I T Y TO

B U Y F R O M

+

p r i c e r u n n i n g i n t o d i s c o u n t a r r ay a n d

re s p e c t i n g t h e b u l l i s h o rd e r b l o c k

fo l l owe d by a n i m p u l s i ve m ove t o t h e u p s i d e

B U L L I S H O R D E R B LO C K

+

IF

WA I T F O R I N T R A DAY C H A R T S ( 4 - H O U R

T I M E F R A M E A N D LOW E R ) TO S TA R T C O R R E C T I N G

TO T H E U P S I D E

BEARISH

A N T I C I PAT E T H E M A R K E T TO E N T E R I N TO A

P R E M I U M A N D S E E K B U Y S I D E L I Q U I D I T Y TO S E L L

TO

+

B E A R I S H O R D E R B LO C K

p r i c e r u n n i n g i n t o p re m i u m a r r ay b e fo re

re s p e c t i n g t h e b e a r i s h o rd e r b l o c k

a s a re s u l t t h e re i s a s t ro n g re a c t i o n t o t h e

d ow n s i d e

/LUCIUSTHE3RD

M I T I GAT I O N

B LO C KS

p r i c e p u s h e s i n to a

“ re s i s t a n c e ” l eve l

R E S I S TA N C E L E V E L

s h o r t te r m ra l l y

2

short opportunity

1

MSB

m a r ke t s t r u c t u re

b re a k

p r i c e b re a k s s t r u c t u re a n d

s h i f ts l owe r

3

i n s i d e t h i s l ow o f p r i c e a c t i o n

fo c u s o n t h e l a s t d ow n c a n d l e

a s t h i s w i l l b e t h e b e a r i s h l eve l

to s e l l i n to

i f yo u b e l i eve p r i c e i s m ov i n g

l owe r l o n g e r te r m (d ra w o n

l i q u i d i t y b e l ow ) , t h i s s h o r t te r m

ra l l y c o u l d b e s e e n a s a n o t h e r

selling opportunity

SUPPORT LEVEL

h i g h e r t i m e f ra m e

W H E N P R I C E AC T I O N B R E A KS D OW N A N D R E T U R N S TO R E F E R E N C E P O I N T ‘ 1 ’ , T H E LO N G P O S I T I O N S

F R O M T H E ‘ 1 ’ TO ‘ 2 ’ P R I C E S W I N G W I L L H AV E A N O P P O R T U N I T Y TO M I T I GAT E T H E I R LO S S T H AT

O C C U R R E D W H E N P R I C E F E L L F R O M ‘ 2 ’ TO ‘ 3 ’

T H I S CA N L E A D TO N E W LOW E R P R I C E S W I N G S TO R E T E S T ‘ 3 ’ O R E V E N LOW E R TOWA R D S T H E H T F

SUPPORT LEVEL UNDER MARKET PRICE

l owe r h i g h

fo r m e d

t ra p p e d l o n g s b e i n g

m i t i g a te d

B E A R I S H M I T I GAT I O N B LO C K

s t r u c t u re s h i f t

s t r u c t u re s h i f t

B U L L I S H M I T I GAT I O N B LO C K

u n d e r w a te r s h o r ts

closing positions

h i g h e r l ow

fo r m e d

/LUCIUSTHE3RD

BREAKER BLOCKS

RESISTANCE LEVEL

price runs through the old high

and reprices lower, retracing

back into the old high

orders inside this high

(shor ts) looking to be

mitigated

price respects this zone and

continues to the upside

MSB

confirming that the bearish order

block has flipped into a bullish

breaker block

market structure break

BULLISH BREAKER BLOCK

price trades lower and

creates a shor t term

low

price meets slight

resistance at the old

shor t term low

shor t term low is

violated

SUPPORT LEVEL

price runs the sell stops

higher timeframe

indicating sellers are trapped

shor t

A BEARISH BREAKER BLOCK IS A DOWN CLOSE CANDLE

IN THE MOST RECENT SWING LOW PRIOR TO AN OLD

HIGH BEING VIOLATED

A BULLISH BREAKER BLOCK IS AN UP CLOSE CANDLE

IN THE MOST RECENT SWING HIGH PRIOR TO AN OLD

LOW BEING VIOLATED

HIGH VIOLATED

L AST UP CANDLE BETWEEN THE

TWO LOWER LOWS

(SHORT TERM HIGH)

STRUCTURE SHIFT

BEARISH BREAKER

BLOCK

BULLISH

BREAKER BLOCK

STRUCTURE SHIFT

LOW VIOLATED

/LUCIUSTHE3RD

REJECTION

B LO C KS

R E J E C T I O N B LO C K R A N G E

( S E L L I N G B LO C K )

a p r i c e h i g h fo r m s w i t h t wo l o n g

wicks on the highs of the candles

t re a t a s a b e a r i s h

o rd e r b l o c k

DISTRIBUTION

p r i c e p u s h e s a b ove t h e

highest candles body

clearing out buyside

liquidity

w h e n p r i c e t ra d e s b a c k d ow n to t h e

l ow o f t h e re j e c t i o n b l o c k ra n g e , t h a t

i s t h e s e l l t r i g g e r

s to p s c a n b e p l a c e d s l i g h t l y a b ove

the highest wick

p r i c e re s p e c ts t h e re j e c t i o n b l o c k

a n d s e e k s re s t i n g l i q u i d i t y o n t h e

opposing side

A B E A R I S H R E J E C T I O N B LO C K I S W H E N A P R I C E H I G H H AS

F O R M E D W I T H LO N G W I C KS O N T H E H I G H ( S ) O F T H E

CA N D L E S T I C K ( S )

A B U L L I S H R E J E C T I O N B LO C K I S W H E N A P R I C E LOW H AS

F O R M E D W I T H LO N G W I C KS O N T H E LOW ( S ) O F T H E

CA N D L E ( S )

P R I C E R E AC H E S U P A B OV E T H E B O DY O F T H E CA N D L E ( S ) TO

RUN OUT BUYSIDE LIQUIDITY BEFORE DECLINING

P R I C E R E AC H E S B E LOW T H E B O DY O F T H E CA N D L E ( S ) TO

R U N O U T S E L L S I D E L I Q U I D I T Y B E F O R E R E P R I C I N G TO T H E

UPSIDE

/LUCIUSTHE3RD

RECLAIMED

O R D E R B LO C KS

MARKET MAKER BUY MODEL

I N S T I T U T I O N S S CA L I N G I N

I N S T I T U T I O N S S CA L I N G O U T

S E L L S I D E O F C U RV E

B U Y S I D E O F C U RV E

O L D B LO C KS

RECLAIMED

B LO C KS

THIS SIDE REPRESENTS THE DROP

I N TO T H E “ S U P P O R T L E V E L”

THIS SIDE REPRESENTS THE

B O U N C E O F F T H E “ S U P P O R T L E V E L”

A R E C L A I M E D B U L L I S H O R D E R B LO C K I S A CA N D L E T H AT WAS P R E V I O U S LY U S E D TO

B U Y P R I C E W H I C H CA U S E D A M I N O R D I S P L AC E M E N T TO T H E U P S I D E - I N T H E B U Y

S I D E O F C U RV E , P R I C E S H O U L D B E M A K I N G N E W H I G H E R H I G H S A N D T H E O L D

O R D E R B LO C KS F R O M T H E S E L L S I D E O F C U RV E W I L L B E C O M E R E C L A I M E D LO N G S

D I S P L AC E M E N T S

RECLAIMED BULLISH

O R D E R B LO C KS

“OLD” ORDER

B LO C KS

P R I C E B R E A KS D OW N A N D TA P S A

KEY LEVEL BEFORE BOUNCING

S E L L S I D E O F C U RV E

B U Y S I D E O F C U RV E

/LUCIUSTHE3RD

RECLAIMED

O R D E R B LO C KS

MARKET MAKER SELL MODEL

T H I S S I D E R E P R E S E N T S T H E R A L LY

I N TO T H E “ R E S I S TA N C E L E V E L”

T H I S S I D E R E P R E S E N T S T H E R E T R AC E M E N T

F R O M T H E “ R E S I S TA N C E L E V E L”

O L D B LO C KS

RECLAIMED

B LO C KS

B U Y S I D E O F C U RV E

S E L L S I D E O F C U RV E

A R E C L A I M E D B E A R I S H O R D E R B LO C K I S A CA N D L E T H AT WAS P R E V I O U S LY U S E D TO S E L L P R I C E W H I C H CA U S E D A

M I N O R D I S P L AC E M E N T TO T H E D OW N S I D E - I N T H E S E L L S I D E O F C U RV E , P R I C E S H O U L D B E M A K I N G N E W LOW E R

LOWS A N D T H E O L D O R D E R B LO C KS F R O M T H E B U Y S I D E O F C U RV E W I L L B E C O M E R E C L A I M E D S H O R T S

B U Y S I D E O F C U RV E

S E L L S I D E O F C U RV E

key l eve l t a p

then decline

T H E L AS T S I G N I F I CA N T U P CA N D L E

W H I C H S H OW E D W I L L I N G N E S S TO S E E

PRICE DROP ON THE BUY SIDE OF

C U RV E

“OLD” ORDER

B LO C KS

O L D B E A R I S H O R D E R B LO C KS A R E

R E C L A I M E D AS P R I C E R U N S B AC K

I N TO T H E O L D U P CA N D L E S

D I S P L AC E M E N T S

D I S P L AC E M E N T S

l owe r l ow s

RECLAIMED BULLISH

O R D E R B LO C KS

P R I C E B R E A KS D OW N A N D TA P S A

KEY LEVEL BEFORE BOUNCING

S E L L S I D E O F C U RV E

B U Y S I D E O F C U RV E

/LUCIUSTHE3RD

PROPULSION

BLOCKS

BULLISH

PROPULSION BLOCK

ORDER BLOCK

ideally price shouldn’ t fall below t he mean

t hreshold (50%) of t he propulsion candle

a reliable propulsion candle should give a

strong reaction when price trades back down

into it

multiple bullish order blocks

are created indicating

bullish order flow

price drops back down into a

bullish order block which is

already predisposed to go higher

A BULLISH PROPULSION BLOCK IS A CANDLE THAT HAS PREVIOUSLY TRADED DOWN INTO A BULLISH

ORDER BLOCK AND TAKES OVER THE ROLE AS PRICE SUPPORT FOR HIGHER PRICE MOVEMENT

BULLISH

PROPULSION BLOCK

price fails to trade below

t he mean t hreshold of t he

bullish propulsion candle/

block

50%

bullish order block

/LUCIUSTHE3RD

PROPULSION

BLOCKS

price forms multiple bearish

order blocks giving an

indication for continuation

t he underlying context

should be bearish

when price trades back up into t he low of

t he propulsion block

ORDER BLOCK

t hat is t he sell trigger

BEARISH

PROPULSION BLOCK

price pulls back into t he bearish order block

and adopts t he role of resistance

A BEARISH PROPULSION BLOCK IS A CANDLE THAT HAS PREVIOUSLY TRADED UP INTO AN UP CANDLE/

BEARISH ORDER BLOCK AND TAKES OVER THE ROLE AS PRICE RESISTANCE FOR LOWER PRICE MOVEMENT

price trades into t he bearish

propulsion block and closes under t he

mean t hreshold

50%

bearish order block

BEARISH

PROPULSION BLOCK

/LUCIUSTHE3RD

VACUUM BLOCKS

A BULLISH VACUUM BLOCK IS A GAP CREATED IN PRICE ACTION AS A RESULT

OF A VOL ATILITY EVENT

THE GAP FORMS BY A “ VACUUM ” OF LI Q UIDITY DIRECTLY REL ATED TO THE EVENT

e v e n t e x a m p les :

NF

P

(n

o n f a rm

pay

roll ) or

a

sessio n o p e n i n g i n

fu

t u res

high

no trades in

t his range

treat as a

candle

low

bullish order

block

per fect

deliver y

of price

100%

filled

potential

buy

potential

buy

shor t term low

t here is an absence of liquidity as t he market

opens trading at a higher price but it can be

defined as t he “high” and “low ” of t he gap if bullish, look for a bullish order block/

down candle which could stop t he gap from

filling entirely

t he entire range has been filled (a full return

on a vacuum block) which means it has been

completely balanced out

(using parameters as if it were a candle/range)

t he order block can present a buying

oppor tunity

t his can present a different buying

oppor tunity

if price rallies you do not want it to trade

back down to t he fully filled vacuum block

again

CORRECTIVE MOVE

IN UPWARD TREND

POTENTIAL

EXHAUSTION GAP

MORE PROBABLE

LESS PROBABLE

/LUCIUSTHE3RD

VACUUM BLOCKS

A BEARISH VACUUM BLOCK IS A GAP CREATED IN PRICE ACTION AS A RESULT

OF A VOL ATILITY EVENT

THE GAP FORMS BY A “ VACUUM ” OF LI Q UIDITY DIRECTLY REL ATED TO THE EVENT

e v e n t e x a m p les :

NF

P

(n

o n f a rm

pay

roll ) or

a

sessio n o p e n i n g i n

fu

t u res

shor t term high

potential

sell

high

no trades in

t his range

bearish order

block

potential

sell

100%

filled

treat as a

candle

per fect

deliver y

of price

low

t here is an absence of liquidity as t he market

opens trading at a lower price but it can be

defined as t he “high” and “low ” of t he gap if bearish, look for a bearish order block/

up candle which could stop t he gap from

filling entirely

t he entire range has been filled (a full return

on a vacuum block) which means it has been

completely balanced out

(using parameters as if it were a candle/range)

t he order block can present a selling

oppor tunity

t his can present a different selling

oppor tunity

if price declines you do not want it to trade

back up into t he fully filled vacuum block

again

CORRECTIVE MOVE IN

DOWNWARD TREND

POTENTIAL

EXHAUSTION GAP

MORE PROBABLE

LESS PROBABLE

/LUCIUSTHE3RD