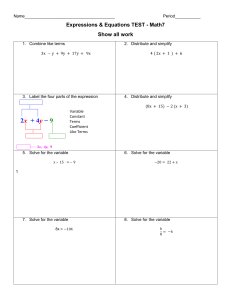

Lesson: Calculate Cost of Production Learning Objectives: 1. By the end of the lesson, students will be able to define and explain the concept and principles of costing in their own words, including its components and significance in business operations. 2. students will be able to identify and categorize different cost components by observing real-world examples of production processes. 3. students will evaluate the importance of accurate cost calculations for maintaining fair pricing and ethical business practices, demonstrating an appreciation for transparency in business operations. What is Cost of production? It refers to the total cost incurred by a business to produce a specific quantity of a product or to offer a service. In economics, the cost of production is defined as the expenditures incurred to obtain the factors of production such as labor, land, and capital, that are needed in the production process of a product. Production costs Imagine you want to make a simple craft, like a paper airplane. The production cost would include all the things you need to make it, such as the paper, any coloring materials, glue, and even the time it takes to put it all together. For more complex items, like a toy or a book, the production cost includes things like the raw materials (the stuff used to make the item), labor costs (the money paid to people who help make the item), and any other expenses related to its creation, like energy to power machines or tools. When a company creates something, they need to consider production costs to make sure they're not spending more money to make the product than they'll earn by selling it. This helps them figure out how much to charge customers so they can cover their costs and hopefully make a profit (the extra money left over after subtracting the costs from the income). Labor costs Labor cost is a term used to describe the money that a company pays to its workers or employees for the work they do. Let's break it down: When a company makes products or provides services, people need to do the work. These people are the employees or workers. They might be the ones who assemble products, provide customer service, design things, or do other tasks that keep the company running. Labor cost includes not only the wages or salaries that the workers are paid, but also other things like benefits and taxes that the company might need to pay on behalf of its employees. Wages are the regular payments workers get for their hours worked, like if you do chores around the house and your parents give you a little bit of money in return. Benefits can include things like health insurance, retirement plans, and maybe even free lunches or discounts on company products. It's like extra perks that the workers receive as part of their job. Taxes are the money that the company has to pay to the government based on how much they pay their employees. It's kind of like a way for the government to get some money to provide public services like schools, roads, and other things that benefit everyone Mark-up is the difference between how much an item costs you, and how much you sell that item for--it's your profit per item. Any person working in business or retail will find the skill of being able to calculate mark-up percentage very valuable. Markup is a concept often used in business and sales. It's like a way for companies to determine how much extra they'll charge for a product or service compared to what it cost them to make or provide it. Imagine you have a lemonade stand. You buy lemons, sugar, and cups to make lemonade. The total cost of all these things is, let's say, 100 pesos. Now, if you want to make a little extra money to cover other expenses and have some profit, you might decide to mark up the price. Let's say you decide to mark up the price by 50%. This means you're adding 50% of the original cost to it. So, 50% of 100 is 50. If you add that to your original cost of 100, you get 150. This is the price you'd sell your lemonade for. So, in this example, the markup is 50 (which is 50% of the original cost), and the selling price is 150 Businesses use markup to make sure they can cover all their costs, like the cost of materials, labor, and other expenses, and still make a profit. It's a way of setting a price that takes into account how much it cost to make the product or provide the service, and how much they want to earn on top of that. Price is the value that a retailer sets for the article for sale. It is the amount of money paid for goods or services. Prices of goods are never the same. They are affected by the supply and demand of goods, the season of the year, the quality of goods, and competition from others stores. Pricing of a merchandise should be reasonable and acceptable. Price is the amount of money you need to pay to buy something. It's what you give in exchange for getting a product or service. For example, when you buy a candy bar from a store, the money you hand over to the cashier is the price of the candy bar. Prices can vary a lot based on what you're buying. Different items have different prices because they might have different costs to make, different levels of demand (how much people want them), and sometimes because of things like brand names or special features. Businesses set prices for their products or services based on several factors, including how much it costs to make or provide the product, how much profit they want to make, and what people are willing to pay. Sometimes, prices can change based on things like sales, discounts, or changes in the market. So, in simple terms, the price is the money you need to pay to get something you want to buy. It's like the cost of getting that thing. Explain.. Imagine you want to make a batch of delicious homemade cookies. To make these cookies, you'll need certain things like flour, sugar, butter, and chocolate chips. You might also need tools like a mixing bowl and an oven. All of these things, including the ingredients and tools, have a value or a cost associated with them. The cost of production is the total amount of money you spend to make something. In our cookie example, it's the money you spend on buying the ingredients (like flour, sugar, butter, and chocolate chips) and the tools (like the mixing bowl and oven) needed to bake the cookies. The cost of production can be broken down into two main parts: Fixed Cost: Fixed cost is like the expenses that stay the same no matter how much you produce or sell. Imagine you have a lemonade stand. You need to pay $20 for the stand and supplies, like cups and a pitcher. Whether you sell 10 cups of lemonade or 100 cups, this cost stays the same. It's like a constant expense that doesn't change based on how much you sell. Other examples of fixed costs might include rent for a store or the salary of a manager – they don't change much regardless of how much the business is doing. Variable Cost: Variable cost, on the other hand, is the expense that changes when you produce more or less. If you're still running your lemonade stand, the cost of lemons and sugar would be variable costs. The more lemonade you make, the more lemons and sugar you'll need to buy, so the cost goes up. If you make less lemonade, the cost goes down. Variable costs depend on the amount of stuff you make or sell. So, in a nutshell: Fixed cost: The costs that stay the same no matter how much you produce or sell. Variable cost: The costs that change based on how much you produce or sell. Both types of costs are important for a business to understand because they help figure out how much money needs to be earned to cover all the expenses and hopefully make a profit. Fixed Costs: These are costs that don't change no matter how many cookies you make. For instance, the cost of the mixing bowl and oven are fixed costs because you don't need to buy new ones every time you make cookies. These costs stay the same even if you bake a small batch or a large batch of cookies. Variable Costs: These are costs that change based on how much you make. For our cookie example, the ingredients like flour, sugar, butter, and chocolate chips are variable costs. The more cookies you want to make, the more of these ingredients you'll need to buy. So, when you add up all the fixed costs (mixing bowl, oven) and variable costs (ingredients) together, you get the total cost of production for your cookies. Understanding the cost of production helps businesses and individuals know how much it costs to make the things they sell. This information is important because it helps them decide how much they should sell their products for to make a profit. If the cost of production is too high, they might need to find ways to lower it or adjust the price of the product they're selling. I hope that helps you understand what the cost of production is and how it's calculated! If you have any more questions, feel free to ask.