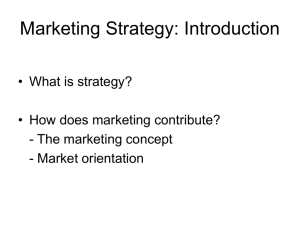

S t. Xavier’s College of Management & Technology NAAC Accredited with B++ Grade (1st Cycle) Digha-Aashiyana Road, Digha Ghat, Patna- 800011, Bihar TOPIC: BCG Subject: Strategic management Under the guidance of: Joel sir Name: Aman kumar Class: Bba 2b Roll no: 75 Department: BBA Table of Contents • • • • Introduction to BCG BCG Matrix Real life Examples Conclusion INTRODUCTION BCG (Boston Consulting Group) Founded in 1963, BCG (Boston Consulting Group) is a global management-consulting firm. BCG helps corporations and other organizations innovate and achieve sustainable competitive advantage. Founded: 1963 Headquarters: Boston, Massachusetts Country: United States CEO: Christoph Schweizer Employees: 22,000 What is BCG MATRIX? • BCG matrix is a framework created by Boston Consulting Group to evaluate the strategic position of the business brand portfolio and its potential. It classifies business portfolio into four categories based on industry attractiveness (growth rate of that industry)and competitive position (relative market share). • These two dimensions reveal likely profitability of the business portfolio in terms of cash needed to support that unit and cash generated by it. The general purpose of the analysis is to help understand, which brands the firm should invest in and which ones should be divested. Stars • Stars exhibit high growth and command high market share. Stars are found in the upper left quadrant of the matrix. A company should invest more in stars, as they are well-established products or brands in highgrowth markets. They generate significant income and account for a significant percentage of the market share. Stars tend to generate greater ROI than inhabitants of the other three quadrants. Cash Cow • Cash Cows exhibit low growth but command high market share. They are found in the lower-left portion of the quadrant, and these products/brands typically command a relatively large market share in a mature and slow-growth industry. • Cash cows require little investment and are typically leading, well-established products in mature markets. The cash these products generate can be invested elsewhere, so a company is wise to milk the cash cow as long as possible. Returns on cash cows usually exceed the market growth rate and generate self-sustaining cash flow. Question Marks • Question Marks show high growth but command low market share and are located in the upper right quadrant. Usually found in a high-growth industry, question marks require significant investment to maintain or increase market share. They’re usually recently introduced products with sound commercial prospects. With sufficient investment, they have the potential to become stars. If neglected, they may become dogs. Dogs • Dogs are found in the lower right quadrant, with both low growth and low market share. The dismal performance may be due to high costs, inferior quality, or a lack of effective marketing. Unless there is some hope of gaining market share, a company is wise to dispose of these drains on resources and cash. Dogs are frequently unprofitable. HIGH HIGH LOW LOW BCG Matrix – Advantages and Limitations • The BCG matrix is very useful for manufacturing companies since an understanding of a product’s market position is imperative to understanding its growth potential. The BCG matrix can also be used to assess the market share of a product relative to competing products. The matrix offers a useful framework for allocating resources to particular products. • However, the matrix does have certain limitations. First, markets may be less clearly defined than the matrix suggests. Moreover, it doesn’t offer information about what the competition is doing. Second, the market growth rate and relative market share are not the only indicators of profitability. Third, this four-quadrant approach may be overly simplistic considering the dynamic nature of markets and industries/sectors. Finally, a high market share does not always result in strong profits given that high costs may also be involved in maintaining that market share. BCG Matrix – How to use the BCG Matrix • Using five parameters – the definition of the market, relative market share, market growth rate, cash generation, and usage of cash – a company should allocate its products to the relevant quadrant. Based on this allocation, the company can determine which products to invest in and which to discontinue. • It might be noted that defining the market is the most important step. If a market is incorrectly defined, the product could be incorrectly classified. The relative market share is calculated by dividing the selected product’s market share (or revenue) by the market share or revenue of the largest competitor in the sector. Moreover, it’s also necessary to calculate the market growth rate. This can be estimated by assessing the average revenue growth of the leading companies within the product sector. Conclusion • The BCG matrix can be usefully deployed to assess a product’s potential growth rate within its industry versus its relative market share to help develop longterm strategic marketing plans that aim to maximize profit. • The matrix can be applied across many industries and is used by some of the world’s most prominent companies, including Coca-Cola, Apple, Samsung, PepsiCo, Nestle, Unilever, Amazon, and KFC. All of these companies have products found in each of the quadrants. REFERENCES • https://www.youtube.com/watch?v=rRsxtLF2xhQ&ab_c hannel=SkillBUZZTrainings • https://www.youtube.com/watch?v=w9CdIKYyxBM&ab _channel=Dr.VivekBindra%3AMotivationalSpeaker • https://www.forbes.com/companies/bcg-bostonconsulting-group/?sh=5314d988358a • https://www.fe.training/free-resources/credit/bcgmatrix/#:~:text=Conclusion,that%20aim%20to%20maxi mize%20profit.