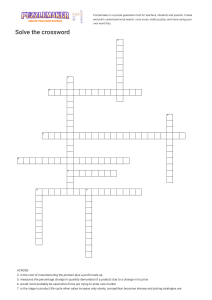

Transfer Pricing in Divisionalized Companies Part ( 1 ) Group 8 Members (Section-2) Name Roll.no. Name Roll.no. Ma Lin Le Waddy Aung II-Comm-113 Ma Thoon Lai Shwe Yee Phoo II-Acc-15 Ma Hnin Phyu Phyu Hlaing II-Comm-115 Ma Kyi Shin Thant II-Acc-16 Ma May Sandar Lwin II-Comm-125 Ma Myo Pyae Pyae Han II-Acc-20 Mg Nay Zin Ko II-Comm-142 Ma Theint Thet Htar San II-Acc-22 Ma May Myint Myat Thu II-Acc-9 Ma Lwin Lwin Myo II-Acc-23 Mg Khant Zay Aung II-Acc-10 Nang Kham Bwar Lin II-Acc-24 Contents 01 Purpose of Transfer Pricing 03 Comparison of Cost-based Transfer Pricing Methods 02 Alternatives Transfer Pricing Methods 04 Proposals for Resolving Transfer Pricing Conflicts Purposes of Transfer pricing A transfer pricing system can be used to meet the following purposes: 1. To provide information that motivates divisional managers to make good economic decisions 2. To provide information that is useful for evaluating the managerial and economic performance of a division 3. To ensure that divisional autonomy is not undermined 4. To intentionally move profits between divisions or locations Alternative Transfer Pricing Methods MARKET-BASED TRANSFER PRICES Market-based transfer prices are the prices at which goods or services are bought and sold between different divisions within a company as if they were external entities in a competitive market. It will not matter whether the supplying division's output is sold externally or internally. Cost Plus A Mark-Up Transfer Price Marginal/ variable Cost Transfer Prices Cost plus mark-up transfer price approach calculates the transfer price by adding a predetermined mark-up to the cost of producing the item or delivering the service. Marginal/ variable Cost Transfer Prices are calculated based on the additional cost incurred by producing one more unit of product or service excluding fixed cost. Full Cost Transfer Price without a Mark-Up Full cost transfer prices without a mark-up are calculated based on the total cost incurred in producing the item without adding any additional profit margin. Negotiated Transfer Prices Negotiated transfer prices are internal prices established through discussions and negotiations between different divisions instead of relying on a fixed formula or cost structure. These prices are mutually agreed upon by the involved parties based on various factors including market conditions, divisional goals and bargaining. Marginal/ Variable Cost Plus Opportunity Cost Transfer Prices This transfer prices consider both the marginal or variable cost of producing item as well as the opportunity cost incurred by the supplying division for using its intermediate product internally rather than selling it externally for profit. For Example : A supplying division can sell its intermediate product which has a variable cost of 30$ for 50$. In this case, the transfer price would be 30$ (variable cost) + 20$ (opportunity cost of not selling it externally) = 50$. Comparison of Cost-Based Transfer Pricing Methods 1. Marginal Cost Transfer Pricing -It sets the transfer price based on additional cost of producing one more unit of a product. -Ideal for short-term decisions. -May not cover fixed costs, potentially causing issues with overall profitability. 2. Full Cost Transfer Pricing -It considers both variable and fixed costs when setting the transfer price. -provides a more comprehensive view of cost structure -Can lead to profitability issues if the selling division has high fixed costs as it may discourage production. 3. Cost Plus Transfer Pricing -Adds predetermined profit margin to the cost of production -Balances covering costs and ensuring profitability -Offers flexibility in profit margin determination. Proposals for Resolving Transfer Pricing Conflicts Our discussion so far has indicated that in the absence of a perfect market for the intermediate product none of the transferr pricing methods can perfectly meet both the decision making and performance evaluation requirements. To resolve such conflicts the following transfer pricing methods have been suggested: 1. A dual-rate transfer pricing system 2. A marginal cost plus a fixed lump sum fee Dual-Rate Transfer Pricing System Dual-rate transfer pricing uses two seperate transfer prices to price each interdivisional transaction. For example, the supplying division may receive the full cost plus a mark-up on each transaction and the receiving division may be charged at the marginal cost of the transfers. In This context, the receiving division pays the supplying division at marginal cost transfer price and the supplying division's markup is used for the purpose of evaluating its performance on overall divisional profitability Dual-rate transfer prices are not wildly used in practice for several reasons. -The use of different transfer prices can cause confusion. -They are considered to be artificial. -They reduce divisional incentives to compete effectively. -Top-level managers do not like to double count internal profits since it can result in misleading information and create a false impression of divisional profits. Thank you For Your Attention!