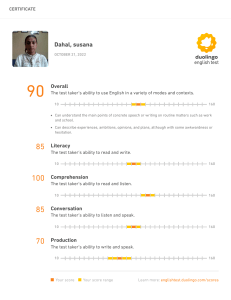

DUOLINGO ($DUOL) Company Background: Sector: Technology Industry: Online education, professional certification, translation, crowdsourcing, software development, software application TTM Financials: Total Revenue =206,736, EBITDA=-25,060, Cost of Revenue=57,120 Q2 2021 Free Cash Flow: $7.9 Market Cap: $6.49 Billion Earnings per Share (Current Quarter): -$0.44 Gross Margin Profitability: 71.22 Number of Employees: 400+ Company Summary: Founded in 2011, Duolingo is a company that specializes in offering an accessible language learning platform that allows the user access to a number of language lessons and earn language certificates. Online Language Learning Industry: With the globalization of the economy and adoption of cost-efficient technological products, the need for accessible language learning is driven by the need for communication around the world. As businesses expand, the demand for multilingual employees also rises. Currently with advanced AI technology and low-cost and effective technology, e-language learning is becoming more accessible and popular than ever. Competition: Currently, Duolingo’s competitors are NovaKid, Rosetta Stone, Preply, Coorori, and Cambly. However, Duolingo is the only platform that offers a majority of their curriculum free to the public, while having a variety of languages and resources available for the user. Source of Revenue: Duolingo operates on a freemium business model and has multiple sources of revenue through their premium subscription, displayed advertisements, and language proficiency tests. DUOLINGO GROWTH Year Revenue Valuation Funding 2011 3.3 million 2012 18 million Users Downloads 5/1 2013 5 million 10 million 2014 10 million 25 million 2015 83 million Available Courses/ Languages 120 million 11 DUOLINGO ($DUOL) 2016 470 million 30 million 108 million 150 million 18/19 2017 13 million 700 million 2018 36 million 1.5 billion 25 million 300 million 62 2019 78 million 2.4 billion 30 million 385 million 91 2020 161 million 6.5 billion 42 million 500 million 95/38 148 million 200 million Investment Thesis: - I recommend longing $DUOL in the next 12 months due to their user forecasts and development of new services. I also recommend that this position be added under the $144 price target, as the current price at $158 holds the price as overvalued. If added at a strategic time below the $144 price target before Duolingo announces their newest services, I believe a 15%+ gain is possible. Strong Growth in Monthly Active Users and Paid Subscribers: According to DUOLINGO’s Q2 Shareholder Presentation, from 2017-2020 the percentage of paid subscribers incrementally increased from 0-4% along with the increase of monthly active users. This trend is likely to continue with the market growth. By their next earnings, it is expected that their revenue will increase through their increase of monthly active users. Expansion to a variety of education services: Because Duolingo’s long term goal is to provide an accessible universal education through their platform, they are currently developing services beyond language learning. In addition to this, they hope to expand the adoption of the Duolingo English Test. With these new developments underway, the company continues to distinguish itself from other companies in the market. Price History DUOLINGO 1 Year Chart DUOLINGO ($DUOL) After releasing its IPO on July 27, 2021 at $102 and trading at $141, Duolingo’s share price continued to increase unlike many other IPO’ed stocks that tend to rise on their IPO date and deflate drastically immediately afterwards. Duolingo has a promising uptrend and has only faced one minor tumble near the end of August when China removed Duolingo from their app stores. Catalysts: 1. Growing Market for online language learning: The online language learning market is expected to grow at a CAGR of 18.7% and reach $21.2 billion in 2027. It can safely be assumed that Duolingo, currently a top rated application, will also grow and gain in popularity along with the consumer demand for language learning platforms. 2. New Products and Services: From its IPO in July, Duolingo has the potential and technology to develop new products and services to compete in the growing market as well as allot for more sources of revenue. According to their Q2 Shareholder presentation, they are ultimately planning to expand their services beyond language learning and provide universal education in different subjects. 3. Company Expansion: Duolingo plans to expand their platform accessibility and services to Asia, which currently has the highest demand for language learning. Valuation Summary: Currently the company’s valuation is at $6.5 billion, and according to multiple analysts the stock is overweight, as the average target price is $144. Duolingo, however, still remains stronger than other companies in the market as it has a higher demand. Risks: 1. Lack of Innovation and New Products: Over time, without innovation, competitors of DUOLINGO may replace the app with better technology and services. 2. Decrease of Paid Subscriptions and Users: If percentage of paid subscriptions decrease throughout time, then DUOLINGO will begin to lose revenue and funding. 3. Worst case scenario: Because this investment is within a year’s term, the share price would not be immediately affected by the two possible risks. If their next quarterly earnings report a decrease in revenue and users, then it would be possible for the company to return to its lowest price target of $125, which would be roughly a 20-21% loss.