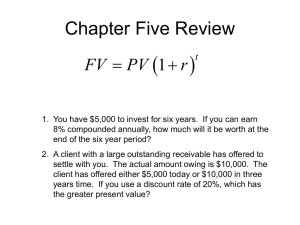

8/26/2020 Assignment Print View 1. You are considering an investment in 30-year bonds issued by Moore Corporation. The bonds have no special covenants. The Wall Street Journal reports that 1-year T-bills are currently earning 3.25 percent. Your broker has determined the following information about economic activity and Moore Corporation bonds: Real risk-free rate Default risk premium Liquidity risk premium Maturity risk premium = = = = 2.25% 1.15% 0.50% 1.75% a. What is the inflation premium? b. What is the fair interest rate on Moore Corporation 30-year bonds? (For all requirements, round your answers to 2 decimal places. (e.g., 32.16)) a. Inflation premium % b. Fair interest rate % https://ezto.mheducation.com/hm.tpx?todo=c15SinglePrintView&singleQuestionNo=1.&postSubmissionView=13252713544045386&wid=1325271437… 1/1 8/26/2020 Assignment Print View 2. A recent edition of The Wall Street Journal reported interest rates of 2.25 percent, 2.60 percent, 2.98 percent, and 3.25 percent for three-year, four-year, five-year, and six-year Treasury notes, respectively. According to the unbiased expectations theory of the term structure of interest rates, what are the expected one-year rates during years 4, 5, and 6? (Do not round intermediate calculations. Round your answers to 2 decimal places. (e.g., 32.16)) Expected One-Year Rates Year 4 % Year 5 % Year 6 % https://ezto.mheducation.com/hm.tpx?todo=c15SinglePrintView&singleQuestionNo=2.&postSubmissionView=13252713576819878&wid=1325271437… 1/1 8/26/2020 Assignment Print View 3. Suppose that the current one-year rate (one-year spot rate) and expected one-year T-bill rates over the following three years (i.e., years 2, 3, and 4, respectively) are as follows: 1R1 = 6%, E(2r1) = 7%, E(3r1) = 7.5%, E(4r1) = 7.85% Using the unbiased expectations theory, calculate the current (long-term) rates for one-, two-, three-, and four-year-maturity Treasury securities. (Round your answers to 2 decimal places. (e.g., 32.16)) Current (Long-Term) Rates One-year % Two-year % Three-year % Four-year % https://ezto.mheducation.com/hm.tpx?todo=c15SinglePrintView&singleQuestionNo=3.&postSubmissionView=13252713544142504&wid=1325271437… 1/1 8/26/2020 Assignment Print View 4. Calculate the present value of $5,000 received five years from today if your investments pay (Do not round intermediate calculations. Round your answers to 2 decimal places. (e.g., 32.16)) Present Value a. 6 percent compounded annually b. 8 percent compounded annually c. 10 percent compounded annually d. 10 percent compounded semiannually e. 10 percent compounded quarterly https://ezto.mheducation.com/hm.tpx?todo=c15SinglePrintView&singleQuestionNo=4.&postSubmissionView=13252713576819859&wid=1325271437… 1/1 8/26/2020 Assignment Print View 5. Suppose we observe the following rates: 1R1 = 10%, 1R2 = 14%, and E(2r1) = 18%. If the liquidity premium theory of the term structure of interest rates holds, what is the liquidity premium for year 2? (Round your intermediate calculations to 5 decimal places and final answer to 3 decimal places. (e.g., 32.161)) Liquidity premium % https://ezto.mheducation.com/hm.tpx?todo=c15SinglePrintView&singleQuestionNo=5.&postSubmissionView=13252713576661047&wid=1325271437… 1/1 8/26/2020 Assignment Print View 6. Calculate the future value in five years of $5,000 received today if your investments pay (Do not round intermediate calculations. Round your answers to 2 decimal places. (e.g., 32.16)) Future Value a. 6 percent compounded annually b. 8 percent compounded annually c. 10 percent compounded annually d. 10 percent compounded semiannually e. 10 percent compounded quarterly https://ezto.mheducation.com/hm.tpx?todo=c15SinglePrintView&singleQuestionNo=6.&postSubmissionView=13252713576819882&wid=1325271437… 1/1 8/26/2020 Assignment Print View 7. Calculate the future value of the following annuity streams: a. $5,000 received each year for 5 years on the last day of each year if your investments pay 6 percent compounded annually. b. $5,000 received each quarter for 5 years on the last day of each quarter if your investments pay 6 percent compounded quarterly. c. $5,000 received each year for 5 years on the first day of each year if your investments pay 6 percent compounded annually. d. $5,000 received each quarter for 5 years on the first day of each quarter if your investments pay 6 percent compounded quarterly. (For all requirements, do not round intermediate calculations. Round your answers to 2 decimal places. (e.g., 32.16)) a. Future value b. Future value c. Future value d. Future value https://ezto.mheducation.com/hm.tpx?todo=c15SinglePrintView&singleQuestionNo=7.&postSubmissionView=13252713576661056&wid=1325271437… 1/1 8/26/2020 Assignment Print View 8. On March 11, 20XX, the existing or current (spot) one-year, two-year, three-year, and four-year zerocoupon Treasury security rates were as follows: 1R1 = 4.75%, 1R2 = 4.95%, 1R3 = 5.25%, 1R4 = 5.65% Using the unbiased expectations theory, calculate the one-year forward rates on zero-coupon Treasury bonds for years two, three, and four as of March 11, 20XX. (Do not round intermediate calculations. Round your answers to 2 decimal places. (e.g., 32.16)) Year 2 One-Year Forward Rates % Year 3 % Year 4 % https://ezto.mheducation.com/hm.tpx?todo=c15SinglePrintView&singleQuestionNo=8.&postSubmissionView=13252713576819880&wid=1325271437… 1/1 8/26/2020 Assignment Print View 9. Calculate the present value of the following annuity streams: a. $5,000 received each year for 5 years on the last day of each year if your investments pay 6 percent compounded annually. b. $5,000 received each quarter for 5 years on the last day of each quarter if your investments pay 6 percent compounded quarterly. c. $5,000 received each year for 5 years on the first day of each year if your investments pay 6 percent compounded annually. d. $5,000 received each quarter for 5 years on the first day of each quarter if your investments pay 6 percent compounded quarterly. (For all requirements, do not round intermediate calculations. Round your answers to 2 decimal places. (e.g., 32.16)) a. Present value b. Present value c. Present value d. Present value https://ezto.mheducation.com/hm.tpx?todo=c15SinglePrintView&singleQuestionNo=9.&postSubmissionView=13252713576661055&wid=1325271437… 1/1 8/26/2020 Assignment Print View 10. Based on economists’ forecasts and analysis, one-year T-bill rates and liquidity premiums for the next four years are expected to be as follows: 1R1 = E(2r1) = E(3r1) = E(4r1) = 5.65% 6.75% 6.85% 7.15% L2 = 0.05 % L3 = 0.10 % L4 = 0.12 % Calculate the four annual rates. (Round your answers to 2 decimal places. (e.g., 32.16)) Annual Rates Year 1 % Year 2 % Year 3 % Year 4 % https://ezto.mheducation.com/hm.tpx?todo=c15SinglePrintView&singleQuestionNo=10.&postSubmissionView=13252713544045391&wid=132527143… 1/1