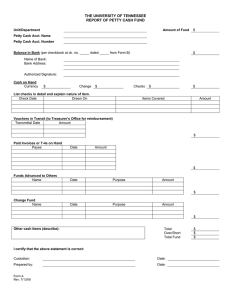

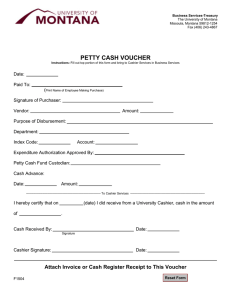

Ysaal, Juliana Kassandra M. 3BSA-2 September 4, 2023 Cash and Cash Equivalents Cash is the standard medium of exchange. Cash means money (in layman’s term). In accounting, cash is money and other negotiable instruments. For asset to be considered/classified as cash: - It must be unrestricted in use or readily available. Held for current maturing obligations. (Obligations must be settled within one year or less) Difference of cash and cash equivalents Cash equivalents - Short-term investments [3-month rule (Date of Purchase of investment)] Highly liquid investments Readily convertible into cash Must be purchased within 3 months before maturity Forms of cash equivalent investments: BSP Treasury Bill Money Market Placement Time Deposit Note: If the problem is silent, it is cash equivalents. Cash Items considered as cash: - Cash on hand (undeposited collections) Such as: coins, bills, checks, money orders, and bank drafts. Cash in bank Such as: demand/checking account and savings account. Cash fund [Parallel: if for paying CL then it’s CA] Short-term obligations (Current Asset) Petty cash fund Travel fund Dividend fund Change fund Ysaal, Juliana Kassandra M. 3BSA-2 September 4, 2023 Long-term obligations (Non-Current Asset). Sinking fund Set aside fund Cash Management Excess cash is not good for the business. Excess cash is invested. Investment of excess cash 1. 3 months or less = Cash equivalent 2. More than 3 months but not exceeding 1 year = Short-term investment 3. More than 1 year = Long-term investment Note: Long-term to Short-term is possible but not Short-term to Cash Equivalents. Measurement of Cash - Face value Foreign currency: Current exchange rate (If legally restricted: Non-current asset) Cash in a financial distressed company: Net realizable value Bank overdraft (prohibited in the Philippines) Cash with credit balance. Cash with negative balance. Treatment: Negative account will be Current Liability Could be off-set if within the same bank. Compensating balance - - Formal (legally restricted) Short-term: Current Assets Long-term: Non- Current Assets Informal (not legally restricted) o Verbatim agreement o Still part of Cash Types of Checks (all checks issued are deducted) 1. Undelivered check – Check already issued but wasn’t received by the recipient. Treatment: Increases cash. 2. Post-dated check – Check received by the recipient but with a date later than the current date. Ysaal, Juliana Kassandra M. 3BSA-2 September 4, 2023 Treatment: Increases cash. 3. Stale check – Checks that are still outstanding (Checks not redeemed within 6 months) Treatment: Increases cash. Accounting for Shortage and Overage Shortage – Cash recorded is higher than the physical count Cash shortage due to cashier’s fault would result to Debit entry of “Due from cashier”. Cash shortage but the cashier is in good faith would result to “Loss”. Overage – Cash recorded is lower than the physical count Cash overage due to cashier’s fault would result to Credit entry of “Payable to cashier”. Cash overage but the cashier is in good faith would result to “Income” Cash recorded will be adjusted in proportion to the physical count. Entries: Shortage Cash shortage 1,500 Cash Due from Cashier/Loss Cash shortage Overage 1,500 1,500 1,500 Cash Cash Overage 1,000 Cash overage 1,000 1,000 Payable to cashier/Income 1,000 Imprest System of Internal Control - Proper control over cash All cash receipts should be deposited intact and all cash disbursements should be made by means of check. Small expenses: it is impractical to issue a check which is why there is an established petty cash fund. Imprest Fund System – Only recognizes expenses when there is replenishment. Ysaal, Juliana Kassandra M. 3BSA-2 September 4, 2023 Fluctuating Fund System – Recording expenses whenever there is movement of money. Set up Imprest Fund System Debit Credit Petty cash fund Cash in bank Record payment of expenses Memorandum entry Replenishment Expenses of fund Fluctuating Fund System Debit Credit Set up Petty cash fund Cash in bank Record payment of expenses Expenses Petty cash fund Replenishment Petty cash of fund fund Cash in bank Increase of funding Petty cash fund Cash in bank Increase of funding Petty cash fund Cash in bank Decrease of funding Cash in bank Cash in bank Decrease of funding Petty cash fund Cash in bank Petty cash fund Ysaal, Juliana Kassandra M. 3BSA-2 September 4, 2023 Bank Reconciliation Types of Bank Accounts 1. Checking Account / Demand Deposit (Unrestricted) - Non-interest bearing (it doesn’t earn any interest) - Checkbook 2. Savings Account (Unrestricted) - Interest bearing (1/2 of 1% per annum) - Subject to 20% final tax - Passbook + ATM 3. Time Deposit (Restricted) - Interest bearing - Certificate Reconciling Items Book Unadjusted Cash Balance Credit Memos (Debit Memos) Adjusted Cash Balance per book xxx xxx xxx xxx Bank Unadjusted Cash Balance Deposit in Transit (Outstanding Checks) Adjusted Cash Balance per bank Credit Memos: - Collection of Receivables in the bank Loan Proceeds Matured Time Deposit (might also include interest income) Debit Memos: - NSF Checks/DAIF Checks Technically Defective Checks Bank Charges Loan Payment Deposit in Transit: - Uncleared Checks Undeposited Collection Outstanding Checks: - Certified Check In terms of errors, the one who committed the mistake is the one who will make adjustments. xxx xxx xxx xxx