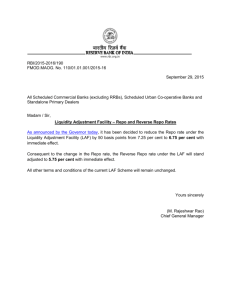

Monetary Policy ECONOMICS Copyright © 2014-2020 TestBook Edu Solutions Pvt. Ltd.: All rights reserved Download Testbook App Monetary Policy What is Monetary Policy? Monetary policy is the macroeconomic policy laid down by the central bank. It involves management of money supply and interest rate and is the demand side economic policy used by the government of a country to achieve macroeconomic objectives like inflation, consumption, growth and liquidity. Monetary policy can be broadly classified as either expansionary or contractionary. Monetary policy tools include open market operations, direct lending to banks, bank reserve requirements, unconventional emergency lending programs, and managing market expectations (subject to the central bank's credibility). Monetary policy is formulated based on inputs gathered from a variety of sources. For instance, the monetary authority may look at macroeconomic numbers like GDP and inflation, industry/sector-specific growth rates and associated figures, geopolitical developments in the international markets, concerns raised by groups representing industries and businesses, survey results from organizations of repute, and inputs from the government and other credible sources. Objectives of Monetary Policy High Employment Price Stability Interest Rate Stability Stability of Financial Markets Stability of Foreign Exchange Markets Economic Growth ECONOMICS | Monetary Policy PAGE 2 Download Testbook App High Employment Any modern government is committed to promote high employment. High employment is a desirable goal of monetary policy for two main reasons: High unemployment causes much human misery, with families suffering financial distress and loss of personal self- respect Secondly, when unemployment is high, the economy has not only idle workers but also idle resources (closed factories and unused equipment), resulting in a loss of output (lower GDP). So, society’s actual output or GDP will be less than its potential (full employment) output. Price Stability Price stability is desirable in a developing country like India, because a rising price level (inflation) creates considerable uncertainty in the economy. For example, the information conveyed by the prices of goods and services is harder to interpret when the overall level of prices is changing, which complicates decision making for consumers, businesses and governments at different levels. Inflation also makes it difficult to plan for the future. For example, it is more difficult to decide how much funds should be put aside to provide for one’s children’s college education in an inflationary environment. Interest Rate Stability Interest-rate stability is desirable because fluc­tuations in interest rates can create uncertainty in the economy and make it more and more difficult to plan for the future. Fluctuations in interest rates also affect consumers’ willingness to buy durable goods, such as houses, motor cars, refrigerators, washing machines or even personal computers. ECONOMICS | Monetary Policy PAGE 3 Download Testbook App Stability of Financial Markets A major reason for the creation of the central bank is that it can promote a more stable financial system. One way in which the central bank promotes stability is helping prevent financial panics (particularly bank failure) through its role as lender of last resort. The central bank is the ultimate source of funds in the money market. Stability in Foreign Exchange Markets With the increasing importance of international trade to the Indian economy, the value of the rupee relative to other currencies has become a major consideration for the RBI. A rise in the value of the rupee makes Indian industries less competitive with those abroad, and declines in the value of the rupee stimulate inflation in India. In addition, preventing large changes in the value of the rupee makes it easier for firms and individuals purchasing or selling goods abroad to plan ahead. Stabilizing extreme movements in the value of the rupee in foreign exchange markets is thus viewed as a worthy goal of monetary policy. Economic Growth The goal of steady economic growth is closely related to the high employment goal, because businesses are more likely to invest in capital equipment to increase productivity and economic growth when unemployment is low. Conversely, if unemployment is high and factories are idle, it does not pay for a firm to invest in additional plants and equipment. Although the two goals are closely related, policies can be specifically aimed at promoting economic growth by directly encouraging firms to invest or by encouraging people to save, which provides more funds for firms to invest. ECONOMICS | Monetary Policy PAGE 4 Download Testbook App Although many of the goals of monetary policy are consistent with each other — high employment with economic growth, interest-rate stability with financial market stability— this is not always the case. The goal of price stability often conflicts with the goals of interest-rate stability and high employment in the short run. Monetary Policy Committee (MPC) About MPC: The RBI has a government-constituted Monetary Policy Committee (MPC) which is tasked with framing monetary policy using tools like the repo rate, reverse repo rate, bank rate, cash reserve ratio (CRR). It has been instituted by the Central Government of India under Section 45ZB of the RBI Act that was amended in 1934. Functions: The MPC is entrusted with the responsibility of deciding the different policy rates including MSF, Repo Rate, Reverse Repo Rate, and Liquidity Adjustment Facility. Composition of MPC: The committee will have six members. Of the six members, the government will nominate three. No government official will be nominated to the MPC. The other three members would be from the RBI with the governor being the ex-officio chairperson. Deputy governor of RBI in charge of the monetary policy will be a member, as also an executive director of the central bank. RBI governor’s role: The RBI Governor will chair the committee. The governor, however, will not enjoy a veto power to overrule the other panel members, but will have a casting vote in case of a tie. ECONOMICS | Monetary Policy PAGE 5 Download Testbook App Understanding Repo and Reverse Repo Rate Repo Rate Repo rate is the rate at which the central bank of a country (Reserve Bank of India in case of India) lends money to commercial banks in the event of any shortfall of funds. Repo rate is used by monetary authorities to control inflation. In the event of inflation, central banks increase repo rate as this acts as a disincentive for banks to borrow from the central bank. This ultimately reduces the money supply in the economy and thus helps in arresting inflation. The central bank takes the contrary position in the event of a fall in inflationary pressures. Repo and reverse repo rates form a part of the liquidity adjustment facility. A repurchase agreement (RP) is a short-term loan where both parties agree to the sale and future repurchase of assets within a specified contract period. The seller sells a Treasury bill or other government security with a promise to buy it back at a specific date and at a price that includes an interest payment. Repurchase agreements are typically short-term transactions, often literally overnight. However, some contracts are open and have no set maturity date, but the reverse transaction usually occurs within a year. Reverse Repo Rate Reverse Repo Rate is defined as the rate at which the Reserve Bank of India (RBI) borrows money from banks for the short term. It is an important monetary policy tool employed by the RBI to maintain liquidity and check inflation in the economy. The Reverse Repo Rate helps the RBI get money from the banks when it needs. In return, the RBI offers attractive interest rates to them. The banks also voluntarily park excess funds with the central bank as it provides them with an opportunity to earn higher interest on surplus money. ECONOMICS | Monetary Policy PAGE 6 Download Testbook App The Reverse Repo Rate is decided by the Monetary Policy Committee (MPC), headed by the RBI Governor. The decision is taken in the bi-monthly meeting of the Committee. Difference between repo rate and reverse repo rate? Under the Reverse Repo Rate, banks deposit excess funds with the RBI and earn interest for it. The opposite of Reverse Repo Rate is the Repo Rate, at which the banks borrow short-term money from the RBI. Comparison Criteria Repo Rate Reverse Repo Rate Lender and Borrower Lender – RBI, Borrower – Commercial Banks. Lender – Commercial Banks, Borrower – RBI. Borrower’s Objective To manage short term deficiency of funds To reduce overall supply of money in the economy Rate of Interest Higher than reverse repo rate Lower than repo rate Interest Charge Applicable to Repurchase Agreement Reverse Repurchase Agreement Mechanism of Operation Commercial banks get funds from Commercial banks deposit their the RBI using government bonds excess funds with RBI and as collateral. receive interest from the deposit. Impact of Higher Rate Cost of funds increases for commercial banks hence loans become more expensive. Money supply in the economy decreases as commercial banks park more surplus funds with RBI. Impact of Lower Rate Cost of funds is lower for commercial banks leading to reduced interest rates on loans. Money supply in the economy increases as banks lend more and reduce their deposits with RBI. ECONOMICS | Monetary Policy PAGE 7 Download Testbook App Significance of Repo Rate and Reverse Repo Rate Liquidity Regulation: Under the liquidity framework designed by RBI, many facilities are offered to commercial banks to meet their requirement of immediate liquidity or deficiency of funds. The main motive of the liquidity framework is to avoid any liquidity crisis in the Indian banking system through implementation of repo agreements. In the similar way, RBI has a framework for managing surplus funds/ cash in the banking system which ensures there is no excess liquidity in the system. And this framework is referred to as reverse repo. Basically, repo transactions inject liquidity into the Indian banking system. On the other hand, reverse repo absorbs liquidity from the Indian banking system. Inflation Control: Reserve Bank of India holds a key responsibility with respect to striking a balance between inflation and economic growth by managing the repo rate and/or reverse repo rate periodically. By changing the repo/reverse repo rate, the RBI can control money flow i.e. liquidity in the economy – too much liquidity usually leads to inflation which can adversely affect the economy, while too little liquidity can lead to an economic slowdown. Impact of Repo Rate and Reverse Repo Rate Increase by RBI The following is the impact of increase in repo rate and reverse repo rate by the RBI: Increase in Repo Rate: Increase in repo rate makes borrowing from the RBI more expensive for commercial banks and this can lead to increase in rates applicable to loans. As the interest rates on various loans increases, fewer loans are applied for disbursed, which restricts the money supply in the economy and may adversely affect the country’s economic growth. Increase in Reverse Repo Rate: If there is excessive liquidity in the banking system, RBI may decide to increase the reverse repo rate. When there is a hike in reverse repo rate, banks can earn higher interest on their excess funds deposited with the Reserve Bank of India. This is a safer investment option for banks so overall flow of money into the markets will be decreased as more of the bank’s surplus funds are deposited with RBI instead of being lent out. ECONOMICS | Monetary Policy PAGE 8 Download Testbook App Impact of Repo Rate and Reverse Repo Rate cuts by RBI The following is the impact of repo rate and reverse repo rate cuts by RBI: Repo Rate Cut Impact: Banking is the first sector to get affected by any change in monetary policies. A cut in repo rate can allow banks to borrow from the Reserve Bank of India at a cheaper rate and infuse higher liquidity in the banking system. This can lead banks to reduce their lending rates for customers leading to cheaper loans in the long term. As bank loans get cheaper, consumers can borrow and spend more which boosts consumption and can eventually lead to economic growth. However, this depends on the decision by the bank whether to pass on the RBI repo rate cut benefits to their customers through cheaper loan offers. Reverse Repo Rate Cut Impact: Whenever RBI decides to reduce the reverse repo rate, banks earn less on their excess money deposited with the Reserve Bank of India. This leads the banks to invest more money in more lucrative avenues such as money markets which increases the overall liquidity available in the economy. While this can also lead to lower interest rate on loans for the bank’s customers, the decision will depend on multiple factors including the bank’s internal liquidity situation and the availability of other potentially less risky and equally lucrative investment opportunities. Inflation Targeting Framework Inflation targeting is a central bank strategy of specifying an inflation rate as a goal and adjusting monetary policy to achieve that rate. Inflation targeting primarily focuses on maintaining price stability, but is also believed by its proponents to support economic growth and stability. Inflation targeting can be contrasted to other possible policy goals of central banking, including the targeting of exchange rates, unemployment, or national income. ECONOMICS | Monetary Policy PAGE 9 Download Testbook App In 2016, the Reserve Bank of India (RBI) signed an agreement with the Indian government that led to the creation of the first-ever monetary policy committee (MPC) in the country. Their mandate: to ensure inflation stayed in the 2-6% range over the next five years, with the target set at the midpoint, 4%. The agreement also mentioned that the MPC would take into account growth concerns while setting policy rates. Four years down the line, India’s inflation-targeting body stands at the crossroads. As the terms of the first set of external members comes to an end, economists remain divided on the efficacy of the inflation-targeting framework in the country. Some economists see the MPC as a rare reform move that has achieved its key goal of low inflation. After the MPC first met in October 2016, household inflation expectations saw a declining trend for some months. Even though the levels remained far above the actual inflation levels, one-year-ahead inflation expectations remained below double digits till mid-2018. From early 2018 onward, one-year-ahead inflation expectations began moving up inexplicably, hitting double-digits again in June 2018. The actual inflation trajectory in early 2019 (for which the expectations were recorded a year ago) was completely different. Some economists have suggested that households are adaptive in forming future expectations, i.e., they rely on current and past data to project the future. But when households were reporting rising inflation expectations in the first half of 2018, headline inflation was actually trending downwards. It remains a puzzle why households reported high inflationary expectations during that period. ECONOMICS | Monetary Policy PAGE 10 Download Testbook App Instruments of Monetary Policy Instruments of Monetary Policy Quantitative/Traditional Measures Qualitative/Selective Measures Quantitative/Traditional Measures The methods used by the central bank to influence the total volume of credit in the banking system, without any regard for the use to which it is put, are called quantitative or general methods of credit control. The quantitative measures are given as follows: Bank Rate Policy: The bank rate policy is the traditional method of credit control used by a central bank. The bank rate or the discount rate is the rate at which a central bank is prepared to discount the first class bills of exchange. In its capacity as ‘lender of last resort’, the central bank helps the commercial banks by rediscounting the first class bills (i.e., by advancing loans against approved securities). The rate of interest which the central bank charges from the commercial banks for rediscounting the bills is called bank rate. The bank rate is distinct from the market interest rate. The bank rate is the rate of discount of the central bank, while the market interest rate is the lending rate charged in the money market by the ordinary financial institutions. ECONOMICS | Monetary Policy PAGE 11 Download Testbook App There is a direct relationship between the bank rate and the market interest rates. A change in the bank rate leads to change in other interest rates prevailing in the market. In this sense, bank rate is the effective rate for lending or borrowing which prevails in the market. Bank rate policy aims at influencing1. The cost and availability of credit to the commercial banks 2. Interest rates and money supply in the economy 3. The level of economic activity of the economy. A rise in the bank rate makes the credit costlier, reduces the volume of credit, discourages economic activity and brings down the price level in the economy. Open Market Operations:’ Open market operations (OMO) refers to a central bank buying or selling short-term Treasury’s and other securities in the open market in order to influence the money supply, thus influencing short term interest rates. In the narrow sense, open market operations refer to the purchase and sale by the central bank of government securities in the money market. In the broad sense, open market operations imply the purchase and sale by the central bank of any kind of eligible paper, like, government securities, bills and securities of private concerns, etc. Objectives of Open Market Operations Policy: The policy of open market operations, by directly changing the cash reserves with the commercial banks, attempts to influence the total volume of credit created in the system and ultimately the level of economic activity and the price level of the country. It is generally adopted to achieve the following objectives: 1. To influence the cash reserves with the banking system; 2. To influence interest rates; 3. To stabilize the securities market by avoiding undue fluctuations in the prices and yields of Securities; 4. To control the extreme business situations of inflation and deflation; 5. To achieve a favorable balance of payments position; and ECONOMICS | Monetary Policy PAGE 12 Download Testbook App 6. To supplement the bank rate policy and thus to increase its efficiency. Cash Reserve Ratio: The method of variable cash reserve ratio or changing minimum cash reserves to be kept with the central bank by the commercial banks is comparatively new method of credit control used by the central banks. While the bank rate policy and the open market operations, due to their limitations, are appropriate only to produce marginal changes in the cash reserves of the commercial banks, the method of cash reserve ratio is a more direct and more effective method in dealing with the abnormal situations when, for example, there are excessive reserves with the commercial banks on the basis of which they are creating too much credit, leading to inflationary situation. Changes in the cash reserve ratio are a powerful method for influencing not only the volume of excess reserves with the commercial banks, but also the credit multiplier of the banking system. The significance of this method lies in the fact that increase (or decrease) in the minimum cash reserve ratio, by reducing (or increasing) the base of the cash reserves of the commercial banks decreases (or increases) their potential credit creation capacity. Thus, a change in reserve requirements affect the money supply in two ways- (a) it changes the level of excess reserves; and (b) it changes the credit multiplier. Suppose the commercial banks keep 10% of their cash reserves with central bank. This means Rs.10 of reserves would be required to support Rs.100 of deposit and the credit multiplier is 10 (i.e., 1/10% =10). To check inflation, the central bank raises the cash reserve ratio from 10% to 12%. As a result of the increase in the cash reserve ratio, the commercial banks will have to maintain a greater cash reserve of Rs.12 instead of Rs.10 for every deposit of Rs. 100 and they will now decrease their lending to get the additional 2% cash. The credit multiplier will fall from 10 to 8.3 (i.e., 1/12% = 8.3). Statutory Liquidity Ratio: Besides CRR, Banks have to invest certain percentage of their deposits in specified financial securities like Central Government or State Government securities. This ECONOMICS | Monetary Policy PAGE 13 Download Testbook App This money is predominantly invested in government approved securities (bonds), Gold, which mean the banks can earn some amount as 'interest' on these investments as against CRR where they do not earn anything. Example - An Individual deposits say Rs 1000 in bank. Then Bank receives Rs 1000 and has to keep some percentage of it with RBI as SLR. If the prevailing SLR is 20% then they will have to invest Rs 200 in Government Securities. If RBI wishes to control credit and discourage credit it would increase CRR & SLR. ECONOMICS | Monetary Policy PAGE 14 Download Testbook App Qualitative/Selective Measures The qualitative or selective credit controls on the other hand, are meant to regulate the terms on which credit is granted in specific sectors. They seek to control the demand for credit for different uses by Determining minimum down payments and Regulating the period of time over which the loan is to be repaid. Qualitative measures are as follows: Marginal Requirements: Control over marginal requirements means control over down payments that must be made in buying securities on credit. The marginal requirement is the difference between the market value of the security and its maximum loan value. If a security has a market value of Rs.100 and if the marginal requirement is 60% the maximum loan that can be advanced for the purchase of security is Rs. 40. Similarly, a marginal requirement of 80% would allow borrowing of only 20% of the price of the security and the marginal requirement of 100% means that the purchasers of securities must pay the whole price in cash. Thus, an increase in the marginal requirements will reduce the amount that can be borrowed for the purchase of a security. This method has many advantages: 1. It controls credit in the speculative areas without affecting the availability of credit in the productive sectors, 2. It controls inflation by curtailing speculative activities on the one hand and by diverting credit to the productive activities on the other, 3. It reduces fluctuations in the market prices of securities, 4. It is a simple method of credit control and can be easily administered. However, the effectiveness of this method requires that there are no leakages of credit from productive areas to the unproductive or speculative areas. ECONOMICS | Monetary Policy PAGE 15 Download Testbook App Regulation of Consumer Credit: Under the consumer credit system, a certain percentage of the price of the durable goods is paid by the consumer in cash. The balance is financed through the bank credit which is repayable by the consumer in installments. The central bank can control the consumer credita) By changing the amount that can be borrowed for the purchase of the consumer durables b) By changing the maximum period over which the installments can be extended. This method seeks to check the excessive demand for durable consumer goods and, thereby, to control the prices of these goods. It has proved very useful in controlling inflationary trends in developed countries where the consumer credit system is widespread. In the underdeveloped countries, however, this method has little significance where such a system is yet to develop. Rationing of Credit: Credit rationing is a selective method of controlling and regulating the purpose for which credit is granted by the commercial banks. Rationing of credit may assume two formsa) The central bank may fix its rediscounting facilities for any particular bank b) The central bank may fix the minimum ratio regarding the capital of a commercial bank to its total assets. In other words, credit rationing aims ata) Limiting the maximum loans and advances to the commercial banks b) Fixing ceiling for specific categories of loans and advances. It includes Priority Sector Lending ECONOMICS | Monetary Policy PAGE 16 Download Testbook App Priority Sector Lending: The RBI mandates banks to lend a certain portion of their funds to specified sectors, like agriculture, Micro, Small and Medium Enterprises (MSMEs), export credit, education, housing, social infrastructure, renewable energy among others. All scheduled commercial banks and foreign banks (with a sizable presence in India) are mandated to set aside 40% of their Adjusted Net Bank Credit (ANDC) for lending to these sectors. Regional rural banks, co-operative banks and small finance banks have to allocate 75% of ANDC to PSL. The idea behind this is to ensure that adequate institutional credit reaches some of the vulnerable sectors of the economy, which otherwise may not be attractive for banks from the profitability point of view. Priority Sector includes the following categories: Agriculture Micro, Small and Medium Enterprises Export Credit Education Housing Social Infrastructure Renewable Energy Others Priority sector loans to the following borrowers are eligible to be considered under Weaker Sections category: - Recently, the Reserve Bank of India (RBI) released revised Priority Sector Lending (PSL) guidelines, which align with emerging national priorities and also bring sharper focus on inclusive development. The PSL guidelines were last reviewed for commercial banks in April 2015 and for Urban Co-operative Banks (UCBs) in May 2018. ECONOMICS | Monetary Policy PAGE 17 Download Testbook App Revised Guidelines Fresh Categories: Bank finance to start-ups up to Rs. 50 crores, loans to farmers for installation of solar power plants for solarisation of grid connected agriculture pumps and loans for setting up Compressed Biogas plants have been included as fresh categories eligible for finance under priority sector. 2. Farmers’ Related: Higher credit limit has been specified for Farmers Producers Organizations (FPOs) undertaking farming with assured marketing of their produce at a predetermined price. Loans for these activities will be subject to an aggregate limit of Rs. 2 crores per borrowing entity. The targets prescribed for small and marginal farmers and weaker sections will be increased in a phased manner. It has defined farmers with land holding of up to one hectare as marginal farmers, and farmers with a landholding of more than one hectare and up to 2 hectares as small farmers. 3. Boosting Credit: The credit limits for renewable energy, health infrastructure, including the projects under ‘Ayushman Bharat’, have been doubled. Bank loans up to a limit of Rs. 30 crores to borrowers for purposes like solar-based and biomass-based power generators, windmills, nonconventional energy-based public utilities, etc. For individual households, the loan limit will be Rs. 10 lakhs per borrower. Bank loans up to a limit of Rs.10 crores per borrower for building healthcare facilities including under ‘Ayushman Bharat’ in Tier II to Tier VI centres, have been allowed. ECONOMICS | Monetary Policy PAGE 18 Download Testbook App 4. Addresses Disparity: It seeks to address the issues concerning regional disparities in the flow of priority sector credit at district level which includes: Ranking districts on the basis of per capita credit flow to the priority sector. Building an incentive framework for districts with comparatively low flow of credit and a dis-incentive framework for districts with comparatively high flow of priority sector credit. Higher weightage has been assigned to priority sector credit in ‘identified districts’ where priority sector credit flow is comparatively low. 5. Moral Suasion: Moral suasion means advising, requesting and persuading the commercial banks to cooperate with the central bank in implementing its general monetary policy. Through this method, the central bank merely uses its moral influence to make the commercial bank to follow its policies. For instance, the central bank may request the commercial banks not to grant loans for speculative purposes. Similarly, the central bank may persuade the commercial banks not to, approach it for financial accommodation. This method is a psychological method and its effectiveness depends upon the immediate and favorable response from the commercial banks. 6. Publicity: The central banks also use publicity as a method of credit control. Through publicity, the central bank seeks a) to influence the credit policies of the commercial bank b) to educate people regarding the economic and monetary condition of the country; and c) to influence the public opinion in favor of its monetary policy. The central banks regularly publish the statement of their assets and liabilities; reviews of credit and business conditions; reports on their own activities, money ECONOMICS | Monetary Policy PAGE 19 Download Testbook App From the published material the banks and the general public can anticipate the future changes in the policies of the central bank. But, this method is not very useful in the less developed countries where majority of the people are illiterate and do not understand the significance of banking statistics. 7. Direct Action: The method of direct action is most extensively used by the central bank to enforce both quantitative as well as qualitative credit controls. This method is not used in isolation; it is often used to supplement other methods of credit control. Direct action refers to the directions issued by the central bank to the commercial banks regarding their lending and investment policies. Types of Monetary Policy followed by Accommodative Contractionary Neutral Accommodative Monetary Policy Accommodative monetary policy is when central banks expand the money supply to boost the economy. Monetary policies that are considered accommodative include lowering the Federal funds rate. These measures are meant to make money less expensive to borrow and encourage more spending. ECONOMICS | Monetary Policy PAGE 20 Download Testbook App Accommodative monetary policy is triggered to encourage more spending from consumers and businesses by making money less expensive to borrow through the lowering of short-term interest rates. Contractionary Policy Contractionary policies are macroeconomic tools designed to combat economic distortions caused by an overheating economy. Contractionary policies aim to reduce the rates of monetary expansion by putting some limits on the flow of money in the economy. Contractionary policies are typically issued during times of extreme inflation or when there has been a period of increased speculation and capital investment fueled by prior expansionary policies. Contractionary policies aim to hinder potential distortions to the capital markets. Distortions include high inflation from an expanding money supply, unreasonable asset prices, or crowding-out effects, where a spike in interest rates leads to a reduction in private investment spending such that it dampens the initial increase of total investment spending. Neutral Monetary Policy The range for the federal funds rate can go from low enough to stimulate economic growth to high enough to slow economic activity. Somewhere between the lows and the highs -- and economists do not all agree just where -- is a rate or range of rates that neither stimulates nor contracts the economy. Identifying that interest rate level and taking action to achieve it is neutral monetary policy. ECONOMICS | Monetary Policy PAGE 21 Download Testbook App Quantitative Easing Quantitative easing is an occasionally used monetary policy, which is adopted by the government to increase money supply in the economy in order to further increase lending by commercial banks and spending by consumers. The central bank (The Reserve Bank of India) infuses a pre-determined quantity of money into the economy by buying financial assets from commercial banks and private entities. This leads to an increase in banks' reserves. Quantitative easing is aimed at maintaining price levels, or inflation. However, these policies can backfire heavily, leading to very high levels of inflation. In case commercial banks fail to lend excess reserves, it may lead to an unbalance in the money market. Market Stabilization Scheme (MSS) Market Stabilization Scheme or MSS is a tool used by the Reserve Bank of India to suck out excess liquidity from the market through issue of securities like Treasury Bills, Dated Securities etc. on behalf of the government. The money raised under MSS is kept in a separate account called MSS Account and not parked in the government account or utilized to fund its expenditures. This led to over-supply of the domestic currency raising inflationary expectations. MSS was introduced to mop up this excess liquidity. The bills and securities issued for the purpose of MSS is matched by an equivalent cash balance held by the Government with the Reserve Bank. Thus, there is a marginal impact on revenue and fiscal deficits of the Government to the extent of interest payment on bills/securities outstanding under the MSS. Further, the cost is shown separately in the Budget. ECONOMICS | Monetary Policy PAGE 22 Download Testbook App Intention of introducing the MSS: It is to differentiate the liquidity absorption of a more enduring nature by way of sterilization from the day-to-day normal liquidity management operations. The total absorption of liquidity from the system by the Reserve Bank will continue to be in line with the monetary policy stance from time to time and accordingly, the liquidity absorption will get apportioned among the instruments of LAF, MSS and normal open market operations (OMOs). Important Facts: The issued securities under the MSS are government bonds and they are called as Market Stabilization Bonds (MSBs). These securities are owned by the government though they are issued by the RBI. The securities or bonds/T-bills issued under MSS are purchased by financial institutions. After demonetization Reserve Bank of India has raised the ceiling for market stabilization scheme or MSS 20 times to Rs 6 lakh crore to suck excess cash out of the banking system and help banks earn some return from the deluge of deposits they have garnered after the government’s demonetization move. Difference between CRR and MSS CRR is a sort of contingency fund and does not earn any interest. MSS bonds, on the other hand, have a fixed tenure and earn returns. ECONOMICS | Monetary Policy PAGE 23