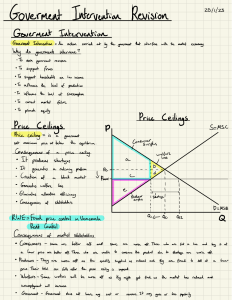

Chapter 4 Government Intervention (Notes) Consequence of price ceiling for markets a. Shortage => excess demand b. Non-price rationing => other methods are required to ration (distribute) the goods to consumers => e.g. waiting line, first come first serve or favouritism etc c. Underground (or parallel) markets => good is sold at a higher price in black market d. Under allocation of resource => not enough resource allocated to production of goods, resulting in under production e. Negative welfare impact => producer surplus decreases and consumer surplus increases Consequence of price ceiling for stakeholders a. Customers => partly gain and partly lose => those who buy the good at lower price gain => those who cannot buy due to shortage lose b. Producers => worse off => lower selling price, revenue decreases c. Workers => worse off => some likely to be fired due to fall in output d. Government => may gain political popularity among consumers who are better off due to price ceiling Consequence of price floor for markets a. Surplus => excess supply b. Government measures to dispose surplus => government needs to decide what to do with the surplus it purchases c. Inefficient firm => Allow firms with higher cost of production to survive and not try to cut cost d. Over allocation of resource => More is produced than what consumers want e. Negative welfare impact => producer surplus increases and consumer surplus decreases 1 Consequence of price floor for stakeholders a. Customers => worse off => pay higher price for lower quantity b. Producers => gain => higher selling price, revenue increases c. Workers => gain => increase in employment due to greater production of good d. Government => worse off => opportunity cost as the government buys the excess supply which could have been spent on other desirable activities in the economy e. Society => worse off => due to welfare loss Consequence of minimum wage for economy a. Illegal workers => Some workers may accept to work for wages below minimum b. Misallocation of resources in labour market => May prevent efficient allocation of labour resources c. Misallocation of resources in product market => Firms using unskilled worker have higher cost of production Consequence of minimum wage for stakeholders a. Workers => Those receive minimum wage gain => Those who unemployed due to minimum wage lose b. Firms => Worse off => Due to higher cost of production for paying minimum wage for unskilled workers c. Consumers => Worse => Pay higher price for lower quantity Why government impose indirect tax? a. A source of revenue b. A method to discourage consumption of goods that are harmful to individuals c. Redistribute income d. Reduce allocative inefficiencies by correcting negative externalities 2 Consequence of indirect tax for stakeholders a. Customers => lose => pay a higher P and buy lower Q b. Producers => lose => receive lower P and sell lower Q c. Workers => loss => some likely to be fired due to fall in output d. Government => gain tax revenue e. Society => lose => there is resource misallocation and welfare loss Why government grant subsidy? a. Increase revenue (hence income) of producers b. Make certain goods (necessities) affordable to low-income consumers c. Encourage production and consumption of merit goods d. Improve allocative efficiencies by correcting positive externalities Consequence of subsidy for stakeholders a. Customers => gain => pay a lower P and buy higher Q b. Producers => gain => receive a higher P and sell higher Q c. Workers => gain => more is produced, hence more people are employed d. Government => lose => must pay subsidy e. Society => lose => there is resource misallocation and welfare loss => government spending on subsidy, leads to opportunity cost => high-cost producers are protected by higher price, leads to inefficiency 3