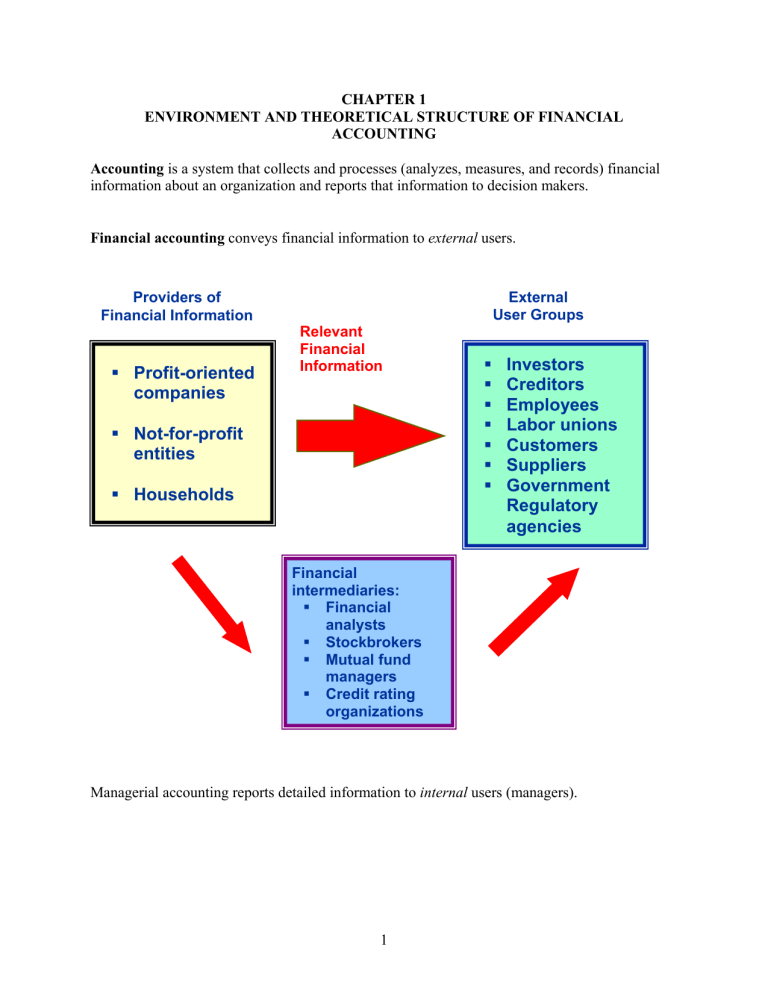

CHAPTER 1 ENVIRONMENT AND THEORETICAL STRUCTURE OF FINANCIAL ACCOUNTING Accounting is a system that collects and processes (analyzes, measures, and records) financial information about an organization and reports that information to decision makers. Financial accounting conveys financial information to external users. Providers of Financial Information Profit-oriented companies External User Groups Relevant Financial Information Not-for-profit entities Households Investors Creditors Employees Labor unions Customers Suppliers Government Regulatory agencies Financial intermediaries: Financial analysts Stockbrokers Mutual fund managers Credit rating organizations Managerial accounting reports detailed information to internal users (managers). 1 Relevant financial information is provided primarily through financial statements and related disclosure notes. Balance Sheet (Statement of Financial Position) Income Statement (Statement of Earnings / Statement of Operations) Statement of Cash Flows Statement of Shareholders’ Equity Types of Business Organizations 1. Corporation: a business incorporated under the laws of a particular state. A corporation acquires capital from investors in exchange for ownership interest and by borrowing from creditors. 2. Partnership: unincorporated business owned by two or more persons known as partners. 3. Sole proprietorship: unincorporated business owned by one person. Information Needs of Investors and Creditors 1. Investors look for two sources of possible cash flow: Periodic dividend distributions from the corporation. The ultimate sale of the ownership shares of stock. Example: An investor purchased 100 shares of ABC Mirror, Inc for $10,000 in 2015. At the end of 2015 the investors received $500 dividends from ABC Mirror, and the investor sold the 100 shares during 2016 for $12,000. 2 2. Creditors lend money to a company for a specific length of time. They hope to gain by charging interest on the money they lend. Example: A bank lent $10,000 to ABC Mirror, Inc for one year at an interest rate of 15%. Accounting information should help investors and creditors evaluate the amount, timing, and uncertainty of the enterprise’s future cash flows. Cash versus Accrual Accounting Example: Carter Company made sales totaling $100,000 per year for two years. Carter collected $50,000 in the first year and $150,000 in the second year. The company paid $40,000 for two years’ rent in the first year. Payments to employees are $50,000 per year. Cash Basis Accounting: Revenue is recognized when cash is received. Expenses are recognized when cash is paid. Summary of Cash Flows Year 1 Year 2 Total Cash receipts from customers Payment of 2 years’ rent Salaries to employees Net cash flow Drawback: Over short periods of time, operating cash flow may not be an accurate predictor of future operating cash flows. 3 Accrual Accounting: Revenue is recognized when earned. Expenses are recognized when incurred. Summary of Operations Year 1 Year 2 Total Revenue Rent expense Salary expense Net income Accrual based net income is considered a better indicator of future operating cash flows than is current net operating cash flows. The accrual accounting model is required by GAAP. The Development of Financial Accounting and Reporting Standards Generally accepted accounting principles (GAAP) are a set of guidelines companies follow in measuring and reporting financial information. Parties involved in the standard setting process: Securities and Exchange Commission (SEC): SEC has the authority to set accounting standards for companies, but always has delegated the responsibility to the private sector. Financial Accounting Standards Board (FASB): the private sector body given the primary responsibility to work out the detailed rules that become GAAP. Supported by the Financial Accounting Foundation (FAF). Answerable only to the Financial Accounting Foundation. Seven full-time, independent voting members serving for 10 years. Members not required to be CPAs. American Institute of Certified Public Accountants (AICPA): a national professional organization that sets professional requirements for CPAs. 4 Auditor’s role: Auditors offer credibility to financial statements by verifying that they are presented fairly in conformity with GAAP. Types of auditor’s opinion: - Unqualified - Qualified - Adverse - Disclaimer Accounting Standards Update (ASU): any new standard issued by FASB FASB Accounting Standards Codification (ASC): Only source of authoritative nongovernmental U.S. GAAP (www.fasb.org) 5 International Financial Reporting Standards (IFRS): a set of global accounting standards issued by IASB. Compliance is voluntary. The enforcement authority lies with the local securities regulator. Over 120 jurisdictions accept IFRS (European Union, Australia, Canada, etc.). FASB and IASB have been working for many years to converge to one global set of accounting standards, however, full convergence will not be achieved in the foreseeable future Parties involved in the standard setting process: International Accounting Standard Committee/Board (IASC/IASB): a private organization dedicated to developing a single set of global accounting standards Establishment of accounting standards is a political process How Does GAAP Come Out? – STEP EXPLANATION 1. The Board receives requests/recommendations for possible projects and reconsideration of existing standards from various sources. 2. The FASB Chairman decides whether to add a project to the technical agenda, subject to oversight by the Foundation’s Board of Trustees and after appropriate consultation with FASB Members and others. 3. The Board deliberates at one or more public meetings the various issues identified and analyzed by the staff. 4. The Board issues an Exposure Draft. 5. The Board holds a public roundtable meeting on the Exposure Draft, if necessary. 6. The staff analyzes comment letters, public roundtable discussion, and any other information. The Board redeliberates the proposed provisions at public meetings. 7. The Board issues an Accounting Standards Update describing amendments to the Accounting Standards Codification. 6 The Conceptual Framework The Framework was to be the foundation for building a set of coherent accounting standards and rules. The Framework is to be a reference of basic accounting theory for solving emerging practical problems of reporting. 1. The objectives are specified in SFAC 8. To provide financial information about the reporting entity that is useful to present and potential equity investors, lenders, and other creditors in making decisions in their capacity as capital providers. 7 2. Hierarchy of Accounting Qualities of Financial Information (SFAC 8) Fundamental qualitative characteristics: Relevance of information means information capable of making a difference in a decision context. Predictive value Confirmatory value Materiality: the magnitude of an omission or misstatement of accounting that, in the light of surrounding circumstances, makes it probable that the judgment of a reasonable person relying on the information would have been influenced by the omission or misstatement. Example: GMAS’ net income confirms investor expectations about future cash-generating ability. Which qualitative characteristic of accounting information is described? GMAS’ investors use 2015 Q1 earnings to predict the earnings in 2016 Q1. Which qualitative characteristic of accounting information is described? Washington Power recently completed an office building at a cost of $7.3 million. Office lamps with a total cost of $1,000 were expensed in the current period, even thought the office lamps can be used for five years. Which qualitative characteristic of accounting information is described? 8 Faithful representation means agreement between a measure and a real-world phenomenon that measure is supposed to represent. Completeness Neutrality Free from error Example: DEP Company reported Property, Plant & Equipment (net) as a line item on balance sheet but omitted the details of composition and depreciation methods in its financial statements. Which qualitative characteristics of accounting information is violated? Billy Company has attempted to determine the replacement cost of its machinery. Three different appraisers arrive at substantially different amounts for the replacement cost. The CFO of Billy Company decides to use the highest appraisal value for external reporting purposes. Which qualitative characteristic of accounting information is violated? Yellowstone Corp misclassified machines used to produce inventory as inventory. Which qualitative characteristic of accounting information is violated? Note: SFAC 8 explicitly rejects conservatism as a desirable characteristic of accounting information because it undermines representational faithfulness. Conservatism: when two alternative accounting methods are acceptable and both equally satisfy the conceptual and implementation principles set out by the FASB, the alternative having the less favorable effect on net income or total assets is preferable. Example: Small Pen filed a lawsuit against Big Pen. Small Pen has already recorded a gain on income statement for the possible amount it feels it might win. Example: Cracker Farms, Inc. uses lower of cost or net realizable value for its inventory valuation. 9 Enhancing qualities: Comparability (Consistency): the similar measurement and reporting for different enterprises (application of the same accounting treatment to similar events by an enterprise period to period). Verifiability: different measures would reach consensus about whether information is a faithful representation. Timeliness Understandability Example: The annual financial statements of August Corp are audited by Ernst & Young. Which qualitative characteristic of accounting information is followed? Owens Corp is using FIFO as inventory valuation method, while all other companies in its industry are using LIFO. Which qualitative characteristic of accounting information may not be followed? Benjamin Balls, Inc. switches from accelerated depreciation of its plant assets to straight-line depreciation to depreciation based on units of activity over a two-year period. Which qualitative characteristic of accounting information is not followed? Spartan company does not issue its first-quarter report until after the second quarter’s results are reported. Which qualitative characteristic of accounting information is violated? 3. Key Constraint (SFAC 8) Cost effectiveness: the benefits derived by external users of financial statements should outweigh the costs incurred by the preparers of the information. Example: New East Co. does not disclose its contract details in the notes to its financial statements, because such disclosure would reveal important information to its competitors. Which constraint on accounting information is described? 10 4. Ten basic elements of financial statements are defined in SFAC 6: Source: Kieso, Weygandt, and Warfield, Intermediate Accounting, 11th Edition Assets are probable future economic benefits obtained or controlled by a particular entity as a result of past transactions or events. Liabilities are probable future sacrifices of economic benefits arising from present obligations of a particular entity to transfer or provide services to other entities in the future as a result of past transactions or events. Equity, or net assets, called shareholders’ equity or stockholders’ equity for a corporation, is the residual interest in the assets of an entity that remains after deducting liabilities. 11 Investments by owners are increases in equity resulting from transfers of resources (usually cash) to a company in exchange for ownership interest. Distributions to owners are decreases in equity resulting from transfers to the owners. Revenues are inflows of assets or settlements of liabilities from the entity’s ongoing major operations. Expenses are outflows or other using up of assets or increases of liabilities during a period from the entity’s ongoing major operations. Gains are increases in equity peripheral transactions of an entity. Losses represent decreases in equity arising from peripheral transactions of an entity. Comprehensive income is the change in equity of a business enterprise during a period from transactions and other events and circumstances from nonowner sources. It includes all changes in equity during a period except those resulting from investments from owners and distributions to owners. 5. Basic Assumptions Economic entity: All economic events identified with a particular economic entity. Example: Robert Smith, owner of Smith Bookstore, Inc., bought a computer for his own use. He paid for the computer by writing a check on the bookstore checking account and charged the “Office Equipment” account. Which accounting assumption is violated? 12 Going concern: Business entity will continue to operate indefinitely. Example: Watson Brewer, Inc. classifies current and noncurrent assets and liabilities in its balance sheet. Which accounting assumption is applied? Periodicity: Life of company is divided into time periods to provide timely information. Example: The economic activities of Rosemary Company are reported every quarter by issuing quarterly reports to external decision makers. Which accounting assumption is applied? Monetary unit: Financial statements are measured in U. S. Dollars. Example: April Flowers Moving, Inc. measures its economic activities in US dollars and does not adjust amounts in its financial statements for the effects of inflation. Which accounting assumption is applied? 6. Principles (SFAC 5) 1) Recognition: an item should be recognized when it meets the following four criteria: Definition: the item meets the definition of an element of financial statements. Measurability: the item has a measurement attribute. Relevance: the information is relevant. Reliability: the information is reliable. Revenue Recognition - Realization: revenue can be recognized if two criteria are satisfied The earning process is complete or virtually complete; and There is reasonable certainty as to the collectability of cash. ASU No. 2014-09: Companies recognize revenue when goods or services are transferred to customers for the amount the company expects to be entitled to receive in exchange for those goods or services. Example: Spartan Company sold the 2016 football game tickets in December 2015 and recognized revenue for year 2015. Which accounting principle is violated? 13 Expense Recognition - Matching: all expenses incurred in earning the revenue recognized for a period must be recognized during the same period. Based on a exact cause-and-effect relationship. By associating an expense with the revenues recognized in a specific time period. By a systematic and rational allocation to specific time periods. In the period incurred, without regard to related revenues. Example: Vermont Enterprise recognizes depreciation expense for a machine over the five-year period during which that machine helps the company earn revenue. Which accounting principle is applied? 2) Measurement Historical Cost: the original transaction value Example: Sandy Creek Corp reports it land on its balance sheet as $500,000, which is the amount it paid to acquire it. The current fair market value of the land is $5,000,000. Net Realizable Value: the amount of cash into which an asset is expected to be converted in the ordinary course of business Example: Sandy Creek Corp sold on credit for $20,000 in 2016 and anticipated bad debts to be 10% of the credit sale. Current Cost: the cost that would be incurred to purchase or reproduce the goods Example: Sandy Creek Corp purchased inventory at a cost of $6,000. At the end of 2016, the replacement cost of its inventory is $5,000. 14 Present Value of future cash flows Example: Sandy Creek Corp bought an equipment from a vendor signing a note in which it promises to pay $20,000 at the end of the year and a total of ten such year-end payments. If they assume an interest rate of 12%, what is the cost of the equipment? Fair Value: the price that would be received to sell assets or paid to transfer a liability in an orderly transaction between market participants at the measurement date. The Move toward Fair Value: Fair value: the price that would be received to sell assets or paid to transfer a liability in an orderly transaction between market participants at the measurement date. The FASB established a framework for measuring fair value whenever fair value is called for in applying GAAP. Market approaches base valuation on market information. Income approaches estimate value by determining the present value of estimated future earnings or cash flows. Cost approaches base valuation on estimates of amounts required to buy or construct an asset of similar quality and condition. 15 GAAP gives a company the option to report some or all of its financial assets and liabilities at fair value. 3) Disclosure Full-Disclosure Principle: all relevant information bearing on the economic affairs of a business must be reported. Parenthetical comments Disclosure notes Supplemental schedules and tables Example: Sam’s Salmon, Inc. decided that, for the sake of brevity, only total assets, liabilities, and owners’ equity are reported on balance sheet. Details as to cash, inventory, accounts payable, and other asset and liability items were omitted. Which accounting principle is violated? Conceptual framework IFRS The conceptual framework guides standard setting and provides a basis for practitioners to make accounting judgments. 16 US GAAP The conceptual framework provides guidance to standard setters.