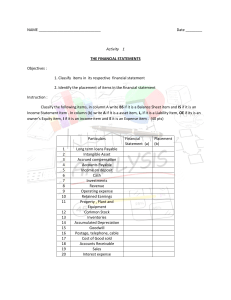

BASIC ACCOUNTING PRINCIPLES Estimated presentation time: 5 hours Presenters: 1. BAUTISTA, JOSHUA M. Objectives: Discuss the basic accounting principles and provide a brief introduction to the accounting process. TOPIC OUTLINE I. Introduction to Accounting (SLIDE) A. Definition (SLIDE) -ACCOUNTING is the art of recording, classifying and summarizing, in a significant manner, and in terms of money, transactions and events which are in part at least of a financial character, and interpreting the results thereof. -Is a service activity. -Is a process 1. 2. 3. 4. 5. 6. 7. B. Users of Financial Statements (SLIDE) Investors Employees Lenders Suppliers and other trade creditors Customers Government and their agencies The public C. Areas and branches of accounting (slide) 1. Public- This sector includes individual practitioners, small, medium sized and multinational accounting firms that render independent professional accounting services to the public. 2. Private- Accountants are employed in various positions such as: vice-president for finance, chief accountant, cost accountant, internal auditor or budget officer or controller which is the highest accounting officer of a business organization. 3. Government- Accountants may be hired as staff, auditor, budget officer or consultant in government units like the Commission on Audit, Bureau of Internal Revenue, Department of Finance, Department of Budget and Management, and the Securities and Exchange Commission. D. Types and legal forms of businesses (slide) 1. Types of Business (slide) a. Service- simplest form of business and provides services to clients or customers in exchange for fees, rent, interest or royalties b. Merchandising- purchase goods from suppliers and, without altering the state of the goods bought, sell the same at a higher price than cost c. Manufacturing- involves the most complex activities and actually produces the goods that it sells to customers 2. Legal Forms of Business (slide) a. Sole Proprietorship- most basic and simplest legal form of business and has only one owner. It is also the easiest one to form. b. Partnership- an association of two or more persons who bind themselves to contribute money, property, or industry to a common fund with the intention of dividing the profits among themselves. Partnerships are governed by the Civil Code of the Philippines c. Corporation- the most complex form of business organizations. A person who invests in a corporation is known to be a “Shareholder”. A shareholder’s ownership in the corporation is evidenced by a stock certificate. It is governed by the Corporation Code of the Philippines II. 1. 2. 3. 4. Fundamental Accounting Concepts A. Basic accounting principles, theories, and assumptions (slide) Business entity principle: business is considered distinct and separate from the owner(s) of the business Dual-effect of business transactions: whenever a business transaction takes place, it is assumed that the value receive is equal to the value given up (for every value received, there is an equal value given up) Debit-Credit Matching principle: Income recorded and reported in one accounting period should be matched against the expenses that directly or indirectly contributed to the generation of the income Accrual basis: income is recognized when it is earned, regardless of when cash is received. Expenses are recognized when incurred, regardless of when cash is paid 5. 6. 7. 8. Cash basis of Accounting: (slide) income is recognized when cash is received, and expenses are recognized when cash is paid Stable monetary unit: it is concerned with information which can be quantified and expressed in terms of money. To be included in the accounting records and financial statements of the enterprise, it must be expressed in terms of a uniform means of measurement Periodicity (Time Period Concept): operating life of an enterprise may be conveniently divided into time periods of equal length called accounting periods. Normal accounting period is equal to 12 months or 1 year Going Concern (Continuity Assumption): enterprise is a going concern and will continue operation for the foreseeable future. It is assumed that the enterprise has neither the intention nor the need to liquidate or curtail materially the scale of its operations B. Elements of Financial Statement (slide) 1. Assets- resource owned and/or controlled by the enterprise and expected to provide future economic benefits to the enterprise. It is acquired by an enterprise as a result of a past transaction or event. 2. Liabilities- present obligation of the enterprise arising from past events, which are to be settled in the future. It is required to be settled in the future 3. Equity-- claim; residual interest in the assets of the enterprise after deducting all its liabilities and arise from the original investment by an owner into the business and increased by additional investments by the owners and by profit earned during a period 4. Income (slide)- increase in economic benefits during the accounting period in the form of inflows or enhancements of assets or decreases of liabilities that result in the increase of equity other than those a relating to contributions from equity participants 5. Expense- decrease in economic benefits during the accounting period in the form of outflows or depletions of assets or incidences of liabilities that result in decreases in equity other than those relating to distributions to equity participants C. Accounting Equation and expanded accounting equation (slide) Assets= Liabilities + Equity Net Assets-focuses on equity or the claim of owners to the assets of the business Equity= Assets – Liabilities Possible effects of business transactions: (slide) a) Increase in assets= increase in liabilities Cash Notes Payable b) Increase in assets = increase in equity Cash Owners, Capital c) Increase in one asset= decrease in another asset Supplies Cash d) Decrease in assets= decrease in liabilities Accounts Payable Cash e) Decrease in assets= decrease in equity Owners, Drawings Cash f) Increase in liabilities= decrease in equity Owners, Capital Notes Payable g) Increase in equity = decrease in liabilities Accounts Payable Common Stock h) Increase in one liability= decrease in another liability Accounts Payable Notes Payable i) Increase in one equity= decrease in one equity Subscribed Share Capital Common Stock Expanded Accounting Equation (slide) Assets= Liabilities + Equity + Income – Expenses D. Double Entry System (slide) 1.For every debit entry, there must be a corresponding credit entry and accounting equation must always be maintained equal 2.Each transaction affects at least two accounts 3.Total debit for a transaction must equal total credits 4.An account is debited when an amount is entered on the left side of the account and credited when amount is entered on the right side 5.The account type determines how increases or decreases in it are recorded E. Steps in accounting Process (slide) 1. 2. 3. 4. 5. Analyzing business transactions through source documents Journalizing, or the recording of transactions in a journal Posting or transferring of the entries from the journal to the ledger Preparing the trial balance Preparing the 10-column worksheet and making the necessary adjusting journal entries Recording adjusting entries to the journal and posting the same to the ledger Preparing the financial statements based on adjusted account balances Recording and posting of closing entries Ruling and balancing real and nominal accounts Preparing post-closing trial balance Preparing reversing entries 6. 7. 8. 9. 10. 11. III. Accounting Cycle (slide) A. Understanding and Analyzing Business Transactions (slide) Business transaction- exchange of values involving two parties or within the enterprise that are evidenced by a source document. External transactions- sale of goods to customers or the provision of services to clients Example: Total Sales amounted to 600,000, of which 80% is via credit with terms 3/10, 2/15, n/30 and the remaining is thru cash. Internal transactions- manufacture of goods for sale and incurrence of losses by the company resulting from fire and flood Example: Merchandise inventory amounting to 500,000 was razed in a fire on the storage warehouse. Source Documents (slide) -Original record of a business transaction (date and nature of transaction amount and parties involves) (such as sales invoice, Delivery receipt, Official receipt, Vendor’s invoice, Purchase requisition forms etc.) To Analyze a Transaction: (slide) 1. Determine whether an asset, a liability, owner’s equity, revenue, or expense account is affected by the transaction. 2. 3. For each account affected by the transaction, determine whether the account increases or decreases. Determine whether each increase or decrease should be recorded as a debit or a credit B. Rules of Debit and Credit (slide) DEBIT TO: Increase an asset account Increase an expense account Increase a loss account Increase a drawing account Decrease a liability account Decrease a capital account Decrease a revenue account CREDIT TO: Increase a liability account Increase a capital account Increase a revenue account Decrease an asset account Decrease an expense account Decrease a loss account Decrease a drawing account Account Balances (slide)-Difference between the total debits and the total credits of each account Debit balance- if total debits are greater than the total credits Credit balance- if the total credits are greater than the total debits Normal balance- usual balance of an account assuming proper accounting has been made C. Chart of accounts (slide) -list of all accounts of the business and their respective account numbers. Use of this would reduce confusion as to the choice of account titles and permits uniformity in recording routine transactions (put image as example) D. Journalizing Once the transactions were identified, these are recorded chronologically in the general journal through journal entries. Sample: On January 01, 2020 Mr. A started business (A’s Store) by investing cash of P 795,075. 1-Jan Cash 795,075.00 Mr. A, Capital 795,075.00 General Journal- book where non repetitive transactions involving infrequently used accounts are initially recorded in a systematic and chronological order; also called the book of original entry. Special Journal- Repetitive entries of the same type, recorded in one of the special journals (sales journal, purchase journal, cash receipts journal) Different entries: (SLIDE) Simple journal entry- one account debited and one account credited Ex. Furnitures and Fixtures Cash Compound journal entry- more than one account is involved in a single entry Ex. Purchases Cash Accounts Payable Memorandum entry- an entry which has no debit or credit, which shows only the date and a brief explanation or reminder. Ex. Authorized to issue 500,000 stocks @P 2.00 par value. E. Ledger and Preliminary Trial Balance (slide) Ledger- group of accounts and known as the book of final entry. Posting is the process of periodically transferring all debits and credits recorded in the general journal to the ledger. Two types of ledgers: General ledger: holds the individual accounts grouped according to the seven account types (asset, liab, capital, income, expense, gains, losses) Subsidiary ledger- supports the general ledger accounts that comprise many separate individual accounts (customers’ accounts) Example 1-Jan 31-Dec Cash 795,075.00 1-Jan 120,000.00 8-Jan 303,360.00 10-Jan 12-Jan 15-Jan 15-Jun 30-Nov 31-Dec 1,218,435.00 Balance [f] Balance 50,000.00 326,435.00 80,000.00 260,000.00 9,000.00 1,000.00 335,000.00 50,000.00 55,000.00 10,000.00 132,000.00 10,000.00 942,000.00 276,435.00 After all transactions were recorded and posted, the Unadjusted trial Balance is prepared to check that the sum of debit account balances equals the sum of credit accounts balances. Trial balance- list of all accounts and their balances and indicated whether total debit equals total credit. It does not guarantee that all transactions have been recorded. It is commonly taken every month-end F. Merchandising (slide) Two methods of accounting for merchandise Businesses: 1. Periodic Inventory System (physical Inventory) -uses “Purchases account” to account for merchandise purchased -merchandise inventory account is used to account for physically counted unsold goods and in preparing an adjusting entry -cost of goods sold is calculated by deducting the cost of the unsold inventory from the total available merchandise for sale (beg. Merchandise inventory plus purchases) 2. Perpetual Inventory System -a running balance or record of the merchandise available on hand is kept by the business with the use of merchandise ledgers. -uses only one account “merchandise inventory” to account for all transactions involving the merchandise like purchasing, and selling. - no adjusting entry is prepared at the end of the period since the cost of unsold goods and cost of goods sold are already in the books. Sample: Purchase Goods for Cash P 260,000 and for Credit P 300,000 from B’s Retail Store terms 2/10 n/30 , FOB Shipping Point. Periodic: Purchases 560,000.00 Cash Accounts Payable Terms: 2/10, n/30; FOB Shipping Point 260,000.00 300,000.00 Perpetual: Merchandise Inventory Cash Accounts Payable Terms: 2/10, n/30; FOB Shipping Point 560,000.00 260,000.00 300,000.00 SHIPPING FOB Shipping FOB Destination Point Ownership delivered to delivered to buyer (title) passes freight carrier to buyer when merchandise is Transportation buyer seller costs are paid by Buyers Book FOB Shipping Point A. Buyer pays for the freight Freight-In Cash B. Seller pays for the freight Freight-In Accounts Payable FOB Destination A. Buyer pays for the freight Accounts Receivable Cash B. Seller pays for the freight No entry required Seller's Book No entry required Accounts Receivable Cash Freight-Out Accounts Payable Freight-Out Cash IV. Adjusting and Correcting Entries A. Accruals (slide) 1. Accrued Income- are revenues that have been earned but have not been recorded in the accounts. An example of an accrued revenue is fees for services that an attorney has provided but has not billed to the client at the end of the period. 2. Accrued Expense- are expenses that have been incurred but have not been recorded in the accounts. An example of an accrued expense is accrued wages owed to employees at the end of a period. B. Deferrals 1. Deferred Income- are items that have been initially recorded as liabilities but are expected to become revenues over time or through the normal operations of the business. An example of deferred revenue is unearned rent a. Liability Method- the initial entry credit is to a liability account b. Income Method- the initial entry credit is to an income account 2. Deferred Expense- are items that have been initially recorded as assets but are expected to become expenses over time or through the normal operations of the business. Supplies and prepaid insurance are two examples of prepaid expenses. a. Asset Method- the initial entry debit is to an asset account b. Expense Method- the initial entry is debit is to an expense account Original Entry Cash Unearned Income Adjusting Entry Unearned Income Cash Income Unearned Income Income Income Prepaid Asset Cash Expense Prepaid Asset Expense Prepaid Asset Expense Cash C. Depreciation (slide) decrease in usefulness of a fixed asset except land. Three factors are considered in determining the amount of depreciation expense to be recognized each period. These three factors are (a) the fixed asset’s initial cost, (b) its expected useful life, and (c) its estimated value at the end of its useful life. This third factor is called the residual value, scrap value, salvage value, or trade-in value. 1. Straight Line (slide) The straight-line method provides for the same amount of depreciation expense for each year of the asset’s useful life. It is computed by dividing the difference between the assets initial cost and residual value by its estimated useful life. (example) 2. Other Methods (theories) (slide) a. Unit of Production- provides for the same amount of depreciation expense for each unit produced or each unit of capacity used by the asset. To apply this method, the useful life of the asset is expressed in terms of units of productive capacity such as hours or miles. The total depreciation expense for each accounting period is then determined by multiplying the unit depreciation by the number of units produced or used during the period. b. Double Declining- provides for a declining periodic expense over the estimated useful life of the asset. To apply this method, the annual straightline depreciation rate is doubled. c. SYD Provides for depreciation that is computed by multiplying the depreciable amount by a series of fractions whose numerator is the digit in the useful life of the asset and whose denominator is the sum of the digits in the useful life of the asset. D. Bad debts (slide) 1. Percentage of Sale Accounts receivable are created by credit sales. The amount of credit sales during the period may therefore be used to estimate the amount of uncollectible accounts expense. The amount of this estimate is added to whatever balance exists in Allowance for Doubtful Accounts. 2. Percentage of A/R The estimate based on receivables is compared to the balance in the allowance account to determine the amount of the adjusting entry. E. Correcting Entries Reasons Why Trial Balance may not be Balance: (slide) 1. 2. 3. 4. 5. Error in footing the debit and credit columns Error in transferring from the ledger to the trial balance Error in posting (e.g. posting debit to credit side of account) Error in journalizing Error of omission Working-Back Method (slide) 1. Check if amount is doubled on debit or credit side 2. Transplacement error- e.g. 1M -> 100,000 3. Transposition error- when position of numbers are mixed (e.g. 535,700 -> 553,700) Error Correction Journal entry is incorrect but not posted. insert correct title or amount. Journal entry is correct but posted incorrectly. Journal entry is incorrect and posted. Procedure Draw a line through the error and insert correct title or amount. Draw a line through the error and post correctly. Journalize and post a correcting entry F. Fractional Year Examples (slide) G. Adjusted Trial Balance (slide) After all the adjusting entries have been posted, another trial balance, called the adjusted trial balance, is prepared. The purpose of the adjusted trial balance is to verify the equality of the total debit balances and total credit balances before we prepare the financial statements. If the adjusted trial balance does not balance, an error has occurred. V. Financial Statements A. Introduction to Financial Statements Financial Statements - means by which the information accumulated in and processed by financial accounting is communicated to users on a periodic basis and is the end-product of the financial accounting process. B. Income Statement (P/L, Comprehensive Income) Income Statement - useful tool for evaluating management’s stewardship of the resources of the enterprise and for assessing the inflow and outflow of cash. C. Statement of Changes in Equity Shows balance of the owner’s investment in the business at the beginning of the accounting period, additional investments made by the owner, withdrawals by the owner for personal use, the profit or loss for the period, and the balance of the owner’s investment at the end of the accounting period. 1. Sole and partnership - Sole Proprietor is the most basic legal form of business and has only one owner, while Partnership is an association of two or more persons who bind themselves to contribute money, property, or industry to a common fund with the intention of dividing the profits among themselves. 2. Corporation (introduction to Retained earnings) - Corporation is the most complex form of business organizations, and consists of a shareholder who invests in a corporation. It is governed by the Corporation Code of the Philippines. A corporation would often prepare a statement of retained earnings in lieu of the changes in equity of a Sole and a Partnership. After then, the information from RE Statement can be used in preparing the Stockholders Equity Statement. D. Balance Sheet - Condition of a business, in monetary terms, as of a given date or point in time and is primarily provided in a statement of financial position or balance sheet. 1. Account form - The account form balance sheet is a financial statement format where the assets are reported on the left side and the liabilities and equity are reported on the right side. 2. Report form - A report form balance sheet is a balance sheet that presents asset, liability, and equity accounts in a vertical format. E. Cash Flow - summarizes cash activity for the period, classified according to the nature of activity. 1. Direct - The direct method of cash flow starts with cash transactions such as cash received and cash paid while ignoring the non-cash transactions. 2. Indirect - Indirect cash flow method, on the other hand, the calculation starts from the net income, and then we go along adjusting the rest. VI. Closing Entries A. The “Income and Expense Summary Account” - is a temporary account into which all income statement revenue and expense accounts are transferred at the end of an accounting period. B. Debit balance in the Income and Expense Summary Account - If the Income Summary has a debit balance, the amount is the company's net loss. The Income Summary will be closed with a credit for that amount and a debit to Retained Earnings or the owner's capital account. C. Credit balance in the Income and Expense Summary Account - if the Income Summary has a credit balance, the amount is the company's net income. The Income Summary will be closed with a debit for that amount and a credit to Retained Earnings or the owner's capital account. D. Closing I&E to Capital - To close all the income accounts, we debit Service Revenue for the full amount and credit Income Summary for the same. To close expense accounts, we credit the expense accounts and debit Income Summary. Then, the Income Summary balance is ultimately closed to the capital account. E. Post-Closing Trial Balance - A post-closing trial balance is a listing of all balance sheet accounts containing non-zero balances at the end of a reporting period. VII. Reversing entries A. Purpose - accountants use reversing entries to cancel out the adjusting entries that were made to accrue revenues and expenses at the end of the previous accounting period. Sample Problem <slide1-3> On January 01, 2020 Mr. A started business (A’s Store) by investing cash of P 795,075 and other transactions for the year are as follows: 1/1 Purchase Furniture costing P 80,000 for cash. 1/8 Purchase Goods for Cash P 260,000 and for Credit P 300,000 from B’s Retail Store terms 2/10 n/30 , FOB Shipping Point. 1/10 Purchase additional Goods on credit for P 50,000 from C’s Store terms n/30, FOB Destination. Paid freight on purchase on January 8 amounting to P 9,000. 1/12 Paid freight on purchase on January 10 amounting to P 1,000. 1/15 Returned P 9,000 of purchased merchandise to C’s Store due to substandard quality. Paid B and C. 4/1 Purchase Office Equipment for P 50,000 by issuing an 8% interest bearing note with maturity on April 1, 2022. Principal and interest are both payable on maturity date. 6/15 Owner withdrew of worth P 50,000 for personal use. 11/30 Monthly salaries of P 5,000 was paid up to November. 12/31 Total Sales amounted to 600,000, of which 80% is via credit with terms 3/10, 2/15, n/30 and the remaining is thru cash. Half of the customers who purchased via credit paid 10 days after the sale, 15% paid 15 days after the sale and 10% did not take the discount and remains outstanding as of the year end. Cost of Goods Sold amounted to P 354,000. Freight on sale was paid by A’s Store amounting to P 10,000, Terms: FOB Destination. Customers who purchased via cash were refunded for P 10,000. 25% of the credit customers defaulted on their payment at due date and instead issued a note to A’s Store. Purchased additional merchandise from C’s Store amounting to P 10,000 on credit to meet expected inventory levels for next year. Other Expenses that were paid are listed as follows Advertising P 12,000 Rent P 60,000 Insurance P 24,000 Light, water and Electricity P 36,000 <slide 4-8> General Journal- Periodic 1-Jan Cash 795,075.00 Mr. A, Capital Furnitures and Fixtures Cash 795,075.00 80,000.00 80,000.00 8-Jan Purchases Cash Accounts Payable Terms: 2/10, n/30; FOB Shipping Point 10-Jan Purchases Accounts Payable Terms: n/30; FOB Destination 560,000.00 260,000.00 300,000.00 50,000.00 50,000.00 Freight-In Cash 9,000.00 12-Jan Accounts Receivable Cash 1,000.00 15-Jan Accounts Payable Purchase Returns and Allowances 9,000.00 Accounts Payable Cash Purchase Discounts 1-Apr Office Equipment Notes Payable 9,000.00 1,000.00 9,000.00 341,000.00 335,000.00 6,000.00 50,000.00 50,000.00 15-Jun Mr. A, Drawings Cash 50,000.00 30-Nov Salaries Expense Cash 55,000.00 31-Dec Cash Accounts Receivable Sales Sales Returns and Allowances Cash Cash Sales Discount Accounts Receivable Freight-out Cash 50,000.00 55,000.00 120,000.00 480,000.00 600,000.00 10,000.00 10,000.00 303,360.00 8,640.00 312,000.00 10,000.00 10,000.00 Notes Receivable Accounts Receivable 120,000.00 120,000.00 Advertising Expense Rent Expense Insurance Expense Utilitites Expense Cash 12,000.00 60,000.00 24,000.00 36,000.00 Purchases Accounts Payable 10,000.00 132,000.00 10,000.00 <slide 9-13> General Journal- Perpetual 1-Jan Cash 795,075.00 Mr. A, Capital Furnitures and Fixtures Cash 8-Jan Merchandise Inventory Cash Accounts Payable Terms: 2/10, n/30; FOB Shipping Point 10-Jan Merchandise Inventory Accounts Payable Terms: n/30; FOB Destination Merchandise Inventory Cash 795,075.00 80,000.00 80,000.00 560,000.00 260,000.00 300,000.00 50,000.00 50,000.00 9,000.00 9,000.00 12-Jan Accounts Receivable Cash 1,000.00 15-Jan Accounts Payable Merchandise Inventory 9,000.00 Accounts Payable Cash Merchandise Inventory 341,000.00 1,000.00 9,000.00 335,000.00 6,000.00 1-Apr Office Equipment Notes Payable 50,000.00 50,000.00 15-Jun Mr. A, Drawings Cash 50,000.00 30-Nov Salaries Expense Cash 55,000.00 31-Dec Cash Accounts Receivable Sales 50,000.00 55,000.00 120,000.00 480,000.00 600,000.00 Cost of Goods Sold Merchandise Inventory 300,000.00 Sales Returns and Allowances Cash 10,000.00 Merchandise Inventory Cost of Goods Sold Cash Sales Discount Accounts Receivable Freight-out Cash Notes Receivable Accounts Receivable 300,000.00 10,000.00 5,000.00 5,000.00 303,360.00 8,640.00 312,000.00 10,000.00 10,000.00 120,000.00 120,000.00 Advertising Expense Rent Expense Insurance Expense Utilitites Expense Cash 12,000.00 60,000.00 24,000.00 36,000.00 Merchandise Inventory Accounts Payable 10,000.00 132,000.00 10,000.00 Cash 1-Jan 795,075.00 31-Dec 120,000.00 303,360.00 1-Jan 80,000.00 8-Jan 260,000.00 10-Jan 9,000.00 12-Jan 1,000.00 15-Jan 335,000.00 15-Jun 50,000.00 30-Nov 55,000.00 31-Dec 10,000.00 132,000.00 10,000.00 1,218,435.00 942,000.00 Balance 276,435.00 [f] 50,000.00 Balance 326,435.00