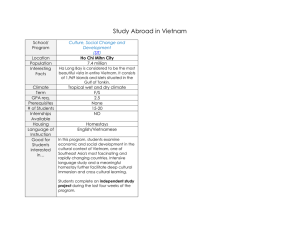

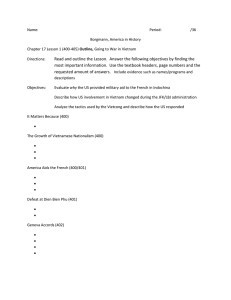

The Vietnam Consumer Survey Staying resilient amidst headwinds February 2021 Foreword 03 Staying resilient amidst headwinds 04 The Vietnam Consumer Survey 10 1. Heart: Understanding changes in consumer sentiment 12 2. Wallet: Observing changes in consumer expenditure 16 3. Mind: Deciphering new purchase drivers 23 Looking ahead 37 Contact us 39 Foreword Although Vietnam is not immune to the COVID-19 pandemic and its accompanying economic headwinds, it has arguably proven itself as one of the more resilient economies in Southeast Asia. What set it apart from the rest were its early, relatively successful efforts at containment, and a compliant population that mostly adhered to safe distancing requirements. This has, in turn, materialised in a resilient Vietnamese consumer, with a positive outlook on the economy. In this second edition of the Vietnam Consumer Survey, we will explore some of the key changes in consumer behaviour and purchasing patterns that have emerged from the recent survey conducted during between June and July 2020 across 1,000 households through face-to-face interviews in four major cities: Can Tho, Da Nang, Hanoi, and Ho Chi Minh City. To facilitate discussions on the consumer journey and highlight segment-specific insights where possible, we have also developed four personas to represent the various key consumer segments in Vietnam: Van, Hai, Chien, and Hoa. Through their lenses, we will explore the consumer journey while analysing the impact of the pandemic and other macro trends on the Vietnamese consumer’s heart, wallet, and mind. We will begin by examining the overall consumer sentiment, including their economic and employment outlook, as well as income expectations. Overall, we observed that the consumer sentiment remains generally optimistic despite the uncertain environment, with a level of resilience displayed even amongst the lower income groups, for whom the impact of COVID-19 has undoubtedly been harder. Next, we explore some of the shifts in consumer spending, which reflect not only a greater prudence amidst the ongoing pandemic, but also a shift in priorities as consumers adapt to new ways of remote working and the accompanying lifestyle changes. Finally, we take a look at the purchasing drivers and other behaviours exhibited throughout the purchasing journey from pre-purchase, to purchase, and post-purchase. While we observed that traditional trade channels continue to hold their own against modern trade channels even amidst the pandemic, there has been a more noticeable shift from traditional trade to e-commerce and online channels. Nevertheless, a variety of different impediments remain in the way of the greater adoption of these platforms, which consumer companies will need to address. We hope that this report will provide you with some insights into the resilient Vietnamese consumer, and the considerations that you will need to make as you prepare for a full-speed recovery ahead. Pua Wee Meng Consumer Industry Leader Deloitte Southeast Asia 03 Staying resilient amidst headwinds | The Vietnam Consumer Survey Staying resilient amidst headwinds Despite the onset of the pandemic, Vietnam’s economy has remained fairly resilient. This is not only a result of the relatively successful efforts by its government to curb COVID-19 transmission – including the implementation of partial lockdowns and social distancing rules that were well-observed by the general population – but also the inherent characteristics and composition of its economy. Specifically, Vietnam’s economy is driven primarily by both export-oriented manufacturing sectors and domestic demand. As demand from Vietnam’s global trade partners began to soften during the course of the pandemic, its strong domestic demand was able to provide a significant level of cushion that enabled its Gross Domestic Product (GDP) to continue to grow, albeit at a slower rate, of 1.8% in 20201. In addition, the ongoing trade war between China and the US has also presented Vietnam with a unique set of opportunities and challenges. While it has benefited from the wave of American and Japanese companies seeking to relocate their manufacturing operations from China, the government has also found it challenging to scale up infrastructure, upskill the labour force, and refine the legal framework for foreign direct investments in the face of the sheer volume of incoming foreign investors. Indeed, one recent study found that of the 33 companies who reported to be relocating their manufacturing operations from China, 23 chose Vietnam as their destination2. Looking ahead, this development is likely to continue to fuel Vietnam’s momentum of strong FDI growth over the last decade, which peaked at a ten-year high of USD 38 billion in 20193. From a consumer point-of-view, the pandemic has also undoubtedly accelerated many digital behaviours and encouraged the greater adoption of e-commerce. In response, many consumer companies have swiftly diverted their investments into digital channels, and made significant efforts to adapt their route-to-market strategies to capitalise on the new shift. In this section, we will explore four characteristics of the Vietnamese consumer in this new normal, and present four consumer personas whose journeys we will follow over the course of the report as we discuss the impact of the pandemic and other macro consumer trends on the three dimensions of the Vietnamese consumer’s heart, wallet, and mind. 1 “Vietnam: Overview”. The World Bank. 6 October 2020. 2 “Jokowi tells ministers to take advantage of US-China trade war, as investors bypass Indonesia”. South China Morning Post. 5 September 2019. 3 “Viet Nam’s FDI capital hits 10-year record in 2019”. Viet Nam News. 27 December 2019. 04 Staying resilient amidst headwinds | The Vietnam Consumer Survey Four characteristics of the Vietnamese consumer Overall, our latest research findings based on the Vietnam Consumer Survey conducted in the midst of the COVID-19 pandemic between June and July 2020 (see ‘Methodology’ section for more details) revealed four key characteristics of the Vietnamese consumer in this new normal: • Positive consumer sentiment With Vietnam’s relatively successful efforts at curbing the pandemic, consumer sentiment has remained fairly positive. This resilience of the Vietnamese consumer provides generally favourable conditions for consumer companies to thrive in the mid- to long-term future. • Shift in priorities towards necessities Changes in the Vietnamese consumer’s expenditures have reflected a shift in priorities towards necessities, and away from discretionary spending. However, their purchasing decisions remain driven by considerations of quality and brand attributes, rather than price. These patterns are consistent with the overall trend of trading up in recent years, as consumer seek higher quality alternatives with their increasing income levels. • Acceleration of digital behaviour The pandemic has boosted the Vietnamese consumer’s receptiveness towards e-commerce and online purchasing channels, especially for certain product categories. Consumer companies should therefore strive to diversify their route-to-market strategies by establishing strong multi-channel – and eventually, omnichannel – capabilities, while working to overcome some of the existing logistical and customer acquisition issues posed by e-commerce channels. • Desire for better purchasing experiences The Vietnamese consumer has expressed a desire for better purchasing experiences, even prioritising this need above their desire for steep discounts or promotions. To design truly frictionless customer experiences for enhanced customer loyalty, consumer companies will need to re-assess their customer journeys to gain a better understanding of customer pain points. The consumer journey Throughout this report, we will explore the consumer journey through the lenses of the four defined personas, while analysing the impacts of the pandemic and other macro consumer trends on the Vietnamese consumer’s heart, wallet, and mind. Specifically, the heart dimension will focus on the changes to consumer sentiment as a result of the pandemic, overall economic conditions, as well as outlook on income and employment; the wallet dimension will focus on the near-term adjustments in consumer spending patterns and other financial priorities; and the mind dimension will focus on adopting a forward-looking approach by delving into the changes in consumer priorities and purchasing journeys for the foreseeable mid- to long-term. Heart • Consumer sentiment • Short-term economic outlook • Employment outlook • Income expectations Wallet • Intention to change expenditure • Expenditure allocation • Planned expenditure allocation Mind • Purchasing drivers • Channel preferences • Digital and e-commerce readiness • Re-purchasing drivers 05 Staying resilient amidst headwinds | The Vietnam Consumer Survey Four Vietnamese consumer personas To facilitate discussions on the consumer journey and highlight segment-specific insights where possible, we have developed four personas to represent the various key consumer segments in Vietnam: Van, Hai, Chien, and Hoa. Persona 1: Van As an early career professional in the 25-29 age group, Van has a lower mid-level monthly income of VND 9-14 million. She is a Generation Z consumer, and is health-conscious, tech-savvy, and an adept user of mobile devices and social media. Van Segment – Early Career Professionals Goals • Professional opportunities • Relationships and family Behaviours • Frequent visitor of restaurants, bars, cinemas, cafés, and karaoke establishments • Frequent purchaser of smartphones, cosmetics, and beauty care products Gender: Female Age: 25 Income: VND 9-14 million Location: Da Nang Knowledge of e-commerce Mindset • Follows sports, fitness, and clothing and footwear trends • Consumes some alcohol and tobacco • Traditional trade and modern trade channels for groceries and other daily necessities Key purchasing channels • e-Commerce and online channels for clothing and footwear, and leisure and holiday activities Preference for physical purchasing channels Key concerns Level of health-consciousness Preferred sources of information Preferred devices • Job security • Upskilling • Social media • Influencers and celebrities • Friends • Smartphone • Laptop • Tablet • Facebook Preferred social media platforms • Instagram • TikTok • YouTube • ZALO 06 Staying resilient amidst headwinds | The Vietnam Consumer Survey Persona 2: Hai Hai is a mid-career professional in the 30-34 age group. He earns an upper mid-level monthly income of VND 14-19 million, and is focused on his priorities of career progression and family development. As a Millennial consumer, he is highly tech-savvy, but is also comfortable with the use of offline purchasing channels. Hai Segment – Mid-Career Professionals Goals • Mortgage and loans • Marriage and family • Investment planning • Frequent visitor of restaurants and bars Behaviours • Frequent purchaser of consumer electronics • Frequent purchaser of leisure and holiday activities Gender: Male Age: 30 Income level: VND 14-19 million Location: Ho Chi Minh City Mindset • Utilises productivity applications for telecommuting • Consumes some alcohol and tobacco • Modern trade channels for most product categories Knowledge of e-commerce Preference for physical purchasing channels • Prioritises sports, fitness, and wellness Key purchasing channels • e-Commerce and online channels for education, leisure and holiday activities, and transportation services • Traditional trade channels for mobile top-up cards and tobacco Level of health-consciousness • Job security Key concerns Preferred sources of information Preferred devices Preferred social media platforms • Health insurance • Wealth accumulation and investments • Social media • Online newspapers • Friends and colleagues • Family and relatives • Smartphone • Laptop • Tablet • ZALO • Facebook • WhatsApp • LinkedIn 07 Staying resilient amidst headwinds | The Vietnam Consumer Survey Persona 3: Chien Chien is a middle-aged working professional in the 45-49 age group. As compared to younger working professionals, Chien commands a higher monthly income of VND 20-40 million, but is now an active pre-retiree who prioritises retirement planning and stable investing over career progression. As a Generation X consumer, he has an average level of tech-savviness, prioritises practicality when making purchasing decisions, and leans towards the use of physical purchasing channels. Chien Segment – Active Pre-Retirees Goals • Mortgage and loans • Marriage and family • Investment planning Behaviours Mindset Gender: Male Age: 48 Income level: VND 20-40 million Location: Hanoi Knowledge of e-commerce Key purchasing channels • Occasional visitor of restaurants and bars • Infrequent purchaser of consumer electronics and household appliances • Practical and risk-averse • Consumes alcohol and tobacco somewhat heavily • Modern trade channels for most product categories, especially consumer electronics and lifestyle products • e-Commerce and online channels for transportation • Traditional trade channels for tobacco Preference for physical purchasing channels • Physical well-being Level of health-consciousness Key concerns • Anxiety about COVID-19 and the need for social distancing • Financial support for college-aged children Preferred sources of information Preferred devices Preferred social media platforms 08 • Social media • Online news aggregators • Family and relatives • Friends and colleagues • Desktop computer • Mobile phone • Facebook • ZALO Staying resilient amidst headwinds | The Vietnam Consumer Survey Persona 4: Hoa Hoa is a senior citizen drawing a low- to mid-level monthly income of VND 4-9 million that comes primarily from sources such as investments, pension funds, and allowances. She is relatively less tech-savvy as compared to the other consumer segments, and has a strong preference for traditional modes of communication and physical purchasing channels. In line with her traditional mindset, she is slightly more price-sensitive and healthconscious, as her concerns over age-related ailments grow. Hoa Segment – Senior Citizens • Retirement income Goals • Healthcare expenditures • Management of household expenditures • Enjoys domestic tourism and travel activities Behaviours • Participates in community-driven activities and exercises • Infrequent purchaser of household appliances Gender: Female Age: 65 Income level: VND 4-9 million Location: Can Tho • Price-sensitive Mindset • Open to alternative medicine • Traditional trade channels for groceries and other daily necessities Knowledge of e-commerce Preference for physical purchasing channels • Does not consume alcohol and tobacco Key purchasing channels Level of health-consciousness • Specialty stores for health supplements and medicines • A mix of traditional trade and modern trade channels for recreational consumer goods and lifestyle products • Physical well-being Key concerns • Anxiety about COVID-19 and the need for social distancing • Caring for grandchildren Preferred sources of information Preferred devices Preferred social media platforms • TV • Healthcare professionals • Family and relatives • Friends • TV • Mobile phone • ZALO • YouTube 09 Staying resilient amidst headwinds | The Vietnam Consumer Survey The Vietnam Consumer Survey Methodology In this second edition of the Vietnam Consumer Survey, we explore some of the latest changes in the consumer journey amidst the tumultuous COVID-19 pandemic uncovered by the recent consumer survey conducted by Deloitte between June and July 2020 across four major cities: Can Tho, Da Nang, Hanoi, and Ho Chi Minh City. Face-to-face interviews were conducted with over 1,000 households, and the respondent sample had been carefully constructed to be representative of Vietnam’s population, in terms of age, gender, marital status, household income, and geographical distribution. Respondents were surveyed on their consumer sentiment, spending patterns, purchasing considerations, communication channels, and purchasing channels across the following product categories: Basic Necessities • Food (Packaged & Fresh) • Food (Canned) • Transportation • Housing & Utilities • Healthcare • Education Lifestyle Products • Internet Services • Clothing & Footwear • Cosmetics & Beauty Care Products • Personal Hygiene Products • Household Cleaning Products • Fitness & Wellness • Leisure & Holiday • Dining Out • Karaoke & Nightclubs Welfare and Savings • Insurance • Welfare & Savings 10 Recreational Consumer Goods • Beverages (Alcoholic) • Beverages (Non-Alcoholic) • Confectionery • Tobacco Consumer Electronics • Audio & Video Electronics Products • Mobile Phones & Digital Gadgets • Household Appliances (Major) • Household Appliances (Small) Staying resilient amidst headwinds | The Vietnam Consumer Survey Demographics of survey respondents Geographical distribution Ho Chi Minh City Marital status distribution Single Can Tho 15% Married 14% 20% 17% 3% Married with children 40% 12% Others 79% 1% Da Nang 20% 7% Monthly household income distribution Monthly household income level, VND million 4-9 52% 30% 1% 37% 10% 9-14 Hanoi 34% 14-20 15% 8% 20-40 Gender distribution 40-60 4% More than 60 3% Age distribution Age group, years 20-24 50% 50% 10% 11% 25-29 30-34 15% 35-39 15% 40-44 15% 45-49 15% 50-54 10% 55-59 10% 11 Staying resilient amidst headwinds | The Vietnam Consumer Survey Heart: Understanding changes in consumer sentiment Consumer sentiment is generally positive, as consumers feel encouraged by the government’s relatively successful efforts at containing the COVID-19 pandemic. There are, however, several regional differences in sentiment between consumers in northern and southern Vietnamese cities. Consumer sentiment remains moderate despite uncertainties Despite the ongoing economic volatility, the Vietnamese consumer appears to be generally optimistic. On average, survey respondents rated their confidence levels in Vietnam’s overall economy 6.7 out of 10 for the next year, and 7.2 out of 10 for the next 3-5 years (where 0 represents the lowest confidence level, and 10 represents the highest confidence level). Although this represents a slight dip from the levels we observed in the 2019 edition of the survey (see Figure 1), it is worthwhile mentioning that these figures are not only positive, but also upward trending – suggesting optimism for economic recovery in the near future. Figure 1: Confidence levels in improvements to overall economy and household income level 8.1 7.8 7.2 6.7 Next year Next 3-5 years 2019 2020 Source: Deloitte’s Vietnam Consumer Survey (2020) Chien is only slightly concerned about the economy as he feels reassured by the government’s efforts to control the pandemic. He believes that the economy will recover in 2021, as Vietnam continues to benefit from the relocation of manufacturing operations from China. He is also pleasantly surprised by the uptick that he witnessed in both the real estate market and stock market in the second half of 2020, and believes that he will be in a comfortable financial position in the year ahead given his current salary level and investment portfolio. 12 Chien Active Pre-Retirees Staying resilient amidst headwinds | The Vietnam Consumer Survey This optimism could be attributed to Vietnam’s relatively successful efforts at combating the COVID-19 outbreak – including the swift implementation of containment measures by the government and a generally compliant population – in comparison to its neighbouring Southeast Asian economies (see Figure 2). Vietnam is also one of three Southeast Asian economies, in addition to Brunei and Myanmar, expected to sustain a positive GDP growth rate in 2020, with expectations for GDP growth coming in at about 6.8% for 20214. Figure 2: Cumulative number of COVID-19 positive cases for selected economies in Southeast Asia Indonesia: 287,008 Singapore: 57,765 Malaysia: 11,224 Vietnam: 1,094 Jan 2020 Feb 2020 Mar 2020 Apr 2020 May 2020 Jun 2020 Jul 2020 Aug 2020 Sep 2020 Source: World Health Organisation Hoa Senior Citizens Hoa has remained generally calm about the economy, and is in fact slightly positive in her mid-term expectations as her children’s jobs have stabilised after some turbulence in the first half of 2020. Her own income consists primarily of a government pension, and a small amount of passive investment income – and is therefore largely fixed. She has been through many economic turbulences in her lifetime, including the hyperinflation of the 1980s, and is therefore confident that the economy will soon recover once the short-term shock abates. Decoding the north-south divide Consumer sentiment appears to vary by city, with survey respondents in the two southern cities of Can Tho and Ho Chi Minh City relatively more optimistic than those in the northern city of Hanoi and the central city of Da Nang (see Figure 3). This is perhaps not entirely a surprise, given that northern Vietnamese consumers are known to be more slightly more traditional, and therefore more conservative and cautious about their expenditure in general. What is more notable, however, is the observation that survey respondents in the central city of Da Nang appeared to be the least optimistic. One possible explanation for this phenomenon is the fact that Da Nang’s economy is highly reliant on tourism receipts – in 2019 alone, it welcomed nearly 8.7 million tourists – and therefore was harder hit by the implementation of COVID-19 related travel bans. Despite efforts to rejuvenate its tourism sector with a brief opening of the city to tourists, a second wave of COVID-19 cases ultimately resulted in a 30-day lockdown in August 2020 with significant knock-on impacts on businesses and livelihoods across tourism-related sectors, such as food and beverage, leisure and entertainment, and accommodation. 4 “Asian Development Outlook Update, September 2020”. Asian Development Bank. September 2020. 13 Staying resilient amidst headwinds | The Vietnam Consumer Survey Figure 3: Consumer sentiment by city Can Tho Da Nang Hanoi 43% 18% 2% 37% 1% 37% 1% 43% 47% Ho Chi Minh City 7% Very positive 37% 56% 7% 17% 1% 37% Fairly positive 9% 1% Fairly negative Neutral Very negative Source: Deloitte Consumer Insights survey (2020) For the same reason, survey respondents from Da Nang also expressed a relatively more pessimistic employment outlook, as well as lower expectations for changes in their income levels. At the same time, survey respondents from Hanoi also continue to express a more cautious stance, which could be inferred from the observation that they hold lower expectations for income increases despite their overall positive employment outlook (see Figure 4 and 5). Figure 4: Employment outlook by city Can Tho 6% Ho Chi Minh City 8% 37% 54% Da Nang 1% 16% Hanoi 1% Figure 5: Expected changes in income level by city 33% 49% 40% 42% 45% Very positive Fairly positive Fairly negative Very negative 3% Can Tho 1% Da Nang 7% Hanoi 8% 16% 41% Neutral 7% 40% 45% 13% 45% 35% Increase by more than 10% Increase by less than 10% No change Reduce by less than 10% Reduce by more than 10% Source: Deloitte’s Vietnam Consumer Survey (2020) Impact of COVID-19 harder on lower income groups Overall, it could be observed that the impact of COVID-19 has been harder on consumers with lower monthly household income levels. In particular, survey respondents in the lowest income group (monthly household income levels of VND 4-9 million), who tend to occupy jobs that are more low-skilled or temporary in nature, also have the lowest levels of optimism for both their employment outlook and economic outlook (see Figure 6). Nevertheless, even within this income group, we observed a certain level of resilience: nearly 80% of survey respondents expressed an optimistic or neutral outlook for both their employment and the overall economy. This positivity increases significantly with income, possibly a result of Vietnam’s established track record of achieving consistent growth in a stable business environment. As many of the survey respondents in the higher income groups are also likely to be holding more senior positions in larger companies, they tend to be more assured of their job security, given that these organisations are more well-equipped to weather the current economic volatility, and have mostly been able to resume operations after the partial lockdown was lifted in May 2020. 14 27% 14% 55% 18% Ho Chi Minh City 10% 11% 39% 15% 2% 1% 5% 7% 3% Staying resilient amidst headwinds | The Vietnam Consumer Survey Figure 6: Employment outlook and economic outlook by monthly household income level Employment outlook Monthly household income level, VND million 9-14 4% 14-20 6% 20-40 9% 40-60 6% More than 60 35% 10% 43% 26% 31% 4-9 Short-term economic outlook Monthly household income level, VND million 16% 45% 45% 10% 39% 53% 14-20 4% 33% 4%1% 20-40 3% 40-60 47% 44% 9-14 4% 31% 59% More than 60 5% 16% 1% 42% 36% 12% 37% 47% 53% 33% 50% 42% 14% 22% 1% 44% 4-9 3% 30% 55% 9% 8% 28% 3% Mid-term economic outlook Monthly household income level, VND million 4-9 7% 9-14 6% 14-20 8% 20-40 9% 40-60 3% More than 60 21% Very positive 43% 14% 36% 36% 50% 7% 31% 56% 5% 19% 6% 66% 33% 64% 21% 3% 55% Fairly positive Neutral Fairly negative Very negative Source: Deloitte’s Vietnam Consumer Survey (2020) Hai Mid-career Professionals Hai is generally positive about the economy and his employment outlook. Although his company had faced some challenges in the first half of 2020, his position now appears to be secure as the business has regained its momentum. There is still a level of uncertainty about the salary raise that he is likely to receive next year, but he believes that the business transformation activities that his company is currently undertaking will put it in good stead for growth in the year ahead. 15 Staying resilient amidst headwinds | The Vietnam Consumer Survey Wallet: Observing changes in consumer expenditure Changes in consumer expenditure suggest greater prudence amidst the ongoing pandemic, as well as a change in priorities as consumers shift from out-of-home consumption to at-home consumption. Narrowing differences between first- and second-tier cities Home to nearly one-fifth of Vietnam’s total population, the metropolitan cities of Hanoi and Ho Chi Minh City are often considered to be Vietnam’s first-tier cities where the majority of international and domestic corporations are headquartered. Accordingly, they are also perceived to have the highest average levels of income and cost of living than second-tier cities, such as Da Nang. Our survey results, however, show that average monthly expenditure levels are similar across all three cities, which suggests a higher than expected cost of living in a tourist city such as Da Nang. This is also supported by the observation for Can Tho, which despite having a higher Gross Regional Domestic Product (GRDP) than Da Nang, indicated a significantly lower average monthly expenditure level (see Figure 7 and 8). Figure 7: Average monthly expenditure levels across cities by monthly household income level Average monthly expenditure level, VND million 24 Hanoi 23 Da Nang 21 Ho Chi Minh City 13 12 9 11 7 9 13 Can Tho Figure 8: GDRP per capita across cities (2019) GDRP per capita, USD 6,372 4,918 3,630 3,447 Can Tho Da Nang 7 5 4-9 C9-14 14-20 More than 20 Hanoi Monthly household income level, VND million Source: Deloitte’s Vietnam Consumer Survey (2020) Ho Chi Minh City Source: Deloitte’s Vietnam Consumer Survey (2020) Necessities are prioritised in expenditure allocation With the ongoing COVID-19 pandemic, a greater proportion of survey respondents have expressed an intention to reduce their expenditure levels: about 36% of them expressed this opinion, as compared to 6% in the 2019 edition of the survey (see Figure 9). Figure 9: Intention to change monthly household expenditure levels (2019-2020) 6% 36% 46% 39% 48% Decrease 25% 2019 2020 Maintain Increase Source: Deloitte’s Vietnam Consumer Survey (2019 and 2020) 16 Staying resilient amidst headwinds | The Vietnam Consumer Survey Furthermore, consumers now prioritise Basic Necessities in their monthly household expenditure allocations, with significant increases in allocations from 2019 levels to the combined category of Food (Packaged, Fresh & Canned) and Housing & Utilities, which increased from 34% to 42% and 7% to 12% respectively (see Figure 10). These increases are likely a result of the adjustments that consumers had to make in their lifestyles in response to social distancing measures, which includes spending more time at home and preparing their own meals. In terms of their expenditure patterns for necessities, there are some slight differences across cities: while survey respondents in Hanoi and Ho Chi Minh City seem to have similar habits, those in Da Nang spend more on Food (Packaged & Fresh), and those in Can Tho spend more on Housing & Utilities. Overall, this increased focus on necessities has also resulted in lower discretionary spending on product categories such as Consumer Electronics, and Leisure & Holiday, which decreased from 10% to 0.2% and 4% to 0.4% respectively from their 2019 levels. While the reduction in Leisure & Holiday spending could be attributed to the travel restrictions currently in place, the reduction in Consumer Electronics spending is likely to be a reflection of the greater prudence demonstrate by consumers during this period of economic uncertainty. Nevertheless, survey respondents in Ho Chi Minh City appear to be more willing to allocate their monthly household expenditure to discretionary spending, while those in Can Tho are least willing to do so, allocating nearly 80% of their monthly household expenditure to necessities. Figure 10: Expenditure allocation by city 45% 43% 43% 3% 4% 5% 12% 12% 9% 8% 15% 13% 4% 2% 5% 7% 5% 1% Can Tho 6% 3% 7% 7% 9% 1% 7% 4% 6% 6% 8% 1% Da Nang Hanoi 40% 4% 11% 9% 5% 4% 10% 6% 9% 2% Ho Chi Minh City Food (Packaged, Fresh & Canned) Transportation Personal Hygiene Products & Household Cleaning Products Healthcare Education Other Lifestyle Products Internet Services Housing & Utilities Source: Deloitte’s Vietnam Consumer Survey (2020) Recreational Consumer Goods Welfare & Savings Expenditure patterns across monthly household income levels Overall, it could be observed that survey respondents shift their monthly household expenditure allocations from basic necessities to discretionary spending as their monthly household income levels increase. In particular, the shift appears to be made from Housing & Utilities to Clothing & Footwear and other Lifestyle Products. Survey respondents also allocated a higher proportion of their monthly household expenditure to Education as their income levels increase, and to financial products such as Insurance and Welfare & Savings, especially for those with monthly household income levels of above VND 20 million (see Figure 11). Interestingly, survey respondents across all monthly household income levels allocate similar proportions of their monthly household expenditure to Recreational Consumer Goods, such as Beverages (Alcoholic) and Tobacco. Here, it seems that this behaviour is driven by a combination of relatively affordable prices and an extensive network of retail channels that offer consumers 24/7 access to these products. As an illustration of the affordability of cigarettes in Vietnam, recent statistics show that the average price of a pack of cigarettes in Vietnam is about USD 1.70, whereas it would cost about USD 3.30, USD 9.70, and USD 2.60 in Malaysia, Singapore, and Thailand respectively5. 5 “International Cigarette Prices”. Cigarette Prices. 17 Staying resilient amidst headwinds | The Vietnam Consumer Survey Figure 11: Expenditure allocation by monthly household income level 44% 43% 4% 4% 13% 12% 10% 4% 4% 11% 12% 8% 9% 9% 7% 6% 4% 4% 2% 6% 5% 3% 7% 7% 6% 6% 8% 1% 8% 1% 8% 1% 4-9 38% 41% 5% 8% 8% 9-14 14-20 38% 41% 6% 4% 9% 11% 10% 9% 7% 6% 5% 5% 7% 7% 7% 5% 6% 8% 8% 7% 3% 3% 4% 20-40 40-60 More than 60 Monthly household income level, VND million Food (Packaged, Fresh & Canned) Healthcare Housing & Utilities Transportation Education Other Lifestyle Products Source: Deloitte’s Vietnam Consumer Survey (2020) Personal Hygiene Products & Household Cleaning Products Internet Services Recreational Consumer Goods Welfare & Savings Changes in planned expenditure reflect new ways of working The COVID-19 pandemic and related social distancing measures have resulted in consumers spending more time at home, and therefore increasing their focus on at-home consumption. In this section, we will explore some of the changes in their planned expenditure in each of the following product categories that have occurred as a result of COVID-19: Basic Necessities Vietnamese consumers appeared to have demonstrated evident stocking-up behaviours during the course of the pandemic: in response to lockdowns in Ho Chi Minh City, for example, sales of packaged bread and carton milk jumped by 122% and 12% respectively as compared to the same period one year ago6. Although Vietnamese consumers have since reduced their basket sizes in terms of the number of items purchased per grocery shopping trip to 2019 levels, their basket values are significantly higher. This suggests that although consumption levels have returned to normalcy, consumers are now willing to spend more per item7, which is also consistent with the higher planned monthly household expenditure on Food (Packaged & Fresh) and Food (Canned) that we have observed (see Figure 12). One significant change in behaviour that also appears to have been catalysed by the COVID-19 pandemic is the planned increase in monthly household expenditure on Healthcare. It is perhaps worth noting here that the increased healthconsciousness is a trend that had already been in motion even before the onset of the pandemic, although COVID-19 had undoubtedly accelerated its development. In particular, prices of essential healthcare products, such as hand sanitisers and face masks, now cost considerably more than they did in 2019. This is a result not only of skyrocketing demand, but also limited global supply capacities that could only be partially mitigated by government intervention, including the imposition of price ceilings and crackdowns on unethical profiteers. In contrast, planned monthly household expenditure on Transportation has decreased as a result of social distancing measures that have reduced the amount of travelling that consumers now require. Education, too, faced cutbacks. Although the public school system is heavily subsidised in Vietnam, enrolment in private cram schools and other enrichment classes are common in urban areas where there is steep competition for places in prestigious schools. With social distancing measures and, in some cases, temporary closure of private education facilities, survey respondents appear to have responded with a reduction in monthly household expenditure allocation for this category. 6 “Living in C-19 times – FMCG: Asian consumer/shopper reaction during lockdown”. Kantar Worldpanel. April 2020. 7 “FMCG Monitor: September 2020 – Vietnam”. Kantar Worldpanel. September 2020. 18 Staying resilient amidst headwinds | The Vietnam Consumer Survey Figure 12: Changes in planned monthly household expenditure on Basic Necessities as a result of COVID-19 Food (Packaged & Fresh) 84% Food (Canned) 70% Transportation 8% Housing & Utilities Education Increase 58% 43% 8% No change 22% 5% 8% 79% 14% 59% Healthcare 11% 30% 35% 11% 7% 50% Decrease Source: Deloitte’s Vietnam Consumer Survey (2020) Hoa Senior Citizens Having stayed home most of the time since the onset of the COVID-19 pandemic, Hoa has dramatically reduced her expenditure on Transportation and Clothing & Footwear by about 62% each. She has also nearly completely ceased spending on out-of-home entertainment activities, including on Fitness & Wellness product categories. Instead, she has increased her expenditure on Food (Packaged & Fresh) and Healthcare, just as many of her peers have done (77% and 70% respectively). For Hoa, the increased expenditure on food is mostly due to the fact that her daughter’s family of three – who lives in the same home as her – are now also working and studying at home as a result of social distancing measures. Lifestyle Products Within Lifestyle Products, we witnessed an overall reduction in planned monthly household expenditure across the board, with the exception of Internet Services and Household Cleaning Products (see Figure 13). This observation again reflects the fact that consumers are spending more time at home, and shifting from out-of-home consumption to at-home consumption, with 100% and 84% of survey respondents indicating that they have made purchases for Internet Services and Household Cleaning Products in the last 12 months (see Figure 14). On the other hand, product categories such as Leisure & Holiday, Dining Out, and Karaoke & Nightclubs experienced the greatest cutbacks, not least because of the closure or restrictions imposed on these activities. Looking ahead, however, there are two key implications for businesses in these sectors. Firstly, these product categories are deemed by consumers to be more discretionary, and therefore are more vulnerable during a pandemic or downturn; secondly, while these product categories have enjoyed impressive growth over the past decade, this experience serves as a blunt reminder of the high demand elasticity of the business model and the high degree of impact that a single market shock could cause. 19 Staying resilient amidst headwinds | The Vietnam Consumer Survey Figure 13: Changes in planned monthly household expenditure on Lifestyle Products as a result of COVID-19 Internet Services 24% 63% 13% Clothing & Footwear 4% 27% 69% Cosmetics & Beauty Care Products 2% 30% 67% Personal Hygiene Products 15% Household Cleaning Products Fitness & Wellness Leisure & Holiday Dining Out 62% 20% 71% 1% 69% 2% 9% 89% 11% Karaoke & Nightclubs 1% 15% No change 9% 30% 2% Increase 23% 87% 84% Decrease Source: Deloitte’s Vietnam Consumer Survey (2020) Figure 14: Purchase of Lifestyle Products within the last 12 months 100% 84% 78% 77% 59% 57% 39% 36% 27% Internet Services Household Cleaning Products Personal Hygiene Products Clothing & Footwear Source: Deloitte’s Vietnam Consumer Survey (2020) Cosmetics & Beauty Care Products Leisure & Holiday Dining Out Apart from cutting back on her discretionary spending, including on Leisure & Holiday and Clothing & Footwear, the COVID-19 pandemic has spurred Van to make some swaps even within product categories. For example, now that she is spending more time at home, she is reallocating her expenditure within the Cosmetics & Beauty Care Products category from cosmetics to beauty care products. While she is also interested in acquiring some new Mobile Phones & Digital Gadgets products, she nevertheless considers it to be a discretionary expenditure that she would try to avoid if possible. 20 Karaoke & Nightclubs Van Early Career Professionals Fitness & Wellness Staying resilient amidst headwinds | The Vietnam Consumer Survey Consumer Electronics In contrast to trends observed in other more affluent economies, survey respondents did not appear to increase their planned monthly household expenditure on Consumer Electronic products (see Figure 15). This suggests that they perceive these products to be more of discretionary products, rather than basic necessities, with a significant proportion in fact choosing to reduce their planned monthly household expenditure on these products. Figure 15: Changes in planned monthly household expenditure on Consumer Electronics as a result of COVID-19 Audio & Video Electronics Products 1% 58% Mobile Phones & Digital Gadgets 3% 61% Household Appliances (Major) 2% 61% 37% Household Appliances (Small) 2% 61% 37% Increase No change 41% 35% Decrease Source: Deloitte’s Vietnam Consumer Survey (2020) 13% Recreational Consumer Goods In terms of Recreational Consumer Goods, we observe that survey respondents have increased their planned monthly household expenditure for Beverages (Non-Alcoholic), while decreasing that for Beverages (Alcoholic) (see Figure 16). This suggests that products largely intended for larger group gatherings or special occasions – or are more focused on out-of-home consumption – may have been negatively impacted by the COVID-19 pandemic, while those that are more suitable for individual or at-home consumption may have fared better. Furthermore, planned monthly household expenditure on Tobacco has also decreased. This is likely a reflection not only of Tobacco as a discretionary product, but also a growing consciousness amongst Vietnamese consumers of its negative health effects in recent years. Figure 16: Changes in planned monthly household expenditure on Recreational Consumer Goods as a result of COVID-19 Beverages (Alcoholic) 17% Beverages (Non-Alcoholic) 31% Confectionery Tobacco Increase No change 58% 26% 27% 50% 23% 10% 23% 45% 46% 44% Decrease Source: Deloitte’s Vietnam Consumer Survey (2020) 21 Staying resilient amidst headwinds | The Vietnam Consumer Survey Chien has reduced his expenditure on Transportation, Clothing & Footwear, Beverages (Alcoholic), and Tobacco, as he found himself consuming less of these categories while he has been spending more time at home. However, like many of his peers (84%), the pandemic has sharpened his focus on Healthcare products, and as result he will allocating more of his budget to this product category to protect himself and his loved ones. Chien Active Pre-Retirees Increased digital uptake Many technology-driven services, including e-commerce platforms and ride-hailing services, have witnessed increasing uptake in Vietnam over the past decade. With partial lockdowns driving consumers to food delivery applications instead of dining out, more than half of survey respondents (60%) now plan to increase their monthly household expenditure on Online Food Delivery (see Figure 17). Nevertheless, the overall user base for technology-driven services remains relatively low in Vietnam. Specifically, our results show that users of Online Food Delivery applications account for only about one-third (33%) of total survey respondents, suggesting that the key battleground for such technology-driven platforms lie in new user acquisition and service penetration, rather than loyalty-building. Figure 17: Changes in planned monthly household expenditure on technology-driven services 60% Online Food Delivery 42% Online Retail Online Ordering (for in-store pick-up) Increase No change 28% 16% 12% 40% 18% 55% 29% Decrease Source: Deloitte’s Vietnam Consumer Survey (2020) Hai has reduced his expenditure on Leisure & Holiday, Clothing & Footwear, and Tobacco. In addition, he has nearly completely cut out expenditures on Fitness & Wellness and Karaoke & Nightclubs as a result of the temporary closures of such establishments and the desire to be more prudent. With the money saved from these activities, he will instead be increasing his expenditure on Food (Packaged & Fresh), Healthcare, and Housing & Utilities. 22 Hai Mid-Career Professionals Staying resilient amidst headwinds | The Vietnam Consumer Survey Mind: Deciphering new purchase drivers While there are no clear indications that the COVID-19 pandemic has resulted in a shift in preferences from Traditional Trade to Modern Trade channels, there has been clearer signs of a shift from Traditional Trade to e-Commerce/Online channels in several specific product categories. Pre-purchase Quality considerations dominate Across product categories, we observe that Quality considerations continue to dominate the Vietnamese consumer’s purchasing decisions. For this edition of the survey, survey respondents were encouraged to provide open-ended answers – rather than simply choosing between fixed product attributes – for us to gain a deeper understanding of their decisionmaking process. In this section, we will explore their purchasing considerations in each of the following product categories: Basic Necessities For the Food (Packaged & Fresh) and Food (Canned) categories, we observe a small increase in the importance of Price considerations from 14% to 16% since the 2019 edition of the survey, that could perhaps be attributed to a slight increase in prudence in view of the current economic situation. It is worthwhile noting, however, that attributes related to food safety considerations, including Expiry Date and Freshness, have become top-of-mind for many survey respondents (see Figure 18). This is likely to be a result of the increasing focus on food safety breaches in recent media coverage, which has been made more salient with the mushrooming of e-commerce retailers offering a variety of different food products with little to no food safety certifications or enforcement8. This increased consciousness of their food origin could be observed across all income brackets, with survey respondents in the southern cities of Can Tho and Ho Chi Minh City expressing significantly higher levels of consciousness (see Figure 19). Figure 18: Purchasing drivers for Basic Necessities Food (Packaged & Fresh) 19% Food (Canned) 19% Transportation 26% Housing & Utilities 25% Healthcare 25% Safety 27% 23% 23% Expiry Date Freshness 16% 8% 9% 10% 15% 6% 0% 32% 13% 3% 0% 35% 10% 14% 0% Price 16% 19% 19% 17% 52% Education Quality 10% 18% Brand 17% 0% 25% 17% 20% 2% 3% 5% 3% Others Source: Deloitte’s Vietnam Consumer Survey (2020) 8 “Hồi hộp với thực phẩm "nhà làm" bán trên mạng”. VietNamNet. 4 September 2020. 23 Staying resilient amidst headwinds | The Vietnam Consumer Survey Figure 19: Consciousness of food origin by city and monthly household income level Monthly household income level, VND million Can Tho Da Nang Hanoi Ho Chi Minh City 44% 28% 27% 39% 23% 6% 1% 41% 41% 12% 7% 2% 40% 33% 18% 4-9 17% 36% 9-14 16% 38% 1% 36% 2% 1% 21% 38% 20-40 20% 35% Somewhat more conscious No change 41% 33% 41% Somewhat less conscious 24% Not conscious at all Source: Deloitte’s Vietnam Consumer Survey (2020) Consumer Electronics and Recreational Consumer Goods With the purchase of Consumer Electronics and Recreational Consumer Goods, survey respondents prioritised Quality and Brand attributes in their purchasing decisions (see Figure 20 and 21). This does not mean that Price considerations do not play a role, but that consumers are seeking the best value possible – a behaviour that can perhaps be best illustrated by the Vietnamese idiom Đắt sắt ra miếng (roughly translated as “to get one’s money’s worth”). Figure 20: Purchasing drivers for Consumer Electronics 15% Mobile Phones & Digital Gadgets 13% 13% 11% 7% Household Appliances (Major) 14% 13% 10% 9% Household Appliances (Small) 15% 9% Durability 100% Quality Technology 8% 14% Safety Price 8% 12% 11% 8% 12% 14% Audio & Video Electronics Products 12% 11% 12% 11% 8% 13% 11% 9% 12% Brand Design 7% 13% 7% 13% 8% 15% 13% 9% Country of Origin Others Source: Deloitte’s Vietnam Consumer Survey (2020) Figure 21: Purchasing drivers for Recreational Consumer Goods Beverages (Alcoholic) 14% Beverages (Non-Alcoholic) 18% 14% Confectionery 19% 13% Tobacco Health Taste 10% Fragrance Source: Deloitte’s Vietnam Consumer Survey (2020) 24 16% Expiry Date 10% 10% 13% 11% 11% 10% 14% Price 16% 13% 12% 12% 11% 7% Brand 14% 13% 12% 17% Country of origin 5% 7% 12% 10% 5% 8% 11% 6% 7% 11% Packaging 3% 1% 36% 33% More than 60 Much more conscious 42% 14-20 40-60 5% 1% 41% 7% 4% Others 41% 4% 1% 4% 31% 3% 31% 3% Staying resilient amidst headwinds | The Vietnam Consumer Survey Lifestyle Products As Lifestyle Products cater to different consumer experiential needs, their purchasing drivers also reflect the Vietnamese consumer’s diverse tastes and preferences (see Figure 22). For the Clothing & Footwear and Cosmetics & Beauty Care Products categories, for instance, Brand attributes are amongst the key purchasing consideration. Country of Origin is also a particular consideration for the Cosmetics & Beauty Care Products category, with France perceived to be closely associated with perfumes and cosmetics, South Korea with skincare products, and Japan with overall quality and consistency. These associations could perhaps explain at least in part why Chinese cosmetics have not taken off in the market despite their affordable prices and wide availability on e-commerce platforms. On the other hand, purchasing decisions for categories such as Karaoke & Nightclubs are highly driven by Price considerations. Given the established cultural practice in Vietnam where the host is often expected to pick up the tab for the entire group after a trip to the karaoke or nightclub, consumers are understandably highly sensitive to prices for these activities. Price is also a significant consideration for the purchase of Internet Services. Such services have since become somewhat of a commodity in recent years, with the various telecommunications service providers competing fiercely for new subscribers by offering attractive data packages. With a low level differentiation amongst the different service providers, Price has become the dominant consideration – although it must be noted that Brand attributes continues to play a role, especially as several smaller service providers have been observed to offer steep promotions to new subscribers, but later fail to deliver consistent service at the expected bandwidth or speed. Figure 22: Purchasing drivers for Lifestyle Products Internet Services Clothing & Footwear Cosmetics & Beauty Care Products 38% 19% 15% 20% Personal Hygiene Products 20% Household Cleaning Products 22% Fitness & Wellness 24% Leisure & Holiday 29% Brand Design 9% 21% 22% 8% 6% 17% 9% 18% 8% 7% 5% 5% 17% 12% 5% 9% 5% 10% Image Country of Origin Comfort 7% 9% 14% 8% 12% 10% 3%1% 14% 17% 8% 7% 5% 8% 12% 7% 2% 11% 15% 9% 4% 24% 6% 3% 21% 10% 4% 71% Karaoke & Nightclubs Price 26% Variety 10% 12% 4% 9% 7% 3% 21% 8% Eco-friendly Others Source: Deloitte’s Vietnam Consumer Survey (2020) 25 Staying resilient amidst headwinds | The Vietnam Consumer Survey Purchase Modern Trade dominates Overall, we observe that Modern Trade channels continue to dominate overall channel preferences (see Figure 23). However, it is interesting to note that the COVID-19 pandemic did not result in a major shift in channel preferences from Traditional Trade to Modern Trade channels, as had been observed in many other regional markets. One reason for this could be the fact that consumers in Vietnam did not experience a “full-scale” lockdown during the initial outbreak of the pandemic, unlike markets such as China, Malaysia, and Singapore where out-of-home movement was permitted only for essential purposes. While Hanoi and Ho Chi Minh City residents were required to work from home under Vietnam’s social distancing measures, grocery trips were not limited by the government. As a result, Wet Markets continue to be the usual grocery shopping destination for many basic necessities. Although Modern Trade channels may provide Vietnamese consumers with greater assurance in terms of hygiene and food safety standards, consumers have not been forced to migrate away from Traditional Trade channels, unlike certain Chinese cities where Wet Markets had been ordered to close in view of hygiene considerations. In terms of their e-Commerce/Online channel preferences, survey respondents typically preferred the use of these channels for the purchase of items in product categories such as Clothing & Footwear, Leisure & Holiday, and Transportation. Here, e-Commerce/Online channels include both e-commerce platforms, as well as online services, such as ride-hailing and food delivery services. Figure 23: Overall channel preferences Others e-Commerce/Online Modern Trade Traditional Trade 2% 11% 34% Others 7% 8% Housing & Utilities 8% Leisure & Holiday 10% Clothing & Footwear 37% 33% Transportation Overall e-Commerce/Online 51% Education Source: Deloitte’s Vietnam Consumer Survey (2020) Like most of his peers in his age group, Hai hardly ever goes without his smartphone. He relies on e-Commerce/Online channels – especially ride hailing and food delivery services – on a daily basis, as his work schedule is demanding and he does not have the time to buy his lunch during office hours, or when his sudden craving for snacks hit in the late afternoon. Recently, he has also booked two domestic flights online in preparation for the upcoming Lunar New Year vacation. Hai is not alone in his preference for e-Commerce/Online channels: 71% of survey respondents in his age group expressed this preference for Transportation services, and 82% of them expressed this preference for the purchase of Leisure & Holiday services. 26 Hai Mid-Career Professionals Staying resilient amidst headwinds | The Vietnam Consumer Survey Preference for Modern Trade channels highly correlated with access Across the various cities, access and preference for Modern Trade channels are highly correlated. Specifically, in Hanoi and Ho Chi Minh City, where there are a larger number of Supermarkets and Convenience Stores, the preference for Modern Trade channels is higher than that in Can Tho and Da Nang. Da Nang, however, showed a palpable shift in channel preferences from Traditional Trade to Modern Trade in this latest edition of the survey (see Figure 24). One reason for this could be that Da Nang was more affected by citywide travel restrictions, which limited consumers’ access to Traditional Trade channels, such as Wet Markets. In other cities such as Ho Chinh City, the preference for Traditional Trade appears to be somewhat stabilising, suggesting the existence of a strong core of consumers who continue to prefer these channels. Figure 24: Channel preferences by city (2018-2020) Can Tho 34% 40% 28% 38% 45% Ho Chi Minh City 1% 14% 7% 2% 30% Hanoi Da Nang 46% 1% 13% 54% 61% 72% 52% 70% 2018 66% 2019 Traditional Trade 58% 2020 72% 2018 62% 2019 Modern Trade 48% 2020 54% 2018 e-Commerce/Online 39% 33% 2019 2020 46% 2018 53% 28% 33% 2019 2020 Others Source: Deloitte’s Vietnam Consumer Survey (2020) Proximity the main draw for Traditional Trade channels Traditional Trade channels tend to be preferred by survey respondents for the purchase of daily essentials, such as Food (Packaged & Fresh), Food (Canned), and Household Cleaning Products (see Figure 25). With an estimated 666,736 Traditional Trade outlets across Vietnam in 20199, consumers in urban areas are nearly guaranteed that they will be able to find an outlet within close proximity to satisfy these needs. Although Modern Trade channels, such as Convenience Stores and Minimarts, have expanded their coverage in recent years, many of the smaller alleys and lanes in Vietnam continue to be occupied by Traditional Trade outlets. That is not to say, however, that consumers are not drawn to Modern Trade channels: these channels offer consumers a more comfortable environment for shopping, in addition to integrated services, and premium product offerings. As a result, consumers tend to prefer Modern Trade channels when they happen to have more time to spend comparing product choices, and to enjoy the overall shopping experience. It is also perhaps not surprising that Modern Trade channels are preferred for Karaoke & Nightclubs and Fitness & Wellness, given that these are experiential activities and Modern Trade channels, including karaoke chains and premium gym or sports facilities, have an edge in their ability to offer modern, air-conditioned facilities for a better customer experience. On the other hand, survey respondents prefer the use of e-Commerce/Online channels for Transportation services. Here, the category includes ride-hailing platforms and other related services, but does not include the online purchase of vehicles or other mobility equipment. 9 “Retailing in Vietnam”. Euromonitor International. March 2020. 27 Staying resilient amidst headwinds | The Vietnam Consumer Survey Figure 25: Channel preferences by product category Basic Necessities Recreational Consumer Goods Food (Packaged & Fresh) 56% Food (Canned) 38% Transportation 24% 72% 76% Household Cleaning Products 45% 25% Traditional Trade 1%1% 17% 2% Confectionery 44% 54% 1% 3% 2% Tobacco 80% 19% 39% 15% 1% 11%1% 55% 42% 57% 82% 31% Modern Trade 68% 6% Audio & Video Electronics Products 21% Mobile Phones & Digital Gadgets 8% 1% Household Appliances (Major) 8%1% Household Appliances (Minor) 75% 91% 18% 13% 79% 84% 1% e-Commerce/Online Others Source: Deloitte’s Vietnam Consumer Survey (2020) Shift towards e-Commerce/Online channels as a result of COVID-19 While there are no clear indications that the COVID-19 pandemic has resulted in a shift in preferences from Traditional Trade to Modern Trade channels, our results revealed clearer signs of a shift from Traditional Trade to e-Commerce/Online channels in three specific product categories: Transportation, Clothing & Footwear, and Internet Services. In terms of Transportation, this shift is likely the consequence of social distancing measures, which encouraged consumers to increase their consumption of food delivery, parcel delivery, and other ancillary on-demand grocery delivery services. Given the reduced need for mobility at this point in time, it is likely that this increase was not significantly driven by increased demand for ride hailing or other mobility services. Conversely, the need for Traditional Trade channels in this category, consisting primarily of traditional taxis, has reduced. Similarly, as consumer spend a greater amount of time at home, their demand for connectivity has increased with new remote working and online entertainment consumption habits. These purchases are now predominantly made online, rather than through the Traditional Trade channels that consumers used to frequent to purchase top-up cards for their mobile services. Perhaps contrary to our expectations, there has been a slight shift away from Modern Trade channels towards Traditional Trade and e-Commerce/Online channels in certain categories where Modern Trade channels had long been perceived to be offering superior customer experiences. These include primarily products in the Recreational Consumer Goods and Lifestyle Products categories, such as Beverages (Alcoholic), Tobacco, Clothing & Footwear, and Household Cleaning Products (see Figure 26). Further analysis revealed that this shift was mostly driven by the change in preferences of survey respondents in Da Nang. This decline in the preference for Modern Trade channels in Da Nang could be attributed to a greater desire by consumers to save money by shifting to Traditional Trade channels, especially in view of the significant impacts of the partial lockdown measures on its tourism-reliant economy. 28 1%1% 54% 63% 38% Fitness & Wellness 9% Karaoke & Nightclubs 48% 1% Consumer Electronics Clothing & Footwear Personal Hygiene Products 50% 45% Lifestyle Products Cosmetics & Beauty Care Products Beverages (Alcoholic) Beverages (Non-Alcoholic) 55% 21% 19% 1%1% 1% 60% Housing & Utilities 9% Healthcare 42% 4% 1% 3% 3% Staying resilient amidst headwinds | The Vietnam Consumer Survey Although it does not appear to have fully materialised yet, one trend that consumer companies can also look forward to is the increase in the willingness of consumers to shop online for their basic necessities and fresh products. Our results found that the majority of survey respondents have indicated an increased willingness to shop online for these categories as a result of the COVID-19 pandemic, with 58% of them expressing this opinion (see Figure 27). Figure 26: Changes in channel preferences as a result of COVID-19 1.8% 1.5% 0.6% 2.3% 4.2% 1.1% -1.0% -0.3% -0.3% -2.5% -0.4% -1.3% 3.1% 2.6% 1.8% 2.0% 0.2% 0.9% 0.4% 1.7% -0.7% -0.9% 0.7% 0.5% -2.4% -2.6% -0.9% -0.2% -1.9% -3.8% -3.9% 0.7% 2.1% 0.4% -2.5% 1.3% 1.1% 0.4% -1.6% -1.4% -1.8% -1.2% Traditional Trade e-Commerce/ Online Modern Trade Modern Trade e-Commerce/ Online Traditional Trade Traditional Trade Modern Trade e-Commerce/ Online Food (Packaged & Fresh) Beverages (Alcoholic) Internet Services Food (Canned) Beverages (Non-Alcoholic) Cosmetics & Beauty Care Products Transportation Confectionery Housing & Utilities Household Cleaning Pro Tobacco Clothing & Footwear Personal Hygiene Products Leisure & Holiday Source: Deloitte’s Vietnam Consumer Survey (2020) Figure 27: Willingness to make online purchases of basic necessities and fresh products as a result of COVID-19 Much more willing 20% Somewhat more willing 38% No change 34% Somewhat less willing Much less willing 6% 2% Source: Deloitte’s Vietnam Consumer Survey (2020) 29 Staying resilient amidst headwinds | The Vietnam Consumer Survey With the recent partial lockdowns in her city, Van had to work remotely from her home for about four weeks. In accordance with the instructions issued by the authorities, she goes out once every two days to purchase her daily essentials at the nearest Wet Market. She made quick trips, purchasing only what she needed, and saw little need to visit Supermarkets located further away for other non-essential purchases. Many of her peers exhibited similar behaviours, with their preference for Modern Trade channels decreasing significantly from 43% to 30%. Van Early Career Professionals Online shopping increases with monthly household income level and decreases with age group Overall, Vietnamese consumers have been quick to embrace the use of e-Commerce/Online channels, with a number of heavyweight contenders, including but not limited to Lazada, Sendo, Shopee, and Tiki, currently jostling in the marketplace. Amongst our survey respondents, nearly 60% of them have shopped online at least once in the last 12 months. However, only a small fraction of about 7% can be considered frequent shoppers, or those that shop online at least once a week (see Figure 28). Figure 28: Overall usage frequency for e-Commerce/Online channels 4% 1% 2% 39% 34% 20% 2-3 times a month Not at all Once a month 2-3 times a week Once a week More than 4 times a week Source: Deloitte’s Vietnam Consumer Survey (2020) The uptake of e-Commerce/Online channels is positively correlated with monthly household income level (see Figure 29). As the majority of expenditure (60%) accounted for by e-Commerce/Online channels is allocated to the three product categories of Transportation, Clothing & Footwear, and Leisure & Holiday, we can infer that the use of e-Commerce/Online channels is typically reserved for discretionary spending, and is therefore an activity that can be undertaken by higher income consumers on a more frequent basis. Conversely, the uptake of e-Commerce/Online channels is negatively correlated with age group. Amongst younger survey respondents aged 35 and below, e-commerce uptake is around 80%, but this figure declines rapidly with age, in line with a decreasing overall level of digital-savviness (see Figure 30). 30 Staying resilient amidst headwinds | The Vietnam Consumer Survey Figure 29: Usage frequency for e-Commerce/Online channels by monthly household income level Monthly household income level, VND million 1% 4-9 2% 13% 1% 9-14 1% 3% 21% 16% 36% 14-20 2% 2% 4% 25% 20-40 3% 6% 43% 37% 29% 40-60 3% 3% More than 60 64% 11% 7% 31% 35% 17% 10% 47% 34% 19% 21% 2-3 times a week More than 4 times a week 27% Once a week 28% 2-3 times a month Once a month Not at all Source: Deloitte’s Vietnam Consumer Survey (2020) Figure 30: Usage frequency for e-Commerce/Online channels by age group Age group, years 20- 24 1%2% 10% 42% 25- 29 3% 3% 39% 30- 34 3% 2% 3% 35- 39 1%2% 40- 44 3%3% 1% 45- 49 1%1% 1% 50- 54 4% 55- 60 2% 9% More than 4 times a week 30% 22% 40% 20% 34% 18% 21% 33% 46% 55% 10% 70% 5% 21% 17% 30% 38% 31% 78% 2% 2-3 times a week 10% 34% Once a week 2-3 times a month Once a month Not at all Source: Deloitte’s Vietnam Consumer Survey (2020) 31 Staying resilient amidst headwinds | The Vietnam Consumer Survey Logistics remains key barrier for e-Commerce/Online channels Although e-Commerce/Online channels promise to offer consumers greater convenience and more competitive prices, the lack of a comprehensive logistics ecosystem continues to remain an impediment in driving greater consumer uptake of e-Commerce/Online channels. Specifically, more than 40% of our survey respondents cited delivery-related factors as the main reason for not making online purchases (see Figure 31). Consumer companies are therefore confronted with the conundrum of providing delivery services that are not only quick, but also cheap – if not free. This is a no mean feat: even large fast-moving consumer goods companies, who have been quick to move to direct-to-consumer channels by hosting storefronts on e-commerce platforms such as Lazada or Shopee, have found it difficult to overcome this challenge. As a result of prohibitively high shipping costs, some players have had to put in place restrictions on the regions to which they ship their products. The cost of shipping a regular bottle of shampoo across different Vietnamese cities, for example, may surpass the actual cost of the product itself – not to mention the risk of damage during the shipment process. Figure 31: Barriers for the uptake of e-Commerce/Online channels by city 12% 9% 8% 9% 16% 9% 8% 14% 11% 16% 14% 9% 9% 10% 9% 13% 12% 17% 12% 13% 6% 11% 11% 15,3% 15% 14% 13,6% 15% 15,5% 21,5% 22% 18,3% 18% 17% 16,6% 16% 16,0% Can Tho Da Nang Hanoi Ho Chi Minh City 7% 17% Delivery fee Delivery time Delivery assurance Price Privacy issues Product variety Return policy Others Source: Deloitte’s Vietnam Consumer Survey (2020) The issue of logistics is particularly acute in second-tier cities, such as Can Tho, which explains why the uptake of e-Commerce/Online channels continue to lag behind those of first-tier cities, such as Hanoi and Ho Chi Minh City (see Figure 32). On average, the delivery of an online order will take about one day for same-city delivery within Hanoi or Ho Chi Minh City, or two days for cross-city delivery between Hanoi and Ho Chi Minh City. Between Hanoi and Can Tho, however, it takes about four to five days. Longer delivery times, costlier shipping fees, and the higher risk of damage associated with long transits, are all factors that hinder consumers in second-tier cities from online purchases, especially since most online retailers have their operations in either Hanoi or Ho Chi Minh City. 32 Staying resilient amidst headwinds | The Vietnam Consumer Survey Figure 32: Usage frequency for e-Commerce/Online channels by city Can Tho 1% 1% 7% Da Nang 1% 4% Hanoi 3% 2-3 times a month 45% 29% 21% 35% 23% 8% Ho Chi Minh City 3% 2% 1% 59% 32% 22% 36% 36% 2-3 times a week Once a week 30% 2-3 times a month Once a month Not at all Source: Deloitte’s Vietnam Consumer Survey (2020) Chien Active Pre-Retirees Like most of his peers, Chien makes purchases on e-Commerce/Online channels occasionally – about once or twice per month. His most frequent online spending includes ride hailing services, and the payment of utilities and mobile phone bills. Chien is not particularly keen to make purchases on e-Commerce/Online channels for other product categories, because he prefers to be able to physically examine the products before he makes a purchase. In the rare instances when he does purchase items online, he looks for platforms that offer free shipping and delivery assurances, as he has had several unpleasant online shopping experiences in the past. Several impediments continue to hinder uptake of digital payments In recent years, Vietnam’s digital payments market has attracted significant attention and investments from large domestic and international players. These include, but are not limited to, e-wallet players, such as Momo, as well as mobile payments applications, such as Viettel Pay, in addition to e-commerce platforms that are also running their own proprietary e-wallet systems within their ecosystems. Amongst our survey respondents, the uptake of digital payment methods is currently about 70%. As with the uptake of e-Commerce/Online channels, the uptake of digital payment is also closely correlated with monthly household income level (see Figure 33). 33 Staying resilient amidst headwinds | The Vietnam Consumer Survey Figure 33: Usage for various digital payment methods Monthly household income level, VND million 18% 4-9 22% 30,1% 20,1% 30% 9-14 3% 2% 21% 23% 25% 20-40 25% Online shopping Home utilities payment 2% 2% 3% 24% 29% Credit card payment 26% 26% 25% 4% 34% 24% 22% 10% Others 54% 21% 22% 4% 23% 1% 19% 2% 21% More than 60 16% 2% 14-20 40-60 20% 22,4% 1% 9% 20% 9% 28% 12% 6% 10% Money transfer Not using Source: Deloitte’s Vietnam Consumer Survey (2020) This is likely not only because higher income consumers typically possess higher levels of digital savviness and higher receptiveness to digital payments (see Figure 34), but also because many consumers in the lower income groups – especially those with monthly household income levels of VND 4-9 million – do not even possess bank accounts. It must be noted, however, that even within the most receptive group of survey respondents (those with monthly income levels of VND 60 million and above), about 27% are still somewhat reluctant (will not switch, or will only switch if required by law) to adopt digital payment methods. Figure 34: Receptiveness towards digital payment methods Monthly household income level, VND million 4% 4-9 17% 9-14 1% 14-20 4% 37% 36,6% 17,5% 10% 32% 13% 40-60 14% More than 60 36% 24% 24% 27% 11% 32% 18% 31% 7% 35% 23% 1% 36% 13% 33% 16% 20-40 53% 15% 22% 9% 3% 28% 24% 10% 19% 17% 31,9% Comfortable using digital payments Intend to use more digital payments Will only switch if required by law None of the above Source: Deloitte’s Vietnam Consumer Survey (2020) 34 Started using digital payments but still prefer cash Will not switch at all Staying resilient amidst headwinds | The Vietnam Consumer Survey Our findings reveal that it is ultimately not a preference for cash, but security concerns that were the top contributing factors for our survey respondents’ reluctance to adopt digital payments (see Figure 35). Concerns surrounding security and transaction errors were also the most cited by survey respondents in the higher income groups: about 70% of those with monthly household income levels of VND 60 million and above expressed such concerns, as compared to only 49% of those with monthly household income levels of VND 4-9 million (see Figure 35). Overall, apart from online shopping, the top two uses of digital payments cited by survey respondents were money transfers/remittances, and the payment of home utilities bills. Figure 35: Barriers for the uptake of digital payment methods Monthly household income level, VND million 12% 9% 10% 5% 5% 4% 7% 4% 14% 44% Prefer cash Security issues 9% 5% 8% 5% 10% 5% 6% 4% 16% 8% 7% 15% 6% 5% 7% 3% 9% 6% 8% 4% 3% No bank account 39% 13% 8% 5% Difficult to control spending 10% 4% 16% 20% Unstable connection 7% 15% 43% 5% 12% 44% 4% 12% 47% 2% 11% 46% 1% 10% 51% 2% 8% Transaction errors Ease of use Others Source: Deloitte’s Vietnam Consumer Survey (2020) 35 Staying resilient amidst headwinds | The Vietnam Consumer Survey Post-purchase Driving repeat purchases through frictionless experiences Conventional knowledge suggests that coupons and discounts are one effective method through which e-Commerce/ Online players can drive repeat purchases – for example, by offering a customer a discount or coupon to make a purchase on the platform if they have not done so for some time. Our results imply that there may be some basis for this: about 9% of overall survey respondents have cited price discounts for return customers as driving their decision for a repeat purchase (see Figure 36). However, price discounts are by no means the most important. Rather, the survey results suggest that providing a highquality, end-to-end customer journey could be more pivotal: overall, survey respondents cited satisfaction with their prior purchase (19%), convenience and speed of delivery (17%), and a pleasant customer service experience (15%) as the main drivers for their decision to make a repeat purchase. Ideally, this experience should also be reinforced with a smooth transaction process (15%), and a clear returns/refunds policy and process (11%). For consumer companies, this suggests the need to review their entire customer journeys to envision and redesign frictionless experiences to encourage repeat purchases. This will entail a more strategic and holistic approach, rather than one that relies primarily on tactical discounts, and suggests that increasing the level of customer loyalty could be one way in which consumer companies can avoid costly price competition and customer acquisition efforts. Figure 36: Drivers of repeat purchases on e-Commerce/Online platforms 9% 4% 15% 10% 11% 15% 17% 19% Ease of conducting a transaction Convenience and speed of delivery Satisfaction with prior purchase Price discounts for returning customers Pleasant customer service experience Source: Deloitte’s Vietnam Consumer Survey (2020) Hai is a frequent user of e-Commerce/Online platforms, and is comfortable navigating them to search for deals and discounts for his purchases. While he appreciates coupons, they are not deal-breakers. Given his busy schedule, hunting for coupons can sometimes be too time-consuming. Rather, Hai would prefer to return to platforms that have previously delivered products that he is satisfied with, and which he already knows are able to fulfil his needs for convenience and speed of delivery, and provide a pleasant customer experience. 36 Loyalty programs Clear returns/refunds policy and process Hai Mid-Career Professionals Others Staying resilient amidst headwinds | The Vietnam Consumer Survey Looking ahead In this second edition of the Vietnam Consumer Survey, we explored some of the latest consumer sentiments and behaviours through the hearts, wallets, and minds of four personas amidst the global COVID-19 pandemic that were uncovered by our recent consumer survey conducted in four major cities: Can Tho, Da Nang, Hanoi, and Ho Chi Minh City. There are four key takeaways. Firstly, we have observed the Vietnamese consumer is generally optimistic about the economy, despite the ongoing COVID-19 pandemic. This optimism can be observed even amongst consumers in lower income groups, possibly a result of a confidence in Vietnam’s established track record of consistent economic growth. Nevertheless, we also witnessed a north-south divide in terms of consumer sentiment, with consumers in the southern of cities of Can Tho and Ho Chi Minh relatively more optimistic than those in the northern city of Hanoi and the central city of Da Nang. Secondly, unlike their counterparts in many other regional markets, the Vietnamese consumer did not appear to have made a marked shift from Traditional Trade to Modern Trade channels during the COVID-19 pandemic. This is perhaps a combination of the less stringent lockdowns that Vietnam has had to impose, as well as the appeal that Traditional Trade channels continue to hold in terms of the proximity and convenience that they are able to offer their customers. There are, however, clearer signs of a shift from Traditional Trade to e-Commerce/Online channels for several specific product categories, which reflect some of the new ways of working and living that the Vietnamese consumer has adopted in the pandemic era. Thirdly, there remain many barriers to adoption for e-commerce and digital payments. In terms of e-commerce, logistics issues are top-of-mind for many consumers, especially those in second-tier cities such as Can Tho, where the problem is particularly acute. Furthermore, several impediments also continue to hinder the uptake of digital payments. These range from the lack of access to bank accounts for consumers in the lower income groups, to concerns surrounding security and fraud amongst the higher income groups. Finally, consumer companies must be mindful that driving repeat e-commerce purchases from the Vietnamese consumer will require a lot more than simple tactics to entice them with discounts or coupons. Rather, the Vietnamese consumer appears to be fairly discerning, and is increasingly focused on the quality of their end-to-end customer journey from transactions and delivery to returns and refunds. Ultimately, the Vietnamese consumer has demonstrated remarkable resilience even amidst the current economic headwinds, no doubt a result of Vietnam’s relatively successful efforts at containing the COVID-19 pandemic thus far. Looking ahead, companies will need to not only understand the dynamics of the underlying macro trends, but also how these forces converge with one another to play out across the Vietnamese market, given its various regional differences and consumer inclinations. 37 Staying resilient amidst headwinds | The Vietnam Consumer Survey Researched and written by Pua Wee Meng Executive Director, Consulting wpua@deloitte.com +65 6232 7244 38 Tushar Milind Oka Senior Manager, Consulting tusoka@deloitte.com +60 111 426 9814 Contact us Southeast Asia Consumer industry practice Southeast Asia and Singapore Pua Wee Meng wpua@deloitte.com +65 6232 7244 Brunei Ng Hui Hua hung@deloitte.com +673 222 5880 Myanmar Aye Cho aycho@deloitte.com +65 6800 2255 Cambodia Kimleng Khoy kkhoy@deloitte.com +855 2396 3788 Lao PDR Choopong Surachutikarn csurachutikarn@deloitte.com +66 2034 0114 Guam Mike Johnson mikjonhson@deloitte.com +1 671 646 3884 Philippines Melissa Delgado medelgado@deloitte.com +63 2 581 9000 Indonesia Maria Christi mchristi@deloitte.com +62 21 5081 9300 Thailand Manoon Manusook mmanusook@deloitte.com +66 2034 0123 Malaysia Pua Wee Meng wpua@deloitte.com +65 623 2 7244 Vietnam Nguyen Vu Duc nguyenvu@deloitte.com +84 4 6288 3568 Deloitte refers to one or more of Deloitte Touche Tohmatsu Limited (“DTTL”), its global network of member firms, and their related entities (collectively, the “Deloitte organization”). DTTL (also referred to as “Deloitte Global”) and each of its member firms and related entities are legally separate and independent entities, which cannot obligate or bind each other in respect of third parties. DTTL and each DTTL member firm and related entity is liable only for its own acts and omissions, and not those of each other. DTTL does not provide services to clients. Please see www.deloitte.com/about to learn more. Deloitte Asia Pacific Limited is a company limited by guarantee and a member firm of DTTL. Members of Deloitte Asia Pacific Limited and their related entities, each of which are separate and independent legal entities, provide services from more than 100 cities across the region, including Auckland, Bangkok, Beijing, Hanoi, Hong Kong, Jakarta, Kuala Lumpur, Manila, Melbourne, Osaka, Seoul, Shanghai, Singapore, Sydney, Taipei and Tokyo. This communication contains general information only, and none of Deloitte Touche Tohmatsu Limited (“DTTL”), its global network of member firms or their related entities (collectively, the “Deloitte organization”) is, by means of this communication, rendering professional advice or services. Before making any decision or taking any action that may affect your finances or your business, you should consult a qualified professional adviser. No representations, warranties or undertakings (express or implied) are given as to the accuracy or completeness of the information in this communication, and none of DTTL, its member firms, related entities, employees or agents shall be liable or responsible for any loss or damage whatsoever arising directly or indirectly in connection with any person relying on this communication. DTTL and each of its member firms, and their related entities, are legally separate and independent entities. © 2021 Deloitte Southeast Asia Ltd For information, contact Deloitte SEA. CoRe Creative Services. RITM0646016