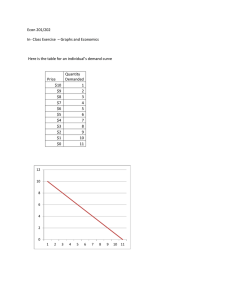

Chapter 1 -Economics is the study of how humans make decisions in the face of scarcity. These can be individual decisions, family decisions, business decisions, or societal decisions. -Scarcity means that human wants for goods, services and resources exceed what is available. Resources, such as labor, tools, land, and raw materials are necessary to produce the goods and services we want but they exist in limited supply -division of labor, the way one produces a good or service is divided into a number of tasks that different workers perform, instead of all the tasks being done by the same person. -economies of scale, which means that for many goods, as the level of production -increases, the average cost of producing each individual unit declines. -Specialization requires trade. -Microeconomics focuses on the actions of individual agents within the economy, like households, workers, and businesses. -the theory of consumer behavior -the theory of the firm -how markets for labor and other resources work -how markets sometimes fail to work properly. -Macroeconomics looks at the economy as a whole. It focuses on broad issues such as growth of production, the number of unemployed people, the inflationary increase in prices, government deficits, and levels of exports and imports. -A nation's central bank conducts monetary policy, which involves policies that affect bank lending, interest rates, and financial capital markets. For the United States, this is the Federal Reserve. -A nation's legislative body determines fiscal policy, which involves government spending and taxes. For the United States, this is the Congress and the executive branch, which originates the federal budget. -A theory is a simplified representation of how two or more variables interact with each other, AKA model -a theory is a more abstract representation, while a model is a more applied or empirical representation. We use models to test theories, but for this course we will use the terms interchangeably. -underground economy, a market where the buyers and sellers make transactions in violation of one or more government regulations -circular flow diagram: The circular flow diagram shows how households and firms interact in the goods and services market, and in the labor market. The direction of the arrows shows that in the goods and services market, households receive goods and services and pay firms for them. In the labor market, households provide labor and receive payment from firms through wages, salaries, and benefits. Assumptions -only 2 economic players (household, firms)no public, government, foreign, financial sectors -2 players directly interact with each other -all resources move through markets -Three ways that societies organize an economy: -traditional economy:What you produce is what you consume. Because tradition drives the way of life, there is little economic progress or development. -command economy, economic effort is devoted to goals passed down from a ruler or ruling class. (example:the lord provided the land for growing crops and protection in the event of war. In return,vassals provided labor and soldiers to do the lord’s bidding) -market economy, decision-making is decentralized. Market economies are based on private enterprise: the private individuals or groups of private individuals own and operate the means of production (resources and businesses). Businesses supply goods and services based on demand. (In a command economy, by contrast, the government owns resources and businesses.) Supply of goods and services depends on what the demands are. A person’s income is based on his or her ability to convert resources (especially labor) into something that society values. The more society values the person’s output, the higher the income (think Lady Gaga or LeBron James). In this scenario, market forces, not governments, determine economic Decisions. -underground economies (or black markets), which are markets where the buyers and sellers make transactions without the government’s approval. -globalization, the expanding cultural, political, and economic connections between people around the world. One measure of this is the increased buying and selling of goods, services, and assets across national borders—in other words, international trade and financial capital flows. -Exports are the goods and services that one produces domestically and sells abroad. -Imports are the goods and services that one produces abroad and then sells domestically. -Gross domestic product (GDP) measures the size of total production in an economy. Thus, the ratio of exports divided by GDP measures what share of a country’s total economic production is sold in other countries. Chapter 2 -opportunity cost to indicate what one must give up to obtain what he or she desires. The idea behind opportunity cost is that the cost of one item is the lost opportunity to do or consume something else. -explicit cost vs. implicit cost -indicates what one must give up to obtain what they desire -the opportunity cost is the value of the next best alternative -Scarcity (limited resources vs unlimited wants)->tradeoffs->choices -Budget= P1 x Q1 + P2 x Q2 -law of diminishing marginal utility, which means that as a person receives more of a good, the additional (or marginal) utility from each additional unit of the good declines. -A rational consumer would only purchase additional units of some product as long as the marginal utility exceeds the opportunity cost. -sunk costs, which are costs that were incurred in the past and cannot be recovered -production possibilities frontier (PPF), PPF is curved due to the law of diminishing marginal utility We measure the additional education by the horizontal distance between B and C. The foregone healthcare is given by the vertical distance between B and C. The slope of the PPF between B and C is (approximately) the vertical distance (the “rise”) over the horizontal distance (the “run”). This is the opportunity cost of the additional education. -the law of increasing opportunity cost, which holds that as production of a good or service increases, the marginal opportunity cost of producing it increases as well. This happens because some resources are better suited for producing certain goods and services instead of others. -Productive efficiency means that, given the available inputs and technology, it is impossible to produce more of one good without decreasing the quantity that is produced of another good. Points A,B,C,D,F are all productively efficient, and points under the curve are productively inefficient. -Allocative efficiency means that the particular combination of goods and services on the production possibility curve that a society produces represents the combination that society most desires. Simply means producers supply the quantity of each product that consumers demand. -When a country can produce a good at a lower opportunity cost than another country, we say that this country has a comparative advantage in that good. -positive statements, describe the world as it is, Normative statements, which describe how the world should be. Chapter 3 -demand to refer to the amount of some good or service consumers are willing and able to purchase at each price. -based on needs and wants -ability to pay, if you can't pay for something, you have no effective demand -price is what a buyer pays for a unit of the specific good or service -quantity demanded is total number of units the consumers would purchase at a set price -inverse relationship between price and quantity demanded is due to the law of demand. The law of demand assumes that all other variables that affect demand are held constant. -supply means the amount of some good or service a producer is willing to supply at each price -A rise in price almost always leads to an increase in the quantity supplied of that good or service -A fall in the price will decrease the quantity supplied -this positive relationship between price and quantity supplied—that a higher price leads to a higher quantity supplied and a lower price leads to a lower quantity supplied—the law of supply. -it assumes that all other variables that affect supply are held constant -demand vs quantity demanded -demand means the relationship between a range of prices and the quantity demanded at those prices, which are usually illustrated by demand curves/demand schedule -quantity demanded is only a certain point on the demand curve or one quantity on the demand schedule -supply vs quantity supplied -supply means the relationship between a range of prices and the quantities supplied at those prices illustrate with a supply curve or a supply schedule. -quantity supplied only a certain point on the supply curve, or one quantity on the supply schedule. -Equilibrium: where demand and supply intersect -determines the price and quantity that will be bought and sold in a market -When the price is below equilibrium, there is excess demand, or a shortage -above-equilibrium price, the quantity supplied exceeds the quantity demanded. We call this an excess supply or a surplus. -The assumption behind a demand curve or a supply curve is that no relevant economic factors, other than the product’s price, are changing. Economists call this assumption ceteris paribus -A product whose demand rises when income rises, and vice versa, is called a normal good -As incomes rise, many people will buy fewer generic brand groceries and more name brand groceries. They are less likely to buy used cars and more likely to buy new cars. They will be less likely to rent an apartment and more likely to own a home. -A product whose demand falls when income rises, and vice versa, is called an inferior good (exogenous) Factors that shifts demand curve -Income -income increases, demand for normal goods go up -income decreases, demand for normal goods go down -taste or preferences -american suddenly likes chicken more than beef, then demand curve for chicken increases and shifts to the right, and demand curve for beef shifts to the left -composition of the population -larger population of elderly people, demand for nursing home shifts to the right and demand for tricycles shifts to the left -larger population of kids, demand for tricycles shifts to the right and demand for nursing homes shifts to the left -prices of related goods -A substitute is a good or service that we can use in place of another good or service. -lower prices of tablets increased demands for tablets, which in turn dropped demand for laptops, since tablet is a substitute for computers, then demand for computers decrease -A complement are goods that often are used together -increase in price for cereals will decrease its demand, which also decreases demand for milk -expectations about future prices/other factors that affect demand -If a hurricane is expected in a week, demand for batteries will increase, even if the price for batteries is high. A shift in demand happens when an economic factor (other than price) causes different quantity to be demanded at every price Factors that shift the supply curve -cost of production -if cost of production decreases, suppliers make more profit which prompts them to make more, hence supply curve shifts to the right, and vice versa -weather and climate -especially for agricultural products, if drought happens, supply for wheat will decrease -New technologies -development of new technologies decreases cost of production, increases supply -government policies -through taxes, regulations, they normally increase cost for suppliers, decreases supply -Subsidies decrease costs of production, increases supply -Laws that government enact to regulate prices are called price controls -A price ceiling keeps a price from rising above a certain level (the “ceiling”), sometimes causes shortages -price floor keeps a price from falling below a given level (the “floor”), sometimes causes surplus -The amount that individuals would have been willing to pay, minus the amount that they actually paid, is called consumer surplus.The extra benefit producers receive from selling a good or service, measured by the price the producer actually received minus the price the producer would have been willing to accept is called producer surplus. -The sum of consumer surplus and producer surplus is social surplus, also referred to as economic surplus or total surplus. Social surplus is larger at equilibrium quantity and price than it would be at any other quantity. This demonstrates the economic efficiency of the market equilibrium. In addition, at the efficient level of output, it is impossible to produce greater consumer surplus without reducing producer surplus, and it is impossible to produce greater producer surplus without reducing consumer surplus. -effect of price ceiling on social surplus: 1)original consumer surplus is T+U, producer surplus is V+W+X 2)after price ceiling, consumer surplus is T+V, producer surplus is X, deadweight loss ( loss in social surplus that occurs when the economy produces at an inefficient quantity) is U+W 3) V is transferred from producer surplus to consumer surplus 4) U+W is like money thrown away that benefits no one -effect of price floor on social surplus: 1) original consumer surplus is G+H+J, producer surplus is I+K 2)after price floor, consumer surplus is G, producer surplus os H+I, deadweight loss is J+K 3)H is transferred from consumer surplus to producer surplus 4) J+K is like money thrown away that benefits no one Chapter 5 -Price elasticity is the ratio between the percentage change in the quantity demanded (Qd) or supplied (Qs) and the corresponding percent change in price. -The price elasticity of demand is the percentage change in the quantity demanded of a good or service divided by the percentage change in the price. -The price elasticity of supply is the percentage change in quantity supplied divided by the percentage change in price. -inelastic demand or supply shows low responsiveness to price changes, unitary elasticities show proportional responsiveness, elastic demand or supply shows high responsiveness to price changes. -when supply suddenly go up, products with inelastic demand drops in prices a lot while products with elastic demand drops only a bit if… then… called.. % change in quantity > % change in price elastic % change in quantity = % change in price unitary % change in quantity < % change in price inelastic -Infinite elasticity or perfect elasticity refers to the extreme case where either the quantity demanded (Qd) or supplied (Qs) changes by an infinite amount in response to any change in price at all. -Zero elasticity or perfect inelasticity, refers to the extreme case in which a percentage change in price, no matter how large, results in zero change in quantity. -constant unitary elasticity A Constant Unitary Elasticity Demand Curve A demand curve with constant unitary elasticity will be a curved line. Notice how price and quantity demanded change by an identical percentage amount between each pair of points on the demand curve. A Constant Unitary Elasticity Supply Curve A constant unitary elasticity supply curve is a straight line reaching up from the origin. Between each pair of points, the percentage increase in quantity supplied is the same as the percentage increase in price. -The analysis, or manner, of how a tax burden is divided between consumers and producers is called tax incidence -If demand is more inelastic than supply, consumers bear most of the tax burden, and if supply is more inelastic than demand, sellers bear most of the tax burden. Elasticity and Tax Incidence An excise tax introduces a wedge between the price paid by consumers (Pc) and the price received by producers (Pp). The vertical distance between Pc and Pp is the amount of the tax per unit. Pe is the equilibrium price prior to introduction of the tax. (a) When the demand is more elastic than supply, the tax incidence on consumers Pc – Pe is lower than the tax incidence on producers Pe – Pp. (b) When the supply is more elastic than demand, the tax incidence on consumers Pc – Pe is larger than the tax incidence on producers Pe – Pp. The more elastic the demand and supply curves, the lower the tax revenue. long-run vs short-run impact of elasticity -Elasticities are often lower in the short run than in the long run. -supply and demand are often inelastic in the short run, so that shifts in either demand or supply can cause a relatively greater change in prices. However, since supply and demand are more elastic in the long run, the long-run movements in prices are more muted, while quantity adjusts more easily in the long run. Income elasticity of demand -for normal goods, the income elasticity of demand is almost always positive. For inferior goods, the income elasticity of demand is almost always negative. Cross-price elasticity of demand -Substitute goods have positive cross-price elasticities of demand, Complement goods have negative cross-price elasticities Elasticity in labor and financial capital market -The wage elasticity of labor supply for teenage workers is generally fairly elastic. Conversely, the wage elasticity of labor supply for adult workers in their thirties and forties is fairly inelastic. -large impact on increasing the quantity saved if the supply curve for financial capital is elastic, because then a given percentage increase in the return to savings will cause a higher percentage increase in the quantity of savings. However, if the supply curve for financial capital is highly inelastic, then a percentage increase in the return to savings will cause only a small increase in the quantity of savings. Chapter 6 -utils measures utility (total amount of satisfaction), it's completely subjective and different for everyone -budget constraint (or budget line) shows the possible combinations of two goods that are affordable given a consumer’s limited income -Consumer equilibrium: point on the budget line where the consumer gets the most satisfaction; this occurs when the ratio of the prices of goods is equal to the ratio of the marginal utilities. -marginal utility is the additional utility provided by one additional unit of consumption. -diminishing marginal utility, which holds that the additional utility decreases with each unit added. -Marginal utility per dollar is the amount of additional utility José receives divided by the product's price. -To find the most utility maximizing choice: or -The substitution effect occurs when a price changes and consumers have an incentive to consume less of the good with a relatively higher price and more of the good with a relatively lower price. -The income effect is that a higher price means, in effect, the buying power of income has been reduced (even though actual income has not changed), which leads to buying less of the good (when the good is normal). -Behavioral economics seeks to enrich our understanding of decision-making by integrating the insights of psychology into economics. -We call this loss aversion, where a $1 loss pains us 2.25 times more than a $1 gain helps us -fungible, or having equal value to the individual, regardless of the situation. Chapter 7 -A firm (or producer or business) combines inputs of labor, capital, land, and raw or finished component materials to produce outputs. -If the firm is successful, the outputs are more valuable than the inputs. -Total revenue is the income the firm generates from selling its products. We calculate it by multiplying the price of the product times the quantity of output sold: -Explicit costs are out-of-pocket costs, that is, actual payments. Wages that a firm pays its employees or rent that a firm pays for its office are explicit costs. -Implicit costs represent the opportunity cost of using resources that the firm already owns. Also include the depreciation of goods, materials, and equipment that are necessary for a company to operate. -For example, working in the business while not earning a formal salary, or using the ground floor of a home as a retail store are both implicit costs -Accounting profit is a cash concept. It means total revenue minus explicit costs—the difference between dollars brought in and dollars paid out. -Economic profit is total revenue minus total cost, including both explicit and implicit costs. Factors of production -Natural Resources (Land and Raw Materials) -Labor – When we talk about production, labor means human effort, both physical and mental. -Capital – When economists use the term capital, they do not mean financial capital (money); rather, they mean physical capital, the machines, equipment, and buildings that one uses to produce the product. -Technology – Technology refers to the process or processes for producing the product -Entrepreneurship – Production involves many decisions and much knowledge. Who makes those decisions? Whose idea it is to combine the inputs to produce the outputs? -production function, a mathematical expression or equation that explains the engineering relationship between inputs and outputs: -Fixed inputs are those that can’t easily be increased or decreased in a short period of time. Fixed inputs define the firm’s maximum output capacity. -In the pizza example, the building is a fixed input. Once the entrepreneur signs the lease, he or she is stuck in the building until the lease expires. -Variable inputs are those that can easily be increased or decreased in a short period of time. -The pizzaiolo can order more ingredients with a phone call, so ingredients would be variable inputs. The owner could hire a new person to work the counter pretty quickly as well. -Fixed costs are the costs of the fixed inputs, they are expenditures that do not change regardless of the level of production -Variable costs are the costs of the variable inputs (e.g. labor). It decreases or increases with output -The short run is the period of time during which at least some factors of production are fixed. -The long run is the period of time during which all factors are variable. -marginal product is the additional output of one more worker. Mathematically, Marginal Product is the change in total product divided by the change in labor: -the Law of Diminishing Marginal Product and it’s a characteristic of production in the short run. Also causes variable costs to start increasing at an increasing rate. -diminishing marginal productivity: increasing labor initially can be very beneficial to increasing output, but specialization of labor can only go so far, so at some point too much labor input can lead to decreasing marginal productivity or even negative output. -Factor payments are what the firm pays for the use of the factors of production. From the firm’s perspective, factor payments are costs. From the owner of each factor’s perspective, factor payments are income. Factor payments include: -Raw materials prices -Rent -Wages and salaries -Interest and dividends: for the use of financial capital (loans and equity investments) -Profit for entrepreneurship:what’s left over from revenues after the firm pays all the other costs. -average cost as total cost divided by the quantity of output produced. AC=TC/Q -marginal cost is the change in total cost divided by the change in output: MC=ΔTC/ΔQ -Average Total Cost, Average Variable Cost, Marginal Cost -Average total cost (sometimes referred to simply as average cost) is total cost divided by the quantity of output. Typically U shaped because ACT starts off high dictated by fixed costs, and starts decreasing as fixed costs are spread out over increase of output. Then it starts increasing again when the law of diminishing returns/productivity kicks in. -average variable cost is when we divide variable cost by quantity of output. AVC curve will always be below ATC curve because it’s ATC minus the fixed costs while AVC don't. -Marginal cost is the additional cost of producing one more unit of output. MC=ΔTC/ΔQ It’s generally upward sloping but it starts to rapidly increase due to diminishing returns. - When MC<ATC, then producing one more unit will reduce average costs overall. ATC will be downward sloping. -When MC>ATC, then producing one more unit will increase average costs overall. ATC will be upward sloping. -where MC=ATC must occur at the minimum point of the ATC curve. -If we divide profit by the quantity of output produced we get average profit, also known as the firm’s profit margin. It helps producers understand how increasing or decreasing production affects profits. In the long run -long run is when all costs are variable, so in planning for the long run, the firm will compare alternative production technologies -Economies of scale refers to the situation where, as the quantity of output goes up, the cost per unit goes down. This is a long-run average cost curve, because it allows all factors of production to change -Thus, the long-run average cost (LRAC) curve is actually based on a group of short-run average cost (SRAC) curves -economies of scale -constant returns to scale:the average cost of production does not change much as scale rises or falls. -diseconomies of scale: a situation where, as the level of output and the scale rises, average costs rise as well. (a) Low-cost firms will produce at output level R. When the LRAC curve has a clear minimum point, then any firm producing a different quantity will have higher costs. In this case, a firm producing at a quantity of 10,000 will produce at a lower average cost than a firm producing, say, 5,000 or 20,000 units. (b) Low-cost firms will produce between output levels R and S. When the LRAC curve has a flat bottom, then firms producing at any quantity along this flat bottom can compete. In this case, any firm producing a quantity between 5,000 and 20,000 can compete effectively, although firms producing less than 5,000 or more than 20,000 would face higher average costs and be unable to compete. -If the LRAC curve has a single point at the bottom, then the firms in the market will be about the same size, but if the LRAC curve has a flat-bottomed segment of constant returns to scale, then firms in the market may be a variety of different sizes. Chapter 8,2 (perfectly competitive) -A perfectly competitive firm has only one major decision to make—namely, what quantity to produce. To understand this, consider a different way of writing out the basic definition of profit: Profit=Total revenue−Total cost =(Price)(Quantity produced)−(Average cost)(Quantity produced) Total revenue for a perfectly competitive firm is a straight line sloping up. The slope is equal to the price of the good. Total cost also slopes up, but with some curvature. At higher levels of output, total cost begins to slope upward more steeply because of diminishing marginal returns. The maximum profit will occur at the quantity where the difference between total revenue and total cost is largest. Comparing marginal revenue and marginal costs -under perfect competition, marginal revenue does not change as the firm produces more output. -to calculate marginal cost - For a perfectly competitive firm, the marginal revenue (MR) curve is a horizontal line because it is equal to the price of the good, which is determined by the market, as Figure 8.4 illustrates. The marginal cost (MC) curve is sometimes initially downward-sloping, if there is a region of increasing marginal returns at low levels of output, but is eventually upward-sloping at higher levels of output as diminishing marginal returns kick in. -profit maximizing choice is when MC=MR @$5 and 80 raspberries, it's a sign that suppliers should stop expanding. But as long as MR>MC, the firm should keep expanding. -Because the marginal revenue received by a perfectly competitive firm is equal to the price P, we can also write the profit-maximizing rule for a perfectly competitive firm as a recommendation to produce at the quantity of output where P = MC. -The intersection of the average variable cost curve and the marginal cost curve, which shows the price below which the firm would lack enough revenue to cover its variable costs, is called the shutdown point. -If the perfectly competitive firm faces a market price above the shutdown point, then the firm is at least covering its average variable costs. - At a price above the shutdown point, the firm is also making enough revenue to cover at least a portion of fixed costs, so it should limp ahead even if it is making losses in the short run, since at least those losses will be smaller than if the firm shuts down immediately and incurs a loss equal to total fixed costs. ● price < minimum average variable cost, then firm shuts down ● price > minimum average variable cost, then firm stays in business -In other words, the marginal cost curve above the minimum point on the average variable cost curve becomes the firm’s supply curve. Chapter 9,2 (monopoly) In general, if a firm produces a product without close substitutes, then we can consider the firm a monopoly producer in a single market. However, if buyers have a range of similar—even if not identical—options available from other firms, then the firm is not a monopoly. -monopolists are not seeking to maximize revenue, but instead to earn the highest possible profit. -Total revenue for a monopolist has the shape of a hill, first rising, next flattening out, and then falling. Total revenue for the monopoly firm called HealthPill first rises, then falls. Low levels of output bring in relatively little total revenue, because the quantity is low. High levels of output bring in relatively less revenue, because the high quantity pushes down the market price. The total cost curve is upward-sloping. Profits will be highest at the quantity of output where total revenue is most above total cost. The profit-maximizing level of output is not the same as the revenue-maximizing level of output, which should make sense, because profits take costs into account and revenues do not. For a monopoly like HealthPill, marginal revenue decreases as it sells additional units of output. The marginal cost curve is upward-sloping. The profit-maximizing choice for the monopoly will be to produce at the quantity where marginal revenue is equal to marginal cost: that is, MR = MC. If the monopoly produces a lower quantity, then MR > MC at those levels of output, and the firm can make higher profits by expanding output. If the firm produces at a greater quantity, then MC > MR, and the firm can make higher profits by reducing its quantity of output. The HealthPill firm first chooses the quantity where MR = MC. In this example, the quantity is 5. The monopolist then decides what price to charge by looking at the demand curve it faces. The large box, with quantity on the horizontal axis and demand (which shows the price) on the vertical axis, shows total revenue for the firm. The lighter-shaded box, which is quantity on the horizontal axis and average cost of production on the vertical axis shows the firm's total costs. The large total revenue box minus the smaller total cost box leaves the darkly shaded box that shows total profits. Since the price charged is above average cost, the firm is earning positive profits. -MR curve is always under demand curve -For a straight-line demand curve, MR and demand have the same vertical intercept. As output increases, marginal revenue decreases twice as fast as demand, so that the horizontal intercept of MR is halfway to the horizontal intercept of demand. -Allocative efficiency is an economic concept regarding efficiency at the social or societal level. It refers to producing the optimal quantity of some output, the quantity where the marginal benefit to society of one more unit just equals the marginal cost. -If P > MC, then the marginal benefit to society (as measured by P) is greater than the marginal cost to society of producing additional units, and a greater quantity should be produced. However, in the case of monopoly, price is always greater than marginal cost at the profit-maximizing level of output. Thus, consumers will suffer from a monopoly because it will sell a lower quantity in the market, at a higher price, than would have been the case in a perfectly competitive market. -natural monopoly-multiple companies but makes more sense to just have 1 company provide it (utility company, landline company)